Professional Documents

Culture Documents

Enter The Appropriate Amounts in The Shaded Cells in Columns D, F, H, J and L

Enter The Appropriate Amounts in The Shaded Cells in Columns D, F, H, J and L

Uploaded by

Elsa MendozaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enter The Appropriate Amounts in The Shaded Cells in Columns D, F, H, J and L

Enter The Appropriate Amounts in The Shaded Cells in Columns D, F, H, J and L

Uploaded by

Elsa MendozaCopyright:

Available Formats

16-31

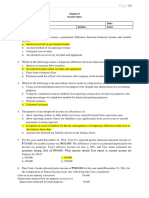

Name: SOLUTION Enter the appropriate amounts in the shaded cells in columns D, F, H, J and L.

1)

Computation of Income Tax Expense - 2002 Financial income Less: Nontaxable revenue Installment sales deferred Plus: Warranty expense Taxable income x Tax rate

$ 40,000 (50,000) (enter as a negative amount) (20,000) (enter as a negative amount) 50,000 $ 20,000 40% $ 8,000

Computation of Tax Related Amounts Enacted Rate 35% 32% 30% 30% Deductible Amount $ 9,000 16,500 20,500 4,000 $ 50,000 Asset Valuation $ 3,150 5,280 6,150 1,200 $ 15,780 Taxable Amount $ 5,000 7,000 2,000 6,000 $ 20,000 Liability Valuation $ 1,750 2,240 600 1,800 $ 6,390

Year 2003 2004 2005 2006

Current items: Deferred tax asset Deferred tax liability Net deferred tax asset Noncurrent items: Deferred tax asset Deferred tax liability Net deferred tax asset Journal Entries Income Tax Expense Income Taxes Payable Deferred Tax Asset - Current Deferred Tax Asset - Noncurrent Income Tax Benefit - Deferred Deferred Tax Liability - Current Deferred Tax Liability - Noncurrent 2)

$ 3,150 1,750 $ 1,400

$ 12,630 4,640 $ 7,990

8,000 8,000 3,150 12,630 9,390 1,750 4,640

Stratco Corporation Partial Income Statement For the Year Ended December 31, 2002 Income from continuing operations before income taxes Income taxes: Current provision $ 8,000 Deferred benefit (9,390) Net income

$ 40,000

(1,390) $ 41,390

You might also like

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document71 pagesChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Quick QuizDocument6 pagesQuick QuizLeng ChhunNo ratings yet

- Chapter 15 SolutionsDocument6 pagesChapter 15 SolutionshappysparkyNo ratings yet

- ACCT550 Homework Week 2Document5 pagesACCT550 Homework Week 2Natasha Declan100% (2)

- Ans CH5Document16 pagesAns CH5Elsa MendozaNo ratings yet

- IAS 12: Practice Questions AnswersDocument8 pagesIAS 12: Practice Questions AnswersTaffy Isheanesu BgoniNo ratings yet

- 00-Text-Ch1 Additional Problems UpdatedDocument3 pages00-Text-Ch1 Additional Problems Updatedzombies_meNo ratings yet

- SM ch13Document63 pagesSM ch13braveusman0% (1)

- VOL 2 16. Accounting For Income TaxationDocument15 pagesVOL 2 16. Accounting For Income TaxationdmangiginNo ratings yet

- CAS QuizDocument6 pagesCAS QuizLeng ChhunNo ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Enter The Appropriate Numbers in The Shaded Cells in Columns I and K BelowDocument1 pageEnter The Appropriate Numbers in The Shaded Cells in Columns I and K BelowElsa MendozaNo ratings yet

- Compre Quiz No. 6Document10 pagesCompre Quiz No. 6Bea LadaoNo ratings yet

- Assignment 6Document8 pagesAssignment 6Muhammad AdilNo ratings yet

- Chaechapter 7 SolutionsDocument16 pagesChaechapter 7 Solutionsmadddy_hydNo ratings yet

- 2000 2001 2000 Liabilites Assets: Balance SheetDocument10 pages2000 2001 2000 Liabilites Assets: Balance SheetGuruswami PrakashNo ratings yet

- Insight Into Deferred TaxesDocument17 pagesInsight Into Deferred TaxesoilresearchfgNo ratings yet

- CH 04Document8 pagesCH 04ashibhallauNo ratings yet

- Solved ProblemsDocument24 pagesSolved ProblemsSammir MalhotraNo ratings yet

- Income Statement: AssetsDocument13 pagesIncome Statement: AssetsAdrian TajmaniNo ratings yet

- Chapter 4. Understanding The Cash Flow Statement Item AmountDocument4 pagesChapter 4. Understanding The Cash Flow Statement Item AmountThu PhạmNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDocument59 pagesIntermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldSumon iqbalNo ratings yet

- Income TaxesDocument3 pagesIncome TaxesCENTENO, JOAN R.No ratings yet

- Accounting For Income TaxesDocument16 pagesAccounting For Income TaxesMUNAWAR ALI100% (5)

- F1 November 2010 AnswersDocument11 pagesF1 November 2010 AnswersmavkaziNo ratings yet

- Post Quiz 1Document3 pagesPost Quiz 1Randelle James FiestaNo ratings yet

- Chapter 16 - Alternate SolutionsDocument9 pagesChapter 16 - Alternate SolutionsAlex MadarangNo ratings yet

- Meet 11-Accounting For Income Taxes-DYP PDFDocument19 pagesMeet 11-Accounting For Income Taxes-DYP PDFRENDY FILIANGNo ratings yet

- LO 7 - Explain The Effect of Various Tax Rates and Tax Rate Changes On Deferred Income TaxesDocument52 pagesLO 7 - Explain The Effect of Various Tax Rates and Tax Rate Changes On Deferred Income TaxesMhamza KarachiNo ratings yet

- Thor Semiconductor Is An Exporter of Transistors To The United StatesDocument6 pagesThor Semiconductor Is An Exporter of Transistors To The United StatesSophia KeratinNo ratings yet

- 5 15Document8 pages5 15Indra PramanaNo ratings yet

- Accounting-8264829Document6 pagesAccounting-8264829nathardeen2000100% (3)

- Chapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Income Taxes Problem SolvingDocument3 pagesIncome Taxes Problem SolvingLara FloresNo ratings yet

- CH 01Document5 pagesCH 01deelol99No ratings yet

- Solutions To End-Of-Chapter ProblemsDocument22 pagesSolutions To End-Of-Chapter ProblemsKalyani GogoiNo ratings yet

- LMT School of Management, Thapar University Masters of Business AdministrationDocument9 pagesLMT School of Management, Thapar University Masters of Business Administrationtechnical sNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Taxable Income and Income Tax - Foreign Tax Credit - AdministrDocument52 pagesTaxable Income and Income Tax - Foreign Tax Credit - AdministrCharlotte MalgapoNo ratings yet

- Constructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONDocument39 pagesConstructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONHoney LimNo ratings yet

- Exercises On Cash Flow StatementsDocument3 pagesExercises On Cash Flow StatementsSam ChinthaNo ratings yet

- Solution To Chapter 21Document25 pagesSolution To Chapter 21Sy Him100% (5)

- Week 4 Practice Questions 1Document17 pagesWeek 4 Practice Questions 1Gabriel Abdillah100% (1)

- Acc 206 Week 1 AssignmentDocument4 pagesAcc 206 Week 1 AssignmentLynna ElliottNo ratings yet

- Enter The Appropriate Amounts in The Shaded Cells Below. A Red Asterisk ( ) Will Appear To The Right of An Incorrect Amount in The Outlined CellsDocument4 pagesEnter The Appropriate Amounts in The Shaded Cells Below. A Red Asterisk ( ) Will Appear To The Right of An Incorrect Amount in The Outlined CellsAbba Consultores Servicios RaffahNo ratings yet

- Introduction To TaxDocument18 pagesIntroduction To TaxVenniah MusundaNo ratings yet

- Week 2 Homework (Chap. 4) - PostedDocument4 pagesWeek 2 Homework (Chap. 4) - PostedMs. Nina100% (5)

- AC2101 Sem GP 9 Presentation 7: Team 7 Lin Yilin, Wang Qian, Xia FanDocument21 pagesAC2101 Sem GP 9 Presentation 7: Team 7 Lin Yilin, Wang Qian, Xia FanLingNo ratings yet

- FSA - Intro PDFDocument10 pagesFSA - Intro PDFsingh somyadeepNo ratings yet

- Week 6 - ch19Document55 pagesWeek 6 - ch19bafsvideo4No ratings yet

- Homework Ch. 7 and 13Document24 pagesHomework Ch. 7 and 13L100% (1)

- Marking Scheme: Section ADocument8 pagesMarking Scheme: Section Aaegean123No ratings yet

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- New LeveragesDocument16 pagesNew Leveragesmackm87No ratings yet

- Sba1501 Management Accounting Unit IiDocument76 pagesSba1501 Management Accounting Unit Iisandhya lakshmanNo ratings yet

- QTDocument13 pagesQTJESTONI RAMOSNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- 2019 GTCap Audited Financial StatementsDocument189 pages2019 GTCap Audited Financial StatementsElsa MendozaNo ratings yet

- 2019 SBC Audited Financial Statements PDFDocument162 pages2019 SBC Audited Financial Statements PDFElsa MendozaNo ratings yet

- 2019 PNB Audited Financial StatementsDocument153 pages2019 PNB Audited Financial StatementsElsa MendozaNo ratings yet

- 2019 PSBank Audited Financial Statements PDFDocument134 pages2019 PSBank Audited Financial Statements PDFElsa MendozaNo ratings yet

- 2019 BDO Audited Financial Statements PDFDocument201 pages2019 BDO Audited Financial Statements PDFElsa MendozaNo ratings yet

- Philippine National Bank - Audited Financial Statements - 31dec2022 - PSEDocument153 pagesPhilippine National Bank - Audited Financial Statements - 31dec2022 - PSEElsa MendozaNo ratings yet

- 2018 PNB Audited Financial StatementsDocument180 pages2018 PNB Audited Financial StatementsElsa MendozaNo ratings yet

- Unit 4 Part 2 Merchandising Transactions Class Exercise Titan QuestionnaireDocument2 pagesUnit 4 Part 2 Merchandising Transactions Class Exercise Titan QuestionnaireElsa MendozaNo ratings yet

- MINUTES+ (Pre-Bid+of+FIT-All+Nego+Proc) Kphsa - PSG +abc+docx +CLEAN+ (Hvb+edit) +-+sgd+by+BAC+ (except+DSOM)Document5 pagesMINUTES+ (Pre-Bid+of+FIT-All+Nego+Proc) Kphsa - PSG +abc+docx +CLEAN+ (Hvb+edit) +-+sgd+by+BAC+ (except+DSOM)Elsa MendozaNo ratings yet

- PSBank Financial Results For The Year 2022 Press Release - PSE Material InformationDocument4 pagesPSBank Financial Results For The Year 2022 Press Release - PSE Material InformationElsa MendozaNo ratings yet

- Filsyn Corporation Parent Company FS 12.31.2021Document50 pagesFilsyn Corporation Parent Company FS 12.31.2021Elsa MendozaNo ratings yet

- Basic Accounting For Non-AccountantsDocument34 pagesBasic Accounting For Non-AccountantsElsa Mendoza0% (1)

- FDNACCT Unit 4 Part 3 Journalizing Promissory Notes Transactions Study GuideDocument3 pagesFDNACCT Unit 4 Part 3 Journalizing Promissory Notes Transactions Study GuideElsa MendozaNo ratings yet

- Basic Accounting For Non-Accounta NtsDocument34 pagesBasic Accounting For Non-Accounta NtsElsa MendozaNo ratings yet

- FDNACCT Unit 4 Part 3 Journalizing Promissory Notes Transactions Study GuideDocument3 pagesFDNACCT Unit 4 Part 3 Journalizing Promissory Notes Transactions Study GuideElsa MendozaNo ratings yet

- Unit-3 Financial-Statements Class-Exercise QuestionsDocument2 pagesUnit-3 Financial-Statements Class-Exercise QuestionsElsa MendozaNo ratings yet

- Unit 4 Part 2 Merchandising Transactions Class Exercise Titan Answer KeyDocument2 pagesUnit 4 Part 2 Merchandising Transactions Class Exercise Titan Answer KeyElsa MendozaNo ratings yet

- Suggested Answers: Exercise 8 - 1Document23 pagesSuggested Answers: Exercise 8 - 1Elsa MendozaNo ratings yet

- Ans CH4Document15 pagesAns CH4Elsa MendozaNo ratings yet