Professional Documents

Culture Documents

MBA Insurance Risk

MBA Insurance Risk

Uploaded by

End EndOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBA Insurance Risk

MBA Insurance Risk

Uploaded by

End EndCopyright:

Available Formats

Punjab Technical University

Jalandhar

Syllabus Scheme

(3

rd

to 4

th

Semester)

for

MBA

Specialization in

Insurance & Risk Management

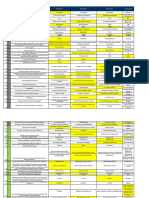

STUDY SCHEME OF M.B.A. - INSURANCE & RISK MANAGEMENT

SEMESTER-3

SEMESTER-4

SUBJECT NAME

SUBJECT

CODE

Total

Hrs.

(Lec+Pr

a)

Marks

Int.

Marks

Ext.

Total

Marks

Applied Operations Research

MBA 301

50

25 75 100

Corporate Legal Environment

MBA 302

50 25 75 100

MAJ OR 1(I&R)

MBA 561

40 25 75 100

MAJ OR 2 (I&R.)

MBA 562

40 25 75 100

MAJ OR 3(I&.R.)

MBA 563

40 25 75 100

Seminar on Management

Information SYSTEM

MBA 306

20 100 0 100

Viva-Voce

MBA 308

25 75 100

TOTAL 240 250 450 700

SUBJECT NAME

SUBJECT

CODE

Total

Hrs.

(Lec+Pra)

Marks

Int.

Marks

Ext.

Total

Marks

Strategic Management

MBA 401

45

25 75 100

Project Evaluation &

Implementation

MBA 402

45 25 75 100

MAJ OR 4(I&R.)/ MINOR1

MBA 564

50 25 75 100

MAJ OR 5(I&R.)/ MINOR2 MBA 565 50 25 75 100

MAJ OR 6(I&R.) / MINOR3

MBA

566

50 25 75 100

Final Research Project & Viva-

Voce

MBA 406

200 200

TOTAL 240 125 575 700

SPECALIZATION GROUP- INSURANCE & RISK MANAGEMENT

MBA 561 - Principles and Practice of Life Insurance & General

Insurance ( PTU PAPER 1)

MBA 562 - Life & Non Life Insurance Domains ( PTU PAPER 2 )

MBA 563 - Law of Insurance ( PTU PAPER 3 )

MBA 564 - Risk Management & Life Insurance Underwriting

(PTU PAPER 4 )

MBA 565 - Liability of Insurance & Life Insurance Claims

(PTU PAPER 5 )

MBA 566- Life Insurance Products & Concepts of Reinsurance

(PTU PAPER-6 )

Major/Minor Specialization :

In 3rd semester the student will have the choice of choosing any three

subjects from a particular specialization group i.e. either from Marketing,

Finance, HRM, IT or INSURANCE & RISK Management.

In the 4th semester, student can undertake the remaining three subjects of

the same specialization group which he/she opted in the 3rd semester. In

this case he/she will be awarded only Major specialization and no minor.

OR

The student can undertake three subjects of some other specialization

group than he/she opted in the 3rd semester. In this case he/she will be

awarded Major specialization in the stream in which he/she has conducted

his/her Final Research Project and Minor specialization for the other

stream.

Guidelines for Internal Assessment :

The internal marks will be based on a continuous assessment and the

following is to be adhered to :

Test/Quizs (15 Marks). Best 2 out of 3.

Presentation/Reports/Home assignments (5 Marks)

Class attendance/General behaviour (5 marks)

Guidelines for External Practical / Viva-Voce :

The external practical /viva-voce will be conducted as per the details

mentioned above in study scheme by an external examiner appointed by the

University.

MBA 561 - Course Name: Principles and Practice of Life Insurance &

General Insurance ( PTU PAPER 1)

INSTRUCTIONS FOR PAPER-SETTER

The question paper will consist of Two parts, A and B. Part A will have 15

short answer questions (40-60 words) of 2 marks each. Part B will have 12

long answer questions of 5 marks each. The syllabus of the subject is divided

into 3 sections I, II and III. The question paper will cover the entire syllabus

uniformly. Part A will carry 5 questions from each section and Part B will

carry 4 questions from each section.

INSTRUCTION FOR CANDIDATES

Candidates are required to attempt all questions from Part A and 9 questions

of Part B out of 12.

Aims and

Objectives

To make students aware of historical background of insurance,

functions of life insurance, application of various principles of life

insurance, policy conditions.

To provide basic knowledge of various life insurance products, their

provisions and benefits and servicing aspects like surrender, paidup,

revi val and claim payment etc.

To develop an understanding among the students of the conceptual

framework of general insurance

To develop the students ability to understand the fundamentals of

insurance including their practical applications to various classes of

general insurance

To make the students understand various practices with specific

reference to underwriting, rating, claims settlement and allied

servicing, available in the general insurance sector with a brief

reference to various types and classes of insurance in this sector

To also familiarize the students with various kinds of forms and

policies.

Course

CONTENT

Origin of the Insurance concept

Principles of Life assurance

Elements in computation of Assurance premium

Selection and Classification of risks

The basic principles of utmost good-faith

Plans of Life Insurance

Application & Acceptance

Origin of General Insurance, Concepts

Basic Principles of Insurance

General Insurance Market

Insurance Forms

Types of Insurance

Underwriting & Rating Practices

Claims : Practice & Procedure

.

Required Reading

Insurance Institute of Indian Courseware IC-02 &

IC -23

Other Readings:

Life and Health Insurance (13

th

Edition), - Black, J r.

Kenneth and Horold Skipper Pearson (Indian Economy

Edition).

Principles of Risk Management and Insurance

(13

th

Edition) Rejda, George (Economy (Indian

Economy Edition)

Risk Management and Insurance Trieschman,

Gustavson and Hoyt South Western College,

Publishing, Cincinnati, Ohio.

ICFAI Course book Life Insurance Vol. I, II, III,

(LBRARO)

Life Insurance S. Heubner (LBRARO)

IC- 1 & 11 (Insurance Institute of India)

Principles of Risk Management & Insurance George

E Rejda (Published by New Delhi: Pearson

Education, 2004)

MBA 562 Course Name: Life & Non Life Insurance Domains ( PTU

PAPER 2 )

INSTRUCTIONS FOR PAPER-SETTER

The question paper will consist of Two parts, A and B. Part A will have 15

short answer questions (40-60 words) of 2 marks each. Part B will have 12

long answer questions of 5 marks each. The syllabus of the subject is divided

into 3 sections I, II and III. The question paper will cover the entire syllabus

uniformly. Part A will carry 5 questions from each section and Part B will carry

4 questions from each section.

INSTRUCTION FOR CANDIDATES:

Candidates are required to attempt all questions from Part A and 9 questions

of Part B out of 12.

Aims and Objectives The objecti ve of this subject is to provide in depth

knowledge on various aspects of Life and General

Insurance like Pension & Retirement plans, Fire &

Consequential Loss, Health and Personal Accident,

Miscellaneous Insurance, Automobile Insurance,

Engineering and Project Insurance, Group and Social

Insurance, Marine Insurance,& Rural Insurance

Course

CONTENT

Pension and Retirement Insurance

Introduction to retirement schemes

Superannuation schemes

Basic Annuity Concepts, variable and market value

adjusted annuities, taxation of annuities.

Regulation of annuities

Marketing basics

Taxation Treatment provisions for Retirement Benefits

Fire & Consequential Loss

History of Fire Insurance;

Need, Purpose & Functions of Fire Insurance

Application of basic principles

Subject matter of fire insurance;

Introduction to All India Fire Tariff;

Classification of Risks;

Building Rules;

FEA Rules/ Discount

Low-Claim Discount

Categorization of Hazardous Goods;

Hazards of Speciatic Trades and Industries.

Fire & Spl. Peril Policy

Scope : In built causes/perils; Add on Covers;

Exclusions: property, Causes and Perils;

Conditions;

Special Policies and Clauses;

IAR Policy : Scope Rating & other aspects;

Warranties and their importance;

Underwriting Aspects and applications;

Rating of fire Risks (Industrial & Non-

industrial);

Rating of Add on Perils;

Fixing of Sum Insured for various Subject

Matters;

Practice of Fire Insurance : procedural

Aspects

(including overseas practices);

Policy Drafting;

Pre inspection of Risks;

Co-insurance practices;

Acceptance Limits.

Consequential loss (Fire) insurance

Claims

Health and Personal Accident

Brief introduction

History & importance of health insurance; definition of

health; role & directive principles of state policy; current

trends in India; IRDA Regulations; Principles &

Standards; Regulatory status of select health insurance

schemes

Documents

Proposal form & its importance; Policy & Schedule;

Endorsements; Riders; Renewals

Health & Accident Insurance In India

Relation of Health Insurance to Life Insurance &

General Insurance Policies; Types of policies ; Standard

Products - Basic health insurance, accident insurance

and related overseas travel insurance; Individual and

Group Coverages; Issues related to Critical Illness,

domiciliary treatment, hospitalization ; comparative

study of few available new health insurance products in

the market.

Underwriting

Concept of Morbidity and importance of morbidity tables

to insurers; Underwriting Factors and Rate making in

health insurance

Claims Management

Documents; Methods of settlement Reimbursement &

Cashless; Third Party Administrators regulations and

their role in health insurance in India

Reinsurance of Health insurance risks

Miscellaneous Insurance

1. Background of Misc. Insurance

2. Scope, Exclusions, Conditions, Underwriting

considerations and Rating aspects of:

Personal :- All Risk Ins., Baggage Ins., TV/Video Ins., Gun

Ins., Pedal Cycle Ins., Cellphone Ins.

Commercial :- Burglry Ins., Plate Glass Ins., Lift Ins.,

Money Ins., Sign Ins., Fidelity Guarantee Ins.

Package Products :- House Holders Ins., Sampoorne

Suraksha/ Sweet Home., Shopkeepers Pkg. Ins., Office

Umbrella Ins., LPG Traders Combines Ins., J eweller

Block Ins.,

Hotellers Pkg. Ins., Bankers Blanket Ins., Doctors Pkg. Ins.,

Film Studio Ins., Stock Brokers Ins., Golfers Pkg. Ins.

3. Special Products & Related Aspects : Kidnap & Ransom

Ins.

4. Special Contingency Policies & Related Aspects.

5. Other Products & their Analysis.

6. Claim procedure and Loss Minimization aspects.

7. Acceptance Limits.

Automobile Insurance

Introduction to Motor Insurance

Legal provisions (Motor Vehicles Act 1938 &

subsequent amendments (1988) and its applications

Documents

Motor Insurance Policies

(i) Liability Only Policy

(ii) Package Policy

(a) Private Vehicles & Two wheelers

(b) Commercial Vehicles

General Regulations

Principles & Practices of Underwriting

Principles & Practices of Claims Management

(i) Own Damage Claims

(ii) Third Party Liability Claims

Reinsurance of Motor Insurance

Engineering and Project Insurance

Origin and history of Engineering Insurance

Special features of Engineering Insurance

Project Insurance (Construction Phase) Policies

Contractors all risks insurance:

Storage cum Erection (Erection All Risks) Insurance:

Contract works Insurance:

Contractors Plant and Machinery Insurance:

Operational phase or Annual policies

Machinery Insurance

Boiler & pressure plant Insurance

Electronic Equipments Insurance

Civil engineering completed risks

Machinery Loss of Profits Insurance:

Advance Loss of Profits Insurance:

Deterioration of stocks Insurance:

General Aspects of Engineering Insurance:

Industrial All Risks

Group and Social Insurance

Group Life Insurance Schemes

Rate making in Group Insurance

Gratuity Schemes and its objectives

Employees recognized provident fund

Social Security Schemes

Taxation Treatment Provisions for Group Insurance

Benefits.

Marine Insurance

General Background

Principles of Trade/Commerce Applicable in Marine

Cargo Insurance

Application of Fundamental Principles to Marine

Insurance

Types of Insurance Documents

Types of Policy

Underwriting Considerations & Rating

Types of Losses & measure of Profits.

Claims

Cargo Loss Prevention :

Containerisation, Multi-Modal Transport, ICDS etc.

Health Insurance (In Brief)

Rural Insurance

Agriculture (Crop Insurance) and Weather Insurance

Agricultural Pumpset Insurance

Insurance of Cattle

Insurance of Poultry and Ducks

Live stock Insurance

Insurance of micro animals

J anata Personal Accident & Gramin Accident Insurance

Horticulture and Plantation Insurance

Farmers Package (Kisan Package) Insurance

Aquaculture (Shrimp & Prawn) Insurance

Re-insurance of Agriculture Risks

Required Readings

Group and Retirement Benefits Schemes IC-83 by

Insurance Institute of India.

Pension Schemes and Retirement Benefits by Hosking

IC-57 -I.I.I. George E. Rejda

J r. Kenneth Black & Harold Skipper Pearson Life and

Health Insurance (13

th

Edition) (Indian Economy Edition)

George E. Rejda Principles of Risk Management &

Insurance (13

th

Edition), (Indian Economy edition)

Insurance Institute of India Publication IC 73 / S.

Heubner Life Insurance

Trieschman, Gustavson & Hoyt Risk Management &

Insurance South Western College Publishing,

Cincinnati, Ohio

ICFAI Publication Life Insurance Vol. I, II & III

(LBRARO)

IC-78 III Publication

Insurance Institute of India publication - Motor Insurance

(IC 72)

ICFAI publication - Insurance Underwriting - Managerial

Perspective Volume III

ICFAI Publication General Insurance Volume I

IRDA Website : <www. Irdaindia.org> for latest

amendments and updates

IC-77 III Publication

Group and Retirement Benefits Schemes IC-83 by

Insurance Institute of India.

Group Life Insurance by Dr. D.W. Gregg.

IC-63, 65, 66- III Publication

IC-71 III Publication

MBA 563 Course Name: Law of Insurance ( PTU PAPER 3 )

INSTRUCTIONS FOR PAPER-SETTER

The question paper will consist of Two parts, A and B. Part A will have 15

short answer questions (40-60 words) of 2 marks each. Part B will have 12

long answer questions of 5 marks each. The syllabus of the subject is divided

into 3 sections I, II and III. The question paper will cover the entire syllabus

uniformly. Part A will carry 5 questions from each section and Part B will carry

4 questions from each section.

INSTRUCTION FOR CANDIDATES

Candidates are required to attempt all questions from Part A and 9 questions

of Part B out of 12.

Aims and

Objectives

To familiarize the students with various laws and regulations

applicable to Insurance Business

COURSE CONTENT 1. Definition and Sources of Law

2. J udicial set-up in India

3. Insurance as a Contract

4. Doctrines of Insurance & their Legal Implications

5. Insurance Act 1938- Important provisions

6. IRDA Act 1999:

a. Composition, Power, Functions and Duties of IRDA

b. IRDA regulations relating to:

i. Licensing of Insurance Agents

ii. Registration of Insurance Companies

iii. General Insurance Re-Insurance

iv. Assets, Liabilities and Solvency Margins

v. Insurance Advertisements and Disclosure

vi. Life Insurance Re-insurance

vii. Investment Amendments

viii. Insurance Surveyors & Loss Assessors

ix. Third Party Administrators

x. Protecting of Policy Holders Interest

xi. Licensing of Brokers

7. Other Important legislations:

i. Grievance Redressal Rules and Insurance

Ombudsman

ii. Consumer Protection Act 1986

iii. Salient provisions of Indian Stamp Act

iv. Indian Limitation Act

v. Indian Evidence Act

Required Reading

Taxmanns: Insurance Law Manual

Universal: Insurance Laws

Rajiv J ain: Insurance Law & Practice

M.N. Srinivasan: Principles of Insurance Law

Avtar Singh: Laws of Insurance

IC-24: Legal Aspects of Life Insurance

MBA 564 Course Name: Risk Management & Life Insurance Underwriting

( PTU PAPER 4 )

INSTRUCTIONS FOR PAPER-SETTER

The question paper will consist of Two parts, A and B. Part A will have 15

short answer questions (40-60 words) of 2 marks each. Part B will have 12

long answer questions of 5 marks each. The syllabus of the subject is divided

into 3 sections I, II and III. The question paper will cover the entire syllabus

uniformly. Part A will carry 5 questions from each section and Part B will carry

4 questions from each section.

INSTRUCTION FOR CANDIDATES

Candidates are required to attempt all questions from Part A and 9 questions

of Part B out of 12.

Aims and Objectives

To make the students understand the basics and techniques

of risk management

Understanding the concepts of risk management would

prepare the students to assess the risks & decide on its

acceptance

Once having decided to accept, the next step in underwriting

will be to price the risk-knowledge of risk management will

help a student to suitably discount the premium

The objecti ve of the course is to impart sound understanding

of the Role, Standards, Principles of Individual & Group

Li ves and practice of the Life Insurance Underwriting. The

inter relationship of underwriting to firms Solvency, Key

Factors Affecting Insurability, Regulatory Aspects and Role

of Reinsurance in Underwriting and latest developments in

Risk Appraisal

.

Course CONTENT

Risk Management

Introduction to concept of risk, hazard and peril,

Concept of tolerable limits and downside, Concept of

risk, Process of Risk Management

Risk Perception, various tools used to perceive a Risk,

Organisation Charts, Flow Charts, Accounting Methods

Exposure Analysis, Check Lists, DOW index, Fault

Tree, Event Tree

HAZOP studies, safety audit

Introduction to the process of Risk evaluation and

concept of Probability, what is PML, (just the concept)

Decision Making Criteria

Importance of valuation of a risk, concept of Sum

Insured and how to fix the Sum Insured

Introduction to the process of Risk Control, Loss

Prevention, various methods

Techniques of Risk Retention, captives and methods of

Self Retention

Risk Transfer Mechanisms

Life Insurance Underwriting

Significance of pricing fundamentals

Underwriting Basics

Organization of Underwriting

Underwriting Philosophy & Guidelines

Sources of Underwriting information

Making an Underwriting decision

Physiological systems, diseases and extra risk

calculation, extra premiums etc.

Group Life Insurance Underwriting.

Technology in Underwriting.

Genetics and Life Insurance Underwriting.

Required Reading Risk Management and Insurance: Vaughan and

Vaughan

Risk Management: a publication of the Insurance

Institute of India

Guide to Risk Management: Sagar Sanyal

Loss prevention in process industries: Lees

Skipper & Black : Life & Health Insurance

George Rejda: Principles of Risk Management &

Insurance.

III Course Book : IC-22

MBA 565 Course Name: Liability of Insurance & Life Insurance Claims

( PTU PAPER 5)

INSTRUCTIONS FOR PAPER-SETTER

The question paper will consist of Two parts, A and B. Part A will have 15

short answer questions (40-60 words) of 2 marks each. Part B will have 12

long answer questions of 5 marks each. The syllabus of the subject is divided

into 3 sections I, II and III. The question paper will cover the entire syllabus

uniformly. Part A will carry 5 questions from each section and Part B will carry

4 questions from each section.

INSTRUCTION FOR CANDIDATES

Candidates are required to attempt all questions from Part A and 9 questions

of Part B out of 12.

Aims and

Objectives

To equip students with knowledge of contemporary practices in

Liability Insurance in Industry

Claims management is the core area of insurance business and

meeting customer satisfaction. In view of the globalization and

liberalization of insurance sector, it has become inevitable to

provide timely settlement of claims. Accordingly the subject of

claim management has been framed to look to the various aspects

of claims management and the legal implications to match with the

consumers expectation

Course CONTENT Recap on the types of Liability Insurance covers

available viz Motor/Employers Liability/Public &

Product liability/Professional Indemnity.

Rating and Premium computation for various Liability

covers Including Industrial/non-Industrial Public Liability

Risks. Additional Covers and extensions.

Professional Indemnity covers with specific reference to

Doctors/Architects/Directors& Officers. Product-liability

Insurance in Specific Industries.

Emerging trends and challenges in the Industry.

Concept of Claims

Classification of Claims

Essential Elements of Claims

Claims Procedure and Claimants

Claims Procedure and the Insurer

Claims Settlements

Claims Disputes and Settlements

Claims Management Systems and Organization

Structure.

Quality of Services and Claims Management

Claims Cost and Cost Effective Settlement

Importance of Cost in Claims Management

Leading Legally Decided Disputed Claims

Required Readings Liability Insurance :IC-74, (I.I.I.)

Liability and Engineering Insurance : IC-79 (I.I.I.)

Principles of Risk Management and insurance: George

Rejda

ICFAI Publications Claim Management Vol. 1& 2.

Insurance Institute of India Publications.

MBA 566 Course Name: Life Insurance Products & Concepts of

Reinsurance ( PTU PAPER 6 )

INSTRUCTIONS FOR PAPER-SETTER

The question paper will consist of Two parts, A and B. Part A will have 15

short answer questions (40-60 words) of 2 marks each. Part B will have 12

long answer questions of 5 marks each. The syllabus of the subject is divided

into 3 sections I, II and III. The question paper will cover the entire syllabus

uniformly. Part A will carry 5 questions from each section and Part B will carry

4 questions from each section.

INSTRUCTION FOR CANDIDATES

Candidates are required to attempt all questions from Part A and 9 questions

of Part B out of 12.

Aims and

Objectives

To make the student aware about the different products available in

the market & their distinguished features.

To familiarize students with the basic concepts and make them

conversant with its application to Industry

Course

CONTENT

Nature of Insurance Products.

Terms, Conditions, Privileges and benefits of various

Insurance Products.

Term Assurance products.

Endowment Products.

Children Endowment Products.

Money Back Products.

Whole Life Products.

ULIP Products.

Comparative Studies of Life Insurance Products of

different Co. and their analysis.

Historical background, meaning, nature, need and

functions of Re- Insurance.

Methods & types of Re-Insurance for

Property/Aviation/Marine Accident/Liability/Life.

Facultative & Treaty arrangements and calculations of

premiums

Re-Insurance Program design, negotiation and

placement, Clauses, Accounting, formats/ methods,

Taxation, legal-aspects, regulations and documentation.

New alternatives, selection, Rating for FID strength, ID

Ward Re- Insurance, Retrocession, Reciprocal trading.

Data collection and use of IT, Management of RI

Department and emerging trends in the Industry

Required Reading Website of Life Insurance Companies

IC-85 of III

Principles of Risk Management and Insurance: George

Rejda

You might also like

- AsphaltDocument182 pagesAsphaltEnd EndNo ratings yet

- Bentley MicroStation CONNECT Edition v10 00 00 25 x64 Torrent - Kickass TorrentsDocument4 pagesBentley MicroStation CONNECT Edition v10 00 00 25 x64 Torrent - Kickass TorrentsEnd End0% (3)

- Life Insurance ProjectDocument73 pagesLife Insurance ProjectSanthosh SomaNo ratings yet

- Mba Insurance Black BookDocument59 pagesMba Insurance Black BookleanderNo ratings yet

- Liberalisation of Insurance Services RefinedDocument22 pagesLiberalisation of Insurance Services RefinedJojin JoseNo ratings yet

- Shriram Llife Insurance Intership ProgrammeDocument9 pagesShriram Llife Insurance Intership ProgrammeGOMATHI VNo ratings yet

- Insurance ProjDocument20 pagesInsurance ProjMahesh ParabNo ratings yet

- SBI Life InsuranceDocument41 pagesSBI Life InsuranceSandeep Mauriya0% (1)

- Literature Review On Insurance Management SystemDocument5 pagesLiterature Review On Insurance Management SystemAncy KalungaNo ratings yet

- Shubham Sharma (Internship Report)Document47 pagesShubham Sharma (Internship Report)SHARMA TECH0% (1)

- Chapter 1-History of Life InsuranceDocument9 pagesChapter 1-History of Life InsuranceGanesh Sadaphal44% (9)

- Credit Point SystemDocument3 pagesCredit Point Systemshanmuga89No ratings yet

- New Syllabus PDFDocument77 pagesNew Syllabus PDFPrashantNo ratings yet

- Life Insurance - Update - Jun18 - HDFC Sec-201806271458398006724Document28 pagesLife Insurance - Update - Jun18 - HDFC Sec-201806271458398006724Jehan BhadhaNo ratings yet

- A Project Report On "Consumer Perception Towards Insurance Sector"Document109 pagesA Project Report On "Consumer Perception Towards Insurance Sector"abhishey guleriaNo ratings yet

- Birla Sun Life InsuranceDocument42 pagesBirla Sun Life InsurancerobanabangbangNo ratings yet

- Finacial Performance of Life InsuracneDocument24 pagesFinacial Performance of Life InsuracneCryptic LollNo ratings yet

- Ic 72Document1 pageIc 72Sandeep NehraNo ratings yet

- Spl. Diploma On Health InsuranceDocument3 pagesSpl. Diploma On Health InsuranceKishore mohan ManapuramNo ratings yet

- IciciDocument8 pagesIcicidhanushNo ratings yet

- Contribution of Insurance IndustryDocument32 pagesContribution of Insurance IndustrysayedhossainNo ratings yet

- A Comparative Study of Public & Private Life Insurance Companies in IndiaDocument9 pagesA Comparative Study of Public & Private Life Insurance Companies in IndiaAamir Sohail KurashiNo ratings yet

- Executive Summary: M.S.R.C.A.S.C BangaloreDocument72 pagesExecutive Summary: M.S.R.C.A.S.C BangaloreSubramanya Dg100% (2)

- III AssociateDocument2 pagesIII Associateagupta_118177No ratings yet

- 88 - IC-Marketing-and-Public-RelationsDocument1 page88 - IC-Marketing-and-Public-RelationsVINAY S N33% (3)

- To Study The Customer Preference Level of Life Insurance: Networth Direct Co. LTDDocument7 pagesTo Study The Customer Preference Level of Life Insurance: Networth Direct Co. LTDpranishmanNo ratings yet

- Royal Sundaram General InsuranceDocument22 pagesRoyal Sundaram General InsuranceVinayak BhardwajNo ratings yet

- ECGC Slide ShareDocument17 pagesECGC Slide ShareBiswajit DuttaNo ratings yet

- Reliance Life Insurence Projected by Sudhakar Chourasiya MaiharDocument74 pagesReliance Life Insurence Projected by Sudhakar Chourasiya Maihars89udhakar100% (3)

- Insurance ReportDocument87 pagesInsurance ReportLeena LalwaniNo ratings yet

- Market Segmentation For Insurance: Users of Insurance Service: Marketing Information SystemDocument10 pagesMarket Segmentation For Insurance: Users of Insurance Service: Marketing Information SystemTejal GuptaNo ratings yet

- A Project Report On Unit Linked Insurance PlanDocument4 pagesA Project Report On Unit Linked Insurance Planjifinjames99No ratings yet

- Ratio Analysis of LICDocument31 pagesRatio Analysis of LICpareekkuldeep0% (1)

- Presentation On Kotak Life InsuranceDocument15 pagesPresentation On Kotak Life Insurancehitesh38560% (1)

- Final ProjectDocument14 pagesFinal Projectkiru_makhija100% (1)

- SBI Life Insurance Ulips Plan ADocument76 pagesSBI Life Insurance Ulips Plan AMohit kolliNo ratings yet

- "PROFITABILITY OF LIFE INSURANCE" Shailesh Kumar Singh and Prof. Peeyush Kumar PandeyDocument9 pages"PROFITABILITY OF LIFE INSURANCE" Shailesh Kumar Singh and Prof. Peeyush Kumar PandeySourya Pratap SinghNo ratings yet

- Ic33 Print Out 660 English PDFDocument54 pagesIc33 Print Out 660 English PDFumesh100% (1)

- Report On BhartiDocument57 pagesReport On BhartiWendy CannonNo ratings yet

- Report On Ulip by Sandeep AroraDocument103 pagesReport On Ulip by Sandeep AroraSANDEEP ARORA100% (1)

- Insurance Industry RM1Document62 pagesInsurance Industry RM1Raj Kumar RanganathanNo ratings yet

- Birla Sun Life Insurance Product Portfolio PROJECT ReportDocument70 pagesBirla Sun Life Insurance Product Portfolio PROJECT Reportkajal nayakNo ratings yet

- A Project Report On Consumer PerceptionDocument106 pagesA Project Report On Consumer PerceptionAKSHIT VERMANo ratings yet

- Life Insurance: AN Assignment OnDocument40 pagesLife Insurance: AN Assignment OnAmar AhirwarNo ratings yet

- New Black Book General Insurance 2017Document69 pagesNew Black Book General Insurance 2017Siddhesh VarerkarNo ratings yet

- Ethics in Insurance Sector of IndiaDocument43 pagesEthics in Insurance Sector of IndianandiniNo ratings yet

- Insurance Domain KnowledgeDocument1 pageInsurance Domain KnowledgeSubbu PuliNo ratings yet

- Marketing of InsuranceDocument22 pagesMarketing of InsuranceshrenikNo ratings yet

- Rishi Project BookDocument93 pagesRishi Project BookAnvesh Pulishetty -B100% (1)

- Issues and Challenges of Insurance Industry in IndiaDocument3 pagesIssues and Challenges of Insurance Industry in Indianishant b100% (1)

- Insurance (Life Insurance Corporation) : A Study OnDocument43 pagesInsurance (Life Insurance Corporation) : A Study Onjugnu_dubeyNo ratings yet

- A Project Report ON: Comparative Study of Ulip Plans Offered by Icici Prudential With Other Life Insurance Companies"Document76 pagesA Project Report ON: Comparative Study of Ulip Plans Offered by Icici Prudential With Other Life Insurance Companies"Ashish JainNo ratings yet

- Qualities of Comp ProfessionalsDocument5 pagesQualities of Comp ProfessionalsGrace OgundareNo ratings yet

- Pricing - Health Insurance Products: Anuradha Sriram - Anshul Mittal - Ankit KediaDocument31 pagesPricing - Health Insurance Products: Anuradha Sriram - Anshul Mittal - Ankit KediaRonit RayNo ratings yet

- Syllabus - Ic 88 Marketing and Public RelationsDocument1 pageSyllabus - Ic 88 Marketing and Public RelationsvinaykogNo ratings yet

- Project Report ON Max Life InsuranceDocument18 pagesProject Report ON Max Life Insuranceayushi bansalNo ratings yet

- Managing Credit Risk in Corporate Bond Portfolios: A Practitioner's GuideFrom EverandManaging Credit Risk in Corporate Bond Portfolios: A Practitioner's GuideNo ratings yet

- Health InsuranceDocument28 pagesHealth Insuranceप्रविण सराफNo ratings yet

- BLENDING of MSS Mix Design TypeDocument3 pagesBLENDING of MSS Mix Design TypeEnd EndNo ratings yet

- Quality Audit - Check Sheet - Carriage WorkshopDocument24 pagesQuality Audit - Check Sheet - Carriage WorkshopEnd End100% (1)

- Highway Design PDFDocument14 pagesHighway Design PDFRajesh BabuNo ratings yet

- Performance Evaluation of Polymer Modified Asphalt MixDocument39 pagesPerformance Evaluation of Polymer Modified Asphalt MixEnd End100% (1)

- Flexible Pavement Design ToolDocument13 pagesFlexible Pavement Design ToolRolando LópezNo ratings yet

- BS 598 104 1989 PDFDocument18 pagesBS 598 104 1989 PDFEnd EndNo ratings yet

- RIDOT Highway Design ManualDocument104 pagesRIDOT Highway Design ManualEnd EndNo ratings yet

- Upgradation of Gurgaon - Faridabad & Ballabgarh - Sohna Roads On BOT BasisDocument2 pagesUpgradation of Gurgaon - Faridabad & Ballabgarh - Sohna Roads On BOT BasisEnd EndNo ratings yet

- Test Method OthersDocument15 pagesTest Method OthersEnd End100% (1)

- Calibration of Rapid Moisture Meter No. R-1Document20 pagesCalibration of Rapid Moisture Meter No. R-1End EndNo ratings yet

- Material Specific Gravity Weight (KG) Volume (Cum) : Age Date of Testing Weight Load Strength Average RemarksDocument8 pagesMaterial Specific Gravity Weight (KG) Volume (Cum) : Age Date of Testing Weight Load Strength Average RemarksEnd EndNo ratings yet

- CBR - 3 - EnergyDocument187 pagesCBR - 3 - EnergyEnd End100% (1)

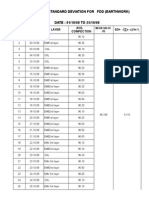

- SD of HighwayDocument8 pagesSD of HighwayEnd EndNo ratings yet

- DBMDocument29 pagesDBMEnd EndNo ratings yet

- StripDocument666 pagesStripEnd EndNo ratings yet

- FloodDocument5 pagesFloodEnd End100% (1)

- (CRMB) 60 Bitumen Test Results Nov 10Document26 pages(CRMB) 60 Bitumen Test Results Nov 10End EndNo ratings yet

- 1 (Varaha) (Suh)Document7 pages1 (Varaha) (Suh)End EndNo ratings yet

- WMM Mix DesignDocument23 pagesWMM Mix DesignEnd EndNo ratings yet

- Bituminous MacadamDocument3 pagesBituminous MacadamEnd EndNo ratings yet

- FNL SRNMP Vol 2 Uppwd r2Document271 pagesFNL SRNMP Vol 2 Uppwd r2End EndNo ratings yet

- Summary of Concrete Mix Design With Ultratech Cement Opc-53Document6 pagesSummary of Concrete Mix Design With Ultratech Cement Opc-53End EndNo ratings yet

- BitumenDocument35 pagesBitumenamanbhu1991100% (6)