Professional Documents

Culture Documents

Suggested Solutions 5740 Deferred Income Tax 1

Suggested Solutions 5740 Deferred Income Tax 1

Uploaded by

cutieaikoCopyright:

Available Formats

You might also like

- TaxDocument8 pagesTaxClaire BarrettoNo ratings yet

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document71 pagesChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Deferred TaxDocument6 pagesDeferred TaxJayson Manalo GañaNo ratings yet

- Ethiopia D3S4 Income TaxesDocument81 pagesEthiopia D3S4 Income TaxesyididiyayibNo ratings yet

- Difference Between Accounting Rules and Tax RulesDocument18 pagesDifference Between Accounting Rules and Tax RulesCezar Rishane Mae SaligueNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Financial Accounting 3A Assignment 2Document10 pagesFinancial Accounting 3A Assignment 2Mikaeel MohamedNo ratings yet

- Chapter 25 and 26Document10 pagesChapter 25 and 26Sittie Aisah AmpatuaNo ratings yet

- Advanced Financial Accounting IDocument21 pagesAdvanced Financial Accounting IAbdiNo ratings yet

- IAS#12Document31 pagesIAS#12Shah KamalNo ratings yet

- Accounting For Income Tax-NotesDocument4 pagesAccounting For Income Tax-NotesMaureen Derial PantaNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- VOL 2 16. Accounting For Income TaxationDocument15 pagesVOL 2 16. Accounting For Income TaxationdmangiginNo ratings yet

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- F7.1 Chap 15 - TaxationDocument33 pagesF7.1 Chap 15 - TaxationLê Đăng Cát NhậtNo ratings yet

- Taxation 100 Imp Questions 1642662172Document160 pagesTaxation 100 Imp Questions 1642662172riyatada16No ratings yet

- 2014 Volume 2 CH 5 AnswersDocument6 pages2014 Volume 2 CH 5 AnswersGirlie SisonNo ratings yet

- Practical Application of Taxation On CorporationsDocument5 pagesPractical Application of Taxation On CorporationsClaire BarbaNo ratings yet

- 2 Easy Questions - AnswersDocument9 pages2 Easy Questions - AnswersMarj AgustinNo ratings yet

- Finacc 6 A3 1Document4 pagesFinacc 6 A3 1200617No ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Depreciation and Deferred Taxes: 15.511 Corporate AccountingDocument4 pagesDepreciation and Deferred Taxes: 15.511 Corporate AccountingLu CasNo ratings yet

- TAXESDocument26 pagesTAXESPurchiaNo ratings yet

- IAS 12: Practice Questions AnswersDocument8 pagesIAS 12: Practice Questions AnswersTaffy Isheanesu BgoniNo ratings yet

- Accounting For Income Tax PROBLEMSDocument27 pagesAccounting For Income Tax PROBLEMSJhon baal S. SetNo ratings yet

- Lobrigas Unit6 AssessmentDocument4 pagesLobrigas Unit6 AssessmentClaudine LobrigasNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- Income Tax - TRAINDocument27 pagesIncome Tax - TRAINSteveNo ratings yet

- HI5020: Corporate Accounting Lecture 6bDocument23 pagesHI5020: Corporate Accounting Lecture 6bFeku RamNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxRyll BedasNo ratings yet

- Meet 11-Accounting For Income Taxes-DYP PDFDocument19 pagesMeet 11-Accounting For Income Taxes-DYP PDFRENDY FILIANGNo ratings yet

- ACC2001 Lecture 4Document53 pagesACC2001 Lecture 4michael krueseiNo ratings yet

- Income Tax Discussion PointsDocument156 pagesIncome Tax Discussion PointsRosemarie Mae DezaNo ratings yet

- Accounting For Income TaxesDocument16 pagesAccounting For Income TaxesMUNAWAR ALI100% (5)

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDNo ratings yet

- Chapter 11 TaxDocument11 pagesChapter 11 Taxkp_popinjNo ratings yet

- Chapt-12 Income Tax - CorporationsDocument8 pagesChapt-12 Income Tax - Corporationshumnarvios86% (7)

- Answers - Chapter 5 Vol 2Document5 pagesAnswers - Chapter 5 Vol 2jamfloxNo ratings yet

- Accounting For Income TaxDocument14 pagesAccounting For Income TaxJasmin Gubalane100% (1)

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- Chapter 4 - Income Taxes Problems Luzon CorporationDocument8 pagesChapter 4 - Income Taxes Problems Luzon CorporationJohanna Raissa CapadaNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- ACC-ACF2100 Lecture 2 HandoutDocument9 pagesACC-ACF2100 Lecture 2 HandoutDanNo ratings yet

- Income Taxes: ProblemsDocument12 pagesIncome Taxes: ProblemsCharles MateoNo ratings yet

- Finals Exam SolutionsDocument6 pagesFinals Exam SolutionsZhengzhou CalNo ratings yet

- Ias 12Document33 pagesIas 12samrawithagos2002No ratings yet

- Ch17 Problem 77 SM 2014e Final 012913Document2 pagesCh17 Problem 77 SM 2014e Final 012913testbankNo ratings yet

- Chapter 10Document4 pagesChapter 10Judith Salome Basquinas0% (1)

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- Estimated Salary For The Year (Document9 pagesEstimated Salary For The Year (Czarina Joy PenaNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- ASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&ADocument96 pagesASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&Agir botNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- HobDocument5 pagesHobcutieaikoNo ratings yet

- HOB SolutionsDocument5 pagesHOB SolutionscutieaikoNo ratings yet

- HOB SolutionsDocument5 pagesHOB SolutionscutieaikoNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesEpal Ako67% (3)

- Suggested Solutions Share Based Payment Compensation 5745 1Document1 pageSuggested Solutions Share Based Payment Compensation 5745 1cutieaikoNo ratings yet

- Tax 2Document11 pagesTax 2cutieaikoNo ratings yet

- Suggested Solutions Receivable Financing 1. A: "Weighted Average Time To Maturity"Document2 pagesSuggested Solutions Receivable Financing 1. A: "Weighted Average Time To Maturity"cutieaikoNo ratings yet

- HobDocument5 pagesHobcutieaikoNo ratings yet

- Formation & OperationDocument4 pagesFormation & OperationcutieaikoNo ratings yet

- Its Fair Value Less Costs To Sell (If Determinable) Its Value in Use (If Determinable) andDocument2 pagesIts Fair Value Less Costs To Sell (If Determinable) Its Value in Use (If Determinable) andcutieaikoNo ratings yet

- SqueezedDocument1 pageSqueezedcutieaikoNo ratings yet

- Suggested SolutionsDocument1 pageSuggested SolutionscutieaikoNo ratings yet

- Business Combination and Date of AcquisitionDocument3 pagesBusiness Combination and Date of AcquisitioncutieaikoNo ratings yet

- Suggested SolutionsDocument1 pageSuggested SolutionscutieaikoNo ratings yet

- Not Collectible Within The Normal Operating Cycle Hence Amount To Be Collected Beyond 12 Months Shall Be Classified As A Noncurrent ReceivableDocument1 pageNot Collectible Within The Normal Operating Cycle Hence Amount To Be Collected Beyond 12 Months Shall Be Classified As A Noncurrent ReceivablecutieaikoNo ratings yet

- Audit Evidence and Audit ProgramsDocument9 pagesAudit Evidence and Audit ProgramscutieaikoNo ratings yet

- Suggested SolutionsDocument1 pageSuggested SolutionscutieaikoNo ratings yet

- AttDocument8 pagesAttcutieaikoNo ratings yet

- Auditing Theory Quiz Final PrintDocument6 pagesAuditing Theory Quiz Final Printnda0403No ratings yet

- Avocado Production in The PhilippinesDocument20 pagesAvocado Production in The Philippinescutieaiko100% (1)

- 2005 - ACCTG 14-02 - Auditing ProblemsDocument5 pages2005 - ACCTG 14-02 - Auditing ProblemscutieaikoNo ratings yet

Suggested Solutions 5740 Deferred Income Tax 1

Suggested Solutions 5740 Deferred Income Tax 1

Uploaded by

cutieaikoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suggested Solutions 5740 Deferred Income Tax 1

Suggested Solutions 5740 Deferred Income Tax 1

Uploaded by

cutieaikoCopyright:

Available Formats

PAGE 1

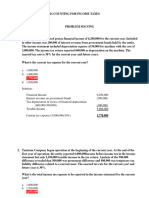

CPA REVIEW SCHOOL OF THE PHILIPPINES Manila PRACTICAL ACCOUNTING PROBLEMS I SUGGESTED SOLUTIONS 5740 DEFERRED INCOME TAX 1. Current tax expense (6,500,000 x 30%) Deferred tax liability (1,000,000 x 30%) Total tax expense (7,500,000 x 30%) Current tax expense (7,000,000 x 30%) Deferred tax liability (1,000,000 x 30%) Total tax expense (6,000,000 x 30%) Pretax accounting income Taxable temporary differences Deductible temporary difference Taxable income Tax rate Current tax expense or income tax payable Current tax expense (7M x 30%) Less: Income tax benefit (2M x 23%) Total tax expense Increase in deferred tax liability (900,000 600,000) Decrease in deferred tax asset Deferred tax expense Taxable temporary difference (2M 1.2M) Pretax financial income Non-taxable interest received (permanent difference) Financial income subject to tax Long term loss accrual in excess of deductible amount Tax depreciation in excess of financial depreciation Taxable income Current tax expense (7M x30%) Deferred tax asset (500,000 x 30%) Deferred tax liability (1,250,000 x 30%) Total tax expense 1,950,000 300,000 2,250,000 2,100,000 ( 300,000) 1,800,000 20,000,000 ( 3,000,000) 1,100,000 18,000,000 30% 5,400,000 2,100,000 500,000 1,600,000 300,000 150,000 450,000 800,000 8,000,000 ( 250,000) 7,750,000 500,000 (1,250,000) 7,000,000 2,100,000 ( 150,000) 375,000 2,325,000 B A B B B Prac. 1 Handouts

2.

3.

4.

5.

B C

6. 7.

--END--

5740

You might also like

- TaxDocument8 pagesTaxClaire BarrettoNo ratings yet

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document71 pagesChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Deferred TaxDocument6 pagesDeferred TaxJayson Manalo GañaNo ratings yet

- Ethiopia D3S4 Income TaxesDocument81 pagesEthiopia D3S4 Income TaxesyididiyayibNo ratings yet

- Difference Between Accounting Rules and Tax RulesDocument18 pagesDifference Between Accounting Rules and Tax RulesCezar Rishane Mae SaligueNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Financial Accounting 3A Assignment 2Document10 pagesFinancial Accounting 3A Assignment 2Mikaeel MohamedNo ratings yet

- Chapter 25 and 26Document10 pagesChapter 25 and 26Sittie Aisah AmpatuaNo ratings yet

- Advanced Financial Accounting IDocument21 pagesAdvanced Financial Accounting IAbdiNo ratings yet

- IAS#12Document31 pagesIAS#12Shah KamalNo ratings yet

- Accounting For Income Tax-NotesDocument4 pagesAccounting For Income Tax-NotesMaureen Derial PantaNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- VOL 2 16. Accounting For Income TaxationDocument15 pagesVOL 2 16. Accounting For Income TaxationdmangiginNo ratings yet

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- F7.1 Chap 15 - TaxationDocument33 pagesF7.1 Chap 15 - TaxationLê Đăng Cát NhậtNo ratings yet

- Taxation 100 Imp Questions 1642662172Document160 pagesTaxation 100 Imp Questions 1642662172riyatada16No ratings yet

- 2014 Volume 2 CH 5 AnswersDocument6 pages2014 Volume 2 CH 5 AnswersGirlie SisonNo ratings yet

- Practical Application of Taxation On CorporationsDocument5 pagesPractical Application of Taxation On CorporationsClaire BarbaNo ratings yet

- 2 Easy Questions - AnswersDocument9 pages2 Easy Questions - AnswersMarj AgustinNo ratings yet

- Finacc 6 A3 1Document4 pagesFinacc 6 A3 1200617No ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Depreciation and Deferred Taxes: 15.511 Corporate AccountingDocument4 pagesDepreciation and Deferred Taxes: 15.511 Corporate AccountingLu CasNo ratings yet

- TAXESDocument26 pagesTAXESPurchiaNo ratings yet

- IAS 12: Practice Questions AnswersDocument8 pagesIAS 12: Practice Questions AnswersTaffy Isheanesu BgoniNo ratings yet

- Accounting For Income Tax PROBLEMSDocument27 pagesAccounting For Income Tax PROBLEMSJhon baal S. SetNo ratings yet

- Lobrigas Unit6 AssessmentDocument4 pagesLobrigas Unit6 AssessmentClaudine LobrigasNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- Income Tax - TRAINDocument27 pagesIncome Tax - TRAINSteveNo ratings yet

- HI5020: Corporate Accounting Lecture 6bDocument23 pagesHI5020: Corporate Accounting Lecture 6bFeku RamNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxRyll BedasNo ratings yet

- Meet 11-Accounting For Income Taxes-DYP PDFDocument19 pagesMeet 11-Accounting For Income Taxes-DYP PDFRENDY FILIANGNo ratings yet

- ACC2001 Lecture 4Document53 pagesACC2001 Lecture 4michael krueseiNo ratings yet

- Income Tax Discussion PointsDocument156 pagesIncome Tax Discussion PointsRosemarie Mae DezaNo ratings yet

- Accounting For Income TaxesDocument16 pagesAccounting For Income TaxesMUNAWAR ALI100% (5)

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDNo ratings yet

- Chapter 11 TaxDocument11 pagesChapter 11 Taxkp_popinjNo ratings yet

- Chapt-12 Income Tax - CorporationsDocument8 pagesChapt-12 Income Tax - Corporationshumnarvios86% (7)

- Answers - Chapter 5 Vol 2Document5 pagesAnswers - Chapter 5 Vol 2jamfloxNo ratings yet

- Accounting For Income TaxDocument14 pagesAccounting For Income TaxJasmin Gubalane100% (1)

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- Chapter 4 - Income Taxes Problems Luzon CorporationDocument8 pagesChapter 4 - Income Taxes Problems Luzon CorporationJohanna Raissa CapadaNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- ACC-ACF2100 Lecture 2 HandoutDocument9 pagesACC-ACF2100 Lecture 2 HandoutDanNo ratings yet

- Income Taxes: ProblemsDocument12 pagesIncome Taxes: ProblemsCharles MateoNo ratings yet

- Finals Exam SolutionsDocument6 pagesFinals Exam SolutionsZhengzhou CalNo ratings yet

- Ias 12Document33 pagesIas 12samrawithagos2002No ratings yet

- Ch17 Problem 77 SM 2014e Final 012913Document2 pagesCh17 Problem 77 SM 2014e Final 012913testbankNo ratings yet

- Chapter 10Document4 pagesChapter 10Judith Salome Basquinas0% (1)

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- Estimated Salary For The Year (Document9 pagesEstimated Salary For The Year (Czarina Joy PenaNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- ASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&ADocument96 pagesASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&Agir botNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- HobDocument5 pagesHobcutieaikoNo ratings yet

- HOB SolutionsDocument5 pagesHOB SolutionscutieaikoNo ratings yet

- HOB SolutionsDocument5 pagesHOB SolutionscutieaikoNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesEpal Ako67% (3)

- Suggested Solutions Share Based Payment Compensation 5745 1Document1 pageSuggested Solutions Share Based Payment Compensation 5745 1cutieaikoNo ratings yet

- Tax 2Document11 pagesTax 2cutieaikoNo ratings yet

- Suggested Solutions Receivable Financing 1. A: "Weighted Average Time To Maturity"Document2 pagesSuggested Solutions Receivable Financing 1. A: "Weighted Average Time To Maturity"cutieaikoNo ratings yet

- HobDocument5 pagesHobcutieaikoNo ratings yet

- Formation & OperationDocument4 pagesFormation & OperationcutieaikoNo ratings yet

- Its Fair Value Less Costs To Sell (If Determinable) Its Value in Use (If Determinable) andDocument2 pagesIts Fair Value Less Costs To Sell (If Determinable) Its Value in Use (If Determinable) andcutieaikoNo ratings yet

- SqueezedDocument1 pageSqueezedcutieaikoNo ratings yet

- Suggested SolutionsDocument1 pageSuggested SolutionscutieaikoNo ratings yet

- Business Combination and Date of AcquisitionDocument3 pagesBusiness Combination and Date of AcquisitioncutieaikoNo ratings yet

- Suggested SolutionsDocument1 pageSuggested SolutionscutieaikoNo ratings yet

- Not Collectible Within The Normal Operating Cycle Hence Amount To Be Collected Beyond 12 Months Shall Be Classified As A Noncurrent ReceivableDocument1 pageNot Collectible Within The Normal Operating Cycle Hence Amount To Be Collected Beyond 12 Months Shall Be Classified As A Noncurrent ReceivablecutieaikoNo ratings yet

- Audit Evidence and Audit ProgramsDocument9 pagesAudit Evidence and Audit ProgramscutieaikoNo ratings yet

- Suggested SolutionsDocument1 pageSuggested SolutionscutieaikoNo ratings yet

- AttDocument8 pagesAttcutieaikoNo ratings yet

- Auditing Theory Quiz Final PrintDocument6 pagesAuditing Theory Quiz Final Printnda0403No ratings yet

- Avocado Production in The PhilippinesDocument20 pagesAvocado Production in The Philippinescutieaiko100% (1)

- 2005 - ACCTG 14-02 - Auditing ProblemsDocument5 pages2005 - ACCTG 14-02 - Auditing ProblemscutieaikoNo ratings yet