Professional Documents

Culture Documents

DCF Calculation v2

DCF Calculation v2

Uploaded by

lkamalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCF Calculation v2

DCF Calculation v2

Uploaded by

lkamalCopyright:

Available Formats

10-Jan-14

XYZ

Discounted Cash Flow Model (DCF)

INPUT

Symbol:

Year:

Discount Rate:

XYZ

2009

15.5%

EPS Growth Rate:

12.9%

Dividend Growth Rate:

8.0%

Year

2009

EPS:

Annual Dividend per Share:

Estimated PE:

17.8

1.75

PE Ratio:

2008

2007

2006

2005

2004

2003

2002

2001

7.43

32.7%

1.75

16.7%

5.60

36.6%

1.50

66.7%

4.10

5.1%

0.90

12.5%

3.90

11.4%

0.80

0.0%

3.50

15.9%

0.80

6.7%

3.02

11.9%

0.75

7.1%

2.70

8.0%

0.70

16.7%

2.50

31.6%

0.60

20.0%

11.43

9.93

9.62

19.96

2021

4.40

36.04

2022

4.75

40.70

2023

5.13

45.95

2024

5.54

51.89

4.40

4.75

5.13

5.54

2025

5.98

58.59

1,044

1,050

18.42

29.91

28.81

19.59

12.71

2000

1999

1.90

0.50

Manual Overrides

EPS Growth Rate:

Div. Growth Rate:

Current Year EPS:

PE:

Future Cash Flow Estimation

Dividends:

EPS:

Sell Stock:

Total Cash Flow:

2009

1.75

8.39

2010

1.89

9.47

2011

2.04

10.70

2012

2.20

12.08

2013

2.38

13.64

2014

2.57

15.40

2015

2.77

17.39

2016

3.00

19.63

2017

3.23

22.17

2018

3.49

25.03

2019

3.77

28.27

1.75

1.89

2.04

2.20

2.38

2.57

2.77

3.00

3.23

3.49

3.77

2020

4.07

31.92

4.1

Total Cash Flow Includes dividends growing at the Div. Growth Rate plus the sale of the stock at year 15 (based on projected PE)

Share Price Value Based on Discounted Cash Flow

Estimated Fair Value of Stock

INR 105.98

Disclaimer

TIP Guy does not claim model's accuracy, appropriateness of use, assertions or any other definitiveness. TIP Guys intention in sharing this model is for illustration and education purpose only. TIP Guy uses this model and takes full

responsibility of its consequences. If you use this model, you take full responsibility for all its consequences.

202662336.xls.ms_office DCF

1/10/2014 6:57 AM

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Harley DavidsonDocument5 pagesHarley DavidsonpagalinsanNo ratings yet

- The Economic Indicator Handbook: How to Evaluate Economic Trends to Maximize Profits and Minimize LossesFrom EverandThe Economic Indicator Handbook: How to Evaluate Economic Trends to Maximize Profits and Minimize LossesNo ratings yet

- Print/Copy To Excel:: Previous YearsDocument3 pagesPrint/Copy To Excel:: Previous Yearssharmavikram876No ratings yet

- Wipro 6.72% - 0.32% 55.20% 209.18% - 55.11% - 13.33% 42.78% 26.13% 24.12% 32.82% STD 0.73708 Pe TCSDocument5 pagesWipro 6.72% - 0.32% 55.20% 209.18% - 55.11% - 13.33% 42.78% 26.13% 24.12% 32.82% STD 0.73708 Pe TCSAnkit_4668No ratings yet

- Auto Model PDFDocument21 pagesAuto Model PDFAAOI2No ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- Pantaloon Retail Shoppers Stop 84.51% - 65.31% - 5.32% 73.20% - 74.40% 102.81% 19.09% 126.44% 179.73% 48.97% STD 0.865815Document7 pagesPantaloon Retail Shoppers Stop 84.51% - 65.31% - 5.32% 73.20% - 74.40% 102.81% 19.09% 126.44% 179.73% 48.97% STD 0.865815Ankit_4668No ratings yet

- Calculation of Cost of EquityDocument22 pagesCalculation of Cost of EquitymaazwasifNo ratings yet

- United Engineers - CIMBDocument7 pagesUnited Engineers - CIMBTheng RogerNo ratings yet

- DMX Technologies: OverweightDocument4 pagesDMX Technologies: Overweightstoreroom_02No ratings yet

- Chapter09 SMDocument14 pagesChapter09 SMkike-armendarizNo ratings yet

- Plantilla de Creigthons 2018Document15 pagesPlantilla de Creigthons 2018MariotelliNo ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- Financial Decision Making: AssignmentDocument19 pagesFinancial Decision Making: AssignmentMutasem AmrNo ratings yet

- Month Average Market Month: BOG TBC BOGDocument4 pagesMonth Average Market Month: BOG TBC BOGNino NatradzeNo ratings yet

- Example Loan PricingDocument4 pagesExample Loan PricingNino NatradzeNo ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- 10 Year Financials of AAPL - Apple Inc. - GuruFocusDocument2 pages10 Year Financials of AAPL - Apple Inc. - GuruFocusEchuOkan1No ratings yet

- Session 3 ADocument10 pagesSession 3 AAashishNo ratings yet

- Markets For The Week Ending September 16, 2011: Monetary PolicyDocument10 pagesMarkets For The Week Ending September 16, 2011: Monetary PolicymwarywodaNo ratings yet

- DABUR Easy Ratio AnalysisDocument4 pagesDABUR Easy Ratio AnalysisLakshay TakhtaniNo ratings yet

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingNo ratings yet

- CF Report Fall 2018Document24 pagesCF Report Fall 2018Tamal GhoshNo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- Dr. Smita Sahoo Ankitesh Kumar Tiwari: Submitted To: Submitted By: Roll No:-74Document16 pagesDr. Smita Sahoo Ankitesh Kumar Tiwari: Submitted To: Submitted By: Roll No:-74Ankitesh Kumar TiwariNo ratings yet

- CH 13 Mod 3 Financial IndicatorsDocument2 pagesCH 13 Mod 3 Financial IndicatorsAkshat JainNo ratings yet

- China Gas (Operation Statistics)Document6 pagesChina Gas (Operation Statistics)ckkeicNo ratings yet

- Interest RatesDocument3 pagesInterest RatesSanchit BudhirajaNo ratings yet

- Forecasting FCFF & FCFEDocument26 pagesForecasting FCFF & FCFEAstrid TanNo ratings yet

- Partners Healthcare (Tables and Exhibits)Document9 pagesPartners Healthcare (Tables and Exhibits)sahilkuNo ratings yet

- NetflixDocument12 pagesNetflixAnurag RoyNo ratings yet

- Year Amount of Deposit Previous Balance InterestDocument3 pagesYear Amount of Deposit Previous Balance Interestrobin0903No ratings yet

- PPF Calculator For 15 YearsDocument3 pagesPPF Calculator For 15 Yearshh9996No ratings yet

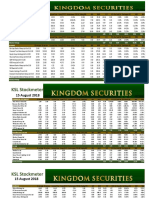

- KSL StockmeterDocument5 pagesKSL StockmeterAn AntonyNo ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- Development Sales Lacking: Wheelock Properties (S)Document7 pagesDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerNo ratings yet

- 3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDocument1 page3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDasdzxcv1234No ratings yet

- BHEL Financial RatiosDocument3 pagesBHEL Financial RatiosprateekbatraNo ratings yet

- Maybank BautoDocument7 pagesMaybank BautoPaul TanNo ratings yet

- FR 11 66 ValuationOfAnIndianTelcomCompanyDocument23 pagesFR 11 66 ValuationOfAnIndianTelcomCompanyAlen MinjNo ratings yet

- LBO - UncompletedDocument10 pagesLBO - UncompletedRachel TangNo ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- Solution To ATCDocument17 pagesSolution To ATCGuru Charan ChitikenaNo ratings yet

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Facebook Working - Students - UnsolvedDocument10 pagesFacebook Working - Students - UnsolvedK Rohith ReddyNo ratings yet

- Bank of Baroda: Q4FY11 - Core Numbers On Track CMPDocument5 pagesBank of Baroda: Q4FY11 - Core Numbers On Track CMPAnkita GaubaNo ratings yet

- Calculation of Blain Kitchenware CaseDocument2 pagesCalculation of Blain Kitchenware CaseAsad Bilal67% (3)

- Samsung Electronics: Earnings Release Q4 2020Document8 pagesSamsung Electronics: Earnings Release Q4 2020Aidə MəmmədzadəNo ratings yet

- Finance Departrment 1Document5 pagesFinance Departrment 1Vansh RanaNo ratings yet

- Gas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Document3 pagesGas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Kazmi Qaim Ali ShahNo ratings yet

- Financial Management Assignment: MarchDocument8 pagesFinancial Management Assignment: MarchSurya KiranNo ratings yet

- ModelDocument103 pagesModelMatheus Augusto Campos PiresNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- Budget AnalysisDocument13 pagesBudget AnalysisRamneet ParmarNo ratings yet

- Jammu and Kashmir Bank: Performance HighlightsDocument11 pagesJammu and Kashmir Bank: Performance HighlightsAngel BrokingNo ratings yet

- Adidas/Reebok Merger: Collin Shaw Kelly Truesdale Michael Rockette Benedikte Schmidt SaravanansadaiyappanDocument27 pagesAdidas/Reebok Merger: Collin Shaw Kelly Truesdale Michael Rockette Benedikte Schmidt SaravanansadaiyappanUdipta DasNo ratings yet

- Astra International TBK.: Balance Sheet Dec-2006 Dec-2007Document18 pagesAstra International TBK.: Balance Sheet Dec-2006 Dec-2007sariNo ratings yet

- Vikas Eco RR - BoBDocument4 pagesVikas Eco RR - BoBlkamalNo ratings yet

- Sustainable Earnings Growth: Snapshot Value of Stock Based OnDocument35 pagesSustainable Earnings Growth: Snapshot Value of Stock Based OnlkamalNo ratings yet

- AP ResultsDocument14 pagesAP ResultslkamalNo ratings yet

- Tamilnadu Study Centres ListDocument16 pagesTamilnadu Study Centres ListlkamalNo ratings yet

- Sharda-Cropchem-Limited 204 InitiatingCoverageDocument4 pagesSharda-Cropchem-Limited 204 InitiatingCoveragelkamalNo ratings yet

- Phone No. 0265-2307815 Email:: Head OfficeDocument1 pagePhone No. 0265-2307815 Email:: Head OfficelkamalNo ratings yet

- BCC BR 107 152Document12 pagesBCC BR 107 152lkamalNo ratings yet

- To Seat/Sleep 64 Coach Numbering: B1, B2 EtcDocument1 pageTo Seat/Sleep 64 Coach Numbering: B1, B2 EtclkamalNo ratings yet

- To Seat/Sleep 24 (Second AC) + 32 (Third AC) Coach Numbering: AB1, AB2 EtcDocument1 pageTo Seat/Sleep 24 (Second AC) + 32 (Third AC) Coach Numbering: AB1, AB2 EtclkamalNo ratings yet

- IZO FAQ: A. Introducing The IZO PlatformDocument4 pagesIZO FAQ: A. Introducing The IZO PlatformlkamalNo ratings yet

- Coach Diagram For Composite First Ac + Second Ac Sleeper Coach (Icf)Document1 pageCoach Diagram For Composite First Ac + Second Ac Sleeper Coach (Icf)lkamalNo ratings yet

- NO01 Poster 71Document7 pagesNO01 Poster 71lkamalNo ratings yet

- EC03 Poster 84Document4 pagesEC03 Poster 84lkamalNo ratings yet

- NO02 Poster 105Document6 pagesNO02 Poster 105lkamalNo ratings yet

- PD01 Poster 57Document6 pagesPD01 Poster 57lkamalNo ratings yet