Professional Documents

Culture Documents

Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

Uploaded by

Partnership Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Copyright:

Available Formats

You might also like

- Tax Form W-8BENDocument8 pagesTax Form W-8BENneuzatyNo ratings yet

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- CRS Entity (Organization)Document7 pagesCRS Entity (Organization)Muhammad HarisNo ratings yet

- 1099-b Whfit FormDocument6 pages1099-b Whfit FormYarod EL100% (5)

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- F 8288Document6 pagesF 8288IRSNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet

- All Withholding Is A Gift!Document8 pagesAll Withholding Is A Gift!Tom Harkins100% (2)

- Q419 Financial StatementsDocument141 pagesQ419 Financial StatementsDana VisanNo ratings yet

- 1604-E Page 2Document1 page1604-E Page 2Jasmin AngieNo ratings yet

- IRS Form Break Down Estate PDFDocument8 pagesIRS Form Break Down Estate PDFSylvester Moore100% (1)

- Charles Schwab Account Opening FormDocument16 pagesCharles Schwab Account Opening FormJeremie100% (1)

- 2012 Building Intl Bridges (03!28!2013)Document17 pages2012 Building Intl Bridges (03!28!2013)Jk McCreaNo ratings yet

- Everytown Gun Safety Action Fund - 990 Tax FormDocument118 pagesEverytown Gun Safety Action Fund - 990 Tax FormCNBC.comNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- Partner's Instructions For Schedule K-1 (Form 1065)Document15 pagesPartner's Instructions For Schedule K-1 (Form 1065)Mario LaflammeNo ratings yet

- Application For A T100 Identification Number (Tin) On The Exercise of Flow-Through Warrants (FTWS) and Details of The Ftws ExercisedDocument2 pagesApplication For A T100 Identification Number (Tin) On The Exercise of Flow-Through Warrants (FTWS) and Details of The Ftws ExercisedtstscribdNo ratings yet

- US Internal Revenue Service: f8264Document3 pagesUS Internal Revenue Service: f8264IRSNo ratings yet

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- Bir 1601fDocument3 pagesBir 1601fJuliet Jayjet Dela CruzNo ratings yet

- 1545-0123 - SS - Revised 1-10-17Document26 pages1545-0123 - SS - Revised 1-10-17Muhammad FaizanNo ratings yet

- File ITR-2 Online User ManualDocument43 pagesFile ITR-2 Online User ManualsrtujyuNo ratings yet

- Form 20FDocument398 pagesForm 20FNguyen KyNo ratings yet

- Regulation Disclosure Statement: Identifying Number Shown On ReturnDocument2 pagesRegulation Disclosure Statement: Identifying Number Shown On ReturnIRSNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument7 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionfiazNo ratings yet

- F 8849Document4 pagesF 8849IRSNo ratings yet

- LM B K Vatsaraj 23june2010Document61 pagesLM B K Vatsaraj 23june2010Basavaraja C KNo ratings yet

- Disclosure No. 1052 2020 Request For Extension of Time To File The Quarterly Report SEC Form 17 QDocument3 pagesDisclosure No. 1052 2020 Request For Extension of Time To File The Quarterly Report SEC Form 17 QMary Jane LaxamanaNo ratings yet

- Information Return For Publicly Offered Original Issue Discount InstrumentsDocument4 pagesInformation Return For Publicly Offered Original Issue Discount InstrumentsShawn60% (5)

- Return of Private Foundation or Sectio N 9a7 @L (11 Nonexempt Charitable TrustDocument15 pagesReturn of Private Foundation or Sectio N 9a7 @L (11 Nonexempt Charitable TrustalavifoundationNo ratings yet

- National Pavilions - Manufacturing Application Form - Oct'13Document6 pagesNational Pavilions - Manufacturing Application Form - Oct'13Durban Chamber of Commerce and IndustryNo ratings yet

- Bir Form 2306 PDFDocument3 pagesBir Form 2306 PDFErwin Bucasas100% (1)

- US Internal Revenue Service: F8878a AccessibleDocument2 pagesUS Internal Revenue Service: F8878a AccessibleIRSNo ratings yet

- US Internal Revenue Service: f1120sn AccessibleDocument2 pagesUS Internal Revenue Service: f1120sn AccessibleIRS100% (1)

- US Internal Revenue Service: f1120sn - 2002Document2 pagesUS Internal Revenue Service: f1120sn - 2002IRSNo ratings yet

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Document9 pagesGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresNo ratings yet

- 1099-Div 2021 3350349Document1 page1099-Div 2021 3350349Adam Clifton0% (1)

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarDocument9 pagesForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarHardik KalariaNo ratings yet

- Black Lives Matter Global Network Foundation Tax FilingsDocument54 pagesBlack Lives Matter Global Network Foundation Tax FilingsRed Voice NewsNo ratings yet

- Revenue Memorandum Order No. 53-98Document25 pagesRevenue Memorandum Order No. 53-98johnnayel50% (2)

- Disclosure Statement: Identifying Number Shown On ReturnDocument2 pagesDisclosure Statement: Identifying Number Shown On ReturnIRSNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument15 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionTausif ArshadNo ratings yet

- New Supplier Set-Up Form R8.9 - FinalDocument4 pagesNew Supplier Set-Up Form R8.9 - FinalGăzdac IoanaNo ratings yet

- TimeClock Plus LLC LOCKBOX W-9 2023 (6) 1Document1 pageTimeClock Plus LLC LOCKBOX W-9 2023 (6) 1rofira9450No ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- This Form May Be Photocopied - Void Unless Complete Information Is SuppliedDocument2 pagesThis Form May Be Photocopied - Void Unless Complete Information Is SuppliedCristian De la cruz cantilloNo ratings yet

- FATCA CORP English - Bank Muscat 1Document17 pagesFATCA CORP English - Bank Muscat 1reema-algheshyanNo ratings yet

- Ldentification: Request For andDocument1 pageLdentification: Request For andclaraNo ratings yet

- 1402 Gain On Transfer SharesDocument2 pages1402 Gain On Transfer SharesMaddahayota CollegeNo ratings yet

- US Internal Revenue Service: f8865 - 2003Document7 pagesUS Internal Revenue Service: f8865 - 2003IRSNo ratings yet

- IRS E-File Signature Authorization For Form 1041: Employer Identification NumberDocument2 pagesIRS E-File Signature Authorization For Form 1041: Employer Identification NumberJerry MandorNo ratings yet

- Q221 - ACEN 17Q (FINAL) SGDDocument118 pagesQ221 - ACEN 17Q (FINAL) SGDSeifuku ShaNo ratings yet

- MyMichigan Medical Center Alpena 2023 990Document108 pagesMyMichigan Medical Center Alpena 2023 990JustinHinkleyNo ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument5 pagesRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNo ratings yet

- Greenergy Holdings Incorporated - SEC Form 17-Q - 13 November 2020Document61 pagesGreenergy Holdings Incorporated - SEC Form 17-Q - 13 November 2020Jullian Paul GregorioNo ratings yet

- US Internal Revenue Service: f8404 - 2001Document2 pagesUS Internal Revenue Service: f8404 - 2001IRSNo ratings yet

Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

Uploaded by

Partnership Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

Uploaded by

Partnership Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Copyright:

Available Formats

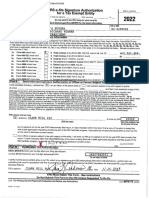

Form

8082

Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

(For use by partners, S corporation shareholders, estate and domestic trust beneficiaries, foreign trust owners and beneficiaries, REMIC residual interest holders, and TMPs.)

See

OMB No. 1545-0790 Attachment Sequence No.

(Rev. December 2011)

Department of the Treasury Internal Revenue Service

separate instructions.

Identifying number

84

Name(s) shown on return

Part I

1

2

General Information

(a) Notice of inconsistent treatment (b) Administrative adjustment request (AAR)

Check boxes that apply:

Identify type of pass-through entity: (b) (c) (d) (e) (a) Partnership S corporation Estate Trust REMIC Employer identification number of pass-through entity 5 Internal Revenue Service Center where pass-through entity filed its return Name, address, and ZIP code of pass-through entity 6 Tax year of pass-through entity / / 7 Your tax year / /

(c) Amount as shown on Schedule K-1, Schedule Q, or similar statement, a foreign trust statement, or your return, whichever applies (see instructions)

3 4

to to

/ /

/ /

Part II

Inconsistent or Administrative Adjustment Request (AAR) Items

(b) Inconsistency is in, or AAR is to correct (check boxes that apply) Amount of item

(a) Description of inconsistent or administrative adjustment request (AAR) items (see instructions)

(d) Amount you are reporting

Treatment of item

(e) Difference between (c) and (d)

10

11

Part III

ExplanationsEnter the Part II item number before each explanation. If more space is needed, continue your explanations on the back.

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 49975G

Form

8082

(Rev. 12-2011)

Form 8082 (Rev. 12-2011)

Page

Part III

Explanations (continued)

Form

8082

(Rev. 12-2011)

You might also like

- Tax Form W-8BENDocument8 pagesTax Form W-8BENneuzatyNo ratings yet

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- CRS Entity (Organization)Document7 pagesCRS Entity (Organization)Muhammad HarisNo ratings yet

- 1099-b Whfit FormDocument6 pages1099-b Whfit FormYarod EL100% (5)

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- F 8288Document6 pagesF 8288IRSNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet

- All Withholding Is A Gift!Document8 pagesAll Withholding Is A Gift!Tom Harkins100% (2)

- Q419 Financial StatementsDocument141 pagesQ419 Financial StatementsDana VisanNo ratings yet

- 1604-E Page 2Document1 page1604-E Page 2Jasmin AngieNo ratings yet

- IRS Form Break Down Estate PDFDocument8 pagesIRS Form Break Down Estate PDFSylvester Moore100% (1)

- Charles Schwab Account Opening FormDocument16 pagesCharles Schwab Account Opening FormJeremie100% (1)

- 2012 Building Intl Bridges (03!28!2013)Document17 pages2012 Building Intl Bridges (03!28!2013)Jk McCreaNo ratings yet

- Everytown Gun Safety Action Fund - 990 Tax FormDocument118 pagesEverytown Gun Safety Action Fund - 990 Tax FormCNBC.comNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- Partner's Instructions For Schedule K-1 (Form 1065)Document15 pagesPartner's Instructions For Schedule K-1 (Form 1065)Mario LaflammeNo ratings yet

- Application For A T100 Identification Number (Tin) On The Exercise of Flow-Through Warrants (FTWS) and Details of The Ftws ExercisedDocument2 pagesApplication For A T100 Identification Number (Tin) On The Exercise of Flow-Through Warrants (FTWS) and Details of The Ftws ExercisedtstscribdNo ratings yet

- US Internal Revenue Service: f8264Document3 pagesUS Internal Revenue Service: f8264IRSNo ratings yet

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- Bir 1601fDocument3 pagesBir 1601fJuliet Jayjet Dela CruzNo ratings yet

- 1545-0123 - SS - Revised 1-10-17Document26 pages1545-0123 - SS - Revised 1-10-17Muhammad FaizanNo ratings yet

- File ITR-2 Online User ManualDocument43 pagesFile ITR-2 Online User ManualsrtujyuNo ratings yet

- Form 20FDocument398 pagesForm 20FNguyen KyNo ratings yet

- Regulation Disclosure Statement: Identifying Number Shown On ReturnDocument2 pagesRegulation Disclosure Statement: Identifying Number Shown On ReturnIRSNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument7 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionfiazNo ratings yet

- F 8849Document4 pagesF 8849IRSNo ratings yet

- LM B K Vatsaraj 23june2010Document61 pagesLM B K Vatsaraj 23june2010Basavaraja C KNo ratings yet

- Disclosure No. 1052 2020 Request For Extension of Time To File The Quarterly Report SEC Form 17 QDocument3 pagesDisclosure No. 1052 2020 Request For Extension of Time To File The Quarterly Report SEC Form 17 QMary Jane LaxamanaNo ratings yet

- Information Return For Publicly Offered Original Issue Discount InstrumentsDocument4 pagesInformation Return For Publicly Offered Original Issue Discount InstrumentsShawn60% (5)

- Return of Private Foundation or Sectio N 9a7 @L (11 Nonexempt Charitable TrustDocument15 pagesReturn of Private Foundation or Sectio N 9a7 @L (11 Nonexempt Charitable TrustalavifoundationNo ratings yet

- National Pavilions - Manufacturing Application Form - Oct'13Document6 pagesNational Pavilions - Manufacturing Application Form - Oct'13Durban Chamber of Commerce and IndustryNo ratings yet

- Bir Form 2306 PDFDocument3 pagesBir Form 2306 PDFErwin Bucasas100% (1)

- US Internal Revenue Service: F8878a AccessibleDocument2 pagesUS Internal Revenue Service: F8878a AccessibleIRSNo ratings yet

- US Internal Revenue Service: f1120sn AccessibleDocument2 pagesUS Internal Revenue Service: f1120sn AccessibleIRS100% (1)

- US Internal Revenue Service: f1120sn - 2002Document2 pagesUS Internal Revenue Service: f1120sn - 2002IRSNo ratings yet

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Document9 pagesGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresNo ratings yet

- 1099-Div 2021 3350349Document1 page1099-Div 2021 3350349Adam Clifton0% (1)

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarDocument9 pagesForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarHardik KalariaNo ratings yet

- Black Lives Matter Global Network Foundation Tax FilingsDocument54 pagesBlack Lives Matter Global Network Foundation Tax FilingsRed Voice NewsNo ratings yet

- Revenue Memorandum Order No. 53-98Document25 pagesRevenue Memorandum Order No. 53-98johnnayel50% (2)

- Disclosure Statement: Identifying Number Shown On ReturnDocument2 pagesDisclosure Statement: Identifying Number Shown On ReturnIRSNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument15 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionTausif ArshadNo ratings yet

- New Supplier Set-Up Form R8.9 - FinalDocument4 pagesNew Supplier Set-Up Form R8.9 - FinalGăzdac IoanaNo ratings yet

- TimeClock Plus LLC LOCKBOX W-9 2023 (6) 1Document1 pageTimeClock Plus LLC LOCKBOX W-9 2023 (6) 1rofira9450No ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- This Form May Be Photocopied - Void Unless Complete Information Is SuppliedDocument2 pagesThis Form May Be Photocopied - Void Unless Complete Information Is SuppliedCristian De la cruz cantilloNo ratings yet

- FATCA CORP English - Bank Muscat 1Document17 pagesFATCA CORP English - Bank Muscat 1reema-algheshyanNo ratings yet

- Ldentification: Request For andDocument1 pageLdentification: Request For andclaraNo ratings yet

- 1402 Gain On Transfer SharesDocument2 pages1402 Gain On Transfer SharesMaddahayota CollegeNo ratings yet

- US Internal Revenue Service: f8865 - 2003Document7 pagesUS Internal Revenue Service: f8865 - 2003IRSNo ratings yet

- IRS E-File Signature Authorization For Form 1041: Employer Identification NumberDocument2 pagesIRS E-File Signature Authorization For Form 1041: Employer Identification NumberJerry MandorNo ratings yet

- Q221 - ACEN 17Q (FINAL) SGDDocument118 pagesQ221 - ACEN 17Q (FINAL) SGDSeifuku ShaNo ratings yet

- MyMichigan Medical Center Alpena 2023 990Document108 pagesMyMichigan Medical Center Alpena 2023 990JustinHinkleyNo ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument5 pagesRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNo ratings yet

- Greenergy Holdings Incorporated - SEC Form 17-Q - 13 November 2020Document61 pagesGreenergy Holdings Incorporated - SEC Form 17-Q - 13 November 2020Jullian Paul GregorioNo ratings yet

- US Internal Revenue Service: f8404 - 2001Document2 pagesUS Internal Revenue Service: f8404 - 2001IRSNo ratings yet