Professional Documents

Culture Documents

Jobs

Jobs

Uploaded by

api-2463937230 ratings0% found this document useful (0 votes)

25 views2 pagesOriginal Title

jobs

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views2 pagesJobs

Jobs

Uploaded by

api-246393723Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

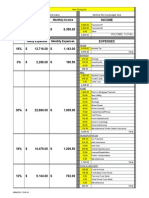

Police Officer

$60,000 Annual Income

$400 Monthly Living Expenses

Taxes: 15% + $1,785

6.2% for Social Security

1.45% for Medicare

Health Insurance: $400 a month

Benefits: Paid Retirement

Paid Life Insurance

Hair Dresser/Barber

$10.91 Hourly + 20%

Commission per Client

$400 Monthly Living Expenses

Taxes: 15% + $1,785

6.2% for Social Security

1.45% for Medicare

No Health Insurance

No Life Insurance

No Retirement

Professional Student

$10 Hourly 25 per Week

$300 Monthly Living Expenses

Taxes: 10% of Taxable Income

No Social Security Deducted

No Medicare Deducted

No Health Insurance

No Life Insurance

No Retirement

No Benefits

Lawyer

$140,000 Annual Income

$400 Monthly Living Expenses

Taxes: 25% + $9,982

6.2% for Social Security

1.45% for Medicare

Benefits: Paid Life Insurance

Paid Retirement

Paid Health Insurance

Senior Management

$82,000 Annual Income

$400 Monthly Living Expenses

Taxes: 25% + $9,982

6.2% for Social Security

1.45% for Medicare

Health Insurance: $400 a month

Benefits: Paid Retirement

Paid Life Insurance

Plumber

$20 Hourly Income

$400 Monthly Living Expenses

Taxes: 15% + $1,785

6.2% for Social Security

1.45% for Medicare

No Health Insurance

No Life Insurance

No Retirement

Waiter/Waitress

$2.19 Hourly +15% per Table

$400 Monthly Living Expenses

Taxes: 10% of Taxable Income

6.2% for Social Security

1.45% for Medicare

No Health Insurance

No Life Insurance

No Retirement

You might also like

- Personnel Budget CalculatorDocument4 pagesPersonnel Budget Calculatorapi-270519701No ratings yet

- Emergency Rates 2012 2015Document2 pagesEmergency Rates 2012 2015enlasnubes1No ratings yet

- 2015 Brackets & Planning Limits (Janney)Document5 pages2015 Brackets & Planning Limits (Janney)John CortapassoNo ratings yet

- Pay SlipDocument50 pagesPay SlipSushil Shrestha100% (1)

- Wilkinskennedy-Taxrates2015 2016Document8 pagesWilkinskennedy-Taxrates2015 2016MARIENo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- Chamber Rate SheetDocument1 pageChamber Rate SheetBshale1No ratings yet

- Lesson 14-Budget Planning WorksheetDocument6 pagesLesson 14-Budget Planning Worksheetapi-253889154No ratings yet

- 2013 Tax RatesDocument4 pages2013 Tax Ratesapi-241405153No ratings yet

- Millers' Tax Computati: Known ParametersDocument2 pagesMillers' Tax Computati: Known ParametersYadav_BaeNo ratings yet

- New Hire Benefits Summary: Medical Plan OptionsDocument3 pagesNew Hire Benefits Summary: Medical Plan OptionsRavi Prakash MayreddyNo ratings yet

- RG146 Pocket GuideDocument30 pagesRG146 Pocket GuideMentor RG146No ratings yet

- Goal Setting CalculatorDocument9 pagesGoal Setting CalculatorPradeep BishtNo ratings yet

- Illustrative ProblemsDocument2 pagesIllustrative ProblemsalsuarezNo ratings yet

- Budget Spreadsheet - Education or Work ForceDocument2 pagesBudget Spreadsheet - Education or Work Forceapi-285960909No ratings yet

- 2010 - Easy - Guide For Foreigner's Year-End Tax SettlementDocument94 pages2010 - Easy - Guide For Foreigner's Year-End Tax Settlement안수현No ratings yet

- Iul PresentationDocument6 pagesIul Presentationapi-258221737100% (1)

- ExcelDocument2 pagesExcelapi-300241947No ratings yet

- Bupa GoldExtras NSW ACT 0415Document3 pagesBupa GoldExtras NSW ACT 0415Laura Leander WildeNo ratings yet

- Summary of Salaries, Benefits, & Allowances (Transparency Seal) OrigDocument1 pageSummary of Salaries, Benefits, & Allowances (Transparency Seal) OrigmysubicbayNo ratings yet

- Ee Benefit SummaryDocument3 pagesEe Benefit SummaryMarckoz przNo ratings yet

- SeKON Employee Benefits Summary 2016Document3 pagesSeKON Employee Benefits Summary 2016Ali HajassdolahNo ratings yet

- Personal Monthly Budget PlannerDocument24 pagesPersonal Monthly Budget PlannerMaroo GoliNo ratings yet

- ASHA UHC Plan Comparison For 2014Document1 pageASHA UHC Plan Comparison For 2014Janet Zimmerman McNicholNo ratings yet

- Your Customized Benefits Plan at HCL America IncDocument2 pagesYour Customized Benefits Plan at HCL America IncShiv RanjanNo ratings yet

- Tax Rates For CWT (Expanded) PDFDocument2 pagesTax Rates For CWT (Expanded) PDFRoseAnnFloriaNo ratings yet

- Surcharge: On Contributi Employee Use Business Proportion - 100% Cost X OperatingDocument4 pagesSurcharge: On Contributi Employee Use Business Proportion - 100% Cost X Operatinglouis_parker_5553No ratings yet

- Budget SpreadsheetDocument3 pagesBudget Spreadsheetapi-285424434No ratings yet

- Sec. 24 NircDocument17 pagesSec. 24 NircCharie Mae YdNo ratings yet

- Tax Reform Acceleration and InclusionDocument28 pagesTax Reform Acceleration and InclusionWilliam Alexander Matsuhara AlegreNo ratings yet

- Assignment: Mr. Chinmay Dev TiwariDocument4 pagesAssignment: Mr. Chinmay Dev TiwariShanu AggarwalNo ratings yet

- Basic Monthly Bills BudgetDocument4 pagesBasic Monthly Bills BudgetDalton WebbNo ratings yet

- Exercise Tax 5 May 2024Document6 pagesExercise Tax 5 May 2024reez23azroyNo ratings yet

- Budget Spreadsheet 2Document3 pagesBudget Spreadsheet 2api-248930594No ratings yet

- BudgetDocument1 pageBudgetapi-258392501No ratings yet

- Financial Statements ActivityDocument6 pagesFinancial Statements Activityapi-277584859No ratings yet

- Arindam Das Salary For The Month of July 2008Document4 pagesArindam Das Salary For The Month of July 2008Bala MuruNo ratings yet

- Financial Planning of Guffran S Golandaj Batch 69/70Document13 pagesFinancial Planning of Guffran S Golandaj Batch 69/70Gufran GolandajNo ratings yet

- Aetna 2014Document1 pageAetna 2014Vignesh EswaranNo ratings yet

- Quiz Time Value of Money For Student MM 21 (Maria BR Sihaloho 207007016)Document4 pagesQuiz Time Value of Money For Student MM 21 (Maria BR Sihaloho 207007016)Ferry PratamaNo ratings yet

- How Will The Carbon Price Affect You? Two Dependents, Aged 8-12 and 13-17Document1 pageHow Will The Carbon Price Affect You? Two Dependents, Aged 8-12 and 13-17ABC News OnlineNo ratings yet

- Budget Variance ReportDocument2 pagesBudget Variance ReportaryanneNo ratings yet

- Individual Income Tax RatesDocument6 pagesIndividual Income Tax RatesLydia Mohammad SarkawiNo ratings yet

- Actual Employee Hourly Costs Calculator - : Free VersionDocument8 pagesActual Employee Hourly Costs Calculator - : Free VersionAltaf AhmadNo ratings yet

- Resolucion Caso Mba PlantillaDocument2 pagesResolucion Caso Mba PlantillaWendy CedeñoNo ratings yet

- Income Tax Calculator FY 2016 17Document6 pagesIncome Tax Calculator FY 2016 17raf1No ratings yet

- Budget Spreadsheet - Education or Work ForceDocument3 pagesBudget Spreadsheet - Education or Work Forceapi-287860978No ratings yet

- Rideeco Savings Calculator: Locate Your Tax Bracket in The ChartDocument1 pageRideeco Savings Calculator: Locate Your Tax Bracket in The ChartRideECO Commuter Benefit ProgramNo ratings yet

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarNo ratings yet

- Bank ChurnersDocument870 pagesBank ChurnersGaurav ChaudharyNo ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- GMHBA FactSheet G75 PDFDocument5 pagesGMHBA FactSheet G75 PDFLaura Leander WildeNo ratings yet

- FBT FinalDocument28 pagesFBT Finalmendonesmariza2No ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- Handout 4Q - Philippine Individual Income Tax TableDocument1 pageHandout 4Q - Philippine Individual Income Tax Tablekathy143100% (5)

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2From EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2No ratings yet

- Forward Budgeting: A Paperless and Electronic Household Budget SystemFrom EverandForward Budgeting: A Paperless and Electronic Household Budget SystemNo ratings yet

- For Single Military Women Only: 10 Easy-Breezy Retirement TipsFrom EverandFor Single Military Women Only: 10 Easy-Breezy Retirement TipsNo ratings yet

- Abigail Frentress: Contact InformationDocument1 pageAbigail Frentress: Contact Informationapi-246393723No ratings yet

- Cover LetterDocument1 pageCover Letterapi-246393723No ratings yet

- Project CalendarDocument2 pagesProject Calendarapi-246393723No ratings yet

- Demo WsDocument3 pagesDemo Wsapi-246393723No ratings yet

- Project Overview 1Document3 pagesProject Overview 1api-246393723No ratings yet