Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2K viewsBank Reconciliation Statement Worksheet With Hints

Bank Reconciliation Statement Worksheet With Hints

Uploaded by

api-252642432Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Statement Date 22-06-2011Document1 pageStatement Date 22-06-2011Kazi Firoz AhmedNo ratings yet

- Report On Dutch Bangla BankDocument22 pagesReport On Dutch Bangla BankIshita Israt100% (1)

- Bank Reconciliation IDocument15 pagesBank Reconciliation IImran ZulfiqarNo ratings yet

- STEPS To Prepare The ADJUSTED Cash Book and Bank Reconciliation StatementDocument1 pageSTEPS To Prepare The ADJUSTED Cash Book and Bank Reconciliation StatementJosh BissoonNo ratings yet

- Confidential Financial StatementDocument1 pageConfidential Financial StatementVioleta BusuiocNo ratings yet

- Financial StatementDocument2 pagesFinancial StatementBenwajihNo ratings yet

- Format Debit Bal Bank StatementDocument1 pageFormat Debit Bal Bank StatementMzee KodiaNo ratings yet

- Non Receipt / Delay: Funds LODR Code: Null: SN Document Type Document Name Date TimeDocument1 pageNon Receipt / Delay: Funds LODR Code: Null: SN Document Type Document Name Date TimeVinod KumarNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Account Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)Document1 pageAccount Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)mr batmanNo ratings yet

- Bank Reconciliation Statement - Why & How To Prepare The - Statement PDFDocument2 pagesBank Reconciliation Statement - Why & How To Prepare The - Statement PDFAman KodwaniNo ratings yet

- Analysis of Bank StatementDocument1 pageAnalysis of Bank StatementPrashantTripathiNo ratings yet

- International Graduate Financial StatementDocument1 pageInternational Graduate Financial Statementmasoudgh2005No ratings yet

- Please Take This To Your Local Bank: CIBC International Student PayDocument6 pagesPlease Take This To Your Local Bank: CIBC International Student PaypanikNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementZuŋɘʀa AɓɗuɭɭʌhNo ratings yet

- Bill To: Account Summary: Date: Statement # Account Number Page 1 of 1Document1 pageBill To: Account Summary: Date: Statement # Account Number Page 1 of 1Ullah KunNo ratings yet

- Sponsor StatementDocument1 pageSponsor Statementanhhungdacop9xNo ratings yet

- PDFDocument4 pagesPDFMark Christian CruzNo ratings yet

- Basic Instructions For A Bank Reconciliation Statement PDFDocument4 pagesBasic Instructions For A Bank Reconciliation Statement PDFAman KodwaniNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementTalha MahmoodNo ratings yet

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementxxpinkywitchxxNo ratings yet

- StatementDocument2 pagesStatementYogendra BabuNo ratings yet

- Fastag E-Statement: Customer Details Bank DetailsDocument2 pagesFastag E-Statement: Customer Details Bank DetailsKunjemy EmyNo ratings yet

- E-Statement of Account: Muhammad IrfanDocument1 pageE-Statement of Account: Muhammad IrfanIrfan ChaudharyNo ratings yet

- Bank Reconciliation StatementDocument1 pageBank Reconciliation StatementAbdul RehmanNo ratings yet

- Bank StatementDocument1 pageBank StatementBobbi Ryan BrayNo ratings yet

- City BankDocument3 pagesCity BankChong ShanNo ratings yet

- Https Iiprd - MetavanteDocument5 pagesHttps Iiprd - MetavanteShahab HussainNo ratings yet

- Sanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Document3 pagesSanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Anonymous KAIoUxP7No ratings yet

- Lenox Supplies Accounts Statement Jan 2016 To August 2016Document7 pagesLenox Supplies Accounts Statement Jan 2016 To August 2016nobleconsultantsNo ratings yet

- My - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Document5 pagesMy - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Sunanda BidariNo ratings yet

- DJBBillDocument2 pagesDJBBillAshish KhantwalNo ratings yet

- Bank Statement Template 1 - TemplateLabDocument3 pagesBank Statement Template 1 - TemplateLabMakel AlqadaffiNo ratings yet

- Bank Card StatementsDocument1 pageBank Card StatementsPsycho Bro100% (1)

- Steps and Rules For Preparing of Bank Reconciliation Statement Name of Company Bank Reconciliation Statement DateDocument2 pagesSteps and Rules For Preparing of Bank Reconciliation Statement Name of Company Bank Reconciliation Statement DaterajdeepNo ratings yet

- StatementDocument3 pagesStatementWilliam KelleyNo ratings yet

- Model Bank StatementDocument2 pagesModel Bank StatementhanhNo ratings yet

- Bank Financial Statements 2020 SDocument54 pagesBank Financial Statements 2020 SSuvajitLaikNo ratings yet

- 2012 April TelephoneBill-Prakash 1981Document5 pages2012 April TelephoneBill-Prakash 1981Surya PrakashNo ratings yet

- Summary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013Document2 pagesSummary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013S Deva PrasadNo ratings yet

- Gujranwala Electric Power Company - Electricity Consumer Bill (Mdi)Document2 pagesGujranwala Electric Power Company - Electricity Consumer Bill (Mdi)Rana AmjadNo ratings yet

- View Certificate PDFDocument1 pageView Certificate PDFRaj Kumar GuleriaNo ratings yet

- 01-Jul-2021Document1 page01-Jul-2021SardarNo ratings yet

- Yes Bank India ChargesDocument2 pagesYes Bank India ChargesRKNo ratings yet

- MR - Augustin Mathew: Page 1 of 1 M-6163060Document1 pageMR - Augustin Mathew: Page 1 of 1 M-6163060AUGUSTINMATHEWNo ratings yet

- CardStatement 2016-11-19Document6 pagesCardStatement 2016-11-19manjuNo ratings yet

- Exchange of Damaged Euro Banknotes PDFDocument3 pagesExchange of Damaged Euro Banknotes PDFBlessing KatukaNo ratings yet

- StatementDocument6 pagesStatementmd arraufNo ratings yet

- Bank Statement (Nisar Ahmad)Document1 pageBank Statement (Nisar Ahmad)hamid mahmoodNo ratings yet

- StatementDocument1 pageStatementKaustub PrakashNo ratings yet

- Sep2015Document2 pagesSep2015Sidhantha JainNo ratings yet

- Customer No.: 2088523 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument3 pagesCustomer No.: 2088523 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressKrishna Kiran VyasNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAkshay RuparelNo ratings yet

- Ooccmkn01 PDFDocument1 pageOoccmkn01 PDFnnuuyy 22No ratings yet

- Duplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallDocument1 pageDuplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallNarendra VermaNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsStephen NjeruNo ratings yet

- Reprinted Copy: Statement of Account 1 31 May 13 To 16 Jun 13 849326707 (46) 5407488Document2 pagesReprinted Copy: Statement of Account 1 31 May 13 To 16 Jun 13 849326707 (46) 5407488ephemeres1No ratings yet

- SAMPLE Bank StatementDocument1 pageSAMPLE Bank StatementLEz100% (2)

- MCQ On Trial Balances and RectificationDocument66 pagesMCQ On Trial Balances and RectificationDeepesh SrivastavaNo ratings yet

- College of Business and Social Sciences Department of Accounting ACC 111 Preparation of Bank Reconciliation StatementDocument28 pagesCollege of Business and Social Sciences Department of Accounting ACC 111 Preparation of Bank Reconciliation StatementKadeyemo 77No ratings yet

Bank Reconciliation Statement Worksheet With Hints

Bank Reconciliation Statement Worksheet With Hints

Uploaded by

api-2526424320 ratings0% found this document useful (0 votes)

2K views1 pageOriginal Title

bank reconciliation statement worksheet with hints

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2K views1 pageBank Reconciliation Statement Worksheet With Hints

Bank Reconciliation Statement Worksheet With Hints

Uploaded by

api-252642432Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

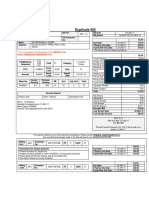

BANK RECONCILIATION STATEMENT Points to remember:

Positive Balance: Dr balance as per cash book / Favourable balances as per cash book/ balance as per cash book Cr balance as per pass book / Favourable balances as per pass book /balance as per pass book

Negative Balance:

/ Unfavourable balance as per cash book / Overdraft as per cash book Dr balance as per Pass book/ Unfavourable balance as per Pass book /Overdraft as per Pass book

Cr balance as per cash book If we start with Cash book balance If we start with Pass book balance Our aim To make Pass book balance equal to Cash book

Our aim To make Cash book balance equal to Pass book

Try this Question

Q 1 On December 31, 2012, the cash book of the M/s. Mona Plastics shows the credit balance Rs.6,500. Cheques amounting to Rs.3,500 deposited into bank but were not collected by the bank. Firm issued cheques of Rs. 1,000 which were not presented for payment. There was a debit in the pass book of Rs.200 for interest and Rs.400 for bank charges. Prepare Bank Reconciliation Statement. Solution:

Bank Reconciliation statement of M/s Mona Plastics As on December 31, 2012

Transactions Credit balance as per Cash book 1. Cheques amounting to Rs.3,500 deposited into bank but were not collected by the bank 2. Firm issued cheques of Rs. 1,000 which were not presented for payment. 3. Debit in the pass book of Rs.200 for interest and Rs.400 for bank charges Plus Items Rs Minus items Rs

Rough work:

You might also like

- Statement Date 22-06-2011Document1 pageStatement Date 22-06-2011Kazi Firoz AhmedNo ratings yet

- Report On Dutch Bangla BankDocument22 pagesReport On Dutch Bangla BankIshita Israt100% (1)

- Bank Reconciliation IDocument15 pagesBank Reconciliation IImran ZulfiqarNo ratings yet

- STEPS To Prepare The ADJUSTED Cash Book and Bank Reconciliation StatementDocument1 pageSTEPS To Prepare The ADJUSTED Cash Book and Bank Reconciliation StatementJosh BissoonNo ratings yet

- Confidential Financial StatementDocument1 pageConfidential Financial StatementVioleta BusuiocNo ratings yet

- Financial StatementDocument2 pagesFinancial StatementBenwajihNo ratings yet

- Format Debit Bal Bank StatementDocument1 pageFormat Debit Bal Bank StatementMzee KodiaNo ratings yet

- Non Receipt / Delay: Funds LODR Code: Null: SN Document Type Document Name Date TimeDocument1 pageNon Receipt / Delay: Funds LODR Code: Null: SN Document Type Document Name Date TimeVinod KumarNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Account Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)Document1 pageAccount Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)mr batmanNo ratings yet

- Bank Reconciliation Statement - Why & How To Prepare The - Statement PDFDocument2 pagesBank Reconciliation Statement - Why & How To Prepare The - Statement PDFAman KodwaniNo ratings yet

- Analysis of Bank StatementDocument1 pageAnalysis of Bank StatementPrashantTripathiNo ratings yet

- International Graduate Financial StatementDocument1 pageInternational Graduate Financial Statementmasoudgh2005No ratings yet

- Please Take This To Your Local Bank: CIBC International Student PayDocument6 pagesPlease Take This To Your Local Bank: CIBC International Student PaypanikNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementZuŋɘʀa AɓɗuɭɭʌhNo ratings yet

- Bill To: Account Summary: Date: Statement # Account Number Page 1 of 1Document1 pageBill To: Account Summary: Date: Statement # Account Number Page 1 of 1Ullah KunNo ratings yet

- Sponsor StatementDocument1 pageSponsor Statementanhhungdacop9xNo ratings yet

- PDFDocument4 pagesPDFMark Christian CruzNo ratings yet

- Basic Instructions For A Bank Reconciliation Statement PDFDocument4 pagesBasic Instructions For A Bank Reconciliation Statement PDFAman KodwaniNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementTalha MahmoodNo ratings yet

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementxxpinkywitchxxNo ratings yet

- StatementDocument2 pagesStatementYogendra BabuNo ratings yet

- Fastag E-Statement: Customer Details Bank DetailsDocument2 pagesFastag E-Statement: Customer Details Bank DetailsKunjemy EmyNo ratings yet

- E-Statement of Account: Muhammad IrfanDocument1 pageE-Statement of Account: Muhammad IrfanIrfan ChaudharyNo ratings yet

- Bank Reconciliation StatementDocument1 pageBank Reconciliation StatementAbdul RehmanNo ratings yet

- Bank StatementDocument1 pageBank StatementBobbi Ryan BrayNo ratings yet

- City BankDocument3 pagesCity BankChong ShanNo ratings yet

- Https Iiprd - MetavanteDocument5 pagesHttps Iiprd - MetavanteShahab HussainNo ratings yet

- Sanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Document3 pagesSanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Anonymous KAIoUxP7No ratings yet

- Lenox Supplies Accounts Statement Jan 2016 To August 2016Document7 pagesLenox Supplies Accounts Statement Jan 2016 To August 2016nobleconsultantsNo ratings yet

- My - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Document5 pagesMy - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Sunanda BidariNo ratings yet

- DJBBillDocument2 pagesDJBBillAshish KhantwalNo ratings yet

- Bank Statement Template 1 - TemplateLabDocument3 pagesBank Statement Template 1 - TemplateLabMakel AlqadaffiNo ratings yet

- Bank Card StatementsDocument1 pageBank Card StatementsPsycho Bro100% (1)

- Steps and Rules For Preparing of Bank Reconciliation Statement Name of Company Bank Reconciliation Statement DateDocument2 pagesSteps and Rules For Preparing of Bank Reconciliation Statement Name of Company Bank Reconciliation Statement DaterajdeepNo ratings yet

- StatementDocument3 pagesStatementWilliam KelleyNo ratings yet

- Model Bank StatementDocument2 pagesModel Bank StatementhanhNo ratings yet

- Bank Financial Statements 2020 SDocument54 pagesBank Financial Statements 2020 SSuvajitLaikNo ratings yet

- 2012 April TelephoneBill-Prakash 1981Document5 pages2012 April TelephoneBill-Prakash 1981Surya PrakashNo ratings yet

- Summary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013Document2 pagesSummary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013S Deva PrasadNo ratings yet

- Gujranwala Electric Power Company - Electricity Consumer Bill (Mdi)Document2 pagesGujranwala Electric Power Company - Electricity Consumer Bill (Mdi)Rana AmjadNo ratings yet

- View Certificate PDFDocument1 pageView Certificate PDFRaj Kumar GuleriaNo ratings yet

- 01-Jul-2021Document1 page01-Jul-2021SardarNo ratings yet

- Yes Bank India ChargesDocument2 pagesYes Bank India ChargesRKNo ratings yet

- MR - Augustin Mathew: Page 1 of 1 M-6163060Document1 pageMR - Augustin Mathew: Page 1 of 1 M-6163060AUGUSTINMATHEWNo ratings yet

- CardStatement 2016-11-19Document6 pagesCardStatement 2016-11-19manjuNo ratings yet

- Exchange of Damaged Euro Banknotes PDFDocument3 pagesExchange of Damaged Euro Banknotes PDFBlessing KatukaNo ratings yet

- StatementDocument6 pagesStatementmd arraufNo ratings yet

- Bank Statement (Nisar Ahmad)Document1 pageBank Statement (Nisar Ahmad)hamid mahmoodNo ratings yet

- StatementDocument1 pageStatementKaustub PrakashNo ratings yet

- Sep2015Document2 pagesSep2015Sidhantha JainNo ratings yet

- Customer No.: 2088523 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument3 pagesCustomer No.: 2088523 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressKrishna Kiran VyasNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAkshay RuparelNo ratings yet

- Ooccmkn01 PDFDocument1 pageOoccmkn01 PDFnnuuyy 22No ratings yet

- Duplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallDocument1 pageDuplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallNarendra VermaNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsStephen NjeruNo ratings yet

- Reprinted Copy: Statement of Account 1 31 May 13 To 16 Jun 13 849326707 (46) 5407488Document2 pagesReprinted Copy: Statement of Account 1 31 May 13 To 16 Jun 13 849326707 (46) 5407488ephemeres1No ratings yet

- SAMPLE Bank StatementDocument1 pageSAMPLE Bank StatementLEz100% (2)

- MCQ On Trial Balances and RectificationDocument66 pagesMCQ On Trial Balances and RectificationDeepesh SrivastavaNo ratings yet

- College of Business and Social Sciences Department of Accounting ACC 111 Preparation of Bank Reconciliation StatementDocument28 pagesCollege of Business and Social Sciences Department of Accounting ACC 111 Preparation of Bank Reconciliation StatementKadeyemo 77No ratings yet