Professional Documents

Culture Documents

Second Assigment RWK

Second Assigment RWK

Uploaded by

Ahmad AfifiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Second Assigment RWK

Second Assigment RWK

Uploaded by

Ahmad AfifiCopyright:

Available Formats

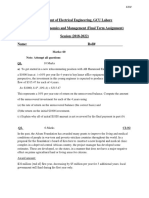

Second Assigment

1. A concrete and building materials company is trying to bring the company-funded portion of its employee retirement fund into compliance with HB-301. The company has already deposited $20,000 in each of the last 5 years. How much must be deposited now in order for the fund to have $350,000 three years from now, if the fund grows at a rate of 15% per year? Burlington Northern is considering the elimination of a railroad grade crossing by constructing a dual-track overpass. The railroad subcontracts for maintenance of its crossing gates at $11,500 per year. Beginning 4 years from now, however, the costs are expected to increase by $1000 per year into the foreseeable future (that is, $12,500 4 years from now, $13,500 five years from now, etc.). The overpass will cost $1,4 million (now) to build, but it will eliminate 100% of the auto-train collisions that have cost an average of $250,000 per year. If the railroad uses a 10-year study period and an interest rate of 10% per year, determine whether the railroad should build the overpass.

2.

3.

4.

Metropolitan Water Utilities purchases surface water from Elephant Butte Irrigation District at a cost of $100,000 per month in the months of February through September. Instead of paying monthly, the utility makes a single payment of $800,000 at the end of the year (i.e., end of December) for the water it used. The delayed payment essentially represents a subsidy by the irrigation district to the water utility. At an interest of 0.25% per month, what is the amount of the subsidy? Metalfab Pump and Filter projects that the cost of steel bodies for certain valves will increase by $2 every 3 months. If the cost for the first quarter is expected to be $80, what is the present worth of the costs for a 3-year period at an interest rate of 3% per quarter?

You might also like

- Ekotek - Alfiano Fuadi5Document40 pagesEkotek - Alfiano Fuadi5Alfiano Fuadi100% (2)

- Tugas 3Document1 pageTugas 3Nabil MuhammadNo ratings yet

- Assignment 1Document2 pagesAssignment 1Jabnon NonjabNo ratings yet

- Home Assignment - 1Document2 pagesHome Assignment - 1Pankaj kumarNo ratings yet

- CFD ExercisesDocument6 pagesCFD ExercisesJohn Paul CristobalNo ratings yet

- Work Sheet On Chapter OneDocument3 pagesWork Sheet On Chapter Onerobel popNo ratings yet

- Tugas 2Document2 pagesTugas 2Syah KrisnadiNo ratings yet

- EEM - Assignment 2 During QuaramtineDocument2 pagesEEM - Assignment 2 During Quaramtineshreya mishraNo ratings yet

- Refresher Mste Module 031723 PDFDocument5 pagesRefresher Mste Module 031723 PDFRennekien MateoNo ratings yet

- Gen HW2Document5 pagesGen HW2Ahmed FayedNo ratings yet

- EE Assignment 1-5 PDFDocument6 pagesEE Assignment 1-5 PDFShubhekshaJalanNo ratings yet

- Chapter 9Document8 pagesChapter 9GODNo ratings yet

- Assignment 3 PresentDocument2 pagesAssignment 3 Presentmarryam nawazNo ratings yet

- Proposition 1 Fact Sheet Electric Bond Issue Fact SheetDocument2 pagesProposition 1 Fact Sheet Electric Bond Issue Fact Sheetapi-281197002No ratings yet

- FM PaperDocument2 pagesFM Paperaftab20No ratings yet

- ABC Pty LTD Case StudyDocument2 pagesABC Pty LTD Case Studypooja.yadav22No ratings yet

- Tugas 02Document2 pagesTugas 02Bazar Lucas 'ulok' TampubolonNo ratings yet

- Economics Tutorial-Sheet-2Document3 pagesEconomics Tutorial-Sheet-2Saburo SahibNo ratings yet

- Assignment 30% Construction Economics and Finance COTM 6021Document6 pagesAssignment 30% Construction Economics and Finance COTM 6021Mengstagegnew0% (1)

- Quiz No. 5Document3 pagesQuiz No. 5Ron CabuangNo ratings yet

- WKT MFGDocument4 pagesWKT MFGGODNo ratings yet

- 101 Practice Problems-Looksfam For MSTC CE Board Exam Prepared by - CEneerDocument17 pages101 Practice Problems-Looksfam For MSTC CE Board Exam Prepared by - CEneernoriebel Oliva100% (1)

- Financial Management AssignmentDocument2 pagesFinancial Management AssignmentyosefNo ratings yet

- Chapter 4 Capitalized CostDocument11 pagesChapter 4 Capitalized CostUpendra ReddyNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- WZ1 - With SolutionsDocument21 pagesWZ1 - With SolutionsAya El hadriNo ratings yet

- Chapter 1 - Tutorial - W.R. Economy - Management (2017-2018) 7988382273984790691Document3 pagesChapter 1 - Tutorial - W.R. Economy - Management (2017-2018) 7988382273984790691Ahmed AmediNo ratings yet

- Project Appraisal TutorialDocument4 pagesProject Appraisal TutorialRahul SharmaNo ratings yet

- Problems For Chapter 1Document1 pageProblems For Chapter 1Görkem DamdereNo ratings yet

- Assignment 2Document2 pagesAssignment 2Hạnh TrươngNo ratings yet

- CEE 307 Engineering Economics HWDocument4 pagesCEE 307 Engineering Economics HWAnonymous UP5RC6JpGNo ratings yet

- CEE 307 Engineering Economics HWDocument4 pagesCEE 307 Engineering Economics HWansarvaliNo ratings yet

- FM09 Project Appraisal and Finance: Assignment No.IDocument3 pagesFM09 Project Appraisal and Finance: Assignment No.IRajesh PatelNo ratings yet

- INDE PreviousDocument4 pagesINDE PreviousOrangeNo ratings yet

- Discounting TutorialDocument1 pageDiscounting TutorialRahul SharmaNo ratings yet

- Tugas Ektek 3Document2 pagesTugas Ektek 3Nahar MunNo ratings yet

- AccountingDocument4 pagesAccountingMohsin BaigNo ratings yet

- UntitledDocument2 pagesUntitledUmar MukhtarNo ratings yet

- Please Clearly Label All Rows and Columns In: ACG 3501 Government Activity 2 InstructionsDocument6 pagesPlease Clearly Label All Rows and Columns In: ACG 3501 Government Activity 2 InstructionsMinh NguyễnNo ratings yet

- Eceecon Problem Set 2Document8 pagesEceecon Problem Set 2Jervin JamillaNo ratings yet

- Engineering Economy: Page 1 of 1Document1 pageEngineering Economy: Page 1 of 1Den CelestraNo ratings yet

- Assignment 4Document4 pagesAssignment 4PrashanthRameshNo ratings yet

- Capital Expenditure DecisionDocument4 pagesCapital Expenditure DecisionSayan MitraNo ratings yet

- ACF AssignmentDocument1 pageACF Assignmentdipesh_sangtani100% (1)

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanNo ratings yet

- MATH Final PreboardDocument8 pagesMATH Final PreboardKristelle V. TorrealbaNo ratings yet

- Assignment 2 2015Document2 pagesAssignment 2 2015marryam nawazNo ratings yet

- FY14-15 Preliminary Capital Budget Requests: Transportation DeptDocument27 pagesFY14-15 Preliminary Capital Budget Requests: Transportation DeptSenateDFLNo ratings yet

- AsfasdaDocument2 pagesAsfasdaAli Emre YeğinNo ratings yet

- Badger Rails: State Approves Additional Funds For Passenger ServiceDocument6 pagesBadger Rails: State Approves Additional Funds For Passenger Serviceapi-26433240No ratings yet

- OKLAHOMA Infrastructure Investment and Jobs Act State Fact SheetDocument3 pagesOKLAHOMA Infrastructure Investment and Jobs Act State Fact SheetOKCFOXNo ratings yet

- Chapter 2 - ProblemsDocument13 pagesChapter 2 - ProblemsTSARNo ratings yet

- AmtrakDocument1 pageAmtrakAmit JindalNo ratings yet

- P4 TestDocument4 pagesP4 TestSameed ArifNo ratings yet

- Allegan County May ElectionsDocument5 pagesAllegan County May ElectionsWXMINo ratings yet

- Work Sheet On Chapter OneDocument3 pagesWork Sheet On Chapter Onerobel popNo ratings yet

- Rebuild AL County CRAF Use 08152019Document1 pageRebuild AL County CRAF Use 08152019WZDX News StaffNo ratings yet

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- Guide to Performance-Based Road Maintenance ContractsFrom EverandGuide to Performance-Based Road Maintenance ContractsNo ratings yet

- On the Road to Achieving Full Electrification in Sri LankaFrom EverandOn the Road to Achieving Full Electrification in Sri LankaNo ratings yet