Professional Documents

Culture Documents

TDS Rates For The A

TDS Rates For The A

Uploaded by

sadathnooriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Rates For The A

TDS Rates For The A

Uploaded by

sadathnooriCopyright:

Available Formats

TDS RATES FOR THE A.Y.

2012-13 (IN %)

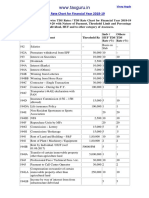

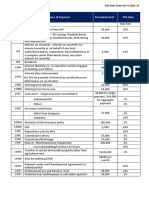

Nature of Payment Made To Residents Threshold (Rs.) Company / Firm / Co-operative Society / Local Authority Rate (%) NA 10 10 10 10 30 30 2 2 10 10 20 20 20 10 10 10 2 10 10 5 5 Individual / HUF If No / Invalid PAN Rate (%) 30 20 20 20 20 30 30 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20

Section - Description 192 - Salaries 193 - Interest on securities 194 - Dividends 194A - Interest other than interest on securities Others 194A - Banks 194B - Winning from Lotteries 194BB - Winnings from Horse Race 194 C - Payment to Contractors - Payment to Contractor - Single Transaction - Payment to Contractor - Aggregate During the F.Y. - Contract - Transporter who has provided valid PAN 194D - Insurance Commission 194E - Payment to Non-Resident Sportsmen or Sports Association - Applicable up to June 30, 2012 - Applicable from July 1, 2012 194EE - Payments out of deposits under NSS 194F - Repurchase Units by MFs 194G - Commission - Lottery 194H - Commission / Brokerage 194I - Rent - Land and Building 194I - Rent - Plant / Machinery 194J - Professional Fees 194LA - Immovable Property 194LB - Income by way of interest from infrastructure debt fund (non-resident) Sec 194 LC - Income by way of interest by an Indian specified company to a non-resident / foreign company on foreign currency approved loan / long-term infrastructure bonds from outside India (applicable from July 1, 2012) 195 - Other Sums 196B - Income from units 196C-Income from foreign currency bonds or GDR (including long-term capital gains on transfer of such bonds) (not being dividend) 196D - Income of FIIs from securities 5000 10000 10000 5000 30000 75000 20000 2500 1000 1000 5000 180000 180000 30000 100000 -

Rate (%) Average rates as applicable 10 10 10 10 30 30 1 1 10 10 20 20 10 10 10 2 10 10 5 5

Average rates as applicable 10 10

10 10

30 20 20

20

20

20

20

You might also like

- Tds BookletDocument22 pagesTds BookletSanjayThakkarNo ratings yet

- Tds Rate ChartDocument49 pagesTds Rate ChartSANJEEVNo ratings yet

- What Are The Incomes Specified For TDSDocument6 pagesWhat Are The Incomes Specified For TDSaniket thakurNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document7 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ABHISHEKNo ratings yet

- TDS Rate ChartDocument9 pagesTDS Rate Chartjibin samuelNo ratings yet

- TDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedDocument13 pagesTDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedAnkur ShahNo ratings yet

- IT Rates For Tax Deduction at SourceDocument12 pagesIT Rates For Tax Deduction at SourceArun EmmiNo ratings yet

- Notification TDS Rates - FV AMC BillDocument8 pagesNotification TDS Rates - FV AMC Billamit chavariaNo ratings yet

- TDS Rates Chart Fy 2020 21 Ay 2021 22Document6 pagesTDS Rates Chart Fy 2020 21 Ay 2021 22Brijendra SinghNo ratings yet

- Ssra Tds Rates 2021-2022Document10 pagesSsra Tds Rates 2021-2022deepu kNo ratings yet

- Intro of TdsDocument6 pagesIntro of Tdsshivani singhNo ratings yet

- WWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Document1 pageWWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Sunny NarangNo ratings yet

- TDS Chart FY 23-24Document6 pagesTDS Chart FY 23-24kuldeep singhNo ratings yet

- TDS Rate Chart 2011 - 12Document1 pageTDS Rate Chart 2011 - 12m_y_chavanNo ratings yet

- TDS Rate Chart: Assessment Year 2011-12Document1 pageTDS Rate Chart: Assessment Year 2011-12Saravanan ElumalaiNo ratings yet

- A) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Document17 pagesA) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Sonika GuptaNo ratings yet

- TDS Rates Ay 2022-23Document10 pagesTDS Rates Ay 2022-23Suriyakumar ShanmugavelNo ratings yet

- TDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14Document2 pagesTDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14CaCs Piyush SarupriaNo ratings yet

- Tds Rate ChartDocument15 pagesTds Rate ChartJain MjNo ratings yet

- Presentation On TDS Provision: by Nilesh Deharkar & AMAN BhattacharyaDocument15 pagesPresentation On TDS Provision: by Nilesh Deharkar & AMAN BhattacharyaAman BhattacharyaNo ratings yet

- Instapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355Document7 pagesInstapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355skassociatetaxconsultantNo ratings yet

- Tds Rate Chart Fy 2021-22Document3 pagesTds Rate Chart Fy 2021-22Kadambari ShelkeNo ratings yet

- TDS RATE CHART FY 2021-22-FinalDocument5 pagesTDS RATE CHART FY 2021-22-FinalLeenaNo ratings yet

- TDS Rates Chart For Financial Year 2021 22 Assessment Year 2022 23 1Document5 pagesTDS Rates Chart For Financial Year 2021 22 Assessment Year 2022 23 1Audit ManifestNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document9 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ajayNo ratings yet

- TDS RatesDocument9 pagesTDS RatesCharu JagetiaNo ratings yet

- TDS Rate Chart'Document8 pagesTDS Rate Chart'PUSHKAR GARGNo ratings yet

- Revised TDS Wef 14.05.20Document7 pagesRevised TDS Wef 14.05.20MANAN KOTHARINo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument11 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rate Chart: (For Assessment Year 2017-18)Document10 pagesTDS Rate Chart: (For Assessment Year 2017-18)Ajay SimonNo ratings yet

- Tds 1 Page Quick RevisionDocument1 pageTds 1 Page Quick RevisionKanth 10100% (1)

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDocument7 pagesTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNo ratings yet

- Section 192:: Payment of SalaryDocument7 pagesSection 192:: Payment of SalaryCacptCoachingNo ratings yet

- TDS Rate Chart For 2013-14Document1 pageTDS Rate Chart For 2013-14Bharath Kumar JNo ratings yet

- TDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Document3 pagesTDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Prince RaichandNo ratings yet

- TDS Rates For FY 2021-22Document12 pagesTDS Rates For FY 2021-222022 YearNo ratings yet

- Accounts & Taxations Interview Related NotesDocument5 pagesAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNo ratings yet

- TDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inDocument15 pagesTDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inSachin GuptaNo ratings yet

- TDS and TCS Rate Chart 2023Document3 pagesTDS and TCS Rate Chart 2023praveenNo ratings yet

- Tds - and - Tcs Rate Chart Fy 2019 20 TdsmanDocument2 pagesTds - and - Tcs Rate Chart Fy 2019 20 Tdsmankumar45caNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument5 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rate Chart FY 2020-2021 (Covid-19) : Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) (Covid-19)Document4 pagesTDS Rate Chart FY 2020-2021 (Covid-19) : Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) (Covid-19)Sahay AlokNo ratings yet

- Particulars TDS Rates (In %)Document6 pagesParticulars TDS Rates (In %)Amiy Anand PandeyNo ratings yet

- TDS TCSDocument231 pagesTDS TCSNarinderpal SinghNo ratings yet

- TDS RatesDocument11 pagesTDS RatesRAVI DWIVEDINo ratings yet

- Income Tax TDS RateDocument7 pagesIncome Tax TDS RateSuresh KesavanNo ratings yet

- CT Part 14-Dividend TaxDocument6 pagesCT Part 14-Dividend TaxSHAURYA VERMANo ratings yet

- TDS ChartDocument4 pagesTDS ChartjaoceelectricalNo ratings yet

- TDS Rate Chart - FY 2021-22Document3 pagesTDS Rate Chart - FY 2021-22Ram YadavNo ratings yet

- Some Issues On Practice of TDS Law Seminar by NIRCDocument29 pagesSome Issues On Practice of TDS Law Seminar by NIRCHarish KalidasNo ratings yet

- What Is Tax Deducted at SourceDocument6 pagesWhat Is Tax Deducted at SourcejdonNo ratings yet

- TDS - and - TCS Rate Chart 2024Document5 pagesTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)No ratings yet

- Tds Rate Chart For Fy 21016Document2 pagesTds Rate Chart For Fy 21016VedpalNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument6 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- Some Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCDocument29 pagesSome Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCJinoy P MathewNo ratings yet

- Business Taxation AssignmentDocument7 pagesBusiness Taxation AssignmentThe Social KarkhanaNo ratings yet

- Tax Deduct at SourceDocument4 pagesTax Deduct at Sourceankit1070No ratings yet

- With Holding Tax RatesDocument3 pagesWith Holding Tax Ratesvenkat6299No ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Section B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)Document8 pagesSection B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)sadathnooriNo ratings yet

- Pá Éãdä Pàët E ÁséDocument4 pagesPá Éãdä Pàët E ÁsésadathnooriNo ratings yet

- To TB JayachandraDocument1 pageTo TB JayachandrasadathnooriNo ratings yet

- BNP Paribas Bank DetailsDocument1 pageBNP Paribas Bank DetailssadathnooriNo ratings yet

- Prov List 11Document23 pagesProv List 11sadathnooriNo ratings yet

- ªàiá£Àågé, «Μàaiàä:-°Auàgádä Ja§ «Záåyðaiàä «ΜàaiàäDocument3 pagesªàiá£Àågé, «Μàaiàä:-°Auàgádä Ja§ «Záåyðaiàä «ΜàaiàäsadathnooriNo ratings yet

- Business Environment Question Bank With AnswersDocument11 pagesBusiness Environment Question Bank With Answerssadathnoori75% (4)

- Explain The Various NonDocument1 pageExplain The Various NonsadathnooriNo ratings yet

- Sub:Statement of Diesel Bill: Date Indent HSD in Ltrs Bill No Rate, Rs AmountDocument16 pagesSub:Statement of Diesel Bill: Date Indent HSD in Ltrs Bill No Rate, Rs AmountsadathnooriNo ratings yet

- Fms TestDocument1 pageFms TestsadathnooriNo ratings yet

- CoinsDocument2 pagesCoinssadathnooriNo ratings yet

- Unit 4 Nbfcs MeaningDocument7 pagesUnit 4 Nbfcs MeaningsadathnooriNo ratings yet

- Noor Part 1Document3 pagesNoor Part 1sadathnooriNo ratings yet

- A Stock ExchangeDocument1 pageA Stock ExchangesadathnooriNo ratings yet

- MbaDocument54 pagesMbasadathnooriNo ratings yet

- 7.blessed SalivaDocument2 pages7.blessed SalivasadathnooriNo ratings yet

- 7.blessed SalivaDocument2 pages7.blessed SalivasadathnooriNo ratings yet