Professional Documents

Culture Documents

Inflation Accounting 123

Inflation Accounting 123

Uploaded by

Pankaj KhindriaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inflation Accounting 123

Inflation Accounting 123

Uploaded by

Pankaj KhindriaCopyright:

Available Formats

Inflation accounting

Inflation accounting is a term describing a range of accounting systems designed to correct problems arising from historical cost accounting in the presence of inflation.

Inflation accounting is used in countries experiencing high inflation or hyperinflation. For example, in countries experiencing hyperinflation the International Accounting Standards Board requires corporate financial statements to be adjusted for changes in purchasing power using a price index.

Historical cost basis

Fair value accounting ( also called replacement cost accounting or current cost accounting) was widely used in the 19th and early 20th centuries, but historical cost accounting became more widespread after values overstated during the 1920s were reversed during the Great Depression of the 1930s.

Most principles of historical cost accounting were developed after the Wall Street Crash of 1929, including the presumption of a stable currency.

Measuring unit principle

Under a historical cost-based system of accounting, inflation leads to two basic problems. First, many of the historical numbers appearing on financial statements are not economically relevant because prices have changed since they were incurred.... Second, since the numbers on financial statements represent dollars expended at different points of time and, in turn, embody different amounts of purchasing power, they are simply not additive.

Hence, adding cash of $10,000 held on December 31, 2009, with $10,000 representing the cost of land acquired in 1995 (when the price level was significantly lower) is a dubious operation because of the significantly different amount of purchasing power represented by the two numbers. By adding dollar amounts that represent different amounts of purchasing power, the resulting sum is misleading, as would be adding 10,000 dollars to 10,000 Euros to get a total of 20,000. Likewise subtracting dollar amounts that represent different amounts of purchasing power may result in an apparent capital gain which is actually a capital loss. If a building purchased in 1970 for $20,000 is sold in 2006 for $200,000 when its replacement cost is $300,000, the apparent gain of $180,000 is illusory.

Misleading reporting under historical cost accounting

In most countries, primary financial statements are prepared on the historical cost basis of accounting without regard either to changes in the general level of prices or to increases in specific prices of assets held, except to the extent that property, plant and equipment and investments may be revalued.

Ignoring general price level changes in financial reporting creates distortions in financial statements such as reported profits may exceed the earnings that could be distributed to shareholders without impairing the company's ongoing operations the asset values for inventory, equipment and plant do not reflect their economic value to the business future earnings are not easily projected from historical earnings the impact of price changes on monetary assets and liabilities is not clear future capital needs are difficult to forecast and may lead to increased leverage, which increases the business's risk when real economic performance is distorted, these distortions lead to social and political consequenses that damage businesses (examples: poor tax policies and public misconceptions regarding corporate behavior)

History of inflation accounting

Accountants in the UK and US have discussed the effect of inflation on financial statements since the early 1900s, beginning with index number theory and purchasing power. Irving Fisher's 1911 book The Purchasing Power of Money was used as a source by Henry W. Sweeney in his 1936 book Stabilized Accounting, which was about Constant Purchasing Power Accounting. This model by Sweeney was used by The American Institute of Certified Public Accountants for their 1963 research study (ARS6) Reporting the Financial Effects of Price-Level Changes, and later used by the Accounting Principles Board (USA), the Financial Standards Board (USA), and the Accounting Standards Steering Committee (UK). In March 1979, the Financial Accounting Standards Board (FASB) wrote Constant Dollar Accounting, which advocated using the Consumer Price Index for All Urban Consumers (CPI-U) to adjust accounts because it is calculated every month.

During the Great Depression, some corporations restated their financial statements to reflect inflation.

At times during the past 50 years standard-setting organizations have encouraged companies to supplement cost-based financial statements with price-level adjusted statements.

During a period of high inflation in the 1970s, the FASB was reviewing a draft proposal for price-level adjusted statements when the Securities and Exchange Commission (SEC) issued ASR 190, which required approximately 1,000 of the largest US corporations to provide supplemental information based on replacement cost. The FASB withdrew the draft proposal.

Inflation accounting models

Inflation accounting is not fair value accounting. Inflation accounting, also called price level accounting, is similar to converting financial statements into another currency using an exchange rate. Under some (not all) inflation accounting models, historical costs are converted to price-level adjusted costs using general or specific price indexes.

Income statement general price-level adjustment example

On the income statement, depreciation is adjusted for changes in general price levels based on a general price index.

(a) 30,000 x 105/100 = 31,500 (b) 30,000 x 110/100 = 33,000 (c) (30,000 x 105/100) - 30,000 = 1,500 (d) (63,000 x 110/105) - 63,000 = 3,000

Constant dollar accounting

Constant dollar accounting is an accounting model that converts non-monetary assets and equities from historical dollars to current dollars using a general price index. This is similar to a currency conversion from old dollars to new dollars. Monetary items are not adjusted, so they gain or lose purchasing power. There are no holding gains or losses recognized in converting values.[

International standard for hyperinflationary accounting

The International Accounting Standards Board defines hyperinflation in IAS 29 as:" the cumulative inflation rate over three years is approaching, or exceeds, 100%." [ Companies are required to restate their historical cost financial reports in terms of the period end hyperinflation rate in order to make these financial reports more meaningful.

The restatement of historical cost financial statements in terms of IAS 29 does not signify the abolishment of the historical cost model. This is confirmed by PricewaterhouseCoopers: "Inflation-adjusted financial statements are an extension to, not a departure from, historical cost accounting."

You might also like

- T. Alan Lovell, Steven G. Tragesser, and Mark V. TollefsonDocument15 pagesT. Alan Lovell, Steven G. Tragesser, and Mark V. TollefsonsherrreNo ratings yet

- Smerdon's ScandinavianDocument672 pagesSmerdon's Scandinavianprimos saNo ratings yet

- Arbitration Award Writing - Lecture Notes - CombinedDocument114 pagesArbitration Award Writing - Lecture Notes - CombinedILTERIS DOGAN100% (1)

- 4 X 4Document2 pages4 X 4muhammad ali0% (1)

- On A Study On Inflation AccountingDocument13 pagesOn A Study On Inflation AccountingomNo ratings yet

- Social Issue Research Project OverviewDocument4 pagesSocial Issue Research Project OverviewKatie HilaridesNo ratings yet

- Inflation AccountingDocument2 pagesInflation AccountingmehulNo ratings yet

- MBA - AFM - Inflation AccountingDocument20 pagesMBA - AFM - Inflation AccountingVijayaraj JeyabalanNo ratings yet

- Inflation AccountingDocument7 pagesInflation AccountingDisha DesaiNo ratings yet

- IAS 29 - NotesDocument29 pagesIAS 29 - NotesJyNo ratings yet

- Inflation AccountingDocument4 pagesInflation AccountinganjalikapoorNo ratings yet

- ACCOUNTING: Inflation AccountingDocument34 pagesACCOUNTING: Inflation Accountingmehul100% (2)

- Inflation Accounting: A Presentation by - ITM XMBA - 33 Dinesh M Manghani Sharon RodriguesDocument15 pagesInflation Accounting: A Presentation by - ITM XMBA - 33 Dinesh M Manghani Sharon RodriguesDinesh Manghani100% (1)

- 113 Unit VDocument61 pages113 Unit V21002hadiNo ratings yet

- C C C CC CCCC CCCCCCCC C C C C C CC CCCCC CCC CC CCC CCC C C C C C CC C C C CC C C C ! C C C C ! C CDocument4 pagesC C C CC CCCC CCCCCCCC C C C C C CC CCCCC CCC CC CCC CCC C C C C C CC C C C CC C C C ! C C C C ! C CHemanshu MehtaNo ratings yet

- 2020 Price Level and Inflation AccountingDocument2 pages2020 Price Level and Inflation AccountingKesa MetsiNo ratings yet

- Hra Unit 4Document19 pagesHra Unit 4World is GoldNo ratings yet

- Inflation AccountingDocument4 pagesInflation AccountingAnand SalotNo ratings yet

- Application of Inflation AccountingDocument21 pagesApplication of Inflation AccountingRajesh WariseNo ratings yet

- Impact of Inflation On The Financial StatementsDocument22 pagesImpact of Inflation On The Financial StatementsabbyplexxNo ratings yet

- Inflation and Monetary PolicyDocument32 pagesInflation and Monetary PolicyHads LunaNo ratings yet

- Accounting For Price Level ChangesDocument8 pagesAccounting For Price Level ChangesSonal RathhiNo ratings yet

- Business Environment Unit 5Document27 pagesBusiness Environment Unit 5Kainos GreyNo ratings yet

- Inflation AccountingDocument8 pagesInflation AccountingbhargavNo ratings yet

- Money and Inf MakomboreroDocument16 pagesMoney and Inf Makomborerotaona madanhireNo ratings yet

- Macro Lecture 4 PDFDocument40 pagesMacro Lecture 4 PDFpulkit guptaNo ratings yet

- Business CycleDocument4 pagesBusiness Cycleatharva1760No ratings yet

- Inflation AccountingDocument10 pagesInflation AccountingKunal ModiNo ratings yet

- Historical Evolution of Management AccountingDocument7 pagesHistorical Evolution of Management AccountingScribdTranslationsNo ratings yet

- Inflation Bba20Document24 pagesInflation Bba20ssd200123No ratings yet

- InflationDocument20 pagesInflationmootu2019No ratings yet

- Forensic AccountingDocument24 pagesForensic AccountingtemedebereNo ratings yet

- Business Cycles: The TheoryDocument39 pagesBusiness Cycles: The TheorySagar IndranNo ratings yet

- Chapter 4 - Inflation and UnemploymentDocument18 pagesChapter 4 - Inflation and UnemploymentFirdaus IsmailNo ratings yet

- Long Term Fiscal PolicyDocument16 pagesLong Term Fiscal PolicyWynne Moses FernandesNo ratings yet

- Inflation AccountingDocument13 pagesInflation AccountingtrinabhagatNo ratings yet

- IPSAS 10 PresentationDocument31 pagesIPSAS 10 PresentationTiya AmuNo ratings yet

- MECO Lecture3Document17 pagesMECO Lecture3saif ur rehmanNo ratings yet

- Lecture - Accounting Concepts - Week 5Document33 pagesLecture - Accounting Concepts - Week 5presleyramoala81No ratings yet

- Notes - Chapter 3Document4 pagesNotes - Chapter 3Walaa Al-BayaaNo ratings yet

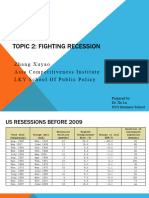

- Week 2 Fighting RecessionDocument42 pagesWeek 2 Fighting Recessiondaisyruyu2001No ratings yet

- Accounting Theory and Alternative Methods For Asset ValuationDocument25 pagesAccounting Theory and Alternative Methods For Asset ValuationAkshay RawatNo ratings yet

- Macro Classes 1-3Document35 pagesMacro Classes 1-3Shajidur RashidNo ratings yet

- Types, Causes and Measures To Control InflationDocument18 pagesTypes, Causes and Measures To Control InflationJagadeesh Putturu100% (1)

- Current at The End of The Reporting Period. Comparative Figures For Prior Period(s) Shall Also Be RestatedDocument3 pagesCurrent at The End of The Reporting Period. Comparative Figures For Prior Period(s) Shall Also Be RestatedJustine VeralloNo ratings yet

- Engineering Economics Lect 4.Document21 pagesEngineering Economics Lect 4.Furqan ChaudhryNo ratings yet

- Macroeconomics1:: Inflation: Its Causes and Costs (Chapter 30)Document32 pagesMacroeconomics1:: Inflation: Its Causes and Costs (Chapter 30)Donghun ShinNo ratings yet

- Lecture 15 InflationDocument13 pagesLecture 15 InflationDevyansh GuptaNo ratings yet

- U5 - Inflation, Business Cycle & Profit TheoriesDocument11 pagesU5 - Inflation, Business Cycle & Profit Theoriessinhapalak1002No ratings yet

- Inflation: Definitions Inflation: Definitions: The Penguin Dictionary of EconomicsDocument9 pagesInflation: Definitions Inflation: Definitions: The Penguin Dictionary of EconomicsSakshi AroraNo ratings yet

- CE 309 FINANCIAL STATEMENT ANALYSIS Lecture Sept 2013Document98 pagesCE 309 FINANCIAL STATEMENT ANALYSIS Lecture Sept 2013kundayi shavaNo ratings yet

- Money Growth and InflationDocument22 pagesMoney Growth and Inflationyurai.kazeNo ratings yet

- 12EPP Chapter 13Document108 pages12EPP Chapter 13Mr RamNo ratings yet

- Capitulo 19 en Ingles Libro CelesteDocument57 pagesCapitulo 19 en Ingles Libro CelesteGinneth Jiménez MadrigalNo ratings yet

- ECO - Chaps - 11-18Document38 pagesECO - Chaps - 11-18Tawhid QurisheNo ratings yet

- Unit 3 Measuring The Cost of LivingDocument32 pagesUnit 3 Measuring The Cost of LivingMinh Thư BùiNo ratings yet

- Managerial EconomicsDocument41 pagesManagerial EconomicsKrishna Chandran PallippuramNo ratings yet

- L 7 8 EconDocument7 pagesL 7 8 EconAngela Ericka CabanesNo ratings yet

- MECO121 UM S2024 Session14Document35 pagesMECO121 UM S2024 Session14rizwanf026No ratings yet

- CORPORATE ACCOUNTING IA2-pdf 2Document12 pagesCORPORATE ACCOUNTING IA2-pdf 2Surya GowdaNo ratings yet

- Project Investment Evaluation: Chethan S.GowdaDocument70 pagesProject Investment Evaluation: Chethan S.GowdaTodesa HinkosaNo ratings yet

- Course Title: Accounting For Managers Course: MBA 18102 CR Session: Spring 2020 Unit IV. Inflation Accounting Faculty: Dr. Gousia ShahDocument14 pagesCourse Title: Accounting For Managers Course: MBA 18102 CR Session: Spring 2020 Unit IV. Inflation Accounting Faculty: Dr. Gousia ShahLeo SaimNo ratings yet

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- Inflation-Conscious Investments: Avoid the most common investment pitfallsFrom EverandInflation-Conscious Investments: Avoid the most common investment pitfallsNo ratings yet

- ReadiGASS Bro 1709Document4 pagesReadiGASS Bro 1709arunkumar277041No ratings yet

- Jagannath Puri YatraDocument62 pagesJagannath Puri YatraAbhiramNo ratings yet

- National Geographic 2022.05Document142 pagesNational Geographic 2022.05yingying ZhengNo ratings yet

- PEMBIMBING: Dr. Yudi Ambeng, Sp.UDocument72 pagesPEMBIMBING: Dr. Yudi Ambeng, Sp.UClarissa SuheryNo ratings yet

- Script For Broadcasting in Purposive CommunicationDocument4 pagesScript For Broadcasting in Purposive CommunicationMarie Yllana DulhaoNo ratings yet

- SoapDocument4 pagesSoapSi OneilNo ratings yet

- UNDERSTANDING THE SELF - NotesDocument10 pagesUNDERSTANDING THE SELF - NotesAiyana AlaniNo ratings yet

- Research DossierDocument7 pagesResearch Dossierapi-253218159No ratings yet

- Anacona Arboleda Prez On BourbakiDocument33 pagesAnacona Arboleda Prez On BourbakiLingerNo ratings yet

- 9th Class Pairing Scheme 2024Document6 pages9th Class Pairing Scheme 2024Zahid RoyNo ratings yet

- Standard Bell Curve For Powerpoint: This Is A Sample Text Here. Insert Your Desired Text HereDocument5 pagesStandard Bell Curve For Powerpoint: This Is A Sample Text Here. Insert Your Desired Text HereGodson YogarajanNo ratings yet

- Quarter 2 Week 6 Day 1: Analyn Dv. Fababaer Srbsmes Tanay, RizalDocument59 pagesQuarter 2 Week 6 Day 1: Analyn Dv. Fababaer Srbsmes Tanay, RizalDronio Arao L-sa100% (1)

- Bksi CKRWDocument6 pagesBksi CKRWYuga Moga SugamaNo ratings yet

- Industrial Co-Operative Hard Copy... !!!Document40 pagesIndustrial Co-Operative Hard Copy... !!!vikastaterNo ratings yet

- SGC Web SocketsDocument171 pagesSGC Web SocketsMarceloMoreiraCunhaNo ratings yet

- Latihan Soal Bahasa Inggris Sma HortatorDocument6 pagesLatihan Soal Bahasa Inggris Sma HortatorIsna FitrianiNo ratings yet

- Quiz On Past Tenses With Awnsers, 9th GradeDocument2 pagesQuiz On Past Tenses With Awnsers, 9th GradeKristupas S100% (1)

- Michael Porter's 5 Forces Model: Asian PaintsDocument4 pagesMichael Porter's 5 Forces Model: Asian PaintsrakeshNo ratings yet

- The Magus AnalysisDocument114 pagesThe Magus AnalysisJohn ScottNo ratings yet

- Argumentative Essay Conclusion ExampleDocument6 pagesArgumentative Essay Conclusion Exampleglzhcoaeg100% (2)

- RocFall 5 BetaDocument5 pagesRocFall 5 BetaMarcus LindonNo ratings yet

- What Is An Echinoderm?Document18 pagesWhat Is An Echinoderm?isuru PereraNo ratings yet

- Tractive EffortDocument5 pagesTractive EffortVarshith RapellyNo ratings yet

- Numinous Japanese GothicDocument22 pagesNuminous Japanese GothicDiana M.No ratings yet

- PD Lesson 5 Coping With Stress in Middle and Late AdolescenceDocument16 pagesPD Lesson 5 Coping With Stress in Middle and Late AdolescenceEL FuentesNo ratings yet