Professional Documents

Culture Documents

Explanation

Explanation

Uploaded by

AJ SuttonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Explanation

Explanation

Uploaded by

AJ SuttonCopyright:

Available Formats

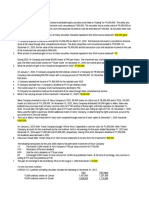

On January 3, 2013, Matteson Corporation acquired 30 percent of the outstanding common stock of OToole Company for $1,450,000.

This acquisition gave Matteson the ability to exercise significant influence over the investee. The book value of the acquired shares was $910,000. Any excess cost over the underlying book value was assigned to a copyright that was undervalued on balance sheet. This copyright has a remaining useful life of 10 years. For the year ended December 31, 2013, OToole reported net income of $354,000 and paid cash dividends of $40,000. At December 31, 2013, what should Matteson report as its investment in OToole under the equity method? Investment $

1,490,200

Explanation:

Purchase price Basic equity accrual ($354,000 30%) Amortization of copyright: Excess payment ($1,450,000 $910,000 = $540,000) to copyright allocated over 10 year life Dividends (40,000 30%) Investment in OToole at December 31, 2013

1,450,000 106,200

(54,000) (12,000)

1,490,200

You might also like

- FQ 001 Sharehoders - Equity and Retained EarningsDocument4 pagesFQ 001 Sharehoders - Equity and Retained Earningsmarygraceomac83% (6)

- Tugas Ch. 15 - Week 10Document9 pagesTugas Ch. 15 - Week 10Lafidan Rizata FebiolaNo ratings yet

- True / False QuestionsDocument19 pagesTrue / False QuestionsMarvinbautista0% (1)

- Excel Assignment #6 Stockholders' Equity Excel ACCT 20100 Fall 2014Document3 pagesExcel Assignment #6 Stockholders' Equity Excel ACCT 20100 Fall 2014Ronald AranhaNo ratings yet

- P16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsDocument3 pagesP16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsRisky FernandoNo ratings yet

- Solution of Exam (Part 2)Document29 pagesSolution of Exam (Part 2)Magdy KamelNo ratings yet

- AP Lecture SW SheDocument23 pagesAP Lecture SW SheMary Dale Joie BocalaNo ratings yet

- Bonds Payable ReviewDocument6 pagesBonds Payable ReviewJyasmine Aura V. AgustinNo ratings yet

- TEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Document5 pagesTEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Mike HerreraNo ratings yet

- Retained EarningsDocument4 pagesRetained EarningsHaru Haru100% (1)

- Seminar 10 PrepQDocument6 pagesSeminar 10 PrepQAlim OsmanNo ratings yet

- Problem 18-8: ©dr. Chula King All Rights ReservedDocument1 pageProblem 18-8: ©dr. Chula King All Rights ReservedFred The FishNo ratings yet

- Ias 28 Investment in Associate IllustrationDocument6 pagesIas 28 Investment in Associate IllustrationVatchdemonNo ratings yet

- Assignment #1Document5 pagesAssignment #1FreelansirNo ratings yet

- Investment Accounts Practice QuestionsDocument10 pagesInvestment Accounts Practice QuestionsJanhvi AroraNo ratings yet

- 5 Investment AccountsDocument11 pages5 Investment AccountsBAZINGANo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)AdrianBrionesGallardoNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Accounting FilesNo ratings yet

- Bond Amortization Methods & Journal EntriesDocument14 pagesBond Amortization Methods & Journal EntriesDishani MaityNo ratings yet

- Audit of SHEDocument8 pagesAudit of SHEJomar Carlo CasupangNo ratings yet

- AC - IntAcctg1 Quiz 03 With AnswersDocument3 pagesAC - IntAcctg1 Quiz 03 With AnswersSherri BonquinNo ratings yet

- Tanjiro:Inosuke & Nezuko:ZenitsuDocument4 pagesTanjiro:Inosuke & Nezuko:ZenitsuJaimellNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)nmdl123No ratings yet

- Chapter 14 QuizDocument7 pagesChapter 14 QuizSherri BonquinNo ratings yet

- Book Value Per ShareDocument3 pagesBook Value Per ShareNor-hayne LucmanNo ratings yet

- Chapter 13 - Sh. Based PaymentsDocument4 pagesChapter 13 - Sh. Based PaymentsXiena75% (4)

- Effective Interest MethodDocument31 pagesEffective Interest MethodMikaela LacabaNo ratings yet

- Chapter 1 HomeworkDocument2 pagesChapter 1 HomeworkRangerNo ratings yet

- Book Value Per Share (Ordinary Shares) 130.00Document1 pageBook Value Per Share (Ordinary Shares) 130.00Nicki Lyn Dela CruzNo ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- Difficult Level Corpo-Drill3Document4 pagesDifficult Level Corpo-Drill3julsNo ratings yet

- Accounting Principles II Stock Splits-895852Document1 pageAccounting Principles II Stock Splits-895852Thalia SandersNo ratings yet

- Notes Receivable: Junior Philippine Institute of Accountants, Inc. University of The Philippines - VisayasDocument5 pagesNotes Receivable: Junior Philippine Institute of Accountants, Inc. University of The Philippines - VisayasGeorge YoungNo ratings yet

- Chapter 10 Reporting and Analysing Equity (Companies: Lecture Notes Solutions - Lecture 8 Topic 8Document2 pagesChapter 10 Reporting and Analysing Equity (Companies: Lecture Notes Solutions - Lecture 8 Topic 8aaronNo ratings yet

- Week 06 - 01 - Module 13 - Effective Interest MethodDocument14 pagesWeek 06 - 01 - Module 13 - Effective Interest Method지마리No ratings yet

- Nova Corporation Book ValueDocument2 pagesNova Corporation Book ValueNicki Lyn Dela CruzNo ratings yet

- Dewi Nabilah Anwar - Akl1 Week 2Document3 pagesDewi Nabilah Anwar - Akl1 Week 2Soe BagyoNo ratings yet

- Pryor Company Receives Net Proceeds ofDocument4 pagesPryor Company Receives Net Proceeds ofAulia HidayatiNo ratings yet

- Examination About Investment 16Document2 pagesExamination About Investment 16BLACKPINKLisaRoseJisooJennieNo ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- EifjifriirfjiifjldskfjwiejfidkejfeifdskfdrifjaikjdkDocument2 pagesEifjifriirfjiifjldskfjwiejfidkejfeifdskfdrifjaikjdkK P DewiNo ratings yet

- Loftus 31.3 31.4 31.5Document9 pagesLoftus 31.3 31.4 31.5Foreign GraduateNo ratings yet

- Activity2-Answer Key1Document9 pagesActivity2-Answer Key1Ruiz, CherryjaneNo ratings yet

- On December 31 2009 Milo Company Had 1 300 000 Shares ofDocument1 pageOn December 31 2009 Milo Company Had 1 300 000 Shares ofM Bilal SaleemNo ratings yet

- Investments and Fair Value Accounting: Principles of Financial Accounting With Conceptual Emphasis On IFRSDocument137 pagesInvestments and Fair Value Accounting: Principles of Financial Accounting With Conceptual Emphasis On IFRSallfi basirohNo ratings yet

- 2020 Spring Midterm II A AnsKey PDFDocument12 pages2020 Spring Midterm II A AnsKey PDFEunice GuoNo ratings yet

- 120.ASX IAW April 29 2011 16.50 DRP Share Issue Price and UnderwritingDocument1 page120.ASX IAW April 29 2011 16.50 DRP Share Issue Price and UnderwritingASX:ILH (ILH Group)No ratings yet

- Paranoid Company Journal Entries: Date Account Title and ExplanationDocument8 pagesParanoid Company Journal Entries: Date Account Title and ExplanationKristel FieldsNo ratings yet

- FA1 Chapter 1 EngDocument21 pagesFA1 Chapter 1 EngYong ChanNo ratings yet

- Parco CorporationDocument2 pagesParco CorporationWawex DavisNo ratings yet

- TecoDocument4 pagesTecopsychiyNo ratings yet

- S A Ipcc May-2011-Gr-1Document100 pagesS A Ipcc May-2011-Gr-1Saibhumi100% (1)

- Proposal Tanaman MelonDocument3 pagesProposal Tanaman Melondr walferNo ratings yet