Professional Documents

Culture Documents

LD1495 Incidence REPORT

LD1495 Incidence REPORT

Uploaded by

Melinda JoyceOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LD1495 Incidence REPORT

LD1495 Incidence REPORT

Uploaded by

Melinda JoyceCopyright:

Available Formats

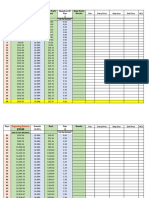

Maine Resident Income Tax in 2010, LD 1495

Current law Proposed law

Individual Tax Individual Tax Change in Tax Percent Families Tax Average Families Tax Average Families with

Tax Liability Percentage Liability Percentage Liability Tax with Tax Decrease Tax with Tax Increase Tax Tax Increase

Expanded Income Families ($ MIL) Distribution ($ MIL) Distribution ($ MIL) Change Decrease ($ MIL) Decrease Increase ($ MIL) Increase (percent)

-$ Infinity <= 13342 133,133 $3.412 0.3% -$7.511 -0.6% -$10.923 -320.2% 132,930 -$10.925 -$82.2 203 $0.002 $10.0 0.2%

13342 <= 19046 66,585 $4.855 0.4% -$1.506 -0.1% -$6.362 -131.0% 66,338 -$6.366 -$96.0 247 $0.004 $17.5 0.4%

19046 <= 25325 66,534 $10.606 0.8% $4.616 0.4% -$5.990 -56.5% 66,200 -$6.003 -$90.7 322 $0.013 $40.8 0.5%

25325 <= 32834 66,562 $29.340 2.3% $21.297 1.8% -$8.043 -27.4% 65,846 -$8.150 -$123.8 696 $0.107 $153.8 1.0%

32834 <= 44385 66,565 $49.568 3.8% $40.866 3.5% -$8.702 -17.6% 64,574 -$9.210 -$142.6 1,987 $0.508 $255.8 3.0%

44385 <= 58705 66,562 $91.909 7.1% $82.253 7.0% -$9.656 -10.5% 63,035 -$10.953 -$173.8 3,521 $1.297 $368.3 5.3%

58705 <= 79287 66,563 $138.401 10.7% $127.499 10.8% -$10.902 -7.9% 61,923 -$13.035 -$210.5 4,632 $2.133 $460.5 7.0%

79287 <= 114104 66,564 $244.094 18.9% $230.860 19.6% -$13.234 -5.4% 59,879 -$17.237 -$287.9 6,685 $4.002 $598.7 10.0%

114104 <= $ Infinity 66,561 $716.640 55.6% $678.707 57.7% -$37.933 -5.3% 53,590 -$58.688 -$1,095.1 12,885 $20.755 $1,610.8 19.4%

Totals 665,629 $1,288.825 100.0% $1,177.081 100.0% -$111.745 -8.7% 634,315 -$140.567 -$221.6 31,178 $28.822 $924.4 4.7%

Top Decile Decomposition: 90-95, 95-99, and 99+ :

114104 <= 152267 33,280 $190.258 14.8% $183.759 15.6% -$6.499 -3.4% 27,951 -$11.034 -$394.8 5,324 $4.535 $851.8 16.0%

152267 <= 333388 26,625 $265.445 20.6% $259.015 22.0% -$6.430 -2.4% 20,278 -$15.021 -$740.8 6,322 $8.591 $1,359.0 23.7%

333388 <= $ Infinity 6,656 $260.937 20.2% $235.933 20.0% -$25.004 -9.6% 5,362 -$32.634 -$6,085.9 1,240 $7.629 $6,152.3 18.6%

Maine Revenue Services

Economic Research Division

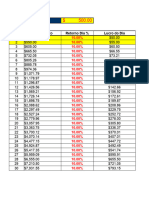

Maine Resident Sales Tax, Fiscal Year 2010, LD 1495

Current law Proposed law

Sales Tax Sales Tax Change in Tax Percent Families Tax Average

Tax Liability Percentage Liability Percentage Liability Tax with Tax Increase Tax

Expanded Income Families ($ MIL) Distribution ($ MIL) Distribution ($ MIL) Change Increase ($ MIL) Increase

-$ Infinity <= 13342 133,133 $38.485 5.3% $41.077 5.2% $2.592 6.7% 106,618 $2.592 $24.3

13342 <= 19046 66,585 $26.677 3.6% $28.535 3.6% $1.857 7.0% 52,683 $1.857 $35.3

19046 <= 25325 66,534 $35.011 4.8% $37.401 4.7% $2.391 6.8% 56,455 $2.391 $42.3

25325 <= 32834 66,562 $53.643 7.3% $57.476 7.3% $3.833 7.1% 62,851 $3.833 $61.0

32834 <= 44385 66,565 $63.462 8.7% $68.437 8.7% $4.975 7.8% 65,125 $4.975 $76.4

44385 <= 58705 66,562 $75.548 10.3% $81.766 10.3% $6.218 8.2% 65,796 $6.218 $94.5

58705 <= 79287 66,563 $87.678 12.0% $94.792 12.0% $7.114 8.1% 66,285 $7.114 $107.3

79287 <= 114104 66,564 $105.242 14.4% $113.929 14.4% $8.687 8.3% 66,564 $8.687 $130.5

114104 <= $ Infinity 66,561 $246.927 33.7% $267.108 33.8% $20.181 8.2% 66,561 $20.181 $303.2

Totals 665,629 $732.673 100.0% $790.520 100.0% $57.848 7.9% 608,937 $57.848 $95.0

Top Decile Decomposition: 90-95, 95-99, and 99+ :

114104 <= 152267 33,280 $75.068 10.2% $81.140 10.3% $6.073 8.1% 33,280 $6.073 $182.5

152267 <= 333388 26,625 $94.299 12.9% $101.968 12.9% $7.669 8.1% 26,625 $7.669 $288.0

333388 <= $ Infinity 6,656 $77.561 10.6% $84.001 10.6% $6.440 8.3% 6,656 $6.440 $967.6

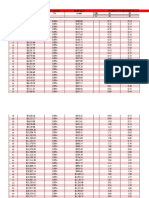

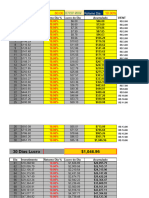

Combined Incidence (Income and Sales and Use Tax) 2010, LD 1495

Incidence analysis combines FY 2010 sales tax proposal and calendar year 2010 income tax proposal

Current law Proposed law

Tax Tax Change inTax Percent Families Tax Average Families Tax Average Families with

Tax Liability Percentage Liability Percentage Liability Tax with Tax Decrease Tax with Tax Increase Tax Tax Increase

Expanded Income Families ($ MIL) Distribution ($ MIL) Distribution ($ MIL) Change Decrease ($ MIL) Decrease Increase ($ MIL) Increase (percent)

-$ Infinity <= 13342 133,133 $41.897 2.1% $33.566 1.7% -$8.331 -19.9% 132,192 -$8.358 -$63.2 941 $0.027 $28.2 0.7%

13342 <= 19046 66,585 $31.533 1.6% $27.029 1.4% -$4.504 -14.3% 65,716 -$4.529 -$68.9 870 $0.025 $28.2 1.3%

19046 <= 25325 66,534 $45.617 2.3% $42.017 2.1% -$3.599 -7.9% 63,602 -$3.660 -$57.6 2,932 $0.061 $20.8 4.4%

25325 <= 32834 66,562 $82.982 4.1% $78.773 4.0% -$4.209 -5.1% 61,390 -$4.432 -$72.2 5,171 $0.223 $43.0 7.8%

32834 <= 44385 66,565 $113.030 5.6% $109.303 5.6% -$3.727 -3.3% 55,313 -$4.627 -$83.6 11,252 $0.900 $80.0 16.9%

44385 <= 58705 66,562 $167.457 8.3% $164.018 8.3% -$3.439 -2.1% 53,301 -$5.373 -$100.8 13,260 $1.934 $145.9 19.9%

58705 <= 79287 66,563 $226.079 11.2% $222.291 11.3% -$3.788 -1.7% 52,501 -$6.810 -$129.7 14,062 $3.022 $214.9 21.1%

79287 <= 114104 66,564 $349.337 17.3% $344.789 17.5% -$4.548 -1.3% 51,083 -$9.937 -$194.5 15,481 $5.389 $348.1 23.3%

114104 <= $ Infinity 66,561 $963.567 47.7% $945.816 48.1% -$17.752 -1.8% 44,781 -$43.828 -$978.7 21,780 $26.076 $1,197.2 32.7%

Totals (2) 665,629 $2,021.498 100.0% $1,967.601 100.0% -$53.897 -2.7% 579,879 -$91.553 -$157.9 85,750 $37.656 $439.1 12.9%

Top Decile Decomposition: 90-95, 95-99, and 99+ :

114104 <= 152267 33,280 $265.326 13.1% $264.899 13.5% -$0.426 -0.2% 23,504 -$6.282 -$267.3 9,776 $5.855 $598.9 29.4%

152267 <= 333388 26,625 $359.744 17.8% $360.983 18.3% $1.239 0.3% 16,821 -$9.745 -$579.4 9,804 $10.985 $1,120.4 36.8%

333388 <= $ Infinity 6,656 $338.498 16.7% $319.933 16.3% -$18.565 -5.5% (1) 4,456 -$27.800 -$6,238.3 2,199 $9.236 $4,199.6 33.0%

Maine Revenue Services

Economic Research Division TAXPAYERS ABOVE (1) 4,456 -$27.800

TOTAL TAXPAYERS (2) 665,629 -$53.897

PERCENTAGE OF TAOTAL 0.67% 51.58%

You might also like

- Wakeland Community Hospital Statement of Operations For The Years Ended December 31, 20X1 and 20X0 (In Thousands) Particulars RevenuesDocument10 pagesWakeland Community Hospital Statement of Operations For The Years Ended December 31, 20X1 and 20X0 (In Thousands) Particulars Revenuesmohitgaba19100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Vedantu - June 2019Document1 pageVedantu - June 2019VikashNo ratings yet

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- MRS Tax Incidence Report 2013Document4 pagesMRS Tax Incidence Report 2013Melinda JoyceNo ratings yet

- Mrs Incidence Report 2011Document2 pagesMrs Incidence Report 2011Melinda JoyceNo ratings yet

- Investimento: Dia Investimento Retorno Dia % Lucro Do DiaDocument44 pagesInvestimento: Dia Investimento Retorno Dia % Lucro Do DiaDarcy LucateliNo ratings yet

- St. Louis Residential Real Estate Statistics For The Week of April 12, 2011Document1 pageSt. Louis Residential Real Estate Statistics For The Week of April 12, 2011Russell NoltingNo ratings yet

- 03 Juros CompostosDocument12 pages03 Juros CompostosVENHAN PARA O MUNDO PES.No ratings yet

- Segue O Plano: InvestimentoDocument12 pagesSegue O Plano: InvestimentoRicardo SouzaNo ratings yet

- Book 1Document3 pagesBook 1Reymark BaldoNo ratings yet

- GERENCIAMENTODocument15 pagesGERENCIAMENTOsued monteiroNo ratings yet

- Trabajo 2Document2 pagesTrabajo 22021 Eco AHUATZIN ALCANTARA MIRANDANo ratings yet

- Genzyme DCF PDFDocument5 pagesGenzyme DCF PDFAbinashNo ratings yet

- St. Louis Residential Real Estate Total Market Overview - May 9, 2011Document1 pageSt. Louis Residential Real Estate Total Market Overview - May 9, 2011Russell NoltingNo ratings yet

- Sales Funnel ANALYSIS EXAMPLE.Document19 pagesSales Funnel ANALYSIS EXAMPLE.VINENNo ratings yet

- Taller Nivel LogisticoDocument7 pagesTaller Nivel LogisticoJose BARRAGAN REYESNo ratings yet

- Taller Nivel LogisticoDocument7 pagesTaller Nivel LogisticoJose BARRAGAN REYESNo ratings yet

- Revenues % Growth Operating Income Oper. Margin % Shares Outstanding Shares RepurchasedDocument7 pagesRevenues % Growth Operating Income Oper. Margin % Shares Outstanding Shares RepurchasedAaron FosterNo ratings yet

- Gerenciamento Completo Blaze Alunos Do MasterDocument12 pagesGerenciamento Completo Blaze Alunos Do MasterMauzi 777No ratings yet

- Colombia BrasilDocument3 pagesColombia BrasilBryanCamiloChiquizaNo ratings yet

- Gerenciamento Do BraboDocument8 pagesGerenciamento Do Brabocareca baixada santistaNo ratings yet

- Common Size Income StatementDocument7 pagesCommon Size Income StatementUSD 654No ratings yet

- Trabajo Final de Ingeniería EconomicaDocument30 pagesTrabajo Final de Ingeniería EconomicaSergio HernandezNo ratings yet

- NWMLS September ReportDocument3 pagesNWMLS September ReportNeal McNamaraNo ratings yet

- IndicesDocument2 pagesIndicesSofia GrinbergNo ratings yet

- FbricadeSalarios Gerenciamento1Document12 pagesFbricadeSalarios Gerenciamento1Vitor BrasilNo ratings yet

- TTP 90 Day Freedom PlanDocument4 pagesTTP 90 Day Freedom PlanRuweida OsmanNo ratings yet

- Coin T2 Purchase Price T1 Stop LossDocument6 pagesCoin T2 Purchase Price T1 Stop LossTai NguyenNo ratings yet

- Planilha GerencimentoDocument456 pagesPlanilha GerencimentoManoel Fernandes Da Silva FilhoNo ratings yet

- ABNB ValuationDocument4 pagesABNB ValuationKasturi MazumdarNo ratings yet

- Ej 2 HWDocument2 pagesEj 2 HWSofia GrinbergNo ratings yet

- Money ManagementDocument13 pagesMoney ManagementMarchie VictorNo ratings yet

- Planilha de Gerenciamento Agressivo (10 - Ao Dia) God TraderDocument2 pagesPlanilha de Gerenciamento Agressivo (10 - Ao Dia) God TraderTrader RonaldoNo ratings yet

- Optional Problem (Retirement Planning)Document1 pageOptional Problem (Retirement Planning)Rushil SurapaneniNo ratings yet

- Ubat CompoundingDocument10 pagesUbat Compoundingmohd zaimNo ratings yet

- Dórea - Gerenciamento de Risco IqDocument172 pagesDórea - Gerenciamento de Risco IqFernanda CorreiaNo ratings yet

- Planilha Gerenciamento AtualDocument12 pagesPlanilha Gerenciamento AtualLaísa SantosNo ratings yet

- Banca: Dia Banca Retorno Dia % Lucro Do DiaDocument13 pagesBanca: Dia Banca Retorno Dia % Lucro Do DiaRodrigo VictórioNo ratings yet

- 03-Juros CompostosDocument24 pages03-Juros CompostosVENHAN PARA O MUNDO PES.No ratings yet

- Crystall BallDocument15 pagesCrystall BallBISHAL AdhikariNo ratings yet

- Leo Projeto CompletoDocument30 pagesLeo Projeto CompletoJadson FernandoNo ratings yet

- Gerenciamento de Juros CompostoDocument8 pagesGerenciamento de Juros Compostoernandyoriel54321No ratings yet

- Compound Growth ChartDocument13 pagesCompound Growth Chartpepe_rozyNo ratings yet

- Gerenciamento Juros CompostoDocument8 pagesGerenciamento Juros CompostobrancopelisonkNo ratings yet

- Planilha-Bruninho - 2Document6 pagesPlanilha-Bruninho - 2palmeiras199920202021mdmNo ratings yet

- MS18110513 Actv. 5Document3 pagesMS18110513 Actv. 5osvaNo ratings yet

- Informatica ActividadesDocument74 pagesInformatica ActividadesEmily AnguayaNo ratings yet

- Secret Technic Compounding JagoDocument17 pagesSecret Technic Compounding JagoArif KurniawanNo ratings yet

- VCF June Improving Margin at Retail - Public VersionDocument23 pagesVCF June Improving Margin at Retail - Public VersionLightship PartnersNo ratings yet

- Gerenciamento Com 60Document9 pagesGerenciamento Com 60VENHAN PARA O MUNDO PES.No ratings yet

- Gerenciamento Com 60Document9 pagesGerenciamento Com 60VENHAN PARA O MUNDO PES.No ratings yet

- 90 Day Trade - MASTERDocument54 pages90 Day Trade - MASTERLauren Gerlaine Reliford100% (1)

- Gere Nci Amen ToDocument15 pagesGere Nci Amen ToDroop ShopNo ratings yet

- Gerenciamento de Juros CompostoDocument9 pagesGerenciamento de Juros CompostoGeneral KamikaziNo ratings yet

- UST Debt Policy Spreadsheet (Reduced)Document9 pagesUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonNo ratings yet

- BNI 111709 v2Document2 pagesBNI 111709 v2fcfroicNo ratings yet

- Lady M Exercises-3Document6 pagesLady M Exercises-3MOHIT MARHATTANo ratings yet

- Netflix Financial StatementsDocument2 pagesNetflix Financial StatementsGoutham RaoNo ratings yet

- 03-JUROS COMPOSTOS PlanilhaDocument12 pages03-JUROS COMPOSTOS Planilhapsidaniela.viegasNo ratings yet

- Gerenciamento de Risco 2-3Document16 pagesGerenciamento de Risco 2-3JOHN WALKERNo ratings yet

- REP 326 TABLERO INDICADORES TIENDA Reporte PDFDocument2 pagesREP 326 TABLERO INDICADORES TIENDA Reporte PDFAlexis Martinez CazaresNo ratings yet

- Mrs Incidence Report 2011Document2 pagesMrs Incidence Report 2011Melinda JoyceNo ratings yet

- Governor Tax Plan 2-27-15 RDocument11 pagesGovernor Tax Plan 2-27-15 RMelinda JoyceNo ratings yet

- NO On One - Website-ResponseDocument6 pagesNO On One - Website-ResponseMelinda JoyceNo ratings yet

- LD 1495 "Tax Reform" The Real Facts: Albert A. Dimillo, Jr. Retired Corp Orate Tax Director & CpaDocument30 pagesLD 1495 "Tax Reform" The Real Facts: Albert A. Dimillo, Jr. Retired Corp Orate Tax Director & CpaMelinda JoyceNo ratings yet

- MRS Tax Incidence Report 2013Document4 pagesMRS Tax Incidence Report 2013Melinda JoyceNo ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- Ca Final DT (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalDocument5 pagesCa Final DT (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalROHIT JAIN100% (1)

- FRBM A AS T F D: CT-TEP Owards Iscal IsciplineDocument5 pagesFRBM A AS T F D: CT-TEP Owards Iscal IsciplineRajkumarNo ratings yet

- Tax Invoice: Jai Bajrang EnterprisesDocument1 pageTax Invoice: Jai Bajrang Enterpriseskundan kumarNo ratings yet

- G.R. No. 175108Document5 pagesG.R. No. 175108r12assocmoderator.nfjpia2324No ratings yet

- Income Tax Deduction TableDocument19 pagesIncome Tax Deduction TablekeronsNo ratings yet

- Multi BillDocument4 pagesMulti BillghareebNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- Capital Budgeting PowerpointDocument15 pagesCapital Budgeting PowerpointAlisa Gabriela Sioco OrdasNo ratings yet

- Ias 19 - Employee Benefits Lecture 1Document14 pagesIas 19 - Employee Benefits Lecture 1NqubekoNo ratings yet

- Organization For Labor Cost Accounting and ControlDocument22 pagesOrganization For Labor Cost Accounting and ControlPatrick LanceNo ratings yet

- Compilation of ExercisesDocument15 pagesCompilation of ExercisesHazel MoradaNo ratings yet

- Sd1011: SD Taxes V 1.0: India Sap Coe, Slide 1Document57 pagesSd1011: SD Taxes V 1.0: India Sap Coe, Slide 1SUSMITANo ratings yet

- GST Update 14.10.2017Document35 pagesGST Update 14.10.2017dipaliNo ratings yet

- Leave Letter 6Document6 pagesLeave Letter 6Sudeep CNNo ratings yet

- GST Economics ProjectDocument11 pagesGST Economics ProjectAbeer ChawlaNo ratings yet

- Vicariato of Sto. Nino de Tondo: Cash and Cash Equivalent P Trade and Other Receivables, Net PDocument5 pagesVicariato of Sto. Nino de Tondo: Cash and Cash Equivalent P Trade and Other Receivables, Net PEdgardo Pajo CulturaNo ratings yet

- Raju and Tarsem Raw CompensationDocument2 pagesRaju and Tarsem Raw Compensationhp so laggingNo ratings yet

- Invoice New EssenttialsDocument2 pagesInvoice New EssenttialsFocus FinderzzNo ratings yet

- Edited SkullcandyDocument1 pageEdited SkullcandyOom OomNo ratings yet

- Cost To The CompanyDocument15 pagesCost To The CompanyrockNo ratings yet

- Sales Tax Special Procedure (Withholding) Rules, PDFDocument6 pagesSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasNo ratings yet

- Lecture Topic 1 General Principles of Taxation and Income TaxDocument24 pagesLecture Topic 1 General Principles of Taxation and Income TaxJANNA TRICIA NACIONALNo ratings yet

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held bySumanthNo ratings yet

- Webinar On How To Deal With Open Cases in The BirDocument25 pagesWebinar On How To Deal With Open Cases in The BirkirkoNo ratings yet

- Attachmentu0sview Att&th 17dcdf85a9a7dc52&attid 0 1&disp Attd&safe 1&zw&saddbDocument1 pageAttachmentu0sview Att&th 17dcdf85a9a7dc52&attid 0 1&disp Attd&safe 1&zw&saddbKumar PushpeshNo ratings yet

- BillFor8 2016Document4 pagesBillFor8 2016Vigneshwaran P VijeyakumarNo ratings yet

- Cost of Acquisition - IBREL - IIPL DemergerDocument2 pagesCost of Acquisition - IBREL - IIPL DemergerSharad RankhambNo ratings yet