Professional Documents

Culture Documents

Econometrics Exam

Econometrics Exam

Uploaded by

prnh88Copyright:

Available Formats

You might also like

- Multiple RegressionDocument100 pagesMultiple RegressionNilton de SousaNo ratings yet

- Chapter 4 Solutions Solution Manual Introductory Econometrics For FinanceDocument5 pagesChapter 4 Solutions Solution Manual Introductory Econometrics For FinanceNazim Uddin MahmudNo ratings yet

- HW 03 SolDocument9 pagesHW 03 SolfdfNo ratings yet

- Solutions To Final1Document12 pagesSolutions To Final1Joe BloeNo ratings yet

- Diagnostico de ModelosDocument4 pagesDiagnostico de Modeloskhayman.gpNo ratings yet

- Panel Data Problem Set 2Document6 pagesPanel Data Problem Set 2Yadavalli ChandradeepNo ratings yet

- Model Specification and Data Problems: 8.1 Functional Form MisspecificationDocument9 pagesModel Specification and Data Problems: 8.1 Functional Form MisspecificationajayikayodeNo ratings yet

- SBR Tutorial 4 - Solution - UpdatedDocument4 pagesSBR Tutorial 4 - Solution - UpdatedZoloft Zithromax ProzacNo ratings yet

- E301sample Questions2 - 12Document3 pagesE301sample Questions2 - 12Osman GulsevenNo ratings yet

- 05 Diagnostic Test of CLRM 2Document39 pages05 Diagnostic Test of CLRM 2Inge AngeliaNo ratings yet

- 1.3. MR Using SPSSDocument24 pages1.3. MR Using SPSSGizaw FulasNo ratings yet

- Variable Selection: Prof. Sharyn O'Halloran Sustainable Development U9611 Econometrics IIDocument79 pagesVariable Selection: Prof. Sharyn O'Halloran Sustainable Development U9611 Econometrics IIMaria PappaNo ratings yet

- Econometrics 2021Document9 pagesEconometrics 2021Yusuf ShotundeNo ratings yet

- Modification of Tukey's Additivity Test: Petr Sime Cek, Marie Sime Ckov ADocument9 pagesModification of Tukey's Additivity Test: Petr Sime Cek, Marie Sime Ckov A53melmelNo ratings yet

- Stat4006 2022-23 PS3Document3 pagesStat4006 2022-23 PS3resulmamiyev1No ratings yet

- EC221 답 지운 것Document99 pagesEC221 답 지운 것이찬호No ratings yet

- Further Regression Topics IIDocument32 pagesFurther Regression Topics IIthrphys1940No ratings yet

- Econometrics and Softwar Applications (Econ 7031) AssignmentDocument8 pagesEconometrics and Softwar Applications (Econ 7031) AssignmentbantalemeNo ratings yet

- Introduction To Econometrics, TutorialDocument22 pagesIntroduction To Econometrics, Tutorialagonza70No ratings yet

- ECONOMETRICS IIIB MEMORUNDUMDocument10 pagesECONOMETRICS IIIB MEMORUNDUMfanimajor1No ratings yet

- Integrated Conditional Moment Testing of Quantile Regression ModelsDocument24 pagesIntegrated Conditional Moment Testing of Quantile Regression ModelsAamir SultanNo ratings yet

- Residual Analysis: There Will Be No Class Meeting On Tuesday, November 26Document5 pagesResidual Analysis: There Will Be No Class Meeting On Tuesday, November 26StarrySky16No ratings yet

- Econometrics I Final Examination Summer Term 2013, July 26, 2013Document9 pagesEconometrics I Final Examination Summer Term 2013, July 26, 2013ECON1717No ratings yet

- Project 2: Technical University of DenmarkDocument11 pagesProject 2: Technical University of DenmarkRiyaz AlamNo ratings yet

- Solutions - Exercises - 1 - and - 2 Multiple - Linear - RegressionDocument8 pagesSolutions - Exercises - 1 - and - 2 Multiple - Linear - RegressionThéobald VitouxNo ratings yet

- X X B X B X B y X X B X B N B Y: QMDS 202 Data Analysis and ModelingDocument6 pagesX X B X B X B y X X B X B N B Y: QMDS 202 Data Analysis and ModelingFaithNo ratings yet

- Statistics - HighlightedDocument7 pagesStatistics - HighlightedBenNo ratings yet

- Error Analysis For IPhO ContestantsDocument11 pagesError Analysis For IPhO ContestantsnurlubekNo ratings yet

- Mid Term UmtDocument4 pagesMid Term Umtfazalulbasit9796No ratings yet

- Hypothesis Tests and Confidence Intervals in Multiple RegressionDocument44 pagesHypothesis Tests and Confidence Intervals in Multiple RegressionRa'fat JalladNo ratings yet

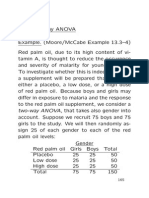

- Analysis of Variance (ANOVA) : Completely Randomized Design (CRD)Document4 pagesAnalysis of Variance (ANOVA) : Completely Randomized Design (CRD)Robert Kier Tanquerido TomaroNo ratings yet

- 10 - Regression 1Document58 pages10 - Regression 1ruchit2809No ratings yet

- University of Parma: Economic StatisticsDocument13 pagesUniversity of Parma: Economic StatisticsHong HiroNo ratings yet

- CH 5 Slidesdd (1ddd)Document71 pagesCH 5 Slidesdd (1ddd)darkooddNo ratings yet

- 14 Building Regression Models Part1-2Document15 pages14 Building Regression Models Part1-2Rama DulceNo ratings yet

- 2015 Preparatory Notes: Australian Chemistry Olympiad (Acho)Document44 pages2015 Preparatory Notes: Australian Chemistry Olympiad (Acho)kevNo ratings yet

- Lecture 8+9 Multicollinearity and Heteroskedasticity Exercise 10.2Document3 pagesLecture 8+9 Multicollinearity and Heteroskedasticity Exercise 10.2Amelia TranNo ratings yet

- Basic Econometrics Old Exam Questions WiDocument9 pagesBasic Econometrics Old Exam Questions WiGuliza100% (1)

- Midterm Exam SolutionsDocument4 pagesMidterm Exam SolutionsDaniel GagnonNo ratings yet

- Anova 1Document36 pagesAnova 1Abhishek Kumar SinghNo ratings yet

- Basic Econometrics HealthDocument183 pagesBasic Econometrics HealthAmin HaleebNo ratings yet

- From Unit Root To Cointegration: Putting Economics Into EconometricsDocument23 pagesFrom Unit Root To Cointegration: Putting Economics Into EconometricsfksdajflsadjfskdlaNo ratings yet

- 2 Way AnovaDocument20 pages2 Way Anovachawlavishnu100% (1)

- Time Series Data: y + X + - . .+ X + UDocument20 pagesTime Series Data: y + X + - . .+ X + UK khan100% (1)

- Lecture36 2012 FullDocument30 pagesLecture36 2012 Fullronaldang89No ratings yet

- Simple RegressionDocument35 pagesSimple RegressionHimanshu JainNo ratings yet

- Simple Nonlinear Time Series Models For Returns: José Maria GasparDocument10 pagesSimple Nonlinear Time Series Models For Returns: José Maria GasparQueen RaniaNo ratings yet

- Old Exam-Dec PDFDocument6 pagesOld Exam-Dec PDFTram Gia PhatNo ratings yet

- Exercise 1 (25 Points) : Econometrics IDocument10 pagesExercise 1 (25 Points) : Econometrics IDaniel MarinhoNo ratings yet

- Multiple Regression Analysis: I 0 1 I1 K Ik IDocument30 pagesMultiple Regression Analysis: I 0 1 I1 K Ik Iajayikayode100% (1)

- Lecture 18. Serial Correlation: Testing and Estimation Testing For Serial CorrelationDocument21 pagesLecture 18. Serial Correlation: Testing and Estimation Testing For Serial CorrelationMilan DjordjevicNo ratings yet

- Slide-Co Minh NTDocument162 pagesSlide-Co Minh NTwikileaks30No ratings yet

- Chem 142 Experiment #1: Atomic Emission: Deadline: Due in Your TA's 3rd-Floor Mailbox 72 Hours After Your Lab EndsDocument8 pagesChem 142 Experiment #1: Atomic Emission: Deadline: Due in Your TA's 3rd-Floor Mailbox 72 Hours After Your Lab Endsapi-301880160No ratings yet

- 6013B0519Y T2 Homework Solutions 20240504Document6 pages6013B0519Y T2 Homework Solutions 20240504Khanh My Ngo TranNo ratings yet

- ANOVA 1 F-RatioDocument17 pagesANOVA 1 F-RatioHamza AsifNo ratings yet

- Lecture 3Document7 pagesLecture 3Nhi TuyếtNo ratings yet

- Experimentation, Validation, and Uncertainty Analysis for EngineersFrom EverandExperimentation, Validation, and Uncertainty Analysis for EngineersNo ratings yet

Econometrics Exam

Econometrics Exam

Uploaded by

prnh88Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Econometrics Exam

Econometrics Exam

Uploaded by

prnh88Copyright:

Available Formats

Econometrics - Exam 1

Exam

Please discuss each problem on a separate sheet of paper, not just

on a separate page!

Problem 1: (20 points)

A sample of data consists of n observations on two variables, Y and X. The

true model is

Y

i

=

1

+

2

X

i

+

i

, (1.1)

where

1

and

2

are parameters and is a disturbance term that satises the

usual regression model assumptions.

In view of the true model,

Y =

1

+

2

X + , (1.2) where

Y ,

X, and are

the sample means of Y , X, and .

Subtracting the second equation from the rst, one obtains

(1.3) Y

i

=

2

X

i

+

i

,

where Y

i

= Y

i

Y , X

i

= X

i

X, and

i

=

i

.

Note that, by construction, the sample means of Y

, X

, and

are all equal

to zero.

One researcher ts

(1.4)

Y = b

1

+ b

2

X

A second researcher ts

(1.5)

Y

= b

1

+ b

2

X

[Note: The second researcher included an intercept in the specication.]

In the following items, you must give mathematical proofs. Unsupported

intuitive guesses will not earn credit.

Econometrics - Exam 2

1. (8 points) Comparing regressions (1.4) and (1.5), and making use of the

expressions for the OLS estimators of the intercept and slope coecient

in a simple regression model, demonstrate that b

2

= b

2

and that b

1

= 0.

2. (4 points) Comparing regressions (1.4) and (1.5), demonstrate that

Y

i

=

Y

i

Y .

3. (3 points) Demonstrate that the residuals in (1.5) are identical to the

residuals in (1.4).

4. (5 points) Explain why, theoretically, the specication (1.5) of the se-

cond researcher is incorrect and he should have tted (1.6)

Y

= b

2

X

not including a constant in his specication. If the second researcher

had tted (1.6) instead of (1.5), how would this have aected his esti-

mator of

2

? Would dropping the unnecessary intercept lead to a gain

in eciency?

Solution:

1. Using e.g. the formula of Assignment 1, Problem 1

b

2

=

(X

i

X

)(Y

i

Y

)

(X

i

X

)

2

using now that

X

= 0 =

Y

=

i

Y

i

(X

i

)

2

using the denition of X

, Y

=

(X

i

X)(Y

i

Y )

(X

i

X)

2

= b

2

b

1

=

Y

b

= 0 as

X

= 0 =

Y

2. E.g.

Y

i

= b

1

+ b

2

X

i

= b

2

X

i

= b

2

(X

i

X) = b

2

X

i

(

Y b

1

) =

Y

i

Y

3. e

i

= Y

i

Y

i

= (Y

i

Y ) (

Y

i

Y ) = e

i

4. The theoretical Equation (1.3) does not include an intercept. Using

(1.6), the researcher should have estimated b

2

=

i

Y

i

(X

i

)

2

. However, (1)

demonstrates that he has eectively done exactly this. Hence, the esti-

mator will be the same. Consequently, there will be no gain in eciency.

Econometrics - Exam 3

Problem 2: (20 points)

The following tables give results for an annual data set for 162 farms overs

the years 1993 to 1998. The variables are:

MILK: milk output in liters per year

COWS: number of cows

LAND: land area, constant for each farm

FEED: feed input

Table 1 gives output of a pooled regression of log(MILK) on an intercept

(C), log(COWS), log(LAND) and log(FEED). Table 2 gives output from a

xed eects regression where the estimated xed eects are not reported,

and Table 3 gives results from a random eects estimation:

Table 1: Pooled Estimation

Dep. Variable: LOG(MILK)

Method: Least Squares

Sample (adjusted): 1 972

Included observations: 972 after adjusting endpoints

variable Coecient Std. Error t-Statistics Prob.

C 6,976457 0,040584 171,9009 0,0000

LOG(COWS) 0,600228 0,023564 25,49150 0,0000

LOG(LAND) 0,020668 0,014120 1,463763 0,1436

LOG(FEED) 0,455605 0,013712 33,22704 0,0000

R-squared 0,956152 Mean dep. var. 11,71364

Adjusted R-squared 0,956017 S.D. dep. var. 0,607083

S.E. of regression 0,127319 Sum squared resid 15,69139

F-statistics 7036,159 Durbin-Watson stat 0,573676

Table 2: Fixed Eects Estimation

Dep. Variable: LOG(MILK)

Econometrics - Exam 4

Method: Pooled Least Squares

Sample: 1993 1998

Included Observations: 6

Number of cross-sections used: 162

Total panel (balanced) observations: 972

variable Coecient Std. Error t-Statistics Prob.

LOG(COWS) 0,674705 0,032031 21,06433 0,0000

LOG(FEED) 0,396393 0,014944 26,52504 0,0000

xed eects ...

R-squared 0,986294 Mean dep. var. 11,71364

Adjusted R-squared 0,983529 S.D. dep. var. 0,607083

S.E. of regression 0,077914 Sum squared resid 4,905013

F-statistics 58142,43 Durbin-Watson stat 1,717733

Table 3: Random Eect Estimation

Dep. Variable: LOG(MILK)

Method: GLS (Variance Component)

Sample: 1993 1998

Included Observations: 6

Number of cross-sections used: 162

Total panel (balanced) observations: 972

variable Coecient Std. Error t-Statistics Prob.

C 7,086916 0,057206 123,8852 0,0000

LOG(COWS) 0,657466 0,027075 24,28350 0,0000

LOG(LAND) 0,020818 0,023718 0,877749 0,3830

LOG(FEED) 0,410013 0,013630 30,08170 0,0000

GLS Transformed Regression

Econometrics - Exam 5

R-squared 0,983509 Mean dep. var. 11,71364

Adjusted R-squared 0,983458 S.D. dep. var. 0,607083

S.E. of regression 0,078080 Sum squared resid 5,901458

Durbin-Watson stat 1,445803

Unweighted Statistics including Random Eects

R-squared 0,986028 Mean dep. var. 11,71364

Adjusted R-squared 0,985985 S.D. dep. var. 0,607083

S.E. of regression 0,071870 Sum squared resid 5,000071

Durbin-Watson stat 1,706445

1. Test the hypothesis that log(LAND) has no signicant eect on milk

production. Describe which model you use, what is the null hypothe-

sis, the test statistics and its distribution. Explain how you used the

displayed output to form your conclusion.

The variable LAND is time invariant and hence we can only use the

pooled or random eects models. In both cases, we can use the displayed

p-values from the t-statistics and conclude that we cannot reject the null

hypothesis of no eect of log(LAND) on milk production (at say 10%

signicance level). In plain English log(LAND) does not seem to have

any signicant eect on log(MILK).

2. Why is the variable log(LAND) not included in Table 2?

The variable LAND is time invariant and hence the individual dummies

capture its eect; i.e. it is perfectly collinear with the cross-sectional

dummies and cannot be included in the xed eect regression.

3. Compare the models in Table 1 and 2. What is the dierence between

them? Which is more restrictive? Explain how would you test for these

restrictions and if possible perform the test.

The pooled model (table 1) is more restrictive that the xed eects model

(table 2). In the pooled model there is a single constant that is common

to all units. The xed eect model replaces the constant with a set of

Econometrics - Exam 6

individual dummies. To test the pooled restriction, we can use the F-

test for the restriction that all these dummies are equal to each other.

The F-test statistics is:

F (n 1, nT n k) =

_

R

2

fixed

R

2

pooled

_

/ (n 1)

_

1 R

2

fixed

_

/ (nT n k)

=

(0.986294 0.956152) / (162 1)

(1 0.986294) / (972 162 2)

=

0.030142/161

0.013706/808

.

=

30

14

808

161

.

= 2

808

161

> 1

The 95% critical value for F (161, 808) is a bit bigger than the critical

value of the F (, ) which is exactly one. Thus our test statistic is

much larger than the critical value and we can reject the null of all the

dummies are equal to each other with 95 percent condence.

4. Compare the models in Table 2 and 3. What is the dierence between

them? Which is more restrictive? Explain how would you test for these

restrictions and if possible perform the test.

The xed eect model (table 2) is more general. The random eects

model (table 3) assumes that the individual eects are not correlated

with the explanatory variables. To test this restriction, we could use

the Hausmann test - under the null of no correlation, both the random

(RE) and xed eects (FE) estimators are consistent and the (RE) is

more ecient; under the alternative RE is inconsistent, while FE is still

consistent. The test statistics (which is asymptotically

2

K

distributed)

is:

H =

_

FE

RE

_

FE

RE

_

,

where is the (asymptotic) variance covariance matrix of

_

FE

RE

_

,

with being the K 1 coecient vector excluding the constant terms.

The matrix is not provided in the tables and hence we cannot calcu-

late the test. Note that the Breusch-Pagan LM test is testing something

dierent - whether the error components are actually present at all.

Although this is a necessary condition for the use of the RE estimator,

it is not a test of the RE restriction relative to a FE model.

Econometrics - Exam 7

Problem 3: (10 points)

Suppose that the joint distribution of the two random variables x and y is

f(x, y) =

e

(+)y

(y)

x

x!

,

where , > 0, y 0, x = 0, 1, 2, ... and x! denotes 1 2 ... x.

1. (8 points) Find the maximum likelihood estimators for and .

2. (2 points) Find the maximum likelihood estimator of /( + ).

Solution:

1.

f(x, y) =

e

(+)y

(y)

x

x!

L(, |y

1

, ..., y

n

, x

1

, ..., x

n

) =

n

i=1

e

(+)y

i

(y

i

)

x

i

x

i

!

ln L(, |...) = nln ( + )

y

i

+ ln

x

i

+

x

i

ln y

i

ln(x

i

!)

ln L

=

n

y

i

= 0

=

n

y

i

=

1

y

ln L

y

i

+

1

x

i

= 0

=

x

i

y

i

=

x

y

2.

+

=

1

y

/

_

x

y

+

1

y

_

=

1

1 + x

Econometrics - Exam 8

Problem 4: (10 points)

Consider the stochastic processes given below, where

t

is a normally distri-

buted white noise. For each process determine whether it is covariance sta-

tionary, strictly covariance stationary, or integrated of order one [i.e. I (1)],

or neither of these:

1. X

t

= 0.7X

t1

+

t

Covariance stationary and strictly covariance stationary.

2. X

t

= X

t1

+

t

+ 8

t1

Integrated of order one.

3. X

t

= 0.3X

t1

+

t

for t T

0

and X

t

= 0.8X

t1

+

t

for t > T

0

.

None of these (the autocovariances are changing around the break so it

is not covariance stationary).

You might also like

- Multiple RegressionDocument100 pagesMultiple RegressionNilton de SousaNo ratings yet

- Chapter 4 Solutions Solution Manual Introductory Econometrics For FinanceDocument5 pagesChapter 4 Solutions Solution Manual Introductory Econometrics For FinanceNazim Uddin MahmudNo ratings yet

- HW 03 SolDocument9 pagesHW 03 SolfdfNo ratings yet

- Solutions To Final1Document12 pagesSolutions To Final1Joe BloeNo ratings yet

- Diagnostico de ModelosDocument4 pagesDiagnostico de Modeloskhayman.gpNo ratings yet

- Panel Data Problem Set 2Document6 pagesPanel Data Problem Set 2Yadavalli ChandradeepNo ratings yet

- Model Specification and Data Problems: 8.1 Functional Form MisspecificationDocument9 pagesModel Specification and Data Problems: 8.1 Functional Form MisspecificationajayikayodeNo ratings yet

- SBR Tutorial 4 - Solution - UpdatedDocument4 pagesSBR Tutorial 4 - Solution - UpdatedZoloft Zithromax ProzacNo ratings yet

- E301sample Questions2 - 12Document3 pagesE301sample Questions2 - 12Osman GulsevenNo ratings yet

- 05 Diagnostic Test of CLRM 2Document39 pages05 Diagnostic Test of CLRM 2Inge AngeliaNo ratings yet

- 1.3. MR Using SPSSDocument24 pages1.3. MR Using SPSSGizaw FulasNo ratings yet

- Variable Selection: Prof. Sharyn O'Halloran Sustainable Development U9611 Econometrics IIDocument79 pagesVariable Selection: Prof. Sharyn O'Halloran Sustainable Development U9611 Econometrics IIMaria PappaNo ratings yet

- Econometrics 2021Document9 pagesEconometrics 2021Yusuf ShotundeNo ratings yet

- Modification of Tukey's Additivity Test: Petr Sime Cek, Marie Sime Ckov ADocument9 pagesModification of Tukey's Additivity Test: Petr Sime Cek, Marie Sime Ckov A53melmelNo ratings yet

- Stat4006 2022-23 PS3Document3 pagesStat4006 2022-23 PS3resulmamiyev1No ratings yet

- EC221 답 지운 것Document99 pagesEC221 답 지운 것이찬호No ratings yet

- Further Regression Topics IIDocument32 pagesFurther Regression Topics IIthrphys1940No ratings yet

- Econometrics and Softwar Applications (Econ 7031) AssignmentDocument8 pagesEconometrics and Softwar Applications (Econ 7031) AssignmentbantalemeNo ratings yet

- Introduction To Econometrics, TutorialDocument22 pagesIntroduction To Econometrics, Tutorialagonza70No ratings yet

- ECONOMETRICS IIIB MEMORUNDUMDocument10 pagesECONOMETRICS IIIB MEMORUNDUMfanimajor1No ratings yet

- Integrated Conditional Moment Testing of Quantile Regression ModelsDocument24 pagesIntegrated Conditional Moment Testing of Quantile Regression ModelsAamir SultanNo ratings yet

- Residual Analysis: There Will Be No Class Meeting On Tuesday, November 26Document5 pagesResidual Analysis: There Will Be No Class Meeting On Tuesday, November 26StarrySky16No ratings yet

- Econometrics I Final Examination Summer Term 2013, July 26, 2013Document9 pagesEconometrics I Final Examination Summer Term 2013, July 26, 2013ECON1717No ratings yet

- Project 2: Technical University of DenmarkDocument11 pagesProject 2: Technical University of DenmarkRiyaz AlamNo ratings yet

- Solutions - Exercises - 1 - and - 2 Multiple - Linear - RegressionDocument8 pagesSolutions - Exercises - 1 - and - 2 Multiple - Linear - RegressionThéobald VitouxNo ratings yet

- X X B X B X B y X X B X B N B Y: QMDS 202 Data Analysis and ModelingDocument6 pagesX X B X B X B y X X B X B N B Y: QMDS 202 Data Analysis and ModelingFaithNo ratings yet

- Statistics - HighlightedDocument7 pagesStatistics - HighlightedBenNo ratings yet

- Error Analysis For IPhO ContestantsDocument11 pagesError Analysis For IPhO ContestantsnurlubekNo ratings yet

- Mid Term UmtDocument4 pagesMid Term Umtfazalulbasit9796No ratings yet

- Hypothesis Tests and Confidence Intervals in Multiple RegressionDocument44 pagesHypothesis Tests and Confidence Intervals in Multiple RegressionRa'fat JalladNo ratings yet

- Analysis of Variance (ANOVA) : Completely Randomized Design (CRD)Document4 pagesAnalysis of Variance (ANOVA) : Completely Randomized Design (CRD)Robert Kier Tanquerido TomaroNo ratings yet

- 10 - Regression 1Document58 pages10 - Regression 1ruchit2809No ratings yet

- University of Parma: Economic StatisticsDocument13 pagesUniversity of Parma: Economic StatisticsHong HiroNo ratings yet

- CH 5 Slidesdd (1ddd)Document71 pagesCH 5 Slidesdd (1ddd)darkooddNo ratings yet

- 14 Building Regression Models Part1-2Document15 pages14 Building Regression Models Part1-2Rama DulceNo ratings yet

- 2015 Preparatory Notes: Australian Chemistry Olympiad (Acho)Document44 pages2015 Preparatory Notes: Australian Chemistry Olympiad (Acho)kevNo ratings yet

- Lecture 8+9 Multicollinearity and Heteroskedasticity Exercise 10.2Document3 pagesLecture 8+9 Multicollinearity and Heteroskedasticity Exercise 10.2Amelia TranNo ratings yet

- Basic Econometrics Old Exam Questions WiDocument9 pagesBasic Econometrics Old Exam Questions WiGuliza100% (1)

- Midterm Exam SolutionsDocument4 pagesMidterm Exam SolutionsDaniel GagnonNo ratings yet

- Anova 1Document36 pagesAnova 1Abhishek Kumar SinghNo ratings yet

- Basic Econometrics HealthDocument183 pagesBasic Econometrics HealthAmin HaleebNo ratings yet

- From Unit Root To Cointegration: Putting Economics Into EconometricsDocument23 pagesFrom Unit Root To Cointegration: Putting Economics Into EconometricsfksdajflsadjfskdlaNo ratings yet

- 2 Way AnovaDocument20 pages2 Way Anovachawlavishnu100% (1)

- Time Series Data: y + X + - . .+ X + UDocument20 pagesTime Series Data: y + X + - . .+ X + UK khan100% (1)

- Lecture36 2012 FullDocument30 pagesLecture36 2012 Fullronaldang89No ratings yet

- Simple RegressionDocument35 pagesSimple RegressionHimanshu JainNo ratings yet

- Simple Nonlinear Time Series Models For Returns: José Maria GasparDocument10 pagesSimple Nonlinear Time Series Models For Returns: José Maria GasparQueen RaniaNo ratings yet

- Old Exam-Dec PDFDocument6 pagesOld Exam-Dec PDFTram Gia PhatNo ratings yet

- Exercise 1 (25 Points) : Econometrics IDocument10 pagesExercise 1 (25 Points) : Econometrics IDaniel MarinhoNo ratings yet

- Multiple Regression Analysis: I 0 1 I1 K Ik IDocument30 pagesMultiple Regression Analysis: I 0 1 I1 K Ik Iajayikayode100% (1)

- Lecture 18. Serial Correlation: Testing and Estimation Testing For Serial CorrelationDocument21 pagesLecture 18. Serial Correlation: Testing and Estimation Testing For Serial CorrelationMilan DjordjevicNo ratings yet

- Slide-Co Minh NTDocument162 pagesSlide-Co Minh NTwikileaks30No ratings yet

- Chem 142 Experiment #1: Atomic Emission: Deadline: Due in Your TA's 3rd-Floor Mailbox 72 Hours After Your Lab EndsDocument8 pagesChem 142 Experiment #1: Atomic Emission: Deadline: Due in Your TA's 3rd-Floor Mailbox 72 Hours After Your Lab Endsapi-301880160No ratings yet

- 6013B0519Y T2 Homework Solutions 20240504Document6 pages6013B0519Y T2 Homework Solutions 20240504Khanh My Ngo TranNo ratings yet

- ANOVA 1 F-RatioDocument17 pagesANOVA 1 F-RatioHamza AsifNo ratings yet

- Lecture 3Document7 pagesLecture 3Nhi TuyếtNo ratings yet

- Experimentation, Validation, and Uncertainty Analysis for EngineersFrom EverandExperimentation, Validation, and Uncertainty Analysis for EngineersNo ratings yet