Professional Documents

Culture Documents

Plagiarism Checker - Viper - Free Plagiarism Checker and Scanner Software

Plagiarism Checker - Viper - Free Plagiarism Checker and Scanner Software

Uploaded by

Vivek KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Plagiarism Checker - Viper - Free Plagiarism Checker and Scanner Software

Plagiarism Checker - Viper - Free Plagiarism Checker and Scanner Software

Uploaded by

Vivek KumarCopyright:

Available Formats

12/3/13

Plagiarism Checker | Viper - Free Plagiarism Checker and Scanner Software

Contact us | Universities | History | Testimonies | Press | About us | Sitemap | Help | Essay help | RSS | Log in

Plagiarism Report For 'ctc.docx'

How does Viper work.....?

[+] Read more.. Location

http://upload.studwor k.or g/example_wor k/3974/Task%201.docx Documents found to be plagiar ised

Title

upload.studwor k.or g

Words Matched

47

Match (%)

2

Unique Words Matched

47

Unique Match (%)

2

Matching Content: 2%

Master Document Text

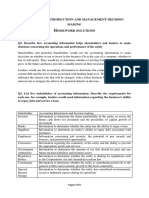

Container Transportation CompanySubmitted toProf. Arnab BasuQuantative Methods - 2Submitted byTeamAbhishek Kumar - 1311352Ashish Krishnan K A - 1311362Deepak Barhate - 1311364Shahul Hameed - 1311400Shakti Mahapatra - 1311401Vivek Transportation Company (CTC) is based in Taiwan and was founded in early 1980's. CTC is one of the world's largest multi-modal marine transportation companies in the world. The company has foot prints globally with approximately 100 offices and branches all over the world. Resources of CTC:CTC has a fleet of more than 100 ships and employed approximately 5000 personnel. CTC had dedicated a fleet of five container vessels to Korea/China/Middle eastern routes, each with a maximum capacity of 2000 TEU and a weight limit of 24,000 tons. The container is available in standard lengths or 40 feet. Scenario in CTC:CTC's main clients are in Middle East. So the demand for containers for CTC peaked during April and ended in fall since the trade was slowed down during the Ramadan month. During the peak season, CTC loads its vessels to a maximum of 95 percent of weight or capacity and during slack season the load factor fell to 90 percent.Current Problems:CTC's traditional pricing system was coordinated by marketing department in the head offices. But these prices do not take into account the loadability of the container. The company had two optionsLoadability The new pricing strategy should try to incorporate the loadability factor into it. In the past, CTC had insisted that the ratio of 20 foot to 40 foot containers should be between 1.2 and 2.0. So any deviation from the specified loadability should be charged with During the peak season, a price reduction of 3 percent would result in 5 percent increase in the volume of containers and during the low price reduction of 5 percent would increase it by 10 percent. So our pricing strategy should include these kinds of priced. Question 1: The historical RM application businesses are airlines, hotels and rental cars. In what way is container shipping similar different from these application areas?The RM of Hotels is mainly dependent on the time of booking (balancing the demand), reservation scheduling premium hotel rooms, etc. Also in this case the revenue is generated from large number of customers booking small number of rooms.In case of airlines its cargo systems, the revenue model is based on charging different prices for same products based on customer requirements - same day express shipping, etc. Cargo capacity in passenger flights is uncertain as it changes with each departure whereas the numbers of seats remain the same.In container transportation, one of the important factors that distinguish from the other RM is space utilization. Rather the pricing depend upon time of booking, customer requirements in the traditional systems, container transportation is a function of loadability factor, type and size of container needed, etc. Also in container transportation, major chunk of revenue comes from long term contracts (1-3 years). requests are made 14 days prior to the freight becomes available for shipment. If there is insufficient capacity, then shipment is delayed for travel which happens 16 days in the future. If the capacity is not filled then it will delay the transportation till the container is filled to optimum level. In either case, customers can move to different transportation company or can choose to wait for the next travel.Question 2. If CTC continues with fixed origin-destination pricing, how should these prices be set if profitability is to be increased?Assumptions:We have made following assumptions to solve the assignment and they are followed throughout the report.The ratio of 20'-40' given in Exhibit-1 is the ratio of number of containers.The vessel collects containers from all the countries mentioned in Exhibit-1 and delivers them to the middle-east.At present Container Transportation Company is following the fixed pricing model. The same price is charged throughout the year from an origin to destination irrespective of the demand. As given in the case, the elasticity of demand exists and in order to maximize revenues of CTC. In Peak Season, a percent reduction in pricing would result 5 percent increase in volume of container and during slack season, a 5 percent reduction would percent increase in container traffic. Considering this factor, change in demand has to be looked at while calculating prices. The fixed Pricing for each port of Origin can be determined using the following optimization model:Decision Variables: Fixed Pricing for each of the port of OriginObjective Function: Maximize the collective revenue at all the ports which will be calculated as follows,Revenue at a port = Price * (Demand peak season + Demand in Lean season)Constraints:Peak Season Capacity Constraint: In peak season vessel will be loaded 95% providing capacity of TEU.Due to the elasticity of Demand at ports, calculation of new demand vis--vis change in price is,New Peak season Demand = Current Peak Season Demand * (1 + ((Current Price - Old Price)/Old Price) * 5/3)The addition of all these demands at all the ports <= Capacity Constraint: In lean season vessel will be loaded 90% providing capacity of 1800 TEU.Due to the elasticity of Demand at ports, calculation new demand vis--vis change in price is,New Lean season Demand = Current Lean Season Demand * (1 + ((Current Price - Old Price)/Old

file:///C:/Users/vivek/Desktop/Report_ctc.docx.html

1/3

12/3/13

Plagiarism Checker | Viper - Free Plagiarism Checker and Scanner Software

addition of all these demands at all the ports <= 1800 (in Lean Period)Weight Constraint Peak Season: Weight of the vessel should not Weight of the vessel = No. of 20' containers * Average weight of 20' container + No. 40' containers no. of 20' containers we used following method,Number of 20' containers in peak condition = Quantity Demanded * (Ratio of container+2*Ratio of 40' container))Weight Constraint Lean Season: Weight of the vessel should not exceed 20132.Weight of the vessel = No. of containers * Average weight of 20' container + No. 40' containers * Average weight of 40' containerTo calculate following method,Number of 20' containers in peak condition = Quantity Demanded * (Ratio of 20' container/(Ratio of 20' container))On solving the above problem, we got following solution,Price Port of Origin New Port Demand Peak Lean China 67.94 60.94 Malaysia 112.04 95.23 717.66 Singapore earn with the fixed revenue model is $2,621,974.65 Question 3: What makes for container "loadability" and how should CTC include factor into its pricing decisions?Container Loadability is the Weight/Volumeratioforthematerialloadedinto the containers. This can drive the efficiencies/inefficiencies in transportation.If weight/volume is such that maximum available space of container is utilized while keeping the weight within the permissible limit, then container loadability is high.In the given case, the volume of 40 feet container is double that of the volume of the 20 feet container. In spite of having double the storage capacity in terms of space, the weight carrying capacity of the container is just 30 tons as compared to 24 tons for the 20 feet container. Hence, in order to make best use of space by having high space occupying & less dense items should be shipped using 40 feet containers whereas heavy & dense items should be containers.CTC can include a multiplying factor for including loadability into its pricing decisions:Multiplyingfactorforprice= weightofcontainer+weight of cargo)/weight of cargo)*(1/Volume utilization of container)As the relative weight of container with respect to cargo increases or the volume utilization falls, then the loadability is poor and hence the price charged should be higher.Question 4: What are CTC's major shipping constraints? How might revenue management pricing change these constraints?Any transportation system is constrained by the capacity which it can carry; same is the scenario with container transportation company (CTC). CTC is constrained with the capacity of the vessel, which can carry utmost 2000 TEU and is limited to carry a weight load of 24000 tons at max.CTC planned to load the vessel with 95% and 90% capacity in season so that they can accommodate any urgent demand which comes in the last moment. Basic idea was that CTC could earn a premium charge on that This limited the capacity planning till 1900 TEU and 1800 TEU and to 22800 tons and 21600 tons in terms of weight.Now if CTC plans variable pricing model, the earlier constraints like the fixed ratio of 20' to 40' container won't be valid. As the demand will be dynamic, the of containers will be varying with demand. Load factor is going to be crucial and will determine the demand of 20' and 40' container. In the demand of 40' container will go high in comparison to 20'. The earlier weight constraints will not be effective and capacity will be constrained factor. Question 5: Demand curves derived from Thomas' price/volume estimatesAs per Thomas Young's estimate, during high season, when price is reduced by 3%, there shall be an increase of 5% in total TEU of demand and during low season, when price is reduced by 5%, there increase of 10% in total TEU of demand.Hence let us consider, the new price to be p for Japan. The change in high season demand corresponding to the new price is given by (p-940)/p. As per estimate, 3% reduction results in increase in price by 5%, So (p-940)/p, results in increase in price by p-940)/pHence actual demand shall be (1-(5/3)* (p-940)/p) of high season demand for Japan= (1-(5/3)* (p-940)/p) * high season demand For low season the demand corresponding to the new price is given by (p-940)/p, assuming that the new price is constant irrespective of high or low seasonAs per estimate, 5% reduction results in increase in price by 10%, So (940-p)/p, results in increase in price by (10/5)* (p-940)/p, Hence actual shall be (1-(10/5)* (p-940)/p) of high season demand for Japan= (1-(10/5)* (p-940)/p) * low season demandWe can thereby plot the new price versus TEU for fixed price irrespective of high or low season as per the following data table:Orange Line - High Demand Blue Line - Lean What is the revenue gain between a fixed price strategy and a variable price strategy?In the fixed price strategy, the prices remain same for the peak as well as the lean demand. After running the solver to determine the optimum prices at each port so as to maximize the overall revenue, the optimal value comes to be 2,621,975/-If we consider that the prices can be changed based on the season, i.e. the peak and the lean demand, we need to separately optimize the price levels for the peak and lean demand. The sum of the optimum values of revenue of the peak and the lean demand is Peak Demand:Decision Variables: Prices at all portsObjective function: Maximize the revenue for the peak demand = Price (peak) * Demand Constraints: Peak season volume <= 1900 Peak season weight <= 22,800Maximum Revenue for the peak season= 1,391,673/-Lean Prices at all portsObjective function: Maximize the revenue for the lean demand = Price (lean) * Demand (lean)Constraints: Peak season Peak season weight <= 21,600Maximum Revenue for the peak season= 1,276,115/-Total Revenue = 2,667,788/-Therefore Revenue gain= Fixed variable price strategy= 2,667,788 - 2,621,975= 45,813/-Question 7: What might be the next step for CTC if it decides to implementing RM?Ans: Continuing with revenue management, CTC can focus on a few of the below mentioned points to improve the revenue it generates Higher prices for last minute premium traffics that cannot wait till next vesselAs seen from question 2, the binding constraint is the weight and the volume, hence improving loadability to utilize both volume and weight capacitiesPremium prices for highly valued low competitive routes like Korea/China to Dubai routesIntroduce price differentiation on the type of container used, as the cost incurred for shipping through the two containers is different. This can incentivize customers to use CTC serviceIntroduce offers during low demand season, as this can bring in the profit through increased numbers in times of low demand

Plagiarism Detection Softw are Plagiarism Test Plagiarism Detector Detect Plagiarism

Essay Checker | Free Check for Plagiarism Lesson plans Avoid Plagiarism Plagiarism Check

Plagiarism Prevention Turnitin | Check for Plagiarism Free Editing Services Coursew ork w riting

Copyright 2012 All Rights Reserved. Scan My Essay - Free Plagiarism Scanner, Checker and Detection Tool. Viper and ScanMyEssay.com are trading names of Angel Business Limited, a Company registered in England and Wales w ith Company Registration No: 07344835, The Loft, 3 Plumptre Street, The Lace Market,

file:///C:/Users/vivek/Desktop/Report_ctc.docx.html

2/3

12/3/13

Plagiarism Checker | Viper - Free Plagiarism Checker and Scanner Software

Nottingham NG1 1JL | Warning - Viper Keygen / Viper Crack Please note that by using ScanMyEssay.com, VIPER and any other softw are or resources on the ScanMyEssay Website, you are signifying your agreement to our terms and conditions, and our privacy policy | XML sitemap | ROR | TXT | HTML | PHP | | Verificador de plagio gratuito | Dtecteur de plagiat gratuit | Viper ...

file:///C:/Users/vivek/Desktop/Report_ctc.docx.html

3/3

You might also like

- Matching Dell - Cost AnalysisDocument1 pageMatching Dell - Cost AnalysisVivek Kumar100% (2)

- Matching Dell - Cost AnalysisDocument1 pageMatching Dell - Cost AnalysisVivek Kumar100% (2)

- Wizz AirDocument2 pagesWizz AirVivek KumarNo ratings yet

- Case Study: Manajemen Logistik & Rantai PasokDocument30 pagesCase Study: Manajemen Logistik & Rantai PasokDede AtmokoNo ratings yet

- Writing An APA Style Research Paper PDFFDocument5 pagesWriting An APA Style Research Paper PDFFAngela MenesesNo ratings yet

- Love Stories of Shimla Hills - Chaudhry, MinakshiDocument251 pagesLove Stories of Shimla Hills - Chaudhry, MinakshiAnkit BhattNo ratings yet

- Komputasi Champignons GaloreDocument2 pagesKomputasi Champignons GaloreChristopher D NaraNo ratings yet

- Will AI Kill JobsDocument5 pagesWill AI Kill JobsDAYSAFTER17No ratings yet

- Tan, Ma. Cecilia ADocument20 pagesTan, Ma. Cecilia ACecilia TanNo ratings yet

- Actividad 3 English Activity V2Document3 pagesActividad 3 English Activity V2Diana catherine Romero pacheco0% (1)

- Group Assignment 2 StatisticDocument3 pagesGroup Assignment 2 StatisticYuyus RifmawanNo ratings yet

- Tabel Chi SquareDocument5 pagesTabel Chi SquareHafidz Yaasiin AslimNo ratings yet

- Gustarina Andini - 1986010205 - Id. Kritik Jurnal Manajemen Risiko Bank SyariahDocument6 pagesGustarina Andini - 1986010205 - Id. Kritik Jurnal Manajemen Risiko Bank SyariahKhavid Normasyhuri 2No ratings yet

- Tabel PDocument2 pagesTabel PIka Dewi Wulan NdariNo ratings yet

- Artikel 1 Vol 2 No 2 CSEFBDocument12 pagesArtikel 1 Vol 2 No 2 CSEFBricky koharNo ratings yet

- 1496-1511 Factors Influencing On Customers E-Satisfaction A Case Study From IranDocument16 pages1496-1511 Factors Influencing On Customers E-Satisfaction A Case Study From IranHilman BasskaraNo ratings yet

- CJR Riset Pemasaran Fretty (7173143016)Document15 pagesCJR Riset Pemasaran Fretty (7173143016)vio AudicaNo ratings yet

- Tabel Durbin WatsonDocument2 pagesTabel Durbin Watsonfajar himawanNo ratings yet

- done-ANALISIS DAN OPTIMASI SISTEM ANTRIAN DI GERAI MINUMAN TEKO BOBADocument16 pagesdone-ANALISIS DAN OPTIMASI SISTEM ANTRIAN DI GERAI MINUMAN TEKO BOBAHeni Damayanti EniNo ratings yet

- Domestic Vs Global Supply ChainDocument2 pagesDomestic Vs Global Supply Chainharsh saini100% (1)

- .Analisis Pengaruh DER, DPR, ROE Dan Size Terhadap PBV Perusahaan Manufaktur Yang Listing Di BEI Periode 2005-2007Document9 pages.Analisis Pengaruh DER, DPR, ROE Dan Size Terhadap PBV Perusahaan Manufaktur Yang Listing Di BEI Periode 2005-2007AtikaSandyNo ratings yet

- Tugas Statistika 3Document13 pagesTugas Statistika 3matamerahNo ratings yet

- Analisis Clustering Dokumen Tugas Akhir Mahasiswa Sistem Informasi Universitas Nasional Menggunakan Metode K-Means ClusteringDocument7 pagesAnalisis Clustering Dokumen Tugas Akhir Mahasiswa Sistem Informasi Universitas Nasional Menggunakan Metode K-Means ClusteringJurnal JTIK (Jurnal Teknologi Informasi dan Komunikasi)No ratings yet

- Tugas Enterprise Resource Planning: Kelas ADocument4 pagesTugas Enterprise Resource Planning: Kelas ARizka HadiwiyantiNo ratings yet

- Pengaruh E-Service Quality Terhadap Perceived Value Dan E - (Survei Pada Pelanggan Go-Ride Yang Menggunakan Mobile Application Go-Jek Di Kota Malang)Document10 pagesPengaruh E-Service Quality Terhadap Perceived Value Dan E - (Survei Pada Pelanggan Go-Ride Yang Menggunakan Mobile Application Go-Jek Di Kota Malang)m.knoeri habibNo ratings yet

- Markov Analysis: To Accompany by Render, Stair, and Hanna Power Point Slides Created by Brian PetersonDocument39 pagesMarkov Analysis: To Accompany by Render, Stair, and Hanna Power Point Slides Created by Brian PetersonassaNo ratings yet

- Contoh Kasus Resiko ItDocument14 pagesContoh Kasus Resiko Itagata ekaNo ratings yet

- Compare MeansDocument52 pagesCompare MeansraiNo ratings yet

- House of Risk A Model For Proactive Supply Chain RDocument16 pagesHouse of Risk A Model For Proactive Supply Chain RRipta RaskaNo ratings yet

- Closing Case of Chapter 5 Trade in Information Technology and U.S. Economic GrowthDocument2 pagesClosing Case of Chapter 5 Trade in Information Technology and U.S. Economic GrowthHendry Haryanto50% (2)

- Commercial Logistics Vs Humanitarian LogisticsDocument2 pagesCommercial Logistics Vs Humanitarian LogisticsekaNo ratings yet

- Kasus Sia Pert10 Siklus ProduksiDocument100 pagesKasus Sia Pert10 Siklus ProduksiAlda ArtantiNo ratings yet

- Basu1977 PDFDocument20 pagesBasu1977 PDFnaeem1990No ratings yet

- Analisis Program Dan Prosedur Audit Pada PT XL Axiata Tbk. - KELOMPOK 4 - AUDITING IIDocument40 pagesAnalisis Program Dan Prosedur Audit Pada PT XL Axiata Tbk. - KELOMPOK 4 - AUDITING IIRifqi Aqilla DivasyahNo ratings yet

- Hambatan Dan Dorongan Supply Chain ManagementDocument4 pagesHambatan Dan Dorongan Supply Chain ManagementesiNo ratings yet

- Wacc 4Document10 pagesWacc 4Rita NyairoNo ratings yet

- Jurnal Teknologi Dan Industri Pertanian Indonesia: KeywordsDocument12 pagesJurnal Teknologi Dan Industri Pertanian Indonesia: KeywordsWahyu AjiNo ratings yet

- Statistika Deskriptif Dan Inferensia Serta Teknik SamplingDocument11 pagesStatistika Deskriptif Dan Inferensia Serta Teknik SamplingFaJar ALmaaNo ratings yet

- Ghina Regiana 082 Exercise 56-60Document2 pagesGhina Regiana 082 Exercise 56-60ghina regianaNo ratings yet

- Module 1 - Introduction and Management Decision Making - Homework SolutionsDocument4 pagesModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelNo ratings yet

- Research Proposal and Report by Dr. Krisna MurtiDocument87 pagesResearch Proposal and Report by Dr. Krisna MurtiNovia WinardiNo ratings yet

- Lampiran 5 Distribusi Nilai R TabelDocument2 pagesLampiran 5 Distribusi Nilai R TabelAnthye100% (1)

- The Effect of Facility and Quality of Service On Loyalty, Through Consumer Satisfaction of Vehicle Rental Services at PT. Madani Business PartnerDocument5 pagesThe Effect of Facility and Quality of Service On Loyalty, Through Consumer Satisfaction of Vehicle Rental Services at PT. Madani Business PartnerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- KS TabelDocument7 pagesKS TabelGalihNo ratings yet

- Nama: Anissa Asyahra NIM: 20.05.51.0253 Mata Kulah: Manajemen Keuangan 2 Tugas Diskusi 2 Manajemen Keuangan 2 SoalDocument15 pagesNama: Anissa Asyahra NIM: 20.05.51.0253 Mata Kulah: Manajemen Keuangan 2 Tugas Diskusi 2 Manajemen Keuangan 2 SoalAnissa AsyahraNo ratings yet

- Tabel PV AnnuityDocument1 pageTabel PV AnnuityLittle RariesNo ratings yet

- OM 202 Case StudyDocument5 pagesOM 202 Case StudyEury MoonNo ratings yet

- 2 Customer Engagement As A New Perspective in Customer ManagementDocument7 pages2 Customer Engagement As A New Perspective in Customer ManagementOdnooMgmrNo ratings yet

- Makalah Interview FixDocument34 pagesMakalah Interview FixafridaNo ratings yet

- TJT BrosurDocument6 pagesTJT BrosurIsmu H MulyonoNo ratings yet

- Acceptance Sampling AtributDocument37 pagesAcceptance Sampling AtributRosiana RahmaNo ratings yet

- Unit 19-20 - 2 PDFDocument10 pagesUnit 19-20 - 2 PDFMuhammad MidhatNo ratings yet

- Tugas Akuntansi Manajemen Lanjutan PROBLEM 4.32 Dan 4.35: Teuku Aldefa Angkasa Wangsa Banowo 2006623132Document3 pagesTugas Akuntansi Manajemen Lanjutan PROBLEM 4.32 Dan 4.35: Teuku Aldefa Angkasa Wangsa Banowo 2006623132Teuku AldefaNo ratings yet

- Answer For Latihan B Pertemuan I & IIDocument5 pagesAnswer For Latihan B Pertemuan I & IIShaka ShakaNo ratings yet

- ID Analisis Swot Pada Umkm Keripik Tempe AmDocument10 pagesID Analisis Swot Pada Umkm Keripik Tempe AmIka IgaNo ratings yet

- CROSSEC1Document10 pagesCROSSEC1nadyadwiandaniNo ratings yet

- Distributor Storage With Last-Mile DeliveryDocument7 pagesDistributor Storage With Last-Mile DeliveryCao Tâm VũNo ratings yet

- All Work Must Be Shown It Can'T Be Just The AnswersDocument3 pagesAll Work Must Be Shown It Can'T Be Just The AnswersJoel Christian MascariñaNo ratings yet

- Measuring The Performance of Intellectual Potential in Knowledge EconomyDocument20 pagesMeasuring The Performance of Intellectual Potential in Knowledge EconomyRonald PutraNo ratings yet

- Daftar Jurnal Sinta 3Document6 pagesDaftar Jurnal Sinta 3Iranti AINo ratings yet

- Akt BiayaDocument35 pagesAkt BiayacocoNo ratings yet

- 3Q - 2016 - CPGT - Citra Maharlika Nusantara Corpora TBK PDFDocument107 pages3Q - 2016 - CPGT - Citra Maharlika Nusantara Corpora TBK PDFYudhi MahendraNo ratings yet

- Earning Per Share (Eps) Dan Economic Value Added (Eva) TerhadapDocument9 pagesEarning Per Share (Eps) Dan Economic Value Added (Eva) TerhadapKarmilaNo ratings yet

- 800-Article Text-1073-1-10-20180509Document16 pages800-Article Text-1073-1-10-20180509Kukuh SwanNo ratings yet

- Container Transportation - Group 5Document4 pagesContainer Transportation - Group 5tushars2012No ratings yet

- Koopmans1949 PDFDocument12 pagesKoopmans1949 PDFxapaudelNo ratings yet

- Age DataDocument147 pagesAge DataVivek KumarNo ratings yet

- MM Case Presentation - V4Document18 pagesMM Case Presentation - V4Vivek KumarNo ratings yet

- Leasecalculator: Keyed To "Valuation of Financial Lease Contracts," Myers SC, Dill DA, Bautista, AJ InputDocument3 pagesLeasecalculator: Keyed To "Valuation of Financial Lease Contracts," Myers SC, Dill DA, Bautista, AJ InputVivek KumarNo ratings yet

- Information On Visa Application Photograph: in Case An Applicant Wears GlassesDocument1 pageInformation On Visa Application Photograph: in Case An Applicant Wears GlassesVivek KumarNo ratings yet

- Assignment 2Document9 pagesAssignment 2Vivek KumarNo ratings yet

- Pre-Test Chapter 6 Ed17Document8 pagesPre-Test Chapter 6 Ed17Vivek KumarNo ratings yet

- OM Groups Secns ABCFDocument8 pagesOM Groups Secns ABCFVivek KumarNo ratings yet

- AdvMicroSolutions PDFDocument27 pagesAdvMicroSolutions PDFĐỗ Huy HoàngNo ratings yet

- Financial Markets & Instruments: Investments Term 3 (2013-15)Document31 pagesFinancial Markets & Instruments: Investments Term 3 (2013-15)Vivek KumarNo ratings yet

- 3G Paging Success Report NBH - TN - 20120322 20120322Document2 pages3G Paging Success Report NBH - TN - 20120322 20120322Vivek KumarNo ratings yet

- Basic Rate AnalysisDocument33 pagesBasic Rate AnalysisSudip GhimireNo ratings yet

- English Week 7 Spoken Text Quarter 1 PDFDocument32 pagesEnglish Week 7 Spoken Text Quarter 1 PDFsimaNo ratings yet

- PercentagesDocument10 pagesPercentagesSinthuja KNo ratings yet

- Caption of Satyam and Infosys and Ibm and TcsDocument6 pagesCaption of Satyam and Infosys and Ibm and TcsJyoti SinghNo ratings yet

- Ibrahim Raja August 2022 Theraplay ReportDocument6 pagesIbrahim Raja August 2022 Theraplay Reportfatma522No ratings yet

- Wordsearch Fruits Fun Activities Games Games Icebreakers Oneonone Ac - 109759Document2 pagesWordsearch Fruits Fun Activities Games Games Icebreakers Oneonone Ac - 109759raquel lujanNo ratings yet

- Lesson Plan 14Document3 pagesLesson Plan 14api-268829047No ratings yet

- Cost Effective Housing PDFDocument16 pagesCost Effective Housing PDFSaurav ShresthaNo ratings yet

- Company LawDocument15 pagesCompany Lawpreetibajaj100% (2)

- Allgaier Apt Tro Fluidizedbedtechnology en 2Document8 pagesAllgaier Apt Tro Fluidizedbedtechnology en 2Fer Lartiga VentocillaNo ratings yet

- ABB Control TP180DA DatasheetDocument3 pagesABB Control TP180DA Datasheetntdien923100% (1)

- Immunomodulators: By: Payal Suthar Department of PharmacognosyDocument26 pagesImmunomodulators: By: Payal Suthar Department of PharmacognosyHely Patel100% (1)

- NB Private Equity Partners Ltd.Document68 pagesNB Private Equity Partners Ltd.ArvinLedesmaChiong100% (1)

- Green Synthesis and Characterization of Silver Nanoparticles, by The Reductive Action of The Aqueous Extract of Blueberry (Vaccinium Corymbosum)Document6 pagesGreen Synthesis and Characterization of Silver Nanoparticles, by The Reductive Action of The Aqueous Extract of Blueberry (Vaccinium Corymbosum)TR DanieleNo ratings yet

- Salesforce Pages Developers GuideDocument810 pagesSalesforce Pages Developers GuideanynameNo ratings yet

- 2017 Somali English ABC Bridge PrimerDocument230 pages2017 Somali English ABC Bridge PrimerSky somaliNo ratings yet

- Nursing Skills To Put On ResumeDocument6 pagesNursing Skills To Put On Resumeaflkubfrv100% (1)

- Manual AccumetDocument63 pagesManual AccumetClaudio Pastén CortésNo ratings yet

- The Sinister Genius of Qassem Soleimani - WSJ PDFDocument5 pagesThe Sinister Genius of Qassem Soleimani - WSJ PDFMuhammad Anique RawnNo ratings yet

- Journal of Macromolecular Science, Part C: To Cite This Article: John R. Martin, Julian F. Johnson & Anthony R. CooperDocument145 pagesJournal of Macromolecular Science, Part C: To Cite This Article: John R. Martin, Julian F. Johnson & Anthony R. CooperRicky Iqbal SNo ratings yet

- Letter From Harvard Leaders To EPA's Andrew Wheeler On Proposed Science PolicyDocument60 pagesLetter From Harvard Leaders To EPA's Andrew Wheeler On Proposed Science PolicyEmily AtkinNo ratings yet

- Literature ReviewDocument4 pagesLiterature Reviewapi-534903749No ratings yet

- Review Exercises DAY 3Document4 pagesReview Exercises DAY 3Heba Abd-AllahNo ratings yet

- Math11 SP Q3 M2 PDFDocument16 pagesMath11 SP Q3 M2 PDFJessa Banawan EdulanNo ratings yet

- Start-Up Report Warranty Registration - EDITABLEDocument1 pageStart-Up Report Warranty Registration - EDITABLESAED ALAWNEHNo ratings yet

- Geophysics & Remote SensingDocument5 pagesGeophysics & Remote SensingHaris Eko SetyawanNo ratings yet

- Changing Landscape of Recruitment IndustryDocument5 pagesChanging Landscape of Recruitment IndustryNupur SinghNo ratings yet