Professional Documents

Culture Documents

2014 Understanding Today's Home Buyer Webinar

2014 Understanding Today's Home Buyer Webinar

Uploaded by

C.A.R. Research & EconomicsCopyright:

Available Formats

You might also like

- Sample of Loan Agreement PhilippinesDocument2 pagesSample of Loan Agreement PhilippinesHannah Finuliar83% (71)

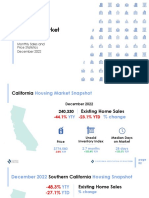

- 2024-05 Monthly Housing Market OutlookDocument57 pages2024-05 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2024-03 Monthly Housing Market OutlookDocument57 pages2024-03 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2023-11 Monthly Housing Market OutlookDocument57 pages2023-11 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- FREE Ebook My Home Is MineDocument24 pagesFREE Ebook My Home Is MineLater83% (6)

- 2023-05 Monthly Housing Market OutlookDocument57 pages2023-05 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2021-12 Monthly Housing Market OutlookDocument55 pages2021-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Airbnb 2018 PDFDocument8 pagesAirbnb 2018 PDFmoloko masemolaNo ratings yet

- 2022-12 Monthly Housing Market OutlookDocument58 pages2022-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2021 AHMS For Press Release (Fina Finall)Document41 pages2021 AHMS For Press Release (Fina Finall)C.A.R. Research & EconomicsNo ratings yet

- 2021-10 Monthly Housing Market OutlookDocument55 pages2021-10 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Cover Letter - Nguyen Thi Thuy VanDocument2 pagesCover Letter - Nguyen Thi Thuy VanthuyvanNo ratings yet

- Reservoir CouplingDocument39 pagesReservoir CouplingGigih Adi PambudiNo ratings yet

- Nielsen Global Video On DemandDocument20 pagesNielsen Global Video On DemandGiorgos Meleas100% (2)

- STA 2395 Notes PDFDocument56 pagesSTA 2395 Notes PDFsarvodaya123No ratings yet

- Chapter 6 - AnswerDocument4 pagesChapter 6 - Answerwynellamae75% (4)

- Ptit Focus 2015 - StatisticsDocument5 pagesPtit Focus 2015 - StatisticsThitikorn WassanarpheernphongNo ratings yet

- E D.2 HQ PRO 001 - Net Pay DefinitionDocument13 pagesE D.2 HQ PRO 001 - Net Pay DefinitionBogdan StanciuNo ratings yet

- Arcgis Exploration Framework Implementation A Petronas Approach FinalDocument29 pagesArcgis Exploration Framework Implementation A Petronas Approach FinalSpring DaysNo ratings yet

- Agriculture and Natural Resources in The Lao PDRDocument248 pagesAgriculture and Natural Resources in The Lao PDRIndependent Evaluation at Asian Development BankNo ratings yet

- Volumetrics Analysis TheoryDocument4 pagesVolumetrics Analysis TheoryJamesNo ratings yet

- Reservoir Technologies of The 21st CenturyDocument127 pagesReservoir Technologies of The 21st CenturyOloum Usho100% (1)

- Estimation of Oil & Gas: by DR Anil KumarDocument40 pagesEstimation of Oil & Gas: by DR Anil KumarHemant Srivastava100% (1)

- Kinsip Harvard CaseDocument11 pagesKinsip Harvard Caseapi-640771540No ratings yet

- PTIT Focus Statistics 2012Document91 pagesPTIT Focus Statistics 2012Thitikorn WassanarpheernphongNo ratings yet

- Buchi Training Papers - Distillation With A Rotary EvaporatorDocument16 pagesBuchi Training Papers - Distillation With A Rotary EvaporatorRoundSTICNo ratings yet

- "An Insight Into Production-Sharing Agreements: How They Prevent States From Achieving Maximum Control Over Their Hydrocarbon Resource" by Mary Sabina Peters and Manu KumarDocument8 pages"An Insight Into Production-Sharing Agreements: How They Prevent States From Achieving Maximum Control Over Their Hydrocarbon Resource" by Mary Sabina Peters and Manu KumarThe International Research Center for Energy and Economic Development (ICEED)No ratings yet

- PWC Oil and Gas Review 2015Document60 pagesPWC Oil and Gas Review 2015Amos DesmondNo ratings yet

- CSP-04 Rev. 3 - Project Procedure GuidelinesDocument118 pagesCSP-04 Rev. 3 - Project Procedure GuidelinesHazrin Hasan100% (1)

- BASF Factbook 2013Document96 pagesBASF Factbook 2013Guery SaenzNo ratings yet

- Energy Industry - Evolving Risk - MarshDocument28 pagesEnergy Industry - Evolving Risk - MarshbxbeautyNo ratings yet

- Braun Ability Case StudyDocument4 pagesBraun Ability Case StudyAfreen SylviaNo ratings yet

- Market Segmentation and Segmentation StrategiesDocument19 pagesMarket Segmentation and Segmentation StrategiesfarazsaifNo ratings yet

- Talent Management and Its Importance in Business Strategy A Critical Literature ReviewDocument3 pagesTalent Management and Its Importance in Business Strategy A Critical Literature ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- SPE 71414 - Improving Investment Decisions Using A Stochastic Integrated Asset ModelDocument16 pagesSPE 71414 - Improving Investment Decisions Using A Stochastic Integrated Asset ModelRayner SusantoNo ratings yet

- Australian Coal Bed Methane:: Principles and Development ChallengesDocument30 pagesAustralian Coal Bed Methane:: Principles and Development Challengesupesddn2010No ratings yet

- Business PlanIMC'Document11 pagesBusiness PlanIMC'Sauumye ChauhanNo ratings yet

- nDGeo Core Plug PorosityDocument2 pagesnDGeo Core Plug PorositygeroldtischlerNo ratings yet

- LPG Characterization and Production Quantification For Oil and Gas ReservoirsDocument9 pagesLPG Characterization and Production Quantification For Oil and Gas Reservoirsdumi-dumiNo ratings yet

- Economics of Gas Gathering CashflowDocument83 pagesEconomics of Gas Gathering CashflowDerrick GloverNo ratings yet

- Natural Gas Virtual-Pipeline For Alternative Energy DistributionDocument25 pagesNatural Gas Virtual-Pipeline For Alternative Energy DistributionJavier Mautong Serrano100% (1)

- Winners Power Gardens Refinery BPLANDocument18 pagesWinners Power Gardens Refinery BPLANOwunari Adaye-OrugbaniNo ratings yet

- Supply Chain in Petroleum IndustryDocument36 pagesSupply Chain in Petroleum IndustryNidhi SharmaNo ratings yet

- Indonesia Petrochemicals ReporDocument77 pagesIndonesia Petrochemicals ReporFitri Nur ArifenieNo ratings yet

- Mad Keen MotorsDocument21 pagesMad Keen MotorsAljun Bonsobre100% (1)

- Customer JourneyDocument19 pagesCustomer Journeydavid ardilaNo ratings yet

- Shale ReviewDocument17 pagesShale ReviewAnonymous QZd4nBoTNo ratings yet

- Web Shell Energy Transition ReportDocument41 pagesWeb Shell Energy Transition ReportTsukomaruNo ratings yet

- Petroleum Economics and Risk Analysis - 2022 Course FlyerDocument2 pagesPetroleum Economics and Risk Analysis - 2022 Course FlyernuzululNo ratings yet

- S Cuddy The - Difference Between Net Pay and Net ReservoirDocument37 pagesS Cuddy The - Difference Between Net Pay and Net ReservoirfahmiNo ratings yet

- Faculty of Engineering Petroleum EngineeringDocument12 pagesFaculty of Engineering Petroleum EngineeringRoba SaidNo ratings yet

- Roquette Industry Paper Board Brochure Corrugating PDFDocument36 pagesRoquette Industry Paper Board Brochure Corrugating PDFsyifa latifa zahidaNo ratings yet

- McKinsey Report - 3D PrintingDocument176 pagesMcKinsey Report - 3D PrintingAbhinav BehlNo ratings yet

- Economic Viability of UGS in NigeriaDocument87 pagesEconomic Viability of UGS in NigeriaNwachukwu Caleb Kelechi100% (3)

- 3-Rock AnalysisDocument112 pages3-Rock AnalysisTruongNo ratings yet

- TG Promote Product Services 190312 V2Document334 pagesTG Promote Product Services 190312 V2Phttii phttiiNo ratings yet

- Opportunity Strategy The Evaluation of TheDocument203 pagesOpportunity Strategy The Evaluation of ThePriti MishraNo ratings yet

- Volumetric EstimationDocument19 pagesVolumetric EstimationYong Kai MingNo ratings yet

- 4-Novel Hydrogen ApplicationsDocument32 pages4-Novel Hydrogen ApplicationsAlex CoțNo ratings yet

- The Future of MarketingDocument30 pagesThe Future of MarketingRodney FitchNo ratings yet

- SampleStrategyMaps ForProfit 8.17.15 CM PDFDocument9 pagesSampleStrategyMaps ForProfit 8.17.15 CM PDFMookameli Matlama MookameliNo ratings yet

- 5 Spe 186891Document22 pages5 Spe 186891Bangsawan AriefNo ratings yet

- Coalbed Methane Consulting Services 08os139Document8 pagesCoalbed Methane Consulting Services 08os139Adhip DuttNo ratings yet

- Calculating ROI For Technology InvestmentsDocument12 pagesCalculating ROI For Technology Investmentsrefvi.hidayat100% (1)

- Case Study of Omani Oil CompanyDocument61 pagesCase Study of Omani Oil Companyshama shoukat0% (1)

- ASGN04 Startup Finances Hector Bravo Huerta 30-1121Document17 pagesASGN04 Startup Finances Hector Bravo Huerta 30-1121hector bravo huertaNo ratings yet

- Millport Coastal Flood Protection Scheme: Environmental StatementDocument49 pagesMillport Coastal Flood Protection Scheme: Environmental StatementCory WashingtonNo ratings yet

- Reservoir Analysis SystemDocument24 pagesReservoir Analysis SystemCosmin Ducea100% (1)

- 2015 Home Buyer SurveyDocument98 pages2015 Home Buyer SurveyC.A.R. Research & EconomicsNo ratings yet

- 2013 Home Buyer Survey - Final (Public)Document82 pages2013 Home Buyer Survey - Final (Public)Aaron LewisNo ratings yet

- 2014 Home Seller SurveyDocument76 pages2014 Home Seller SurveyC.A.R. Research & EconomicsNo ratings yet

- Housing Preferences of the Boomer Generation:: How They Compare to Other Home BuyersFrom EverandHousing Preferences of the Boomer Generation:: How They Compare to Other Home BuyersNo ratings yet

- Monthly Housing Market OutlookDocument57 pagesMonthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2024-04 Monthly Housing Market OutlookDocument57 pages2024-04 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2024-02 Monthly Housing Market OutlookDocument57 pages2024-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-12 Monthly Housing Market OutlookDocument57 pages2023-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-09 Monthly Housing Market OutlookDocument57 pages2022-09 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2024-02 Monthly Housing Market OutlookDocument57 pages2024-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-Q1 Traditional Housing Affordability Index (HAI)Document9 pages2023-Q1 Traditional Housing Affordability Index (HAI)C.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2023-12 Monthly Housing Market OutlookDocument57 pages2023-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-07 Monthly Housing Market OutlookDocument56 pages2023-07 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2022-02 Monthly Housing Market OutlookDocument55 pages2022-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-03 Monthly Housing Market OutlookDocument57 pages2023-03 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-06 Monthly Housing Market OutlookDocument57 pages2022-06 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-08 Monthly Housing Market OutlookDocument57 pages2022-08 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-03 Monthly Housing Market OutlookDocument55 pages2022-03 Monthly Housing Market OutlookC.A.R. Research & Economics100% (2)

- 2022-05 Monthly Housing Market OutlookDocument56 pages2022-05 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2021-11 Monthly Housing Market OutlookDocument55 pages2021-11 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2021 AHMS For Press Release (120821)Document41 pages2021 AHMS For Press Release (120821)C.A.R. Research & EconomicsNo ratings yet

- Wesleyan University - Philippines Graduate School: 786 Chandi Lending CorporationDocument12 pagesWesleyan University - Philippines Graduate School: 786 Chandi Lending CorporationAnn DumlaoNo ratings yet

- 1.Package8C 19.02.2019 PDFDocument518 pages1.Package8C 19.02.2019 PDFvinujohnpanickerNo ratings yet

- Theories of Business CycleDocument3 pagesTheories of Business CycleGhanshyam BhambhaniNo ratings yet

- Summer Training Report On Nakoda LTDDocument82 pagesSummer Training Report On Nakoda LTDSanup SimonNo ratings yet

- Cases From Loan To Usury LawDocument18 pagesCases From Loan To Usury LawMelissa DionisioNo ratings yet

- International Financial AnalysisDocument36 pagesInternational Financial AnalysisPriyaGnaeswaran100% (1)

- Fatawa 2004 Riba and InterestDocument65 pagesFatawa 2004 Riba and InterestISLAMIC LIBRARYNo ratings yet

- Depository Institutions FMDocument37 pagesDepository Institutions FMEricNo ratings yet

- MFIs in Bangladesh Vs Sri LankaDocument17 pagesMFIs in Bangladesh Vs Sri Lankasaksi76@gmail.comNo ratings yet

- SME Sector in Oman - PaperDocument73 pagesSME Sector in Oman - Paperakmohideen100% (1)

- 026 Philex Mining Co. Vs CIRDocument3 pages026 Philex Mining Co. Vs CIRkeith105No ratings yet

- Notes and Loans Payable ExerciseDocument4 pagesNotes and Loans Payable ExerciseLovenia M. FerrerNo ratings yet

- Pas 7 Statement of Cash FlowsDocument3 pagesPas 7 Statement of Cash FlowsJESSIE GIL DUMONo ratings yet

- 978402applied Math Test Paper - Xi Set 2 - Sem 2Document4 pages978402applied Math Test Paper - Xi Set 2 - Sem 2MehulNo ratings yet

- 721 Decision CanorecoDocument45 pages721 Decision CanorecoHjktdmhmNo ratings yet

- 5e Personal Finance Jeff MaduraDocument22 pages5e Personal Finance Jeff MaduraDuy Trần Tấn50% (2)

- Abu Dhabi Finance-GlossaryDocument18 pagesAbu Dhabi Finance-GlossaryManjul TakleNo ratings yet

- Joywo Updated003Document28 pagesJoywo Updated003Hezekia KiruiNo ratings yet

- Project AppraisalDocument29 pagesProject AppraisalsaravmbaNo ratings yet

- Cash Flow StatementDocument28 pagesCash Flow StatementJaan Sonu100% (2)

- CAIIB - Financial Management - MODULE C - RATIO ANALYSIS R K MohantyDocument61 pagesCAIIB - Financial Management - MODULE C - RATIO ANALYSIS R K Mohantymalaika_heaven100% (1)

- Transaction Codes For SAP FICODocument28 pagesTransaction Codes For SAP FICOAjinkya Mohadkar100% (1)

- How To Design A Plain Vanilla Interest Rate Swap: Fixed FloatingDocument3 pagesHow To Design A Plain Vanilla Interest Rate Swap: Fixed FloatingaS hausjNo ratings yet

- Table 1 - SWOT AnalysisDocument6 pagesTable 1 - SWOT AnalysisJebewathani SundaravelNo ratings yet

- Tax - PDF of Prof. Mamalateo'sDocument18 pagesTax - PDF of Prof. Mamalateo'sRenante Rodrigo100% (1)

- Unit 27: The Basic Tools of FinanceDocument4 pagesUnit 27: The Basic Tools of FinanceMinh Châu Tạ ThịNo ratings yet

2014 Understanding Today's Home Buyer Webinar

2014 Understanding Today's Home Buyer Webinar

Uploaded by

C.A.R. Research & EconomicsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 Understanding Today's Home Buyer Webinar

2014 Understanding Today's Home Buyer Webinar

Uploaded by

C.A.R. Research & EconomicsCopyright:

Available Formats

UNDERSTANDING TODAYS HOME

BUYER

Presented by

Carmen Hirciag, MBA

Senior Research Analyst

Survey Methodology

1,400 telephone interviews

conducted in February 2014

home buyers who purchased Aug. 2013 Jan. 2014

SoCal

55%

NorCal

20%

Other CA

26%

WHO IS THE 2014 BUYER?

Demographics

Typical CA Home Buyer

Average Age: 48

12%

32%

26%

25%

7%

25-34

35-44

45-54

55-64

65+

0% 5% 10% 15% 20% 25% 30% 35%

A

g

e

Q. What is your age?

Buyer Age Continues Rising

40

41 41 41

44

41

40

38

37

36

35

38

48

0

10

20

30

40

50

60

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Average Age

Q. What is your age?

Younger Buyers Continue to Decline

0%

20%

40%

60%

80%

100%

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

Refused

65+

55-64

45-54

35-44

25-34

Under 25

Q. What is your age?

Housing Affordability Index

0%

10%

20%

30%

40%

50%

60%

CA

Housing Affordability (State) Peak vs. Current

0%

10%

20%

30%

40%

50%

60%

70%

80%

US

CA SFH

CA

Condo/Townhomes

Los Angeles

Metropolitan Area

Inland Empire

S.F. Bay Area

59%

33%

41%

34%

48%

22%

71%

56%

64%

56%

71%

45%

Q1-2014 Q1-2012

Minimum Annual Income Required Peak vs. Current

By Counties, 2014 Q1 vs. 2012 Q1

Region Peak 2014 Q1 % CHG

CA SFH $56,320

$86,419

53%

CA Condo/Townhomes $44,440

$71,994

62%

Los Angeles Metropolitan Area

$53,780 $81,195

51%

Inland Empire

$35,170 $55,302

57%

S.F. Bay Area

$90,370 $140,977

56%

US

$32,000 $39,734

24%

SERIES: Housing Affordability Index of Existing Detached Homes

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Percent of First-time Buyers Continues Decline

8%

7%

15%

25%

25%

19%

19%

38%

46%

43%

54%

42%

12%

Q. Was this your first home purchase?

Minorities are the Majority

White 36%

Hispanic 26%

Black 12%

Asian/Pacific

Islander 26%

Q. How would you describe your ethnic background?

Majority of Buyers are Married

married 59%

Single 27%

Other 14%

Married Buyers on the Decline

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Married Single Other

Q. What is your marital status?

More than Half of Buyers have College Degrees

High

School

Some

College

Vocation/

Technical

College

Grad

Post Grad

0%

10%

20%

30%

40%

50%

7%

11%

23%

50%

11%

Q. What is the highest level of education you have completed?

7/10 Buyers have Annual Household Income >

$100K

$50-000-$74,999

$75,000-$99,999

$100,000-$149,999

$150,000-$199,999

$200,000 +

0%

5%

10%

15%

20%

25%

30%

3%

25%

27%

27%

17%

Q. Which of the following categories best represents you total annual income from all sources?

Buyers Annual Household Income Rises

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$200,000 +

$150,000-$199,999

$100,000-$149,999

$75,000-$99,999

$50-000-$74,999

Under $50,000

Q. Which of the following categories best represents you total annual income from all sources?

Fewer Repeat Buyers Previously Under Water

Q. Was the outstanding loan balance on your previous home higher than the sale price?

0%

2%

4%

6%

8%

10%

12%

2013 2014

12%

4%

THE BUYING EXPERIENCE

Listing Price Rises 7%

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

2013 2014

$355,000

$380,000

Median

Q. What was the initial listing price of the home you purchased?

Median Purchase Price Rises 25% YTY

$0

$100,000

$200,000

$300,000

$400,000

$500,000

Q. What was the price of the home you purchased?

Purchase Price

26%

27%

24%

7%

5%

3%

10%

-5% 5% 15% 25% 35% 45%

$200,000-

$299,999

$300,000-

$399,999

$400,000-

$499,999

$500,000-

$599,999

$600,000-

$699,999

$700,000-

$799,999

$800,000+

Median: $375,000

Q. What was the price of the home you purchased?

Purchase/Listing Prices Nearly Equal

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

Listing Purchase

$380,000

$375,000

Median

Q. What was the price of the home you purchased?

Median Distance from Previous Residence: 15

Miles

0% 5% 10% 15% 20% 25% 30% 35% 40%

1-10

11-25

26-100

>100

38%

22%

16%

24%

M

i

l

e

s

Q. How many miles away was your previous residence from the home you bought?

Buyers Staying Closer to Previous Residence

Q. How many miles away was your previous residence from the home you bought?

0

5

10

15

20

25

2013 2014

25

15

M

i

l

e

s

Median

Nearly 6/10 Buyers Were Previous Home Owners

Owned

59%

Rented

40%

Lived with

Parents

2%

Q. What was the living arrangement immediately before your recent home purchase?

More Buyers Owned Previous Residence

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2011 2012 2013 2014

Owned Rented Lived w/parents Other

Q. What was the living arrangement immediately before your recent home purchase?

Buyers Spending Less Time than Last Year

Considering Purchase Before Contacting Agent

0

5

10

15

20

25

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Q. How many weeks did you consider buying a home before contacting a real estate agent? (Asked if agent was used)

Average Weeks

Buyers Spending Less Time than Last Year Investigating

Homes & Neighborhoods Before Contacting Agent

0

5

10

15

20

25

30

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

W

e

e

k

s

Q. How many weeks did you spend investigating homes and neighborhoods before contacting a real estate agent? (Asked if agent was used)

Average Weeks

The Home Search is Getting Lengthier

0

5

10

15

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Average Weeks

Q. Once you found your agent, about how many weeks did you spend looking for a home with your agent? (Asked if agent was used)

All Buyers Viewed at Least 10 Homes Before

Buying

29%

16%

37%

19%

10 12-18 20 > 20

Number of Homes

Q. How many different homes did you preview and visit with your agent prior to making a purchase?

Increase in Homes Viewed Reflects Inventory

Improvement

0

5

10

15

20

25

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Q. How many different homes did you preview and visit with your agent prior to making a purchase?

Median

91% of Buyers Made Offers on Other Homes

0%

5%

10%

15%

20%

25%

30%

35%

0 1 2 3 4 5+

9%

10%

11%

24%

14%

32%

Number of Offers

Q. How many offers did you make on other homes?

Buyers Made More Offers on Other Homes

Q. How many offers did you make on other homes?

3

3.6

0

0.5

1

1.5

2

2.5

3

3.5

4

2013 2014

Average

Price Decreases are Main Reason for Buying

Change in family

Long term appreciation

Desired larger home

Investment/Tax advantage

Desired better/other location

Favorable price/financing

Low interest rates

Promotion/raise

Price decreases

8%

9%

13%

15%

16%

17%

29%

34%

54%

Q. What were your main reasons for buying your home?

Buyers Didnt Purchase Sooner Because

57%

Not many good housing options

53%

Waited to see when prices would stabilize

36%

No real buying urgency

30%

Difficulty qualifying for mortgage

21%

Needed to sell existing home

20%

Needed to save for down payment

15%

Waited until finances improved

Q. Why didnt you buy a home sooner?

Nearly Half of Buyers Settled on Best Available Home

Satisfied 54%

Selected best

option given

limited supply

46%

Q. Are you satisfied with the home you purchased or do you feel like you selected the best option given the limited supply of homes?

More Buyers Settled on Best Available Home

Q. Are you satisfied with the home you purchased or do you feel like you selected the best option given the limited supply of homes?

0%

20%

40%

60%

80%

100%

2013

2014

66%

54%

34%

46%

Satisfied Settled

Most Buyers Found Home through Agent

Home builder/developer

For sale sign

Open house

Website

Agent

0%

20%

40%

60%

2%

3%

3%

39%

54%

Q. How did you find the home you purchased?

More Buyers are Finding Homes Online

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2009

2010

2011

2012

2013

2014

Agent Website Other

Q. How did you find the home you purchased?

Most Homes Were Listed on MLS

Yes

81%

No

19%

Q. Was the home you purchased listed on a multiple listing service?

Fewer Homes Were Listed on MLS

Q. Was the home you purchased listed on a multiple listing service?

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2013 2014

Buyers Plan to Keep Homes Longer

Q. How long do you plan to keep the property?

0

1

2

3

4

5

6

7

8

9

2013 2014

6

8.8

Average Years

Buyers Optimistic About Long Term Direction of

Home Prices

60%

26%

14%

81%

10%

9%

Up

Flat

Unsure

1 Year 5 Years

Q Do you think home prices in the neighborhood where you purchased will go up, down, or stay flat in one year, in five years?

More Buyers Believe Prices Will Rise

60%

81%

8%

35%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

In 1 Year In 5 Years

2014

2009

Q Do you think home prices in the neighborhood where you purchased will go up in one year, in five years?

Internet Use

More Buyers Using Mobile

85%

91%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2013 2014

Q. Did you use a mobile device in the home buying process?

91% of Buyers Used Mobile Device in Buying Process

78%

Look for comparable prices

45%

Search for homes

45%

Communicate

43%

Take photos of homes/amenities/neighborhoods

42%

Research a particular home

41%

Search websites

39%

Communicate w/agent

22%

Research communities/neighborhoods

Q. How did you use your mobile device in the home buying process? N = 1269

Zillow is Most Useful App

Q. What was the most useful app that you used during the home buying process? N = 1269

Realtor.com & Zillow are Most Useful Websites in

Buying Process

4%

5%

8%

9%

10%

22%

31%

0% 5% 10% 15% 20% 25% 30% 35%

Q. What was the single most useful website that you visited during your home buying process?

Brokerage

Agent

Realtor.com & Zillow Most Useful Websites

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

2007 2008 2009 2010 2011 2012 2013 2014

Zillow realtor.com Brokerage Yahoo Redfin

Q. What was the single most useful website that you visited during your home buying process?

Most Buyers Found Home on Realtor.com or

Zillow

4%

5%

8%

12%

13%

26%

33%

0% 5% 10% 15% 20% 25% 30% 35%

Q. On which website did you find your home?

Realtor.com & Zillow Helped Most Buyers Find

Homes

0%

5%

10%

15%

20%

25%

30%

35%

2011 2012 2013 2014

realtor.com Zillow Trulia Redfin

Q. On which website did you find your home?

Social Media Use Continues Rising

0%

10%

20%

30%

40%

50%

60%

70%

80%

2011 2012 2013 2014

52%

68%

75%

77%

Q. Did you use social media (such as Facebook, Twitter, YouTube, etc.) in your home buying process?

77% of Buyers Used Social Media in Buying

Process

Q. Which social media websites did you use during your home buying process? N = 1073

Social Media Used for Buying Tips &

Neighborhood Info

0% 10% 20% 30% 40% 50%

Agents' YouTube

Neighborhood profiles

Home buying info

Neighborhood amenities

Neighborhood lifestlye

Agent referrals

Agent's Facebook page

Neighborhood info from friends

Buying tips, suggestions from friends

20%

23%

23%

31%

33%

35%

42%

44%

44%

Q. How did you use social media (such as Facebook, Twitter, YouTube, etc.) in your home buying process? N = 1073

92% of Buyers are Receptive to Receiving

Information via Social Media

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

2011 2012 2013 2014

4.2

4.1

4.1

4.1

Average

Q. How receptive would you be to receiving information about the home buying process directly from your real estate agent via social

media? (Scale: 1-5)

Fewer Buyers Google their Agent

0%

10%

20%

30%

40%

50%

60%

70%

80%

2007 2008 2009 2010 2011 2012 2013 2014

Q. Did you Google your agent?

Internet Info as Useful as Agent Info

Agent info as

useful as

internet info

28%

Internet info

less useful than

agent info 26%

Internet info

more useful

than agent info

23%

Internet info

different from

agent info 19%

Q. How would you compare the information you gathered on the Internet to the information provided by your real estate agent?

N = 1238

Financing

Fewer Buyers Obtained Financing

0%

20%

40%

60%

80%

100%

2009

2010

2011

2012

2013

2014

100%

94%

92%

96%

91%

74%

Q. Did you obtain financing for your home purchase?

More than Buyers Paid Cash

Financing 74%

Cash 26%

Q. How did you pay for the home you purchased?

Most Cash Buyers Used Proceeds from Previous

Residence

0% 20% 40% 60% 80% 100%

Borrowed/gifted

Pension fund

Proceeds from sale/refi of another

Inheritance

Personal savings

Sale of personal assets

Proceeds from previous residence

5%

16%

29%

32%

40%

44%

95%

Q. If all cash, where did the funds come from? N = 367

Average Down Payment Remains Above 20%

25%

31%

26%

25%

25%

28%

0%

5%

10%

15%

20%

25%

30%

35%

2009 2010 2011 2012 2013 2014

Average

Q. What was your down payment for the home purchased, in percent of the home value?

Most Buyers Obtain Fixed Rate Loans

Fixed 92%

Adjustable 8%

Q. What type of loan do you have?

Fixed Rate Loans Remain Majority

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2009 2010 2011 2012 2013 2014

69%

79%

84%

93%

91% 92%

31%

15%

16%

7%

8%

8%

6%

1%

Fixed Adjustable Other

Q. What type of loan do you have?

85% of Loans are for 30 Years

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2011

2012

2013

2014

85%

87%

85%

86%

15%

13%

15%

14%

15 Year 30 Year

Q. What was the duration of your loan?

Buyers Have Less Difficulty With Financing

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

2009

2010

2011

2012

2013

2014

8.1

8.5

8.0

8.5

8.6

7.1

Average

Q. Please rate how easy or difficult it was to obtain financing on a scale of 1 to 10 with 1 being very easy and 10 being very difficult.

2/3 Buyers Did Not Have Appraisal Problems

66%

15%

19%

None

Had to get 2nd appraisal

Had to find more recent

comps

Q. What, if any, problems did you have with the home appraisal when attempting to obtain financing?

More Buyers Had Appraisal Problems

Q. What, if any, problems did you have with the home appraisal when attempting to obtain financing?

0%

50%

100%

2013

2014

None Had to get 2nd appraisal Had to get more recent comps

BUYER/AGENT RELATIONSHIP

Fewer Buyers Used Agent

74%

86% 86%

84%

86%

89%

87%

90%

92%

94%

96%

91%

88%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Q. Did you use a real estate agent in your home buying process?

Most Buyers Find Agents Online

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Relationships/Contacts Advertising Internet Other

Q. How did you find your real estate agent?

More than Buyers Interviewed at Least 2 Agents

0%

5%

10%

15%

20%

25%

1 2 3 4 5 6 7

24%

23%

10%

18%

16%

5%

4%

# of Agents Interviewed

Q. How many agents did you interview prior to selecting the agent you used in your recent home purchase?

Buyers Continue Interviewing Multiple Agents

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

2.3 2.3

2.4

2.5 2.5

2.4

2.8

2.2

1.8

2.2

3.2

3.1

Average

Q. How many agents did you interview prior to selecting the agent you used in your recent home purchase?

Previous Performance Important to Buyers in

Selecting Agent

3%

7%

8%

13%

13%

22%

29%

Most knowledgeable

Distressed property knowledge

Negotiating ability

1st to respond

Seemed most aggressive

Seemed most reponsive

Previously used agent

Q. What was the single most important reason for selecting the agent that you used in your recent home purchase?.

Gap in Phone & Text Communication

Telephone

Email

Text Message

In Person

11%

47%

40%

1%

38%

46%

15%

0%

Preferred Actual

Q. What was your preferred method of communicating with your agent?

Q. How did your agent actually communicate with you?

10%

24%

35%

38%

37%

42%

44%

49%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

2007 2008 2009 2010 2011 2012 2013 2014

Q. What was the typical response time you expected from your agent to return any form of communication to you?

More Buyers Expect Instant Response from Agents

Room for Improvement in Agent Response Time

0%

10%

20%

30%

40%

50%

60%

Instantly Within 30

mins.

Within 1

hr.

Within 2

hrs.

Within 4

hrs.

Same day 1 business

day or

longer

49%

29%

16%

4%

2%

0% 0%

18%

7%

11%

17%

24%

13%

10%

Expected Actual

Q. What was the typical response time you expected from your agent to return any form of communication to you?

Q. On average, what was the actual response time of your agent to return any form of communication to you?

Agent Satisfaction Ratings Improve

- Average Ratings on 1-5 Scale -

2013 2014

Your real estate agents negotiating skills 3.2 3.4

Overall process of finding a home 3.2 3.3

Overall satisfaction with your real estate agent 3.1 3.3

Q. Please rate your degree of satisfaction with the following aspects of your home buying experience on a scale of 1-5, where 1 is least

satisfied and 5 is most satisfied.

Buyer Satisfaction Improves Slightly

1

1.5

2

2.5

3

3.5

4

4.5

5

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Process of Finding a Home Satisfaction with Agent

Q. Please rate your degree of satisfaction with the following aspects of your home buying experience on a scale of 1-5, where 1 is least

satisfied and 5 is most satisfied.

Reasons for Satisfaction With Agent

Q. Why do you have that level of satisfaction with your agent?

Reasons for Dissatisfaction With Agent

Q. Why do you have that level of satisfaction with your agent?

More Buyers Would Work w/Agent Again

88%

87%

50%

67%

61%

64%

72%

54%

60%

52%

61%

2%

3%

4%

3%

15%

13%

11%

11%

12%

22%

33%

10% 10%

46%

30%

25%

22%

17%

35%

28%

26%

6%

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Unsure No Yes

Q. Would you work with the same agent again?

What Buyers Would Change About the Home

Buying Experience

1. Better Communication with agent (38%)

2. Faster agent response (26%)

3. Better agent negotiation (19%)

4. Better market understanding (14%)

5. More assistance with mortgage approval (3%)

Q. If there was one thing you could change about the home buying experience, what would it be?

SO WHAT?

Key Conclusions & Opportunities

Buyer Demographics are Changing

Buying Process Begins Before Agent is Contacted

Buyers Need Most Agent Assistance in Finding the

Right Home

0% 10% 20% 30% 40% 50% 60% 70% 80%

Determine affordability

Determine comps

Negotiate terms of sale

Price negotiation

Find the right home

30%

56%

60%

75%

79%

Q. In which part(s) of the transaction did you need the most assistance from your agent?

Communication

Important to buyers

in agent selection

Response time

Being aggressive

Negotiation skills

Knowledgeable

Communicate better

Respond

immediately

Market your

skills effectively

Communicate

according to

client preference

Importance of Mobile

Financing

Buyers had

difficulty

obtaining

financing

54%

Lender

contacts

Loan options

Downpayment

assistance

programs

Provide

solutions

What Buyers Would Change About the Home

Buying Experience

1. Better Communication with agent (38%)

2. Faster agent response (26%)

3. Better agent negotiation (19%)

Q. If there was one thing you could change about the home buying experience, what would it be?

Advice to Agents from Buyers

Respond faster (63%)

Communicate according to client preference (55%)

Communicate better (44%)

Negotiate better (24%)

Understand market direction better (12%)

Q. What advice would you give to real estate agents to improve the process or the level of service?

THANK YOU!

carmenh@car.org

How to Use Statistics to Establish

Yourself as a Market Expert

Thursday, June 26, 2014

2:00 PM - 3:00 PM

To register:

WWW.CAR.ORG/MARKETDATA/VIDEOS

Join us for our next webinar

QUESTIONS?

C.A.R. NEWS

The Finance Helpline

FREE Member Benefit

Provides one-on-one help

Direct Line to Lenders

finance.car.org

(213)739-8383

financehelpline@car.org

Being a member of C.A.R. for 27 years, this member service, by

far, in my humble opinion, is the next best thing to having a license

in this climate. Bravo! - REALTOR

mortgage.car.org

Mortgage Resource Directory

The Ripple Effect

that begins with a REALTOR

Dominate evening drive-time

every Friday 2:30 p.m. 6:30 p.m.

Los Angeles, Sacramento San Diego, and San

Francisco

Tonight Show Starring Jimmy Fallon

The Today Show

Ellen

Dr. Oz

The Voice

Many other popular TV shows

New This Year

Social Media Custon Content

REALTOR RealTalk

www.realtorrealtalk.com

Interior Designer Thom

Filicia

HGTV Vignettes

EXPO Appearance

Room Makeover Sweepstakes

EXPO Luncheon Speakers

Terri

Sjodin

Best-selling author of

Small Message, Big

Impact

Captain Chesley

Sully

Sullenberger

Best-selling author

of Highest Duty

Leslie

Appleton-Young

C.A.R. Vice President

and Chief Economist

Tuesday Wednesday

Thursday

You might also like

- Sample of Loan Agreement PhilippinesDocument2 pagesSample of Loan Agreement PhilippinesHannah Finuliar83% (71)

- 2024-05 Monthly Housing Market OutlookDocument57 pages2024-05 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2024-03 Monthly Housing Market OutlookDocument57 pages2024-03 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2023-11 Monthly Housing Market OutlookDocument57 pages2023-11 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- FREE Ebook My Home Is MineDocument24 pagesFREE Ebook My Home Is MineLater83% (6)

- 2023-05 Monthly Housing Market OutlookDocument57 pages2023-05 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2021-12 Monthly Housing Market OutlookDocument55 pages2021-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Airbnb 2018 PDFDocument8 pagesAirbnb 2018 PDFmoloko masemolaNo ratings yet

- 2022-12 Monthly Housing Market OutlookDocument58 pages2022-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2021 AHMS For Press Release (Fina Finall)Document41 pages2021 AHMS For Press Release (Fina Finall)C.A.R. Research & EconomicsNo ratings yet

- 2021-10 Monthly Housing Market OutlookDocument55 pages2021-10 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Cover Letter - Nguyen Thi Thuy VanDocument2 pagesCover Letter - Nguyen Thi Thuy VanthuyvanNo ratings yet

- Reservoir CouplingDocument39 pagesReservoir CouplingGigih Adi PambudiNo ratings yet

- Nielsen Global Video On DemandDocument20 pagesNielsen Global Video On DemandGiorgos Meleas100% (2)

- STA 2395 Notes PDFDocument56 pagesSTA 2395 Notes PDFsarvodaya123No ratings yet

- Chapter 6 - AnswerDocument4 pagesChapter 6 - Answerwynellamae75% (4)

- Ptit Focus 2015 - StatisticsDocument5 pagesPtit Focus 2015 - StatisticsThitikorn WassanarpheernphongNo ratings yet

- E D.2 HQ PRO 001 - Net Pay DefinitionDocument13 pagesE D.2 HQ PRO 001 - Net Pay DefinitionBogdan StanciuNo ratings yet

- Arcgis Exploration Framework Implementation A Petronas Approach FinalDocument29 pagesArcgis Exploration Framework Implementation A Petronas Approach FinalSpring DaysNo ratings yet

- Agriculture and Natural Resources in The Lao PDRDocument248 pagesAgriculture and Natural Resources in The Lao PDRIndependent Evaluation at Asian Development BankNo ratings yet

- Volumetrics Analysis TheoryDocument4 pagesVolumetrics Analysis TheoryJamesNo ratings yet

- Reservoir Technologies of The 21st CenturyDocument127 pagesReservoir Technologies of The 21st CenturyOloum Usho100% (1)

- Estimation of Oil & Gas: by DR Anil KumarDocument40 pagesEstimation of Oil & Gas: by DR Anil KumarHemant Srivastava100% (1)

- Kinsip Harvard CaseDocument11 pagesKinsip Harvard Caseapi-640771540No ratings yet

- PTIT Focus Statistics 2012Document91 pagesPTIT Focus Statistics 2012Thitikorn WassanarpheernphongNo ratings yet

- Buchi Training Papers - Distillation With A Rotary EvaporatorDocument16 pagesBuchi Training Papers - Distillation With A Rotary EvaporatorRoundSTICNo ratings yet

- "An Insight Into Production-Sharing Agreements: How They Prevent States From Achieving Maximum Control Over Their Hydrocarbon Resource" by Mary Sabina Peters and Manu KumarDocument8 pages"An Insight Into Production-Sharing Agreements: How They Prevent States From Achieving Maximum Control Over Their Hydrocarbon Resource" by Mary Sabina Peters and Manu KumarThe International Research Center for Energy and Economic Development (ICEED)No ratings yet

- PWC Oil and Gas Review 2015Document60 pagesPWC Oil and Gas Review 2015Amos DesmondNo ratings yet

- CSP-04 Rev. 3 - Project Procedure GuidelinesDocument118 pagesCSP-04 Rev. 3 - Project Procedure GuidelinesHazrin Hasan100% (1)

- BASF Factbook 2013Document96 pagesBASF Factbook 2013Guery SaenzNo ratings yet

- Energy Industry - Evolving Risk - MarshDocument28 pagesEnergy Industry - Evolving Risk - MarshbxbeautyNo ratings yet

- Braun Ability Case StudyDocument4 pagesBraun Ability Case StudyAfreen SylviaNo ratings yet

- Market Segmentation and Segmentation StrategiesDocument19 pagesMarket Segmentation and Segmentation StrategiesfarazsaifNo ratings yet

- Talent Management and Its Importance in Business Strategy A Critical Literature ReviewDocument3 pagesTalent Management and Its Importance in Business Strategy A Critical Literature ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- SPE 71414 - Improving Investment Decisions Using A Stochastic Integrated Asset ModelDocument16 pagesSPE 71414 - Improving Investment Decisions Using A Stochastic Integrated Asset ModelRayner SusantoNo ratings yet

- Australian Coal Bed Methane:: Principles and Development ChallengesDocument30 pagesAustralian Coal Bed Methane:: Principles and Development Challengesupesddn2010No ratings yet

- Business PlanIMC'Document11 pagesBusiness PlanIMC'Sauumye ChauhanNo ratings yet

- nDGeo Core Plug PorosityDocument2 pagesnDGeo Core Plug PorositygeroldtischlerNo ratings yet

- LPG Characterization and Production Quantification For Oil and Gas ReservoirsDocument9 pagesLPG Characterization and Production Quantification For Oil and Gas Reservoirsdumi-dumiNo ratings yet

- Economics of Gas Gathering CashflowDocument83 pagesEconomics of Gas Gathering CashflowDerrick GloverNo ratings yet

- Natural Gas Virtual-Pipeline For Alternative Energy DistributionDocument25 pagesNatural Gas Virtual-Pipeline For Alternative Energy DistributionJavier Mautong Serrano100% (1)

- Winners Power Gardens Refinery BPLANDocument18 pagesWinners Power Gardens Refinery BPLANOwunari Adaye-OrugbaniNo ratings yet

- Supply Chain in Petroleum IndustryDocument36 pagesSupply Chain in Petroleum IndustryNidhi SharmaNo ratings yet

- Indonesia Petrochemicals ReporDocument77 pagesIndonesia Petrochemicals ReporFitri Nur ArifenieNo ratings yet

- Mad Keen MotorsDocument21 pagesMad Keen MotorsAljun Bonsobre100% (1)

- Customer JourneyDocument19 pagesCustomer Journeydavid ardilaNo ratings yet

- Shale ReviewDocument17 pagesShale ReviewAnonymous QZd4nBoTNo ratings yet

- Web Shell Energy Transition ReportDocument41 pagesWeb Shell Energy Transition ReportTsukomaruNo ratings yet

- Petroleum Economics and Risk Analysis - 2022 Course FlyerDocument2 pagesPetroleum Economics and Risk Analysis - 2022 Course FlyernuzululNo ratings yet

- S Cuddy The - Difference Between Net Pay and Net ReservoirDocument37 pagesS Cuddy The - Difference Between Net Pay and Net ReservoirfahmiNo ratings yet

- Faculty of Engineering Petroleum EngineeringDocument12 pagesFaculty of Engineering Petroleum EngineeringRoba SaidNo ratings yet

- Roquette Industry Paper Board Brochure Corrugating PDFDocument36 pagesRoquette Industry Paper Board Brochure Corrugating PDFsyifa latifa zahidaNo ratings yet

- McKinsey Report - 3D PrintingDocument176 pagesMcKinsey Report - 3D PrintingAbhinav BehlNo ratings yet

- Economic Viability of UGS in NigeriaDocument87 pagesEconomic Viability of UGS in NigeriaNwachukwu Caleb Kelechi100% (3)

- 3-Rock AnalysisDocument112 pages3-Rock AnalysisTruongNo ratings yet

- TG Promote Product Services 190312 V2Document334 pagesTG Promote Product Services 190312 V2Phttii phttiiNo ratings yet

- Opportunity Strategy The Evaluation of TheDocument203 pagesOpportunity Strategy The Evaluation of ThePriti MishraNo ratings yet

- Volumetric EstimationDocument19 pagesVolumetric EstimationYong Kai MingNo ratings yet

- 4-Novel Hydrogen ApplicationsDocument32 pages4-Novel Hydrogen ApplicationsAlex CoțNo ratings yet

- The Future of MarketingDocument30 pagesThe Future of MarketingRodney FitchNo ratings yet

- SampleStrategyMaps ForProfit 8.17.15 CM PDFDocument9 pagesSampleStrategyMaps ForProfit 8.17.15 CM PDFMookameli Matlama MookameliNo ratings yet

- 5 Spe 186891Document22 pages5 Spe 186891Bangsawan AriefNo ratings yet

- Coalbed Methane Consulting Services 08os139Document8 pagesCoalbed Methane Consulting Services 08os139Adhip DuttNo ratings yet

- Calculating ROI For Technology InvestmentsDocument12 pagesCalculating ROI For Technology Investmentsrefvi.hidayat100% (1)

- Case Study of Omani Oil CompanyDocument61 pagesCase Study of Omani Oil Companyshama shoukat0% (1)

- ASGN04 Startup Finances Hector Bravo Huerta 30-1121Document17 pagesASGN04 Startup Finances Hector Bravo Huerta 30-1121hector bravo huertaNo ratings yet

- Millport Coastal Flood Protection Scheme: Environmental StatementDocument49 pagesMillport Coastal Flood Protection Scheme: Environmental StatementCory WashingtonNo ratings yet

- Reservoir Analysis SystemDocument24 pagesReservoir Analysis SystemCosmin Ducea100% (1)

- 2015 Home Buyer SurveyDocument98 pages2015 Home Buyer SurveyC.A.R. Research & EconomicsNo ratings yet

- 2013 Home Buyer Survey - Final (Public)Document82 pages2013 Home Buyer Survey - Final (Public)Aaron LewisNo ratings yet

- 2014 Home Seller SurveyDocument76 pages2014 Home Seller SurveyC.A.R. Research & EconomicsNo ratings yet

- Housing Preferences of the Boomer Generation:: How They Compare to Other Home BuyersFrom EverandHousing Preferences of the Boomer Generation:: How They Compare to Other Home BuyersNo ratings yet

- Monthly Housing Market OutlookDocument57 pagesMonthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2024-04 Monthly Housing Market OutlookDocument57 pages2024-04 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2024-02 Monthly Housing Market OutlookDocument57 pages2024-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-12 Monthly Housing Market OutlookDocument57 pages2023-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-09 Monthly Housing Market OutlookDocument57 pages2022-09 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2024-02 Monthly Housing Market OutlookDocument57 pages2024-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-Q1 Traditional Housing Affordability Index (HAI)Document9 pages2023-Q1 Traditional Housing Affordability Index (HAI)C.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2023-12 Monthly Housing Market OutlookDocument57 pages2023-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-07 Monthly Housing Market OutlookDocument56 pages2023-07 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2022-02 Monthly Housing Market OutlookDocument55 pages2022-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-03 Monthly Housing Market OutlookDocument57 pages2023-03 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-06 Monthly Housing Market OutlookDocument57 pages2022-06 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-08 Monthly Housing Market OutlookDocument57 pages2022-08 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-03 Monthly Housing Market OutlookDocument55 pages2022-03 Monthly Housing Market OutlookC.A.R. Research & Economics100% (2)

- 2022-05 Monthly Housing Market OutlookDocument56 pages2022-05 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2021-11 Monthly Housing Market OutlookDocument55 pages2021-11 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2021 AHMS For Press Release (120821)Document41 pages2021 AHMS For Press Release (120821)C.A.R. Research & EconomicsNo ratings yet

- Wesleyan University - Philippines Graduate School: 786 Chandi Lending CorporationDocument12 pagesWesleyan University - Philippines Graduate School: 786 Chandi Lending CorporationAnn DumlaoNo ratings yet

- 1.Package8C 19.02.2019 PDFDocument518 pages1.Package8C 19.02.2019 PDFvinujohnpanickerNo ratings yet

- Theories of Business CycleDocument3 pagesTheories of Business CycleGhanshyam BhambhaniNo ratings yet

- Summer Training Report On Nakoda LTDDocument82 pagesSummer Training Report On Nakoda LTDSanup SimonNo ratings yet

- Cases From Loan To Usury LawDocument18 pagesCases From Loan To Usury LawMelissa DionisioNo ratings yet

- International Financial AnalysisDocument36 pagesInternational Financial AnalysisPriyaGnaeswaran100% (1)

- Fatawa 2004 Riba and InterestDocument65 pagesFatawa 2004 Riba and InterestISLAMIC LIBRARYNo ratings yet

- Depository Institutions FMDocument37 pagesDepository Institutions FMEricNo ratings yet

- MFIs in Bangladesh Vs Sri LankaDocument17 pagesMFIs in Bangladesh Vs Sri Lankasaksi76@gmail.comNo ratings yet

- SME Sector in Oman - PaperDocument73 pagesSME Sector in Oman - Paperakmohideen100% (1)

- 026 Philex Mining Co. Vs CIRDocument3 pages026 Philex Mining Co. Vs CIRkeith105No ratings yet

- Notes and Loans Payable ExerciseDocument4 pagesNotes and Loans Payable ExerciseLovenia M. FerrerNo ratings yet

- Pas 7 Statement of Cash FlowsDocument3 pagesPas 7 Statement of Cash FlowsJESSIE GIL DUMONo ratings yet

- 978402applied Math Test Paper - Xi Set 2 - Sem 2Document4 pages978402applied Math Test Paper - Xi Set 2 - Sem 2MehulNo ratings yet

- 721 Decision CanorecoDocument45 pages721 Decision CanorecoHjktdmhmNo ratings yet

- 5e Personal Finance Jeff MaduraDocument22 pages5e Personal Finance Jeff MaduraDuy Trần Tấn50% (2)

- Abu Dhabi Finance-GlossaryDocument18 pagesAbu Dhabi Finance-GlossaryManjul TakleNo ratings yet

- Joywo Updated003Document28 pagesJoywo Updated003Hezekia KiruiNo ratings yet

- Project AppraisalDocument29 pagesProject AppraisalsaravmbaNo ratings yet

- Cash Flow StatementDocument28 pagesCash Flow StatementJaan Sonu100% (2)

- CAIIB - Financial Management - MODULE C - RATIO ANALYSIS R K MohantyDocument61 pagesCAIIB - Financial Management - MODULE C - RATIO ANALYSIS R K Mohantymalaika_heaven100% (1)

- Transaction Codes For SAP FICODocument28 pagesTransaction Codes For SAP FICOAjinkya Mohadkar100% (1)

- How To Design A Plain Vanilla Interest Rate Swap: Fixed FloatingDocument3 pagesHow To Design A Plain Vanilla Interest Rate Swap: Fixed FloatingaS hausjNo ratings yet

- Table 1 - SWOT AnalysisDocument6 pagesTable 1 - SWOT AnalysisJebewathani SundaravelNo ratings yet

- Tax - PDF of Prof. Mamalateo'sDocument18 pagesTax - PDF of Prof. Mamalateo'sRenante Rodrigo100% (1)

- Unit 27: The Basic Tools of FinanceDocument4 pagesUnit 27: The Basic Tools of FinanceMinh Châu Tạ ThịNo ratings yet