Professional Documents

Culture Documents

BIR Form 1604 CFfinalgggg PDF

BIR Form 1604 CFfinalgggg PDF

Uploaded by

Jeffrey Harrison0 ratings0% found this document useful (0 votes)

23 views4 pagesOriginal Title

BIR-Form-1604-CFfinalgggg.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

23 views4 pagesBIR Form 1604 CFfinalgggg PDF

BIR Form 1604 CFfinalgggg PDF

Uploaded by

Jeffrey HarrisonCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

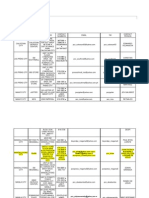

(To be filled up by the BIR)

DLN: PSOC: PSIC:

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1 For the Year 2 Amended Return? 3 No of Sheets Attached

(YYYY) Yes No

Part I B a c k g r o u n d I n f o r m a t i o n

4 TIN 5 RDO Code 6 Line of Business/

Occupation

7 Withholding Agent's Name (Last Name, First Name, Middle Name for Individuals)/(Registered Name for Non-Individuals) 8 Telephone No.

9 Registered Address 10 Zip Code

11 In case of overwithholding/overremittance after the year-end adjustment on compensation, If yes, specify

have you released the refund/s to your employee/s? Yes No the date of refund

12 Total Amount of Overremittance on 13 Month of First Crediting of 14 Category of Withholding Agent

Tax Withheld under Compensation Overremittance Private Government

Part II S u m m a r y o f R e m i t t a n c e s

Schedule 1 R e m i t t a n c e p e r B I R F o r m N o. 1601-C

DATE OF NAME OF BANK/BANK CODE/ TOTAL AMOUNT

REMITTANCE ROR NO., IF ANY REMITTED

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

TOTAL

Schedule 2 R e m i t t a n c e p e r B I R F o r m N o. 1601-F

DATE OF NAME OF BANK/BANK CODE/ TAXES TOTAL AMOUNT

REMITTANCE ROR NO., IF ANY WITHHELD REMITTED

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

TOTAL

Schedule 3 R e m i t t a n c e p e r B I R F o r m N o. 1602

DATE OF NAME OF BANK/BANK CODE/ TAXES TOTAL AMOUNT

REMITTANCE ROR NO., IF ANY WITHHELD REMITTED

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

TOTAL

Schedule 4 R e m i t t a n c e p e r B I R F o r m N o. 1603

DATE OF NAME OF BANK/BANK CODE/ TAXES TOTAL AMOUNT

REMITTANCE ROR NO., IF ANY WITHHELD REMITTED

1ST QTR

2ND QTR

3RD QTR

4TH QTR

TOTAL

We declare, under the penalties of perjury, that this declaration has been made in good faith, verified by us, and to the best of our Stamp of Receiving Office and

knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the Date of Receipt

regulations issued under authority thereof.

15

16

Tax Agent Acc. No./Atty's Roll No.(if applicable) Date of Issuance

Date of Expiry

President/Vice President/Principal Officer/Accredited Tax Agent/ Treasurer/Assistant Treasurer

Authorized Representative/Taxpayer (Signature Over Printed Name)

TIN of Signatory

(Signature Over Printed Name)

Title/Position of Signatory TIN of Signatory Title/Position of Signatory

1604-CF

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

July 2008 (ENCS)

Annual Information Return

of Income Taxes Withheld on

Compensation and Final Withholding Taxes

BIR Form No.

MONTH TAXES WITHHELD ADJ USTMENT PENALTIES

MONTH PENALTIES

PENALTIES

PENALTIES QUARTER

MONTH

BIR Form 1604-CF (ENCS) - PAGE 2

Part III Alphabetical List of Employees/ Payees from whom Taxes were Withheld (format only)

Schedule 5 ALPHALIST OF PAYEES SUBJECT TO FINAL WITHHOLDING TAX (Reported Under BIR Form No. 2306)

SEQ TIN NAME OF PAYEES ADDRESS OF * STATUS ATC NATURE OF INCOME AMOUNT OF RATE AMOUNT OF TAX

NO. (Last Name, First Name, PAYEES (As to Residence/ PAYMENT INCOME OF WITHHELD

Middle Name for Individuals, Nationality) (Refer to BIR Form No. 1601-F) PAYMENT TAX (Not Creditable)

complete name for Non - Individuals)

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10)

P P

Total P

Schedule 6 ALPHALIST OF EMPLOYEES OTHER THAN RANK AND FILE WHO WERE GIVEN FRINGE BENEFITS DURING THE YEAR (Reported Under BIR Form No. 2306)

SEQ NAME OF EMPLOYEES ATC AMOUNT OF GROSSED - UP AMOUNT OF

NO. FRINGE BENEFIT MONETARY TAX WITHHELD

Last Name First Name Middle Name VALUE (NOT CREDITABLE)

(1) (2) (3a) (3b) (3c) (4) (5) (6) (7)

P P P

Total P P P

* A - Citizens of the Philippines B - Resident Alien Individuals C - Non-Resident Alien Engaged in Business D - Non-Resident Alien not Engaged in Business

E - Domestic Corporation F - Resident Foreign Corp. G - Non-Resident Foreign Corp.

H - Alien employees of oil exploration service contractors and subcontractors, offshore banking units and regional or area headquarters of multinational corporations

TIN

ALPHABETICAL LIST OF EMPLOYEES/PAYEES FROM WHOM TAXES WERE WITHHELD (FORMAT ONLY)

(Use Schedule 7.5 for Minimum Wage Earner)

Schedule 7.1 ALPHALIST OF EMPLOYEES TERMINATED BEFORE DECEMBER 31 (Reported Under BIR Form No. 2316)

Schedule 7.2 ALPHALIST OF EMPLOYEES WHOSE COMPENSATION INCOME ARE EXEMPT FROM WITHHOLDING TAX BUT SUBJECT TO INCOME TAX (Reported Under BIR Form No. 2316) (Applicable from January 1 to July 5, 2008)

SEQ TIN Net

NO Last First Middle Taxable Tax Due

Name Name Name 13th Month Pay De Minimis Basic Salaries & Other Forms on Health and/or Compensation

& Other Benefits Benefits Salary of Compensation Income

(1) (2) (3a) (3b) (3c) 4(b) 4(c) 4(g) 4(h) (7) (8)

TOTALS P P P P P P P P P P P P

Schedule 7.3 ALPHALIST OF EMPLOYEES AS OF DECEMBER 31 WITH NO PREVIOUS EMPLOYER WITHIN THE YEAR (Reported Under BIR Form No.2316)

SEQ TIN

NO Last First Middle

Name Name Name 13th Month Pay De Minimis Basic

& Other Benefits Benefits Salary

(1) (2) (3a) (3b) (3c) 4(b) 4(c) 4(g)

TOTALS P P P P P P P P P P

Schedule 7.3 (continuation) ALPHALIST OF EMPLOYEES AS OF DECEMBER 31 WITH NO PREVIOUS EMPLOYER WITHIN THE YEAR

Code Amount

(5a) (5b)

P P P P P P P P

Schedule 7.4 ALPHALIST OF EMPLOYEES AS OF DECEMBER 31 WITH PREVIOUS EMPLOYER/S WITHIN THE YEAR (Reported Under BIR Form No. 2316)

SEQ TIN

NO Gross

Last First Middle Compensation

Name Name Name Income De Minimis Total Non-Taxable Basic Salaries & 13th Month De Salaries & Total Non-Taxable

Benefits Compensation Income Salary Other Forms Pay & Other Minimis Other Forms Compensation Income

(Previous) of Compensation Benefits Benefits of Compensation (Present)

(1) (2) (3a) (3b) (3c) (4a) (4c) (4f) (4g) (4i) (4k) (4l) (4n) (4o)

TOTALS P P P P P P P P P P P P P P P

Schedule 7.4 (continuation) ALPHALIST OF EMPLOYEES AS OF DECEMBER 31 WITH PREVIOUS EMPLOYER/S WITHIN THE YEAR

Net TAX

Taxable DUE

Basic Compen- (JAN. -

Salary sation DEC.)

Code Amount Income

(4p) (5a) (5b) (7) (8)

P P P P P P P P P P P P P P

Schedule 7.5 ALPHALIST OF MINIMUM WAGE EARNERS (Reported Under BIR Form No. 2316)

SEQ TIN

NO

Last First Middle

Name Name Name Gross Basic/ Holiday Overtime Night Hazard De Minimis Total Taxable

Compensation SMW Pay Pay Shift Pay Benefits (Previous Employer)

Income Previous Differential

(1) (2) (3a) (3b) (3c) (5a) (5b) (5c) (5d) (5e) (5f) (5h) (5n = 5l + 5m)

P P P P P P P P P P P P P P

Schedule 7.5 (continuation)

Basic SMW Basic SMW Factor Used Holiday Overtime Night Shift Hazard De Minimis Salaries & Other

Per Day Per Year (No. of Pay Pay Differential Pay Benefits Forms of

From To Days/Year) Compensation

(5o) (5p) (5r) (5t) (5u) (5v) (5w) (5x) (5y) (5aa) (5ac)

P P P P P P P P P P P P P P P P

Schedule 7.5 (continuation)

Code Amount

(6a) (6b) (11b) = (10a+10b) - (9)

P P P P P P P P P

EMPLOYER

PRESENT

EMPLOYER

(10b) (10a)

Total Taxable

(Previous Employer)

(4j= 4g+4h+4i)

PREVIOUS

13th Month Pay

& Other

Benefits

(4h)

and Union Dues

(5ab)

and Union Dues

(5i)

Pag - ibig Contributions,

Of Compensation

(4e)

(9b)

PRESENT

EMPLOYER EMPLOYER

NON - TAXABLE

SSS,GSIS,PHIC &

Pag - ibig Contributions,

and Union Dues

(4d)

YEAR - END ADJUSTMENT (10a or 10b)

Salaries & Total Non- SSS,GSIS,PHIC &

Region No.

issued by the present employer )

(11)=(9b+10a) or (9b-10b)

OVER WITHHELD TAX AMOUNT W/HELD

Gross

Compensation

Assigned

Where

Income

PRESENT EMPLOYER

NON-TAXABLE TAXABLE

SALARIES &

OTHER FORMS & Other of Employment

Basic SMW

Per Month

(8)

(5ae)

13th Month Pay

(4)

Benefits

(5ad)

TOTALS

SSS,GSIS,PHIC &

Insurance

AMOUNT OF TAX

WITHHELD

AS ADJUSTED

Net Taxable

Compensation

Income

TAX WITHHELD

(JAN. - NOV.)

(To be reflected in BIR Form No. 2316 issued

EXEMPTION

Premium Paid on

Health and/or

Hospital

(7)

Total Compensation Income

(Previous & Present

Employers )

(5ag) (5af)

Total

Compensation

Present

OF COMP.

Other Forms

of Compensation

(5m)

13th Month Pay

& Other

Benefits

(5l)

Compensation

(5j)

Compensation

Income (5k)

REFUNDED TO

EMPLOYEE

(10b)=(9a+9b)-(8)

IN DECEMBER

(10a)=(8)-(9a+9b)

& PAID FOR

AMOUNT OF TAX

WITHHELD

AS ADJUSTED

(To be reflected in BIR Form No. 2316

Hospital

Insurance

(6)

PREVIOUS

(9a)

(11)=(9+10a) or (9-10b)

IN DECEMBER

NON - TAXABLE

GROSS COMPENSATION INCOME

( to be reflected in BIR Form No. 2316)

(12)

PREVIOUS EMPLOYER

TAXABLE

(10b)=(9) - (8)

EMPLOYEE

(10a) = (8) - (9)

OVER WITHHELD TAX

REFUNDED TO

(9)

EXEMPTION

Premium Paid on

Health and/or (JAN. -DEC.)

(8) (7) (6)

Income

Net

Taxable

Total Taxable

Compensation Income

4(j)

Compensation Income

13th Month Pay

& Other Benefits

4(h) 4(i)

NAME OF EMPLOYEES

Gross

Compensation

AS ADJUSTED

4(f)

Total Non-Taxable/Exempt

YEAR - END ADJUSTMENT (10a or 10b)

Hospital Insurance

TAX WITHHELD

(JAN. - NOV.)

SSS,GSIS,PHIC, & Pag - ibig

Contributions, and Union Dues

4(d)

Salaries & Other Forms

of Compensation

4(e)

Hospital

Insurance (6)

Compensation

Income

4(f)

Code

( 5a) ( 5b)

Amount Compensation

Income

4(a)

4(a)

Income

(4) GROSS COMPENSATION INCOME

NON - TAXABLE

of Compensation

TAXABLE

Salaries & Other Forms

4(d)

SSS,GSIS,PHIC, & Pag - ibig

Contributions, and Union Dues

Salaries & Other Forms

of Compensation

4(e)

(Use the same format as in Schedule 7.3 but prepare a separate column (before Gross Compensation) for inclusive date of employment.

The annualized method should have been applied in computing the tax due from the employee upon termination of the employment contract.)

NON - TAXABLE

NAME OF EMPLOYEES

Gross Total Non-Taxable/Exempt Premium Paid TAXABLE

(4) GROSS COMPENSATION INCOME

EXEMPTION

TAXABLE

Benefits

(4b)

Premium Paid on

Health and/or

TAX WITHHELD Total Taxable

and Union Dues

(Previous & Present

(4m)

(4s = 4p+4q+4r)

Employers )

& Other

Total

Compensation

Present

(4t = 4j+ 4s)

PRESENT EMPLOYER

NON - TAXABLE

SSS,GSIS,PHIC &

Pag - ibig Contributions,

13th Month Pay Salaries

Other Forms

NAME OF EMPLOYEES

PRESENT EMPLOYER

TAXABLE

GROSS COMPENSATION INCOME

PREVIOUS EMPLOYER

EXEMPTION (JAN. - NOV.)

Benefits

(4q)

Salaries & 13th Month Pay

& Other Other Forms

of Compensation

(4r)

Substituted

Filing?

Yes/No

NAME OF EMPLOYEES

Compensation

AMOUNT WITHHELD

AND PAID FOR

AMOUNT OF TAX

WITHHELD

TAX DUE

ALPHALIST OF MINIMUM WAGE EARNERS (Reported Under BIR Form No. 2316)

YEAR - END ADJUSTMENT (11a or 11b)

Inclusive Date

(5q) (5s)

13th Month Pay

& Other

Benefits

(5z)

by the present employer )

(12) = (10b+11a) or (10b -11b)

OVER WITHHELD TAX

REFUNDED TO

EMPLOYEE

AMOUNT W/HELD

& PAID FOR

IN DECEMBER

(11a) = (9) - (10a+10b)

TAX

DUE

(JAN. - DEC.)

(9)

Salaries & Other

Forms of

GROSS COMPENSATION INCOME

ALPHALIST OF MINIMUM WAGE EARNERS (Reported Under BIR Form No. 2316)

Benefits

(5g)

13th Month Pay

& Other Pag - ibig Contributions, Taxable/Exempt

BIR Form No. 1604 CF - Annual Information Return of Income Taxes Withheld on Compensation and Final

Withholding Taxes

Guidelines and Instructions

Who Shall File

This return shall be filed in triplicate by

every employer or withholding agent/payor who is

either an individual, estate, trust, partnership,

corporation, government agency and

instrumentality, government-owned and controlled

corporation, local government unit and other

juridical entity required to deduct and withhold taxes

on compensation paid to employees and on other

income payments subject to Final Withholding

Taxes. The tax rates for and nature of income

payments subject to withholding tax on

compensation and final withholding taxes are

printed in BIR Form 1601-C and 1601F,

respectively.

If the payor is the Government of the

Philippines or any political subdivision or

agency/instrumentality thereof, or government-

owned and controlled corporation, the return shall

be made by the officer or employee having control

of the payments or by any designated officer or

employee.

If the person required to withhold and pay

the tax is a corporation, the return shall be made in

the name of the corporation and shall be signed and

verified by the president, vice president or

authorized officer and shall be countersigned by the

treasurer or assistant treasurer.

With respect to fiduciary, the return shall be

made in the name of the individual, estate or trust

for which such fiduciary acts, and shall be signed

and verified by such fiduciary. In case of two or

more fiduciaries, the return shall be signed and

verified by one of such fiduciaries.

When and Where to File

The return shall be filed on or before

January 31 of the year following the calendar year in

which the compensation payment and other income

payments subjected to final withholding taxes were

paid or accrued.

The return shall be filed with the Revenue

Collection Officer or duly authorized City/Municipal

Treasurer of the Revenue District Office having

jurisdiction over the withholding agent's place of

business/office.

A taxpayer may file a separate return for the

head office and for each branch or place of

business/office or a consolidated return for the head

office and all the branches/offices except in the

case of large taxpayers where only one

consolidated return is required.

Penalty for failure to file information returns

In the case of each failure to file an

information return, statement or list, or keep any

record, or supply any information required by the

Code or by the Commissioner on the date

prescribed therefor, unless it is shown that such

failure is due to reasonable cause and not to willful

neglect, there shall, upon notice and demand by the

Commissioner, be paid by the person failing to file,

keep or supply the same, One thousand pesos

(P= 1,000.00) for each such failure: Provided,

however, that the aggregate amount imposed for all

such failures during a calendar year shall not

exceed Twenty five thousand pesos (P= 25,000.00).

Attachments Required

1. Alphalist of Employees as of December 31 with

No Previous Employer within the Year.

2. Alphalist of Employees as of December 31 with

Previous Employer/s within the Year.

3. Alphalist of Employees Terminated before

December 31.

4. Alphalist of Employees Whose Compensation

Income Are Exempt from Withholding Tax but

Subject to Income Tax.

5. Alphalist of Employees other than Rank & File

Who Were Given Fringe Benefits During the

year.

6. Alphalist of Payees Subjected to Final

Withholding Tax.

7. Alphalist of Minimum Wage Earners.

Note: All background information must be

properly filled up.

All returns filed by an accredited tax agent on

behalf of a taxpayer shall bear the following

information:

A. For CPAs and others (individual

practitioners and members of GPPs);

a.1 Taxpayer Identification Number (TIN);

and

a.2 Certificate of Accreditation Number,

Date of Issuance, and Date of Expiry.

B. For members of the Philippine Bar

(individual practitioners, members of GPPs);

b.1 Taxpayer Identification Number (TIN);

and

b.2 Attorneys Roll Number or Accreditation

Number, if any

The last 4 digits of the 13-digit TIN refer to the

branch code.

Box No. 1 refers to transaction period and not

the date of filing this return.

TIN= Taxpayer Identification Number.

The ATC in the Alphabetical List of

Payees/Employees shall be taken from BIR

Form Nos. 2316 and 2306.

Employees earning an annual compensation

income of not exceeding P= 60,000 from one

employer who did not opt to be subjected to

withholding tax on compensation shall be

reported under Schedule 7.2 (Alphalist of

Employees Whose Compensation Income are

Exempt from Withholding Tax But Subject to

Income Tax). (Applicable from January 1 to July

5, 2008)

ENCS

You might also like

- The Art of Clean Up Life Made Neat and Tidy - Ursus WehrliDocument56 pagesThe Art of Clean Up Life Made Neat and Tidy - Ursus WehrliBritney MalcolmNo ratings yet

- Sample of Barangay Situational Analysis ReportDocument17 pagesSample of Barangay Situational Analysis Reportgheljosh76% (17)

- Durkheim, Individualism and The IntellectualsDocument15 pagesDurkheim, Individualism and The IntellectualsYang ShenNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- Statutory Check List 927Document62 pagesStatutory Check List 927Saravana KumarNo ratings yet

- Annual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesDocument6 pagesAnnual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesStanly OrtizNo ratings yet

- 1604 CFDocument8 pages1604 CFNette CutinNo ratings yet

- 1604-CF FormDocument2 pages1604-CF Formjenie_rojen200423100% (2)

- 1604-CFDocument8 pages1604-CFmamasita25No ratings yet

- 1604 CFDocument6 pages1604 CFromarcambriNo ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- BIR FormDocument4 pagesBIR FormfyeahNo ratings yet

- Income Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDocument6 pagesIncome Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDesh PremiNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument12 pagesITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNo ratings yet

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekaleNo ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- The Details of Income (Other Than Salary) and The Saving For The Purpose Mentioned Above May Kindly Be Considered As Detailed BelowDocument1 pageThe Details of Income (Other Than Salary) and The Saving For The Purpose Mentioned Above May Kindly Be Considered As Detailed BelowindianroadromeoNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeNo ratings yet

- 1604 eDocument2 pages1604 eMay Angelica TenezaNo ratings yet

- Euv 1ST 2011 1701QDocument6 pagesEuv 1ST 2011 1701QAdrian Raymnd EspirituNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- 1701qjuly2008 (ENCS)Document5 pages1701qjuly2008 (ENCS)Mary Rose AnilloNo ratings yet

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 pagesAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArleneNo ratings yet

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 pagesAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxTESSA SHINo ratings yet

- Annual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesDocument4 pagesAnnual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesTennex TanquionNo ratings yet

- 1701 June 2013 Schedules 1 To 12BDocument7 pages1701 June 2013 Schedules 1 To 12BStephen Paul EscañoNo ratings yet

- SCHEDULE V - PART II - Annual Return: Form of Annual Return of A Company Having A Share CapitalDocument6 pagesSCHEDULE V - PART II - Annual Return: Form of Annual Return of A Company Having A Share CapitalaaptamilnaduNo ratings yet

- PF Form No 12a, 10,5Document6 pagesPF Form No 12a, 10,5Hareesh Kumar Reddy100% (1)

- 1604 e 99Document4 pages1604 e 99ILubo AkNo ratings yet

- Sr. No. Act Provisions Forms FrequencyDocument6 pagesSr. No. Act Provisions Forms FrequencyAkshay Guleria AkkiNo ratings yet

- PF Forms FormatsDocument10 pagesPF Forms FormatsSnehal ChauhanNo ratings yet

- Bureau of Internal Revenue Form 1604e 2016Document2 pagesBureau of Internal Revenue Form 1604e 2016Lynnard Philip PanesNo ratings yet

- Annual Return Susruta 2012Document6 pagesAnnual Return Susruta 2012Rajneesh SehgalNo ratings yet

- SSS R3 Contribution Collection List in Excel FormatDocument2 pagesSSS R3 Contribution Collection List in Excel FormatChristopher Daniels0% (2)

- R3 Form Download Contribution Collection ListDocument2 pagesR3 Form Download Contribution Collection ListRvn Nvr33% (3)

- SSS R3 Contribution Collection List in Excel FormatDocument2 pagesSSS R3 Contribution Collection List in Excel FormatJaniene Secuya100% (2)

- Bir 2013Document1 pageBir 2013karlycoreNo ratings yet

- PhilHealth Revised Employer Remittance Report-RF-1Document2 pagesPhilHealth Revised Employer Remittance Report-RF-1Grace GayonNo ratings yet

- Annual Income Tax Return: Encs)Document3 pagesAnnual Income Tax Return: Encs)Darlyn GuinaNo ratings yet

- Quarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoDocument1 pageQuarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoAlexis TrinidadNo ratings yet

- 2011 - ITR2 - r6Document33 pages2011 - ITR2 - r6Bathina Srinivasa RaoNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 6 Month Budget Plannet: Learning to manage money and stay on track for your goalsFrom Everand6 Month Budget Plannet: Learning to manage money and stay on track for your goalsNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- BIR Form 1800 - Donor's Tax ReturnDocument2 pagesBIR Form 1800 - Donor's Tax ReturnangelgirlfabNo ratings yet

- Excise Tax Return: For Alcohol ProductsDocument4 pagesExcise Tax Return: For Alcohol ProductsAngela ArleneNo ratings yet

- TOBACCO CompleteDocument3 pagesTOBACCO CompleteAngela ArleneNo ratings yet

- Petroleum CompleteDocument4 pagesPetroleum CompleteAngela ArleneNo ratings yet

- MINERAL CompleteDocument3 pagesMINERAL CompleteAngela ArleneNo ratings yet

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDocument2 pagesReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneNo ratings yet

- Documentary Stamp Tax FormDocument3 pagesDocumentary Stamp Tax Formnegotiator0% (1)

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 pagesAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArleneNo ratings yet

- Form 1927Document7 pagesForm 1927Angela ArleneNo ratings yet

- Forensic Accounting - Fraud Examination Sesi 1 Pengertian Akuntansi ForensikDocument31 pagesForensic Accounting - Fraud Examination Sesi 1 Pengertian Akuntansi ForensikBaMbAng HartaDINo ratings yet

- Notice: Environmental Statements Availability, Etc.: Chuitna Coal Project, AKDocument1 pageNotice: Environmental Statements Availability, Etc.: Chuitna Coal Project, AKJustia.comNo ratings yet

- Lead Bank SchemeDocument5 pagesLead Bank SchemeGopi ShankarNo ratings yet

- Celtic Woman - Joy To The World Lyrics PDFDocument1 pageCeltic Woman - Joy To The World Lyrics PDFtilaarNo ratings yet

- PC Express BranchesDocument5 pagesPC Express BranchesMarietta Fragata RamiterreNo ratings yet

- Commercial Dispatch Eedition 11-5-20Document12 pagesCommercial Dispatch Eedition 11-5-20The DispatchNo ratings yet

- Lasam Vs SmithDocument2 pagesLasam Vs SmithPauline80% (5)

- ProjectionDocument13 pagesProjectionNeha ThakurNo ratings yet

- Grade 12 Fabm 2 ReviewerDocument36 pagesGrade 12 Fabm 2 ReviewerAgabus MoralesNo ratings yet

- Ventilator HidriaDocument1 pageVentilator HidriaIov IftodeNo ratings yet

- 03 Back of The Envelope EstimationDocument6 pages03 Back of The Envelope EstimationsrawatNo ratings yet

- Civ Pro Yeazell SP 2004 2Document76 pagesCiv Pro Yeazell SP 2004 2Thomas JeffersonNo ratings yet

- HP Elitebook Revolve Data SheetDocument4 pagesHP Elitebook Revolve Data SheetAditya BistNo ratings yet

- ANSYS Polyflow in ANSYS Workbench Users GuideDocument60 pagesANSYS Polyflow in ANSYS Workbench Users GuideV CafNo ratings yet

- The InductorDocument25 pagesThe InductorSureshraja9977No ratings yet

- Timeline of Philippine HistoryDocument24 pagesTimeline of Philippine Historyayat1234No ratings yet

- Sexual HarrasmentDocument33 pagesSexual HarrasmenttirasyadaNo ratings yet

- ASSESSMENT OF DAMAGES - Justice Yaw Appau PDFDocument17 pagesASSESSMENT OF DAMAGES - Justice Yaw Appau PDFgreatabrahamNo ratings yet

- 6 Bromo Cresol GreenDocument7 pages6 Bromo Cresol GreenVincent KwofieNo ratings yet

- Kso 20211117001514UE4 InvoiceDocument1 pageKso 20211117001514UE4 InvoiceSiskanah DewiNo ratings yet

- NB-CPD SG02 04 012r1 Masonry MortarsDocument16 pagesNB-CPD SG02 04 012r1 Masonry MortarsCristina StancuNo ratings yet

- Annual Report DSSA 2018 PDFDocument320 pagesAnnual Report DSSA 2018 PDFSudarmadi DmaNo ratings yet

- 10q Oct 17 PDFDocument23 pages10q Oct 17 PDFDaniel KwanNo ratings yet

- Rosewood Hotels & Resorts: Customer Lifetime Value (CLTV) Analysis InputsDocument3 pagesRosewood Hotels & Resorts: Customer Lifetime Value (CLTV) Analysis InputsVishal GoyalNo ratings yet

- Reading Material - CompiledDocument172 pagesReading Material - CompiledArpit DhakaNo ratings yet

- Personal Introduction: Forum: IssueDocument8 pagesPersonal Introduction: Forum: IssueNishu DeswalNo ratings yet

- Bank Failures in 2010Document14 pagesBank Failures in 2010Richarnellia-RichieRichBattiest-CollinsNo ratings yet