Professional Documents

Culture Documents

2 Management Programme Term-End Examination June, 2010 Ms-45: International Financial Management

2 Management Programme Term-End Examination June, 2010 Ms-45: International Financial Management

Uploaded by

payal sachdevOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Management Programme Term-End Examination June, 2010 Ms-45: International Financial Management

2 Management Programme Term-End Examination June, 2010 Ms-45: International Financial Management

Uploaded by

payal sachdevCopyright:

Available Formats

No.

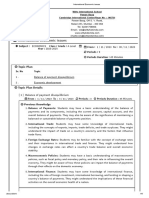

of Printed Pages : 2

MANAGEMENT PROGRAMME Term-End Examination

co

MS-45

June, 2010 MS-45 : INTERNATIONAL FINANCIAL MANAGEMENT

Time : 3 hours Maximum Marks : 100 (Weigh tage 70%)

Note : Attempt any five questions. All questions carry equal marks.

In the context of IMF (International Monetary Fund) explain what is Pool of Reserves ? Discuss the IMF's Funding Facilities available to member countries. What do you understand by equilibrium, disequilibrium and adjustment in balance of payments ? Explain the Keynesian approach and the Monetary approach towards the process of adjustment.

3.

Explain Interest Rate Parity relationship and reasons for its deviation.

MS-45

P.T.O.

What are External Commercial Borrowings (ECBs) ? Explain the guidelines for accessing ECB's through approval route. Discuss the role of Export Credit Guarantee Corporation (ECGC) in financing the exports and briefly explain the different products and services offered by ECGC. What are the factors that influence cross border investments ? Explain their impact on capital budgeting decisions. Explain the distinguishing features of Multinational Cash Management and discuss the techniques used to optimize cash flows. 8. What are different types of Exchange Rate Exposures ? Describe the techniques used to manage Transaction Exposure.

MS-45

You might also like

- MBA in Finance - AssignmentsDocument8 pagesMBA in Finance - Assignmentsrajsolankibarmer0% (1)

- SBP Interview GuidelinesDocument14 pagesSBP Interview Guidelinesschehzad60% (5)

- Question BankDocument5 pagesQuestion Bankkalpitgupta786No ratings yet

- MBAC 830 Oral Exam QuestionsDocument19 pagesMBAC 830 Oral Exam QuestionsguevarramilanyNo ratings yet

- Strategies Influencing Growth and Development CNDocument5 pagesStrategies Influencing Growth and Development CNa.palmerooniNo ratings yet

- IFMDocument2 pagesIFMN ArunsankarNo ratings yet

- International Economic Issues - ALDocument6 pagesInternational Economic Issues - ALanamika.sharmaNo ratings yet

- Question Bank FMDocument4 pagesQuestion Bank FMN Rakesh100% (3)

- Mec-007 EngDocument36 pagesMec-007 EngnitikanehiNo ratings yet

- Mba DEC 2022 Exam - MergedDocument13 pagesMba DEC 2022 Exam - MergedAman SharmaNo ratings yet

- 2012 JDE Delis - Bank Competition, Nancial Reform, and Institutions The Importance ofDocument16 pages2012 JDE Delis - Bank Competition, Nancial Reform, and Institutions The Importance ofWahyutri IndonesiaNo ratings yet

- B3 IefDocument2 pagesB3 IefSaima SaeedNo ratings yet

- Financial Management QuestionsDocument3 pagesFinancial Management Questionsjagdish002No ratings yet

- International Finance ManagementDocument6 pagesInternational Finance ManagementSailpoint CourseNo ratings yet

- FMI Long Questions EditedDocument7 pagesFMI Long Questions EditedChanna KeshavaNo ratings yet

- Question Bank Sem VDocument23 pagesQuestion Bank Sem VVivek Kumar'c' 265No ratings yet

- Mid MCDocument47 pagesMid MCPhuong PhamNo ratings yet

- Pricing Corporate Bond and Credit CurveDocument14 pagesPricing Corporate Bond and Credit Curvefarhan hakimNo ratings yet

- Que Bank PFMDocument5 pagesQue Bank PFMAmit KesharwaniNo ratings yet

- Term Paper On Development of Banking Sector in EthiopiaDocument13 pagesTerm Paper On Development of Banking Sector in EthiopiaSHALAMA DESTA TUSANo ratings yet

- International Finance First Exam GuidelinesDocument12 pagesInternational Finance First Exam GuidelinesHernanNo ratings yet

- 5106LBSBW 2021-22 Exam PaperDocument2 pages5106LBSBW 2021-22 Exam PaperKakaNo ratings yet

- CSCF T1 - P20Document20 pagesCSCF T1 - P20asialbhNo ratings yet

- Alesh Blackbook - International Trade FinanceDocument76 pagesAlesh Blackbook - International Trade Financepankajgaba64No ratings yet

- Mec 04 2014 15Document8 pagesMec 04 2014 15Hardeep SinghNo ratings yet

- A M I F I: Sian Arket Ntegration and Inancial NnovationDocument4 pagesA M I F I: Sian Arket Ntegration and Inancial NnovationabhinavgautamNo ratings yet

- Post-Liberalisation Efficiency and Productivity of The Banking Sector in PakistanDocument28 pagesPost-Liberalisation Efficiency and Productivity of The Banking Sector in PakistanTuu TueNo ratings yet

- C CCC C CCCCCCCC: C C C C CDocument2 pagesC CCC C CCCCCCCC: C C C C Ckun04No ratings yet

- PHD Thesis On Banking and FinanceDocument4 pagesPHD Thesis On Banking and FinanceApril Smith100% (1)

- Financial Management Important QuestionsDocument3 pagesFinancial Management Important QuestionsSaba TaherNo ratings yet

- Imp Ques - Managerial EconomicsDocument6 pagesImp Ques - Managerial EconomicsPavan Kumar NNo ratings yet

- Class Work 02 - Practice Questions On Unit 01 and Unit 02 Unit 01 - Introduction To Forex MarketsDocument4 pagesClass Work 02 - Practice Questions On Unit 01 and Unit 02 Unit 01 - Introduction To Forex MarketsSushmitha SureshNo ratings yet

- University of Education Lahore (Multan Campus) : Article SummaryDocument5 pagesUniversity of Education Lahore (Multan Campus) : Article SummaryAsif ShabbirNo ratings yet

- BA7024 CorporateFinancequestionbankDocument5 pagesBA7024 CorporateFinancequestionbankNorman MberiNo ratings yet

- An Empirical Assessment of The Export-Financial Constraint Relationship: How Different Are Small and Medium Enterprises?Document12 pagesAn Empirical Assessment of The Export-Financial Constraint Relationship: How Different Are Small and Medium Enterprises?Usman KhalidNo ratings yet

- Determinants of Tunisian Bank Profitability: Raoudha Béjaoui, Manouba University Houssam Bouzgarrou, Manouba UniversityDocument11 pagesDeterminants of Tunisian Bank Profitability: Raoudha Béjaoui, Manouba University Houssam Bouzgarrou, Manouba UniversityAkshay ShettyNo ratings yet

- BTC Objectives Coverage RegulatoryFrameworkDocument18 pagesBTC Objectives Coverage RegulatoryFrameworkbarassaNo ratings yet

- Fdi PDFDocument65 pagesFdi PDFvisnjaNo ratings yet

- Asian Development Bank Institute: ADBI Working Paper SeriesDocument45 pagesAsian Development Bank Institute: ADBI Working Paper SeriesVijay DeshpandeNo ratings yet

- Ecs2605 - Study Unit 2Document3 pagesEcs2605 - Study Unit 2Rico BartmanNo ratings yet

- Report Information From Proquest: October 31 2015 22:35Document17 pagesReport Information From Proquest: October 31 2015 22:35Regie AlbeldaNo ratings yet

- The Impact of Macro Factors On The Profitability of China's Commercial Banks in The Decade After WTO AccessionDocument6 pagesThe Impact of Macro Factors On The Profitability of China's Commercial Banks in The Decade After WTO AccessiondinandaNo ratings yet

- Macro With YearDocument5 pagesMacro With YearHasan Asif SouravNo ratings yet

- Mba Banking and Finance Thesis TopicsDocument5 pagesMba Banking and Finance Thesis Topicsleanneuhlsterlingheights100% (1)

- Assign Topics To DiscussDocument9 pagesAssign Topics To DiscussSatyendr KulkarniNo ratings yet

- Gbe Unit 5Document10 pagesGbe Unit 5mojnkuNo ratings yet

- A Short Term Liquidity Forecasting ModelDocument40 pagesA Short Term Liquidity Forecasting ModelNitish SikandNo ratings yet

- Preston University Library: Course Outline Fall Semester 2011Document5 pagesPreston University Library: Course Outline Fall Semester 2011Iffat ChaudhryNo ratings yet

- IF Unit 3 Part BDocument41 pagesIF Unit 3 Part BThanos The titanNo ratings yet

- Book-No-94-Export-Mgmt - T Y B ADocument198 pagesBook-No-94-Export-Mgmt - T Y B ATsolmonNo ratings yet

- Developing The SME Segment in Kuwait - enDocument26 pagesDeveloping The SME Segment in Kuwait - enmmmmmmmNo ratings yet

- Review International Economics 2Document1 pageReview International Economics 2Châu Anh TrịnhNo ratings yet

- International Finance: Theories and Policies An IntroductionDocument49 pagesInternational Finance: Theories and Policies An IntroductionZainNo ratings yet

- International Financial Management Question BankDocument43 pagesInternational Financial Management Question BankneelamhospitaleducationalNo ratings yet

- CFAS MODULE and AssDocument87 pagesCFAS MODULE and AsshellokittysaranghaeNo ratings yet

- CFAS MODULE and AssDocument87 pagesCFAS MODULE and AsshellokittysaranghaeNo ratings yet

- Final Checklist Paper 1 Case Study Questions (Skandvig Terra PLC SVT)Document31 pagesFinal Checklist Paper 1 Case Study Questions (Skandvig Terra PLC SVT)Pearl NarangNo ratings yet

- I.F.M.mba Que PaperDocument3 pagesI.F.M.mba Que PaperbabadhirubabaNo ratings yet

- Specialization: International Business: Masters Program in Business Administration (MBA)Document2 pagesSpecialization: International Business: Masters Program in Business Administration (MBA)Meena NaveinNo ratings yet

- The Monetary System: Analysis and New Approaches to RegulationFrom EverandThe Monetary System: Analysis and New Approaches to RegulationNo ratings yet

- Unit 8 PDFDocument19 pagesUnit 8 PDFpayal sachdevNo ratings yet

- Complaint ApplicationDocument1 pageComplaint Applicationpayal sachdevNo ratings yet

- Unit 6 PDFDocument10 pagesUnit 6 PDFpayal sachdevNo ratings yet

- Unit 2 PDFDocument19 pagesUnit 2 PDFpayal sachdevNo ratings yet

- Strategic Supply Chain ManagementDocument16 pagesStrategic Supply Chain ManagementKknow Ddrug100% (3)

- RBI Annual Report 2010-11Document208 pagesRBI Annual Report 2010-11Aparna PandeyNo ratings yet

- Strategic Supply Chain ManagementDocument16 pagesStrategic Supply Chain ManagementKknow Ddrug100% (3)

- Methi N Soyachunks PulaoDocument2 pagesMethi N Soyachunks Pulaopayal sachdevNo ratings yet

- Bombay Biryani: Kitchen InnDocument20 pagesBombay Biryani: Kitchen Innpayal sachdevNo ratings yet

- Literature ReviewDocument20 pagesLiterature Reviewpayal sachdevNo ratings yet

- Qualitative Vs QuantitativeDocument30 pagesQualitative Vs QuantitativeMeet SavkarNo ratings yet

- Literature ReviewDocument20 pagesLiterature Reviewpayal sachdevNo ratings yet

- Organisational DesignDocument37 pagesOrganisational Designpayal sachdevNo ratings yet

- AccountingDocument19 pagesAccountingpayal sachdevNo ratings yet

- Income TaxDocument21 pagesIncome Taxpayal sachdevNo ratings yet

- Ingredients: Recipe SourceDocument1 pageIngredients: Recipe Sourcepayal sachdevNo ratings yet