Professional Documents

Culture Documents

Geopolitics and The Worlds Gold Holdings

Geopolitics and The Worlds Gold Holdings

Uploaded by

mihajlocCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Survival in AuschwitzDocument20 pagesSurvival in Auschwitzapi-29961091233% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- LearnEnglish Speaking B2 Giving AdviceDocument5 pagesLearnEnglish Speaking B2 Giving AdviceAzza DriaaNo ratings yet

- Items GameDocument1,917 pagesItems Gameclearmoon247No ratings yet

- Our Princes Call Hymn SheetDocument1 pageOur Princes Call Hymn SheetJiggaWhaaNo ratings yet

- Sentence TransformationDocument21 pagesSentence TransformationAtchula100% (5)

- Emilio Jacinto Kartilla NG KatipunanDocument5 pagesEmilio Jacinto Kartilla NG KatipunanAyna Shalin BaltNo ratings yet

- Lomarda v. FudalanDocument2 pagesLomarda v. FudalanJc50% (4)

- The Boston Globe - March 14, 2019Document40 pagesThe Boston Globe - March 14, 2019Deepak NopanyNo ratings yet

- El Evangelio Eterno EnglishDocument8 pagesEl Evangelio Eterno Englishlizeth duqueNo ratings yet

- Petitiomn For Review Seno CalderonDocument22 pagesPetitiomn For Review Seno CalderonFrancis DinopolNo ratings yet

- Salient Features of The 9th Bipartite SettlementDocument2 pagesSalient Features of The 9th Bipartite SettlementUttam AuddyNo ratings yet

- CONTEMPT OF COURT JurisprudenceDocument10 pagesCONTEMPT OF COURT Jurisprudencenxfkfbvjw7No ratings yet

- Roxtec RS PPS S Seal v1Document6 pagesRoxtec RS PPS S Seal v1vladraqulNo ratings yet

- A Glimpse of HeavenDocument5 pagesA Glimpse of HeavenibrehbrehNo ratings yet

- Imam Al-Qurtubi On Allah's Speech - Not Composed of Letters and SoundDocument2 pagesImam Al-Qurtubi On Allah's Speech - Not Composed of Letters and SoundtakwaniaNo ratings yet

- Letter GatuslaoDocument4 pagesLetter GatuslaoGerlie Joy CastanosNo ratings yet

- Floyd v. Doubleday Et Al - Document No. 21Document12 pagesFloyd v. Doubleday Et Al - Document No. 21Justia.comNo ratings yet

- Restore Police Ligitimacy, Social Capital, and Policing Styles To Improve Police Community RelationsDocument21 pagesRestore Police Ligitimacy, Social Capital, and Policing Styles To Improve Police Community RelationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

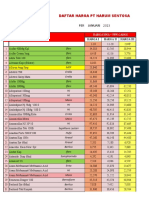

- HARGAHARSENJAN23Document48 pagesHARGAHARSENJAN23apotek telagasariNo ratings yet

- Boy Scouts of America V DaleDocument2 pagesBoy Scouts of America V DaleZachary FigueroaNo ratings yet

- Applicability of Civil Code ArtDocument9 pagesApplicability of Civil Code ArtMark Lester AlariaoNo ratings yet

- History of San Nicolas National High SchoolDocument5 pagesHistory of San Nicolas National High SchoolEmelyn V. CudapasNo ratings yet

- IOR Written Assignment OutlineDocument7 pagesIOR Written Assignment OutlineNur AfifahNo ratings yet

- Dr. Vijay Kumar Kadam vs. StateDocument5 pagesDr. Vijay Kumar Kadam vs. StatemadgoblinopNo ratings yet

- G.R. No. 201292 - Pension and Gratuity Management Center v. AAADocument9 pagesG.R. No. 201292 - Pension and Gratuity Management Center v. AAAMart Amiel LafortezaNo ratings yet

- Patriarchy in Flux and The Invisible Women of The Mexican WomenDocument49 pagesPatriarchy in Flux and The Invisible Women of The Mexican WomenTeresa100% (1)

- Jan Ship ConstructionDocument5 pagesJan Ship ConstructionGanesh AnandNo ratings yet

- Licaros vs. Gatmaitan 362 SCRA 548, August 09, 2001Document16 pagesLicaros vs. Gatmaitan 362 SCRA 548, August 09, 2001mary elenor adagioNo ratings yet

- Background of The Liberation of GoaDocument4 pagesBackground of The Liberation of GoaManasvi VermaNo ratings yet

- Forensic Accounting AssignmentDocument4 pagesForensic Accounting AssignmentSam PatriceNo ratings yet

Geopolitics and The Worlds Gold Holdings

Geopolitics and The Worlds Gold Holdings

Uploaded by

mihajlocOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Geopolitics and The Worlds Gold Holdings

Geopolitics and The Worlds Gold Holdings

Uploaded by

mihajlocCopyright:

Available Formats

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

(Global Research, April 23, 2011)

Below are the official country level central bank holdings of gold (scroll down) as well as estimates of mine production of gold by major gold producing countries.

The figures on gold holdings pertain to central bank holdings. They do not include private holdings of gold by individuals and financial institutions.

The official central bank figures cannot be verified, nor can the total amount of gold derivatives transacted in financial markets. There is no reliable data on private gold holdings.

With regard to official US gold holdings at Fort Knox, there has been no independent audit of official holdings. According to Rep. Ron Paul: "Our Federal Reserve admits to nothing, and they should prove all the gold is there. There is a reason to be suspicious, and even if you are not suspicious, why wouldn't you have an audit? ( Ron Paul calls for audit of US Gold Reserves , quoted in The New American, August 30, 2010).

" The last and only time that an audit was performed on the gold held in Fort Knox was issued within hours of President Dwight Eisenhowers inauguration on January 20, 1953." (New American, op.cit. emphasis added)

Physical gold holdings constitute a crucial geopolitical variable in the confrontation between competing economic powers. They are also central to an understanding of the debt crisis.

1 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

Both Russia and China have significantly increased their gold holdings in recent years. Large amounts of US dollar denominated debt instruments have been converted into gold.

The official figures for China are based on released data by the People's Bank of China. There is reason to believe that only part of the official purchases are made public, to the extent that the People's Bank of China reserves may be much higher those recorded in official statistics. Conversely, there is reason to believe thatUS holdings at Fort Knox may be significantly lower than what is conveyed in official figures.

"China is on a gold buying spree these days. The Chinese central bank-the People's Bank of China-is taking a series of steps to increase its gold reserves to ensure that the precious yellow metal replaces forex reserves held in the US dollar. In the last few months, there have been talks of China following India in buying gold reserves from the International Monetary Fund (IMF). So when IMF announced that it would be selling its remaining 191 tonnes of gold in the open market, several bullion analysts predicted that China would somehow jump into the fray and buy IMF gold. Both China and India are competing in the global bullion markets to be the largest consumers and importers of gold." (See ibtimes.com ).

Both China and Russia are major producers of gold. Of geopolitical significance, China is the World's largest producer of physical gold.

According to 2009 figures, China is the World's largest gold producer; 313.98 metric tons, representing 11.8 percent of global gold production.

1. China: 313.98 mt 2. Australia: 227.00 mt 3. United States: 216.00 mt 4. South Africa: 204.92 mt 5. Russia: 205.00 mt

2 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

6. Peru: 180mt (estimate) 7. Indonesia: 90.00 mt 8. Canada: 95.00 mt (estimate) 9. Ghana 90.20 mt 10. Uzbekistan 80mt (estimate) Other: 854mt TOTAL: 2572mt http://www.goldsheetlinks.com/production.htm

SOURCE: www.thegoldstandardnow.org

View PDF File

Country

Tonnes

1.

United States

3 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

8,133.5

2.

Germany

3,401.8

3.

IMF

2,827.2

4.

Italy

2,451.8

5.

4 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

France

2,435.4

6.

China

1,054.1

7.

Switzerland

1,040.1

8.

Russia

784.1

5 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

9.

Japan

765.2

10.

Netherlands

612.5

11.

India

557.7

12.

6 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

ECB

501.4

13.

Taiwan

423.6

14.

Portugal

382.5

15.

Venezuela

365.8

7 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

16.

Saudi Arabia

322.9

17.

United Kingdom

310.3

18.

Lebanon

286.8

19.

Spain

8 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

281.6

20.

Austria

280.0

21.

Belgium

227.5

22.

Algeria

173.6

9 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

23.

Philippines

156.5

24.

Libya

143.8

25.

Singapore

127.4

26.

Sweden

10 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

125.7

27.

South Africa

124.9

28.

BIS

120.0

29.

Turkey

116.1

30.

11 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

Greece

111.7

31.

Romania

103.7

32.

Poland

102.9

33.

Thailand

99.5

12 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

34.

Australia

79.9

35.

Kuwait

79.0

36.

Egypt

75.6

37.

13 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

Indonesia

73.1

38.

Kazakhstan

67.3

39.

Denmark

66.5

40.

Pakistan

64.4

14 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

41.

Argentina

54.7

42.

Finland

49.1

43.

Bulgaria

39.9

44.

WAEMU

15 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

36.5

45.

Malaysia

36.4

46.

Belarus

35.3

47.

Peru

34.7

16 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

48.

Brazil

33.6

49.

Slovakia

31.8

50.

Bolivia

28.3

51.

Ukraine

17 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

27.5

52.

Ecuador

26.3

53.

Syria

25.8

54.

Morocco

22.0

55.

18 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

Sri Lanka

17.5

56.

Korea

14.4

57.

Cyprus

13.9

Country

19 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

Tonnes

58.

Bangladesh

13.5

59.

Serbia

13.1

60.

Netherlands Antilles

13.1

20 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

61.

Jordan

12.8

62.

Czech Republic

12.7

63.

Cambodia

12.4

64.

Qatar

21 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

12.4

65.

Laos

8.8

66.

Latvia

7.7

67.

Mexico

7.3

68.

22 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

El Salvador

7.3

69.

CEMAC

7.1

70.

Guatemala

6.9

71.

Colombia

6.9

23 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

72.

Macedonia

6.8

73.

Tunisia

6.8

74.

Ireland

6.0

75.

24 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

Lithuania

5.8

76.

Bahrain

4.7

77.

Mauritius

3.9

78.

Canada

3.4

25 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

79.

Tajikistan

3.3

80.

Slovenia

3.2

81.

Aruba

3.1

82.

Hungary

26 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

3.1

83.

Kyrgyz Republic

2.6

84.

Mozambique

2.3

85.

Luxembourg

2.2

27 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

86.

Hong Kong

2.1

87.

Suriname

2.0

88.

Iceland

2.0

89.

Papua New Guinea

28 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

2.0

90.

Trinidad and Tobago

1.9

91.

Albania

1.6

92.

Yemen

1.6

93.

29 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

Cameroon

0.9

94.

Mongolia

0.9

95.

Honduras

0.7

96.

Paraguay

0.7

30 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

97.

Dominican Republic

0.6

98.

Gabon

0.4

99.

Malawi

0.4

100.

31 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

Central

African Rep.

0.3

101.

Chad

0.3

102.

Congo

0.3

103.

Uruguay

0.3

32 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

104.

Fiji

0.2

105.

Estonia

0.2

106.

Chile

0.2

107.

Malta

33 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

0.1

108.

Costa Rica

0.1

109.

Haiti

0.0

110.

Burundi

0.0

34 / 35

Geopolitics and the World's Gold Holdings

: Michel Chossudovsky , 25 2011 05:52

111.

Oman

0.0

112.

Comoros

0.0

113.

Kenya

0.0

* A tonne, also referred to as a metric ton, has a unit of mass equal to 1,000 kg

Statistics acquired from: "World Official Gold Holdings." World Gold Council, Jan 2011. Web. 1 Feb 2011.

35 / 35

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Survival in AuschwitzDocument20 pagesSurvival in Auschwitzapi-29961091233% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- LearnEnglish Speaking B2 Giving AdviceDocument5 pagesLearnEnglish Speaking B2 Giving AdviceAzza DriaaNo ratings yet

- Items GameDocument1,917 pagesItems Gameclearmoon247No ratings yet

- Our Princes Call Hymn SheetDocument1 pageOur Princes Call Hymn SheetJiggaWhaaNo ratings yet

- Sentence TransformationDocument21 pagesSentence TransformationAtchula100% (5)

- Emilio Jacinto Kartilla NG KatipunanDocument5 pagesEmilio Jacinto Kartilla NG KatipunanAyna Shalin BaltNo ratings yet

- Lomarda v. FudalanDocument2 pagesLomarda v. FudalanJc50% (4)

- The Boston Globe - March 14, 2019Document40 pagesThe Boston Globe - March 14, 2019Deepak NopanyNo ratings yet

- El Evangelio Eterno EnglishDocument8 pagesEl Evangelio Eterno Englishlizeth duqueNo ratings yet

- Petitiomn For Review Seno CalderonDocument22 pagesPetitiomn For Review Seno CalderonFrancis DinopolNo ratings yet

- Salient Features of The 9th Bipartite SettlementDocument2 pagesSalient Features of The 9th Bipartite SettlementUttam AuddyNo ratings yet

- CONTEMPT OF COURT JurisprudenceDocument10 pagesCONTEMPT OF COURT Jurisprudencenxfkfbvjw7No ratings yet

- Roxtec RS PPS S Seal v1Document6 pagesRoxtec RS PPS S Seal v1vladraqulNo ratings yet

- A Glimpse of HeavenDocument5 pagesA Glimpse of HeavenibrehbrehNo ratings yet

- Imam Al-Qurtubi On Allah's Speech - Not Composed of Letters and SoundDocument2 pagesImam Al-Qurtubi On Allah's Speech - Not Composed of Letters and SoundtakwaniaNo ratings yet

- Letter GatuslaoDocument4 pagesLetter GatuslaoGerlie Joy CastanosNo ratings yet

- Floyd v. Doubleday Et Al - Document No. 21Document12 pagesFloyd v. Doubleday Et Al - Document No. 21Justia.comNo ratings yet

- Restore Police Ligitimacy, Social Capital, and Policing Styles To Improve Police Community RelationsDocument21 pagesRestore Police Ligitimacy, Social Capital, and Policing Styles To Improve Police Community RelationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- HARGAHARSENJAN23Document48 pagesHARGAHARSENJAN23apotek telagasariNo ratings yet

- Boy Scouts of America V DaleDocument2 pagesBoy Scouts of America V DaleZachary FigueroaNo ratings yet

- Applicability of Civil Code ArtDocument9 pagesApplicability of Civil Code ArtMark Lester AlariaoNo ratings yet

- History of San Nicolas National High SchoolDocument5 pagesHistory of San Nicolas National High SchoolEmelyn V. CudapasNo ratings yet

- IOR Written Assignment OutlineDocument7 pagesIOR Written Assignment OutlineNur AfifahNo ratings yet

- Dr. Vijay Kumar Kadam vs. StateDocument5 pagesDr. Vijay Kumar Kadam vs. StatemadgoblinopNo ratings yet

- G.R. No. 201292 - Pension and Gratuity Management Center v. AAADocument9 pagesG.R. No. 201292 - Pension and Gratuity Management Center v. AAAMart Amiel LafortezaNo ratings yet

- Patriarchy in Flux and The Invisible Women of The Mexican WomenDocument49 pagesPatriarchy in Flux and The Invisible Women of The Mexican WomenTeresa100% (1)

- Jan Ship ConstructionDocument5 pagesJan Ship ConstructionGanesh AnandNo ratings yet

- Licaros vs. Gatmaitan 362 SCRA 548, August 09, 2001Document16 pagesLicaros vs. Gatmaitan 362 SCRA 548, August 09, 2001mary elenor adagioNo ratings yet

- Background of The Liberation of GoaDocument4 pagesBackground of The Liberation of GoaManasvi VermaNo ratings yet

- Forensic Accounting AssignmentDocument4 pagesForensic Accounting AssignmentSam PatriceNo ratings yet