Professional Documents

Culture Documents

Sahaj Assessment Year Indian Income Tax Return Year: I - Individual

Sahaj Assessment Year Indian Income Tax Return Year: I - Individual

Uploaded by

Jason SoansCopyright:

Available Formats

You might also like

- Lesson 1 Tax Planning & ManagementDocument35 pagesLesson 1 Tax Planning & ManagementkelvinNo ratings yet

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Your Receipt From Airbnb: London Price BreakdownDocument1 pageYour Receipt From Airbnb: London Price BreakdownAkmal Niam FirdausiNo ratings yet

- Taxation Law ProjectDocument26 pagesTaxation Law Projectshekhar singhNo ratings yet

- ITR1 - PHII - r6 (With Interest)Document8 pagesITR1 - PHII - r6 (With Interest)arun1aNo ratings yet

- Income Tax Return Form-1 Sahaj - Excel FormatDocument9 pagesIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Vikas KumarNo ratings yet

- Itr 1Document2 pagesItr 1zakirhusssainNo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument4 pagesReceipt No/ Date Seal and Signature of Receiving Officialtsrahod@yahoo.comNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Document9 pagesSahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Abhijeet DeyNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSk SahuNo ratings yet

- NotificationDocument7 pagesNotificationapi-25886395No ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)ashim kumar PramanickNo ratings yet

- 12 Itr1 10 11Document6 pages12 Itr1 10 11ramanwweNo ratings yet

- Form PDF 301906800310714Document2 pagesForm PDF 301906800310714deepkaryan1988No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnசிவா நடராஜன்No ratings yet

- Deductions Under Chapter VI A (Section) : Date of Filing of Original ReturnDocument2 pagesDeductions Under Chapter VI A (Section) : Date of Filing of Original Returnismailkhan.dbaNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Dharmendra SinghNo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument10 pagesReceipt No/ Date Seal and Signature of Receiving OfficialRAMAPPA100% (2)

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam JainNo ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document5 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)anon-928287100% (1)

- Form PDF 692100430280713Document2 pagesForm PDF 692100430280713sunilNo ratings yet

- Form PDF 378544500300118Document7 pagesForm PDF 378544500300118raodinesh0001No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSijo Kaviyil JosephNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSiddhant SwainNo ratings yet

- 2018 03 31 12 23 14 702 - 1958189601Document5 pages2018 03 31 12 23 14 702 - 1958189601Kethavarapu RamjiNo ratings yet

- I T R-1-Ver1 (2pages)Document4 pagesI T R-1-Ver1 (2pages)mohan6789No ratings yet

- Form ITR-1Document2 pagesForm ITR-1vinay.bpNo ratings yet

- Form ITR-1-2009-10Document7 pagesForm ITR-1-2009-10vikram_enercon3941No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnValesh MonisNo ratings yet

- Form PDF 860011410060114Document2 pagesForm PDF 860011410060114prakashdebleyNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnram4a5No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnDr-Firoz ShaikhNo ratings yet

- 2010 ITR1 R11-Pahlad SinghDocument16 pages2010 ITR1 R11-Pahlad SinghtakshashilalibraryNo ratings yet

- 2017 09 18 16 47 37 050 - 118817245Document5 pages2017 09 18 16 47 37 050 - 118817245Nitin KumarNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 17 - 1 8Document13 pagesSahaj Individual Income Tax Return Assessment Year 2 0 17 - 1 8Ganesh Babu SwaminathanNo ratings yet

- Salma Bano: Indian Income Tax ReturnDocument3 pagesSalma Bano: Indian Income Tax Return9956272017No ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document3 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)nilihitaNo ratings yet

- 2017 07 16 14 13 28 351 - 970124135Document5 pages2017 07 16 14 13 28 351 - 970124135Ganesh DasaraNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnsky2flyboy@gmail.comNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnpavanNo ratings yet

- 2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017Document6 pages2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017ApoorvNo ratings yet

- 2019 09 18 18 03 50 397 - Ehbps8472n - 2016Document5 pages2019 09 18 18 03 50 397 - Ehbps8472n - 2016Darvesh mishraNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusurajit halderNo ratings yet

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDocument5 pages2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNo ratings yet

- Ack. 2010-11Document1 pageAck. 2010-11Kiran GajjarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurudibyan dasNo ratings yet

- DocumentDocument5 pagesDocumentAkshay KumarNo ratings yet

- Form PDF 358979100180620Document10 pagesForm PDF 358979100180620Sajan JhaNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Document13 pagesSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Ganesh Babu SwaminathanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKrishna KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNadeemNo ratings yet

- Itr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 986260850020121 Assessment Year: 2020-21Document10 pagesItr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 986260850020121 Assessment Year: 2020-21PANKAJ KOTHARINo ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- 2019 08 18 21 20 24 392 - 1566143424392 - XXXPS7518X - AcknowledgementDocument1 page2019 08 18 21 20 24 392 - 1566143424392 - XXXPS7518X - Acknowledgementajayavisagar1No ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 994254410070818 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 994254410070818 Assessment Year: 2018-19Prashant GuptaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruসোমতীর্থ দাসNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPavitra Nityanand DasNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Document9 pagesSahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Prince BalaNo ratings yet

- The Growth of The Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional GuidanceDocument53 pagesThe Growth of The Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional GuidancesandydocsNo ratings yet

- GH - 0872Document1 pageGH - 0872ruchiscreation ruchiscreationNo ratings yet

- Return of IncomeDocument9 pagesReturn of Incomes4sahithNo ratings yet

- Gmail - Your Air France Booking Is Pending Payment 2Document5 pagesGmail - Your Air France Booking Is Pending Payment 2shawn alexNo ratings yet

- InvoiceDocument2 pagesInvoicesandipmisal2000No ratings yet

- National Income - DPP 02 - (Kautilya)Document4 pagesNational Income - DPP 02 - (Kautilya)Name SNo ratings yet

- Tax Module 2 Unit 2Document10 pagesTax Module 2 Unit 2Beatriz LorezcoNo ratings yet

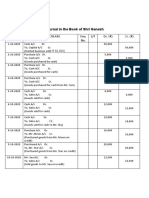

- Journal in The Book of Shri Ganesh: Date Particulars Vou. No. L/F Dr. Cr.Document4 pagesJournal in The Book of Shri Ganesh: Date Particulars Vou. No. L/F Dr. Cr.Anuj GohainNo ratings yet

- Hotel BillDocument1 pageHotel BillFahim MarwatNo ratings yet

- F 941Document4 pagesF 941gopaljiiNo ratings yet

- Answers To The BAR: Taxation 1994-2006 (Arranged by Topics)Document2 pagesAnswers To The BAR: Taxation 1994-2006 (Arranged by Topics)Susan PascualNo ratings yet

- Al Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelDocument2 pagesAl Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelASHIQ HUSSAINNo ratings yet

- CITY - BANK Philippines BCXDocument1 pageCITY - BANK Philippines BCXHabib MiaNo ratings yet

- Western Union Money Transfer Receipt PDF PDF FreeDocument5 pagesWestern Union Money Transfer Receipt PDF PDF FreeShalva SamkharadzeNo ratings yet

- QQy 5 N OKBej DP 2 U 8 MDocument4 pagesQQy 5 N OKBej DP 2 U 8 MAaditi yadavNo ratings yet

- 04 Republic v. PNBDocument5 pages04 Republic v. PNBCharles MagistradoNo ratings yet

- Definitions Under GSTDocument3 pagesDefinitions Under GSTjsphdvdNo ratings yet

- Bio Assets at FVDocument7 pagesBio Assets at FVVince MiramonNo ratings yet

- The Difference Between Tax Avoidance and Tax EvasionDocument6 pagesThe Difference Between Tax Avoidance and Tax EvasionPARUL BOBALNo ratings yet

- Fieldcore Service Solutions Fcssi Iraq (Baghdad) : Payable Within 60 Days Due Net Inv DateDocument10 pagesFieldcore Service Solutions Fcssi Iraq (Baghdad) : Payable Within 60 Days Due Net Inv DateAreej YounesNo ratings yet

- Einvoice of Japla PVC 2nd BillDocument1 pageEinvoice of Japla PVC 2nd BillSAYAN SARKARNo ratings yet

- Taxguru - In-Taxes and Constitutional LimitationsDocument4 pagesTaxguru - In-Taxes and Constitutional LimitationsAbi CherubNo ratings yet

- Enrollment and Maintenance Form - Full-Client v09282022Document1 pageEnrollment and Maintenance Form - Full-Client v09282022Janella MarieNo ratings yet

- TAXATIONDocument144 pagesTAXATIONjonapdfsNo ratings yet

- Flipkart Labels 23 Feb 2024 08 17Document50 pagesFlipkart Labels 23 Feb 2024 08 17royalskhatriNo ratings yet

- AR IBY IntegrationDocument36 pagesAR IBY IntegrationManikBahl1100% (2)

- Sap 940Document3 pagesSap 940Rashmi RaviNo ratings yet

Sahaj Assessment Year Indian Income Tax Return Year: I - Individual

Sahaj Assessment Year Indian Income Tax Return Year: I - Individual

Uploaded by

Jason SoansOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sahaj Assessment Year Indian Income Tax Return Year: I - Individual

Sahaj Assessment Year Indian Income Tax Return Year: I - Individual

Uploaded by

Jason SoansCopyright:

Available Formats

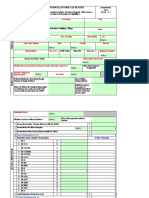

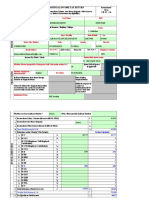

SAHAJ

FORM

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property (excluding loss brought forward from previous years) / Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)] (Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

ITR-1

Assessment Year Year

2011-12

PAN

First Name PERSONAL INFORMATION Flat / Door / Building Road / Street

Middle Name

Last Name Status

I - Individual Area / Locallity Date of birth (DD/MM/YYYY) 00/00/0000 Pin Code Sex (Select) M-Male

Town/City/District

State

Email Address Income Tax Ward / Circle

Mobile no

(Std code) Phone No

FILING STATUS

Employer Category (if in employment) OTH Return filed under section [Pl see Form Instruction] 11 - u/s 139(1) Date 1 2 3 4 System Calculated 0 0 0 0 0 0 0 0 0 0 0 0 0 0 6 7 8 9 10 0 0 13 14 15 Seal and Signature of Receiving Official 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Whether original or revised return?

O-Original

If revised, enter Receipt no / Date RES - Resident Residential Status 1 Income from Salary / Pension (Ensure to fill Sch TDS1) Income from one House Property 2 3 Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2c) 5 Deductions under Chapter VI A (Section) 5a a 80 C 5b b 80 CCC 5c c 80 CCD 5d d 80 CCF 5e e 80 D 5f f 80 DD 5g g 80 DDB 5h h 80 E 5i i 80 G 5j j 80 GG 5k k 80 GGA 5l l 80 GGC 5m m 80 U 6 6 Deductions (Total of 5a to 5m) 7 Total Income (4 - 6) 8 Tax payable on Total Income 9 Education Cess, including secondary and higher secondary cess on 8 10 Total Tax, Surcharge and Education Cess (Payable) (8 + 9) 11 11 Relief under Section 89 12 12 Relief under Section 90/91 13 Balance Tax Payable (10 - 11 - 12) 14 Total Interest Payable 15 Total Tax and Interest Payable (13 + 14) For Office Use Only Receipt No/ Date

TAX COMPUTATION

INCOME & DEDUCTIONS

0 0 0

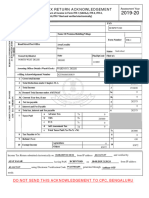

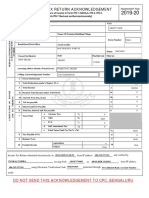

23 Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)] Tax Deduction Income charg Name of the Total tax Account Number SI.No eable under the Employer Deducted (TAN) of the head Salaries Employer (3) (4) (5) (1) (2) 1 2 3 (Click + to add more rows to 23) TDS on Salary above. Do not delete blank rows. ) 24 Details of Tax Deducted at Source Other than Salary Tax Deduction Account Number (TAN) of the Deductor (2) Name of the Deductor (3) Total tax Deducted (4) Amount out of (4) claimed for this year (5)

SI.No

(1) 1 2 3 4

(Click + to add more rows ) TDS other than Salary above. Do not delete blank rows. )

25 Sl No 1 2 3 4 5 6

Details of Advance Tax and Self Assessment Tax Payments Date of Deposit (DD/MM/YYYY) Serial Number of Challan

BSR Code

Amount (Rs)

(Click '+' to add more rows ) Tax Payments. Do not delete blank rows. )

TAXES PAID

16 Taxes Paid a Advance Tax (from item 25) b TDS (Total from item 23 + item 24)

16a 16b

0 0

0 c Self Assessment Tax (item 25) 16c 0 Total Taxes Paid (16a+16b+16c) 17 0 Tax Payable (15-17) (if 15 is greater than 17) 18 0 Refund (17-15) if 17 is greater than 15 19 Enter your Bank Account number (Mandatory ) No Select Yes if you want your refund by direct deposit into your bank account, Select No if you want refund by Cheque 22 In case of direct deposit to your bank account give additional details MICR Code Type of Account(As applicable) 26 Exempt income for reporting purposes only (from Dividends, Agri. income < 5000) VERIFICATION I, (full name in block letters), son/daughter of solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2011-12 Place Date Sign here -> PAN 27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No of TRP Name of TRP Counter Signature of TRP REFUND 17 18 19 20 21

28

If TRP is entitled for any reimbursement from the Government, amount thereof (to be filled by TRP)

You might also like

- Lesson 1 Tax Planning & ManagementDocument35 pagesLesson 1 Tax Planning & ManagementkelvinNo ratings yet

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Your Receipt From Airbnb: London Price BreakdownDocument1 pageYour Receipt From Airbnb: London Price BreakdownAkmal Niam FirdausiNo ratings yet

- Taxation Law ProjectDocument26 pagesTaxation Law Projectshekhar singhNo ratings yet

- ITR1 - PHII - r6 (With Interest)Document8 pagesITR1 - PHII - r6 (With Interest)arun1aNo ratings yet

- Income Tax Return Form-1 Sahaj - Excel FormatDocument9 pagesIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Vikas KumarNo ratings yet

- Itr 1Document2 pagesItr 1zakirhusssainNo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument4 pagesReceipt No/ Date Seal and Signature of Receiving Officialtsrahod@yahoo.comNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Document9 pagesSahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Abhijeet DeyNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSk SahuNo ratings yet

- NotificationDocument7 pagesNotificationapi-25886395No ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)ashim kumar PramanickNo ratings yet

- 12 Itr1 10 11Document6 pages12 Itr1 10 11ramanwweNo ratings yet

- Form PDF 301906800310714Document2 pagesForm PDF 301906800310714deepkaryan1988No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnசிவா நடராஜன்No ratings yet

- Deductions Under Chapter VI A (Section) : Date of Filing of Original ReturnDocument2 pagesDeductions Under Chapter VI A (Section) : Date of Filing of Original Returnismailkhan.dbaNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Dharmendra SinghNo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument10 pagesReceipt No/ Date Seal and Signature of Receiving OfficialRAMAPPA100% (2)

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam JainNo ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document5 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)anon-928287100% (1)

- Form PDF 692100430280713Document2 pagesForm PDF 692100430280713sunilNo ratings yet

- Form PDF 378544500300118Document7 pagesForm PDF 378544500300118raodinesh0001No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSijo Kaviyil JosephNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSiddhant SwainNo ratings yet

- 2018 03 31 12 23 14 702 - 1958189601Document5 pages2018 03 31 12 23 14 702 - 1958189601Kethavarapu RamjiNo ratings yet

- I T R-1-Ver1 (2pages)Document4 pagesI T R-1-Ver1 (2pages)mohan6789No ratings yet

- Form ITR-1Document2 pagesForm ITR-1vinay.bpNo ratings yet

- Form ITR-1-2009-10Document7 pagesForm ITR-1-2009-10vikram_enercon3941No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnValesh MonisNo ratings yet

- Form PDF 860011410060114Document2 pagesForm PDF 860011410060114prakashdebleyNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnram4a5No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnDr-Firoz ShaikhNo ratings yet

- 2010 ITR1 R11-Pahlad SinghDocument16 pages2010 ITR1 R11-Pahlad SinghtakshashilalibraryNo ratings yet

- 2017 09 18 16 47 37 050 - 118817245Document5 pages2017 09 18 16 47 37 050 - 118817245Nitin KumarNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 17 - 1 8Document13 pagesSahaj Individual Income Tax Return Assessment Year 2 0 17 - 1 8Ganesh Babu SwaminathanNo ratings yet

- Salma Bano: Indian Income Tax ReturnDocument3 pagesSalma Bano: Indian Income Tax Return9956272017No ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document3 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)nilihitaNo ratings yet

- 2017 07 16 14 13 28 351 - 970124135Document5 pages2017 07 16 14 13 28 351 - 970124135Ganesh DasaraNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnsky2flyboy@gmail.comNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnpavanNo ratings yet

- 2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017Document6 pages2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017ApoorvNo ratings yet

- 2019 09 18 18 03 50 397 - Ehbps8472n - 2016Document5 pages2019 09 18 18 03 50 397 - Ehbps8472n - 2016Darvesh mishraNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusurajit halderNo ratings yet

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDocument5 pages2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNo ratings yet

- Ack. 2010-11Document1 pageAck. 2010-11Kiran GajjarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurudibyan dasNo ratings yet

- DocumentDocument5 pagesDocumentAkshay KumarNo ratings yet

- Form PDF 358979100180620Document10 pagesForm PDF 358979100180620Sajan JhaNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Document13 pagesSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Ganesh Babu SwaminathanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKrishna KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNadeemNo ratings yet

- Itr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 986260850020121 Assessment Year: 2020-21Document10 pagesItr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 986260850020121 Assessment Year: 2020-21PANKAJ KOTHARINo ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- 2019 08 18 21 20 24 392 - 1566143424392 - XXXPS7518X - AcknowledgementDocument1 page2019 08 18 21 20 24 392 - 1566143424392 - XXXPS7518X - Acknowledgementajayavisagar1No ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 994254410070818 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 994254410070818 Assessment Year: 2018-19Prashant GuptaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruসোমতীর্থ দাসNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPavitra Nityanand DasNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Document9 pagesSahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Prince BalaNo ratings yet

- The Growth of The Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional GuidanceDocument53 pagesThe Growth of The Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional GuidancesandydocsNo ratings yet

- GH - 0872Document1 pageGH - 0872ruchiscreation ruchiscreationNo ratings yet

- Return of IncomeDocument9 pagesReturn of Incomes4sahithNo ratings yet

- Gmail - Your Air France Booking Is Pending Payment 2Document5 pagesGmail - Your Air France Booking Is Pending Payment 2shawn alexNo ratings yet

- InvoiceDocument2 pagesInvoicesandipmisal2000No ratings yet

- National Income - DPP 02 - (Kautilya)Document4 pagesNational Income - DPP 02 - (Kautilya)Name SNo ratings yet

- Tax Module 2 Unit 2Document10 pagesTax Module 2 Unit 2Beatriz LorezcoNo ratings yet

- Journal in The Book of Shri Ganesh: Date Particulars Vou. No. L/F Dr. Cr.Document4 pagesJournal in The Book of Shri Ganesh: Date Particulars Vou. No. L/F Dr. Cr.Anuj GohainNo ratings yet

- Hotel BillDocument1 pageHotel BillFahim MarwatNo ratings yet

- F 941Document4 pagesF 941gopaljiiNo ratings yet

- Answers To The BAR: Taxation 1994-2006 (Arranged by Topics)Document2 pagesAnswers To The BAR: Taxation 1994-2006 (Arranged by Topics)Susan PascualNo ratings yet

- Al Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelDocument2 pagesAl Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelASHIQ HUSSAINNo ratings yet

- CITY - BANK Philippines BCXDocument1 pageCITY - BANK Philippines BCXHabib MiaNo ratings yet

- Western Union Money Transfer Receipt PDF PDF FreeDocument5 pagesWestern Union Money Transfer Receipt PDF PDF FreeShalva SamkharadzeNo ratings yet

- QQy 5 N OKBej DP 2 U 8 MDocument4 pagesQQy 5 N OKBej DP 2 U 8 MAaditi yadavNo ratings yet

- 04 Republic v. PNBDocument5 pages04 Republic v. PNBCharles MagistradoNo ratings yet

- Definitions Under GSTDocument3 pagesDefinitions Under GSTjsphdvdNo ratings yet

- Bio Assets at FVDocument7 pagesBio Assets at FVVince MiramonNo ratings yet

- The Difference Between Tax Avoidance and Tax EvasionDocument6 pagesThe Difference Between Tax Avoidance and Tax EvasionPARUL BOBALNo ratings yet

- Fieldcore Service Solutions Fcssi Iraq (Baghdad) : Payable Within 60 Days Due Net Inv DateDocument10 pagesFieldcore Service Solutions Fcssi Iraq (Baghdad) : Payable Within 60 Days Due Net Inv DateAreej YounesNo ratings yet

- Einvoice of Japla PVC 2nd BillDocument1 pageEinvoice of Japla PVC 2nd BillSAYAN SARKARNo ratings yet

- Taxguru - In-Taxes and Constitutional LimitationsDocument4 pagesTaxguru - In-Taxes and Constitutional LimitationsAbi CherubNo ratings yet

- Enrollment and Maintenance Form - Full-Client v09282022Document1 pageEnrollment and Maintenance Form - Full-Client v09282022Janella MarieNo ratings yet

- TAXATIONDocument144 pagesTAXATIONjonapdfsNo ratings yet

- Flipkart Labels 23 Feb 2024 08 17Document50 pagesFlipkart Labels 23 Feb 2024 08 17royalskhatriNo ratings yet

- AR IBY IntegrationDocument36 pagesAR IBY IntegrationManikBahl1100% (2)

- Sap 940Document3 pagesSap 940Rashmi RaviNo ratings yet