Professional Documents

Culture Documents

Certificate of Residence: This Form Is To Be Used Only by Residents of States With A Reciprocal Tax Agreement.

Certificate of Residence: This Form Is To Be Used Only by Residents of States With A Reciprocal Tax Agreement.

Uploaded by

Nina PinedaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate of Residence: This Form Is To Be Used Only by Residents of States With A Reciprocal Tax Agreement.

Certificate of Residence: This Form Is To Be Used Only by Residents of States With A Reciprocal Tax Agreement.

Uploaded by

Nina PinedaCopyright:

Available Formats

Form WH-47

SF# 9686 (R/12-97)

Certificate of Residence

This form is to be used only by residents of States with a reciprocal tax agreement. * Employer TID Number Street and City Address Social Security Number

Indiana Employer's Name Employee Name

The employee swears to be a legal resident of the State of , does not own personal property in Indiana, and understands that income from salaries, wages, tips and commissions received from Indiana sources are taxable in their state of residence and not subject to Indiana Adjusted Gross Income Tax as a result of the reciprocal tax agreement with the State of . Employee further states the Indiana employer will be advised of any change in legal residence. Note: The employee understands that the employer remains responsible for withholding any applicable Indiana County taxes. Date , Employee Signature day of

Subscribed and sworn to before me, a Notary Public in and for said County and State, this , My Commission Expires . Notary Public Signature My County of Residence

Do not send this form to the Indiana Department of Revenue

it is to be filed with and held by the employer.

*States that have reciprocal agreements with Indiana are: Kentucky, Michigan, Ohio, Pennsylvania and Wisconsin.

You might also like

- Ownership Certificate: Information About Form 1000 Is at WWW - Irs.gov/uac/about-Form-1000Document2 pagesOwnership Certificate: Information About Form 1000 Is at WWW - Irs.gov/uac/about-Form-1000OneNation100% (2)

- Form W-8BEN Rev 920Document2 pagesForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- Credit Application HMF - Fill - FinalDocument2 pagesCredit Application HMF - Fill - FinalJonathan Keith MobleyNo ratings yet

- NQ Non-Spouse Rind - 0080Document5 pagesNQ Non-Spouse Rind - 0080Alexander HerbertNo ratings yet

- Tax For EveryoneDocument7 pagesTax For EveryoneDang FloresNo ratings yet

- In-Service Withdrawal FormDocument1 pageIn-Service Withdrawal FormlanzahouseNo ratings yet

- Form W-8BEN R713072 01-06-2022Document2 pagesForm W-8BEN R713072 01-06-2022hasangundkalliNo ratings yet

- Fisher's Election To Have Tax Deducted at Source: Protected BDocument1 pageFisher's Election To Have Tax Deducted at Source: Protected BMatt WoodNo ratings yet

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (6)

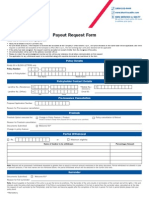

- Payout Request FormDocument2 pagesPayout Request FormSATHISHLATEST2005100% (11)

- MW507Document2 pagesMW507Thirunavukkarasu AnandanNo ratings yet

- 133304Document3 pages133304Sharon Downing OstremNo ratings yet

- Life Cancellation FormDocument2 pagesLife Cancellation FormSavka SavkaNo ratings yet

- FATCA Declaration Individual FINALDocument3 pagesFATCA Declaration Individual FINALadvaitNo ratings yet

- BIR Form 0605 UsesDocument4 pagesBIR Form 0605 UsesCykee Hanna Quizo LumongsodNo ratings yet

- Surrender FormDocument6 pagesSurrender FormShaikhSabiyaNo ratings yet

- Universal Member Application: Personal InformationDocument2 pagesUniversal Member Application: Personal InformationHunter GrayNo ratings yet

- US Internal Revenue Service: f2350 - 1996Document2 pagesUS Internal Revenue Service: f2350 - 1996IRSNo ratings yet

- 2020 TaxReturnDocument6 pages2020 TaxReturnRicko CooperNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- How To File Your Income Tax Return in The Philippines-COMPENSATIONDocument10 pagesHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280No ratings yet

- Tax Credit Return PDFDocument2 pagesTax Credit Return PDFserbisyongtotooNo ratings yet

- Ownership Certificate: I.R.S. Specifications To Be Removed Before PrintingDocument2 pagesOwnership Certificate: I.R.S. Specifications To Be Removed Before PrintingFrancis Wolfgang UrbanNo ratings yet

- Can Tax Residency t2062 Fill 18eDocument6 pagesCan Tax Residency t2062 Fill 18eMax PowerNo ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- Bank Account Updation FormDocument2 pagesBank Account Updation Forms.sabapathyNo ratings yet

- F 8233Document2 pagesF 8233محمدجوزيايNo ratings yet

- Printapplication GE SSDocument8 pagesPrintapplication GE SSmgworkNo ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- Inbound 799583783419321901Document2 pagesInbound 799583783419321901lestine1969No ratings yet

- Application and Credit Card Account Agreement: 1. APPLICANT INFORMATION: Please Tell Us About YourselfDocument8 pagesApplication and Credit Card Account Agreement: 1. APPLICANT INFORMATION: Please Tell Us About Yourselfsaxmachine1411No ratings yet

- Missouri Form Mo W 4Document1 pageMissouri Form Mo W 4itargetingNo ratings yet

- US Internal Revenue Service: f2350 - 1999Document2 pagesUS Internal Revenue Service: f2350 - 1999IRSNo ratings yet

- Extended KYC Annexure IndividualsDocument2 pagesExtended KYC Annexure IndividualsNarendra Reddy BhumaNo ratings yet

- GUIDELINESFORGIFDocument2 pagesGUIDELINESFORGIFGirish KalburgiNo ratings yet

- FATCA Individual PDFDocument2 pagesFATCA Individual PDFPrathik NamakalNo ratings yet

- FATCA Form Individual 061015 V1Document2 pagesFATCA Form Individual 061015 V1sanjay901No ratings yet

- Policy Fund Withdrawal Form: FWP/FSC CodeDocument2 pagesPolicy Fund Withdrawal Form: FWP/FSC CodeEra gasper100% (1)

- Sundaram FATCA CRS Form IndividualDocument2 pagesSundaram FATCA CRS Form IndividualAnonymous cXDbOjUr1dNo ratings yet

- Instructions For Form W-7 (11 - 2023) - Internal Revenue ServiceDocument42 pagesInstructions For Form W-7 (11 - 2023) - Internal Revenue ServiceJurist PeaceNo ratings yet

- Tax FormDocument1 pageTax FormTop Cooling fanNo ratings yet

- Tax Unit 2Document63 pagesTax Unit 2sunaina aliNo ratings yet

- fw8 PDFDocument2 pagesfw8 PDFSalaam Bey®No ratings yet

- Document Pack 9ST99MJR PDFDocument6 pagesDocument Pack 9ST99MJR PDFMohamed Diaa Mortada100% (1)

- Ental Pplication: (If Less Than Three Years Ago)Document2 pagesEntal Pplication: (If Less Than Three Years Ago)Brandon WeberNo ratings yet

- 656 Offer in Compromise: Attach Application Fee and Payment Here. IRS Received DateDocument4 pages656 Offer in Compromise: Attach Application Fee and Payment Here. IRS Received DateRonell D. MooreNo ratings yet

- Lousianna Tax InstructionDocument17 pagesLousianna Tax Instructionchuckhsu1248No ratings yet

- Minnesota Property Tax Refund: Forms and InstructionsDocument28 pagesMinnesota Property Tax Refund: Forms and InstructionsJeffery MeyerNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- 2020 Yukon Personal Tax Credits Return: Td1YtDocument2 pages2020 Yukon Personal Tax Credits Return: Td1YtBryan WilleyNo ratings yet

- Form 15Cb: U. Mohanan & Co Chartered AccountantDocument4 pagesForm 15Cb: U. Mohanan & Co Chartered AccountantKrishna S MohanNo ratings yet

- Employer GuideDocument34 pagesEmployer GuideJoshua MangrooNo ratings yet

- Vendor Onboard PackageDocument6 pagesVendor Onboard PackageNick BlanchetteNo ratings yet

- MO W-4 Employee's Withholding Certificate: Reset Form Print FormDocument1 pageMO W-4 Employee's Withholding Certificate: Reset Form Print FormAmina chahalNo ratings yet

- W-9 FormDocument2 pagesW-9 FormTrish HitNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet