Professional Documents

Culture Documents

Department of Management Studies University of Dhaka: Submitted To

Department of Management Studies University of Dhaka: Submitted To

Uploaded by

Randolph NewtonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Department of Management Studies University of Dhaka: Submitted To

Department of Management Studies University of Dhaka: Submitted To

Uploaded by

Randolph NewtonCopyright:

Available Formats

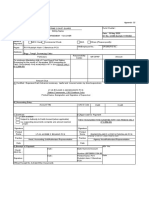

DEPARTMENT OF MANAGEMENT STUDIES

UNIVERSITY OF DHAKA

COURSE TITLE: Management of Mut!nat!ona Co"#o"at!on

Re#o"t

On

Course no. EM - 555

Submitted to

D"$ S%e& Goam Maoa

Professor, Department of Management Studies

University of Da!a

Submitted by

"afi Mamood #ain

Student $D % &'-()-))-&*)

EM+, ))

nd

+at-

$

Pa"t A: Go'a T"en&( of FDI

FOREIGN DIRECT INVESTMENT )FDI*+ GLO,AL SOURCING

AND INDUSTRIAL LINKAGES

.e g/oba/i0ation of produ-tion is -reating potentia//y important -ompetitive

opportunities and -a//enges for ,sia-Pa-ifi- SMEs as supp/iers and -ompetitors 1itin

te frame1or! of g/oba/ va/ue -ains. $t is usefu/ to -onsider tis issue 1itin te more

genera/ -onte2t of trends in 3D$ and g/oba/ sour-ing, and teir imp/i-ations for industria/

/in!ages invo/ving SMEs. Over te /ast t1o de-ades, te use of e2terna/ outsour-ing as

be-ome an important strategi- issue, 1it in-reasing re-ognition of te benefits tat

effe-tive outsour-ing and internationa/ produ-tion strategies -an provide. $n te never-

ending 4uest for greater effi-ien-y and -ost savings, many -ompanies ave de-ided to

sour-e parts and -omponents from /o1--ost supp/iers g/oba//y, and in many instan-es

ave transferred -ertain segments of or te entire produ-tion pro-ess to ne1 /o-ations

overseas. $ndeed, internationa/ pro-urement and nove/ offsore integrated produ-tion

arrangements ave be-ome -riti-a/ to te -ompetitiveness and su--ess of g/oba/ firms.

Many -orporations no1 ave estab/ised presen-es a-ross #ort ,meri-a, Europe and

te ,sia-Pa-ifi- region, often a1ay from teir o1n -orporate ead4uarters and traditiona/

mar!ets. ,s a resu/t, 3D$ and trade ave gro1n in an unpre-edented fasion 5U#C.,D

)&&*6.

T"en&( !n fo"e!gn &!"e-t !n.e(tment

7/oba/ 3D$ f/o1s rose by ((8 in )&(' to an estimated US9(.:; tri//ion, up from a

revised US9(.') tri//ion in )&(). 3D$ inf/o1s in-reased in a// ma<or e-onomi- groupings

= deve/oped, deve/oping and transition e-onomies. $n )&(', te sift in mar!et

e2pe-tations to1ards an ear/ier tapering of 4uantitative easing in te United States -aused

some vo/ati/ity for internationa/ investments. .e impa-t 1as /arge in some emerging

mar!ets, 1i- suffered rea/ e2-ange rate depre-iation, sto-! mar!et de-/ines and a

1itdra1a/ of -apita/. >o1ever, in -ontrast to foreign portfo/io f/o1s tat de-/ined

dramati-a//y in te se-ond and tird 4uarter of )&(', 3D$ f/o1s 1ere re/ative/y /ess

vo/ati/e 5figure )6.

$

$

De.eo#e& -ount"!e( a--ount fo" on% t/o0f!ft1( of go'a FDI

&e(#!te a 234 "!(e

$nf/o1s to deve/oped -ountries appear to be re-overing, 1it pre/iminary estimates

so1ing a ()8 rise in )&(', over )&(), to US95?; bi//ion, for te group of '* e-onomies

as a 1o/e 5tab/e (6. >o1ever, te pi-ture is mi2ed@ despite positive signs of re-overy in

some deve/oped -ountry regions, su- as parts of te EU, 3D$ f/o1s to te United States

fai/ed to reverse teir de-/ine, -ontrary to oter signs of e-onomi- re-overy over te past

year. $nf/o1s to Aapan rose by ;(8 to US9).* bi//ion, but ,ustra/ia and #e1 Bea/and

sa1 sarp de-/ines of )*8 to US9:& bi//ion and ?58 to US9&.5 bi//ion, respe-tive/y.

3/o1s to deve/oped e-onomies 1ere terefore sti// at on/y ::8 of teir pea! /eve/ of

$

)&&?. Even toug te gro1t rate in 3D$ f/o1s to deve/oped -ountries 1as t1i-e tat

-ompared to deve/oping -ountries in )&(', it 1as not enoug to restore teir position as

primary re-ipients of 3D$ inf/o1s. .e deve/oped -ountry sare remained 1e// be/o1

a/f of g/oba/ inf/o1s at 'C8 5figure '6. .e aggregate inf/o1s to te EU in re-ent years

1ere /arge/y a--ounted for by f/o1s to four re/ative/y sma// e-onomies +e/gium,

$re/and, te #eter/ands and Du2embourg tat offer a ta2-friend/y environment for

investment, parti-u/ar/y for spe-ia/ purpose entities. ,s a resu/t, tese e-onomies are

osts to a /arge number of .#CsE finan-ia/ or treasury fun-tions. >aving fa//en by over

US9(;C bi//ion in )&(), inf/o1s to tese four e-onomies gre1 by over US9(&& bi//ion in

)&('. E/se1ere in te EU, 7ermany 5F'C)8 to US9').' bi//ion6, Spain 5F'?8 to

US9'?.( bi//ion6 and $ta/y 5from US9&.( bi//ion to US9C.C bi//ion6 sa1 a substantia/

re-overy in teir 3D$ inf/o1s. Converse/y, f/o1s de-/ined in (5 out of )? EU e-onomies,

1it te /argest de-/ines observed in 3ran-e 5-??8 to US95.? bi//ion6 and >ungary 5from

US9('.* bi//ion to -US9' bi//ion6. Outside te EU, inf/o1s to #or1ay and S1it0er/and

a/so fe// sarp/y by :;8 to US9C.: bi//ion and by C*8 US9&.) bi//ion, respe-tive/y.

Estimates for #ort ,meri-a so1 tat inf/o1s gre1 by ;8 due to a turnaround in

Canada 5F:C8 to US9;:.( bi//ion6 1ere inf/o1s rose a-ross a broad range of industries.

.e re-overy 1as /arge/y as-ribed to a sarp in-rease in intra--ompany /oans to foreign

affi/iates in Canada. Cross-border MG, sa/es in bot Canada and te United States

de-/ined, 1i- is part/y e2p/ained by /arge divestments. $nf/o1s to $srae/ 5F :*8 to

US9(: bi//ion6, primari/y attra-ted by te -ountryEs ig-te- industry, are estimated to

ave rea-ed a /eve/ -omparab/e to te previous ig in )&&;. $n ,ustra/ia, 1i- as

benefited from te -ommodity boom in te re-ent past, MG, sa/es a/ved and 3D$

inf/o1s de-/ined by more tan a 4uarter in )&('. ,n upturn in MG, sa/es e/ped

in-rease 3D$ inf/o1s to Aapan, but te va/ue of inf/o1s 1as sti// margina/.

$

De.eo#!ng A(!a "ema!n( t1e /o"&5( to# FDI (#ot6 Lat!n Ame"!-a at (!m!a" e.e(

to Eu"o#e

Continuing their 2012 performance, developing economies a--ounted for more tan a/f

of g/oba/ 3D$ again in )&(', as teir inf/o1s rea-ed a ne1 ig, at an estimated US9?5C

bi//ion. .e in-rease 1as main/y driven by Datin ,meri-an and te Caribbean, and ,fri-a

1i/e deve/oping ,sia = te 1or/dEs /argest re-ipient region for 3D$ = sa1 its f/o1s at a

/eve/ simi/ar to )&() 5figure :6.

$

.ota/ inf/o1s to developing Asia = -omprising East ,sia, Sout ,sia, Sout-East ,sia

and Hest ,sia = as a 1o/e amounted to an estimated US9:&; bi//ion in )&(', at a /eve/

simi/ar to )&(). .e performan-e of sub-regions -ontinues to diverge, 1it 3D$ gro1t

rates ranging bet1een '8 in Sout ,sia 5to US9'' bi//ion6, )8 in Sout-East ,sia 5to

US9((; bi//ion6, (8 in East ,sia 5to US9)(C bi//ion6 and -)&8 in Hest ,sia 5do1n to

US9'* bi//ion6. Hit inf/o1s to Cina at an estimated US9()? bi//ion in-/uding bot

finan-ia/ and non-finan-ia/ se-tors te -ountry again ran!ed se-ond in te 1or/d,

-/osing te gap 1it te United States to some US9') bi//ion 5figure 56. $ndia

e2perien-ed a (?8 gro1t in 3D$ f/o1s, to US9)* bi//ion, despite une2pe-ted -apita/

outf/o1s in te midd/e of te year. 3D$ gro1t s/o1ed in te ,sso-iation of Souteast

,sian #ations 5,SE,#6, as inf/o1s to Singapore te /argest re-ipient in Sout-East

,sia stagnated at US95; bi//ion. >o1ever, prospe-ts for tis regiona/ grouping

-ontinue to be promising, as more 3D$ arrives from Cina and Aapan in a 1ide range of

se-tors, in-/uding infrastru-ture, finan-e and manufa-turing.

Hest ,sia is te on/y region to see a fift -onse-utive de-/ine in 3D$ in )&(', dropping

by anoter )&8 to US9'* bi//ion. .e regionEs t1o main re-ipients Saudi ,rabia and

.ur!ey bot registered signifi-ant 3D$ de-/ines of (C8 to US9C.C bi//ion and (58 to

US9(( bi//ion, respe-tive/y. .ur!ey 1itnessed virtua//y a tota/ absen-e of /arge 3D$

dea/s. $n addition, te 1orsening po/iti-a/ instabi/ity in many parts of te region ave

-aused un-ertainty and negative/y affe-ted investment. 3D$ f/o1s to Latin America and

$

the Caribbean in-reased by (*8 in )&(' te fourt -onse-utive year of gro1t

rea-ing an estimated US9)C: bi//ion. Hi/e in previous years 3D$ gro1t to te region

1as /arge/y driven by Sout ,meri-a, in )&(' Centra/ ,meri-a and te Caribbean 1ere

te main re-ipient of 3D$ gro1t 53D$ inf/o1s in-reasing by C'8 and '*8 respe-tive/y6.

3/o1s to Sout ,meri-a de-/ined by ?8. .e US9(* bi//ion a-4uisition of 7rupo

Mode/o in Me2i-o e2p/ains most of Centra/ ,meri-aIs in-rease in 3D$, 1i/e te strong

rise in te Caribbean 1as main/y driven by te +ritis Jirgin $s/ands 5see be/o16. .e

de-/ine of 3D$ f/o1s to Sout ,meri-a -ame after tree years of strong gro1t bo/stered

by te strengt of -ommodity pri-es tat fue//ed rising profits on investment as 1e// as

reinvested earnings in te mining industry. De-reasing -ommodity pri-es seem to ave

brougt a stop to te boom in 3D$ in tis industry, espe-ia//y in -ountries su- as Ci/e 5-

''8 to US9)&.: bi//ion6 and Peru 5-)8 to US9() bi//ion6. $n addition, 3D$ to +ra0i/

te /argest re-ipient of 3D$ in te sub-region, 1it :?8 of Sout ,meri-an tota/ 3D$

f/o1s in )&(' de-/ined by a s/igt '.C8 in )&(', but remained signifi-ant 5US9;'

bi//ion6. #everte/ess, tis de-/ine sou/d be seen in te -onte2t of strong gro1t in

previous years tat boosted 3D$ in +ra0i/ to istori-a/ ig 3D$ inf/o1s to ,fri-a rose by

;.*8 to an estimated US95;.' bi//ion. .is 1as due to te strong performan-e of

Soutern ,fri-an -ountries, in-/uding Sout ,fri-a and Mo0ambi4ue tat e2perien-ed

re-ord inf/o1s of more tan US9(& bi//ion and US9? bi//ion, respe-tive/y, as 1e// as

/o1er /eve/s of divestment in ,ngo/a -ompared to previous years. .e oter sub-regions

sa1 teir inf/o1s de-rease. Persistent po/iti-a/ and so-ia/ tensions -ontinued to subdue

f/o1s to #ort ,fri-a, 1ere on/y Moro--o registered so/id gro1t of ):8, to US9'.5

bi//ion. #onete/ess, tere are signs tat investors are ready to return to te region, 1it

many big -ross-border dea/s targeting Egypt. $n Sub-Saaran ,fri-a, #igeriaEs /a-!/ustre

performan-e 5US95.5 bi//ion6 is te resu/t of foreign .#CsE retreat from te oi/ industry.

T1e Ru((!an Fe&e"at!on 7um#( to t1!"& !n go'a "an8!ng

9 fo" t1e f!"(t t!me e.e"

.ransition e-onomies e2perien-ed a signifi-ant :58 rise in 3D$ inf/o1s, rea-ing a

re-ord /eve/ an estimated US9(); bi//ion. 3D$ inf/o1s to te Kussian 3ederation

<umped by *'8 to US9C: bi//ion ma!ing it te 1or/dEs tird /argest re-ipient of 3D$ for

te first time ever 5figure 56. .e rise 1as predominant/y as-ribed to te /arge a-4uisition

$

by +P 5United "ingdom6 of (*.58 of Kosneft 5Kussia 3ederation6 as part of KosneftEs

US95? bi//ion a-4uisition of .#"-+P, 1i- is o1ned by a -ompany registered in te

+ritis Jirgin $s/ands. 3D$ in te Kussian 3ederation is e2pe-ted to !eep pa-e 1it its

)&(' performan-e as te Kussian 7overnmentEs Dire-t $nvestment 3und a US9(&

bi//ion fund to promote 3D$ in te -ountry as been very a-tive/y dep/oyed in

-o//aboration 1it foreign partners, for e2amp/e funding a dea/ 1it ,bu DabiIs

3inan-e Department to invest up to US95 bi//ion in Kussian infrastru-ture.

$

Con-u(!on :

3D$ f/o1s -ou/d rise furter in )&(: and )&(5, to US9(.; tri//ion and US9(.* tri//ion,

respe-tive/y, as g/oba/ e-onomi- gro1t gains momentum. ,-tivity is e2pe-ted to

improve furter in )&(: and )&(5, /arge/y on a--ount of re-overy in deve/oped

e-onomies. 7DP gro1t, gross fi2ed -apita/ formation and trade are pro<e-ted to rise

g/oba//y over te ne2t years. .ose improvements -ou/d prompt .#Cs to gradua//y

transform teir re-ord /eve/s of -as o/dings into ne1 investments.

>o1ever, uneven /eve/s of gro1t, fragi/ity and unpredi-tabi/ity in a number of

e-onomies, and te ris!s asso-iated 1it a gradua/ e2it from te 4uantitative easing

program by te United States and oter ma<or -ountries may dampen te re-overy. .e

announ-ed dea/s for 3D$ pro<e-ts in /ate )&(', be tey MG,s or greenfie/d, suggest tat

te /ift off in 3D$ may not be strong in te sort term.

$

Pa"t , :In&u(t"% an& -ount"% /!(e D!(t"!'ut!on of ,anga&e(1!

Com#an% )In-u&!ng !n.e(tment !n ,anga&e(1*

Int"o&u-t!on

3or a resour-e poor -ountry /i!e +ang/ades 3oreign Dire-t $nvestment 53D$6 -an p/ay a

-ru-ia/ ro/e in industria/ finan-ing troug gatering s-attered funds from various g/oba/

investors in tis -onne-tion 3oreign Dire-t $nvestment 53D$6 as p/ayed a !ey ro/e in te

moderni0ation of te +ang/ades e-onomy for te /ast (5 years. .e tota/ trend in te

3D$ f/o1s of te deve/oping -ountries so1s an en-ouraging pi-ture in genera/ terms.

More investment is -oming from private se-tors in te deve/oping -ountries from te

deve/op one troug /i-ensing, fran-ising, merging, <oint venture, -ontra-t

manufa-turing and so fort. Most of te time deve/oping -ountries be-ome investors

among temse/ves. .e situation for DDCIs 5Deast Deve/oped Countries6 do not /oo! tat

brigt. Jie1ed in tis -onte2t +ang/ades is one of te most popu/ous DDCIs needs to

ma!e o1n sto-! ta!ing of te -ontemporary g/oba/ e-onomi- situation as far as te 3D$

f/o1s are -on-erned. 7overnment of +ang/ades revised its industria/ po/i-y of (CC( and

offers a number of good fa-i/ities and in-entives by (CCC to attra-t 3D$. .oug te

po/i-y as -anged, 3D$ f/o1s to +ang/ades are so far been neg/igib/e. $ts reform

program for out1ards /oo!ing e-onomi-s a-tivities ave fai/ed to attra-t 3D$ a si0eab/e in

-omparison 1it oter ,sian Countries. ,-tua//y su--ess of any po/i-y or organi0ation

a-ievement depends on its abi/ity to estab/is and maintain a good fit bet1een itse/f and

environment 1ere it 1i// appropriate and on identifying te -ompetitive advantages and

e2p/oiting te opportunities in te more effi-ient manner tan tat of te -ompetitors. .e

1or/d e-onomy is in stream of -ange in order to integrate itse/f to a-ieve desire

ob<e-tives of te e-onomi- g/oba/i0ation for te gro1t and prosperity for te irrespe-tive

of region in a// parts of te 1or/d. .rends in e-onomi- po/i-ies in bot deve/oped and

deve/oping -ountries ave been great/y inf/uen-ed by te g/oba/i0ation tat is free mar!et

e-onomy and as a matter of fa-t foreign investment and trade /abia/i0ation ave be-ome

its prime impu/ses. .e e2isten-es of mar!et opportunities, deve/opment of

-ommuni-ation, information te-no/ogy and -omparative advantages in internationa/

$

/eve/ motivate foreign investor in te internationa/ business operation. Kesear-ers ave

mar!ed 3D$ as an important fa-tor in a--e/erating e-onomi- su--ess and 1ea/t of a

-ountry as 1e// as a door in -reating <obs, fa-i/itating e-onomy, and -reating more

-ompetitive environment and -ontributing produ-tivity to te ost -ountry. $n

+ang/ades, 3D$ p/ays a signifi-ant ro/e in 7DP a--e/eration and e-onomi- gro1t

5Motta/eb )&&?6. 3D$ as a mentionab/e ro/e in te moderni0ation of te +ang/ades

e-onomy for /ast t1o de-ades. $t e/ps te -ountry in bui/ding up infrastru-ture, -reating

more emp/oyment, deve/oping -apa-ity, enan-ing s!i//s of te /abor for-e of te ost

-ountry troug transferring te-no/ogi-a/ !no1/edge and manageria/ -apabi/ity, and

e/ping in integrating domesti- e-onomy and te g/oba/ e-onomy. Jarious positive

attributes of +ang/ades is no1 dra1ing te attention of te investors from bot

deve/oped and deve/oping -ountries. $n +ang/ades, it is avai/ab/e to get s!i//ed /abor at

re/ative/y /o1 1ages. Moreover, tere is reasonab/y stab/e ma-ro e-onomi- environment.

.ese t1o important fa-tors -an ma!e +ang/ades an a//uring destination for foreign

investors. Do1est 1age rates among te ,sian -ountries, to/erab/e inf/ation rate,

reasonab/y stab/e 5e2-ept previous year6 e2-ange rate, investment friend/y -ustom

regu/ations and attra-tive in-entive pa-!ages ma!e +ang/ades a favorab/e investment

destination. +ang/ades be-ame more open to1ard 3D$ po/i-ies over te /ast de-ades.

.ese above features 1i// -ertain/y maintain te re-ent advan-ement in 3D$ investment in

+ang/ades by te foreign investors

FDI T"en&( !n ,anga&e(1

3o//o1ing te in-entives offered by te 7overnment of +ang/ades, te foreign investors

ave started -oming to +ang/ades for investment. 3D$ inf/o1s into +ang/ades may

-onsist of (&&8 foreign o1ned investment and <oint venture bet1een +ang/adesi

investor and foreign investor. 3oreign investments registered 1it +oard of $nvestment

during (CC& to )&(& are presented in .ab/e (@

$

.ab/e ( -/arifies tat registered foreign investment -onsists of ?*8 of <oint venture

investment -ompared to tota/ investment units 1i/e ))8 of so/e foreign investment. $n

-ase of re4uired investment -ent per-ent foreign investment needs :(8 of tota/

investment re4uired and 5C8 of tota/ investment is re4uired for <oint venture investment.

+ut emp/oyment opportunity as not been appened a--ording to investment opportunity

and no. of registered units. .ese migt ave been appened be-ause of /abor intensive

and -apita/ intensive pro<e-ts. .e .ab/e ( as not so1n year-1ise registered units,

re4uired investment and emp/oyment opportunities.

.e .ab/e ) so1s te year-1ise brea! up of (&&8 registered 3D$ proposa/s

.ab/e ) so1s te year/y brea! up of (&&8 proposed registered 3D$ into +ang/ades and

$

emp/oyment opportunity for te period of (CC&-)&(&. .e .ab/e -/arifies te f/u-tuations

in te proposed registered 3D$ inf/o1s into +ang/ades. .e f/u-tuations in -ase of

emp/oyment opportunities are a/so seen in te .ab/e. $t is seen in te .ab/e tat te

igest investment 3D$ inf/o1s in )&&5 and /o1est in (CC:. Emp/oyment opportunities

are seen igest in (CCC and /o1est in (CC&. .ere may be many reasons attributed for

tese f/u-tuations. .e reasons may be inade4uate in-entives to investors, po/iti-a/

vo/ati/ity, red tapism, -apita/ intensive and /abor intensive pro<e-ts. ,mong te reasons

may be te dominant fa-tors for /o1 3D$ inf/o1s into +ang/ades. .e 3D$ inf/o1s into

+ang/ades ave been -on-entrated in different sub- se-tors.

.e figure so1s in-onsistent pro-eedings of (&&8 foreign investment in +ang/ades

sin-e (CC&. $n spite of aving in-entives, friend/y investment po/i-ies, /o1 /abor -ost,

-omparative advantages, estab/isment of EPBs +ang/ades not attain desirab/e

investment. .e above figure so1s an in-reasing trend from year (CC5 to (CCC. +ut

after tat tere is a de-reasing up to )&&( and again up1ard trend to year )&&5 and again

a do1n 1ard trend up to )&(&

.e se-tor-1ise 3D$ inf/o1s into +ang/ades are presented in .ab/e '.

$

.ab/e ' presents te se-tor-1ise 3D$ inf/o1s into +ang/ades and emp/oyment

opportunities. .ere are f/u-tuations in investment inf/o1s and emp/oyment opportunities

in te .ab/e. $t is

seen in te tab/e tat Servi-es Se-tor attra-t igest investment inf/o1s, fo//o1ed by

-emi-a/ sub-se-tor. .e /o1est investment inf/o1s are seen in Printing, Pub/ising and

Pa-!aging Se-tor. $n -ase of emp/oyment opportunities, .e2ti/e Se-tor so1s te igest

number of emp/oyees, fo//o1ed by agro-based Se-tor and te /o1est number of

emp/oyees is seen in Printing, Pub/ising and Pa-!aging Se-tor. .ere is no -onsisten-y

bet1een investment and number of emp/oyments. .is migt be appened be-ause of

-apita/ intensive and /abor intensive pro<e-ts.

$

.e figure-) so1s (&&8foreign investment in different se-tor. .e servi-e se-tor

investment a/one ;*.(&8 and investment in -emi-a/ se--tor is )*.'(8. .e /o1est

investment in Printing pub/ising and pa-!aging is a--ounted on/y &.&'8 of tota/

investment.

.e 3D$ investment f/o1s ave -ome from many -ountries. .e 3D$ inf/o1s -oming

from top ten -ountries are presented in .ab/e :@

.ab/e : presents te investment inf/o1s, number of units and emp/oyment opportunities

of ten top investing -ountries. .ere are f/u-tuations in invested amount, emp/oyment

opportunities and number of units in te -ountries. .e .ab/e -/arifies tat tere is no

-orre/ation bet1een amount invested and emp/oyment opportunities. .is may be

appened be-ause of te -apita/ intensive and /abor intensive natures of investment.

United ,rab Emirates invested te igest amount in ; nits, fo//o1ed by "ingdom of

Saudi ,rabia in : units 1i/e emp/oyment generation of United ,rab Emirates is ;,5('

and "ingdom of Saudi ,rabia is ),(5:. .e /o1est investment is seen for Cina, but

emp/oyment generation from te investment is ?&?(. .e igest emp/oyment generation

-omes from te investment of Sout "orea and te /o1est emp/oyment generation -omes

from te investment of Egypt.

.ab/e 5 presents te 3D$ inf/o1s and emp/oyment opportunities troug <oint venture

investments in +ang/ades. .ere are f/u-tuations in 3D$ inf/o1s and emp/oyment

opportunities over te years as seen in te .ab/e. .e igest investment inf/o1s are seen

in )&&*, fo//o1ed by CC?. .e /o1est investment inf/o1s are seen in (CC(. .e igest

emp/oyment opportunities are seen in )&&;, fo//o1ed by )&&?. .e /o1est emp/oyment

opportunities are seen in (CC(. re/ationsip bet1een invested amount and emp/oyment

opportunities is not -onsistent. .ere ay be te reasons of -apita/ intensive and /abor

intensive pro<e-ts

$

$

3oreign investors troug <oint venture pro<e-ts ave -ome from different -ountries. .e

top ten -ountries from 1ere investors ave -ome to +ang/ades are so1n in .ab/e ;.

$

.e igest 3D$ <oint venture investment as -ome from "ingdom of Saudi ,rabia,

fo//o1ed by #or1ay. e /o1est 3D$ <oint venture investment as -ome from te United

,rab Emirates. $n terms of emp/oyment opportunities United "ingdom as so1n te

igest investment opportunities and /o1est emp/oyment opportunities are seen for te

"ingdom of Saudi ,rabia. e a-tua/ 3D$ investment inf/o1s ave not been e4ua/ to

registered 3D$ investment inf/o1s as presented ear/ier. .e year-1ise a-tua/ 3D$ inf/o1s

into +ang/ades during (CC;-)&&C are presented in .ab/e ?@

.ab/e ? so1s te igest a-tua/ 3D$ inf/o1s into +ang/ades in )&&* fo//o1ed by te

year )&&; and te /o1est a-tua/ 3D$ investment inf/o1s are seen (CC; fo//o1ed by te

year (CCC. .e igest 3D$ inf/o1s n terms of fi2ed -apita/ formation is seen in te year

(CC? fo//o1ed by te year (CC*. .e /o1est 3D$ inf/o1s in terms of fi2ed -apita/

formation are seen in te year (CC; and )&&' fo//o1ed by te year (CCC.

.e tab/e as not so1n te -onsistent a-tua/ 3D$ inf/o1s into +ang/ades. .is migt be

appened e-ause of po/iti-a/ instabi/ity of te -ountry, inade4uate infrastru-ture fa-i/ities,

redtapism, inade4uate fis-a/ and finan-ia/ in-entives to1ards foreign investors and non-

resident +ang/adesi investors et-. among te fa-tors, po/iti-a/ instabi/ity and inade4uate

infrastru-ture fa-i/ities are -onsidered to be dominant. .e a-tua/ investment in terms of

registered investment is not satisfa-tory. .e registered 3D$ investment inf/o1s and

a-tua/ 3D$ investment inf/o1s into +ang/ades are resented in .ab/e *@

$

$

Con-u&!ng Rema"8(

.e study dea/s 1it te nature of e-onomy of +ang/ades. Kevie1 of te re/ated

/iterature points out tat e-onomi- deve/opment of a -ountry /i!e +ang/ades by and

/arge depends upon 3D$ inf/o1s into +ang/ades. .o attra-t more 3D$, te 7overnment

of te Peop/eIs Kepub/i- of +ang/ades as offered many in-entives for foreign

investors. Sti//, it is seen in te study tat a-tua/ 3D$ investment as been remain at very

insignifi-ant /eve/ -ompared to fi2ed -apita/ formation and registered 3D$ investment

proposa/. 3or better 3D$ investment f/o1s, te study as out/ined te fo//o1ing possib/e

suggestions@

5i6 $n addition to te in-entives offered to attra-t 3D$ inf/o1s, te 7overnment of

+ang/ades is to ensure po/iti-a/ stabi/ity of te -ountry. .e investors need to !eep

teir investment se-ured 1itout fa-ing any prob/em. .oug tere are many agreements

bet1een +ang/ades and oter -ountries, it 1i// not bring positive resu/ts unti/, te

7overnment and opposition po/iti-a/ parties 1or! a/togeter.

5ii6 $n order to find out /oopo/es of our 3D$ po/i-ies, te 7overnment sou/d -ompare

our 3D$ po/i-ies 1it te 3D$ po/i-ies of su--essfu/ -ountries

Refe"en-e(

(. .e Hor/d +an! 5(CC;6, World Debt Tables: !ternal "inance for Developing

Countries, Jo/.(, Hasington, D.C., US,

). 7ray, S.A. 5et a/, )&&(6, Go'a A--ount!ng an& Cont"o: A manage"!a

Em#1a(!(+ Aon Hi/ey and sons, $n-,, #e1 Lor!, p. (.

'. +ende #obende, ,. 5et a/, )&&)6, "oreign Direct #nvestment in ast Asia: Trend and

Developments, A(!a Pa-!f!- :ou"na of E-onom!-( an& ,u(!ne((, Jo/. ;5(6 , pp.:-)5.

:. 3ind/ay, K. 5(C?*6, $elative %ac&'ardness, Direct "oreign #nvestment and the

Transfer of Technolog(: A )imple D(namic *odel, ;ua"te"% :ou"na of E-onom!-(,

Jo/. C),pp. (-(;.

5. Caves, K. E.5(CC;6, Mu/tinationa/ Enterprise and E-onomi- ,na/ysis, )nd ed.,

Cambridge University Press, Cambridge.

$

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Challenges For Financial Managers in A Changing Economic EnvironmentDocument7 pagesChallenges For Financial Managers in A Changing Economic EnvironmentFaria MehboobNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)vikash kumarNo ratings yet

- Auditing Principles and Practices II Assignment AnswerDocument6 pagesAuditing Principles and Practices II Assignment Answerbona birra67% (3)

- Too Big To FailDocument3 pagesToo Big To FailРинат ДавлеевNo ratings yet

- EXAMDocument13 pagesEXAMJess SiazonNo ratings yet

- Amit Kumar Share KhanDocument77 pagesAmit Kumar Share KhanRohit GanjooNo ratings yet

- What Is Net Present Value?Document3 pagesWhat Is Net Present Value?Louina YnciertoNo ratings yet

- Legal Aspect of Banker Customer RelationshipDocument26 pagesLegal Aspect of Banker Customer RelationshipPranjal Srivastava100% (10)

- Company Law NotesDocument125 pagesCompany Law NotesSaaksshi SinghNo ratings yet

- 1 - 2406090143Faz-Transfer-Proof - ENDocument1 page1 - 2406090143Faz-Transfer-Proof - ENMarco AndreéNo ratings yet

- Credit Recovery ManagementDocument75 pagesCredit Recovery ManagementSudeep Chinnabathini75% (4)

- 12 Month Cash FlowDocument3 pages12 Month Cash FlowDarkchild HeavensNo ratings yet

- Executed Michigan SB 248, 2011 PA 142 (Sept. 20, 2011)Document6 pagesExecuted Michigan SB 248, 2011 PA 142 (Sept. 20, 2011)Paul MastersNo ratings yet

- Finance Research Paper Topics ListDocument5 pagesFinance Research Paper Topics Listfzgzygnp100% (1)

- Smooth Drive TyresDocument13 pagesSmooth Drive TyresRavi Kumar MahatoNo ratings yet

- Carpentry Pro Plan v1664134062229Document30 pagesCarpentry Pro Plan v1664134062229jweremaNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 March 26Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 March 26Australian Property ForumNo ratings yet

- Performance Appraisal in BanksDocument54 pagesPerformance Appraisal in BanksParag More100% (1)

- CGS Dumanjug 1119-002Document1 pageCGS Dumanjug 1119-002Jona Jane VerdidaNo ratings yet

- 2.2 IjarahDocument24 pages2.2 IjarahMuhammad AbdullahNo ratings yet

- Case Study ON State Bank of India: VRS StoryDocument9 pagesCase Study ON State Bank of India: VRS StoryKapil SoniNo ratings yet

- Of Trading: The Psychology of Trading. 7 or 8 of Every 10 OperationsDocument4 pagesOf Trading: The Psychology of Trading. 7 or 8 of Every 10 OperationsjoseluisvazquezNo ratings yet

- ch1 - InvestmentDocument38 pagesch1 - InvestmenthussamNo ratings yet

- 1st Quarter AccountingDocument29 pages1st Quarter AccountingAlfred Lawrence HonralesNo ratings yet

- Budget Classificatio N: Addis AbabaDocument2 pagesBudget Classificatio N: Addis Ababaembiale ayaluNo ratings yet

- Verano 2022 Q2 SEC FilingDocument64 pagesVerano 2022 Q2 SEC FilingTony LangeNo ratings yet

- ABE Level 5 Diploma in Business ManagementDocument3 pagesABE Level 5 Diploma in Business ManagementS.L.L.CNo ratings yet

- FM CH02Document94 pagesFM CH02nitu mdNo ratings yet

- A6 DR 4 G QQ Kbu QaaeDocument4 pagesA6 DR 4 G QQ Kbu QaaeKiran KumarNo ratings yet

- IRDA Agent Exam Sample Paper 1Document12 pagesIRDA Agent Exam Sample Paper 1Awdhesh SoniNo ratings yet