Professional Documents

Culture Documents

MBA 504 Ch3 Solutions

MBA 504 Ch3 Solutions

Uploaded by

Ad QasimCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBA 504 Ch3 Solutions

MBA 504 Ch3 Solutions

Uploaded by

Ad QasimCopyright:

Available Formats

Chapter 3 Process Costing

QUESTIONS 1. Job-order costing systems and process costing systems are the two primary accounting systems used to record production costs. 2. Equivalent units is the quantity of partially completed units expressed in terms of whole units. The number is used in calculating the average unit costs under process costing. 3. Direct labor and overhead, together, are called conversion costs. 4. The costs associated with units received from a preceding department within the company for further processing are called transferred-in costs. 5. Material may enter at the start of a production process while labor and overhead are incurred throughout the process. 6. Cost per equivalent unit = (Cost in beginning work in process + Cost incurred in current period) (Units completed + Equivalent units in ending work in process). 7. Cost to account for = (Cost in beginning work in process + Cost incurred in current period). 8. Reconciliation helps to ensure that mistakes are not made in calculations and units are not lost. 9. Transferred-in costs are the costs associated with units received from a preceding department within the company received for further processing. Therefore, they occur in all production departments except the first. 10. The four steps involved in preparing a production cost report are as follows: a. Account for the number of physical units b. Calculate the cost per equivalent unit for material, labor, and overhead c. Assign costs to items completed and items in ending work in process d. Account for the amount of product cost

3-2

Jiambalvo Managerial Accounting

EXERCISES

E1. In the production of chips, much of manufacturing overhead is a fixed cost. This cost is assigned to completed items and work in process. By starting a large number of items at year end, and given the simplifying assumption that items in process are 50% complete, a significant proportion of the fixed manufacturing overhead will end up in work in process, which reduces the cost of finished items and ultimately the cost of goods sold. The result is that profit will be artificially inflated. This approach to increasing profit may mislead investors and other stakeholders and cause them to make bad decisions. Thus, the behavior is not ethical. E2. Cost per equivalent unit is calculated for material, labor and overhead. For each of these items, we sum the cost in beginning work in process and the cost incurred during the period. This becomes the numerator of the calculation. Then, we determine the number of units completed and the equivalent units in ending work in process. This becomes the denominator of the calculation. It is important to note that the equivalent units in ending work in process may be different for material, labor, and overhead. This is because material, labor, and overhead enter the production process at different times. E3. a. There are 11 steps: Brew House Step 1, malted barleybarley is mixed with water, dried and cured. Step 2, millthe grain is cracked by steel grinders. Step 3, mash tunmalt is mixed with warm water in the mash tun. Step 4, lauter tunthe mash is pumped into the lauter tun where it is sprayed with hot water to help extract sugar from the malt.

Chapter 3 Process Costing

3-3

Step 5, brew kettlethe base of beer, or wort, is pumped into the brew kettle where it is boiled, concentrated and clarified. Step 6, heat exchangerthe wort is cooled before it is moved to a fermentation cellar where it will become beer. In order to speed the cooling process, it is passed through a heat exchanger. In the cellar Step 7, fermenterhere, specially cultured yeast, Saccharomyces cerevisiae, is added to induce fermentation. Step 8, filtrationafter the beer has been cold cellared in the fermenter, it is passed through a filter. Packaging Step 9, bottlingthe bottling line is made up of several components. At the heart of the system is a counter-pressured filler which is capable of filling 400 bottles a minute. Step 10, keggingRedhook uses Snakey kegs, which have the advantage of being much easier to sterilize and fill than older types such as Golden Gates. Step 11, shippingales are shipped out to stores and pubs across the United States in refrigerated trucks to keep them fresh. b. For each type of beer that Red Hook produces, a large number of identical units are produced in a continuous process. Thus, the company is likely to use process costing. c. Barley is added at the start. In step 7, yeast is added. d. The process is capital intensive. Large pieces of equipment are maintained by only one or two workers. For example, the automated bottling line fills 400 bottles a minute.

3-4

Jiambalvo Managerial Accounting

E4. Units in beginning work in process Units started in July Units to account for Units completed Units in ending work in process Total units accounted for

1,000 43,000 44,000 cans 40,000 ? 44,000 cans

Units in ending work in process = 44,000 - 40,000 = 4,000 cans.

E5. Units in beginning work in process Units started in August Units to account for Units completed Units in ending work in process Total units accounted for

10,000 ? 52,000 gallons 40,000 12,000 52,000 gallons

Units started in August = 52,000 - 10,000 = 42,000 gallons.

Chapter 3 Process Costing

3-5

E6. Direct Labor Beginning WIP Cost incurred in May Total cost Units Units completed Equivalent units, ending WIP (2,000 pounds 50%) Total

$120,000 500,000 $620,000

10,000 pounds 1,000 11,000 pounds

Cost per equivalent unit = $620,000 11,000 pounds = $56.36 per pound

E7. Let X = the cost in beginning work in process Material: ($140,000 + X) (30,000 + 10,000) = $5 X = $60,000 Labor: ($60,000 + X) (30,000 + 2,000) = $2 X = $4,000 Overhead: ($87,000 + X) (30,000 + 2,000) = $3 X = $9,000

3-6

Jiambalvo Managerial Accounting

E8. The denominator is equal to units completed plus equivalent units in ending work in process. Material Units completed Equivalent units in ending work in process Total Labor Units completed Equivalent units in ending work in process Total Overhead Units completed Equivalent units in ending work in process Total

2,700 400 3,100

2,700 250 2,950

2,700 250 2,950

E9. a. Cost per equivalent unit for material is $6.10. Material cost in items completed is $244,000. Therefore, the number of completed units is 40,000 (i.e., $244,000 $6.10). Units in beginning work in process Units started in July Units to account for Units completed Units in ending work in process Total units accounted for 1,000 43,000 44,000 cans 40,000 ? 44,000

This implies that 4,000 units are in ending work in process. b. Cost of ending work in process is $5,800 as follows: Material (.2 4,000 units $6.10) Labor and overhead (.1 4,000 units $2.30) Ending work in process $4,880 920 $5,800

Chapter 3 Process Costing

3-7

E10. Ending Work in Process Material (800 1.0 $0.50) Labor and overhead (800 .8 $0.90) Total Cost of Items Completed Material (4,000 $0.50) Labor and overhead (4,000 $0.90) Total

$400 576 $976

$2,000 3,600 $5,600

E11. Ending Work in Process Material (4 .8 $2,500) Labor (4 .6 $1,000) Overhead (4 .6 $2,000) Total Cost of Items Completed Material (85 $2,500) Labor (85 $1,000) Overhead (85 $2,000) Total

$ 8,000 2,400 4,800 $15,200

$212,500 85,000 170,000 $467,500

3-8

Jiambalvo Managerial Accounting

E12. a. Material: Cost in beginning work in process Cost incurred during the period Total Conversion costs: Cost in beginning work in process Cost incurred during the period Total Equivalent units in ending work in process: Material (1,000 units .8) Conversion costs (1,000 .4) Cost per equivalent unit for material: $422,180 (41,000 + 800) Cost per equivalent unit for conversion costs: $380,880 (41,000 + 400) Total cost per equivalent units

$ 18,000 404,180 $422,180 9,000 371,880 $380,880 800 400 $10.10 9.20 $19.30 $

b. Cost of items completed in October: 41,000 units $19.30

$791,300

c. Cost of ending work in process: Material cost (800 $10.10) Conversion cost (400 $9.20) Total cost of ending work in process

$ 8,080 3,680 $11,760

Chapter 3 Process Costing PROBLEMS

3-9

P1. a. The company started the month with 5,000 units and 100,000 units were entered into production. Thus, the company must account for 105,000 units. At the end of the month, the company had 2,000 units in ending work in process. This implies that 103,000 units were completed (105,000 - 2,000). The denominators for the calculations of cost per equivalent are: Units Completed 103,000 103,000 103,000

Cost Added

Material Labor Overhead

Equivalent Units in Ending WIP 2,000 1,600 1,600

Total

Total 105,000 104,600 104,600

Beginning WIP

Denominator Cost per EU

Material Labor Overhead Total

$3,000 125 175 $3,300

$65,250 6,151 7,147 $78,548

$68,250 6,276 7,322 $81,848

105,000 104,600 104,600

$0.65 0.06 0.07 $0.78

b. Cost of items completed in May is $80,340: 103,000 units $0.78 = $80,340 Cost of items in ending work in process: Material (2,000 equivalent units $0.65) Labor (1,600 equivalent units $0.06) Overhead (1,600 equivalent units $0.07) Total c. Beginning work in process Cost added Total Cost of items completed Cost of ending WIP Total

$1,300 96 112 $1,508 $ 3,300 78,548 $81,848 $80,340 1,508 $81,848

3-10

Jiambalvo Managerial Accounting

P2. a. The company started the month with 600 units and 3,200 units were entered into production. Thus, the company must account for 3,800 units. At the end of the month, the company had 800 units in ending work in process. This implies that 3,000 units were completed (3,800 - 800). The denominators for the calculations of cost per equivalent are: Units Completed 3,000 3,000 3,000 Equivalent Units in Ending WIP 480 400 400

Material Labor Overhead

Total 3,480 3,400 3,400

Beginning WIP Material $ 48,000 Labor 12,600 Overhead 84,000 Total $144,600

Cost Added $ 317,400 94,500 590,900 $1,002,800

Total $ 365,400 107,100 674,900 $1,147,400

Cost per Denominator EU 3,480 $105.00 3,400 31.50 3,400 198.50 $335.00

b. Cost of items completed in May is $1,005,000: 3,000 units $335.00 = $1,005,000 Cost of items in ending work in process: Material (480 equivalent units $105.00) Labor (400 equivalent units $31.50) Overhead (400 equivalent units $198.50) Total c. Beginning work in process Cost added Total Cost of items completed Cost of ending WIP Total

$ 50,400 12,600 79,400 $142,400 $ 144,600 1,002,800 $1,147,400 $1,005,000 142,400 $1,147,400

Chapter 3 Process Costing

3-11

P3. a. Olympic LaminatorsSeptember Unit Reconciliation Units in beg. WIP (60% material, 30% conversion costs) Units started during Units to account for Units completed Units in ending WIP (50% material, 20% conversion costs) Units accounted for *Computed as 7,000 - 5,000 = 2,000. Cost per Equivalent Unit Calculation Material Cost Beginning WIP $144,000 Cost incurred during Sept. 216,000 Total $360,000 Units Units completed Equivalent units, ending WIP Total Cost per equivalent unit Cost Reconciliation Total cost to account for Cost of completed units (2,000 units $321) Cost of ending WIP Material (2,500 equivalent units $80) Labor (1,000 equivalent units $217) Overhead (1,000 equivalent units $24) Total cost accounted for b. Finished Goods Inventory Work in Process Inventory 2,000 2,500 4,500 $80 Labor $120,000 531,000 $651,000 2,000 1,000 3,000 $217 Overhead $ 20,000 52,000 $72,000 2,000 1,000 3,000 $24

3,000 4,000 7,000 2,000* 5,000 7,000

Total $ 284,000 799,000 $1,083,000

$321

$1,083,000 $ 642,000 $200,000 217,000 24,000

441,000 $1,083,000

642,000 642,000

3-12

Jiambalvo Managerial Accounting

P4. Aussie Yarn CompanyAugust Unit Reconciliation Units in beg. WIP ((100% material, 60% conversion costs) Units started during Units to account for Units completed Units in ending WIP (100% material, 40% conversion costs) Units accounted for *Computed as 30,000 - 4,000 = 26,000. Cost per Equivalent Unit Calculation Material Cost Beginning WIP Cost incurred during Sept. Total Units Units completed Equivalent units, ending WIP Total Cost per equivalent unit Cost Reconciliation Total cost to account for Cost of completed units (26,000 units $1.746) Cost of ending WIP Material (4,000 equivalent units $0.876) Labor (1,600 equivalent units $0.400) Overhead (1,600 equivalent units $0.470) Total cost accounted for $ 4,000 22,280 $26,280 Labor $ 1,050 9,990 $11,040 Overhead $ 1,450 11,522 $12,972

5,000 25,000 30,000 26,000* 4,000 30,000

Total $ 6,500 43,792 $50,292

26,000 4,000 30,000 $0.876

26,000 1,600 27,600 $0.400

26,000 1,600 27,600 $0.470 $1.746

$50,292 $45,396 $3,504 640 752

4,896 $50,292

Chapter 3 Process Costing

3-13

P5. a.

Work in process, dept. 1 80,000 Material inventory To record material used in department 1 Work in process, dept. 2 20,000 Material inventory To record material used in department 2

80,000

20,000

b.

Work in process, dept. 1 Wages payable To record labor in department 1 Work in process, dept. 2 Wages payable To record labor in department 2

45,000 45,000

55,000 55,000

c.

Work in process, dept. 1 230,000 Manufacturing overhead To record overhead applied in department 1 Work in process, dept. 2 110,000 Manufacturing overhead To record overhead applied in department 2

230,000

110,000

d.

Work in process, dept. 2 381,000 Work in process, dept. 1 381,000 To record cost of units transferred from department 1 to department 2 Note: This includes all beginning costs and costs incurred, since there is no ending work in process in this department (26,000 + 80,000 + 45,000 + 230,000). Finished goods inventory 576,000 Work in process, dept. 2 576,000 To record cost units completed and transferred to finished goods. Note: 46,000 + 20,000 + 55,000 + 110,000 + 381,000 36,000 = 576,000.

3-14

Jiambalvo Managerial Accounting

P6. a.

Work in process 40,000 Material inventory To record material used in production Work in process Wages payable To record labor Work in process Manufacturing overhead To record overhead applied Finished goods inventory Work in process To record cost of units completed Cost of goods sold Finished goods inventory To record cost of units sold 300 2,000 300 180 180 2,000 1,880 1,880 2.25 5.40 10.80 18.45 8,000

40,000

b.

8,000

c.

32,000 32,000

d.

80,000 80,000

e.

80,000 80,000

P7. a. b. c. d. e. f. g. h. i. j. k. l.

Chapter 3 Process Costing

3-15

P8. Step 1. Cost per equivalent unit = 1.6667 + 1.3091 + 2.6182 = 5.594 Cost of completed items (given) = $2,797,000 Cost per equivalent unit = $5.594 Therefore, the number of completed units = $2,797,000 5.594 = 500,000 Step 2. Units in ending WIP (given) Add number of completed units Units accounted for Step 3. Units to account for = units accounted for Less units in beginning WIP (given) Units started during December Step 4. Equivalent units, ending WIP: Material (10,000 100%) Labor (10,000 10%) Overhead (10,000 10%) Step 5. Units completed (calculated above) Total units for cost per equivalent unit calculation: Material = 500,000 + 10,000 Labor and Overhead = 500,000 + 1,000

10,000 500,000 510,000

510,000 20,000 490,000

10,000 1,000 1,000

500,000 510,000 501,000

3-16

Jiambalvo Managerial Accounting

Step 6. Total cost in cost per equivalent unit calculation: Material = 510,000 $1.6667 Labor = 501,000 1.3091 Overhead = 501,000 2.6182 Step 7. Cost incurred in December: Material = $850,017.00 - 33,334.00 Labor = $655,859.10 - 5,236.40 Overhead = $1,311,718.20 - 10,472.80 Step 8. Cost Reconciliation: Total cost to account for

$850,017.00 $655,859.10 $1,311,718.20

$816,683.00 $650,622.70 $1,301,245.40

$2,817,594.30

Cost of completed units (500,000 $5.594) $2,797,000.00 Cost of Ending WIP $16,667.00 Materials (10,000 $1.6667) 1,309.10 Labor (1,000 $1.3091) Overhead (1,000 $2.6182) 2,618.20 20,594.30 Total cost accounted for: $2,817,594.30

Chapter 3 Process Costing

3-17

P9. Mixing Department, Oral Care ToothpasteApril Unit Reconciliation Units in beg. WIP (100% material, 80% conversion costs) Units started during Units to account for Units completed Units in ending WIP (100% material, 70% conversion costs) Units accounted for *Computed as 610,000 - 20,000 = 590,000. Cost per Equivalent Unit Calculation Material Cost Beginning WIP $ 4,000 Cost incurred during April 246,100 Total $250,100 Units Units completed Equivalent units, ending WIP Total Cost per equivalent unit Labor $ 800 65,640 $66,440 Overhead $ 1,680 119,120 $120,800 Total $ 6,480 430,860 $437,340

10,000 600,000 610,000 590,000* 20,000 610,000

590,000 20,000 610,000 $0.41

590,000 14,000 604,000 $0.11

590,000 14,000 604,000 $0.20 $0.72

3-18

Jiambalvo Managerial Accounting

Cost Reconciliation Total cost to account for Cost of completed units (590,000 units $0.72) Cost of ending WIP Material (20,000 equivalent units $.41) Labor (14,000 equivalent units $.11) Overhead (14,000 equivalent units $.20) Total cost accounted for $437,340 $ 424,800 $8,200 1,540 2,800

12,540 $437,340

Packing Department, Oral Care ToothpasteApril Unit Reconciliation Units in Beg. WIP (50% material, 40% conversion costs) Units started during Units to account for Units completed Units in ending WIP (90% material, 80% conversion costs) Units accounted for *Computed as 600,500 - 30,000 = 570,500.

10,500 590,000 600,500 570,500* 30,000 600,500

Chapter 3 Process Costing

3-19

Cost per Equivalent Unit Calculation

Material Labor Overhead Trans.In Total

Cost Beginning WIP $ 630 Cost incurred during Sept. 77,045 Total $77,675 Units Units completed Equivalent units, ending WIP Total Cost per equivalent unit Cost Reconciliation Total cost to account for

$ 42 $ 84 $ 7,455 5,903 11,890 424,800 $5,945 $11,974 $432,255

$ 8,211 519,638 $527,849

570,500 570,500 570,500 27,000 24,000 24,000 597,500 594,500 594,500 $0.130 $0.010 $0.020

570,500 30,000 600,500 $0.720 $0.880

$527,849 $ 502,040 $ 3,510 240 480 21,600

Cost of completed units (570,500 units $0.880) Cost of ending WIP Material (27,000 equivalent units $.130) Labor (24,000 equivalent units $.010) Overhead (24,000 equivalent units $.020) Trans. in (30,000 equivalent units $.720) Total cost accounted for * Difference between cost to account for and cost accounted for due to rounding.

25,830 $527,870*

3-20

Jiambalvo Managerial Accounting

P10. Mixing Department, Carnival Caramel CompanyMarch Unit Reconciliation Units in beg. WIP (100% material, 80% conversion costs) Units started during Units to account for Units completed Units in ending WIP (100% material, 60% conversion costs) Units accounted for *Computed as 42,000 - 1,000 = 41,000. Cost per Equivalent Unit Calculation Material Cost Beginning WIP Cost incurred during Sept. Total Units Units completed Equivalent units, ending WIP Total Cost per equivalent unit $ 2,000 40,840 $42,840 Labor 800 20,832 $21,632 $ Overhead $ 960 23,168 $24,128 Total $ 3,760 84,840 $88,600

2,000 40,000 42,000 41,000* 1,000 42,000

41,000 1,000 42,000 $1.02

41,000 600 41,600 $0.52

41,000 600 41,600 $0.58 $2.12

Chapter 3 Process Costing

3-21

Cost Reconciliation Total cost to account for Cost of completed units (41,000 units $2.12) Cost of ending WIP Material (1,000 equivalent units $1.02) Labor (600 equivalent units $.52) Overhead (600 equivalent units $.58) Total cost accounted for $88,600 $86,920 $1,020 312 348

1,680 $88,600

Shaping Department, Carnival Caramel CompanyMarch Unit Reconciliation Units in beg. WIP (70% conversion costs) 3,000 Units started during 41,000 Units to account for 44,000 Units completed Units in ending WIP (50% conversion costs) Units accounted for *Computed as 44,000 500 = 43,500. 43,500* 500 44,000

3-22

Jiambalvo Managerial Accounting

Cost per Equivalent Unit Calculation

Material Labor Overhead Trans.In Total

Cost Beginning WIP Cost incurred during Sept. Total Units Units completed Equivalent units, ending WIP Total Cost per equivalent unit Cost Reconciliation Total cost to account for

$ 450 $ 290.00 $ 6,360 11,800 8,022.50 86,920 $12,250 $8,312.50 $93,280

7,100.00 106,742.50 $113,842.50

43,500 250 43,750 $0.28

43,500 250 43,750 $0.19

43,500 500 44,000 $2.12 $2.59

$113,842.50 $ 112,665.00 $ 0.00 70.00 47.50 1,060.00

Cost of completed units (43,500 units $2.59) Cost of ending WIP Material Labor (250 equivalent units $.28) Overhead (250 equivalent units $.19) Trans. in (500 equivalent units $2.12) Total cost accounted for

1,177.50 $113,842.50

You might also like

- Case Study Introduction of Detergents Disinfectant Rotation, Residue Removal 2018Document43 pagesCase Study Introduction of Detergents Disinfectant Rotation, Residue Removal 2018wahNo ratings yet

- Chapter 4Document45 pagesChapter 4Yanjing Liu67% (3)

- JBMC Business Model Canvas - The Night OwlsDocument1 pageJBMC Business Model Canvas - The Night OwlsRahman ArmenzariaNo ratings yet

- Landau CompanyDocument4 pagesLandau Companysherwinrs100% (2)

- Channel, Sales and DistributionDocument14 pagesChannel, Sales and DistributionMohit Kumar Gupta0% (1)

- Changing MindsDocument15 pagesChanging MindsMohit Kumar Gupta100% (1)

- Chapter 6 Work, Energy and PowerDocument12 pagesChapter 6 Work, Energy and PowerZhu Jiankun100% (1)

- MBA 504 Ch4 SolutionsDocument25 pagesMBA 504 Ch4 SolutionsPiyush JainNo ratings yet

- MBA 504 Ch5 SolutionsDocument12 pagesMBA 504 Ch5 SolutionspheeyonaNo ratings yet

- Cost II Chapter ThreeDocument11 pagesCost II Chapter ThreeSemira100% (1)

- Standard (I Unit Produced) ParticularsDocument11 pagesStandard (I Unit Produced) ParticularsForam Raval100% (1)

- PVC Analysis QNDocument14 pagesPVC Analysis QNAnipa HubertNo ratings yet

- Arens Chapter20Document105 pagesArens Chapter20rochielanciolaNo ratings yet

- Chapter 6 Accounting For MaterialsDocument3 pagesChapter 6 Accounting For MaterialsIbrahim SameerNo ratings yet

- Receivable ManagementDocument40 pagesReceivable ManagementrenudhingraNo ratings yet

- CH 04Document40 pagesCH 04thrust_xone100% (1)

- Chapter 4 Solutions: A) Explain The FollowingDocument23 pagesChapter 4 Solutions: A) Explain The FollowingAdebayo Yusuff AdesholaNo ratings yet

- Dec 2014Document2 pagesDec 2014Zahiratul QamarinaNo ratings yet

- Chapter 7 Surgical Asepsis and Antiseptic MeasuresDocument2 pagesChapter 7 Surgical Asepsis and Antiseptic MeasuresAndrew BonusNo ratings yet

- MBA 504 Ch9 SolutionsDocument24 pagesMBA 504 Ch9 Solutionspheeyona100% (1)

- Chapter Two-Accounting For InventoryDocument25 pagesChapter Two-Accounting For Inventoryzewdie100% (1)

- The Cost of Trade CreditDocument4 pagesThe Cost of Trade CreditWawex DavisNo ratings yet

- Estate Under Administration-Tax2Document15 pagesEstate Under Administration-Tax2onet88No ratings yet

- Inventories (PAS No. 2)Document14 pagesInventories (PAS No. 2)Da Eun LeeNo ratings yet

- Estimating IRR With Fake Payback Period-L10Document9 pagesEstimating IRR With Fake Payback Period-L10akshit_vij0% (1)

- Products Commonly Treated With IrradiationDocument3 pagesProducts Commonly Treated With Irradiationkean.treylanNo ratings yet

- ENCANA Corporation: The Cost of Capital: Weight of Debt Rate of Debt Tax Weight of Equity Rate of EquityDocument3 pagesENCANA Corporation: The Cost of Capital: Weight of Debt Rate of Debt Tax Weight of Equity Rate of EquityVamsi GunturuNo ratings yet

- Tailieumienphi - VN Lecture Logistics Theory Lecture 16 Material Requirements PlanningDocument21 pagesTailieumienphi - VN Lecture Logistics Theory Lecture 16 Material Requirements PlanningBong ThoNo ratings yet

- Solution Test 1Document3 pagesSolution Test 1anis izzatiNo ratings yet

- Income From House Property PracticalDocument52 pagesIncome From House Property PracticalShreekanta DattaNo ratings yet

- MBA 504 Ch11 SolutionsDocument31 pagesMBA 504 Ch11 Solutionschawlavishnu100% (1)

- CH 07 SMDocument34 pagesCH 07 SMChris Tian FlorendoNo ratings yet

- Wacc Mini CaseDocument12 pagesWacc Mini CaseKishore NaiduNo ratings yet

- Likert Scale: Itemized Rating Scale - in The Itemized Rating Scale, The Respondents Are Provided WithDocument1 pageLikert Scale: Itemized Rating Scale - in The Itemized Rating Scale, The Respondents Are Provided WithDisha groverNo ratings yet

- ACC406 - Chapter - 13 - Relevant - Costing - IIDocument20 pagesACC406 - Chapter - 13 - Relevant - Costing - IIkaylatolentino4No ratings yet

- Theory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesDocument5 pagesTheory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesPia DagmanNo ratings yet

- Case Case:: Colorscope, Colorscope, Inc. IncDocument4 pagesCase Case:: Colorscope, Colorscope, Inc. IncBalvinder SinghNo ratings yet

- Duo PLC Produces Two Products A and B Each HasDocument2 pagesDuo PLC Produces Two Products A and B Each HasAmit Pandey50% (2)

- Principles of Accounting II PDFDocument212 pagesPrinciples of Accounting II PDFMekonnen TarikuNo ratings yet

- Ch08 Cost AllocationDocument46 pagesCh08 Cost AllocationRavikumar Sampath100% (1)

- Managerial Accounting Hilton 6e Chapter 4 Solution PDFDocument68 pagesManagerial Accounting Hilton 6e Chapter 4 Solution PDFNoor QamarNo ratings yet

- Title of Degree Program: Defination of Credit Hours: Degree Plan: Prerequisites: Course Offered: Course TtleDocument5 pagesTitle of Degree Program: Defination of Credit Hours: Degree Plan: Prerequisites: Course Offered: Course TtleHoundsterama50% (2)

- Lesson 4-Quantitative TechniquesDocument7 pagesLesson 4-Quantitative TechniquesLuiNo ratings yet

- Profitability AnalysisDocument6 pagesProfitability AnalysisMelanieNo ratings yet

- Credit ControlDocument93 pagesCredit ControlCSHERENUNo ratings yet

- Chap 7 - Flexible Budget, Direct Cost Variance and Management Control - Students NoteDocument13 pagesChap 7 - Flexible Budget, Direct Cost Variance and Management Control - Students NoteZulIzzamreeZolkepliNo ratings yet

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Document50 pagesCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathNo ratings yet

- Analyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionDocument37 pagesAnalyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Manufacturing SolutionsDocument8 pagesManufacturing SolutionsMothusi M NtsholeNo ratings yet

- Blocher8e EOC SM Ch04 FinalDocument46 pagesBlocher8e EOC SM Ch04 FinalDiah ArmelizaNo ratings yet

- 7 Lecture Activity Based Costing and Management 1Document65 pages7 Lecture Activity Based Costing and Management 1Dorothy Enid AguaNo ratings yet

- Catalogo SterisDocument57 pagesCatalogo SterisJuan Manuel Valdez Von Fürth0% (1)

- Chapter 14 SolutionsDocument35 pagesChapter 14 SolutionsAnik Kumar MallickNo ratings yet

- Chapter 6 - Business StrategyDocument5 pagesChapter 6 - Business StrategySteffany RoqueNo ratings yet

- Depreciation AssignmentDocument13 pagesDepreciation AssignmentfarisktsNo ratings yet

- Nominal Trade Credit Cost FormulaDocument4 pagesNominal Trade Credit Cost FormulaWawex DavisNo ratings yet

- Chapter - 6 Activity Based CostingDocument41 pagesChapter - 6 Activity Based CostingAlyssa GalivoNo ratings yet

- Process Costing: Questions For Writing and DiscussionDocument49 pagesProcess Costing: Questions For Writing and DiscussionKhoirul MubinNo ratings yet

- Introduction To Managerial AccountingDocument8 pagesIntroduction To Managerial AccountingWam OwnNo ratings yet

- Sesi 9 Process CostDocument76 pagesSesi 9 Process CostAnggrainiNo ratings yet

- HorngrenIMA14eSM ch14Document40 pagesHorngrenIMA14eSM ch14Piyal Hossain100% (1)

- Bab 6 Proces CostingDocument14 pagesBab 6 Proces CostingFransiskusSinaga100% (1)

- Laptop RecallDocument5 pagesLaptop RecallMohit Kumar GuptaNo ratings yet

- Asian Paints Limited Bhandup Plant, Mumbai, Maharashtra.: Company BackgroundDocument12 pagesAsian Paints Limited Bhandup Plant, Mumbai, Maharashtra.: Company BackgroundriyaparabNo ratings yet

- Coca Cola Project ReportDocument14 pagesCoca Cola Project ReportMohit Kumar GuptaNo ratings yet

- HERO HOndaDocument21 pagesHERO HOndaMohit Kumar GuptaNo ratings yet

- Hero HondaDocument20 pagesHero HondaMohit Kumar Gupta0% (1)

- Coca Cola Project ReportDocument14 pagesCoca Cola Project ReportMohit Kumar GuptaNo ratings yet

- Counter Tactics - It Consists 3 Major Noticeable StepsDocument3 pagesCounter Tactics - It Consists 3 Major Noticeable StepsMohit Kumar GuptaNo ratings yet

- ChannelDocument12 pagesChannelMohit Kumar GuptaNo ratings yet

- ChannelDocument12 pagesChannelMohit Kumar GuptaNo ratings yet

- Hero HondaDocument20 pagesHero HondaMohit Kumar Gupta0% (1)

- Aifs/ Finance Case StudyDocument5 pagesAifs/ Finance Case StudyMohit Kumar GuptaNo ratings yet

- Aifs/ Finance Case StudyDocument5 pagesAifs/ Finance Case StudyMohit Kumar GuptaNo ratings yet

- MBA 504 Ch2 SolutionsDocument24 pagesMBA 504 Ch2 SolutionsChris Cotten100% (1)

- Changing Minds by Howard GadnerDocument18 pagesChanging Minds by Howard GadnerMohit Kumar GuptaNo ratings yet

- (A) Design - Introduction To Transformer DesignDocument16 pages(A) Design - Introduction To Transformer DesignZineddine BENOUADAHNo ratings yet

- A. Title of Experiment B. Date and Time of Experiment: Wednesday, 10Document15 pagesA. Title of Experiment B. Date and Time of Experiment: Wednesday, 10LichaNo ratings yet

- Comparison of Three Phase PV System in PSCAD and PowerFactoryDocument8 pagesComparison of Three Phase PV System in PSCAD and PowerFactorymlkz_01No ratings yet

- ManvantaraDocument3 pagesManvantaraafterragnarokNo ratings yet

- LAB 2 - Running Speed (Method 2) OEL 1Document3 pagesLAB 2 - Running Speed (Method 2) OEL 1ZULFAQAR BIN MOHAMMAD NIZAMNo ratings yet

- Sri Lank An Airline IndustryDocument29 pagesSri Lank An Airline IndustryTuan RifkhanNo ratings yet

- Metzeler TDB 2019 LRDocument246 pagesMetzeler TDB 2019 LRGabriel BruschiNo ratings yet

- Likedislikedon't LikeDocument3 pagesLikedislikedon't LikeBriza PaolaNo ratings yet

- Jack and The Beanstalk Treatment-2Document10 pagesJack and The Beanstalk Treatment-2api-668257195No ratings yet

- AAB2000C1Document11 pagesAAB2000C1marcos morillo0% (1)

- Practice Exam Linear Algebra PDFDocument2 pagesPractice Exam Linear Algebra PDFShela RamosNo ratings yet

- Tax System SriLankaDocument44 pagesTax System SriLankamandarak7146No ratings yet

- Veins and Hydrothermal DepositsDocument2 pagesVeins and Hydrothermal Depositsalimurtadha100% (1)

- Low Noise Amplifier Basics: by V. M. García-ChocanoDocument4 pagesLow Noise Amplifier Basics: by V. M. García-ChocanoPranjal Jalan100% (1)

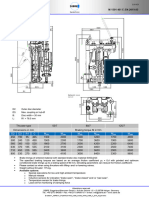

- Gas Pressure Reducing: Gas Pressure Reducing & Shut-Off Valve & Shut-Off Valve Series 71P11A Series 71P11ADocument4 pagesGas Pressure Reducing: Gas Pressure Reducing & Shut-Off Valve & Shut-Off Valve Series 71P11A Series 71P11AĐình Sơn HoàngNo ratings yet

- KDIGO CKD MBD Quick Reference Guide June 2022Document11 pagesKDIGO CKD MBD Quick Reference Guide June 2022Esy LNo ratings yet

- Uccx732X Dual 4-A Peak High-Speed Low-Side Power-Mosfet DriversDocument38 pagesUccx732X Dual 4-A Peak High-Speed Low-Side Power-Mosfet DriversTeles SilvaNo ratings yet

- Soal PAS K13 Kelas 9 Ganjil Tp. 2019-2020Document5 pagesSoal PAS K13 Kelas 9 Ganjil Tp. 2019-2020Fairuz AbadiNo ratings yet

- Data Sheet USB5 II 2019 05 ENDocument1 pageData Sheet USB5 II 2019 05 ENJanne LaineNo ratings yet

- The Efects of Tree Characteristics On Rainfall Interception in UrbanDocument8 pagesThe Efects of Tree Characteristics On Rainfall Interception in UrbanGuilherme SantanaNo ratings yet

- Water Stability - What Does It Mean and How Do You Measure It ?Document9 pagesWater Stability - What Does It Mean and How Do You Measure It ?Richard EscueNo ratings yet

- (2001) (Sun) (Two-Group Interfacial Area Transport Equation For A Confined Test Section)Document367 pages(2001) (Sun) (Two-Group Interfacial Area Transport Equation For A Confined Test Section)Erol BicerNo ratings yet

- HDR10+ System Whitepaper: September 4, 2019 HDR10+ Technologies, LLCDocument14 pagesHDR10+ System Whitepaper: September 4, 2019 HDR10+ Technologies, LLCDragomir ConstantinNo ratings yet

- Bata Shoe Company (Bangladesh) Ltd.Document6 pagesBata Shoe Company (Bangladesh) Ltd.Vurdalack666No ratings yet

- Background of Philippine Art and Literature in Romantic RealismDocument2 pagesBackground of Philippine Art and Literature in Romantic RealismRaldz CoyocaNo ratings yet

- Sewing Skills Checklist PDFDocument44 pagesSewing Skills Checklist PDFyemkem100% (1)

- Uremic EncephalophatyDocument48 pagesUremic EncephalophatySindi LadayaNo ratings yet

- Urinalysis - Fatin AinaDocument14 pagesUrinalysis - Fatin AinaAl- ImanuddinNo ratings yet

- CR Unit 1 &11 (Part A &B)Document12 pagesCR Unit 1 &11 (Part A &B)durai muruganNo ratings yet