Professional Documents

Culture Documents

Negotiable Instrument Is A Document Guaranteeing The Payment of A Specific Amount of Money

Negotiable Instrument Is A Document Guaranteeing The Payment of A Specific Amount of Money

Uploaded by

akramlodhikhanCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ManzilDocument30 pagesManzilAbu96% (54)

- BrewDog EFPIV Prospectus UKDocument66 pagesBrewDog EFPIV Prospectus UKWilliam SulinskiNo ratings yet

- Case 02846497: AFR 2012: Show DetailsDocument2 pagesCase 02846497: AFR 2012: Show DetailsakramlodhikhanNo ratings yet

- Country Names and AdjectivesDocument4 pagesCountry Names and AdjectivesakramlodhikhanNo ratings yet

- Obituary Father in Law ChairmanTAAPDocument1 pageObituary Father in Law ChairmanTAAPakramlodhikhanNo ratings yet

- ET-233 Ut Formulas of TractionDocument1 pageET-233 Ut Formulas of TractionakramlodhikhanNo ratings yet

- List of Companies: Enr. No. Name of CompanyDocument32 pagesList of Companies: Enr. No. Name of Companyakramlodhikhan0% (1)

- New International Karwan-E-Arfat (PVT) LTD: Particulars Credit DebitDocument1 pageNew International Karwan-E-Arfat (PVT) LTD: Particulars Credit DebitakramlodhikhanNo ratings yet

- Government Boys High School NoDocument1 pageGovernment Boys High School NoakramlodhikhanNo ratings yet

- New International Karwan-E-Arfat (PVT) LTD: Shop No. 3, Shams Arcade Risala Road Gari Kahat Hyd 022-2782447, 022-2784370Document1 pageNew International Karwan-E-Arfat (PVT) LTD: Shop No. 3, Shams Arcade Risala Road Gari Kahat Hyd 022-2782447, 022-2784370akramlodhikhanNo ratings yet

- Subsidiary Instructions 2022Document272 pagesSubsidiary Instructions 2022Sairem Sarat SinghNo ratings yet

- Principles From Decisions of SC On Penalties and Select Issues Under Penal ProvisionsDocument51 pagesPrinciples From Decisions of SC On Penalties and Select Issues Under Penal ProvisionsSaikumar SawantNo ratings yet

- ENG Merchant 4275Document7 pagesENG Merchant 4275thirdNo ratings yet

- RTR Cop ApplicationDocument10 pagesRTR Cop ApplicationAvinash KashyapNo ratings yet

- Debenture Application Form 1Document2 pagesDebenture Application Form 1Amit_PuzariNo ratings yet

- CBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Document16 pagesCBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Kuldeep JatNo ratings yet

- RTR Specimen For CPLDocument9 pagesRTR Specimen For CPL6E-TeamNo ratings yet

- BrewDog Prospectus 2013 Equity For PunksDocument70 pagesBrewDog Prospectus 2013 Equity For PunksCrowdfundInsiderNo ratings yet

- Perdana Petroleum - NPA and RSF FormDocument3 pagesPerdana Petroleum - NPA and RSF FormChen YishengNo ratings yet

- Vendor Master Request FormDocument8 pagesVendor Master Request FormaasthaNo ratings yet

- Introduction To Financial Products - Mid Term Set 1Document3 pagesIntroduction To Financial Products - Mid Term Set 1Harsha OjhaNo ratings yet

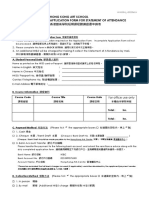

- Hong Kong Art School Statement-of-AttendanceDocument2 pagesHong Kong Art School Statement-of-AttendanceTammy TangNo ratings yet

- Singapore ENT Course - Registration Form (Final)Document2 pagesSingapore ENT Course - Registration Form (Final)Faisal BashirNo ratings yet

- 3CD ReportDocument14 pages3CD ReportRuloans VaishaliNo ratings yet

- Prem Tuition Fees Schedule AY2023 24Document4 pagesPrem Tuition Fees Schedule AY2023 24LIN WUNNA (TA TA) PHYONo ratings yet

- Samadhan Company Law BookDocument236 pagesSamadhan Company Law BookAmrit SohalNo ratings yet

- Form 3CD - Meenakshi SoniDocument15 pagesForm 3CD - Meenakshi SoniAditya AroraNo ratings yet

- Tar MRL Company PDFDocument18 pagesTar MRL Company PDFrishi Kr.No ratings yet

- Dossier 2023 2024Document8 pagesDossier 2023 2024PRANJUL SAHUNo ratings yet

- Form F3CB-3CD - Filed FormDocument12 pagesForm F3CB-3CD - Filed FormSaddam LoneNo ratings yet

- Application For A Boatmasters' Licence New Entrants: Personal DetailsDocument18 pagesApplication For A Boatmasters' Licence New Entrants: Personal DetailstadilakshmikiranNo ratings yet

- Sale and Purchase AgreementDocument27 pagesSale and Purchase AgreementAlia AnisaNo ratings yet

- MSF 4274 Deck MerchantDocument10 pagesMSF 4274 Deck Merchantunlimited87No ratings yet

- Banking Theory and Practice Final - FinalDocument209 pagesBanking Theory and Practice Final - FinalesubalewkumsaNo ratings yet

- HIMSS AP15 - Exhibitor's Service Manual - 6Document86 pagesHIMSS AP15 - Exhibitor's Service Manual - 6Trần KhươngNo ratings yet

- Tax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainDocument52 pagesTax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainVrind JainNo ratings yet

- PNC Verification Form 0Document2 pagesPNC Verification Form 0Rabia Zafar100% (1)

- Remittance: Bwbs 2013 Islamic Bank OperationDocument15 pagesRemittance: Bwbs 2013 Islamic Bank OperationWardatul RaihanNo ratings yet

- Prospectus CinsDocument70 pagesProspectus CinsImran ansariNo ratings yet

Negotiable Instrument Is A Document Guaranteeing The Payment of A Specific Amount of Money

Negotiable Instrument Is A Document Guaranteeing The Payment of A Specific Amount of Money

Uploaded by

akramlodhikhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Negotiable Instrument Is A Document Guaranteeing The Payment of A Specific Amount of Money

Negotiable Instrument Is A Document Guaranteeing The Payment of A Specific Amount of Money

Uploaded by

akramlodhikhanCopyright:

Available Formats

Negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time with the

payer named on the negotiable instrument.More specifically, it is a document contemplated by a contract, which warrants the payment of money without condition which may be paid on demand or at a future date. Examples of negotiable instruments include promissory notes, bills of exchange, bank notes and cheques. Although, some banknotes are not legal negotiable instruments such as current Federal Reserve Notes. Although passing for negotiable instruments most FRN's in circulation today are no longer legal negotiable instruments since the promise to pay or pay to the bearer on demand was taken off the notes near 1963. They no longer promise to pay dollars but claim to be dollars themselves.See: As payment of money is promised subsequently, the instrument itself can be used by the holder in due course as a store of value. The instrument can be transferred to a third party and it is the holder of the instrument who will ultimately get paid by the payer on the instrument. Transfers can happen at less than the face value of the instrument and this is known as discounting, this may happen for example if there is doubt about the payer's ability to pay. Due to the nature of the negotiable instrument as store of value, most countries passed laws specifically related to negotiable instruments.

History

Common prototypes of bills of exchanges and promissory notes originated in China. Here, in the 8th century during the reign of the Tang Dynasty they used special instruments called feitsyan for the safe transfer of money over long distances.[1] Later such document for money transfer used by Arab merchants, who had used the prototypes of bills of exchange suftadja and hawala in 1013th centuries, then such prototypes had used by Italian merchants in the 12th century. In Italy in the 1315th centuries, bills of exchange and promissory notes obtain their main features, while further phases of their development have been associated with France (1618th centuries, where the endorsement had appeared) and Germany (19th century, formalization of Exchange Law). In England (and later in the U.S.), exchange law was different from continental Europe because of different legal systems.[citation needed][2]

The modern emphasis on negotiability may also be traced to Lord Mansfield.[3] Germanic Lombards documents may also have some elements of negotiability.[4]

Negotiable instruments distinguished from other types of contracts

A negotiable instrument can serve to convey value constituting at least part of the performance of a contract, albeit perhaps not obvious in contract formation, in terms inherent in and arising from the requisite offer and acceptance and conveyance of consideration. The underlying contract contemplates the right to hold the instrument as, and to negotiate the instrument to, a holder in due course, the payment on which is at least part of the performance of the contract to which the negotiable instrument is linked. The instrument, memorializing (1) the power to demand payment; and, (2) the right to be paid, can move, for example, in the instance of a 'bearer instrument', wherein the possession of the document itself attributes and ascribes the right to payment. Certain exceptions exist, such as instances of loss or theft of the instrument, wherein the possessor of the note may be a holder, but not necessarily a holder in due course. Negotiation requires a valid endorsement of the negotiable instrument. The consideration constituted by a negotiable instrument is cognizable as the value given up to acquire it (benefit) and the consequent loss of value (detriment) to the prior holder; thus, no separate consideration is required to support an accompanying contract assignment. The instrument itself is understood as memorializing the right for, and power to demand, payment, and an obligation for payment evidenced by the instrument itself with possession as a holder in due course being the touchstone for the right to, and power to demand, payment. In some instances, the negotiable instrument can serve as the writing memorializing a contract, thus satisfying any applicable Statute of Frauds as to that contract.

A cheque with Thomas Jefferson as payee and payor from 1809

A cheque from 1905

A cheque from 1933

A cheque sample from Canada 2006 A cheque (or check in American English) is a document[nb 1] that orders a payment of money from a bank account. The person writing the cheque, the drawer, usually has a current account (most English speaking countries)[which?] or chequing/checking account (US; also, occasionally, Canada) where their money was previously deposited. The drawer writes the various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay that person or company the amount of money stated. Cheques are a type of bill of exchange and were developed as a way to make payments without the need to carry large amounts of money. While paper money evolved from promissory notes, another form of negotiable instrument, similar to cheques in that they were originally a written order to pay the given amount to whoever had it in their possession (the "bearer"). Technically, a cheque is a negotiable instrument[nb 2] instructing a financial institution to pay a specific amount of a specific currency from a specified transactional account held in the drawer's name with that institution. Both the drawer and payee may be natural persons or legal entities. Specifically, cheques are order instruments, and are not in general payable simply to the bearer (as bearer instruments are) but must be paid to the payee. In some countries, such as the US, the payee may endorse the cheque, allowing them to specify a third party to whom it should be paid. Although forms of cheques have been in use since ancient times and at least since the 9th century, it was during the 20th century that cheques became a highly popular non-cash method for making payments and the usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked in or around the early 1990s.[1] Since then cheque usage has fallen, being partly replaced by electronic payment systems. In an increasing number of countries cheques have either become a marginal payment system or have been completely phased out.

1. 2. 3. 4. 5.

Bill

of

exch.

as

payment

medium with due date Bill of exch. as short term credit for customer Bill of exch. as flexible financing medium: Vendor can discount bill of exchange before due date dependent on financial requirements. The bill of exchange is usually created by the Accounts Payable/Accounts Receivable department of a company. Bills of exchange are handled as Special G/L transactions in the SAP System and a Special G/L indicator is updated in the respective bill of exchange line items, via which the special account determination is determined. Types of BOE:

1. Promissory note The customer is the creator of the bill of exchange and at the same time the drawee of the bill of exchange. He sends the bill of exchange to his business partner. 2. Paper BOE, BOE payment request The vendor sends a bill of exchange to his business partner to be signed. The customer sends it back on a certain date. The vendor can request that the bill be sent back-> Draft paper bill. 3. Bank bill of exchange here exists a general agreement between business partners. The vendor creates a bill of exchange, enters the customer as beneficiary and sends this bill of exchange directly to the bank- bank bill of exchange. Bank Draft A banker's draft (also called a bank cheque, certified cheque in Canada or, in the US, a cashier's check) is a cheque (or check) where the funds are taken directly from the financial institution rather than the individual drawer's account. A normal cheque represents an instruction to transfer a sum of money from the drawer's account to the payee's account. When the payee deposits the cheque into their account, the cheque is verified as genuine (or 'cleared', a process typically

taking several days) and the transfer is performed (usually via a clearing house or similar system). Any individual or company operating a current account (or checking account) has authority to draw cheques against the funds stored in that account. However, it is impossible to predict when the cheque will be deposited after it is drawn. Because the funds represented by a cheque are not transferred until the cheque is deposited and cleared, it is possible the drawer's account may not have sufficient funds to honour the cheque when the transfer finally occurs. This dishonoured or 'bounced' cheque is now worthless and the payee receives no money, which is why cheques are less secure than cash. By contrast, when an individual requests a banker's draft they must immediately transfer the amount of the draft (plus any applicable fees and charges) from their own account to the bank's account. (An individual without an account at the issuing bank may request a banker's draft and pay for it in cash, subject to applicable anti-money laundering law and the bank's issuing policies.) Because the funds of a banker's draft have already been transferred they are proven to be available; unless the draft is a forgery or stolen, or the bank issuing the draft goes out of business before the draft is deposited and cleared, the draft will be honoured. Like other types of cheques, a draft must still be cleared and so it will take several days for the funds to become available in the payee's account.[1] In the United Kingdom the use of bankers' drafts is being phased out.[citation needed] With the advent of new technology such as debit cards, internet banking and Faster Payments the method of a guaranteed paper cheque is now regarded as slower and less secure for both the issuing bank and the customer.[citation needed]

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ManzilDocument30 pagesManzilAbu96% (54)

- BrewDog EFPIV Prospectus UKDocument66 pagesBrewDog EFPIV Prospectus UKWilliam SulinskiNo ratings yet

- Case 02846497: AFR 2012: Show DetailsDocument2 pagesCase 02846497: AFR 2012: Show DetailsakramlodhikhanNo ratings yet

- Country Names and AdjectivesDocument4 pagesCountry Names and AdjectivesakramlodhikhanNo ratings yet

- Obituary Father in Law ChairmanTAAPDocument1 pageObituary Father in Law ChairmanTAAPakramlodhikhanNo ratings yet

- ET-233 Ut Formulas of TractionDocument1 pageET-233 Ut Formulas of TractionakramlodhikhanNo ratings yet

- List of Companies: Enr. No. Name of CompanyDocument32 pagesList of Companies: Enr. No. Name of Companyakramlodhikhan0% (1)

- New International Karwan-E-Arfat (PVT) LTD: Particulars Credit DebitDocument1 pageNew International Karwan-E-Arfat (PVT) LTD: Particulars Credit DebitakramlodhikhanNo ratings yet

- Government Boys High School NoDocument1 pageGovernment Boys High School NoakramlodhikhanNo ratings yet

- New International Karwan-E-Arfat (PVT) LTD: Shop No. 3, Shams Arcade Risala Road Gari Kahat Hyd 022-2782447, 022-2784370Document1 pageNew International Karwan-E-Arfat (PVT) LTD: Shop No. 3, Shams Arcade Risala Road Gari Kahat Hyd 022-2782447, 022-2784370akramlodhikhanNo ratings yet

- Subsidiary Instructions 2022Document272 pagesSubsidiary Instructions 2022Sairem Sarat SinghNo ratings yet

- Principles From Decisions of SC On Penalties and Select Issues Under Penal ProvisionsDocument51 pagesPrinciples From Decisions of SC On Penalties and Select Issues Under Penal ProvisionsSaikumar SawantNo ratings yet

- ENG Merchant 4275Document7 pagesENG Merchant 4275thirdNo ratings yet

- RTR Cop ApplicationDocument10 pagesRTR Cop ApplicationAvinash KashyapNo ratings yet

- Debenture Application Form 1Document2 pagesDebenture Application Form 1Amit_PuzariNo ratings yet

- CBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Document16 pagesCBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Kuldeep JatNo ratings yet

- RTR Specimen For CPLDocument9 pagesRTR Specimen For CPL6E-TeamNo ratings yet

- BrewDog Prospectus 2013 Equity For PunksDocument70 pagesBrewDog Prospectus 2013 Equity For PunksCrowdfundInsiderNo ratings yet

- Perdana Petroleum - NPA and RSF FormDocument3 pagesPerdana Petroleum - NPA and RSF FormChen YishengNo ratings yet

- Vendor Master Request FormDocument8 pagesVendor Master Request FormaasthaNo ratings yet

- Introduction To Financial Products - Mid Term Set 1Document3 pagesIntroduction To Financial Products - Mid Term Set 1Harsha OjhaNo ratings yet

- Hong Kong Art School Statement-of-AttendanceDocument2 pagesHong Kong Art School Statement-of-AttendanceTammy TangNo ratings yet

- Singapore ENT Course - Registration Form (Final)Document2 pagesSingapore ENT Course - Registration Form (Final)Faisal BashirNo ratings yet

- 3CD ReportDocument14 pages3CD ReportRuloans VaishaliNo ratings yet

- Prem Tuition Fees Schedule AY2023 24Document4 pagesPrem Tuition Fees Schedule AY2023 24LIN WUNNA (TA TA) PHYONo ratings yet

- Samadhan Company Law BookDocument236 pagesSamadhan Company Law BookAmrit SohalNo ratings yet

- Form 3CD - Meenakshi SoniDocument15 pagesForm 3CD - Meenakshi SoniAditya AroraNo ratings yet

- Tar MRL Company PDFDocument18 pagesTar MRL Company PDFrishi Kr.No ratings yet

- Dossier 2023 2024Document8 pagesDossier 2023 2024PRANJUL SAHUNo ratings yet

- Form F3CB-3CD - Filed FormDocument12 pagesForm F3CB-3CD - Filed FormSaddam LoneNo ratings yet

- Application For A Boatmasters' Licence New Entrants: Personal DetailsDocument18 pagesApplication For A Boatmasters' Licence New Entrants: Personal DetailstadilakshmikiranNo ratings yet

- Sale and Purchase AgreementDocument27 pagesSale and Purchase AgreementAlia AnisaNo ratings yet

- MSF 4274 Deck MerchantDocument10 pagesMSF 4274 Deck Merchantunlimited87No ratings yet

- Banking Theory and Practice Final - FinalDocument209 pagesBanking Theory and Practice Final - FinalesubalewkumsaNo ratings yet

- HIMSS AP15 - Exhibitor's Service Manual - 6Document86 pagesHIMSS AP15 - Exhibitor's Service Manual - 6Trần KhươngNo ratings yet

- Tax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainDocument52 pagesTax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainVrind JainNo ratings yet

- PNC Verification Form 0Document2 pagesPNC Verification Form 0Rabia Zafar100% (1)

- Remittance: Bwbs 2013 Islamic Bank OperationDocument15 pagesRemittance: Bwbs 2013 Islamic Bank OperationWardatul RaihanNo ratings yet

- Prospectus CinsDocument70 pagesProspectus CinsImran ansariNo ratings yet