Professional Documents

Culture Documents

Expected Return Common Stock: Inputs Last Dividend Price of Stock Expected Growth Rate Output Expected Return

Expected Return Common Stock: Inputs Last Dividend Price of Stock Expected Growth Rate Output Expected Return

Uploaded by

Himanshu PatidarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Expected Return Common Stock: Inputs Last Dividend Price of Stock Expected Growth Rate Output Expected Return

Expected Return Common Stock: Inputs Last Dividend Price of Stock Expected Growth Rate Output Expected Return

Uploaded by

Himanshu PatidarCopyright:

Available Formats

Stock Expected Return

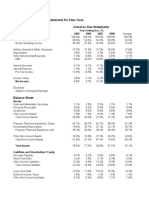

EXPECTED RETURN COMMON STOCK

INPUTS

LAST DIVIDEND

PRICE OF STOCK

EXPECTED GROWTH RATE

$ 1.25 Dollar Amount

$ 45.00 Dollar Amount

9.00% Decimal

OUTPUT

EXPECTED RETURN

11.8%

3.8%

4.8%

5.8%

6.8%

7.8%

8.8%

9.8%

10.8%

11.8%

12.8%

13.8%

14.8%

15.8%

16.8%

17.8%

18.8%

19.8%

20.8%

21.8%

22.8%

EXPECTED RETURNS AT DIFFERENT GROWTH RATES

25.0%

20.0%

EXPECTED RETURN

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

19%

20%

11.8%

15.0%

10.0%

5.0%

0.0%

0%

5%

10%

15%

GROWTH RATE

20%

25%

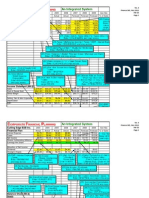

Stock Price - Zero Growth

PRICE OF COMMON STOCK - ZERO GROWTH MODEL

INPUTS

LAST DIVIDEND

EXPECTED RETURN (ROR)

3.00 Dollar Amount

6.00% Decimal

OUTPUT

PRICE OF STOCK

$ 50.00

Stock Price - Constant Growth

PRICE OF COMMON STOCK - CONSTANT GROWTH MODEL

INPUTS

LAST DIVIDEND

EXPECTED RETURN (ROR (k)

GROWTH RATE (g)

1.17 Dollar Amount

13.60% Decimal

8.10% Decimal

k must > g

OUTPUT

PRICE OF STOCK

$

$

$

$

$

$

$

$

$

$

$

$

$

21.27

61.58

40.34

30.00

23.88

19.83

16.96

14.81

13.15

11.82

10.73

9.83

9.07

STOCK PRICE AT DIFFERENT RORs

$70.00

$60.00

$50.00

STOCK PRICE

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

19%

20%

21%

$ 23.00

$40.00

$30.00

$20.00

$10.00

$5%

7%

9%

11%

13%

15%

17%

REQUIRED RATE OF RETURN

19%

21%

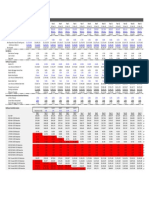

Stock Price - Variable Growth

PRICE OF STOCK - VARIABLE GROWTH MODEL

INPUTS

LAST YEAR (e.g., 1996)

LAST DIVIDEND

GROWTH RATE (g)

EXPECTED RETURN (ROR) (k)

1996

$ 1.17

1997

30.00%

13.60% Decimal

1998

1999

30.00%

30.00%

2000

2001

8.10%

8.10% Decimal

OUTPUT

DIVIDENDS

PRICE

1.52

1.98

2.57

$ 2.78

$ 54.61

CASH FLOWS

1.52

1.98

2.57

$ 57.39

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

19%

20%

21%

3.00

$39.09

$

$

$

$

$

$

$

$

$

$

$

$

$39.09

114.83

74.92

55.48

43.98

36.38

30.99

26.96

23.84

21.36

19.33

17.64

16.22

STOCK PRICE AT DIFFERENT RORs

$140.00

$120.00

PRICE OF STOCK

PRESENT VALUE

$100.00

$80.00

$60.00

$40.00

$20.00

$6%

11%

16%

REQUIRED RATE OF RETURN

21%

You might also like

- Sneaker 2013 ExcelDocument8 pagesSneaker 2013 ExcelMehwish Pervaiz71% (7)

- Data For Ratio Detective ExerciseDocument1 pageData For Ratio Detective ExercisemaritaputriNo ratings yet

- Stock Valuation TempDocument5 pagesStock Valuation TempANH Nguyen TrucNo ratings yet

- Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsFrom EverandCocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsNo ratings yet

- Finance Detective - Ratio AnalysisDocument2 pagesFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNo ratings yet

- Hedge Fund Indices MayDocument3 pagesHedge Fund Indices Mayj.fred a. voortmanNo ratings yet

- 4Q11 Earnings Release: Conference Call PresentationDocument23 pages4Q11 Earnings Release: Conference Call PresentationMultiplan RINo ratings yet

- Common Stock Valuation ModelsDocument1 pageCommon Stock Valuation ModelsShiblyNo ratings yet

- Data For Ratio DetectiveDocument1 pageData For Ratio DetectiveRoyan Nur HudaNo ratings yet

- Syndicate 3 - Analisa Ratio IndustriDocument5 pagesSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- EPAM Q2 2017 Fact Sheet 08-02-17Document20 pagesEPAM Q2 2017 Fact Sheet 08-02-17Rajesh KumarNo ratings yet

- Mayes 8e CH11 SolutionsDocument22 pagesMayes 8e CH11 SolutionsRamez AhmedNo ratings yet

- CH 13 Mod 2 Common Size StatementsDocument2 pagesCH 13 Mod 2 Common Size StatementsAkshat JainNo ratings yet

- Required Supplementary Information Schedules of Employer ContributionsDocument5 pagesRequired Supplementary Information Schedules of Employer ContributionsAnonymous Ul3litqNo ratings yet

- Port OrchardDocument2 pagesPort OrchardTad SooterNo ratings yet

- Sample Optimization - Exercise (Mywork)Document6 pagesSample Optimization - Exercise (Mywork)sushant ahujaNo ratings yet

- Profit and Loss Income StatementDocument3 pagesProfit and Loss Income StatementJamaluddin SaidNo ratings yet

- EVA Tree Analysis of Financial Statement (Deb Sahoo)Document3 pagesEVA Tree Analysis of Financial Statement (Deb Sahoo)Deb SahooNo ratings yet

- Trial SimulationDocument14 pagesTrial Simulationkhushi kumariNo ratings yet

- HW20Document18 pagesHW20kayteeminiNo ratings yet

- Investments Problem SetDocument5 pagesInvestments Problem Setzer0fxz8209No ratings yet

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaNo ratings yet

- Roic Revenue Growth: Appendix 1: Key Business DriversDocument7 pagesRoic Revenue Growth: Appendix 1: Key Business DriversPeter LiNo ratings yet

- Cap Rate Calculator MatrixDocument3 pagesCap Rate Calculator MatrixkaviisNo ratings yet

- Month Average Market Month: BOG TBC BOGDocument4 pagesMonth Average Market Month: BOG TBC BOGNino NatradzeNo ratings yet

- Example Loan PricingDocument4 pagesExample Loan PricingNino NatradzeNo ratings yet

- California Housing Market Forecast: June 2016Document7 pagesCalifornia Housing Market Forecast: June 2016C.A.R. Research & EconomicsNo ratings yet

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisAK_Chavan100% (1)

- Class Exercise Fashion Company Three Statements Model - CompletedDocument16 pagesClass Exercise Fashion Company Three Statements Model - CompletedbobNo ratings yet

- 2-1 Modelo FCDDocument12 pages2-1 Modelo FCDPaolaRamosAlbarracinNo ratings yet

- Company 1: October 2004 Profit and LossDocument2 pagesCompany 1: October 2004 Profit and LossAry BenzerNo ratings yet

- Caps and FloorsDocument12 pagesCaps and Floorsdry_madininaNo ratings yet

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- Shorenstein Yale Slides 2Document15 pagesShorenstein Yale Slides 2Anton FortichNo ratings yet

- 63 22dh202493 Huỳnh Nhật Trường Cf 6.03Document30 pages63 22dh202493 Huỳnh Nhật Trường Cf 6.03taylormit1242003No ratings yet

- QTY On Hand Selling Price Unit Cost Gross Profit G.P. %Document7 pagesQTY On Hand Selling Price Unit Cost Gross Profit G.P. %Ahmed JabrNo ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- FIN439 - CokeTemplate - TOWSON UNIVERSITYDocument35 pagesFIN439 - CokeTemplate - TOWSON UNIVERSITYJose RuizNo ratings yet

- Financial Performance SpreadsheetDocument15 pagesFinancial Performance SpreadsheetDarlene Bacatan AmancioNo ratings yet

- Value SpreadsheetDocument58 pagesValue SpreadsheetJitendra SutarNo ratings yet

- Assignment For Quiz 3Document3 pagesAssignment For Quiz 3Shahzad ShaikhNo ratings yet

- Converting Nominal Yield Into Effective YieldDocument48 pagesConverting Nominal Yield Into Effective YieldOUSSAMA NASRNo ratings yet

- Actividad Capítulo 9Document35 pagesActividad Capítulo 9Naomi NaranjoNo ratings yet

- 2011 Data SheetDocument2 pages2011 Data SheetAlabama PossibleNo ratings yet

- Sales Tracker Template 2Document9 pagesSales Tracker Template 2Amzah Fansuri MadziNo ratings yet

- Sales Tracker TemplateDocument9 pagesSales Tracker TemplateAL-Mawali87No ratings yet

- Refinance Analysis v1.01Document1 pageRefinance Analysis v1.01AlexNo ratings yet

- X - Modelo FCD (Alumno)Document22 pagesX - Modelo FCD (Alumno)Ariel Fernando Rodriguez OrellanaNo ratings yet

- DCF RestaurantDocument15 pagesDCF RestaurantRaden Roro Triani AgustinNo ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- GLO-BUS Forecast Sheet Template 2021-03-16Document143 pagesGLO-BUS Forecast Sheet Template 2021-03-16thanhtam6696No ratings yet

- Debt Policy at UST Inc.Document47 pagesDebt Policy at UST Inc.karthikk1990100% (2)

- BOLT DCF ValuationDocument1 pageBOLT DCF ValuationOld School ValueNo ratings yet

- Arcadian Finance2Document19 pagesArcadian Finance2Marlisa Lukmana50% (2)

- 10 Year Financial PlanDocument41 pages10 Year Financial PlanatulNo ratings yet

- 97Document2 pages97Anonymous 1997No ratings yet

- Company's Current StatusDocument36 pagesCompany's Current StatusSergio OlarteNo ratings yet

- MA September 2018 Sales - CountyDocument4 pagesMA September 2018 Sales - CountyAnonymous RscerR0lNo ratings yet

- Special Excel Class 11 8 2016Document8 pagesSpecial Excel Class 11 8 2016Stella KazanciNo ratings yet

- Mergers, Acquisitions, Divestitures, and Other RestructuringsFrom EverandMergers, Acquisitions, Divestitures, and Other RestructuringsNo ratings yet