Professional Documents

Culture Documents

Business Cycle

Business Cycle

Uploaded by

rathnakotari0 ratings0% found this document useful (0 votes)

29 views29 pagesbusiness cycle

Original Title

Business Cycle Ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbusiness cycle

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

29 views29 pagesBusiness Cycle

Business Cycle

Uploaded by

rathnakotaribusiness cycle

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 29

Business Cycle

Dr. Gopalakrishna B.V.

Faculty in MBA,

SDM College,

Business cycle or trade cycle is a part of the

capitalistic economy.

The business cycle refers to fluctuation in

economic activities such as levels of income,

employment, prices and output, occurs more or

less in regular time sequences.

Business cycle is characterised by upward and

downward movement of economic activities.

In a business cycle, there are wave-like

fluctuations in aggregate employment, income

output and price level.

Definitions

Prof. Haberlers defines an alternation of

periods of prosperity and depression of good

and bad trade.

J.M. Keynes it composed of periods of good

trade characterised by rising prices and low

employment percentage, altering with period of

bad trade characterised by falling prices and

high unemployment percentage.

Gordons define business cycles consist of

recurring alternation of expansion and

contraction in aggregate economic activities in

the economy.

Estey cyclical fluctuations are characterised by

alternating waves of expansion and contraction.

Characteristics of Business cycle

1. Business cycle is a part of the capitalist economy.

2. Cyclical fluctuations are wave like movements.

3. Fluctuations are recurrent in nature

4. They are non-periodic or irregular the peak and

troughs do not occur at regular intervals.

5. They occur in such aggregate variables as output,

income, employment and prices.

6. Upswings and downswings are cumulative process

in their effects.

7. They are not secular trends such as long-run growth

or decline in economic activity.

Phases/stages of Business cycle

A typical cycle is generally divided into

five phases

1. Depression

2. Recovery

3. Full employment

4. Prosperity

5. Recession

1. Depression

Recession merges into depression when there is a

general decline in economic activity.

There is considerable reduction in the production of

goods and services, employment, income, demand and

prices.

The general decline in economic activity leads to a fall in

bank deposits.

When credit expansion stops, even business community

is not willing to borrow.

Thus, a depression is characterised by mass

unemployment general fall in prices, wages, profits,

interest rate, consumption expenditure, investment

bank loans and advances falling factories close down

capital goods industries are also closed down.

During this phase, there will be pessimism leading to

closing down of business firms.

2. Recovery

Recovery denotes the turning point of business

cycle from depression to prosperity.

There is a slow rise in output, employment,

income and price demand for commodities go

up steadily.

There is increase in investment bank and

financial institutions are also willing to granting

loans and advances.

Pessimism gives way to optimism.

The process of recovery becomes combative

and leads to prosperity.

3. Prosperity

In this period, demand, output, employment and

income are at a high level, they tend to raise prices.

But wages, salaries, interest rates, rentals and

taxes do not rise in proportion to the rise in prices.

The gap between prices and cost increases - the

margin of profit increases.

The increase of profit and the prospect of its

continuance commonly cause a rapid rise in stock

market values.

The economy is engulfed in waves of optimism.

Larger profit expectation further increase

investment which is helped by liberal bank credit.

This leads to peak or boom.

4. Recession

Recession starts downward movement of economic

activities from peak/boom.

It is a state in which there is general deceleration in the

economic activity resulting in cuts in production and

employment falling prices of stock market.

Banking and financial institutional loans and advances

beginning to decline.

As a result profit margins decline further because costs

starts overtaking prices.

Recession may be mild/severe it lead to a sudden

explosive situation emanating from banking system and

stock markets.

Such experience of the United States in 1873, 1893,

1907, 1933 and 2007.

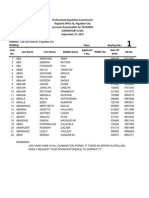

Expansions and Recessions in US

Period of Expansion Length (in months) Period of Recession Length (in months)

Oct.1949-Jul.1953 44 Jul. 1953 May 1954 10

May 1954-Aug. 1957 39 Aug. 1957 Apr. 1958 9

Apr. 1958-Apr. 1960 24 Apr. 1960 Feb. 1961 10

Feb. 1961- Dec. 1969 105 Dec. 1969 Nov. 1970 10

Nov. 1970- Nov. 1973 36 Nov. 1973 Mar. 1975 16

Mar. 1975- Jan. 1980 58 Jan. 1980 Jul. 1980 6

Jul. 1980- Jul. 1981 12 Jul. 1981 Nov. 1982 16

Nov. 1982- Jul. 1990 92 Jul. 1990 Mar. 1991 9

Mar. 1991- Mar. 2001 120 Mar. 2001 Nov. 2001 8

Nov. 2007

Theories of Business cycles

1. Hawtreys monetary theory

2. Hayeks monetary over investment theory

3. Schumpeters innovations theory

4. The psychological theory

5. The Cobweb theory

6. J.M. Keynes business theory

7. Samuelsons model of business cycle

8. Hicks theory of business cycle

1. Hawtreys monetary theory

According to Prof. R.G. Hawtrey business

cycle is a purely monetary phenomenon.

It is changes in the flow of monetary demand on

the part of businessmen that lead to prosperity

and depression in the economy.

The cyclical fluctuations are caused by

expansion and contraction of bank credit which,

in turn lead to variations in the flow of monetary

demand on the part of producers and traders.

Credit is expanded or reduced by the banking

system by lowering or raising the rate of interest

or purchasing or selling securities to merchants.

This increases or decreases the flow of money

in the economy and thus brings about prosperity

or depression.

Expansion phase bank credit increases

lending rate of interest falling encourages to

borrower to borrow money in large scale rate

of interest will decline credit become cheap

stocks/inventories peak/boom

Contraction phase bank credit decreases

lending rate of interest increases borrower

reduces loans cost of loans become costlier

production falls etc.

2. Hayeks monetary over investment theory

F.A. Hayeks formulated monetary over-

investment theory of trade cycle.

He explained his theory on the basis of

distinction between the natural interest rate and

market interest rate.

The natural rate of interest is that rate at which

the demand for learnable funds equal the supply

of voluntary savings (loans = savings)

Market rate of interest is the money rate at which

prevails in the market and is determined by the

demand and supply of money.

According to Hayek as long as the natural rate of

interest are equals the market rate of interest

the economy in the state of equilibrium and full

employment existence no places for trade

cycle.

The trade cycles in the economy are caused by

inequality between market rate of interest and

natural rate of interest.

When the market interest rate is less than the

natural rate, there is prosperity in the economy.

On the other hand, when the market interest is

more than the natural rate, the economy is in

depression.

3. Schumpeters innovations theory

The innovations theory of trade cycles is associated with

the name of Joseph Schumpeter.

According to him, innovations in the structure of an

economy are the source of economic fluctuations.

Trade cycles are the outcome of economic development

in a capitalist society.

Schumpter approach involves two stages

First stage deals with initial impact of innovation

Second stage follows through reactions to the original impact

of innovation.

When the economy is in equilibrium where every factor

fully employed cost = receipts product price =

average and marginal cost profit and interest are zero

no savings and investments circular flow.

Schumpeter theory starts with the breaking up of the

circular flow by an innovation in the form of a new

product by entrepreneur for earning profits.

Schumpeters innovations theory.

An innovation may consists of

1. The introduction of a new product

2. The introduction of a new method of production

3. The opening up of a new market

4. New sources of raw-materials or semi-

manufactured goods and

5. New organizations of an industry.

Changes in technology and expansion of bank

credit.

Trade cycle starts with equilibrium.

Upward movement from equilibrium are prosperity

and recession.

Downward movement equilibrium to depression and

revival.

4. The Psychological theory

The psychological theory of business cycle has

been developed by Prof. A.C. Pigou.

He explain the phenomenon of business cycle

on the basis of changes in the psychology of

industrialists and businessmen.

According to Pigou, expectations (optimistic and

pessimism) originated from some real factors

such as good harvests, wars, natural calamities,

industrial disputes, innovation etc.

The cause of business cycle into two categories

1. inpulses 2. conditions.

1. Inpulses refers to those causes which set a process

in motion

2. Conditions the vehicles through which the process

passes and upon which the impulses act.

5. The Cobweb theory

The cobweb theory of business cycles was

advocated by Prof. Schultz in 1930, latter

it was fully developed by Prof. Kaldar,

Tinbergen and Ricci.

The cobweb model is used to explain the

dynamics of demand, supply and price

over long period of time.

The movement of up and down of prices

and output of the commodities causes for

business cycle.

6. Keynes theory of trade cycle

Keynes does not develop a complete and pure

trade cycle.

According to Keynes effective demand will

influence on fluctuations in economic activities.

These effective demand consist of aggregate

demand function and aggregate supply function.

Aggregate demand function consists

consumption and investment expenditure.

Aggregate effective demand determines the

level of income and employment.

Keynes believes that consumption

expenditure (short period) is stable and it

is fluctuation in investment expenditure

which is responsible for changes in output,

income and employment.

Investment depends on rate of interest

and marginal efficiency of capital.

Since rate of interest is more or less stable

marginal efficiency of capital determines

the level of investment.

These MEC depends on two factors such

as perspective yield and supply price of

the capital asset.

Keynes theory of trade cycle

An increase in MEC will create more

employment, output and income leads to

prosperity.

On the other hand, a decline in MEC leads to

unemployment and fall in income and output,

this result depression.

During the period of expansion businessmen are

optimistic where MEC is rapidly increases so

entrepreneurs undertake new investment the

process of expansion goes on till boom is

reached.

While, on the other hand, if MEC is falling

profits level are also falling price of

raw-material equipment cost falls wages

also go down this leads to depression.

Keynes explain business cycle with

reference to two kinds of turning points

Upper turning point consists of

recovery and boom/peak.

Lower turning point depression and

recovery etc.

Control of Business Cycle

Economic statilisation is one of the main

remedies to effective control of business cycle.

Economic stabilizations is not merely confined

to single sector of an economy but embraces

all the sectors.

There are three ways by which a business

cycle can be controlled.

1. Monetary Policy

2. Fiscal Policy

3. Automatic Stabilisers

1. Monetary policy

Monetary policy as a method to control business

fluctuations is operated by the central bank of country.

Monetary policy mainly concerned with money supply,

bank credit and interest rates.

The central bank can adopts a number of methods to

control the business cycle with the help of quantitative

and qualitative credit control.

Dear money policy during boom/peak it raises its

bank rate policy, sells securities in the open market

operation and raises the cash reserve ratio and adopts

number of selective credit control.

Cheap money policy during recession/depression

reduces the bank rate policy and interest rates of banks

and also buys securities in the open market, reduces

cash reserve ratio etc.

2. Fiscal policy

Monetary policy alone cannot check business cycle.

Therefore, economists like JM Keynes and Hansen &

many others have recommended that fiscal policy can be

bring about stabilisation of business cycle.

Fiscal policy is a policy of government which is

concerned with public expenditure, taxation and public

borrowing.

These three instruments have to be effectively utilised to

control the severity of boom and depression.

During the period of recession and depression,

government should reduces taxation substantially,

increases of public expenditure public works social

and economic infrastructure. Repayment of loans to

public - deficit budgeting

In times of boom, government should raises tax rates,

levy new taxes, reduces public spending and public

borrowing following surplus budgeting

3. Automatic Stabilisers

When economics fluctuation takes place in

the economy, the available monetary

policy and fiscal tools cannot be geared

quickly to set right the imbalance. Then

automatic stabilizers become the

prominence.

Automatic stabilizers should be used as

supplemented with fiscal and monetary

policies.

Automatic stabilizers are also called as

built-in-stabilizers it is proportion to the

rise and fall of economic activity.

The progressive taxation and unemployment

insurance schemes are the two important tools

measures the automatic stabilizers in the

economy.

During periods of prosperity or boom the

employers pay taxes more and withdrawing

unemployment benefits.

While, during period of depression government

allowed to provision of unemployment benefits,

and lowers the taxes and increasing public

expenditure.

Thus, the flow of money is regulated

automatically from the people to the government

in times of both boom and depression.

You might also like

- Metro Business and Commercial Account Opening Form & Mandate (Commercial & Private)Document19 pagesMetro Business and Commercial Account Opening Form & Mandate (Commercial & Private)SimonNo ratings yet

- Business Cycle or Economic CycleDocument35 pagesBusiness Cycle or Economic CycleEllaineyLeyn100% (2)

- Theories of ProfitDocument6 pagesTheories of Profitvinati100% (1)

- BKM CH 03 Answers W CFADocument8 pagesBKM CH 03 Answers W CFAAmyra KamisNo ratings yet

- Basic Maintenance KPI MetricsDocument20 pagesBasic Maintenance KPI MetricsKrishna Jasha100% (5)

- 03 InterestRateSwapsDocument123 pages03 InterestRateSwapstniravNo ratings yet

- Ho BRDocument3 pagesHo BRSummer Star33% (3)

- The Business Cycle: Definition and PhasesDocument6 pagesThe Business Cycle: Definition and PhasesIbrahim Khan100% (1)

- Business CycleDocument9 pagesBusiness CycleHarsha SekaranNo ratings yet

- Macro-Economics Lecture (BBA)Document262 pagesMacro-Economics Lecture (BBA)Sahil NoorzaiNo ratings yet

- Chapter 4 Supply AnalysisDocument11 pagesChapter 4 Supply AnalysisNeelabh KumarNo ratings yet

- Theories of Interest RateDocument10 pagesTheories of Interest RateAshutoshNo ratings yet

- Measures To Control Inflation - RecessionDocument10 pagesMeasures To Control Inflation - Recessionprof_akvchary100% (2)

- Business CycleDocument38 pagesBusiness CyclezubairsheikhNo ratings yet

- Unit 6 InflationDocument26 pagesUnit 6 InflationdawsonNo ratings yet

- Economics General Price LevelDocument15 pagesEconomics General Price LevelNeelam FartyalNo ratings yet

- Cost & Cost CurvesDocument46 pagesCost & Cost CurvesManoj Kumar SunuwarNo ratings yet

- Indian Economy During The Pre-British PeriodDocument3 pagesIndian Economy During The Pre-British PeriodRuthi VanlalhmangaihiNo ratings yet

- Equilibrium and Disequilibrium in Balance of PaymentDocument9 pagesEquilibrium and Disequilibrium in Balance of PaymentDari ThangkhiewNo ratings yet

- Causes and Measures of DisequilibriumDocument28 pagesCauses and Measures of DisequilibriumPankaj Chetry100% (1)

- Portfolio ManagementDocument15 pagesPortfolio ManagementSVSERODENo ratings yet

- Sapm Unit 5Document49 pagesSapm Unit 5Alavudeen Shajahan100% (1)

- EconomicsDocument11 pagesEconomicssubhashreeNo ratings yet

- Advantages of Fixed Exchange RatesDocument5 pagesAdvantages of Fixed Exchange Ratesok100% (1)

- Unit-14 Deficit Financing PDFDocument12 pagesUnit-14 Deficit Financing PDFSatish DasNo ratings yet

- Project-Baumol Sales Revenue Maximization ModelDocument10 pagesProject-Baumol Sales Revenue Maximization ModelSanjana BhabalNo ratings yet

- Unit III - Demand AnalysisDocument52 pagesUnit III - Demand AnalysisAmita GandhiNo ratings yet

- Note On Methods of Forecasting DemandsDocument3 pagesNote On Methods of Forecasting DemandsSteveNo ratings yet

- Why Average Cost Curve IsDocument2 pagesWhy Average Cost Curve IsHasinaImamNo ratings yet

- Partial Equilibrium: EconomicsDocument5 pagesPartial Equilibrium: EconomicsSamantha SamdayNo ratings yet

- 2 - International Parity ConditionsDocument116 pages2 - International Parity ConditionsMUKESH KUMARNo ratings yet

- Structural Dimensions of Indian EconomyDocument71 pagesStructural Dimensions of Indian EconomyRaghu Sabbithi75% (4)

- Incremental and Marginal Principle (Akash Chi Trans Hi)Document10 pagesIncremental and Marginal Principle (Akash Chi Trans Hi)akashchitranshNo ratings yet

- Balance of PaymentDocument4 pagesBalance of PaymentAMALA ANo ratings yet

- Quantity Theory of MoneyDocument8 pagesQuantity Theory of MoneySamin SakibNo ratings yet

- STUDY MATERIAL ON Profit and Theories of Profit.Document63 pagesSTUDY MATERIAL ON Profit and Theories of Profit.Aparna ViswakumarNo ratings yet

- Financial ServicesDocument77 pagesFinancial ServicesGiridhara Raju80% (5)

- Law of Variable ProportionDocument16 pagesLaw of Variable Proportionradhkrishan100% (2)

- S U B MI TT ED BY: Anshul Sabharwal Iii YrDocument22 pagesS U B MI TT ED BY: Anshul Sabharwal Iii YrNishant GuptaNo ratings yet

- Project On Foreign ExchangeDocument59 pagesProject On Foreign ExchangeSandeep SinghNo ratings yet

- Economic AnalysisDocument12 pagesEconomic AnalysiszaryNo ratings yet

- Introduction To Trade BlocsDocument19 pagesIntroduction To Trade BlocsMT RANo ratings yet

- Components of Balance of Payments I: NtroductionDocument3 pagesComponents of Balance of Payments I: NtroductionSamuel HranlehNo ratings yet

- Economics Notes On SupplyDocument5 pagesEconomics Notes On SupplyunicornsarecoolasiceNo ratings yet

- Money and Banking PDFDocument19 pagesMoney and Banking PDFMOTIVATION ARENANo ratings yet

- Keynesion Theory of EmploymentDocument9 pagesKeynesion Theory of EmploymentPoorvi MedatwalNo ratings yet

- Bba Chapter 4 Pricing Under Various Market ConditionsDocument21 pagesBba Chapter 4 Pricing Under Various Market ConditionsDr-Abu Hasan Sonai SheikhNo ratings yet

- Institutional Support WPDocument9 pagesInstitutional Support WPRs rsNo ratings yet

- Free Trade ArticleDocument15 pagesFree Trade ArticlewilsonlariosNo ratings yet

- National IncomeDocument29 pagesNational Incomeshahidul0No ratings yet

- Classical Theory of Macro EconomicsDocument9 pagesClassical Theory of Macro EconomicsSantosh Chhetri100% (1)

- Share CapitalDocument76 pagesShare CapitalCollege CollegeNo ratings yet

- Theory of DemandDocument10 pagesTheory of DemandSakshi SharmaNo ratings yet

- Capital Market TheoryDocument14 pagesCapital Market TheorySaiyan VegetaNo ratings yet

- PDF 4-Innovation Theory of Trade Cycle by SchumpterDocument4 pagesPDF 4-Innovation Theory of Trade Cycle by SchumpterKushal BhatiaNo ratings yet

- Security Analysis & Portfolio Management Syllabus MBA III SemDocument1 pageSecurity Analysis & Portfolio Management Syllabus MBA III SemViraja GuruNo ratings yet

- New Issue MarketDocument18 pagesNew Issue Marketoureducation.inNo ratings yet

- Difference Between Balance of Trade (BOT) & Balance of Payment (BOP)Document2 pagesDifference Between Balance of Trade (BOT) & Balance of Payment (BOP)Bhaskar KabadwalNo ratings yet

- Dividend Discount Model in Valuation of Common StockDocument15 pagesDividend Discount Model in Valuation of Common Stockcaptain_bkx0% (1)

- Market Efficiency PDFDocument17 pagesMarket Efficiency PDFBatoul ShokorNo ratings yet

- InflationDocument93 pagesInflationPawan Pant100% (1)

- Business Cycle: Dr. Ajay MassandDocument31 pagesBusiness Cycle: Dr. Ajay MassandAshish kumar NairNo ratings yet

- Managerial Economics For Mcom 3rd Sem by - DR - Neha MATHUR-1Document10 pagesManagerial Economics For Mcom 3rd Sem by - DR - Neha MATHUR-1mrunal shethiyaNo ratings yet

- Gale Researcher Guide for: Policy Responses to the Business CycleFrom EverandGale Researcher Guide for: Policy Responses to the Business CycleNo ratings yet

- Multinational CorporationsDocument25 pagesMultinational CorporationssamrulezzzNo ratings yet

- Chapter IDocument140 pagesChapter Isuraj5884No ratings yet

- Valuing Business EDP SDMDocument104 pagesValuing Business EDP SDMsamrulezzzNo ratings yet

- International Labor RelationsDocument60 pagesInternational Labor RelationssamrulezzzNo ratings yet

- PatentsDocument17 pagesPatentssamrulezzzNo ratings yet

- New Venture Creation-FinalDocument16 pagesNew Venture Creation-Finalshining12350% (2)

- International FinanceDocument83 pagesInternational Financesamrulezzz100% (1)

- International Human Resource ManagementDocument34 pagesInternational Human Resource Managementpraveen yadavNo ratings yet

- Corporate Entrepreneurship and InnovationDocument15 pagesCorporate Entrepreneurship and Innovationsamrulezzz100% (1)

- Ethics and Social ResponsibilityDocument7 pagesEthics and Social ResponsibilitysamrulezzzNo ratings yet

- MSC Rob KoldewijnDocument59 pagesMSC Rob KoldewijnsamrulezzzNo ratings yet

- RepatriationDocument22 pagesRepatriationsamrulezzz100% (2)

- Brewster & Bournois ModelDocument4 pagesBrewster & Bournois Modelsamrulezzz100% (1)

- Industrial Disputes Act, 1947Document42 pagesIndustrial Disputes Act, 1947samrulezzz100% (3)

- Chapter 2 Factories Act, 1948Document11 pagesChapter 2 Factories Act, 1948samrulezzzNo ratings yet

- Brewster & Bournois ModelDocument8 pagesBrewster & Bournois Modelsamrulezzz100% (3)

- Industrial Disputes Act, 1947Document42 pagesIndustrial Disputes Act, 1947samrulezzz100% (3)

- Simulation: Presentation By: Disha Khandige Muralidhar BaligaDocument8 pagesSimulation: Presentation By: Disha Khandige Muralidhar BaligasamrulezzzNo ratings yet

- Study Material-Mba LLDocument216 pagesStudy Material-Mba LLsamrulezzzNo ratings yet

- Jet and Paramount Airwys AssignDocument13 pagesJet and Paramount Airwys AssignsamrulezzzNo ratings yet

- Factories Act, 1948Document35 pagesFactories Act, 1948samrulezzz100% (1)

- Human Resouces OutsourcingDocument18 pagesHuman Resouces OutsourcingsamrulezzzNo ratings yet

- Training and DevelopmentDocument17 pagesTraining and DevelopmentsamrulezzzNo ratings yet

- BF - Pricing - EHP2-8 - Master - Version v9 (Relation BR - Licence)Document60 pagesBF - Pricing - EHP2-8 - Master - Version v9 (Relation BR - Licence)AZn5ReDNo ratings yet

- Acc 305 PDFDocument147 pagesAcc 305 PDFgosaye desalegn100% (3)

- 11g Audit VaultDocument47 pages11g Audit VaultAkin AkinmosinNo ratings yet

- DDDaudit SYSDauditDocument12 pagesDDDaudit SYSDauditicturnerNo ratings yet

- PDF Report Halal Cosmetics and Skin Care Survey 10992Document21 pagesPDF Report Halal Cosmetics and Skin Care Survey 10992Bintoro Joyo100% (1)

- SLT Porters 5 ForcesDocument4 pagesSLT Porters 5 ForcesIfraz IlyasNo ratings yet

- Assignment 4: SWOT Analysis Using EFAS and IFAS Table (8 Factors Each)Document6 pagesAssignment 4: SWOT Analysis Using EFAS and IFAS Table (8 Factors Each)Leah Jean GabaNo ratings yet

- Crafters As A Target Group For Lowe's Target Segment Summary Target's Psychographic SummaryDocument18 pagesCrafters As A Target Group For Lowe's Target Segment Summary Target's Psychographic Summaryapi-286160588No ratings yet

- Ducab ENGLISH Arabic V6 - Issue 62 PDFDocument40 pagesDucab ENGLISH Arabic V6 - Issue 62 PDFAjeesh Abdul AzeezNo ratings yet

- The Five Second Flirt From Become Your Own MatchmakerDocument5 pagesThe Five Second Flirt From Become Your Own MatchmakersamrulessNo ratings yet

- Oracle PO Charge AccountDocument13 pagesOracle PO Charge AccountvenkatsssNo ratings yet

- Management Accounting Exam Paper May 2012Document23 pagesManagement Accounting Exam Paper May 2012MahmozNo ratings yet

- Downloadasset.2014 12 Dec 19 14.sap For Chemicals PDF - BypassregDocument1 pageDownloadasset.2014 12 Dec 19 14.sap For Chemicals PDF - BypassregLabNo ratings yet

- 4 Activity 5 PPEDocument9 pages4 Activity 5 PPEDaniella Mae ElipNo ratings yet

- Ccra Level 2 SyllabusDocument8 pagesCcra Level 2 SyllabusPavan ValishettyNo ratings yet

- Wireless Notice Board - OdtDocument23 pagesWireless Notice Board - OdtPavanNo ratings yet

- Pagadian Room Assignment Elementary LETDocument278 pagesPagadian Room Assignment Elementary LETTheSummitExpress75% (4)

- SAP PP ProcessDocument51 pagesSAP PP Processkannanraj666No ratings yet

- Nmims Project Sep 21Document33 pagesNmims Project Sep 21Dev ChitkaraNo ratings yet

- DR - Mahesh Kumar: Prepared byDocument20 pagesDR - Mahesh Kumar: Prepared bymahesh kumarNo ratings yet

- Perhitungan IRR, BCR Dan NPVDocument26 pagesPerhitungan IRR, BCR Dan NPVadhityamspNo ratings yet

- Alicia Cecilia Fonseca ERP Assignment 4Document6 pagesAlicia Cecilia Fonseca ERP Assignment 4Alicia Cecilia FonsecaNo ratings yet

- Course Syllabus: MIS Executives Seminar (MIS 320) Spring 2012 (CRN 20170)Document5 pagesCourse Syllabus: MIS Executives Seminar (MIS 320) Spring 2012 (CRN 20170)ddlarkcorkNo ratings yet

- Week 6 Practice 101Document19 pagesWeek 6 Practice 101David LimNo ratings yet

- How Market Makers Condition The MarketDocument18 pagesHow Market Makers Condition The MarketGuy Surrey100% (2)