Professional Documents

Culture Documents

2010 Millage Rate

2010 Millage Rate

Uploaded by

paulacham44120 ratings0% found this document useful (0 votes)

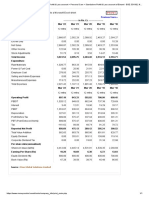

290 views1 pageThis document contains information about insurance premium tax and local option sales tax (LOST) calculations for an unincorporated county area. It shows the unincorporated and incorporated property values, sets the millage rate at 21.73 for unincorporated areas, and calculates gross and rollback millage rates for insurance premium tax at 2.25 mills and LOST at 2.99 mills based on dividing tax revenues by property values. The unincorporated millage rate remains 21.73 after accounting for these taxes.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains information about insurance premium tax and local option sales tax (LOST) calculations for an unincorporated county area. It shows the unincorporated and incorporated property values, sets the millage rate at 21.73 for unincorporated areas, and calculates gross and rollback millage rates for insurance premium tax at 2.25 mills and LOST at 2.99 mills based on dividing tax revenues by property values. The unincorporated millage rate remains 21.73 after accounting for these taxes.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

290 views1 page2010 Millage Rate

2010 Millage Rate

Uploaded by

paulacham4412This document contains information about insurance premium tax and local option sales tax (LOST) calculations for an unincorporated county area. It shows the unincorporated and incorporated property values, sets the millage rate at 21.73 for unincorporated areas, and calculates gross and rollback millage rates for insurance premium tax at 2.25 mills and LOST at 2.99 mills based on dividing tax revenues by property values. The unincorporated millage rate remains 21.73 after accounting for these taxes.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

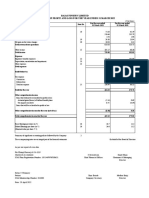

Insurance Premium Tax 658,124

Local Option Sales Tax 966,893

Unincorporated Digest 291,870,309

Incorporated Digest 31,414,310

County Wide 323,284,619

Millage set by Board 21.73

(unincorporated)

INSURANCE PREMIUM TAX

1 Take Unincorporated Millage set by Board 6,342,341.81

(Amount of mills x unincorporated digest)

2 Add Insurance Premium Tax 658,124.00

7,000,465.81

3 Divided by unincorporated digest 23.98 Gross Mills

Insurance Premium Tax divided by unincorporated digest 2.25 Insurance Premium Tax Mills

21.73 Unincorporated

LOST

1 Unincorporated Digest (Step 2) 7,000,465.81

2 Incorporated Digest (incorporated digest x gross mills) 753,467.54

7,753,933.35

3 Add LOST 966,893.00

8,720,826.35

Divided by County Wide 26.98 Gross Mills

LOST divided by County Wide 2.99 LOST Rollback Mills

23.98 Incorporated

26.98 Gross Mills

4 Less LOST Rollback Mills 2.99 LOST Rollback Mills

5 Less Insurance Premium Tax Mills 2.25 Insurance Premium Tax Mills

21.73 Unincorporated

You might also like

- Payslip To Print - Report Design 10-01-2020Document1 pagePayslip To Print - Report Design 10-01-2020martin avinaNo ratings yet

- Housing Society Maintenance Charges As Per Bye LawDocument2 pagesHousing Society Maintenance Charges As Per Bye LawrishuNo ratings yet

- ComparativeDocument3 pagesComparativePiyush FarsaiyaNo ratings yet

- Indian Oil (CFS) Profit and Loss - 2023Document1 pageIndian Oil (CFS) Profit and Loss - 2023kavyagarg8542No ratings yet

- For ReleaseDocument72 pagesFor ReleaseJohnnel CabajarNo ratings yet

- RD AdjustmentDocument16 pagesRD AdjustmentBrian AlmeidaNo ratings yet

- Dabur 5Document1 pageDabur 5faheem.ashrafNo ratings yet

- Statement of Profit and Loss: For The Year Ended 31st March, 2021Document2 pagesStatement of Profit and Loss: For The Year Ended 31st March, 2021Only For StudyNo ratings yet

- DCF On Jubilant FoodworksDocument20 pagesDCF On Jubilant Foodworkskcufthatsh1t0No ratings yet

- Zydus Wellness Standalone Yearly Results Vanaspati & Oils Standalone Yearly Results of Zydus Wellness - BSE 531335, NSE ZYDUSWELLDocument2 pagesZydus Wellness Standalone Yearly Results Vanaspati & Oils Standalone Yearly Results of Zydus Wellness - BSE 531335, NSE ZYDUSWELLRozy SinghNo ratings yet

- BFS Standalone P&L2022Document1 pageBFS Standalone P&L2022manoj mahantaNo ratings yet

- Column1 Balance Sheet of PfizerDocument10 pagesColumn1 Balance Sheet of PfizerDeven PrajapatiNo ratings yet

- Cash Flow Statement ConsolidatedDocument2 pagesCash Flow Statement Consolidatedsamarth rajvaidNo ratings yet

- Nestle P and LDocument2 pagesNestle P and Lashmit gumberNo ratings yet

- Voith PDFDocument2 pagesVoith PDFABHAY KUMAR SINGHNo ratings yet

- Berkshire QDocument4 pagesBerkshire Qmarco colomboNo ratings yet

- For The Month Of: August 2017: Jose D. Halili 93Document4 pagesFor The Month Of: August 2017: Jose D. Halili 93Christine HaliliNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document9 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)hemant goyalNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- Alvaran, CeliaDocument4 pagesAlvaran, CeliaRosevie Anne GabayNo ratings yet

- Tata MotorsDocument41 pagesTata MotorsShubham SharmaNo ratings yet

- Segment Reporting - ITC-2013Document2 pagesSegment Reporting - ITC-2013Ashis Kumar MuduliNo ratings yet

- Consol Result Mar23Document16 pagesConsol Result Mar23Amit KumarNo ratings yet

- Photocopy of Check Disbursement Voucher Billing Statement Official ReceiptDocument3 pagesPhotocopy of Check Disbursement Voucher Billing Statement Official ReceiptRejane VidadNo ratings yet

- Bajaj Finserv: Previous YearsDocument2 pagesBajaj Finserv: Previous Yearsrohansparten01No ratings yet

- Receipt Budget, 2024-2025 1: Tax Revenue 1. Corporation TaxDocument10 pagesReceipt Budget, 2024-2025 1: Tax Revenue 1. Corporation TaxmohaksmartNo ratings yet

- India Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008Document6 pagesIndia Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008amitkr91No ratings yet

- Century Textiles LTDDocument3 pagesCentury Textiles LTDAprajita SharmaNo ratings yet

- T Hi Liv S: - Ouc NG e OverDocument9 pagesT Hi Liv S: - Ouc NG e OverRavi AgarwalNo ratings yet

- BookDocument4 pagesBookspj1962001No ratings yet

- Nuvama Board Report 22 23 25 JAN 2024Document90 pagesNuvama Board Report 22 23 25 JAN 2024cheatersoul7No ratings yet

- Half Year Financial Results 30 Sept 2022Document11 pagesHalf Year Financial Results 30 Sept 2022Ashwin staffNo ratings yet

- June 2022Document2 pagesJune 2022akshay kausaleNo ratings yet

- Tata Steel LTD (TATA IN) - AdjustedDocument10 pagesTata Steel LTD (TATA IN) - AdjustedAswini Kumar BhuyanNo ratings yet

- Sample FS Schedule 3 Tool For CompaniesDocument20 pagesSample FS Schedule 3 Tool For CompaniesGirish HNo ratings yet

- Standalone Results - June 2017 - 0Document3 pagesStandalone Results - June 2017 - 0Varun SidanaNo ratings yet

- R D Offlc Mbic Oad, Va o A 3 003: of MaDocument10 pagesR D Offlc Mbic Oad, Va o A 3 003: of MaRavi AgarwalNo ratings yet

- Dabur Consolidated Statement of Profit & Loss PDFDocument1 pageDabur Consolidated Statement of Profit & Loss PDFRupasingh100% (1)

- 2021AnnualReport FINAL 39 43Document5 pages2021AnnualReport FINAL 39 43Wilson BastidasNo ratings yet

- PBIT Margin Before Exceptional Item (%) 28.76Document4 pagesPBIT Margin Before Exceptional Item (%) 28.76YatinSharmaNo ratings yet

- Aditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Document6 pagesAditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Bhavesh PatelNo ratings yet

- Touc NG Lives Over: YearsDocument15 pagesTouc NG Lives Over: YearsRavi AgarwalNo ratings yet

- Nike FinancialsDocument3 pagesNike Financialslrsrz8No ratings yet

- A Proposed Production of Massage Oil From Pandan Leaves Statement of Comprehensive Income For The Years Ended December 31 Scenario 1Document3 pagesA Proposed Production of Massage Oil From Pandan Leaves Statement of Comprehensive Income For The Years Ended December 31 Scenario 1'Mariciela LendioNo ratings yet

- Profit Loss AccountDocument2 pagesProfit Loss Accountbudsy.lambaNo ratings yet

- Valuation: Beta and WACCDocument4 pagesValuation: Beta and WACCnityaNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- Emami PNLDocument1 pageEmami PNLsZCCSZcNo ratings yet

- Tax Revenue Major HeadDocument5 pagesTax Revenue Major HeadBadriNo ratings yet

- Cash Flow Statement For The Year Ended March 31 2008Document12 pagesCash Flow Statement For The Year Ended March 31 2008rockhillsNo ratings yet

- 26057-2009-Metro. Inc. vs. Commissioner of Internal20210618-12-93cv58Document29 pages26057-2009-Metro. Inc. vs. Commissioner of Internal20210618-12-93cv58Ramos Claude VinzonNo ratings yet

- Combinepdf (12) - 211116 - 124747Document80 pagesCombinepdf (12) - 211116 - 124747HADTUGINo ratings yet

- Cash Flow Statement 2019-2020 CCLDocument2 pagesCash Flow Statement 2019-2020 CCLAmit SinghNo ratings yet

- Princess Apostol PNB Intensify PHP 05192021125043Document3 pagesPrincess Apostol PNB Intensify PHP 05192021125043Dangay National High SchoolNo ratings yet

- Spandana Sporthy Balance SheetDocument1 pageSpandana Sporthy Balance SheetMs VasNo ratings yet

- Baldwin Bicycle CompanyDocument7 pagesBaldwin Bicycle CompanyIndustry ReportNo ratings yet

- Hero Motocorp: PrintDocument2 pagesHero Motocorp: PrintPhuntru PhiNo ratings yet

- WSP GL FS Q22023 enDocument24 pagesWSP GL FS Q22023 endennis72288No ratings yet

- MA 2022 Group 2, Section CDocument12 pagesMA 2022 Group 2, Section CAditi AggarwalNo ratings yet

- 2012 Budget ApprovedDocument54 pages2012 Budget Approvedpaulacham4412No ratings yet

- 2012 Approved BudgetDocument51 pages2012 Approved Budgetpaulacham4412No ratings yet

- 2012 Proposed Budget July 14 2011 Budget HearingDocument51 pages2012 Proposed Budget July 14 2011 Budget Hearingpaulacham4412No ratings yet

- Road Work 2010Document15 pagesRoad Work 2010paulacham4412No ratings yet

- Brantley County Subdivision Ordinance 5-11-10Document44 pagesBrantley County Subdivision Ordinance 5-11-10paulacham4412No ratings yet

- Amendment Noise ControlDocument4 pagesAmendment Noise Controlpaulacham4412No ratings yet

- Property Case Manila Electric Company V City AssessorDocument30 pagesProperty Case Manila Electric Company V City AssessorWahida TatoNo ratings yet

- Petitioner vs. vs. Respondents Siguion Reyna, Montecillo & Ongsiako Eduardo Z GatchalianDocument5 pagesPetitioner vs. vs. Respondents Siguion Reyna, Montecillo & Ongsiako Eduardo Z Gatchalian刘王钟No ratings yet

- Chavez Vs Ongpin, G.R. No. 76778, June 6, 1990Document6 pagesChavez Vs Ongpin, G.R. No. 76778, June 6, 1990christie joiNo ratings yet

- City of Union City: Detailed Tax SummaryDocument2 pagesCity of Union City: Detailed Tax SummaryAlicia RuckerNo ratings yet

- Van Buren County Draft Assessment Section of The Palisades Economic Recovery StrategyDocument88 pagesVan Buren County Draft Assessment Section of The Palisades Economic Recovery StrategyWWMTNo ratings yet

- Patricia Fairclough-Staggers' Conflicting TRIM NoticesDocument1 pagePatricia Fairclough-Staggers' Conflicting TRIM NoticesBen KellerNo ratings yet

- Cpa Review: Taxation TAX - 1701. Basic Principles of Taxation Lecture Notes 1. The Inherent Powers of The State (Pet)Document26 pagesCpa Review: Taxation TAX - 1701. Basic Principles of Taxation Lecture Notes 1. The Inherent Powers of The State (Pet)Remalyn BarridaNo ratings yet

- Charlevoix County News - December 01, 2011Document12 pagesCharlevoix County News - December 01, 2011Dave BaragreyNo ratings yet

- FOI-Penticton Briefing Note For PremierDocument7 pagesFOI-Penticton Briefing Note For PremierJoe FriesNo ratings yet

- Contract To Sell: WitnessethDocument4 pagesContract To Sell: WitnessethNicki BombezaNo ratings yet

- Current Events and RESA - Brokers Review Handouts - Sir VincentDocument13 pagesCurrent Events and RESA - Brokers Review Handouts - Sir VincentRon FabiNo ratings yet

- Personal Notes On TaxationDocument119 pagesPersonal Notes On Taxationgilbert marimon chattoNo ratings yet

- Benguet Corp. vs. Board of Assessment Appeals - GR No. 106041 - Case DigestDocument1 pageBenguet Corp. vs. Board of Assessment Appeals - GR No. 106041 - Case DigestC SNo ratings yet

- 1014017423-Special NoticeDocument4 pages1014017423-Special NoticeMohammadNo ratings yet

- Philippine Fisheries Development Authority V CA GR No. 169836 July 31, 2007Document1 pagePhilippine Fisheries Development Authority V CA GR No. 169836 July 31, 2007Emil BautistaNo ratings yet

- CIR Vs ST LukeDocument7 pagesCIR Vs ST LukeJohnde MartinezNo ratings yet

- CASE DIGEST: Commissioner of Customs v. Navarro, G.R. No. L-33146 (77 SCRA 264)Document6 pagesCASE DIGEST: Commissioner of Customs v. Navarro, G.R. No. L-33146 (77 SCRA 264)Reth GuevarraNo ratings yet

- Warrant of Levy On Real Property TaxDocument1 pageWarrant of Levy On Real Property TaxRhestie IlaganNo ratings yet

- LESSON 2 FUNDA Overview of The BS REM ProgramDocument9 pagesLESSON 2 FUNDA Overview of The BS REM Programroland.gridphNo ratings yet

- Real Property Taxation FINALDocument54 pagesReal Property Taxation FINALIc San PedroNo ratings yet

- WMCDocument35 pagesWMCKoyaldinna Mehboob BashaNo ratings yet

- 40.MIAA Vs ParanaqueDocument25 pages40.MIAA Vs ParanaqueClyde KitongNo ratings yet

- Singapore Tax GuideDocument20 pagesSingapore Tax GuideTaccad ReydennNo ratings yet

- Taxation - Review - BSA - LGC, OIC - 2018NDocument9 pagesTaxation - Review - BSA - LGC, OIC - 2018NKenneth Bryan Tegerero TegioNo ratings yet

- REO-Local-Taxation As of May 2020 REO-Local-Taxation As of May 2020Document20 pagesREO-Local-Taxation As of May 2020 REO-Local-Taxation As of May 2020Refinej WickerNo ratings yet

- Burns, Et Al, v. Greenville County Council - Nov. 28 RulingDocument14 pagesBurns, Et Al, v. Greenville County Council - Nov. 28 RulingAnnaBrutzman100% (1)

- National Development Co. v. Cebu City, 215 SCRA 382 - Exemption - Government IntrumentalitiesDocument2 pagesNational Development Co. v. Cebu City, 215 SCRA 382 - Exemption - Government IntrumentalitiesIVYJEAN LAGURANo ratings yet

- Steamboat Springs City Council AgendaDocument265 pagesSteamboat Springs City Council AgendaScott FranzNo ratings yet

- Notes To Taxation I PartIIDocument7 pagesNotes To Taxation I PartIIIsolde212No ratings yet