Professional Documents

Culture Documents

Cash Flow Analysis

Cash Flow Analysis

Uploaded by

caniinvest01Copyright:

Available Formats

You might also like

- Convertible Bond - Term Sheet: SAMPLE - For Reference OnlyDocument3 pagesConvertible Bond - Term Sheet: SAMPLE - For Reference OnlyGKNo ratings yet

- Securitisation in Ireland ExaminationDocument12 pagesSecuritisation in Ireland ExaminationConor Hogan60% (5)

- Buy Vs Rent Analysis For NYC Co-OpDocument9 pagesBuy Vs Rent Analysis For NYC Co-OpJordan BeeberNo ratings yet

- 8 Get Your Finances & Credit in OrderDocument15 pages8 Get Your Finances & Credit in OrdercropdownunderNo ratings yet

- Mortgage Bond - ProspectusDocument48 pagesMortgage Bond - ProspectusfaiyazadamNo ratings yet

- Monthly Summary of Mortgage Activities For The Period Ending April 2019Document17 pagesMonthly Summary of Mortgage Activities For The Period Ending April 2019Nico Gillo ObejeroNo ratings yet

- A Guide To The Initial Public Offering ProcessDocument12 pagesA Guide To The Initial Public Offering Processaparjain3No ratings yet

- Home LoansDocument56 pagesHome LoansabhiNo ratings yet

- Mode of SecurityDocument5 pagesMode of SecurityFazle MahmudNo ratings yet

- Starter Homes Investing Blueprint: Created by Mark WaltersDocument10 pagesStarter Homes Investing Blueprint: Created by Mark WaltersEaton GoodeNo ratings yet

- NRIA Summary C D Order 6-21-2022Document63 pagesNRIA Summary C D Order 6-21-2022RSNo ratings yet

- Loot - Convertible Picus Countersigned PDFDocument10 pagesLoot - Convertible Picus Countersigned PDFPaul LangemeyerNo ratings yet

- Issue and Redemption of Long-Term LiabilitiesDocument22 pagesIssue and Redemption of Long-Term Liabilitiesabbyplexx100% (1)

- Standard Chartered Wealth Management PackDocument35 pagesStandard Chartered Wealth Management PackAnura BirdNo ratings yet

- Banking FinanceDocument9 pagesBanking FinanceAstik TripathiNo ratings yet

- Fin DomDocument111 pagesFin DomRohit PanigrahiNo ratings yet

- Net Lease Tenant ProfilesDocument82 pagesNet Lease Tenant ProfilesnetleaseNo ratings yet

- Final - Real Estate Exchange Traded FundsDocument12 pagesFinal - Real Estate Exchange Traded FundsUrvisha Mistry100% (1)

- ChelseaFund - TermSheet - May 10-VMADocument2 pagesChelseaFund - TermSheet - May 10-VMAMarius AngaraNo ratings yet

- Bond Pricing, Yield Measures and Total Return (2) .Document42 pagesBond Pricing, Yield Measures and Total Return (2) .Josua PranataNo ratings yet

- Chapter 1 - Investments: Background and IssuesDocument61 pagesChapter 1 - Investments: Background and IssuesMadhan RajNo ratings yet

- Seller-Financed Real EstateDocument20 pagesSeller-Financed Real EstateMarvellous YeezorNo ratings yet

- Special Contracts: 1. Delivery of Goods - It MayDocument8 pagesSpecial Contracts: 1. Delivery of Goods - It MayHarsh Gupta100% (1)

- Kyc Individual FormDocument21 pagesKyc Individual FormNino NinosNo ratings yet

- RepoDocument7 pagesRepoMonil VisariyaNo ratings yet

- AIG Private Equity 2007 Annual ReportDocument70 pagesAIG Private Equity 2007 Annual ReportAsiaBuyoutsNo ratings yet

- Chapter 3 Analysing Financing ActivitiesDocument35 pagesChapter 3 Analysing Financing ActivitiesGRACE CHANNo ratings yet

- (Contractor Name, Complete Address Including ZIP Code and Legal Title) (Surety Name and Complete Address Including ZIP Code)Document3 pages(Contractor Name, Complete Address Including ZIP Code and Legal Title) (Surety Name and Complete Address Including ZIP Code)HR LEGOLANDNo ratings yet

- 1 (Rev) Corporate GovernanceDocument16 pages1 (Rev) Corporate GovernanceSourav SenNo ratings yet

- BCRED Overview PresentationDocument27 pagesBCRED Overview Presentation2jjnvwdmxpNo ratings yet

- Types of CDOsDocument9 pagesTypes of CDOsKeval ShahNo ratings yet

- Offering MemorandumDocument115 pagesOffering MemorandumMigle Bloom100% (1)

- Commercial Connections: The Signature Series IssueDocument12 pagesCommercial Connections: The Signature Series IssueNational Association of REALTORS®No ratings yet

- Fidelity Real Estate Investment PortfolioDocument5 pagesFidelity Real Estate Investment PortfolioMaryna BolotskaNo ratings yet

- Insurance Bad Faith ClaimsDocument6 pagesInsurance Bad Faith ClaimsBelly OrsaNo ratings yet

- Realestate Firpta Us White PaperDocument20 pagesRealestate Firpta Us White PaperRoad AmmonsNo ratings yet

- Memo Model Netting ActDocument12 pagesMemo Model Netting ActChristine LiuNo ratings yet

- What Is The Business Transfer Tax For Intangible Assets?Document3 pagesWhat Is The Business Transfer Tax For Intangible Assets?sninaricaNo ratings yet

- Confidential Private Placement Memorandum: (For Private Circulation Only)Document48 pagesConfidential Private Placement Memorandum: (For Private Circulation Only)Pratim MajumderNo ratings yet

- Business Law Presentation FINALDocument24 pagesBusiness Law Presentation FINALNur Liyana Izzati Roslan100% (1)

- Canada-Net Pay CalculationsDocument20 pagesCanada-Net Pay CalculationsShaik ShafiNo ratings yet

- Duke Energy PremierNotes ProspectusDocument37 pagesDuke Energy PremierNotes ProspectusshoppingonlyNo ratings yet

- Capital Raising Regulation D SEC Vladimir IvanovDocument11 pagesCapital Raising Regulation D SEC Vladimir IvanovCrowdfundInsiderNo ratings yet

- Tax EquityDocument105 pagesTax EquityTran LyNo ratings yet

- Lo Property Book Final New 2013Document118 pagesLo Property Book Final New 2013Jen TanNo ratings yet

- MORB - 05 - of - 16 - Trust and Investment ManagementDocument55 pagesMORB - 05 - of - 16 - Trust and Investment ManagementMichael AlinaoNo ratings yet

- Placement Memorandum of CPR Investors, LLC - Final Investor Package (Nov. 27, 2019)Document225 pagesPlacement Memorandum of CPR Investors, LLC - Final Investor Package (Nov. 27, 2019)safe tradeNo ratings yet

- PDF 3. Investec - PPM (August 12 2021)Document197 pagesPDF 3. Investec - PPM (August 12 2021)AJNo ratings yet

- Non Life Insurance Companies & Life Insurance CompaniesDocument38 pagesNon Life Insurance Companies & Life Insurance CompaniesSyedFaisalHasanShahNo ratings yet

- Example Gift AgreementDocument2 pagesExample Gift AgreementRebel SaffoldNo ratings yet

- Mortgage Brokers AustraliaDocument4 pagesMortgage Brokers AustraliaChrisNo ratings yet

- Debt, NPV, Interest Rate, Loans, Bonds, ArbitrageDocument68 pagesDebt, NPV, Interest Rate, Loans, Bonds, ArbitrageGagAnasNo ratings yet

- The Book of Jargon - Project FinanceDocument108 pagesThe Book of Jargon - Project FinanceLukas PodolskengNo ratings yet

- 03 - LLMIT CH 3 Feb 08 PDFDocument20 pages03 - LLMIT CH 3 Feb 08 PDFPradyut TiwariNo ratings yet

- Unsecured PNDocument4 pagesUnsecured PNDoctrine ChurchNo ratings yet

- Comparing The Agreements For Landry'sDocument80 pagesComparing The Agreements For Landry'sDealBookNo ratings yet

- 000 Peru LNG IPO ProspectusDocument231 pages000 Peru LNG IPO ProspectusniezhenggangNo ratings yet

- Treasury Operations In Turkey and Contemporary Sovereign Treasury ManagementFrom EverandTreasury Operations In Turkey and Contemporary Sovereign Treasury ManagementNo ratings yet

Cash Flow Analysis

Cash Flow Analysis

Uploaded by

caniinvest01Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Analysis

Cash Flow Analysis

Uploaded by

caniinvest01Copyright:

Available Formats

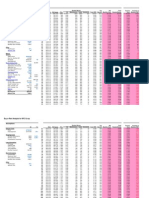

Cash Flow Analysis Unit 2105, 87 Berry St North Sydney NSW 2060

A. Purchase Price B. Settlement Costs: Govt. Stamp Duty Legal Fees (Solicitor/Conveyance fee) Building Inspection Pest Inspection Title search Buyer's Agent Fees NSW

$ $ $ $ $ $ $

565,000 20,915 950 100 100 -

Purchase

Loan Amount LVR % Interest rate % Loan

430,000 76% 6.15%

C. Loan Costs: Lender's Mortgage Insurance (LMI) $ Loan Application fees $ Other Loan costs (bank valuation, registration of mortgage, $ etc) D. Renovations:

650 200

Renovations

Internal Renovations (if any) External Renovations (if any)

$ $

2,500 500

Dr Total Purchase Price Paid by: Loan Amount Your Deposit Settlement Costs Loan Costs Renovations $

Cr 590,915

Funding

76% $ 24% $ $ $ $ $

430,000 135,000 22,065 850 3,000 590,915 $ 590,915 160,915 625 2,708 32,500 48 6.60%

Your Initial Cash Outlay Rent per Week ~ Rent Per month ~ Rent per Annum Occupancy Factor Property management fees %

Rental

$ $

Inflow + Rent Receivable - Interest Payable - Council rates - Water rates - Strata Levies (Body corporate) - Landlord Insurance - Building & Contents Insurance - Property management fees - Repairs & Maintenance (roughly per year) - Yearly Pest treatment $ 30,000 $ $ $ $ $ $ $ $ $

Outflow 26,445 1,100 640 3,000 700 1,980 300 -

Accountant's Fees Legal Fees Stationary, Phone & postage Travel expenses Annual tenancy renewal fees Sum Total Profit/Loss (Before Tax) $ 30,000

$ $ $ $ $ $

100 50 100 34,415

-4,415

Profit/Loss (Before Tax) Depreciation (Non-CF Loss) Final Transaction Summary Other Deductibles (Reno & Loan costs) P&L (for Tax) Tax Credits Profit/Loss (After Tax) Cash Flows weekly monthly per annum Growth * Estimated suburb growth rate (per annum) Estimated Return (per annum)

-4,415 -10,875 -770 -16,060 5,942 1,527 Befor Tax -85 -368 -4,415 After Tax 29 127 1,527

11.00% 62,150

You might also like

- Convertible Bond - Term Sheet: SAMPLE - For Reference OnlyDocument3 pagesConvertible Bond - Term Sheet: SAMPLE - For Reference OnlyGKNo ratings yet

- Securitisation in Ireland ExaminationDocument12 pagesSecuritisation in Ireland ExaminationConor Hogan60% (5)

- Buy Vs Rent Analysis For NYC Co-OpDocument9 pagesBuy Vs Rent Analysis For NYC Co-OpJordan BeeberNo ratings yet

- 8 Get Your Finances & Credit in OrderDocument15 pages8 Get Your Finances & Credit in OrdercropdownunderNo ratings yet

- Mortgage Bond - ProspectusDocument48 pagesMortgage Bond - ProspectusfaiyazadamNo ratings yet

- Monthly Summary of Mortgage Activities For The Period Ending April 2019Document17 pagesMonthly Summary of Mortgage Activities For The Period Ending April 2019Nico Gillo ObejeroNo ratings yet

- A Guide To The Initial Public Offering ProcessDocument12 pagesA Guide To The Initial Public Offering Processaparjain3No ratings yet

- Home LoansDocument56 pagesHome LoansabhiNo ratings yet

- Mode of SecurityDocument5 pagesMode of SecurityFazle MahmudNo ratings yet

- Starter Homes Investing Blueprint: Created by Mark WaltersDocument10 pagesStarter Homes Investing Blueprint: Created by Mark WaltersEaton GoodeNo ratings yet

- NRIA Summary C D Order 6-21-2022Document63 pagesNRIA Summary C D Order 6-21-2022RSNo ratings yet

- Loot - Convertible Picus Countersigned PDFDocument10 pagesLoot - Convertible Picus Countersigned PDFPaul LangemeyerNo ratings yet

- Issue and Redemption of Long-Term LiabilitiesDocument22 pagesIssue and Redemption of Long-Term Liabilitiesabbyplexx100% (1)

- Standard Chartered Wealth Management PackDocument35 pagesStandard Chartered Wealth Management PackAnura BirdNo ratings yet

- Banking FinanceDocument9 pagesBanking FinanceAstik TripathiNo ratings yet

- Fin DomDocument111 pagesFin DomRohit PanigrahiNo ratings yet

- Net Lease Tenant ProfilesDocument82 pagesNet Lease Tenant ProfilesnetleaseNo ratings yet

- Final - Real Estate Exchange Traded FundsDocument12 pagesFinal - Real Estate Exchange Traded FundsUrvisha Mistry100% (1)

- ChelseaFund - TermSheet - May 10-VMADocument2 pagesChelseaFund - TermSheet - May 10-VMAMarius AngaraNo ratings yet

- Bond Pricing, Yield Measures and Total Return (2) .Document42 pagesBond Pricing, Yield Measures and Total Return (2) .Josua PranataNo ratings yet

- Chapter 1 - Investments: Background and IssuesDocument61 pagesChapter 1 - Investments: Background and IssuesMadhan RajNo ratings yet

- Seller-Financed Real EstateDocument20 pagesSeller-Financed Real EstateMarvellous YeezorNo ratings yet

- Special Contracts: 1. Delivery of Goods - It MayDocument8 pagesSpecial Contracts: 1. Delivery of Goods - It MayHarsh Gupta100% (1)

- Kyc Individual FormDocument21 pagesKyc Individual FormNino NinosNo ratings yet

- RepoDocument7 pagesRepoMonil VisariyaNo ratings yet

- AIG Private Equity 2007 Annual ReportDocument70 pagesAIG Private Equity 2007 Annual ReportAsiaBuyoutsNo ratings yet

- Chapter 3 Analysing Financing ActivitiesDocument35 pagesChapter 3 Analysing Financing ActivitiesGRACE CHANNo ratings yet

- (Contractor Name, Complete Address Including ZIP Code and Legal Title) (Surety Name and Complete Address Including ZIP Code)Document3 pages(Contractor Name, Complete Address Including ZIP Code and Legal Title) (Surety Name and Complete Address Including ZIP Code)HR LEGOLANDNo ratings yet

- 1 (Rev) Corporate GovernanceDocument16 pages1 (Rev) Corporate GovernanceSourav SenNo ratings yet

- BCRED Overview PresentationDocument27 pagesBCRED Overview Presentation2jjnvwdmxpNo ratings yet

- Types of CDOsDocument9 pagesTypes of CDOsKeval ShahNo ratings yet

- Offering MemorandumDocument115 pagesOffering MemorandumMigle Bloom100% (1)

- Commercial Connections: The Signature Series IssueDocument12 pagesCommercial Connections: The Signature Series IssueNational Association of REALTORS®No ratings yet

- Fidelity Real Estate Investment PortfolioDocument5 pagesFidelity Real Estate Investment PortfolioMaryna BolotskaNo ratings yet

- Insurance Bad Faith ClaimsDocument6 pagesInsurance Bad Faith ClaimsBelly OrsaNo ratings yet

- Realestate Firpta Us White PaperDocument20 pagesRealestate Firpta Us White PaperRoad AmmonsNo ratings yet

- Memo Model Netting ActDocument12 pagesMemo Model Netting ActChristine LiuNo ratings yet

- What Is The Business Transfer Tax For Intangible Assets?Document3 pagesWhat Is The Business Transfer Tax For Intangible Assets?sninaricaNo ratings yet

- Confidential Private Placement Memorandum: (For Private Circulation Only)Document48 pagesConfidential Private Placement Memorandum: (For Private Circulation Only)Pratim MajumderNo ratings yet

- Business Law Presentation FINALDocument24 pagesBusiness Law Presentation FINALNur Liyana Izzati Roslan100% (1)

- Canada-Net Pay CalculationsDocument20 pagesCanada-Net Pay CalculationsShaik ShafiNo ratings yet

- Duke Energy PremierNotes ProspectusDocument37 pagesDuke Energy PremierNotes ProspectusshoppingonlyNo ratings yet

- Capital Raising Regulation D SEC Vladimir IvanovDocument11 pagesCapital Raising Regulation D SEC Vladimir IvanovCrowdfundInsiderNo ratings yet

- Tax EquityDocument105 pagesTax EquityTran LyNo ratings yet

- Lo Property Book Final New 2013Document118 pagesLo Property Book Final New 2013Jen TanNo ratings yet

- MORB - 05 - of - 16 - Trust and Investment ManagementDocument55 pagesMORB - 05 - of - 16 - Trust and Investment ManagementMichael AlinaoNo ratings yet

- Placement Memorandum of CPR Investors, LLC - Final Investor Package (Nov. 27, 2019)Document225 pagesPlacement Memorandum of CPR Investors, LLC - Final Investor Package (Nov. 27, 2019)safe tradeNo ratings yet

- PDF 3. Investec - PPM (August 12 2021)Document197 pagesPDF 3. Investec - PPM (August 12 2021)AJNo ratings yet

- Non Life Insurance Companies & Life Insurance CompaniesDocument38 pagesNon Life Insurance Companies & Life Insurance CompaniesSyedFaisalHasanShahNo ratings yet

- Example Gift AgreementDocument2 pagesExample Gift AgreementRebel SaffoldNo ratings yet

- Mortgage Brokers AustraliaDocument4 pagesMortgage Brokers AustraliaChrisNo ratings yet

- Debt, NPV, Interest Rate, Loans, Bonds, ArbitrageDocument68 pagesDebt, NPV, Interest Rate, Loans, Bonds, ArbitrageGagAnasNo ratings yet

- The Book of Jargon - Project FinanceDocument108 pagesThe Book of Jargon - Project FinanceLukas PodolskengNo ratings yet

- 03 - LLMIT CH 3 Feb 08 PDFDocument20 pages03 - LLMIT CH 3 Feb 08 PDFPradyut TiwariNo ratings yet

- Unsecured PNDocument4 pagesUnsecured PNDoctrine ChurchNo ratings yet

- Comparing The Agreements For Landry'sDocument80 pagesComparing The Agreements For Landry'sDealBookNo ratings yet

- 000 Peru LNG IPO ProspectusDocument231 pages000 Peru LNG IPO ProspectusniezhenggangNo ratings yet

- Treasury Operations In Turkey and Contemporary Sovereign Treasury ManagementFrom EverandTreasury Operations In Turkey and Contemporary Sovereign Treasury ManagementNo ratings yet