Professional Documents

Culture Documents

Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076

Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076

Uploaded by

Rohit NuwalCopyright:

Available Formats

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- BEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Document3 pagesBEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Kapil SharmaNo ratings yet

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsNo ratings yet

- HPCL Audited Results31Mar2013Document1 pageHPCL Audited Results31Mar2013Pranav DesaiNo ratings yet

- DemonstraDocument74 pagesDemonstraFibriaRINo ratings yet

- 2Q13 Financial StatementsDocument52 pages2Q13 Financial StatementsFibriaRINo ratings yet

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Regd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)Document1 pageRegd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)nitin2khNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Breeze-Eastern Corporation: Securities and Exchange CommissionDocument31 pagesBreeze-Eastern Corporation: Securities and Exchange Commissionashish822No ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- QMar2013 Financials of Relieance WeavingDocument20 pagesQMar2013 Financials of Relieance WeavingTauraabNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Q4FY2013 Interim ResultsDocument13 pagesQ4FY2013 Interim ResultsrickysuNo ratings yet

- Statement of Assets & Liabilties As On September 30, 2016 (Result)Document2 pagesStatement of Assets & Liabilties As On September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- MEIK Unaudited Results For HY Ended 30 Sep 13Document1 pageMEIK Unaudited Results For HY Ended 30 Sep 13Business Daily ZimbabweNo ratings yet

- SACL Unaudited Results For HY Ended 30 Sep 13Document1 pageSACL Unaudited Results For HY Ended 30 Sep 13Business Daily ZimbabweNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDocument8 pagesJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNo ratings yet

- Financial Statements For The Year Ended 31 December 2009Document64 pagesFinancial Statements For The Year Ended 31 December 2009AyeshaJangdaNo ratings yet

- PCC - Financial Stahtements 2013 - Final by RashidDocument56 pagesPCC - Financial Stahtements 2013 - Final by RashidFahad ChaudryNo ratings yet

- Itr - 1Q13Document75 pagesItr - 1Q13Usiminas_RINo ratings yet

- Oldtown QRDocument26 pagesOldtown QRfieya91No ratings yet

- Nucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003Document1 pageNucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003nit111No ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Hrtex 2012-2013 AnnualDocument43 pagesHrtex 2012-2013 AnnualObydulRanaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Document8 pagesPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaNo ratings yet

- 1st Quarter 2014Document20 pages1st Quarter 2014khanbaba1998No ratings yet

- 1st Quarter Ended September 30th 2013-1Document21 pages1st Quarter Ended September 30th 2013-1mustafakNo ratings yet

- FITTERS - 3rd Quarter 2013Document16 pagesFITTERS - 3rd Quarter 2013Liew Chee KiongNo ratings yet

- HDFC Consolidate Q3Document5 pagesHDFC Consolidate Q3Satish MehtaNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Apl 2013Document45 pagesApl 2013Wasif Pervaiz DarNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Quarterly Financial Report 3Q09Document91 pagesQuarterly Financial Report 3Q09Multiplan RINo ratings yet

- COLC Unaudited Results For HY Ended 31 Dec 13Document1 pageCOLC Unaudited Results For HY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Beximco Hy2014Document2 pagesBeximco Hy2014Md Saiful Islam KhanNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocument14 pagesASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)No ratings yet

- TTR RRL: LimitedDocument5 pagesTTR RRL: LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2013 (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2013 (Result)Shyam SunderNo ratings yet

- Analysis of Apollo TiresDocument12 pagesAnalysis of Apollo TiresTathagat ChatterjeeNo ratings yet

- Q1FY2013Document1 pageQ1FY2013Suresh KumarNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076

Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076

Uploaded by

Rohit NuwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076

Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076

Uploaded by

Rohit NuwalCopyright:

Available Formats

Colgate-Palmolive (India) Limited Registered Office : Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400

076

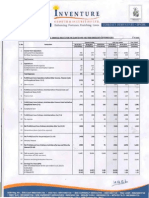

STATEMENT OF UNAUDITED RESULTS FOR THE QUARTER AND SIX MONTHS ENDED SEPTEMBER 30, 2013 (Rs. Lacs) Particulars

Quarter Ended September 30, 2013 (Unaudited)

Quarter Ended June 30, 2013 (Unaudited)

Quarter Ended September 30, 2012 (Unaudited)

Half Year Ended September 30, 2013 (Unaudited)

Half Year Ended September 30, 2012 (Unaudited)

Year Ended March 31, 2013 (Audited)

PART I 1 Income from Operations (a) Net Sales / Income from Operations (Net of excise duty) (b) Other Operating Income Total Income from Operations (net) 2 Expenses (a) Cost of materials consumed (b) Purchases of stock-in-trade (c) Changes in inventories of finished goods, work-in-progress and stock-in-trade (d) Employee benefits expense (e) Depreciation and Amortisation expenses (f) Advertising (g) Other Expenses Total Expenses 3 Profit from Operations before Other Income, Finance Costs and Exceptional Items Other Income Profit from Ordinary activities before Finance Costs and Exceptional Items Finance Costs Profit from Ordinary Activities after Finance Costs but before Exceptional Items Exceptional Items (Refer Note 5) Profit from Ordinary Activities before tax Tax expense (net of prior year reversals) Net Profit after Taxes Paid-up Equity Share Capital (Face value: Rupee 1 per share) Reserve excluding Revaluation Reserve Basic and Diluted Earnings per share (Rs.) 8.05 13.62 10.67 21.67 19.30

89,569 504 90,073

84,462 1,507 85,969

77,377 1,865 79,242

174,031 2,011 176,042

150,985 3,866 154,851

308,411 7,970 316,381

26,432 11,060 (1,280) 5,346 1,166 11,947 21,935 76,606

25,473 8,909 (1,556) 6,199 1,174 10,139 20,277 70,615

25,789 5,665 929 5,430 1,060 8,892 14,959 62,724

51,905 19,969 (2,836) 11,545 2,340 22,086 42,212 147,221

48,398 11,395 2,562 11,672 2,111 17,264 29,737 123,139

99,155 23,644 2,220 24,944 4,370 35,459 65,278 255,070

13,467 1,302 14,769 -

15,354 1,712 17,066 -

16,518 1,487 18,005 -

28,821 3,014 31,835 -

31,712 2,609 34,321 -

61,311 4,992 66,303 -

4 5 6 7

14,769 14,769 3,817 10,952 1,360

17,066 7,064 24,130 5,608 18,522 1,360

18,005 18,005 3,497 14,508 1,360

31,835 7,064 38,899 9,425 29,474 1,360

34,321 34,321 8,071 26,250 1,360

66,303 66,303 16,628 49,675 1,360

8 9 10 11 12

13 14

47,599 36.53

Particulars

Quarter Ended September 30, 2013 (Unaudited)

Quarter Ended June 30, 2013 (Unaudited)

Quarter Ended September 30, 2012 (Unaudited)

Half Year Ended September 30, 2013 (Unaudited)

Half Year Ended September 30, 2012 (Unaudited)

Year Ended March 31, 2013 (Unaudited)

PART II A 1 PARTICULARS OF SHAREHOLDING Public Shareholding - Number of Shares - Percentage of holding Promoters and Promoter Group Shareholding (a) Pledged/ Encumbered - Number of shares - Percentage of shares (as a % of the total shareholding of promoter and promoter group) - Percentage of shares (as a % of the total share capital of the Company) (b) Non-Encumbered - Number of shares - Percentage of shares (as a % of the total shareholding of promoter and promoter group) - Percentage of shares (as a % of the total share capital of the Company)

66,636,481 49%

66,636,481 49%

66,636,481 49%

66,636,481 49%

66,636,481 49%

66,636,481 49%

Nil Nil Nil

Nil Nil Nil

Nil Nil Nil

Nil Nil Nil

Nil Nil Nil

Nil Nil Nil

69,356,336 100% 51%

69,356,336 100% 51%

69,356,336 100% 51%

69,356,336 100% 51%

69,356,336 100% 51%

69,356,336 100% 51%

Information on investor complaints pursuant to Clause 41 of the Listing Agreement for the quarter ended September 30, 2013. Received during the quarter Resolved during the quarter -

Nature of complaints * Non receipt of dividend warrants

Opening Balance -

Closing Balance -

Non receipt of share certificates lodged for transfer or capital reduction Others * Excludes disputed cases and sub-judice matters.

Notes 1.

STATEMENT OF ASSETS AND LIABILTIES (Rs. Lacs) Particulars

As at September 30, 2013 (Unaudited)

As at March 31, 2013 (Audited)

EQUITY AND LIABILITIES 1 Shareholders' Funds (a) Share Capital (b) Reserves and Surplus Sub-total - Shareholders' Funds 2 Non-current Liabilities (a) Other Long-term Liabilities (b) Long-term Provisions Sub-total - Non-current Liabilities 3 Current Liabilities (a) Trade Payables (b) Other Current Liabilities (c) Short-term Provisions Sub-total - Current Liabilities TOTAL - EQUITY AND LIABILITIES

1,360 77,073 78,433

1,360 47,599 48,959

78 2,531 2,609

85 3,490 3,575

48,705 15,986 7,827 72,518 153,560

46,662 25,018 6,464 78,144 130,678

ASSETS 1 Non-current Assets (a) Fixed Assets (b) Non-current Investments (c) Deferred Tax Assets (Net) (d) Long-term Loans and Advances (e) Other Non-current Assets Sub-total - Non-current Assets 2 Current Assets (a) Current Investments (b) Inventories (c) Trade Receivables (d) Cash and Bank Balances (e) Short-term Loans and Advances (f) Other Current Assets Sub-total - Current Assets TOTAL - ASSETS check 48,367 3,713 2,141 11,649 199 66,069 38,262 3,713 2,244 7,030 125 51,374

22,477 6,883 41,042 16,554 535 87,491 153,560 0 -

998 18,530 8,121 42,880 8,447 328 79,304 130,678 0

Notes (Contd.) 2. Net Sales for the quarter and half year ended September 30, 2013 increased by 16% and 15%, respectively, over the same period of the previous year. 3. 4. 5. Net Profit before Tax for the quarter and half year ended September 30, 2013 is Rs. 14,769 Lacs and Rs. 38,899 Lacs, respectively, as against Rs. 18,005 Lacs and Rs. 34,321 Lacs for the similar periods of the previous year. In accordance with the requirements of Accounting Standard -17, Segment Reporting, the Company's business segment is 'Personal Care' (including Oral Care) and hence it has no other primary reportable segments. The company after obtaining necessary approvals from the Board of Directors and Shareholders, sold and transferred the whole of the Company's "Global Shared Services Organization" (GSSO Divison) by way of a slump sale to Colgate Global Business Services Private Limited (CGBSPL), a 100% subsidiary of the ultimate holding company, Colgate-Palmolive Company, U.S.A. with effect from June 1, 2013, on a going concern basis for a total consideration of Rs. 5,989 Lacs. This amount, after necessary adjustments to the relevant assets and liabilities of the erstwhile division is shown under "Exceptional Items". The Capital Gain tax arising from the transaction is included in "Tax Expense". Previous period/ year figures have been reclassified to conform with current period/ year presentation, where applicable.

6.

The Statutory Auditors have carried out a Limited Review of the Financial results of the quarter ended September 30, 2013 as per Clause 41 of the Listing Agreement. The above results have been reviewed by the Audit Committee and approved by the Board of Directors at their Meeting held today. The full text of Colgate releases is available: www.colgate.co.in.

COLGATE-PALMOLIVE (INDIA) LIMITED

Mumbai October 25, 2013

P. PARAMESWARAN (Ms.) MANAGING DIRECTOR

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- BEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Document3 pagesBEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Kapil SharmaNo ratings yet

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsNo ratings yet

- HPCL Audited Results31Mar2013Document1 pageHPCL Audited Results31Mar2013Pranav DesaiNo ratings yet

- DemonstraDocument74 pagesDemonstraFibriaRINo ratings yet

- 2Q13 Financial StatementsDocument52 pages2Q13 Financial StatementsFibriaRINo ratings yet

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Regd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)Document1 pageRegd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)nitin2khNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Breeze-Eastern Corporation: Securities and Exchange CommissionDocument31 pagesBreeze-Eastern Corporation: Securities and Exchange Commissionashish822No ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- QMar2013 Financials of Relieance WeavingDocument20 pagesQMar2013 Financials of Relieance WeavingTauraabNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Q4FY2013 Interim ResultsDocument13 pagesQ4FY2013 Interim ResultsrickysuNo ratings yet

- Statement of Assets & Liabilties As On September 30, 2016 (Result)Document2 pagesStatement of Assets & Liabilties As On September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- MEIK Unaudited Results For HY Ended 30 Sep 13Document1 pageMEIK Unaudited Results For HY Ended 30 Sep 13Business Daily ZimbabweNo ratings yet

- SACL Unaudited Results For HY Ended 30 Sep 13Document1 pageSACL Unaudited Results For HY Ended 30 Sep 13Business Daily ZimbabweNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDocument8 pagesJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNo ratings yet

- Financial Statements For The Year Ended 31 December 2009Document64 pagesFinancial Statements For The Year Ended 31 December 2009AyeshaJangdaNo ratings yet

- PCC - Financial Stahtements 2013 - Final by RashidDocument56 pagesPCC - Financial Stahtements 2013 - Final by RashidFahad ChaudryNo ratings yet

- Itr - 1Q13Document75 pagesItr - 1Q13Usiminas_RINo ratings yet

- Oldtown QRDocument26 pagesOldtown QRfieya91No ratings yet

- Nucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003Document1 pageNucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003nit111No ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Hrtex 2012-2013 AnnualDocument43 pagesHrtex 2012-2013 AnnualObydulRanaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Document8 pagesPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaNo ratings yet

- 1st Quarter 2014Document20 pages1st Quarter 2014khanbaba1998No ratings yet

- 1st Quarter Ended September 30th 2013-1Document21 pages1st Quarter Ended September 30th 2013-1mustafakNo ratings yet

- FITTERS - 3rd Quarter 2013Document16 pagesFITTERS - 3rd Quarter 2013Liew Chee KiongNo ratings yet

- HDFC Consolidate Q3Document5 pagesHDFC Consolidate Q3Satish MehtaNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Apl 2013Document45 pagesApl 2013Wasif Pervaiz DarNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Quarterly Financial Report 3Q09Document91 pagesQuarterly Financial Report 3Q09Multiplan RINo ratings yet

- COLC Unaudited Results For HY Ended 31 Dec 13Document1 pageCOLC Unaudited Results For HY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Beximco Hy2014Document2 pagesBeximco Hy2014Md Saiful Islam KhanNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocument14 pagesASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)No ratings yet

- TTR RRL: LimitedDocument5 pagesTTR RRL: LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2013 (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2013 (Result)Shyam SunderNo ratings yet

- Analysis of Apollo TiresDocument12 pagesAnalysis of Apollo TiresTathagat ChatterjeeNo ratings yet

- Q1FY2013Document1 pageQ1FY2013Suresh KumarNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet