Professional Documents

Culture Documents

Fom Mba SCM Porsche Ag Stark

Fom Mba SCM Porsche Ag Stark

Uploaded by

Lars StarkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fom Mba SCM Porsche Ag Stark

Fom Mba SCM Porsche Ag Stark

Uploaded by

Lars StarkCopyright:

Available Formats

1.

Introduction 1

2. Company Profile 3

3. Macro Environment 6

4. Micro Environment 11

5. Internal Environment 22

6. SWOT Analysis 32

7. Porters Generic Strategy 35

8. Ansoffs Growth Strategy 37

9. Strategic Options Evaluation 40

10. Outlook & Recommendations 42

1

1931 1951 1963 1972 1994 2002 2009 2012

Porsche

was founded

Ferdinand

Porsches

death

911

introduction

Porsche AG

most profitable

automotive company

worldwide

SUV

Cayenne

VW as

Porsche shareholder

100%

takeover

by VW

2

3

4

5

6

7

Shift to

Growth

Markets

Modularization

of automotive

platforms

Embedded

electronic task

systems

Low-cost small

cars

Increasing

electrification

of powertrains

8

Stability in Germany

Instability in North Africa and Middle East

Protectionism

Political

Germany as strong exporter

Low GDP growth expectations in Europe

Economic

Aging population in industrialized countries

Democratization of premium goods

Strong demand for luxury vehicles due to social status attraction

Social

E-Mobility development

Low-cost automobiles trend

Technological

Stronger emission limits

Increasing customer awareness of environmental needs

Environmental

Favorable tax system in Germany

Comprehensible judicial system in Germany

Legal

9

10

11

12

Passenger Cars 2010

Change

10/09 in % 2011

Change

11/10 in % 2012

Change

12/12 in %

Europe 16,491,307 -0.7% 17,159,553 4.1% 16,187,240 -5.7%

Europe (EU 27 countries + EFTA) 13,792,051 -4.8% 13,601,051 -1.4% 12,537,514 -7.8%

Westeurope (EU 15 countries + EFTA) 12,984,549 -5.0% 12,815,435 -1.3% 11,773,266 -8.1%

New EU-countries (EU 10 countries) 807,502 -1.3% 785,616 -2.7% 764,248 -2.7%

Germany 2,916,259 -23.4% 3,173,634 8.8% 3,082,504 -2.9%

Russia 1,912,794 30.5% 2,653,688 38.7% 2,755,384 3.8%

USA 5,635,432 4.3% 6,089,403 8.1% 7,241,900 18.9%

Japan 4,203,181 7.6% 3,509,036 -16.5% 4,572,333 30.3%

Brazil 2,644,706 6.9% 2,647,250 0.1% 2,851,540 7.7%

India 2,387,197 31.4% 2,510,313 5.2% 2,773,516 10.5%

China 13,757,794 33.2% 14,472,416 5.2% 15,495,240 7.1%

13

Competitive

Rivalry

T

h

r

e

a

t

o

f

N

e

w

E

n

t

r

y

Buyer Power

T

h

r

e

a

t

o

f

S

u

b

s

t

i

t

u

i

o

n

Supplier

Power

Threat of New Entry LOW

High capital requirements

Strong brand loyalty

High industry uncertainty

Competitive Rivalry HIGH

Many competitors

Low switching costs

High profits intensifies competition

Buyer Power LOW

Highly differentiated premium cars

Strong brand names

Low price sensitivity

Supplier Power MEDIUM

Mutual dependence

Threat of Substitution LOW

Strong quality of premium cars

Not many equal substitute products

14

15

P

r

e

m

i

u

m

P

r

i

c

e

Brand Strength

L

o

w

H

i

g

h

Weak Strong

Group 2

Audi

Jaguar Land Rover

Aston Martin

Group 1

Porsche

BMW

Daimler

Rolls-Royce

Group 3

Lamborghini

Ferrari

Group 4

Maserati

16

O

f

f

e

r

R

a

n

g

e

Quality

N

a

r

r

o

w

W

i

d

e

Low High

Group 1

BMW

Daimler

Group 2

Audi

Group 3

Aston Martin

Jaguar Land Rover

Porsche

Group 4

Ferrari

Maserati

Bentley

Rolls-Royce

Group 5

Tesla

Lamborghini

17

Strength Measure

Importance

Weight

Strength

Rating

Weighted

Score

Strength

Rating

Weighted

Score

Strength

Rating

Weighted

Score

Strength

Rating

Weighted

Score

Strength

Rating

Weighted

Score

Strength

Rating

Weighted

Score

Strength

Rating

Weighted

Score

Quality / product performance 0.15 8 1.2 6 0.9 6 0.9 6 0.9 6 0.9 8 1.2 7 1.05

Reputation/image 0.15 7 1.05 6 0.9 8 1.2 7 1.05 6 0.9 8 1.2 7 1.05

Manufacturing capability 0.10 6 0.9 7 1.05 8 1.2 6 0.9 7 1.05 8 1.2 8 1.2

Technological skills 0.10 8 1.2 8 1.2 6 0.9 6 0.9 8 1.2 7 1.05 6 0.9

Dealer network / distribution

capability 0.05 7 1.05 8 1.2 7 1.05 7 1.05 7 1.05 7 1.05 6 0.9

New product innovation

capability 0.15 7 1.05 6 0.9 5 0.75 6 0.9 7 1.05 6 0.9 5 0.75

Financial resources 0.10 8 1.2 7 1.05 7 1.05 7 1.05 8 1.2 7 1.05 7 1.05

Relative cost position 0.15 8 1.2 6 0.9 6 0.9 5 0.75 7 1.05 6 0.9 6 0.9

Customer service capabilites 0.05 8 1.2 6 0.9 6 0.9 6 0.9 7 1.05 7 1.05 7 1.05

Sum of importance weights 1.00

Overall weighted competitive

strength rating

10.05 9 8.85 8.4 9.45 9.6 8.85

Jaguar Land Rover

Competitive Strength Assessment -

Porsche and competitors Porsche BMW Rolls-Royce Mercedes-Benz Audi Aston Martin

18

19

20

21

22

23

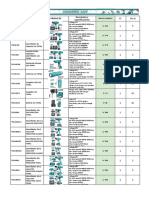

Model Type 1st Last PLC Stage

Boxster Roadster 1996 2012 Maturity

Cayman Coupe 2005 2013 Growth

911 Coupe / Cabriolet 1963 2013 Maturity

Panamera Gran Turismo 2009 2013 Growth

Cayenne SUV 2002 2013 Growth

Release

24

25

26

Porsche AG

Income Statement

million

Year 2012 2011 *2010

Revenue 13,865 10,928 3,867

Changes in inventories and own work capitalized 1,016 1,095 258

Total operating performance 14,881 12,023 4,125

Other operating income 537 657 263

Cost of materials -8,124 -6,822 -2,267

Personnel expenses -1,648 -1,349 -511

Amortization of intangible assets and

depreciation of property, plant and equipment and

leased assets -1,114 -871 -338

Other operating expenses -2,093 -1,593 -566

Profit before financial result 2,439 2,045 706

Finance costs -258 -323 -154

Other financial result 467 386 170

Financial result 209 63 16

Profit before tax 2,648 2,108 722

Income tax -808 -648 -218

Profit after tax 1,840 1,460 504

thereof profit attributable to non-controlling

interests 36 29 9

thereof profit attributable to shareholders 1,804 1,431 495

Profit transferred to Porsche Zwischenholding

GmbH -1,312 -871 -330

*Year 2010: August to December only considered

27

Porsche AG

Key Financial Ratios

million

Year 2012 2011 *2010

Liquidity Ratios

Current Ratio 0.69 0.73 0.59

Working Capital -2,142 -1,727 -2,474

Leverage Ratios

Debt-to-assets-ratio 0.66 0.68 0.67

Debt-to-equity ratio 1.94 2.09 1.99

Long-term debt-to-equity ratio 1.06 1.18 1.08

Profitability Ratios

Gross profit margin 45.4% 43.3% 45.0%

Operating profit margin 17.6% 18.7% 18.3%

Net profit margin 13.3% 13.4% 13.0%

Return on invested capital 11.6% 9.6% 3.6%

Activity Ratios

Days of inventory 55.67 56.23 134.28

Inventory turnover 6.56 6.49 2.72

Other important measures of financial

performance

Internal cash flow 2,954 2,331 842

*Year 2010: August to December only

considered - Income Statement und Cash Flow

28

Cars Sold

Model Variants 2012 2011 Chg. in %

141,075 118,868 18.7%

Boxster /

Cayman

4 11,825 12,753

25,457 19,377

Panamera 8 29,030 26,840

31.4%

8.2%

24.8%

-7.3%

Cayenne 8 74,763 59,898

911 12

29

30

2010 2011 2012

97,273

118,868

141,075

World

2010 2011 2012

37,509

43,748

49,639

Europe

2010 2011 2012

13,211

14,959

17,487

Germany

2010 2011 2012

27,357

34,350

41,060

America

2010 2011 2012

25,321

29,023

35,043

USA

2010 2011 2012

29,838

40,770

50,376

Asia-Pacific

2010 2011 2012

14,785

24,340

31,205

China

31

32

33

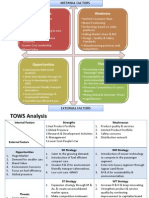

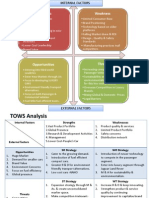

- strong premium car brand strength - narrow offer range

- high quality cars - low vertical range of manufacture

- strong market power with parent VW - weak liquidity position

- success and team-oriented culture

- flat organization

- outstanding revenues and profits

- superb innovation and design expertise

- strong value added services

- long-term strategy

- strong collaborations

- cost-efficient and flexible production

- modularization of automotive platforms - shift of development and production to growth markets

- increasing demand for e-mobility - increasing demand for low-cost small cars

- mobility concepts for elder people - political instability and protectionism worldwide

- strong demand from BRIC countries - low GDP growth rates worldwide

- rising buyer demand for SUV - changes to the current tax system

- expansion of sportive cars demand - intense competition

- increase in bargaining power of suppliers

- rising raw material prices

- disruptive e-technology developments

- dilution of Porsche brand image

34

35

36

37

38

39

40

41

Evaluation Criteria

Strategic Options

- - - - - - - -

++ ++ ++ ++

+++ +++ +++ +++

+/- +/- + +

+ + +/- +

+/- +/- +/- +/-

+ +/- +/- +

++++ ++++ ++++ ++++

Result

Market development

Diversification

M&A

Alliances

Market penetration III

Internal development I

Suitability Feasibility Acceptability

Consolidation

Product development II

42

43

LONG-TERM

SUCCESS

44

You might also like

- Nike, Inc.: MHE-FTR-060Document16 pagesNike, Inc.: MHE-FTR-060Urooj AdamjeeNo ratings yet

- Tata Motors SWOT TOWS CPM MatrixDocument6 pagesTata Motors SWOT TOWS CPM MatrixPreetam Pandey33% (3)

- Mobileye - The Future of Driverless CarsDocument6 pagesMobileye - The Future of Driverless CarspranjalNo ratings yet

- IBM Stock ValuationDocument23 pagesIBM Stock ValuationZ_BajgiranNo ratings yet

- Customer Care at Etots ComDocument7 pagesCustomer Care at Etots ComTwinkle ChoudharyNo ratings yet

- Ford PresentationDocument47 pagesFord Presentationshagi25No ratings yet

- OPerations Pepsi MultanDocument33 pagesOPerations Pepsi MultanAmmar HassanNo ratings yet

- PRECIOS CF STOCK TOTAL PERU 2021.xlsx - PRECIOSDocument36 pagesPRECIOS CF STOCK TOTAL PERU 2021.xlsx - PRECIOSMashtu94100% (1)

- Porsche Cars: Facts Everyone Should Know About Porsche 64, Porsche 914 and MoreFrom EverandPorsche Cars: Facts Everyone Should Know About Porsche 64, Porsche 914 and MoreNo ratings yet

- SCOTTDocument20 pagesSCOTTOliviaNo ratings yet

- Apple SWOTDocument39 pagesApple SWOTyopNo ratings yet

- Caso BMGT IndustriesDocument3 pagesCaso BMGT IndustriesJean Marcos Cueva SanchezNo ratings yet

- Concept Generation: Teaching Materials To AccompanyDocument26 pagesConcept Generation: Teaching Materials To AccompanyAshok DargarNo ratings yet

- Article Takeaways Etsy, Airbnb and UberDocument2 pagesArticle Takeaways Etsy, Airbnb and UberManan IFtikharNo ratings yet

- Case Preparation Chart - Making Stickk StickDocument2 pagesCase Preparation Chart - Making Stickk StickSIMRANNo ratings yet

- HBS Select Case Studies Title ListDocument141 pagesHBS Select Case Studies Title ListBayu Aji Prasetyo100% (2)

- Submitted By: Navjot Singh (Roll No.: 25)Document9 pagesSubmitted By: Navjot Singh (Roll No.: 25)Er Navjot SinghNo ratings yet

- Microsoft Dynamics CRM Online A Complete Guide - 2021 EditionFrom EverandMicrosoft Dynamics CRM Online A Complete Guide - 2021 EditionNo ratings yet

- The O. M. Scott & Sons CompanyDocument4 pagesThe O. M. Scott & Sons Companycarolina120209100% (1)

- Ceo Excellence Dewar en 45415Document6 pagesCeo Excellence Dewar en 45415Ambienta GraduacionesNo ratings yet

- APPLE Case SolutionDocument11 pagesAPPLE Case SolutionsamgoshNo ratings yet

- Renault Nissan PerspectiveDocument11 pagesRenault Nissan PerspectivestaceychoiNo ratings yet

- Consumer Behavior Final Project - 062711Document47 pagesConsumer Behavior Final Project - 062711Victor J ChowNo ratings yet

- Team Maxxim VW Marketing StrategyDocument36 pagesTeam Maxxim VW Marketing StrategyShaiksha SyedNo ratings yet

- European Autos & Parts 2009 Q4 BarclaysDocument181 pagesEuropean Autos & Parts 2009 Q4 BarclaysAlphatrackerNo ratings yet

- Informe VW 2013Document0 pagesInforme VW 2013pedro_mentado7No ratings yet

- Hamill Bassue Owen Hendershot Goran NagradicDocument47 pagesHamill Bassue Owen Hendershot Goran NagradicIrfan SaleemNo ratings yet

- Daimler Annual Report 2012Document280 pagesDaimler Annual Report 2012manojkumar024No ratings yet

- Standalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaDocument126 pagesStandalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaGourav VermaNo ratings yet

- Book - Automotive Technology RoadmapDocument458 pagesBook - Automotive Technology RoadmapSunil Deshpande100% (1)

- One FordDocument47 pagesOne FordDin Aziz100% (1)

- Ford PresentationDocument47 pagesFord PresentationSam Khan KhattakNo ratings yet

- BMW Annual Report 2013Document208 pagesBMW Annual Report 2013api-253150011No ratings yet

- Prof. Dr. VahlandDocument31 pagesProf. Dr. VahlandRenê PinheiroNo ratings yet

- Strategic Management Presentation On VW FINALDocument32 pagesStrategic Management Presentation On VW FINALSoham SahaNo ratings yet

- Daimler 2011 Annual ReportDocument258 pagesDaimler 2011 Annual ReportPoom JohnNo ratings yet

- Volkswagen AR2013Document324 pagesVolkswagen AR2013cherikokNo ratings yet

- Ar Tatamotors 2009 2010 18082010121500Document121 pagesAr Tatamotors 2009 2010 18082010121500sonalsinghiNo ratings yet

- 2 Plan Estrategico PeugeotDocument25 pages2 Plan Estrategico PeugeotOsmar LindoNo ratings yet

- Europe Automotive Exhaust System Industry 2015 Market Research ReportDocument7 pagesEurope Automotive Exhaust System Industry 2015 Market Research Reportapi-282708578No ratings yet

- Global Automobile Industry: T.Pandu Ranga Rao Y9IB20030Document11 pagesGlobal Automobile Industry: T.Pandu Ranga Rao Y9IB20030Pandu TiruveedhulaNo ratings yet

- Annual Report 2011Document258 pagesAnnual Report 2011Luai RabahNo ratings yet

- Skoda Auto Case StudyDocument19 pagesSkoda Auto Case StudyFathi Salem Mohammed Abdullah100% (6)

- Tata Motors Swot TowSDocument6 pagesTata Motors Swot TowSVinayGolchhaNo ratings yet

- BMW Group Annual Report 2011Document282 pagesBMW Group Annual Report 2011Harrie TholenNo ratings yet

- Skoda AutoDocument36 pagesSkoda Auto613450% (2)

- Autoforum Oct 2011 LRDocument64 pagesAutoforum Oct 2011 LRtekbir1981No ratings yet

- Experience DriversityDocument140 pagesExperience DriversitySilviu TrebuianNo ratings yet

- Independreportfutureautoinduk 2008Document122 pagesIndependreportfutureautoinduk 2008bambino707No ratings yet

- Ford PresentationDocument47 pagesFord PresentationDIEGONo ratings yet

- StratGroupPres Ford CompanyDocument13 pagesStratGroupPres Ford CompanyLornaPeñaNo ratings yet

- Skoda Auto CaseStudyDocument18 pagesSkoda Auto CaseStudyAsif AliNo ratings yet

- Global Automotive Seat Cover Industry Report 2015Document7 pagesGlobal Automotive Seat Cover Industry Report 2015api-282708578No ratings yet

- Volkswagen AR2014Document504 pagesVolkswagen AR2014cherikokNo ratings yet

- TI India - PPT - Oct 12Document60 pagesTI India - PPT - Oct 12vishmittNo ratings yet

- A8 Strategic Memo PresentationDocument26 pagesA8 Strategic Memo PresentationSandeep RajuNo ratings yet

- Global Automotive Ground Strap Industry Report 2015Document7 pagesGlobal Automotive Ground Strap Industry Report 2015api-282708578No ratings yet

- Global Automotive Blade Fuse Industry Report 2015Document7 pagesGlobal Automotive Blade Fuse Industry Report 2015api-282708578No ratings yet

- Strategic Analysis Pak Suzuki MotorsDocument27 pagesStrategic Analysis Pak Suzuki Motorsnasirenam0% (1)

- Ford Case AnalysisDocument16 pagesFord Case AnalysisRUPANTAR SAMANTA 122023601047No ratings yet

- Ford Case AnalysisDocument16 pagesFord Case AnalysisRUPANTAR SAMANTA 122023601047No ratings yet

- Engineering Economy Lecture Notes 1Document4 pagesEngineering Economy Lecture Notes 1warlockeNo ratings yet

- API CAN DS2 en Excel v2 2254420Document453 pagesAPI CAN DS2 en Excel v2 2254420Abdul wahabNo ratings yet

- HRM401 Compensation and BenefitsDocument2 pagesHRM401 Compensation and BenefitsM R AlamNo ratings yet

- Finance Act 2011Document19 pagesFinance Act 2011Andrey PavlovskiyNo ratings yet

- Caro 2004Document5 pagesCaro 2004Aswathy JejuNo ratings yet

- Livestock LRRD 2014 SR - Ismat - Alam PDFDocument27 pagesLivestock LRRD 2014 SR - Ismat - Alam PDFPranoy ChakrabortyNo ratings yet

- FS 1Document19 pagesFS 1Christian Jay SelehenciaNo ratings yet

- Day 1 v. Transport Strategy 5.6.Document29 pagesDay 1 v. Transport Strategy 5.6.Boris PrelčecNo ratings yet

- Data TechDocument34 pagesData TechPartha ChakaravartiNo ratings yet

- LogisticsDocument18 pagesLogisticsharshilNo ratings yet

- Gri 102 General Disclosures 2016Document44 pagesGri 102 General Disclosures 2016Pablo MalgesiniNo ratings yet

- WAABERI ACADEMY (AutoRecovered)Document31 pagesWAABERI ACADEMY (AutoRecovered)yaxyesahal123No ratings yet

- Export Import Policy of India (Group No.1)Document30 pagesExport Import Policy of India (Group No.1)Pranav ChandraNo ratings yet

- Dwnload Full Contemporary Financial Management 10th Edition Moyer Solutions Manual PDFDocument35 pagesDwnload Full Contemporary Financial Management 10th Edition Moyer Solutions Manual PDFquachhaitpit100% (19)

- Porter'S Five Forces: Modern SCM201Document19 pagesPorter'S Five Forces: Modern SCM201Le Hong Phuc (K17 HCM)No ratings yet

- Ifrs 10 Consolidated Financial Statements SnapshotDocument2 pagesIfrs 10 Consolidated Financial Statements SnapshotangaNo ratings yet

- Cini Project WorkDocument29 pagesCini Project WorkSanjay ChaturvediNo ratings yet

- Internal AuditorDocument1 pageInternal Auditorapi-291346174No ratings yet

- TATA STEEL's Acquisition of CORUSDocument9 pagesTATA STEEL's Acquisition of CORUSPallabi DowarahNo ratings yet

- Jurnal InternasionalDocument10 pagesJurnal InternasionalAmelia Wahyuni DewiNo ratings yet

- D2 Case Study V CDL Creating Value Through Sustainability PDFDocument9 pagesD2 Case Study V CDL Creating Value Through Sustainability PDFfredz.acctNo ratings yet

- Program-Manager - JD-12 01 2022Document4 pagesProgram-Manager - JD-12 01 2022Bishaka TuladharNo ratings yet

- Grade 7 Term 3 Business SchemesDocument4 pagesGrade 7 Term 3 Business Schemeswesley kipkoechNo ratings yet

- Mba Elective Strategic Sourcing Syllabus 2019Document8 pagesMba Elective Strategic Sourcing Syllabus 2019Dhanabal WiskillNo ratings yet

- Blockchain and FinTech - Lecture 1 Courses 2022Document75 pagesBlockchain and FinTech - Lecture 1 Courses 2022puhao yeNo ratings yet

- T4 May 2014 - For PublicationDocument28 pagesT4 May 2014 - For Publicationmagnetbox8No ratings yet

- London Library Annual Report 2010-2011Document36 pagesLondon Library Annual Report 2010-2011Fuzzy_Wood_PersonNo ratings yet

- Sridhar Peddisetty's Space - My Notes On PGMP ExamDocument78 pagesSridhar Peddisetty's Space - My Notes On PGMP ExamRashid Zaib100% (1)

- Business Economics Curriculum PDFDocument67 pagesBusiness Economics Curriculum PDFTushar KanodiaNo ratings yet