Professional Documents

Culture Documents

Who Are The Qualified Dependents Under BIR

Who Are The Qualified Dependents Under BIR

Uploaded by

gelskOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Who Are The Qualified Dependents Under BIR

Who Are The Qualified Dependents Under BIR

Uploaded by

gelskCopyright:

Available Formats

Who are the Qualified Dependents under BIR?

Not all dependents can claim to for additional 25,000 pesos additional exemption. That

is the why the term being used is QU!"#"$% %$&$N%$NT '("!% )Q%'*.

To +now more do read on.

The most common concern regarding this, that if one can claim his,her parents as their dependents or

their brother or sisters, cousins or any immediate relati-e that they say they support.

#urthermore, some also claim cases where they support their brother or sister who is mentally

incapacitated or physically unable to wor+ and needs support.

."/ states in RR 10-2008 "An individual whether single or married, shall be allowed an

additional exemption of 25,000 pesos for eah !"A#$%$&' '&(&)'&)* +,$#' -!'+.,

provided that the total number of dependents shall not exeed four -/. dependents0 *he

additional exemptions for !'+ shall be laimed b1 2)#3 2)& of the spouses in the ase of

married individuals0"

%$&$N%$NT '("!% means a legitimate, illegitimate or !$0!!1 %2&T$% '("!% chiefly dependent

upon and li-ing with the taxpayer if such dependent is not more than 23 years of age, unmarried and

not gainfully employed or if such dependent, regardless of age, is incapable of self4support because of

mental or physical defect. )Taken from RR 10-2010*

This pro-ision disallows our parents to be our dependents based on term 5QU!"#"$% %$&$N%$NT

'("!% or '("!%/$N )Q%'*5.

"f a person claims his brother or sister or relati-e as his,her dependent who is not o-er the age of 23

and is li-ing with them. They need to be !$0!!1 %2&T$%. 2therwise they cannot be 6ualified as

dependents per se.

#or those dependents regardless of age who is "N'&.!$ of 7$!# 7U&&2/T due to 8$NT! or

&(17"'! %$#$'T. These type of dependents can be 6ualified pro-ided one can show proof thru a

'$/T"#"$% 8$%"'! %2'U8$NT attesting to said 58$NT! or &(17"'! %$#$'T5.

%o understand that any claim of Q%' for additional exemptions will be ascertained by the employer

thru ."/ #orm 2905 which one will file with regards to this update of additional exemption.

You might also like

- Getting A Cusip NumberDocument2 pagesGetting A Cusip Numberjoerocketman95% (93)

- Arguments Marmalade.Document18 pagesArguments Marmalade.RISHANK TIWARINo ratings yet

- Guide 5525 - Basic Guide - Sponsor Your Spouse, Partner or Child-20161215-Flyabroad PDFDocument22 pagesGuide 5525 - Basic Guide - Sponsor Your Spouse, Partner or Child-20161215-Flyabroad PDFanchalNo ratings yet

- Guide 5289 - Spouse or Common-Law Partner in Canada ClassDocument58 pagesGuide 5289 - Spouse or Common-Law Partner in Canada ClassmalyajnarwaleyNo ratings yet

- Reviewer - MaDocument6 pagesReviewer - Magelsk50% (2)

- Minimis Principle), Defined by The JSIS in The General Implementing Provisions (GIP) As SpousesDocument4 pagesMinimis Principle), Defined by The JSIS in The General Implementing Provisions (GIP) As SpousesANTONIS TRIFYLLISNo ratings yet

- How The United States Immigration System WorksDocument10 pagesHow The United States Immigration System WorksMorenita ParelesNo ratings yet

- Assignment 2 Txcp2Document5 pagesAssignment 2 Txcp2Asm BurraqNo ratings yet

- Claiming DependentsDocument9 pagesClaiming DependentschloeiskingNo ratings yet

- Family Code Case DigestsDocument50 pagesFamily Code Case DigestsPigging EtchuzeraNo ratings yet

- Maintenance Under Hindu LawDocument9 pagesMaintenance Under Hindu LawAnurag Atulya100% (2)

- Comparison Among Void, Voidable and Legal SeparationDocument5 pagesComparison Among Void, Voidable and Legal SeparationStephanie ValentineNo ratings yet

- Application To The Human Rights Tribunal of Ontario Area of Discrimination: Goods, Services and Facilities (Form 1-C)Document5 pagesApplication To The Human Rights Tribunal of Ontario Area of Discrimination: Goods, Services and Facilities (Form 1-C)zaroabdulNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument11 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledKris BorlonganNo ratings yet

- The Philippine Adoption LawDocument11 pagesThe Philippine Adoption LawNielson Marcelino100% (1)

- How The United States Immigration System Works: I. Family-Based ImmigrationDocument10 pagesHow The United States Immigration System Works: I. Family-Based ImmigrationMatt StevensNo ratings yet

- ABD OverviewDocument12 pagesABD Overviewpennywizard19No ratings yet

- Basic Certification - Study Guide (For Tax Season 2017)Document6 pagesBasic Certification - Study Guide (For Tax Season 2017)Center for Economic ProgressNo ratings yet

- Social Security Survivors Benefits (En-05-10084, 2019)Document16 pagesSocial Security Survivors Benefits (En-05-10084, 2019)Jay JohnsonNo ratings yet

- Tax Saving Options Fy2012-2013Document5 pagesTax Saving Options Fy2012-2013vijay_786No ratings yet

- Basic Rules of Medicaid in Missouri August 2016Document7 pagesBasic Rules of Medicaid in Missouri August 2016api-329599807No ratings yet

- Family Act Factsheet ElderlyDocument4 pagesFamily Act Factsheet ElderlyZekel HealthcareNo ratings yet

- Aug06.2016.docsolon Wants Age Bracket of Taxpayers' Dependents Raised From 21 To 23 Years Old in Light of K To 12 CurriculumDocument2 pagesAug06.2016.docsolon Wants Age Bracket of Taxpayers' Dependents Raised From 21 To 23 Years Old in Light of K To 12 Curriculumpribhor2No ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthBenz DyNo ratings yet

- How The United States Immigration System Works 0Document11 pagesHow The United States Immigration System Works 0KarenNo ratings yet

- 3.272-Exclusions From IncomeDocument6 pages3.272-Exclusions From IncomePatriciaRichardsonNo ratings yet

- Suffolk Cognitive-Behavioral, PLLC Read Only, Do Not Remove From Office A Separate "HIPPA Signature Form" Is AttachedDocument4 pagesSuffolk Cognitive-Behavioral, PLLC Read Only, Do Not Remove From Office A Separate "HIPPA Signature Form" Is AttachedAnonymous Ax12P2srNo ratings yet

- DivorceDocument5 pagesDivorceAlthea SorianoNo ratings yet

- Reflective PaperDocument8 pagesReflective PapernajlovejonesNo ratings yet

- Newsletter January 2012Document5 pagesNewsletter January 2012frg_leaderNo ratings yet

- Section 8 HousingDocument40 pagesSection 8 HousingJon SmithNo ratings yet

- 2016 Virginia Academy of Elder Law AttorneysDocument16 pages2016 Virginia Academy of Elder Law AttorneysMichael DuntzNo ratings yet

- IS01 Service Pension OverviewDocument12 pagesIS01 Service Pension OverviewNige McIntoshNo ratings yet

- Healthcare ReformDocument11 pagesHealthcare Reformapi-250258901No ratings yet

- Personal Financial Statement: Personal Data On Your SpouseDocument3 pagesPersonal Financial Statement: Personal Data On Your Spousenomi_425No ratings yet

- Cruz16e Chap09 IMDocument10 pagesCruz16e Chap09 IMJosef Galileo SibalaNo ratings yet

- What Goes Into A TrustDocument3 pagesWhat Goes Into A TrustPaolo Hechanova100% (1)

- Rights and Responsibilities: Welcome To The Georgia Division of Family and Children Services!Document14 pagesRights and Responsibilities: Welcome To The Georgia Division of Family and Children Services!Jeniffer AraujoNo ratings yet

- L. I. L. L.: SecttonDocument10 pagesL. I. L. L.: SecttonKamogeloGavanistroNtsokoNo ratings yet

- Instructions For Completing Enrollment Application For Health BenefitsDocument5 pagesInstructions For Completing Enrollment Application For Health BenefitsDonna Mae RafolNo ratings yet

- Factsheet Wills For Parents of People With Intellectual DisabilityDocument9 pagesFactsheet Wills For Parents of People With Intellectual DisabilityIDRS_NSWNo ratings yet

- Am No 02 1 19 SC Commitment of Children PDFDocument6 pagesAm No 02 1 19 SC Commitment of Children PDFHaniyyah Ftm0% (1)

- Identify Desired Results (Stage 1) Content Standards: Title of Unit Grade Level Time Frame Developed byDocument8 pagesIdentify Desired Results (Stage 1) Content Standards: Title of Unit Grade Level Time Frame Developed bywestpoint1522No ratings yet

- Financial Exploitation of The Elderly and Disabled: Can Held Liable Financial Exploitation of The Elderly and Disabled: Can Held Liable? A Business Law Case Study Banks BeDocument5 pagesFinancial Exploitation of The Elderly and Disabled: Can Held Liable Financial Exploitation of The Elderly and Disabled: Can Held Liable? A Business Law Case Study Banks BeSonyAcerNo ratings yet

- Disini Sss Gsis Ecsif TableDocument11 pagesDisini Sss Gsis Ecsif TableHEROPROVIDONo ratings yet

- 19 International School Alliance v. QuisumbingDocument10 pages19 International School Alliance v. Quisumbinglenard5No ratings yet

- How To Save Income Tax Via Medical Expenditures Under Sections 80D, 80DD, 80DDB, 80UDocument3 pagesHow To Save Income Tax Via Medical Expenditures Under Sections 80D, 80DD, 80DDB, 80Uchaudhary.sunil22No ratings yet

- SECTION 1. Presidential Decree No. 1146, As Amended, Otherwise Known AsDocument29 pagesSECTION 1. Presidential Decree No. 1146, As Amended, Otherwise Known Asclaudette2014No ratings yet

- Defining "Family" For Studies of Health Insurance CoverageDocument6 pagesDefining "Family" For Studies of Health Insurance Coveragekirs0069No ratings yet

- Child Support GuidelinesDocument13 pagesChild Support GuidelinesThalia SandersNo ratings yet

- Sponsor Your Spouse, Common-Law Partner, Conjugal Partner or Dependent Child - Complete Guide (IMM 5289) - Canada - CaDocument1 pageSponsor Your Spouse, Common-Law Partner, Conjugal Partner or Dependent Child - Complete Guide (IMM 5289) - Canada - CaTheRefepNo ratings yet

- Info On TaxtermsDocument5 pagesInfo On TaxtermsChandramohan KadgiNo ratings yet

- Guide 3999 Cic CanadaDocument52 pagesGuide 3999 Cic CanadaLaura Brebeanu0% (1)

- Financial Focus Newsletter - Fall 2011 IssueDocument4 pagesFinancial Focus Newsletter - Fall 2011 IssueACA - Fee-only Financial PlannersNo ratings yet

- Sample Ap HF AgreementDocument4 pagesSample Ap HF Agreementapi-688699435No ratings yet

- RAO - Application FormDocument8 pagesRAO - Application Formgirlygirl10No ratings yet

- A - Checklist - of - Tasks - After - A - Death - of - A - Veteran - PDF Filename UTF-8''A Checklist of Tasks After A Death of A VeteranDocument4 pagesA - Checklist - of - Tasks - After - A - Death - of - A - Veteran - PDF Filename UTF-8''A Checklist of Tasks After A Death of A Veteransuasponte2No ratings yet

- Pennsylvania Hal A Chic Living WillDocument8 pagesPennsylvania Hal A Chic Living WillDaniel LambNo ratings yet

- Research Article Writing NihathDocument12 pagesResearch Article Writing Nihath6wxsb9tjnmNo ratings yet

- RMO No 19-2015Document10 pagesRMO No 19-2015gelskNo ratings yet

- RMO No. 6-2015 - FTDocument2 pagesRMO No. 6-2015 - FTgelskNo ratings yet

- RMC No 24-2015Document4 pagesRMC No 24-2015gelskNo ratings yet

- Revenue Regulations No. 12-2015: SECTION 8. TRANSITORY PROVISIONS. - in Order To Provide Ample Time inDocument1 pageRevenue Regulations No. 12-2015: SECTION 8. TRANSITORY PROVISIONS. - in Order To Provide Ample Time ingelskNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon CityDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon CitygelskNo ratings yet

- RMO 18-2015 Full TextDocument4 pagesRMO 18-2015 Full TextgelskNo ratings yet

- Approach To Patient With Diseases of The Kidney and Urinary Tract FINALDocument9 pagesApproach To Patient With Diseases of The Kidney and Urinary Tract FINALgelskNo ratings yet

- Bureau of Internal RevenueDocument5 pagesBureau of Internal RevenuegelskNo ratings yet

- Chapter 13 Capital BudgetingDocument60 pagesChapter 13 Capital BudgetinggelskNo ratings yet

- Johnstone 9e Auditing Chapter6 PPtFINALDocument89 pagesJohnstone 9e Auditing Chapter6 PPtFINALgelskNo ratings yet

- Franchisee TerritoriesDocument7 pagesFranchisee TerritoriesSsbangaloreNo ratings yet

- Nsic Scheme PDFDocument12 pagesNsic Scheme PDFVijayalakshmi SriramNo ratings yet

- Certification Course For Compliance OfficersDocument1 pageCertification Course For Compliance Officerssheshe gamiaoNo ratings yet

- CONSTI Underlined CasesDocument162 pagesCONSTI Underlined CasesTrishNo ratings yet

- Oracle Database 11g: Administration Workshop I: D50102GC20 Edition 2.0 September 2009 DXXXXDocument2 pagesOracle Database 11g: Administration Workshop I: D50102GC20 Edition 2.0 September 2009 DXXXXأميرة محمدNo ratings yet

- English Assignment 023Document3 pagesEnglish Assignment 023Himanshu ShahNo ratings yet

- PSBD Model QuestionsDocument14 pagesPSBD Model Questionssajid hussain100% (1)

- Financial Accounting IvDocument10 pagesFinancial Accounting Ivprajaktashete372No ratings yet

- Proforma of Self Declaration For ScribeDocument2 pagesProforma of Self Declaration For Scribevij2009No ratings yet

- Oca Vs PerelloDocument45 pagesOca Vs Perelloinsert nameNo ratings yet

- RPG Code For Corporate Governance and EthicsDocument19 pagesRPG Code For Corporate Governance and EthicsGodrej24 ProjectNo ratings yet

- Incidental Questions RevisitedDocument66 pagesIncidental Questions RevisitedSwati PandaNo ratings yet

- Mischief (Section 425 To Section 440 of The Indian Penal Code 1860)Document4 pagesMischief (Section 425 To Section 440 of The Indian Penal Code 1860)Rajeshwari MgNo ratings yet

- Skanska Employment Application FormDocument3 pagesSkanska Employment Application Formsujan dasNo ratings yet

- AshBritt Company InformationDocument50 pagesAshBritt Company InformationStephen White100% (1)

- bq1-mcq-2017 (1) Leave RuleDocument64 pagesbq1-mcq-2017 (1) Leave RuleamardeepNo ratings yet

- Proposed Code of Ethics and Professional Responsibility ofDocument16 pagesProposed Code of Ethics and Professional Responsibility ofRamirezNo ratings yet

- Sbs Motions in Civil Cases Opposition ReplyDocument3 pagesSbs Motions in Civil Cases Opposition ReplyGlad Barretto100% (1)

- Sher Shah Moot Problem AppellantsDocument25 pagesSher Shah Moot Problem AppellantsjahanwiNo ratings yet

- People v. Masterson: Shawn Holley LetterDocument2 pagesPeople v. Masterson: Shawn Holley LetterTony OrtegaNo ratings yet

- Piano Violin EpiphyllumDocument4 pagesPiano Violin EpiphyllumCamila KrukNo ratings yet

- GPR 430 EduLaw Course Outline 2022-2023Document6 pagesGPR 430 EduLaw Course Outline 2022-2023Joy kawiraNo ratings yet

- Significance Test - ExampleDocument3 pagesSignificance Test - ExampleMukesh KumarNo ratings yet

- Dimayuga v. Benedicto IIDocument16 pagesDimayuga v. Benedicto IIAlthea Angela GarciaNo ratings yet

- WWW - Mlmupc.gov - KH: The Khmer Version Is The Official Version of The Land LawDocument55 pagesWWW - Mlmupc.gov - KH: The Khmer Version Is The Official Version of The Land LawLong VichekaNo ratings yet

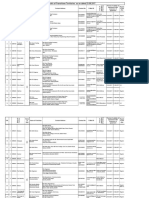

- Mario Lopez Company Voucher Register Voucher Payee Date Credits Accounts No. Date Paid Ck. No PayableDocument3 pagesMario Lopez Company Voucher Register Voucher Payee Date Credits Accounts No. Date Paid Ck. No PayableAnonnNo ratings yet

- AFFIDAVIT OF Aggregate LandholdingsDocument3 pagesAFFIDAVIT OF Aggregate LandholdingsBJ JavierNo ratings yet

- Chapter 1 and 2Document111 pagesChapter 1 and 2Fasiko AsmaroNo ratings yet

- 1 TOR - Vehicle Rental Jan Feb - 011224Document20 pages1 TOR - Vehicle Rental Jan Feb - 011224Marlon ViejoNo ratings yet