Professional Documents

Culture Documents

TAD 4 Tax Increment and Maximum Percentage Calcultions Page

TAD 4 Tax Increment and Maximum Percentage Calcultions Page

Uploaded by

CityStink AugustaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAD 4 Tax Increment and Maximum Percentage Calcultions Page

TAD 4 Tax Increment and Maximum Percentage Calcultions Page

Uploaded by

CityStink AugustaCopyright:

Available Formats

Attachment number 3 \nPage 25

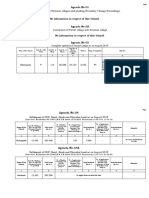

Tax Allocation Increment Base Value (M)*

On or before December 30, 2013, the Augusta-Richmond County Commission will apply to the Georgia State Revenue Commissioner for a determination of the tax allocation increment base of the proposed tax allocation district. As a part of this process, the commission will amend Augusta's Tax Allocation District #1 to delete the parcels from which this TAD #4 has been created. These parcels will then be included in the determination of the tax allocation increment base for the TAD #4. The base assessed value for all parcels in TAD #4 is estimated in the following table.

Augusta Tax Allocation District #4 Parcel Information, 2013

Total Number of Parcels Total Area

(1)

1,098

Approximately 339.20 acres

Total Assessed Value (40%) of Taxable Parcels in the Augusta TAD #4

$129,079,156

Total Assessed Value (40%) of Taxable Parcels in all TADs(2)

$340,636,115

Total Assessed Value of Taxable Parcels in Augusta-Richmond County $3,804,705,958 Value of TAD 4 as a Percent of Augusta/Richmond County's Total Tax Digest 3.393% Value of all Augusta TADs as a Percent of Total Tax Digest (2013 values)

8.953%

(1) Tax exempt and utility properties are not reflected in that total (total number of parcels 1324) (2) Includes parcels in TAD 1, TAD 2,TAD 3 and TAD 4 based on 2013 taxable values

By Georgia law, tax allocation districts are allowed to make up no more than ten percent of a city or county's total tax digest. At the time of creation Augusta's TAD #1, approved in 2008, was valued at 9.4 percent of the City of Augusta's total tax digest; Augusta's TAD #2 approved in 2010 was valued at 0.17 percent; and Augusta's TAD #3 approved in 2011 was valued at 0.0075 percent of this tax digest. Any tax parcels that were formerly included in Augusta/Richmond County's TAD #1 have been amended out of that tax allocation district and are now a part of the new TAD #4, creating no appreciable change in the total assessed value of taxable parcels as a percent of the Augusta/Richmond County's total tax digest. TAD #4 is therefore well within the allowable limit.

Total Property Taxes Collected within the Tax District that will serve as the Increment Base

(Total Assessed Value of Taxable Property) $129,079,156 x (Usable Millage) .1681

Laying the Groundwork for Strategic Investments & Growth

Item 4 Page # 24

You might also like

- Tad One Resolution Amended 2010 With HighlightsDocument75 pagesTad One Resolution Amended 2010 With HighlightsCityStink AugustaNo ratings yet

- Approved BudgetDocument4 pagesApproved BudgetAnonymous Pb39klJNo ratings yet

- 2018 Tax ReportDocument112 pages2018 Tax ReportYolandaNo ratings yet

- PDFDocument1 pagePDFPradeep SinglaNo ratings yet

- Computation of Deferred Tax Liability - An Example: Farm Management Guide MF-2358Document6 pagesComputation of Deferred Tax Liability - An Example: Farm Management Guide MF-2358hmi_pkNo ratings yet

- Property Tax Assessment Notices Reflect Change in Real Estate Market Since 2013Document6 pagesProperty Tax Assessment Notices Reflect Change in Real Estate Market Since 2013Aaron KrautNo ratings yet

- 2020 Carter AssessmentDocument1 page2020 Carter AssessmentMary LandersNo ratings yet

- 2015 Annual ReportDocument19 pages2015 Annual ReportRob PortNo ratings yet

- DownloadDocument2 pagesDownloadetosangrur1No ratings yet

- United States Court of Appeals, Third CircuitDocument8 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Mortgage Recording Tax Return: General InformationDocument4 pagesMortgage Recording Tax Return: General Informationshubik1No ratings yet

- Steps by Steps For Filling GST Return 3BDocument23 pagesSteps by Steps For Filling GST Return 3BBala VinayagamNo ratings yet

- Integrated Goods and ServiceDocument33 pagesIntegrated Goods and ServiceThiru VenkatNo ratings yet

- AnkitDocument4 pagesAnkitsitNo ratings yet

- Bennett Jones - Ontario and Toronto Land Transfer TaxDocument30 pagesBennett Jones - Ontario and Toronto Land Transfer TaxRogaes EnpédiNo ratings yet

- 2011 Annual Stat ReportDocument19 pages2011 Annual Stat ReportRob PortNo ratings yet

- Returns To Be Filed by Composition Tax Payers: Gstr-4ADocument1 pageReturns To Be Filed by Composition Tax Payers: Gstr-4ATejaswi J DamerlaNo ratings yet

- AK Tax Process-RevisedDocument2 pagesAK Tax Process-RevisedNTS2001No ratings yet

- Tax Law Review Syllabus Part 2Document20 pagesTax Law Review Syllabus Part 2chaynagirlNo ratings yet

- July 2017 Vertex Calculation GuideDocument1,417 pagesJuly 2017 Vertex Calculation Guidesieger74No ratings yet

- Notfctn 79 Central Tax English 2020Document19 pagesNotfctn 79 Central Tax English 2020Shaik MastanvaliNo ratings yet

- Timothy A. Frey, Et Al v. Comptroller of The Treasury, No. 62, September Term, 2009 (Md. Sept. 29, 2011)Document109 pagesTimothy A. Frey, Et Al v. Comptroller of The Treasury, No. 62, September Term, 2009 (Md. Sept. 29, 2011)Paul MastersNo ratings yet

- PT Annual 2012Document105 pagesPT Annual 2012Ajai KarthikeyanNo ratings yet

- The Requisites of Direct Double Taxation AreDocument5 pagesThe Requisites of Direct Double Taxation AreLara YuloNo ratings yet

- HB1059Document3 pagesHB1059SenRomerNo ratings yet

- GST Collection From The New Zealand Property Sector: Iris ClausDocument14 pagesGST Collection From The New Zealand Property Sector: Iris ClausAli NadafNo ratings yet

- City of Tucker Feasibility StudyDocument35 pagesCity of Tucker Feasibility StudyTucker InitiativeNo ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- SAD - GeorgiaDocument7 pagesSAD - GeorgiaKristina VađinaNo ratings yet

- State Sales and Use Tax ReturnDocument2 pagesState Sales and Use Tax ReturnRick JordanNo ratings yet

- Acope8800c 2020Document4 pagesAcope8800c 2020Asif EbrahimNo ratings yet

- Goods and Services TaxDocument15 pagesGoods and Services TaxSeemaNaikNo ratings yet

- Types of GST ReturnsDocument8 pagesTypes of GST ReturnsAshish GuptaNo ratings yet

- Annual Report On New York State Tax Expenditures 2013-14 State Fiscal YearDocument193 pagesAnnual Report On New York State Tax Expenditures 2013-14 State Fiscal YearRick KarlinNo ratings yet

- 2013 City of Toronto Budget Briefing NoteDocument2 pages2013 City of Toronto Budget Briefing NotePaisley RaeNo ratings yet

- 0919-20, Land Management ManualDocument8 pages0919-20, Land Management ManualSiddhartha Bhowmik ArkoNo ratings yet

- Detailed Statement of ClarificationDocument1 pageDetailed Statement of ClarificationDivyanshu TejwaniNo ratings yet

- Office of The Inland Revenue and Customs (South), Karachi: Director General AuditDocument14 pagesOffice of The Inland Revenue and Customs (South), Karachi: Director General AuditHamid AliNo ratings yet

- Mining Tax MemoDocument1 pageMining Tax Memopeter_martin9335No ratings yet

- GST ReturnsDocument3 pagesGST ReturnsTru TaxNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961tusharmohite0No ratings yet

- GST Returns - Types, Forms, Due Dates & PenaltiesDocument7 pagesGST Returns - Types, Forms, Due Dates & PenaltiesRaj ArlaNo ratings yet

- Land Tax GuideDocument32 pagesLand Tax GuidetestnationNo ratings yet

- Description: Tags: TaxassessorinstDocument3 pagesDescription: Tags: Taxassessorinstanon-238930No ratings yet

- REPLYDocument4 pagesREPLYVishal DwivediNo ratings yet

- Taxation Module1Document55 pagesTaxation Module1Techbotix AppsNo ratings yet

- 1.pooshya Exports DRC 07Document9 pages1.pooshya Exports DRC 07bhanuprakash.ctoNo ratings yet

- 2021-Uy 13dec22Document29 pages2021-Uy 13dec22gelothegreat06No ratings yet

- Esd #2Document10 pagesEsd #2FarzanNo ratings yet

- Truenorth 7 5 MillionDocument3 pagesTruenorth 7 5 MillionRob CooperNo ratings yet

- US Internal Revenue Service: rp-98-61Document21 pagesUS Internal Revenue Service: rp-98-61IRSNo ratings yet

- Thanks For Your Payment: Here Are The Details of Your TransactionDocument1 pageThanks For Your Payment: Here Are The Details of Your TransactionAuguste RiedlNo ratings yet

- Agriculture Law: RL33718Document20 pagesAgriculture Law: RL33718AgricultureCaseLawNo ratings yet

- Declaration of New Revenue Villages and Pending Boundary Change ProceedingsDocument3 pagesDeclaration of New Revenue Villages and Pending Boundary Change ProceedingsDIPTIMAYEE BEHERANo ratings yet

- SubjectDocument2 pagesSubjectapi-247793055No ratings yet

- Via E-Mail: Secretary@dps - Ny.govDocument21 pagesVia E-Mail: Secretary@dps - Ny.govAnonymous taKFxTAZcNo ratings yet

- 3bgoods and Services TaxDocument39 pages3bgoods and Services Taxmonishabala17No ratings yet

- Taxperts TipsDocument23 pagesTaxperts TipsKelsey ReedNo ratings yet

- GSTR 3B Vs GSTR 1 Tax Comparison Report 2Document14 pagesGSTR 3B Vs GSTR 1 Tax Comparison Report 2Mani SinghNo ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- Tad One Resolution Amended 2010 With HighlightsDocument75 pagesTad One Resolution Amended 2010 With HighlightsCityStink AugustaNo ratings yet

- Augusta TAD 1 2013 AmendmentDocument102 pagesAugusta TAD 1 2013 AmendmentCityStink AugustaNo ratings yet

- TAD 4 Resolution LOST FundsDocument1 pageTAD 4 Resolution LOST FundsCityStink AugustaNo ratings yet

- TAD 4 Plan Saying LOST UnneededDocument1 pageTAD 4 Plan Saying LOST UnneededCityStink AugustaNo ratings yet

- The Augusta Convention CenterDocument2 pagesThe Augusta Convention CenterCityStink AugustaNo ratings yet

- Right of First RefusalDocument6 pagesRight of First RefusalCityStink AugustaNo ratings yet