Professional Documents

Culture Documents

Exercise 3 5&3 8

Exercise 3 5&3 8

Uploaded by

rasyid_hasan0 ratings0% found this document useful (0 votes)

69 views1 pageThe document contains two manufacturing overhead calculation exercises. The first exercise calculates a predetermined overhead rate of RM 23.40 based on estimated overhead costs and direct labor hours. It then applies this rate to a job with actual direct labor hours of 10,800 to calculate total overhead of RM 252,720. The second exercise calculates an underapplied overhead of RM 5,700 based on actual and applied overhead, which would increase cost of goods sold and decrease gross profit.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains two manufacturing overhead calculation exercises. The first exercise calculates a predetermined overhead rate of RM 23.40 based on estimated overhead costs and direct labor hours. It then applies this rate to a job with actual direct labor hours of 10,800 to calculate total overhead of RM 252,720. The second exercise calculates an underapplied overhead of RM 5,700 based on actual and applied overhead, which would increase cost of goods sold and decrease gross profit.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

69 views1 pageExercise 3 5&3 8

Exercise 3 5&3 8

Uploaded by

rasyid_hasanThe document contains two manufacturing overhead calculation exercises. The first exercise calculates a predetermined overhead rate of RM 23.40 based on estimated overhead costs and direct labor hours. It then applies this rate to a job with actual direct labor hours of 10,800 to calculate total overhead of RM 252,720. The second exercise calculates an underapplied overhead of RM 5,700 based on actual and applied overhead, which would increase cost of goods sold and decrease gross profit.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

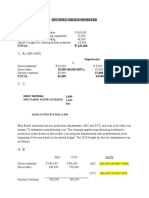

EXERCISE 3-5

Predetermined overhead rate = Estimated total manufacturing overhead cost

Estimated total amount of the allocation base

Total overhead applied to a = Predetermined x Actual direct labor-hours

Particular job overhead rate charged to the job

*Predetermined overhead rate = RM 23.40

*Actual total man. Overhead costs = RM 249,000

*Total direct labor-hours = 10,800

Total Overhead applied to a = 23.40 x 10,800

particular job

= RM 252,720

EXERCISE 3-8 (A)

Estimated to manufacturing overhead = RM 218,400

Actual total manufacturing overhead = RM215,000

POR = RM 18.20 x 11,500

= RM 209,300

= 215,000 – 209,300

= RM 5,700

RM 5,700 is Underapplied

EXERCISE 3-8 (B)

RM 5700 adalah Underapllied,maka ini akan meningkatkan jumlah kos barang dijual

dan akan menurunkan jumlah untung kasar.

You might also like

- AA025 PYQ 2015 - 2014 (ANS) by SectionDocument4 pagesAA025 PYQ 2015 - 2014 (ANS) by Sectionnurauniatiqah49No ratings yet

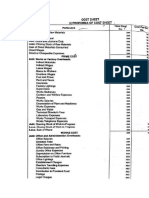

- Cost Sheet ProblemsDocument18 pagesCost Sheet ProblemsMariam Mathen77% (57)

- Chapter 3 Job Order CostingDocument20 pagesChapter 3 Job Order Costingazam_rasheedNo ratings yet

- Chapter 2 EconomyDocument42 pagesChapter 2 EconomyAidi Redza100% (3)

- Chapter 6Document13 pagesChapter 6Juliet Austria Dimalibot67% (3)

- COST SHEET NumericalsDocument9 pagesCOST SHEET Numericalsmisaki chanNo ratings yet

- Homework Chapter 3Document5 pagesHomework Chapter 3Lê Vũ Phương DungNo ratings yet

- Problems SolvingDocument4 pagesProblems SolvingAhmed RaeisiNo ratings yet

- Revision Question Topic 3,4-AnswerDocument5 pagesRevision Question Topic 3,4-AnswerNur WahidaNo ratings yet

- Ppce Unit-5Document21 pagesPpce Unit-5Jackson ..No ratings yet

- Additional Materials For MidtermDocument11 pagesAdditional Materials For MidtermjohannachannnnnnNo ratings yet

- BBA II - Google DriveDocument1 pageBBA II - Google Drivechowdharyeeshika11No ratings yet

- Example of MATRICS ACCOUNTING ASSESMENTDocument6 pagesExample of MATRICS ACCOUNTING ASSESMENTARISHANo ratings yet

- Tutorial 2 CH 3Document4 pagesTutorial 2 CH 3Codreanu AndaNo ratings yet

- Activity#1 - VILLALOBOS, AngeluDocument6 pagesActivity#1 - VILLALOBOS, AngeluJeluMVNo ratings yet

- Assignment 1Document4 pagesAssignment 1Rahul ARNo ratings yet

- Finance AssignmentDocument7 pagesFinance AssignmentsyafiqahanidaNo ratings yet

- Answers To Activity 1Document5 pagesAnswers To Activity 1jangjangNo ratings yet

- RM RM Sales (14,000 X RM120) (-) Cost of Goods Sold:: (-) Overapplied Fixed Overhead (2,500)Document2 pagesRM RM Sales (14,000 X RM120) (-) Cost of Goods Sold:: (-) Overapplied Fixed Overhead (2,500)Sofia ArissaNo ratings yet

- ACC 2242 in Class CH 5Document7 pagesACC 2242 in Class CH 5Salman I SadibNo ratings yet

- Cost Behavior & Activity-Based Costing and ManagementDocument5 pagesCost Behavior & Activity-Based Costing and ManagementRandom Ac100% (1)

- PRACTICE-EXERCISES-SOLUTIONS-I_MI1_10.2023Document6 pagesPRACTICE-EXERCISES-SOLUTIONS-I_MI1_10.2023honguyenkimkhanh55No ratings yet

- VarianceDocument3 pagesVarianceWan Noor AsmuniNo ratings yet

- CHAPTER 9 StandardDocument6 pagesCHAPTER 9 Standardsarahayeesha1No ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- UNIT 3 & 5 - Cost Classification & Cost SheetDocument14 pagesUNIT 3 & 5 - Cost Classification & Cost Sheetkevin75108No ratings yet

- Acc 202 Exercise MyselfDocument5 pagesAcc 202 Exercise Myselfnhidiepnguyet08112004No ratings yet

- Cost Sheet ProblemsDocument18 pagesCost Sheet ProblemsZahid RahmanNo ratings yet

- Unit CostingDocument3 pagesUnit CostingAnkit YadavNo ratings yet

- Process CostingDocument6 pagesProcess Costingepakhil01No ratings yet

- Costing 2 Material - 014417Document40 pagesCosting 2 Material - 014417sirjamtech36No ratings yet

- Revenue CostsDocument17 pagesRevenue CostsCatherine MOSQUITENo ratings yet

- Accounting Unit Additional Execerses AA025 Sem 2, 2019/2020Document5 pagesAccounting Unit Additional Execerses AA025 Sem 2, 2019/2020nur athirahNo ratings yet

- Ss - Maf551 Feb 22Document7 pagesSs - Maf551 Feb 22izwanNo ratings yet

- Chapter 7 (Tutorial) : Job Order Costing AccountingDocument31 pagesChapter 7 (Tutorial) : Job Order Costing AccountingNurin QistinaNo ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- Assignment of Chapter 1 - Muad TabounDocument1 pageAssignment of Chapter 1 - Muad TabounMoad NasserNo ratings yet

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- A) POHR RM 750,000 RM 500,000 1.5 Rate DL/HDocument8 pagesA) POHR RM 750,000 RM 500,000 1.5 Rate DL/HNur Aliyaa IzzatiNo ratings yet

- AIB Final Written ExamDocument13 pagesAIB Final Written ExamNeeza GautamNo ratings yet

- ch3 ManagerialDocument4 pagesch3 Managerialtam tamNo ratings yet

- (W5) Tutorial Answer Chapter 3 JOCDocument4 pages(W5) Tutorial Answer Chapter 3 JOCMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- BBA 6thDocument3 pagesBBA 6thFazal Wahab100% (1)

- Past Year 2019 Sem 2 Ans (ZW)Document4 pagesPast Year 2019 Sem 2 Ans (ZW)zhaoweiNo ratings yet

- Acc Assignment Sem 2Document23 pagesAcc Assignment Sem 2Luqman HaqimNo ratings yet

- Assignment #2 DM&DL L Variance With SolutionDocument9 pagesAssignment #2 DM&DL L Variance With SolutionJeannet LagcoNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- 03122020055228-Job Costing Problems & Solutions NotesDocument4 pages03122020055228-Job Costing Problems & Solutions NotesRohit RanaNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 24Document15 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 24Mr. JalilNo ratings yet

- Activities For OM 103Document5 pagesActivities For OM 103Trina Mae BarrogaNo ratings yet

- EXTRA QUESTIONS FOR CHAPTER 7 To EndDocument34 pagesEXTRA QUESTIONS FOR CHAPTER 7 To EndSooXueJiaNo ratings yet

- PANDIT PURNAJUARA - TUGAS CASE 3 - BLEMBA 67 WEEKEND - Financial Report and ControlDocument5 pagesPANDIT PURNAJUARA - TUGAS CASE 3 - BLEMBA 67 WEEKEND - Financial Report and ControlPandit PurnajuaraNo ratings yet

- Accounting For Manufacturing OverheadsDocument18 pagesAccounting For Manufacturing Overheadshi_monestyNo ratings yet

- Unit 3 Part 1 - CostingDocument17 pagesUnit 3 Part 1 - CostingPrarthana R Industrial EngineeringNo ratings yet

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Income Statement Under Job Order and Activity-Based CostingDocument10 pagesIncome Statement Under Job Order and Activity-Based CostingSadhna MaharjanNo ratings yet

- Acc123 Reviewer With AnswerDocument11 pagesAcc123 Reviewer With AnswerLianaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet