Professional Documents

Culture Documents

Trade Finance Guide2007ch1

Trade Finance Guide2007ch1

Uploaded by

Jitendra Raghuwanshi0 ratings0% found this document useful (0 votes)

23 views2 pagesinternational trade finance guide

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentinternational trade finance guide

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

23 views2 pagesTrade Finance Guide2007ch1

Trade Finance Guide2007ch1

Uploaded by

Jitendra Raghuwanshiinternational trade finance guide

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

3

TRADE FINANCE GUIDE

Chapter 1

Methods of Payment in

International Trade

T

o succeed in todays global marketplace, exporters must offer their customers attrac-

tive sales terms supported by the appropriate payment method to win sales against

foreign competitors. As getting paid in full and on time is the primary goal for each

export sale, an appropriate payment method must be chosen carefully to minimize the

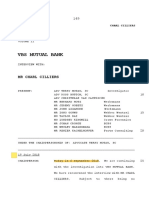

payment risk while also accommodating the needs of the buyer. As shown below, there are

four primary methods of payment for international transactions. During or before contract

negotiations, it is advisable to consider which method in the diagram below is mutually

desirable for you and your customer.

Key Points

International trade presents a spectrum of risk, causing uncertainty over the timing

of payments between the exporter (seller) and importer (foreign buyer).

To exporters, any sale is a gift until payment is received.

Therefore, the exporter wants payment as soon as possible, preferably as soon as an

order is placed or before the goods are sent to the importer.

To importers, any payment is a donation until the goods are received.

Therefore, the importer wants to receive the goods as soon as possible, but to delay

payment as long as possible, preferably until after the goods are resold to generate

enough income to make payment to the exporter.

Least

Secure

Most

Secure

Exporter

Importer

Documentary

Collections

Documentary

Collections

Cash-in-Advance

Cash-in-Advance

Letters of Credit

Letters of Credit

Open Account

Open Account

PAYMENT RISK DIAGRAM

4

U. S. Department of Commerce

International Trade Administration

Cash-in-Advance

With this payment method, the exporter can avoid credit risk, since payment is received

prior to the transfer of ownership of the goods. Wire transfers and credit cards are the most

commonly used cash-in-advance options available to exporters. However, requiring

payment in advance is the least attractive option for the buyer, as this method creates cash

flow problems. Foreign buyers are also concerned that the goods may not be sent if pay-

ment is made in advance. Thus, exporters that insist on this method of payment as their

sole method of doing business may find themselves losing out to competitors who may be

willing to offer more attractive payment terms.

Letters of Credit

Letters of credit (LCs) are among the most secure instruments available to international

traders. An LC is a commitment by a bank on behalf of the buyer that payment will be

made to the exporter provided that the terms and conditions have been met, as verified

through the presentation of all required documents. The buyer pays its bank to render this

service. An LC is useful when reliable credit information about a foreign buyer is difficult

to obtain, but you are satisfied with the creditworthiness of your buyers foreign bank. An

LC also protects the buyer since no payment obligation arises until the goods have been

shipped or delivered as promised.

Documentary Collections

A documentary collection is a transaction whereby the exporter entrusts the collection of

a payment to the remitting bank (exporters bank), which sends documents to a collecting

bank (importers bank), along with instructions for payment. Funds are received from

the importer and remitted to the exporter through the banks involved in the collection in

exchange for those documents. Documentary collections involve the use of a draft that

requires the importer to pay the face amount either on sight (document against payment

D/P) or on a specified date in the future (document against acceptanceD/A). The draft

lists instructions that specify the documents required for the transfer of title to the goods.

Although banks do act as facilitators for their clients under collections, documentary

collections offer no verification process and limited recourse in the event of nonpayment.

Drafts are generally less expensive than letters of credit.

Open Account

An open account transaction means that the goods are shipped and delivered before pay-

ment is due, usually in 30 to 90 days. Obviously, this is the most advantageous option to

the importer in cash flow and cost terms, but it is consequently the highest risk option for

an exporter. Due to the intense competition for export markets, foreign buyers often press

exporters for open account terms since the extension of credit by the seller to the buyer is

more common abroad. Therefore, exporters who are reluctant to extend credit may face the

possibility of the loss of the sale to their competitors. However, with the use of one or more

of the appropriate trade finance techniques, such as export credit insurance, the exporter

can offer open competitive account terms in the global market while substantially mitigat-

ing the risk of nonpayment by the foreign buyer.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Admission Letter ATUDocument1 pageAdmission Letter ATUIsaac Clarity MensahNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Premium Paid Certificate For The Year 2022-2023Document1 pagePremium Paid Certificate For The Year 2022-2023yogesh bafnaNo ratings yet

- Bulk Mro Industrial Supply Private Limited: Detailed ReportDocument10 pagesBulk Mro Industrial Supply Private Limited: Detailed ReportAnishNo ratings yet

- Finance 1 Modules 3-6Document58 pagesFinance 1 Modules 3-6MTECH ASIANo ratings yet

- Quiz 2nd YearDocument4 pagesQuiz 2nd YearJeryco Quijano BrionesNo ratings yet

- Mutual Fund PPT 123Document53 pagesMutual Fund PPT 123Sneha SinghNo ratings yet

- Challan Canara Bank Pro ClerksDocument1 pageChallan Canara Bank Pro ClerksRuthvik ReddyNo ratings yet

- Supri Se Test P3-1A (Masasi Company) : Submitted ToDocument6 pagesSupri Se Test P3-1A (Masasi Company) : Submitted ToMD RafianNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/21 October/November 2022Document17 pagesCambridge International AS & A Level: Accounting 9706/21 October/November 2022damiangoromonziiNo ratings yet

- Igcse Accounting Control Accounts - Questions AnswersDocument24 pagesIgcse Accounting Control Accounts - Questions AnswersOmar WaheedNo ratings yet

- Risk Sharing: Sylvain Botteron, Luca Gallo, Céline Gonçalves Madeira, Shthursha KathiraveluDocument26 pagesRisk Sharing: Sylvain Botteron, Luca Gallo, Céline Gonçalves Madeira, Shthursha Kathiraveludavid AbotsitseNo ratings yet

- Project Appraisal ExamDocument4 pagesProject Appraisal ExamVasco CardosoNo ratings yet

- GE1202 Managing Your Personal Finance: InsuranceDocument41 pagesGE1202 Managing Your Personal Finance: InsuranceAiden LANNo ratings yet

- Transcription - Charl Cilliers (06.09.18)Document86 pagesTranscription - Charl Cilliers (06.09.18)Leila DouganNo ratings yet

- Accounting For Franchise ContractsDocument7 pagesAccounting For Franchise ContractsRoi Martin A. De VeyraNo ratings yet

- NonArcaETFs ETNs090808Document5 pagesNonArcaETFs ETNs090808mgarrett00No ratings yet

- The Construction Industry Is Divided Into Two SectorsDocument12 pagesThe Construction Industry Is Divided Into Two SectorsJoseph FranciscoNo ratings yet

- REPORTING AND ANALYZING Cash FlowsDocument39 pagesREPORTING AND ANALYZING Cash FlowsmarieieiemNo ratings yet

- 179-Article Text-1014-1-10-20210725Document15 pages179-Article Text-1014-1-10-20210725Eka TriwulandariNo ratings yet

- AEC MANUAL Class NotesDocument65 pagesAEC MANUAL Class NotesManimegalai.VNo ratings yet

- Ais255 Case StudyDocument4 pagesAis255 Case StudyNoor SyazaniNo ratings yet

- Credit Management For CooperativesDocument141 pagesCredit Management For CooperativesAndres Lorenzo III75% (16)

- Engineering Economics NotesDocument84 pagesEngineering Economics NotesJay Mark CayonteNo ratings yet

- The Differences Between Islamic Banking and Conventional BankingDocument26 pagesThe Differences Between Islamic Banking and Conventional Bankingmohd_azrul_5100% (1)

- AnnexDocument10 pagesAnnexapi-3810664No ratings yet

- Philippine Deposit Insurance Corporation (Pdic) : FM103 (Banking and Financial Institutions)Document4 pagesPhilippine Deposit Insurance Corporation (Pdic) : FM103 (Banking and Financial Institutions)Mariel Crista Celda Maravillosa100% (1)

- Decoled FR Sas: Account MovementsDocument1 pageDecoled FR Sas: Account Movementsnatali vasylNo ratings yet

- Smartprotect Legacy Max BrochureDocument10 pagesSmartprotect Legacy Max BrochureSuthasiri DineshNo ratings yet

- UntitledDocument9 pagesUntitledapi-213954485No ratings yet

- Difference Between Profitability Vs LiquidityDocument5 pagesDifference Between Profitability Vs LiquidityAbdul KhanNo ratings yet