Professional Documents

Culture Documents

Sbi Project Report

Sbi Project Report

Uploaded by

Anil MakvanaCopyright:

Available Formats

You might also like

- Punjab State Cooperative Bank 1 (Repaired)Document60 pagesPunjab State Cooperative Bank 1 (Repaired)DeepikaSaini75% (4)

- Project On NpaDocument83 pagesProject On NpaTouseef Shagoo64% (11)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Bank of Maharashtra Home LoanDocument95 pagesBank of Maharashtra Home Loansayyadsajidali100% (5)

- Perception of Customer Services Provided by Axis BankDocument45 pagesPerception of Customer Services Provided by Axis BankMunish Pathania100% (1)

- MBA Finance Project On Retail Banking With Special Reference To YES BANKDocument111 pagesMBA Finance Project On Retail Banking With Special Reference To YES BANKOmkar Vedpathak75% (4)

- SBI Mba Project ReportDocument89 pagesSBI Mba Project ReportSandeep Singh Kohli77% (22)

- Axis Bank (Black Book) (1) TejuDocument55 pagesAxis Bank (Black Book) (1) TejuTEJASHVINI PATEL0% (2)

- Rural Banking ProjectDocument55 pagesRural Banking ProjectDelisa Misquitta0% (1)

- CH 4 Money Market (Bharti Pathak)Document24 pagesCH 4 Money Market (Bharti Pathak)Mehak Ayoub0% (1)

- Numerical Methods in FinanceDocument268 pagesNumerical Methods in FinanceJeremiahOmwoyo100% (1)

- A Study On Home Loans - SbiDocument57 pagesA Study On Home Loans - Sbirajesh bathulaNo ratings yet

- SBI Internship ReportDocument14 pagesSBI Internship ReportMashum AliNo ratings yet

- Role of E-Banking With Special Reference To Axis Bank NewDocument80 pagesRole of E-Banking With Special Reference To Axis Bank NewMd WasimNo ratings yet

- Project - Viva On Financial Analysis of Indian BankDocument36 pagesProject - Viva On Financial Analysis of Indian Banksanthoshni100% (5)

- Bba ProjectDocument51 pagesBba ProjectShobharaj Hegade100% (2)

- Research Methodology Title of Project "A Comparative Study On Retail Banking With Special Reference To AXIS Bank"Document6 pagesResearch Methodology Title of Project "A Comparative Study On Retail Banking With Special Reference To AXIS Bank"Rajpal SheoranNo ratings yet

- Mba Project On LoanDocument47 pagesMba Project On Loanshuhel100% (1)

- A Report of Bank of BarodaDocument27 pagesA Report of Bank of BarodaAbhishekRajputNo ratings yet

- Consumer Satisfaction On Nashik Merchamt BankDocument40 pagesConsumer Satisfaction On Nashik Merchamt BankKunal Hire-Patil100% (2)

- Retail Loans ProjectDocument43 pagesRetail Loans ProjectLeo SamNo ratings yet

- Loans & Advancess in SBIDocument98 pagesLoans & Advancess in SBIShanu shriNo ratings yet

- Comparative Study On Advance Products of Bank of MaharashtraDocument54 pagesComparative Study On Advance Products of Bank of MaharashtraSami Zama0% (1)

- Bank of Baroda Summer Intership Project7Document78 pagesBank of Baroda Summer Intership Project7Binita Kumari83% (6)

- Mba Banking Project Report On Study On Home Loans of Icici BankDocument45 pagesMba Banking Project Report On Study On Home Loans of Icici Bankkhalil234No ratings yet

- Summer Training ReportDocument71 pagesSummer Training Reportbanti kumar50% (2)

- Project On Loans and AdvancesDocument3 pagesProject On Loans and Advancesbilgrak67% (6)

- Customer Satisfaction Towards HDFC BANKS and SBIDocument89 pagesCustomer Satisfaction Towards HDFC BANKS and SBIdivya palaniswamiNo ratings yet

- Project Report PNBDocument60 pagesProject Report PNBa_blackeyed86% (21)

- Axis Bank Research PaperDocument53 pagesAxis Bank Research PaperRuchika Rai0% (1)

- Study On Home LoansDocument52 pagesStudy On Home Loansbrijeshcoco0% (1)

- Study of Agriculture Loan in Bank of Maharashtra - BBA Finance Summer Training Project ReportDocument46 pagesStudy of Agriculture Loan in Bank of Maharashtra - BBA Finance Summer Training Project Reportharpreet gumber80% (15)

- Service and Customer Satisfaction Process in Axis Bank AkhilDocument66 pagesService and Customer Satisfaction Process in Axis Bank AkhilDinesh ChahalNo ratings yet

- Theoretical Framework of Home LoanDocument8 pagesTheoretical Framework of Home LoanTulika GuhaNo ratings yet

- Sip Report On Punjab National BankDocument75 pagesSip Report On Punjab National BankIshaan YadavNo ratings yet

- Bank of BarodaDocument90 pagesBank of Barodaabhishek pandeyNo ratings yet

- Profile of SBIDocument15 pagesProfile of SBIkarthikrishnaNo ratings yet

- Project Report - Union BankDocument203 pagesProject Report - Union BankAnkur Malhotra92% (12)

- SBI Bank ProjectDocument150 pagesSBI Bank Projectee23258No ratings yet

- SbiDocument84 pagesSbireddyreshma44_414448No ratings yet

- Project Report On Working Capital Assessment CANARA BANKDocument73 pagesProject Report On Working Capital Assessment CANARA BANKAsrar67% (6)

- Project On Comparison Between Diff BanksDocument90 pagesProject On Comparison Between Diff BanksViPul67% (27)

- Project On Axis BankDocument36 pagesProject On Axis Bankratandeepjain86% (7)

- Axis BankDocument98 pagesAxis BankMalay Shah50% (2)

- Project On SBI BankDocument48 pagesProject On SBI BankArvind Mahandhwal80% (5)

- Co Operative Banking Final ProjectDocument65 pagesCo Operative Banking Final ProjectYogi525No ratings yet

- ICICI Home LoansDocument92 pagesICICI Home LoansNitin Vats100% (1)

- Bank of Baroda Project (Blackbook)Document50 pagesBank of Baroda Project (Blackbook)Riya100% (6)

- Union Bank of IndiaDocument53 pagesUnion Bank of IndiaSonu DhangarNo ratings yet

- COmpetitive Analysis Bank of BarodaDocument84 pagesCOmpetitive Analysis Bank of BarodaShubham Chavan0% (1)

- Comparative Analysis of SBI & HDFC BankDocument101 pagesComparative Analysis of SBI & HDFC BankArvind Mahandhwal73% (55)

- Sbi Project ReportDocument117 pagesSbi Project ReportSai PrintersNo ratings yet

- Sbi Project ReportDocument113 pagesSbi Project Reportsandeep_pabbathi2020No ratings yet

- Sbi Project ReportDocument121 pagesSbi Project ReportSyaapeNo ratings yet

- GP - NPA in Various BanksDocument161 pagesGP - NPA in Various BanksDarshil KhadkhadNo ratings yet

- Summer Internship Report (Sanket Yadav) PDFDocument54 pagesSummer Internship Report (Sanket Yadav) PDFtejasNo ratings yet

- Final Project Samip Yajnik UbiDocument143 pagesFinal Project Samip Yajnik UbiVikash R JainNo ratings yet

- Project Report On NPA Policies of Bank of MaharashtraDocument64 pagesProject Report On NPA Policies of Bank of MaharashtraAMIT K SINGH88% (8)

- Internship Report MijanDocument103 pagesInternship Report Mijantanvir.ahammad01688No ratings yet

- Credit Management in Indian Overseas BankDocument60 pagesCredit Management in Indian Overseas BankAkash DixitNo ratings yet

- Yogesh Nivrutti Padekar Project ReportDocument62 pagesYogesh Nivrutti Padekar Project ReportSubodh SonawaneNo ratings yet

- Loan Disbursement and Recovery System of Janata Bank LimitedDocument66 pagesLoan Disbursement and Recovery System of Janata Bank LimitedTareq AlamNo ratings yet

- Annual Report of FAYSAL Bank Limited 2009Document129 pagesAnnual Report of FAYSAL Bank Limited 2009zabeehNo ratings yet

- Assignment S1 2023 PDFDocument13 pagesAssignment S1 2023 PDFDuy Trung BuiNo ratings yet

- CreditDocument8 pagesCreditmiranaismNo ratings yet

- Cash Flow Statements: by CA. Pramod Prabhu. S.HDocument17 pagesCash Flow Statements: by CA. Pramod Prabhu. S.HsonibijuNo ratings yet

- EPCL Preference Prospectus Approved by SECP (09-12-20)Document134 pagesEPCL Preference Prospectus Approved by SECP (09-12-20)owais khalidNo ratings yet

- Final - Problem Set FM FinalDocument25 pagesFinal - Problem Set FM FinalAzhar Hussain50% (2)

- Portfolio Investment & Risk AnalysisDocument13 pagesPortfolio Investment & Risk AnalysisrastehertaNo ratings yet

- Maxis Market ShareDocument4 pagesMaxis Market Sharenur atiq0% (1)

- Swing Trading The Speculator Way 124Document10 pagesSwing Trading The Speculator Way 124KL RoyNo ratings yet

- Srno Branchcode Name of The Sub Broker Bostt Exstt DiffsttDocument3 pagesSrno Branchcode Name of The Sub Broker Bostt Exstt Diffsttvgppearl115No ratings yet

- Low Latency White Paper BookletDocument20 pagesLow Latency White Paper BookletytgfNo ratings yet

- Impact of Corporate Decision Incorporate Finance: (Project Report: Corporate Regulation)Document16 pagesImpact of Corporate Decision Incorporate Finance: (Project Report: Corporate Regulation)Yash TiwariNo ratings yet

- Asset Valuation Problem Solving - CMDocument3 pagesAsset Valuation Problem Solving - CMGessille SalavariaNo ratings yet

- 202003291608410129geetika Kapoor SECONDARY MARKETDocument24 pages202003291608410129geetika Kapoor SECONDARY MARKETHasrat AliNo ratings yet

- GT Gold Corp.: Release Date: 25 June 2020Document12 pagesGT Gold Corp.: Release Date: 25 June 2020anon analyticsNo ratings yet

- PGDBF SyllabusDocument18 pagesPGDBF SyllabusAtul MadNo ratings yet

- Practical Accounting 1Document14 pagesPractical Accounting 1Anonymous Lih1laaxNo ratings yet

- Associated Bank v. CA and SarmientoDocument2 pagesAssociated Bank v. CA and SarmientoChedeng KumaNo ratings yet

- MATLAB For Finance FRM CFADocument20 pagesMATLAB For Finance FRM CFAShivgan JoshiNo ratings yet

- MFRS132 Financial InstrumentsDocument49 pagesMFRS132 Financial InstrumentsAin YanieNo ratings yet

- Investment Banking Deadlines: Graduate Jobs Applications LSE 2017/2018Document43 pagesInvestment Banking Deadlines: Graduate Jobs Applications LSE 2017/2018AigulNo ratings yet

- As 6 Depreciation AccountingDocument5 pagesAs 6 Depreciation AccountingJagmohanKiruthivasanKameswariNo ratings yet

- Slash Harmonic Pattern Trading StrategyDocument9 pagesSlash Harmonic Pattern Trading StrategyBabbli SinghNo ratings yet

- BrokerDocument40 pagesBrokerMotiram paudelNo ratings yet

- Bitcoin Intrinsic Value - Wedbush Report - December 2013Document7 pagesBitcoin Intrinsic Value - Wedbush Report - December 2013igzolt100% (3)

- Foreign Exchange Risk: Foreign Exchange Risk (Also Known As Exchange Rate Risk or Currency Risk) Is ADocument3 pagesForeign Exchange Risk: Foreign Exchange Risk (Also Known As Exchange Rate Risk or Currency Risk) Is ASonali RawatNo ratings yet

- Bruce G. McCarthy The PipelineDocument27 pagesBruce G. McCarthy The Pipelinethetruththewholetruthandnothingbutthetruth100% (2)

- Result Presentation For December 31, 2015 (Result)Document27 pagesResult Presentation For December 31, 2015 (Result)Shyam SunderNo ratings yet

Sbi Project Report

Sbi Project Report

Uploaded by

Anil MakvanaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sbi Project Report

Sbi Project Report

Uploaded by

Anil MakvanaCopyright:

Available Formats

PREFACE

Loans have to be paid back one day. Had this been realized by all, how nice life would

have been on this Planet. It would not have prompted the poet to say Neither be a Lender,

nor a orrower e.! "las# $iven the realities in life, this could remain at best a wishful

thinkin%.

&o their business is to lend and lend more. 'heir proficiency( skill( competency are all

tested in how much they lend and how much they )*+,-*) and how .uickly. &uffice it

would be to state that this can be likened to the vi%our and stren%th with which one %oes

about after fully recoverin% from any ailment. It is a%reed by al beyond doubt )ecovery!

is essential and %et recovery! is very essential.

/e know ri%ht form the appraisal sta%e up to the actual repayment sta%e the banks need to

be careful. /e also know that once the money is in the hands of a borrower, attitudinal

chan%es take place. 'he borrower, with some few e0ceptions may be, feels a bit more

complacent as after all it is not this own money! which is at stake. 'herefore an attempt

is made here to put all that we know already proper perspective.

TNRCMS MAYANK SHAH 1

ACKNOWLEDGEMENT

"t outset, we would like to thank the institutions for havin% provided us with an

opportunity to carry out a pro2ect of this ma%nitude that helped me satisfy my curiosity as

far as my area of interest was concerned.

'he essence of this pro2ect, i.e. its contents have been compiled with help of varied

sources of secondary database, but we would specially like to acknowled%e the support,

su%%estions and feedback received from my Pro2ect $uide3

14 5r.6.P.&."rya

"$5, ,f )"&5*+++

&tate ank ,f India, )a2kot

74 5r.5.8. )aval

5ana%er of )"&5*+++,

&tate ank of India, )a2kot.

94 5rs.:yoti ; 5r."vinash &in%h

,fficer, )"&5*+++,

&tate ank ,f India, )a2kot.

"lso my faculty member 5r. "bhay )a2a %uide and su%%est me about the pro2ect. "

lot of other people have also contributed directly and indirectly to completion of this

pro2ect would not have seen li%ht of the day. ,ur hearts felt %ratitude to all of them.

TNRCMS MAYANK SHAH 7

DECLARATION

I the undersi%ned 5r.5ayank &. &hah, a student of 5" <=inance4 &emester3III,

hereby declare that the pro2 ect work presented in this report is my ori%inal work.

'his work has not been previousl y submit ted to any other universit y for any other

e0amination.

8ate> 1?

t h

:ul y, 7@@A

Place> )a2 kot

3333333333333333333333

<5ayank &. &hah4

TNRCMS MAYANK SHAH 9

EXECUTIVE SUMMARY

'he most important problem that the Indian banks are facin% is the problem of their NP"s.

It is only since a couple of years that this particular aspect has been %iven so much

importance. 'he banks have to overcome these difficulties properly in order to effectively

counter the competition faced by the forei%n banks. /ith the framin% of laws as per

international standards and settin% up of 8ebt recovery tribunal we can say that steps have

been taken in this direction.

anks in India have traditionally been saddled with very hi%h Non3Performin% "ssets. 'he

bankin% sector was headin% for a crisis in 7@@1 with NP"Bs crossin% a mammoth CD@@@

crores. anks burdened with hu%e NP"Bs faced uphill tasks in recoverin% then due to

archaic laws and procedures. )ealizin% the %ravity of the situation the %overnment was

.uick to implement the recommendations of the Narsimham +ommittee and "ndhuar2una

+ommittee leadin% to the enactment of the &)*&I "+' 7@@7.< &ecuritisation and

)econstruction of =inancial "ssets and *nforcement of &ecurity Interest "ct4.

'his "ct %ave the banks the much needed teeth to curb the menace of NP"Bs. 'he non

performin% assets <NP"s4 of banks have at last be%un shrinkin%. "s reported from

surveys, it is understood that there has been substantial improvements in non performin%

assets and this has been because of several measures such as formation of asset

reconstruction companies, debt restructurin% norms, securitization, provisionin% norms

and prudential norms for income reco%nition. 'he %ross NP"s of the bankin% system are

about 1C per cent of the total assets of the nationalized banks as of 7@@@3@1. 'his is a%ainst

a %lobal norm of about ?E. Hence there is a lon% way to %o before we can say that the

NP"Bs of our banks are under control. 'he improvements in NP"s of individual

nationalized banks have been in the order of 1@E to 7@E, thanks to the various schemes

and measures introduced. 'his paper addresses the results we have achieved so far since

TNRCMS MAYANK SHAH D

the measures have been implemented and the thrust on measures that need to be taken to

e0pedite recovery of NP"s. /e also %ive our su%%estions as to how NP" retrieval can be

made easy and in what way the NP" scenario is headed.

'he problem is no doubt about recovery mana%ement where the ob2ective is to find out

about the reasons behind NP"s and to create networks for recovery. anks of )a2kot have

been considered where 71 e0ecutive have been approached with a structured .uestion to

elicit information.

'he crucial factor that decides the performance of banks now days is the spottin% of non3

performin% assets <NP"4. NP"s are those loans %iven by a bank or financial institution

where the borrower defaults or delays interest or principal payments banks are now

re.uired to reco%nize such loans faster and then classify them as problem assts.

"s far as the study is concerned the followin% may be summarized.

Nearly 1@E of the banks in $u2arat responded within a month for loan applications

received by them from their corporate clients. If was also found that CF E of the banks

used to appraise loan proposals from their corporate clients with the viewpoint of

recovery. In $u2arat re%ion it was found that about C7 E of the banker opined that there

was a need to evaluate the loan applications critically.

'he respondents assi%ned hi%hest wei%ht to companyBs current performance and the

second hi%hest was assi%ned to companyBs past performance. "round 1@ E of the banks in

$u2arat recovered their dues on time from their corporate clients after maturity in $u2arat.

'he most preferred measures were pervasion and le%al action. 'he most common

su%%estion received for improvin% the recovery system in $u2arat was re%ardin%

improvin% the 2udicial system and dele%atin% more power and autonomy to the banks.

TNRCMS MAYANK SHAH ?

INDEX

Sr. Particular Page

No.

O Preface

O Acknowe!"#en$

O Decara$%on

O E&ec'$%(e S'##er)

*

+

,

-

*. In$ro!'c$%on

f *arly History of ank

f 'ype of ank

f &tatus wise bifurcation of anks

/0*1

1@

17

1D

+. A2o'$ S3I

f History

f "wards ; )eco%nition

f 5ission

f ,r%anization &tructure

,. S'r(e) 4 Re5earc6 on NPA5

f )esearch Plan

f Introduction

f 8ebt )ecovery Problem

f NP"s and 'heir *ffects

TNRCMS MAYANK SHAH C

f &teps to solve NP"s

f 'ools for 5ana%in% NP"s

f &trate%y for Prevention of NP"s

f Non Le%al 5easure

-. SWOT Ana)5%5

1. FUTURE PLAN

7. CONCLUSION

8. 3I3LIOGRAP9Y

/. ANNEXURE

TNRCMS MAYANK SHAH F

INTRODUCTION

TNRCMS MAYANK SHAH A

'he word GbankB it derived from the word GbancusB or Gban.ueB that is =rench.

'here was other of the opinion that the word GbankB is ori%inally derived from the $erman word

GbackB meanin% 2oint for which was Italianized into GbancoB. ut whatever be the ori%in of the

word bank as Prof. )ramchandra )ao says.! It would trace the history of bankin% in *urope from

middle a%es.!

$enerall y, banks do the business of money they take deposits of moneys from

client and %ive loan to the person who has need of money. ut in this a%e, for the

convenience of customer, banks provides some other services to their customer

such as bankers che.ue, overdraft, internet bankin%, "'5 facilit y, payi n% of

bills, credit card, tele%raphi c transfer, insurance, demat etc.

=or a people, it is difficult to keep a very bi% amount of money in his house

safely. &o, people save their money to bank. ank %ives loan to the person who

has need of money and %ets hi%her interest on it than the interest of deposit. 'he

mar%in between the interest of loan and interest of deposit is the income of bank.

TNRCMS MAYANK SHAH H

EARLY 9ISTORY OF 3ANKING

"s earl y as 7@@@ . +. the abyl onians had developed a bankin% system. 'here is

evidence to show the temples of abylon were used as banks. "fter a period of

time, there was a spread of irreli%ion, which soon destroyed the public sense of

securit y in depositin% money and valuable in temples. 'he priests were lon%er

actin% as financial a%ents. 'he )omans did minute re%ulations, as to conduct

private bankin% and to create confidence in it. Loan banks were also common in

)ome. =rom these the poor citizens received loans without payi n% interest,

a%ainst security of land for 9 or D years.

8urin% the earl y periods, althou%h private individual mostl y did the bankin%

business, many countries established public banks either for the purpose of

facilitatin% commerce or to serve the %overnment.

However, upon the revival of civili zat ion, %rowin% necessit y forced the issued in

the middl e of the 17

t h

century and banks were established at -enice and $enoa.

'he ank of -enice established in 11?F is supposed to be the most ancient bank.

,ri%inal l y, it was not a bank in the modern sense, durin% simpl y an office for the

transfer of the public debt.

In India, as earl y as the -edic Period, bankin%, in most crude from e0isted. 'he

books of 5anu contain references re%ardin% deposits, pled%es, policy of loans,

and rate of interest. 'rue, the bankin% in those days lar%el y mint money lendin%

and they did not know the compli cated mechanism of modern bankin%.

'his is true not only in the case of India but also of other countries. "lthou%h,

the business of bankin% is as old as authentic history, bankin% institutions have

TNRCMS MAYANK SHAH 1@

since than chan%ed in character and content very much. 'hey are developed from

a few simple operations involvin% the satisfaction of a few individual wants to

the complicated mechanism of modern bankin%, involvin% the satisfaction of

capital slowly seekin% employment and thus providin% the very life blood of

commerce.

TNRCMS MAYANK SHAH 11

TYPE OF 3ANKS

+ )e%ional )ural ank <))4

+ Nationalized ank

+ &tate ank $roup

+ +o3operative ank

+ Private ank

+ =orei%n ank

RESERVE 3ANK OF INDIA

'he Hilton3youn% commission, appointed in 1H7C has recommended the necessity

of centrall y empowered institution to have effective control over currency and

financial transaction in the county. "ccordin%l y, the $overnment had then passed

)eserve ank of India "ct, 1H9D and established the )eserve ank of India with

effect from 1

s t

"pril 1H9?. 'he principal ai m behind this was to or%anize proper

control over the currency mana%ement in the interest of country benefits and to

maintain financial stabilit y. /ith this, the )I mainl y looks after the followin%

import ant functions>

+ 'o keep effective control over creation of credits and currency suppl y

+ 'o control the ankin% transactions of +entral and &tate $overnments.

+ 'o act as +entral administered "uthorit y of all other anks in the country.

+ 'o or%anize control over =orei%n +urrency 'ransaction.

+ 'o assist for improvement in financial aspect of the country.

NATIONALISED 3ANKS

TNRCMS MAYANK SHAH 17

'he ankin% +ompany "ct establishes it in :ul y 1HCH by national ization of 1D

ma2 or banks of India. 'he sent percent ownership of the bank is of %overnment of

India.

STATE 3ANK GROUP

'he &tate ank of India was established under

the &tate ank of India "ct, 1H??, the subsidiary

banks under the &tate ank of India <subsidiary

anks4 "ct 1H?H. 'he )eserve ank of India

owns the &tate ank of India, to a lar%e e0tent,

and rest of the part is some private ownership in

the share capital of &tate ank of India. 'he &tate

ank of India owns the subsidiary anks.

OLD PRIVATE 3ANK

'hese banks are re%istered under +ompany "ct, 1H?C. asic 8ifference

between co3operative banks and private banks is its aim. +o3operative

banks work for its member and private banks work for earn profit.

NEW PRIVATE 3ANKS

'hese banks lead the market of Indian bankin% business in very

short period. ecause of its variety services and approach to handle

customer and also because of lon% workin% hours and speed of

TNRCMS MAYANK SHAH 19

services. 'his is also re%istered under the +ompany "ct. 1H?C. etween old and new private

sector bank, there is wide difference.

FOREIGN 3ANKS

=orei%n ank means multi3countries bank. In case of India =orei%n anks are such anks. /hich

open its branch office in India and their head office is outside of India.

TNRCMS MAYANK SHAH 1D

STATUS WISE 3IFURCATION OF

3ANKS

'hey are divided into two %roups>

+ &cheduled anks

+ Non &cheduled anks

SC9EDULED 3ANKS

In first schedule, %overnment of India notifies the Primary anks, which are licensed and whose

demand and time liability are not less than ?@ crores in 1HAF.

$overnment of India notify the Primary banks, which are licensed and whose demand and time

liability are not less than 1@@crores can only .ualify to be included in the second schedule since

1HH9.

" bank becomes scheduled when it fulfils the followin%s>

+ " %rade ratin% from )I

+ 8emand and 'ime Liabilit y over 1@@crores.

+ &atisfy the )I %uidelines related to +)) and &L)

+ "s per the norms Priorit y &ector wise landin% benefits of bein% a &cheduled

co3operative are described below>3

+ )I would provide )ediscountin% facilit y at nominal rate

+ )I %ives remi ttance facili t y at par

TNRCMS MAYANK SHAH 1?

'he demerits of becomin% a scheduled co3operative bank is that the bank will not %et @.?E

subsidy from )I

'he conferment of scheduled status on the banks has certain advanta%es like refinance facility,

directly industrial finance from )eserve ank of India. "vail of )eserve ank of India

)emittance facility scheme, accept deposits from local bodies, .uasi3%overnment or%anization,

reli%ious, and charitable institutions, %uarantees and che.ues issued by anks are accepted by

$overnment 8epartments. "t the same time, it casts %reater responsibility on the banks in the

maintenance of books of accounts and submissions of returns.

Sc6e!'e! 2ank5 %n In!%a

&cheduled +ommercial ank

&cheduled +o3operative ank

NON0SC9EDULED 3ANKS

'he banks, which are not applicable as per the criteria of &cheduled anks, are

called as a Non3scheduled anks. 'hese are very small banks.

TNRCMS MAYANK SHAH 1C

TNRCMS MAYANK SHAH 1F

STATE 3ANK OF INDIA

'he ori%in of the S$a$e 3ank of In!%a %oes back to the first decade of the nineteenth century with

the establishment of the ank of +alcutta in +alcutta on 7 :une 1A@C. 'hree years later the bank

received its charter and was re3desi%ned as the ank of en%al <7 :anuary 1A@H4. " uni.ue

institution, it was the first 2oint3stock bank of ritish India sponsored by the $overnment of

en%al. 'he ank of ombay <1? "pril 1AD@4 and the ank of 5adras <1 :uly 1AD94 followed the

ank of en%al. 'hese three banks remained at the ape0 of modern bankin% in India till their

amal%amation as the Imperial ank of India on 7F :anuary 1H71.

Primarily "n%lo3Indian creations, the three presidency banks came into e0istence either as a result

of the compulsions of imperial finance or by the felt needs of local *uropean commerce and were

not imposed from outside in an arbitrary manner to modernise IndiaIs economy. 'heir evolution

was, however, shaped by ideas culled from similar developments in *urope and *n%land, and was

influenced by chan%es occurrin% in the structure of both the local tradin% environment and those

in the relations of the Indian economy to the economy of *urope and the %lobal economic

framework.

3ank of 3en"a 9.O.

TNRCMS MAYANK SHAH 1A

E5$a2%56#en$

'he establishment of the ank of en%al marked the advent of limited liability, 2oint3stock

bankin% in India. &o was the associated innovation in bankin%, viz. the decision to allow the ank

of en%al to issue notes, which would be accepted for payment of public revenues within a

restricted %eo%raphical area. 'his ri%ht of note issue was very valuable not only for the ank of

en%al but also its two siblin%s, the anks of ombay and 5adras. It meant an accretion to the

capital of the banks, a capital on which the proprietors did not have to pay any interest. 'he

concept of deposit bankin% was also an innovation because the practice of acceptin% money for

safekeepin% <and in some cases, even investment on behalf of the clients4 by the indi%enous

bankers had not spread as a %eneral habit in most parts of India. ut, for a lon% time, and

especially up to the time that the three presidency banks had a ri%ht of note issue, bank notes and

%overnment balances made up the bulk of the invertible resources of the banks.

'he three banks were %overned by royal charters, which were revised from time to time. *ach

charter provided for a share capital, four3fifth of which were privately subscribed and the rest

owned by the provincial %overnment. 'he members of the board of directors, which mana%ed the

affairs of each bank, were mostly proprietary directors representin% the lar%e *uropean mana%in%

a%ency houses in India. 'he rest were %overnment nominees, invariably civil servants, one of

whom was elected as the president of the board.

Gro': P6o$o"ra:6 of Cen$ra 3oar! ;*<+*=

TNRCMS MAYANK SHAH 1H

3'5%ne55

'he business of the banks was initially confined to discountin% of bills of e0chan%e or other

ne%otiable private securities, keepin% cash accounts and receivin% deposits and issuin% and

circulatin% cash notes. Loans were restricted to )s.one lakh and the period of accommodation

confined to three months only. 'he security for such loans was public securities, commonly called

+ompanyIs Paper, bullion, treasure, plate, 2ewels, or %oods Inot of a perishable natureI and no

interest could be char%ed beyond a rate of twelve per cent. Loans a%ainst %oods like opium,

indi%o, salt woollens, cotton, cotton piece %oods, mule twist and silk %oods were also %ranted but

such finance by way of cash credits %ained momentum only from the third decade of the

nineteenth century. "ll commodities, includin% tea, su%ar and 2ute, which be%an to be financed

later, were either pled%ed or hypothecated to the bank. 8emand promissory notes were si%ned by

the borrower in favour of the %uarantor, which was in turn endorsed to the bank. Lendin% a%ainst

shares of the banks or on the mort%a%e of houses, land or other real property was, however,

forbidden.

Indians were the principal borrowers a%ainst deposit of +ompanyIs paper, while the business of

discounts on private as well as salary bills was almost the e0clusive monopoly of individuals

*uropeans and their partnership firms. ut the main function of the three banks, as far as the

%overnment was concerned, was to help the latter raise loans from time to time and also provide a

de%ree of stability to the prices of %overnment securities.

TNRCMS MAYANK SHAH 7@

O! 3ank of 3en"a

Ma>or c6an"e %n $6e con!%$%on5

" ma2or chan%e in the conditions of operation of the anks of en%al, ombay and 5adras

occurred after 1AC@. /ith the passin% of the Paper +urrency "ct of 1AC1, the ri%ht of note issue of

the presidency banks was abolished and the $overnment of India assumed from 1 5arch 1AC7 the

sole power of issuin% paper currency within ritish India. 'he task of mana%ement and circulation

of the new currency notes was conferred on the presidency banks and the $overnment undertook

to transfer the 'reasury balances to the banks at places where the banks would open branches.

None of the three banks had till then any branches <e0cept the sole attempt and that too a short3

lived one by the ank of en%al at 5irzapore in 1A9H4 althou%h the charters had %iven them such

authority. ut as soon as the three presidency bands were assured of the free use of %overnment

'reasury balances at places where they would open branches, they embarked on branch e0pansion

at a rapid pace. y 1AFC, the branches, a%encies and sub a%encies of the three presidency banks

covered most of the ma2or parts and many of the inland trade centres in India. /hile the ank of

en%al had ei%hteen branches includin% its head office, seasonal branches and sub a%encies, the

anks of ombay and 5adras had fifteen each.

TNRCMS MAYANK SHAH 71

3ank of Ma!ra5 No$e Da$e! */7* for R5.*?

Pre5%!enc) 3ank5 Ac$

'he presidency anks "ct, which came into operation on 1 5ay 1AFC, brou%ht the three

presidency banks under a common statute with similar restrictions on business. 'he proprietary

connection of the $overnment was, however, terminated, thou%h the banks continued to hold

char%e of the public debt offices in the three presidency towns, and the custody of a part of the

%overnment balances. 'he "ct also stipulated the creation of )eserve 'reasuries at +alcutta,

ombay and 5adras into which sums above the specified minimum balances promised to the

presidency banks at only their head offices were to be lod%ed. 'he $overnment could lend to the

presidency banks from such )eserve 'reasuries but the latter could look upon them more as a

favour than as a ri%ht.

TNRCMS MAYANK SHAH 77

3ank of Ma!ra5

'he decision of the $overnment to keep the surplus balances in )eserve 'reasuries outside the

normal control of the presidency banks and the connected decision not to %uarantee minimum

%overnment balances at new places where branches were to be opened effectively checked the

%rowth of new branches after 1AFC. 'he pace of e0pansion witnessed in the previous decade fell

sharply althou%h, in the case of the ank of 5adras, it continued on a modest scale as the profits

of that bank were mainly derived from trade dispersed amon% a number of port towns and inland

centres of the presidency.

India witnessed rapid commercialisation in the last .uarter of the nineteenth century as its railway

network e0panded to cover all the ma2or re%ions of the country. New irri%ation networks in

5adras, Pun2ab and &ind accelerated the process of conversion of subsistence crops into cash

crops, a portion of which found its way into the forei%n markets. 'ea and coffee plantations

transformed lar%e areas

of the eastern 'erais, the hills of "ssam and the Nil%iris into re%ions of estate a%riculture par

e0cellence. "ll these resulted in the e0pansion of IndiaIs international trade more than si03fold.

'he three presidency banks were both beneficiaries and promoters of this commercialisation

process as they became involved in the financin% of practically every tradin%, manufacturin% and

minin% activity in the sub3continent. /hile the anks of en%al and ombay were en%a%ed in the

financin% of lar%e modern manufacturin% industries, the ank of 5adras went into the financin%

TNRCMS MAYANK SHAH 79

of lar%e modern manufacturin% industries, the ank of 5adras went into the financin% of small3

scale industries in a way which had no parallel elsewhere. ut the three banks were ri%orously

e0cluded from any business involvin% forei%n e0chan%e. Not only was such business considered

risky for these banks, which held %overnment deposits, it was also feared that these banks

en2oyin% %overnment patrona%e would offer unfair competition to the e0chan%e banks which had

by then arrived in India. 'his e0clusion continued till the creation of the )eserve ank of India in

1H9?.

3ank of 3o#2a)

Pre5%!enc) 3ank5 of 3en"a

'he Presidency anks of en%al, ombay and 5adras with their F@ branches were mer%ed in

1H71 to form the Imperial ank of India. 'he triad had been transformed into a monolith and a

%iant amon% Indian commercial banks had emer%ed. 'he new bank took on the triple role of a

TNRCMS MAYANK SHAH 7D

commercial bank, a bankerIs bank and a banker to the %overnment.

ut this creation was preceded by years of deliberations on the need for a I&tate ank of IndiaI.

/hat eventually emer%ed was a Ihalf3way houseI combinin% the functions of a commercial bank

and a .uasi3central bank.

'he establishment of the )eserve ank of India as the central bank of the country in 1H9? ended

the .uasi3central bankin% role of the Imperial ank. 'he latter ceased to be bankers to the

$overnment of India and instead became a%ent of the )eserve ank for the transaction of

%overnment business at centres at which the central bank was not established. ut it continued to

maintain currency chests and small coin depots and operate the remittance facilities scheme for

other banks and the public on terms stipulated by the )eserve ank. It also acted as a bankersI

bank by holdin% their surplus cash and %rantin% them advances a%ainst authorised securities. 'he

mana%ement of the bank clearin% houses also continued with it at many places where the )eserve

ank did not have offices. 'he bank was also the bi%%est tendered at the 'reasury bill auctions

conducted by the )eserve ank on behalf of the $overnment.

'he establishment of the )eserve ank simultaneously saw important amendments bein% made to

the constitution of the Imperial ank convertin% it into a purely commercial bank. 'he earlier

restrictions on its business were removed and the bank was permitted to undertake forei%n

e0chan%e business and e0ecutor and trustee business for the first time.

I#:er%a 3ank

'he Imperial ank durin% the three and a half decades of its e0istence recorded an impressive

%rowth in terms of offices, reserves, deposits, investments and advances, the increases in some

cases amountin% to more than si03fold. 'he advances, the increases in some cases amountin% to

more than si03fold. 'he financial status and security inherited from its forerunners no doubt

provided a firm and durable platform. ut the lofty traditions of bankin% which the Imperial ank

consistently maintained and the hi%h standard of inte%rity it observed in its operations inspired

TNRCMS MAYANK SHAH 7?

confidence in its depositors that no other bank in India could perhaps then e.ual. "ll these

enabled the Imperial ank to ac.uire a pre3eminent position in the Indian bankin% industry and

also secure a vital place in the countryIs economic life.

S$a#: of I#:er%a 3ank of In!%a

/hen India attained freedom, the Imperial ank had a capital base <includin% reserves4 of

)s.11.A? crores, deposits and advances of )s.7F?.1D crores and )s.F7.HD crores respectively and a

network of 1F7 branches and more than 7@@ sub offices e0tendin% all over the country.

F%r5$ F%(e Year Pan

In 1H?1, when the =irst =ive Jear Plan was launched, the development of rural India was %iven

the hi%hest priority. 'he commercial banks of the country includin% the Imperial ank of India

had till then confined their operations to the urban sector and were not e.uipped to respond to the

emer%ent needs of economic re%eneration of the rural areas. In order, therefore, to serve the

economy in %eneral and the rural sector in particular, the "ll India )ural +redit &urvey

TNRCMS MAYANK SHAH 7C

+ommittee recommended the creation of a state3partnered and state3sponsored bank by takin%

over the Imperial ank of India, and inte%ratin% with it, the former state3owned or state3associate

banks. "n act was accordin%ly passed in Parliament in 5ay 1H?? and the &tate ank of India was

constituted on 1 :uly 1H??. 5ore than a .uarter of the resources of the Indian bankin% system thus

passed under the direct control of the &tate. Later, the &tate ank of India <&ubsidiary anks4 "ct

was passed in 1H?H, enablin% the &tate ank of India to take over ei%ht former &tate3associated

banks as its subsidiaries <later named "ssociates4.

'he &tate ank of India was thus born with a new sense of social purpose aided by the DA@ offices

comprisin% branches, sub offices and three Local Head ,ffices inherited from the Imperial ank.

'he concept of bankin% as mere repositories of the communityIs savin%s and lenders to

creditworthy parties was soon to %ive way to the concept of purposeful bankin% sub servin% the

%rowin% and diversified financial needs of planned economic development. 'he &tate ank of

India was destined to act as the pacesetter in this respect and lead the Indian bankin% system into

the e0citin% field of national development

'he ank is actively involved since 1HF9 in non3profit activity called +ommunity &ervices

ankin%. "ll &I branches and administrative offices throu%hout the country sponsor and

participate in lar%e number of welfare activities and social causes. &I business is more than

bankin% because we touch the lives of people anywhere in many ways. &I commitment to

nation3buildin% is complete ; comprehensive.

TEC9NOLOGY UPGRADATION

&IBs Information 'echnolo%y Pro%ramme aims at achievin% efficiency in operations, meetin%

customer and market e0pectations and facin% competition. &I achievements are summarized

below>

TNRCMS MAYANK SHAH 7F

FULL 3RANC9 COMPUTERISATION ;FC35=@ "ll the branches of the ank are now fully

computerised. 'his strate%y has contributed to improvement in customer service.

ATM SERVICES@ 'here are ?7H@ "'5s on the "'5 Network. 'hese "'5s are located in 1F71

centers spread across the len%th and breadth of the country, thereby creatin% a truly national

network of "'5s with an unparalleled reach. -alue added services like "'5 locator, payment of

fees for colle%e students, multilin%ual screens, voice over and drawl of cash advance by &I credit

card holders have been introduced.

INTERNET 3ANKING ;IN3=@ 'his on3line channel enables customers to access their account

information and initiate transactions on a 7D0F, boundary less basis. 777? branches, coverin% ???

centers are e0tendin% IN service to their customers. "ll functionalities other than +ash and

+learin% have been e0tended to individual retail customers. " separate Internet ankin% 5odule

for +orporate customers has been launched and available at 19@? branches. ulk upload of data

for +orporate, Inter3branch funds transfer for )etail customers, ,nline payment of +ustoms duty

and $ovt. ta0, *lectronic ill Payment, &5& "lerts, *3Poll, II' $"'* =ee +ollection, ,ff3line

+ustomer )e%istration Process and )ailway 'icket ookin% are the new features deployed.

GOVT. 3USINESS @ &oftware has been developed and rolled out at FFA? fully computerised

branches. *lectronic %eneration of all reports for reportin%, settlement and reconciliation of $ovt.

funds is available.

STEPS@ Knder &'*P&, the bankIs electronic funds transfer system, the Products offered are

e'ransfer <e'4, e)ealisation <e)4, e8ebit <+5P4 and "'5 reconciliation. &'*P& handles

payment messa%es and reconciliation simultaneously.

TNRCMS MAYANK SHAH 7A

SEFT@ &I has launched the &pecial *lectronic =und 'ransfer <&*='4 &cheme of )I, to

facilitate efficient and e0peditious Inter3bank transfer of funds. 7D1 branches of our ank in

various LH, +entres are participatin% in the scheme. &ecurity of messa%e transmission has been

enhanced.

MICR Cen$re@ 5I+) +he.ue Processin% systems are operational at 1C centre viz. 5umbai, New

8elhi, +hennai, 6olkata, -adodara, &urat, Patna, :abalpur, $walior, :odhpur, 'richur, +alicut,

Nasik, )aipur, hubaneswar and 8ehradun.

Core 3ank%n"@ 'he +ore ankin% &olution provides the state3of3the3art anywhere anytime bankin%

for our customers. 'he facility is available at 1@17 branches.

Tra!e F%nance @ 'he solution has been implemented, providin% efficiency in handlin% 'rade

=inance transactions with Internet access to customers and %reatly enhances the bankIs services to

+orporate and +ommercial Network branches. 'his new 'rade =inance solution, *LI5ILL&,

will be implemented at all domestic branches as well as at =orei%n offices en%a%ed in trade

finance business durin% the year.

WAN @ 'he bank has set up a /ide "rea Network, known as &I connect, which provides

connectivity to DA1H branchesMoffices of &I $roup across 9A? cities as at 91st 5arch 7@@A. 'his

network provides across the board benefits by providin% nationwide connectivity for its business

applications

D%rec$or5 on $6e 3ankA5 Cen$ra 3oar!

a5 on ,*5$ Dece#2er +??/

TNRCMS MAYANK SHAH 7H

3OARD OF DIRECTORS

Cen$ra 3oar! Of S$a$e 3ank Of In!%a ;A5 on *5$ A:r% +??/=

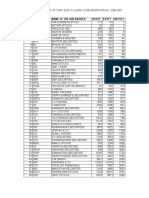

S.No. Na#e of D%rec$or Sec. of S3I Ac$B *<11

1.

&hri ,.P. hatt

+hairman

1H<a4

7.

&hri &.6.hattacharyya

58 ; ++;),

1H<b4

9. &hri &uman 6umar ery 1H<c4

D. 8r. "shok :hun2hunwala 1H<c4

.? 8r. 8eva Nand alodhi 1H<d4

C. Prof. 5ohd. &alahuddin "nsari 1H<d4

F. 8r.<5rs.4 -asantha harucha 1H<d4

A. &hri "run )amanathan 1H<e4

H. &mt. &hyamala $opinath 1H<f4

ASSOCIATE 3ANKS

S$a$e 3ank of In!%a has the followin% seven "ssociate anks <"s4 with controllin% interest

ran%in% from F?E to 1@@E.

1. &tate ank of ikaner and :aipur <&:4

7. &tate ank of Hyderabad <&H4

9. &tate ank of Indore <&Ir4

D. &tate ank of 5ysore <&54

?. &tate ank of Patiala <&P4

C. &tate ank of &aurashtra <&&4

F. &tate ank of 'ravancore <&'4

"s on 91

st

march, 7@@A the financial information of &tate bank of India is %iven as under

TNRCMS MAYANK SHAH 9@

F%nanc%a De$a%5 RS ;%n crore=

Ca:%$a 7,*.-8

3orrow%n"5 1*B8+8.-*

De:o5%$5 1B,8B-?,.<-

In(e5$#en$5 *B/<B,?*.+8

A!(ance5 -B*7B87/.*<

Prof%$ 7B8+<.11

&ource > balance sheet and profit and loss accounts schedule of state bank of

India from annual reports of year endin% 91

st

march, 7@@A

Genera S6are6o!er Infor#a$%on

TNRCMS MAYANK SHAH 91

Number of shareholders as on 9@.H.7@@D was ?.C1 lacs. 'he shareholdin% pattern was as under.

SHARE HOLDERS SHARE HOLDERS PERCENTAGES PERCENTAGES

Reserve Bank of India 59.73 %

Non-residens !"IIs# $CBs# NRIs% &9.'3 %

Banks# "Is in()*din+ ins*ran(e (o,-anies ../& %

M**a) f*nds01TI ..27 %

3o,esi( (o,-anies0-rivae (or-orae 4odies0r*ss &.79 %

Resident individuals 5.97 %

59.73%

19.83%

6.21%

6.47%

1.79%

5.97%

Reserve Bank of India

Non-residents (FIIs !"Bs NRIs#

Banks FIs in$%&din' ins&ran$e $o()anies

*&t&a% f&nds+,-I

.o(esti$ $o()anies+)rivate $or)orate /odies+tr&sts

Resident individ&a%s

TNRCMS MAYANK SHAH 97

5I&&I,N 5I&&I,N

To retain the Banks Position as the Premier Indian Financial Services

Group, with world class standards and significant Global business,

committed to ecellence in customer, shareholder and emplo!ee

satisfaction and to pla! a leading role in the epanding and diversif!ing

financial services sector while continuing emphasis, on its development

banking role"

+ DR. KALAM TALKS A3OUT S3I PLAN AND MISSON

*/ 8*LHI > President ".P.:. "bdul 6alam on 'uesday chalked out a seven3point action plan for

the &tate ank of India <&I4 while ur%in% the countryIs premier bank to create a )s. ?,@@@3crore

venture capital fund and hike lendin% to the farm sector.

In his address at the &IIs icentennial +elebrations here, 5r. 6alam noted that within the ne0t

three years, the bank should raise the credit to the farm and a%ro3processin% sector from 1@ to 7@

per cent of its total loan disbursal.

"%ricultural %rowth, he said, was la%%in% behind while sectors such as manufacturin% and

services were showin% robust increases. " hi%her credit disbursal, he said, was essential to hike

farm %rowth to over four per cent as it was a vital re.uirement for increasin% the overall $ross

8omestic Product %rowth to 1@ per cent.

Knveilin% his plan, 5r. 6alam asked the &I to allocate )s. ?,@@@ crores as venture capital from

7@@F3@A for the purposes of fundin% innovative scientists and technolo%ists for speedier societal

transformation. 'his would include the development of I+' products, software development and

software services.

'he President also advised the bank to create and nurture five rural development pro2ects, on the

lines of the bio3fuel pro2ect and seaweed pro2ect, as it had the potential to provide employment to

?@ lakh persons in the rural areas at the least.

TNRCMS MAYANK SHAH 99

5r. 6alam also asked the &I to adopt and innovatively fund at least one lakh sick units in the

small3scale sector to infuse the latest technolo%y and turn them into profitable ventures.

"nother sector with %reat potential, 5r. 6alam said, was medical tourism in which the bank could

e0tend funds at competitive interest rates for settin% up corporate hospitals which would also

serve the rural areas. Likewise, yet another sector for the bankIs participation, he said, was

infrastructure development, includin% provision of ?@ million .uality houses with basic

infrastructure in rural areas in association with state and +entral entities.

'urnin% to the pli%ht of villa%ers cau%ht in the NNvicious cycle of borrowin%,II 5r. 6alam asked the

&I to adopt a NNvilla%er3friendlyII bankin% system to free them from the clutches of money3

lenders.

5r. 6alam also lamented that hassle3free loans were bein% e0tended by the &I to students of

only the best en%ineerin% colle%es, medical colle%es and business schools. NNI would re.uest the

&I to e0amine the possibility of providin% loans to students who would like to pursue science

and commerce as a career,O he said.

esides, ways should be found to fund the education of those meritorious students who could not

%et admission to top en%ineerin%, medical and 3schools owin% to strin%ent competition, 5r.

6alam said.

TNRCMS MAYANK SHAH 9D

TNRCMS MAYANK SHAH 9?

&I has ba%%ed

the awards for

5ost Preferred

ank! and 5ost

preferred brand!

for home Loan in

CN3C AwaaC

+onsumer

"wards in

"u%ust 7@@F

&I has ba%%ed

the awards for

5ost Preferred

ank! and 5ost

preferred brand!

for home Loan in

CN3C AwaaC

+onsumer

"wards in

"u%ust 7@@F

SBI is placed at

70

th

in Top

1000 Banks

Survey by

Banker

Magazine, J uly

007, !up " ro#

107 last year$

SBI is placed at

70

th

in Top

1000 Banks

Survey by

Banker

Magazine, J uly

007, !up " ro#

107 last year$

SBI ranked %

th

in the

&cono#ics

Ti#es Market

'ap (ist, !up

" ro# )0 last

year$

SBI ranked %

th

in the

&cono#ics

Ti#es Market

'ap (ist, !up

" ro# )0 last

year$

Today,

SBI * SBI '+, is

the -o.1

syndicator o"

do#estic debt

in Asia Pacif ic

REGI ON.

Today,

SBI * SBI '+, is

the -o.1

syndicator o"

do#estic debt

in Asia Pacif ic

REGI ON.

-o.1 in

#ergers /

+c0uisition

1eals !21

1eals o" 3S 4

15.6bn$

.

-o.1 in

#ergers /

+c0uisition

1eals !21

1eals o" 3S 4

15.6bn$

.

The only

I ndian Bank

to " ind a

place in the

Fortune

Global )00

(ist

The only

I ndian Bank

to " ind a

place in the

Fortune

Global )00

(ist

TNRCMS MAYANK SHAH 9C

SBI is No 1

provider of

AGRI Finance

and No. 1 in

Credit in!in"

of Rs #. $%

lacs S&GS

SBI is No 1

provider of

AGRI Finance

and No. 1 in

Credit in!in"

of Rs #. $%

lacs S&GS

SBI is #arket

(eader in

" inancing

SSI s 7ith a

#arket share

o" 58

SBI is #arket

(eader in

" inancing

SSI s 7ith a

#arket share

o" 58

Readers

di"est 'a(

)* Golden

A+ard f or

bein" a,on"

t-e t+o ,ost

trusted ban!s

in I ndia

Readers

di"est 'a(

)* Golden

A+ard f or

bein" a,on"

t-e t+o ,ost

trusted ban!s

in I ndia

Kp %radation of

ratin%s by citi

%roupM 5or%an

&tanley

5oodysBs &;P

Kp %radation of

ratin%s by citi

%roupM 5or%an

&tanley

5oodysBs &;P

9

rd

in the

Econo#%c

T%#e5 brand

*.uity )ankin%

'op ?@ most

trusted service

brands in the

service sector

9

rd

in the

Econo#%c

T%#e5 brand

*.uity )ankin%

'op ?@ most

trusted service

brands in the

service sector

3'5%ne55

S$an!ar! 6a5

Awar!e! the

est anker of

the Jear "ward

to &hri

,.P.hatt for his

initiative to

reener%ize the

ank

3'5%ne55

S$an!ar! 6a5

Awar!e! the

est anker of

the Jear "ward

to &hri

,.P.hatt for his

initiative to

reener%ize the

ank

TNRCMS MAYANK SHAH 9F

CNN I BN net7ork

16 has selected

shri. 9.,.Bhatt as

I ndian o" the :ear

Business 007 " or

sho7ing ho7 a

public sector

behe#oth can " le;

its #uscle in the

" erociously

co#petitive

Banking sector

CNN I BN net7ork

16 has selected

shri. 9.,.Bhatt as

I ndian o" the :ear

Business 007 " or

sho7ing ho7 a

public sector

behe#oth can " le;

its #uscle in the

" erociously

co#petitive

Banking sector

Asian centre for

corporate Governance &

Sustainability and

Indian Merchants

Chamber has awarded

the Transformational

Leader Award 2! to

Shri "#$#%hatt for

leadership& charisma&

inspiration and

intellectual sti,ulation

f or t-e entire SBI

tea,

Asian centre for

corporate Governance &

Sustainability and

Indian Merchants

Chamber has awarded

the Transformational

Leader Award 2! to

Shri "#$#%hatt for

leadership& charisma&

inspiration and

intellectual sti,ulation

f or t-e entire SBI

tea,

CHAIRMAN

.'./ DEPUTY MANAGING CCO/ CHIEF CORPORATE DIRECTOR

OFFICER

CFO/ CHIEF FINANE CB/ CORE BANKING

OFFICER

TNRCMS MAYANK SHAH

DMD 4 CCO

DMD 4 CCO

DMD 4 CFO

DMD 4 CFO

DMD 4 CDO

DMD 4 CDO

DMD CORPORATE

STRATEGY 4 NEW

3USINESS

DMD CORPORATE

STRATEGY 4 NEW

3USINESS

DMD ;IT=

DMD ;IT=

C9IF ECONOMIC

ADVISOR

C9IF ECONOMIC

ADVISOR

CVO

CVO

DMD RURAL 4 AGRI

3USINESS GROUP

DMD RURAL 4 AGRI

3USINESS GROUP

9A

MD 4 GE

;C3=

MD 4 GE

;N3=

DMD 4 GE

;TRESASURY

4 MARKETS

DMD 4 GE

;ASSOCIATES

4 &K&I8I")I*&

DMD ;I 4 MA=

;Loca$e! a$ 9)!era2a!=

NB/ NON BANKING IB/ INTERNATIONAL BANKING

&tate bank of India has been facin% %reat rivalry and ma2or competition with other public sector

banks and some of private commercial banks. &tate bank of India has many banks as art rival.

&ome of its art rival.

L%5$ of #a>or co#:e$%$or5 of S3I

I. I+I+I ank

II. ank of aroda

III. +anara ank

IV. Pun2ab National ank

V. ank of India

VI. Knion ank of India

VII. +entral ank of India

VIII. H8=+ ank

IX. ,riental ank of +ommerce.

Here especially some of the public sector and private sector banks are %ivin% hardcore

competition to the state bank of India. &o let us have some of the best banks which is also

mentioned above and mentioned below in detail.

ICICI 3ANK

TNRCMS MAYANK SHAH 9H

I+I+I bank stands for Industrial +redit and Investment +orporation of India. 'his I+I+I

bank is one of the heavywei%ht banks of private sector of India. It is providin% the core

competition to the state bank of India. *specially in lendin% money, Investment.

ut in profit makin% state bank of India is standin% ahead. "nd when and where social

responsibility of concern state bank of India is headin% hi%h than any other banks in India

9DFC 3ANK

H8=+ stands for Housin% 8evelopment and =inance +orporation ltd. 'his is also one of

the leadin% banks of India in private sector. 'his bank is also providin% hardcore

competition to all the banks as well as state bank of India

ut we mention earlier that state bank of India is ahead in bankin% India. &o H8=+ bank

has to work hard to reach at the milestone achieved by state bank of India.

3ANK OF 3ARODA

ank of aroda is also one of the leadin% public sector banks in India. ank of aroda is

known as ,. 'his P&K bank is also providin% the tou%h competition to all other banks

in India. 'he , bank is very renowned banks of India today. It is very chan%ed and

very professionally workin% public sector banks

, has %ot professional in recent time so. It has to work very hard to achieve position

and reputation which are achieved by &tate &ank of India.

TNRCMS MAYANK SHAH D@

MARKET SHARE

31%

3%

3%

3%

4%

5% 5%

6%

7%

10%

23%

1-2-3 B2N4 !F

IN.I2

5.F" B2N4

,"! B2N4

"3N-R2 B2N4 !F

IN.I2

,NI!N B2N4 !F

IN.I2

B2N4 !F B2R!.2

B2N4 !F IN.I2

6,N72B N2-I!N28

B2N4

#$%&

'F

B$#(

%$)(&T S*$)& I# +&'PSITS $#+

$+,$#-&S ./0

ST$T& B$#( 'F I#+I$ 12"13 /

*+F- B$#( 1"24 /

5-' B$#( 1"26/

-&#T)$ B$#( 'F I#+I$ 1"76 /

5#I'# B$#( 'F I#+I$ 7"31 /

B$#( 'F B$)'+$ 6"42 /

B$#( 'F I#+I$ 6"38 /

P5#9$B #$TI'#$: B$#( ;"76 /

-$#$)$ B$#( ;"64 /

I-I-I B$#( 42"11 /

'T*&) B$#(S 33"3< /

T'T$: 422/

TNRCMS MAYANK SHAH D1

9OUSING LOAN@

Home is where the heart is# "t &I, we understand this better than most P the toil and sweat that %oes into

buildin%M buyin% a house and the subse.uent pride and 2oy of ownin% one. 'his is why our Housin% loan

schemes are desi%ned to make it simple for you to make a choice at least as far as financin% %oes#

E%"%2%%$)

5inimum a%e 71 years as on the date of sanction

&teady source of income

Loan A#o'n$

"pplicantM any one of the applicants are a%ed over 71 years and upto D? years P C@ times Net 5onthly

Income <N5I4 or ? times Net "nnual Income <N"I4, sub2ect to a%%re%ate repayment obli%ations not

*0ceedin% ?F.?@E of N5IM N"I

"pplicant<s4 a%ed over D? years of a%e P DA times N5I or D times N"I, sub2ect to a%%re%ate

repayment obli%ations not e0ceedin% ?@Eof N5IM N"I

Mar"%n

PurchaseM +onstruction of a new HouseM =latM Plot of land> 1?E

Purchase of an e0istin% HouseM =lat> 1?E

)epairsM )enovation of an e0istin% HouseM =lat> 7@E

TNRCMS MAYANK SHAH D7

9OUSING LOAN D INTEREST RATES@

In$ere5$ ra$e5

Foa$%n" %n$ere5$ ra$e5 ;%nke! $o S$a$e 3ank A!(ance Ra$e D S3AR=@

;S3AR@ *+.81E=

Ten're Ra$e of In$ere5$ ;:.a.=

Kpto ? years 7.@@E below &") 5inimum 1@.F?E

"bove ? and upto 1@ years 1.?@E below &") 5inimum 11.7?E

"bove 1@ and upto 1? years 1.?@E below &") 5inimum 11.7?E

"bove 1? and upto 7@ years 1.@@E below &") 5inimum 11.F?E

Ten're Ra$e of In$ere5$ ;:.a.=F

Kpto ? years 11.?@E

"bove ? and upto 1@ years 11.F?E

Ma&%#'# Re:a)#en$ Per%o!

=or applicants upto D? years of a%e> 7@ years

=or applicants over D? years of a%e> 1? years

TNRCMS MAYANK SHAH

F%&e! %n$ere5$ ra$e5@

D9

CAR LOAN

5ove ahead in life with &I +ar Loans# If you have been puttin% off purchasin% that car, we invite you to

%o throu%h our +ar Loans scheme.

Low interest rates, easy repayment options, total transparency, Low processin% char%es, finance to include

vehicle re%istration char%es, insurance and one time road ta0.

/ell, what are you waitin% forQ :ust step in to any of our branches <more than C@@@4 that offer +ar Loans

or our Personal ankin% ranches and %ive wheels to your desire#

Jou can apply for an &I +ar Loan to purchase>

" new car, 2eep, 5ulti Ktility -ehicle <5K-4 or &K- <any make or model4

"n old car M 2eep M 5K- M&K- <not more than ? years old4. <any make or model4

E%"%2%%$)

'o avail an &I +ar Loan, you should be

Individual between the a%e of 713C? years of a%e.

" Permanent employee of &tateM+entral $overnment, Public &ector Kndertakin%,

Private company or a reputed establishment

" Professionals or self3employed individual who is an income ta0 assesses or

" Person en%a%ed in a%riculture and allied activities.

Net "nnual Income )s. F?,@@@M3 and above.

Sa%en$ Fea$'re5

Loan A#o'n$

'here is no upper limit for the amount of a car loan. It is limited only by your repayin% capacity. " ma0imum

loan amount of 7.? times the net annual income can be sanctioned. If married, your spouseBs income could

also be considered provided the spouse %uarantees the loan 'he loan amount includes finance for one3time road

ta0, re%istration and insurance#

TNRCMS MAYANK SHAH DD

Mar"%n

NewG'5e! (e6%ce5 1@31?E when loan is upto )s.C lacs

7@39@E when loan e0ceeds )s.C lacs

Re:a)#en$

Jou en2oy the lon%est repayment period in the industry with us. )epayment period for new vehicles>

Ma&%#'# of /- #on$65

)epayment period for old vehicles> Kp to AD months from the date of ori%inal purchase of the vehicle.

SC9EME FOR LOAN FOR TWO W9EELERS

E&%5$%n" In$ere5$ Ra$e

S$r'c$'re w.e.f. ,*.?,.+??/

Re(%5e! In$ere5$ Ra$e

S$r'c$'re w.e.f. +8.?7.+??/

Foa$%n" Ra$e of In$ere5$ 17.7?E p.a. 17.F?E p.a.

F%&e! Ra$e of In$ere5$ 17.?@E p.a. 19.@@E p.a.

NOTE@ A $6e5e %n$ere5$ ra$e5 are 5'2>ec$ $o c6an"eB w%$6o'$ no$%ce .

T6e re(%5e! %n$ere5$ ra$e5 are a::%ca2e on) on fre56 !e:o5%$5 an! renewa of #a$'r%n" !e:o5%$5.

TNRCMS MAYANK SHAH D?

EDUCATION LOAN@

" term loan %ranted to Indian Nationals for pursuin% hi%her education in India or abroad where admission

has been secured.

E%"%2e Co'r5e5

"ll courses havin% employment prospects are eli%ible.

$raduation coursesM Post %raduation coursesM Professional courses

,ther courses approved by K$+M$overnmentM"I+'* etc.

A#o'n$ of Loan

=or studies in India, ma0imum )s. 1@ lacs

&tudies abroad, ma0imum )s. 7@ lacs

In$ere5$ Ra$e

=or loans upto )s. D lakh 1@.?@E p.a.

=or loans above )s. D lakh 11.?@E p.a.

Re:a)#en$ Ten're

)epayment will commence one year after completion of course or C months after securin% a 2ob, whichever is

earlier.

Pace of S$'!) Loan A#o'n$

Re:a)#en$ Per%o!

%n Year5

In India

Kp to )s. F.? lacs ?3F

"bove )s. F.? lacs ?31@

"broad

Kp to )s. 1? lacs ?3F

"bove )s. 1? lacs ?31@

TNRCMS MAYANK SHAH DC

Sec'r%$)

A#o'n$ S$'!%e5 In In!%a S$'!%e5 A2roa!

Kpto )s. D lacs No &ecurity No &ecurity

"bove )s. D lacs to )s. F.?@ lacs

'hird Party

$uarantee

'hird Party $uarantee

"bove )s. F.?@ lacs to )s. 1@ lacs<India4M

)s. 1? lacs<"broad4

'an%ible +ollateral

security for full

value of loan

'an%ible +ollateral security of suitable

value of loan or third party %uarantee

)s 1? lacs to )s. 7@ lacs RRR

'an%ible +ollateral security for full

value of loan

Mar"%n

=or loans up to )s.D.@ lacs > No 5ar%in

=or loans above )s.D.@ lacs>

o &tudies in India> ?E

o &tudies "broad> 1?E

TNRCMS MAYANK SHAH DF

;*= Learn%n" 4 De(eo:#en$

ank has taken up several key initiatives to motivate and retain its manpower. In order to

channelize the ener%y created by the Parivartan campai%n, the ank has launched a Landmark

e0ercise for creation of the new -ision 5ission ; -alues statement which will be in place

shortly. Joun% officers are bein% encoura%ed to take3up mana%ement education by way of

sponsorship tie3up with the &. P. :ain Institute of 5ana%ement. ?@ officers have been enrolled in

the pro%ramme on a trial basis. ank is stron% in the areas of trainin% ; development throu%h D

ape0 level trainin% colle%es and D? learnin% centres across the country. Ge3learnin%B pro2ect has

been launched to enable any where, anytime learnin%.

;+= 9RMS

=or levera%in% technolo%y in employee mana%ement area, the ank has started automation of its

H) processes throu%h &"P3*)P3H)5& software. ,nce fully implemented, it will not only create

a central repository of all employees data but also will make available a variety of services, like

online re.uest submission and viewin% of individual data etc. to all the employees across the &tate

ank %roup on an online Greal timeB basis. H)5& will brin% efficiency in H) operations and help

the 5ana%ement in makin% employee related decisions faster. Pensioners of &I, II and

"ssociate anks will also form a part of this initiative and their pension will be processed throu%h

H)5&.

;,= Per5onne Mana"e#en$

'he ank has launched Performance Linked Incentive &cheme for the ranch

mana%ersM"$5s<)e%ion4M 8$5s<5odule4 and 'eam Incentive &cheme for the staff members of

the ranch. 'he incentive scheme was launched with the aim of enthusin% and motivatin% the

staff members of the ranch so that the bank is placed in a position to face the competition

unleashed due to liberalization of economy and maintain its lead over others. 'he scheme has

been successful in enthusin% the staff and %arnerin% usiness for the ank.

;-= E#:o)ee5 S6are P'rc6a5e Sc6e#e ;S3I ESPS0+??/=

TNRCMS MAYANK SHAH DA

'he ank also launched *mployees &hare Purchase &cheme alon% with the )i%hts issue with the

,b2ective of providin% incentive to *li%ible *mployees, to stimulate their efforts towards the

continued success of the ank and to provide a 5eans to attract, reward and retain talent in the

ank, to reward eli%ible employees as also to encoura%e e.uity ownership by them. 'he price was

fi0ed at )s.1?H@M3 <the face value of 1 share is )s.1@M34 per e.uity share. 'he &cheme ,pened on

7A.@9.7@@A and closed on 9@.@D.7@@A.

;1= In!'5$r%a Rea$%on5

f " number of H) initiatives such a payment of Performance linked incentives to staff,

rationalisation of promotion policies and improvement in various staff loan schemes were

taken up durin% the year. &uch initiatives have helped in increasin% the motivation level of

staff si%nificantly.

f 'o meet re.uirement of staff for an on%oin% branch e0pansion pro%ramme, separate

recruitment e0ercises were undertaken to recruit clerical staff for metroMurban centers,

ruralMsemi urban centers and also for marketin%. 'his also helped in reducin% the a%e

profile of staff and postin% of youn%er staff at the front line.

f 'he process of consultation and discussion with both the staff and officers federations

continued durin% the year.

f 'he industrial relations climate of the ank remained cordial durin% the year.

;7= S$aff S$ren"$6

'he ank had a total stren%th of 1,FH,7@? on the 91

st

5arch, 7@@A. ,f this, 97.79E are officers,

D7.AFE clerical staff and the remainin% 7D.H@E were sub3staff.

;8= I#:e#en$a$%on of Per5on5 w%$6 !%5a2%%$%e5 ;PWD= Ac$ *<<1

,ur ank provides reservation to persons with disabilities <P/8s4 as per the %uidelines of the

$overnment of India and section 99 of the P/8 "ct 1HH?. 'he total number of persons with

disabilities who were employed as on 91.@9.7@@A was as follows>

;/= Re:re5en$a$%on of Sc6e!'e! Ca5$e5 an! Sc6e!'e! Tr%2e5

"s on the 91st 5arch, 7@@A, 9DA@7 <1H.D7E4 of the ankBs total staff stren%th, belon%ed to

&cheduled +aste and 11DC@ <C.9@E4 belon%ed to &cheduled 'ribes. In order to effectively redress

the %rievances of the &+M&' employees, Liaison ,fficers have been desi%nated at all

administrative offices of the ank. &enior officials of the ank hold re%ular meetin%s at periodic

intervals with the representatives of &+M&' /elfare =ederation and &+M&' /elfare "ssociation at

TNRCMS MAYANK SHAH DH

+orporate +entre, LH,s and Sonal ,ffices. 'he ank conducts workshops on reservation policy

for &+sM&'sM,+s. &o also, pre recruitment and pre3promotion trainin% pro%rammes are

conducted by the ank to enable &+M&'candidates to achieve the prescribed standards to

effectively compete with other candidates.

TNRCMS MAYANK SHAH ?@

Re5earc6 Pan

;A= Def%n%n" $6e Pro2e#@

HNon :erfor#%n" A55e$5 %n 2ank%n" In!'5$r)I has become a subject of intense

importance and discussion. It has assumed greater significance in the

world of banking and banks. It has become a barometer of the health

of banks and discussions on any bank is incomplete without the

mention of NPA, NPA has now become heart of the banking Industry,

which in turn, is the heart of finance and economy of a nation.

"ssets of a bank, %enerally, consist of cash investment, loans and advances, fi0ed assets and

miscellaneous assets. 'he resources of a bank are deployed in these assets. 'he resources

consist of capital and reserves, deposits, borrowin%s and other liabilities. 'hese liabilities are

carried at a cost and hence its deployments into various assets should %enerate enou%h income

to service the cost of the liabilities. In other words, the assets in which the liabilities are

deployed should perform in such a way that it %enerate income to cover the cost of resources

and also a surplus, which is a profit of the bank, 'hus the performance of assets reflects the

health of the bankin% industry.

*arlier, the buzzword in the bankin% industry was deposits as it is the basic raw material for

the bankin% industry. 'he status of the bank was, determined on the volume and size of its

TNRCMS MAYANK SHAH ?1

deposits. 'he career of bankers used to depend on the level of deposits achieved by him.

anks were not bothered about the performance of their assets. ut from 1HH1, a sea chan%e

was made in the way income of banks was reco%nized. /ith the first %eneration economic and

finance sector reforms comin% into bein%, the method of income reco%nition in

the bankin% sector was chan%ed from accrual basis to cash basis. "n income will be carried to

profit and loss account only of it is realized in cash in H@ days. 'his was like a bolt from blue

for deposit P happy bankers. "ll alon%, they were simply doin% an accountin% e0ercise in

debitin% a loan account and credit the income account without botherin% to see whether it is

actually paid by the borrower or not. 'hus the performance of an asset was defined for the first

time in Indian ankin% Industry.

'his chan%e of income reco%nition compelled the banks to unreco%nized the income if the

interest is not received in cash from the borrowers. Not only is this, dependin% upon the

.uality of the assets, various provisions now re.uired to be made on such non performin%

assets. 'his had compelled many lar%e banks to declare loss for the first time in history of

bankin%. 'his had ominous portents for the entire bankin% industry. 'his also resulted in

dwindlin% flow of credit of trade and industry.

'hus NP" has the potential to directly affect the economy of the country. 5any bi% nations

like :apan are sufferin% from this disease of hi%h NP"Bs. ,ur country also now havin% a lar%e

portion of bank credit locked in NP"Bs and hence NP" is receivin% %reater importance of

NP"Bs , that we thou%ht to select it as a sub2ect for $rand Pro2ect.

TNRCMS MAYANK SHAH ?7

* Re5earc6 Pro2e#

'o study the state of recovery mana%ement.

+ Re5earc6 O2>ec$%(e

+ 'o identify reasons that lead to &tandard assets of the bank becomin% NP"s

+ 'o &u%%estin% &trate%y to recovery Non Performin% "ssets and prevention of

further NP"s

, Re5earc6 Me$6o!oo"%e5

;*= Sa#:e De5%"n

'he tar%et population consists of &tate bank of India of )a2kot.

'he sample size comprise of 'wenty one *0ecutives of &tate bank of India of

)a2kot.

;+= Coec$%on of Da$a

" structured .uestionnaire was prepared to elicit information form the respondents.

&econdary data collection was done throu%h data available from ooks, ank

)e%ister and ank system.

;,= Sa#:%n" Me$6o!

'he research was done usin% &imple )andom &lin%.

;-= Da$a Ana)5%5

'he analysis of primary data is done with the help of computerized statistical tools.

TNRCMS MAYANK SHAH ?9

In$ro!'c$%on

'he crucial factor that decides the performance of banks nowadays is the spottin% of non3

performin% assets <NP"4. NP"s are those loans %iven by a bank of financial institution

where the borrower defaults of delays interest of principal payments.

anks are now re.uired to reco%nize such loans faster and then classify them as problem

assets. +lose to 1C percent of loans made by Indian banks are NP"s3very hi%h compared to

? percent in advanced countries.

anks are not allowed to book any income from NP"s. "lso, they have to provide for these

NP"s, or keep money aside in case they canBt collect from the borrower, which affects their

profitability adversely.

Ca55%f%ca$%on of NPA5

In "pril 1HH7, it was decided to implement the Narsimham +ommitteeBs recommendations

on financial sector reforms in a phased manner over a three3year period commencin% from

the financial year 1HH73H9. Income )eco%nition, "ssets +lassification and Provisionin%

<I)"+4 norms were introduced with a view to reflect a true picture of financials of anks

on the basis of their bookin% the income on actual basis than on accrual basis and also

classify assets accordin% to the level of risks attached to them. 'he criteria for classification

is >

Perfor#%n"GS$an!ar!5 A55e$5@ Loan assets in respect of which interest and principal are

received re%ularly are called standard or performin% assets. &tandard assets also include

loans where arrears of interest and M or of principal do not e0ceed H@ days as at the end of a

financial year. No provisionin% is re.uired for such loans.

TNRCMS MAYANK SHAH ?D

Accor!%n" $o R3I <NP"s4 >3 "ny loan repayment or interest thereof that is delayed

beyond H@ days has to be identified as an NP". NP"s are further sub3classified into sub3

standard, doubtful and loss assets>

S'205$an!ar! A55e$5@ &ub3standard assets are those that are non3performin% for a period

not e0ceedin% two years. "lso, in cases where the loan repayment is rescheduled, )I has

asked banks to reco%nize the loans as sub3standard at least for one year.

Do'2$f' A55e$5@ Loans which have remained non3performin% for a period e0ceedin% two

years and which are not considered as loss assets are known as doubtful assets. 5a2or

portions of assets under this cate%ory relate to GsickB companies referred to the oard for

Industrial and =inancial )econstruction <I=)4 and waitin% finalization of rehabilitation

packa%es.

Lo55 A55e$5@ " loss asset is one where loss has been identified but the amount has not been

written off wholly or partly. In other words, such an asset is considered uncollectible. 'here

may be some salva%e value.

Pro(%5%on for NPA5

'he )I has also laid down provisionin% rules for the non3performin% assets. 'his means

that banks have to set aside a portion of their funds to safe%uard a%ainst any losses incurred

on impaired loans. anks have to set aside 1@ percent of sub3standard assets as provisions.

'he provisionin% for doubtful assets is 7@ percent and for loss assets it is 1@@ percent.

TNRCMS MAYANK SHAH ??

De2$ Reco(er) Pro2e#5

<14 'o identify assets and properties of borrowers and %uarantors is a difficult e0ercise. *ven

when banks %et the decrees, e0ecution may be difficult as the e0act position of borrowerBsM

%uarantorBs properties may not be known .i.e. whether it is unencumbered, in %ood

physical and financial condition etc.

<74 +onstraints of time and ade.uate staff to supervise and follow3up the lar%e number of

accounts that are often scattered over wide areas, also hinders recovery effort. "t times

inade.uate transport and roads also hinders recovery effort. "t times inade.uate transport

and roads also make it difficult to reach borrowers.

<94 8espite the %ood intentions, it will depend on how fast the measures are implemented.