Professional Documents

Culture Documents

Marketing Execution: Pricing Quiz: Roll No.: Name: Section

Marketing Execution: Pricing Quiz: Roll No.: Name: Section

Uploaded by

Johnny WilliamsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marketing Execution: Pricing Quiz: Roll No.: Name: Section

Marketing Execution: Pricing Quiz: Roll No.: Name: Section

Uploaded by

Johnny WilliamsCopyright:

Available Formats

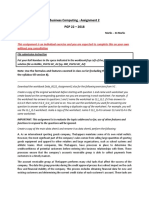

Roll No.

: 2012197

Name: Anoop R

Section: ME A

Assumptions:

1. MRP is Rs 125

2. State 1 has Local Sales Tax (LST) of 8%. This is applicable on 1st sale in State only.

3. State 2 has Value Added Tax (VAT) of 10% but retailer is exempt (composition scheme based on turnover)

4. State 3 (or a different product category in State 2) has VAT of 12% but retailer is not exempt

5. Stockist margin is 6%

6. Retailer margin is 14%

State 1 State 2 State 3

Cost to consumer including taxes (MRP) 125.00 125.00 125.00

State 3

Tax included in above 0.00 0.00 2.30

Cost to consumer excluding taxes 125.00 125.00 122.70

Retailer Margin 17.50 17.50 17.18

Cost to retailer including taxes 107.50 107.50 105.52

State 2 State 3

Tax included in above 0.00 1.54 2.00 1.54

1

Cost to retailer excluding taxes 107.50 105.96 103.52 FALSE

100

Stockist Margin 6.45 6.36 6.21

Cost to stockist including taxes 101.05 99.60 97.31

Tax included in above 7.49 9.05 10.43

Cost to stockist excluding taxes (MSP) 93.56 90.55 86.89

Instructions:

1. Close this file, rename it to: YourName_RollNo_Pricing Quiz, and then open it again

2. Enter your details at the top of this sheet

3. State 1 is allocated 2 marks, State 2 is allocated 3 marks and State 3 is allocated 5 marks

4. Every item in each State should be correct down to the last paisa - there are no marks for partial answers or correct "workings"

5. The 3 Solver parameters should be saved in the spaces provided with bold outlines. No marks will be awarded if these spaces are left blank even though your answer may be correct.

6. Once you are done, email your Excel sheet to tarunp@gim.ac.in with the subject line: "YourName_RollNo_Pricing Quiz"

7. Check that your email has been received in the inbox of my laptop before leaving the classroom

Solver Load Locations

MARKETING EXECUTION: PRICING QUIZ

You might also like

- Business Report - To UploadDocument15 pagesBusiness Report - To UploadStaffing Studio72% (39)

- SMDM Business-Report Arvind Soni-2Document15 pagesSMDM Business-Report Arvind Soni-2arvindsoni0080% (1)

- DDM HW1 Akash SrivastavaDocument14 pagesDDM HW1 Akash SrivastavaAkash Srivastava100% (2)

- Advanced Portfolio Management: A Quant's Guide for Fundamental InvestorsFrom EverandAdvanced Portfolio Management: A Quant's Guide for Fundamental InvestorsNo ratings yet

- Mscfe CRT m2Document6 pagesMscfe CRT m2Manit Ahlawat100% (1)

- SPSW Practice Assessment Book Muddle StoneDocument7 pagesSPSW Practice Assessment Book Muddle StoneMelita Rudo Ncube ZhuwararaNo ratings yet

- Chap 2Document48 pagesChap 2sankalpakash100% (1)

- Chapters 7 and 8 EditedDocument20 pagesChapters 7 and 8 Editedomar_geryesNo ratings yet

- Lab 2 StudentDocument27 pagesLab 2 StudentJeanette MyersNo ratings yet

- Excel DIAD Model May 2015Document6 pagesExcel DIAD Model May 2015Manny JorgeNo ratings yet

- Assignment 2 BC-22Document4 pagesAssignment 2 BC-22Satyajit RoyNo ratings yet

- QM-II Midterm OCT 2014 SolutionDocument19 pagesQM-II Midterm OCT 2014 SolutionsandeeptirukotiNo ratings yet

- Taxes, Tips, and DiscountsDocument11 pagesTaxes, Tips, and DiscountsMr. PetersonNo ratings yet

- Business Report Project SMDM - Divjyot Shah Singh - 10102021Document19 pagesBusiness Report Project SMDM - Divjyot Shah Singh - 10102021Divjyot100% (1)

- Part 1: 60 Points.: Bus 145-D09 Midterm Exam #2 April 2020Document6 pagesPart 1: 60 Points.: Bus 145-D09 Midterm Exam #2 April 2020Shubeg SinghNo ratings yet

- Marketing 8680: Database Marketing Abc5 Fis Malësori 14254587Document7 pagesMarketing 8680: Database Marketing Abc5 Fis Malësori 14254587Fis MalesoriNo ratings yet

- ISDA2 - Stage 2 Group 47Document11 pagesISDA2 - Stage 2 Group 47missmokoena20No ratings yet

- Lincoln Memorial University: Caylor School of NursingDocument37 pagesLincoln Memorial University: Caylor School of NursingMbi1965100% (2)

- Practice Final Exam: Good Luck!Document7 pagesPractice Final Exam: Good Luck!Ram IyerNo ratings yet

- How To Interpret Backtest ResultsDocument7 pagesHow To Interpret Backtest Resultsvenus828No ratings yet

- 3 Issues of Oracle Payables PLZ Help MeDocument4 pages3 Issues of Oracle Payables PLZ Help MerhrashelNo ratings yet

- In Class ActivityDocument1 pageIn Class Activitynavrosesandhu5No ratings yet

- Part 2 Risk and Return Raising Capital Corporate Restructuring and Bankruptcy - Sol 20 Jan 2024Document63 pagesPart 2 Risk and Return Raising Capital Corporate Restructuring and Bankruptcy - Sol 20 Jan 2024Tess PetancioNo ratings yet

- 4EC1 02 Pre-First-Assessment ExemplarsDocument21 pages4EC1 02 Pre-First-Assessment ExemplarsShibraj DebNo ratings yet

- SAP Certified Application Associate - Financial Accounting With SAP ERP - FullDocument41 pagesSAP Certified Application Associate - Financial Accounting With SAP ERP - FullMohammed Nawaz ShariffNo ratings yet

- How To Use Solver in Kingsoft 2Document6 pagesHow To Use Solver in Kingsoft 2RazvanNo ratings yet

- Part 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Document66 pagesPart 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Alyssa PilapilNo ratings yet

- حل المشروعDocument13 pagesحل المشروعانور الحاجNo ratings yet

- Payables R12 AccountingDocument13 pagesPayables R12 AccountingCGNo ratings yet

- 2Document13 pages2Ashish BhallaNo ratings yet

- Ma1 Examreport July Dec 2018 PDFDocument4 pagesMa1 Examreport July Dec 2018 PDFeiffa batrisyiaNo ratings yet

- CFA Level 2 Equity Valuation Study ExamplesDocument6 pagesCFA Level 2 Equity Valuation Study ExamplessaurabhNo ratings yet

- Business Report Project - SMDM Group 10 16-March-2020Document12 pagesBusiness Report Project - SMDM Group 10 16-March-2020Rajat Prakash singhNo ratings yet

- Introduction To Solver: Smalcolm - Doc, and The Excel File Malcolm - XLS) - The Sample ExcelDocument6 pagesIntroduction To Solver: Smalcolm - Doc, and The Excel File Malcolm - XLS) - The Sample ExcelYusuf HusseinNo ratings yet

- Common Errors at The Time of Executing J1inchlnDocument4 pagesCommon Errors at The Time of Executing J1inchlnPavan KocherlakotaNo ratings yet

- Peg Sept11 p1Document18 pagesPeg Sept11 p1patriciadouceNo ratings yet

- Lab 2: Modules: Step 1: Examine The Following AlgorithmDocument27 pagesLab 2: Modules: Step 1: Examine The Following AlgorithmJeanette Myers100% (1)

- Lab 2 StudentDocument27 pagesLab 2 StudentJeanette Myers100% (1)

- TH THUD C4 Basic 2023 EDocument13 pagesTH THUD C4 Basic 2023 Ephanthimyduyen2102No ratings yet

- AREA D OTs ANSWERS UPDATEDDocument12 pagesAREA D OTs ANSWERS UPDATEDAmir HamzaNo ratings yet

- SAP Certified Application Associate - Financial Accounting With SAP ERP - FullDocument41 pagesSAP Certified Application Associate - Financial Accounting With SAP ERP - FullMohammed Nawaz ShariffNo ratings yet

- Real Time Tickets in SAP SDDocument6 pagesReal Time Tickets in SAP SDNoopur Rai100% (1)

- Real Time Tickets in SAP SD: 1) Billing Document Not Released To Accounting / Accounts DeterminationDocument3 pagesReal Time Tickets in SAP SD: 1) Billing Document Not Released To Accounting / Accounts DeterminationPallavi SolaseNo ratings yet

- Manage Prescribed Load List (PLL) AR0008 C: InstructionsDocument5 pagesManage Prescribed Load List (PLL) AR0008 C: InstructionsAmazinmets07No ratings yet

- SAP ERP Financial Accounting (FI) Certifications Practice Exam - MiniDocument22 pagesSAP ERP Financial Accounting (FI) Certifications Practice Exam - MinifarazhussainkhanNo ratings yet

- P1 March 2014 QPDocument20 pagesP1 March 2014 QPGabriel KorleteyNo ratings yet

- SAS Code TestDocument9 pagesSAS Code TestStiven DingNo ratings yet

- Business Report SMDM (July 2020) - Mohammed Tayab KhanDocument14 pagesBusiness Report SMDM (July 2020) - Mohammed Tayab Khantayab khanNo ratings yet

- Corporate Finance 9th Edition Ross Solutions ManualDocument33 pagesCorporate Finance 9th Edition Ross Solutions Manualtaylorhughesrfnaebgxyk100% (28)

- Cheatsheet For Oracle Financials For IndiaDocument8 pagesCheatsheet For Oracle Financials For IndiaKishore BellamNo ratings yet

- DD Unit 5. SlidesDocument27 pagesDD Unit 5. SlidesThanos GowdaNo ratings yet

- Data Mining Business ReportDocument38 pagesData Mining Business ReportThaku SinghNo ratings yet

- International Bond Pricing Homework: OutputDocument7 pagesInternational Bond Pricing Homework: OutputvikbitNo ratings yet

- ACC311 Mid FallDocument7 pagesACC311 Mid Fallfari kh100% (1)

- Business Report Project: Student's Name - ANAMIT DEB GUPTADocument12 pagesBusiness Report Project: Student's Name - ANAMIT DEB GUPTAGupta AnacoolzNo ratings yet

- Dosage Calculations PacketDocument39 pagesDosage Calculations PacketJack KeurigNo ratings yet

- SFMSOLUTIONS Master Minds PDFDocument10 pagesSFMSOLUTIONS Master Minds PDFHari KrishnaNo ratings yet

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet