Professional Documents

Culture Documents

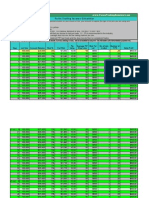

Description Value Unit Instructions / Explanations: To Be 1.5 or Higher

Description Value Unit Instructions / Explanations: To Be 1.5 or Higher

Uploaded by

PaitonPalilatiCopyright:

Available Formats

You might also like

- Disciplined Trader Trade Journal (Spread Betting)Document850 pagesDisciplined Trader Trade Journal (Spread Betting)sb jazzduo50% (2)

- DCASTFX Fixed Ratio Money ManagementDocument9 pagesDCASTFX Fixed Ratio Money ManagementKurniawan AkbarNo ratings yet

- Mistakes Are The Downfall of Most TradersDocument10 pagesMistakes Are The Downfall of Most TradersJaoNo ratings yet

- MM SpreadsheetDocument3 pagesMM SpreadsheetPaitonPalilatiNo ratings yet

- Master Trading JournalDocument389 pagesMaster Trading Journalsrinivas_urv100% (3)

- Forex Risk Management and Position SizingDocument18 pagesForex Risk Management and Position SizingSamuel AnemeNo ratings yet

- Expectancy: What Is Expectancy in A Nutshell?Document3 pagesExpectancy: What Is Expectancy in A Nutshell?rafa manggala100% (1)

- Money Management Controlling Risk and Capturing Profits by Dave LandryDocument20 pagesMoney Management Controlling Risk and Capturing Profits by Dave LandryRxCapeNo ratings yet

- Make Money with Binary Options: The Calends StrategyFrom EverandMake Money with Binary Options: The Calends StrategyRating: 4 out of 5 stars4/5 (4)

- Trading Position SizeDocument2 pagesTrading Position Sizeraghu94086No ratings yet

- For Ex CalculatorDocument5 pagesFor Ex CalculatorArvind ChaudharyNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by Hectorarvin4dNo ratings yet

- Money Management Calculator 2.0: 1. Float Details 2. Trade DetailsDocument8 pagesMoney Management Calculator 2.0: 1. Float Details 2. Trade DetailsPierre van WykNo ratings yet

- Risk Management - LeviathanDocument9 pagesRisk Management - LeviathanPloutos IbnLasion100% (2)

- Forex Income CalculatorDocument8 pagesForex Income CalculatorjamesNo ratings yet

- Forex TipsDocument5 pagesForex Tipsapi-371789400No ratings yet

- Risk ManagementDocument20 pagesRisk Managementmike aboladeNo ratings yet

- Position Size Calculator: Position Size Calculator Position Size Calculator Using Stop Price Using Stop PercentDocument2 pagesPosition Size Calculator: Position Size Calculator Position Size Calculator Using Stop Price Using Stop PercentNida ZaidiNo ratings yet

- Article Forex TradeDocument4 pagesArticle Forex TradeVinh TinNo ratings yet

- Forex Leverage A Double Edged SwordDocument16 pagesForex Leverage A Double Edged SwordVickfor LucaniNo ratings yet

- Forex Lot and LeverageDocument10 pagesForex Lot and LeverageThato MotlhabaneNo ratings yet

- Forex Lot and LeverageDocument10 pagesForex Lot and LeverageThato MotlhabaneNo ratings yet

- Forex Lot and Leverage PDFDocument10 pagesForex Lot and Leverage PDFiven kelebuka100% (2)

- How To Achieve 99% Quality Backtests in MetaTrader 4Document16 pagesHow To Achieve 99% Quality Backtests in MetaTrader 4KHALID .ANo ratings yet

- LeverageDocument9 pagesLeverageShuvro RahmanNo ratings yet

- Disciplined Trader Trade Journal - Lots (Virgem)Document850 pagesDisciplined Trader Trade Journal - Lots (Virgem)Junior MadridNo ratings yet

- Understanding Risk Management by Invaluable™Document5 pagesUnderstanding Risk Management by Invaluable™michaellight132No ratings yet

- Money ManagementDocument5 pagesMoney ManagementCcy Choon Yuan100% (1)

- Testing ReportDocument10 pagesTesting ReportEnrique BlancoNo ratings yet

- Critical Level Pos - TEMPLATEDocument11 pagesCritical Level Pos - TEMPLATErazern46No ratings yet

- SML Position Sizing Calculator-3Document2 pagesSML Position Sizing Calculator-3Kile100% (1)

- The Risk ManagementDocument16 pagesThe Risk ManagementErosRMNo ratings yet

- Alma Miranda - Math and MoneyDocument21 pagesAlma Miranda - Math and Moneyductrung8008No ratings yet

- Master Trading JournalDocument352 pagesMaster Trading Journalpier100% (2)

- 8 Money ManagementDocument13 pages8 Money Managementpaparock34No ratings yet

- Money Management Controlling Risk and Capturing Profits (Trading Forex)Document20 pagesMoney Management Controlling Risk and Capturing Profits (Trading Forex)Shavya SharmaNo ratings yet

- Position Sizing and Money ManagementDocument2 pagesPosition Sizing and Money ManagementMhd Bazzi100% (1)

- DD and Account Size - Madan KumarDocument4 pagesDD and Account Size - Madan KumarIMaths PowaiNo ratings yet

- 5 Ways To Increase Investing and Trading ProfitsDocument76 pages5 Ways To Increase Investing and Trading ProfitsKoyasanNo ratings yet

- Lots, Leverage and Margin - Forex4noobsDocument5 pagesLots, Leverage and Margin - Forex4noobsTesa MuhammadNo ratings yet

- Money Management Controlling Risk and Capturing ProfitsDocument20 pagesMoney Management Controlling Risk and Capturing ProfitsIan Moncrieffe100% (10)

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by Hectorpasindu pereraNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorEli NcNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectormohdkhidirNo ratings yet

- Cost-Volume-Profit (CVP) Analysis Is Used To Determine How Changes in Costs and VolumeDocument9 pagesCost-Volume-Profit (CVP) Analysis Is Used To Determine How Changes in Costs and VolumeLynDioquinoNo ratings yet

- CVP AnalysisDocument7 pagesCVP AnalysisMark Adrian ArellanoNo ratings yet

- For Ex CalculatorDocument3 pagesFor Ex CalculatorHapidin HavidNo ratings yet

- For Ex CalculatorDocument3 pagesFor Ex Calculatorashraftanoli765No ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorKalfy WarspNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorBAGAS HIDAYATNo ratings yet

- Disciplined Trader Trade Journal (Lots)Document730 pagesDisciplined Trader Trade Journal (Lots)kzkids54No ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorKalfy WarspNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorArdi AnsyahNo ratings yet

- 27 Risk ManagementDocument12 pages27 Risk Managementhassandmj100% (2)

- System Trader 2Document26 pagesSystem Trader 2Aggelos KotsokolosNo ratings yet

- Lesson 7 Stop Loss PlacementDocument7 pagesLesson 7 Stop Loss PlacementrosalinNo ratings yet

- Optimal Hedging StrategyDocument1 pageOptimal Hedging StrategylucnesNo ratings yet

- How To Master Your Investment In 30 Minutes A Day (Preparation)From EverandHow To Master Your Investment In 30 Minutes A Day (Preparation)No ratings yet

- How To Not Blow Up Your Trading Account: Definitive Guide to Money and Risk Management For Forex TradersFrom EverandHow To Not Blow Up Your Trading Account: Definitive Guide to Money and Risk Management For Forex TradersRating: 5 out of 5 stars5/5 (1)

Description Value Unit Instructions / Explanations: To Be 1.5 or Higher

Description Value Unit Instructions / Explanations: To Be 1.5 or Higher

Uploaded by

PaitonPalilatiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Description Value Unit Instructions / Explanations: To Be 1.5 or Higher

Description Value Unit Instructions / Explanations: To Be 1.5 or Higher

Uploaded by

PaitonPalilatiCopyright:

Available Formats

Description Equity Max. risked (% of equity) Max. risked ($$$) Stop Loss PIP Value Max.

amount of lots Actual amount of lots Gain/Loss per PIP Profit Target Reward/Risk-Ratio Actual gain Actual loss Spot rate Contract size per lot Contract size total Available leverage Margin requirement Used leverage Used margin

Value Unit Instructions / Explanations 4,803.00 USD enter your current account equity (incl. floating profit/loss) 3.00 % enter personal risk tolerance (max. 3-5% of equity recommended) 144.09 USD maximum loss you are willing to take 30 PIPs enter stop loss as determined in your analysis 0.20 USD enter current PIP-value for the currency pair 24.0 lots this is the maximum amount of lots tradeable to stay within your risk tolerance 0 lots enter your actual amount of lots you decide to trade 0.02 USD equals lot size x PIP value 40 PIPs enter amount of PIPs when limit is reached 1.3 :1 to be 1.5 or higher 0.80 USD actual gain when limit is reached 0.60 USD actual loss when stop is hit 1.37 USD enter current exchange rate of base currency vs. USD (for accounts in USD) 10,000.00 USD 10,000 for mini lots, 100,000 for regular lots 1,373.18 USD total value of transaction 100 0.3 350 :1 :1 % specific for account type and broker ratio borrowed money / equity, max. 10:1 recommended percentage of equity / borrowed money, min. 10% recommended 13.73 USD min. equity for contract size

fields requiring an entry

The calculator is intended to be a vital step towards the goal of mechanical and structured trading, taking the guess-work out With a few inputs it calculates the maximum amount of lots that should be traded to stay within one's personal risk tolerance a Also it can be used as a tool to to gain more understanding of much-discussed issues like RRR, Margin and Leverage. Note: although created with utmost care I cannot take responsibility for any faults in the calculations!

g, taking the guess-work out of your trading in regards to MM. one's personal risk tolerance and to avoid overleveraging the account. argin and Leverage.

the calculations!

You might also like

- Disciplined Trader Trade Journal (Spread Betting)Document850 pagesDisciplined Trader Trade Journal (Spread Betting)sb jazzduo50% (2)

- DCASTFX Fixed Ratio Money ManagementDocument9 pagesDCASTFX Fixed Ratio Money ManagementKurniawan AkbarNo ratings yet

- Mistakes Are The Downfall of Most TradersDocument10 pagesMistakes Are The Downfall of Most TradersJaoNo ratings yet

- MM SpreadsheetDocument3 pagesMM SpreadsheetPaitonPalilatiNo ratings yet

- Master Trading JournalDocument389 pagesMaster Trading Journalsrinivas_urv100% (3)

- Forex Risk Management and Position SizingDocument18 pagesForex Risk Management and Position SizingSamuel AnemeNo ratings yet

- Expectancy: What Is Expectancy in A Nutshell?Document3 pagesExpectancy: What Is Expectancy in A Nutshell?rafa manggala100% (1)

- Money Management Controlling Risk and Capturing Profits by Dave LandryDocument20 pagesMoney Management Controlling Risk and Capturing Profits by Dave LandryRxCapeNo ratings yet

- Make Money with Binary Options: The Calends StrategyFrom EverandMake Money with Binary Options: The Calends StrategyRating: 4 out of 5 stars4/5 (4)

- Trading Position SizeDocument2 pagesTrading Position Sizeraghu94086No ratings yet

- For Ex CalculatorDocument5 pagesFor Ex CalculatorArvind ChaudharyNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by Hectorarvin4dNo ratings yet

- Money Management Calculator 2.0: 1. Float Details 2. Trade DetailsDocument8 pagesMoney Management Calculator 2.0: 1. Float Details 2. Trade DetailsPierre van WykNo ratings yet

- Risk Management - LeviathanDocument9 pagesRisk Management - LeviathanPloutos IbnLasion100% (2)

- Forex Income CalculatorDocument8 pagesForex Income CalculatorjamesNo ratings yet

- Forex TipsDocument5 pagesForex Tipsapi-371789400No ratings yet

- Risk ManagementDocument20 pagesRisk Managementmike aboladeNo ratings yet

- Position Size Calculator: Position Size Calculator Position Size Calculator Using Stop Price Using Stop PercentDocument2 pagesPosition Size Calculator: Position Size Calculator Position Size Calculator Using Stop Price Using Stop PercentNida ZaidiNo ratings yet

- Article Forex TradeDocument4 pagesArticle Forex TradeVinh TinNo ratings yet

- Forex Leverage A Double Edged SwordDocument16 pagesForex Leverage A Double Edged SwordVickfor LucaniNo ratings yet

- Forex Lot and LeverageDocument10 pagesForex Lot and LeverageThato MotlhabaneNo ratings yet

- Forex Lot and LeverageDocument10 pagesForex Lot and LeverageThato MotlhabaneNo ratings yet

- Forex Lot and Leverage PDFDocument10 pagesForex Lot and Leverage PDFiven kelebuka100% (2)

- How To Achieve 99% Quality Backtests in MetaTrader 4Document16 pagesHow To Achieve 99% Quality Backtests in MetaTrader 4KHALID .ANo ratings yet

- LeverageDocument9 pagesLeverageShuvro RahmanNo ratings yet

- Disciplined Trader Trade Journal - Lots (Virgem)Document850 pagesDisciplined Trader Trade Journal - Lots (Virgem)Junior MadridNo ratings yet

- Understanding Risk Management by Invaluable™Document5 pagesUnderstanding Risk Management by Invaluable™michaellight132No ratings yet

- Money ManagementDocument5 pagesMoney ManagementCcy Choon Yuan100% (1)

- Testing ReportDocument10 pagesTesting ReportEnrique BlancoNo ratings yet

- Critical Level Pos - TEMPLATEDocument11 pagesCritical Level Pos - TEMPLATErazern46No ratings yet

- SML Position Sizing Calculator-3Document2 pagesSML Position Sizing Calculator-3Kile100% (1)

- The Risk ManagementDocument16 pagesThe Risk ManagementErosRMNo ratings yet

- Alma Miranda - Math and MoneyDocument21 pagesAlma Miranda - Math and Moneyductrung8008No ratings yet

- Master Trading JournalDocument352 pagesMaster Trading Journalpier100% (2)

- 8 Money ManagementDocument13 pages8 Money Managementpaparock34No ratings yet

- Money Management Controlling Risk and Capturing Profits (Trading Forex)Document20 pagesMoney Management Controlling Risk and Capturing Profits (Trading Forex)Shavya SharmaNo ratings yet

- Position Sizing and Money ManagementDocument2 pagesPosition Sizing and Money ManagementMhd Bazzi100% (1)

- DD and Account Size - Madan KumarDocument4 pagesDD and Account Size - Madan KumarIMaths PowaiNo ratings yet

- 5 Ways To Increase Investing and Trading ProfitsDocument76 pages5 Ways To Increase Investing and Trading ProfitsKoyasanNo ratings yet

- Lots, Leverage and Margin - Forex4noobsDocument5 pagesLots, Leverage and Margin - Forex4noobsTesa MuhammadNo ratings yet

- Money Management Controlling Risk and Capturing ProfitsDocument20 pagesMoney Management Controlling Risk and Capturing ProfitsIan Moncrieffe100% (10)

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by Hectorpasindu pereraNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorEli NcNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectormohdkhidirNo ratings yet

- Cost-Volume-Profit (CVP) Analysis Is Used To Determine How Changes in Costs and VolumeDocument9 pagesCost-Volume-Profit (CVP) Analysis Is Used To Determine How Changes in Costs and VolumeLynDioquinoNo ratings yet

- CVP AnalysisDocument7 pagesCVP AnalysisMark Adrian ArellanoNo ratings yet

- For Ex CalculatorDocument3 pagesFor Ex CalculatorHapidin HavidNo ratings yet

- For Ex CalculatorDocument3 pagesFor Ex Calculatorashraftanoli765No ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorKalfy WarspNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorBAGAS HIDAYATNo ratings yet

- Disciplined Trader Trade Journal (Lots)Document730 pagesDisciplined Trader Trade Journal (Lots)kzkids54No ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorKalfy WarspNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorArdi AnsyahNo ratings yet

- 27 Risk ManagementDocument12 pages27 Risk Managementhassandmj100% (2)

- System Trader 2Document26 pagesSystem Trader 2Aggelos KotsokolosNo ratings yet

- Lesson 7 Stop Loss PlacementDocument7 pagesLesson 7 Stop Loss PlacementrosalinNo ratings yet

- Optimal Hedging StrategyDocument1 pageOptimal Hedging StrategylucnesNo ratings yet

- How To Master Your Investment In 30 Minutes A Day (Preparation)From EverandHow To Master Your Investment In 30 Minutes A Day (Preparation)No ratings yet

- How To Not Blow Up Your Trading Account: Definitive Guide to Money and Risk Management For Forex TradersFrom EverandHow To Not Blow Up Your Trading Account: Definitive Guide to Money and Risk Management For Forex TradersRating: 5 out of 5 stars5/5 (1)