Professional Documents

Culture Documents

Wills - Sena Ebook

Wills - Sena Ebook

Uploaded by

Sharps VillaCopyright:

Available Formats

You might also like

- TM 9-2800 1943 Standard Military Motor Vehicles 1 September 1943Document465 pagesTM 9-2800 1943 Standard Military Motor Vehicles 1 September 1943Advocate100% (4)

- The Holy Spirit Book - Robert Kayanja Vol 7 - 388 PagesDocument388 pagesThe Holy Spirit Book - Robert Kayanja Vol 7 - 388 PagesBRAVE BRANo ratings yet

- Brain SyncDocument1 pageBrain SyncvickimabelliNo ratings yet

- Toronto AppDocument3 pagesToronto Appmelvin martinezNo ratings yet

- Concept of Wills and SuccessionDocument113 pagesConcept of Wills and Successionhaze_toledo5077100% (4)

- Corpo Notes 2018 PrelimsDocument14 pagesCorpo Notes 2018 PrelimsCzara DyNo ratings yet

- Ticman Notes 3Document3 pagesTicman Notes 3Mar Jan GuyNo ratings yet

- Culled Primarily From The Lectures of Atty. Kenneth Glenn L. ManuelDocument45 pagesCulled Primarily From The Lectures of Atty. Kenneth Glenn L. Manueldarkbliss MNo ratings yet

- Art 1082Document11 pagesArt 1082Joy OrenaNo ratings yet

- Marx Notes - Civ Rev 1 SenaDocument146 pagesMarx Notes - Civ Rev 1 SenaPending_name100% (1)

- Civ2 - Sena EbookDocument155 pagesCiv2 - Sena EbookkrstnliuNo ratings yet

- SB10 4F Criminal Law Review Final Wave Titles Eleven To Fourteen Book Two 1Document52 pagesSB10 4F Criminal Law Review Final Wave Titles Eleven To Fourteen Book Two 1JImlan Sahipa IsmaelNo ratings yet

- 14.4 Paramount Vs JapzonDocument2 pages14.4 Paramount Vs JapzonJv FerminNo ratings yet

- Merope de Catalan vs. Loula Catalan-Lee (Doctrine of Presumed-Identity Approach or Processual Presumption)Document2 pagesMerope de Catalan vs. Loula Catalan-Lee (Doctrine of Presumed-Identity Approach or Processual Presumption)Andrei Jose V. LayeseNo ratings yet

- Neri and Benatiro CaseDocument2 pagesNeri and Benatiro CaseMoira RoSe ManayonNo ratings yet

- Spouses Rubin and Portia Hojas v. Philippine Amanah Bank Gr. No. 193453 June 5, 2013Document2 pagesSpouses Rubin and Portia Hojas v. Philippine Amanah Bank Gr. No. 193453 June 5, 2013Jaypee OrtizNo ratings yet

- Arellano University School of Law 2019-2020: Submitted ToDocument8 pagesArellano University School of Law 2019-2020: Submitted ToGiee De Guzman100% (1)

- Philippine National Bank v. Spouses Cheah Chee Chong and Ofelia Camacho CheahDocument1 pagePhilippine National Bank v. Spouses Cheah Chee Chong and Ofelia Camacho Cheah12234567890No ratings yet

- Land Bank Vs MonetDocument2 pagesLand Bank Vs MonetRyDNo ratings yet

- Bohanan vs. BohananDocument6 pagesBohanan vs. BohananAlexNo ratings yet

- Maramag v. de GuzmanDocument3 pagesMaramag v. de GuzmanBion Henrik PrioloNo ratings yet

- Socio/ Academic/ Anecdotal RecordDocument24 pagesSocio/ Academic/ Anecdotal RecordJeisther Timothy GalanoNo ratings yet

- RAMOS - Diaz Vs PeopleDocument5 pagesRAMOS - Diaz Vs PeopleRovi Kennth RamosNo ratings yet

- Yaptinchay, The Supreme Court in This Case RuledDocument2 pagesYaptinchay, The Supreme Court in This Case RuledLorenz Allan GatpolintanNo ratings yet

- 5 Persons Case DigestDocument9 pages5 Persons Case DigestYasser AureadaNo ratings yet

- Banking Laws Case DigestsDocument61 pagesBanking Laws Case DigestsMaxi Dominick TahanlangitNo ratings yet

- Outline For Constitutional - Law 2016 (Dangat)Document15 pagesOutline For Constitutional - Law 2016 (Dangat)vmanalo16100% (1)

- Alfonso v. Office of The President (2007)Document4 pagesAlfonso v. Office of The President (2007)BananaNo ratings yet

- Abs-Cbn Bradcasting Corporation v. Office of The Ombudsman, Gr. No 133347, Oct 15, 2008, 569 Scra 59Document11 pagesAbs-Cbn Bradcasting Corporation v. Office of The Ombudsman, Gr. No 133347, Oct 15, 2008, 569 Scra 59Agnes FranciscoNo ratings yet

- Libi vs. Intermediate Appellate CourtDocument14 pagesLibi vs. Intermediate Appellate Courtvince005100% (1)

- Chua V VictorioDocument9 pagesChua V VictoriothebluesharpieNo ratings yet

- HOMEWORK NO. 2 Baste Civ Law Review 2Document4 pagesHOMEWORK NO. 2 Baste Civ Law Review 2Brigette DomingoNo ratings yet

- Legal Med ReviewerDocument88 pagesLegal Med ReviewerYusop B. MasdalNo ratings yet

- Judicial Admission DigestsDocument2 pagesJudicial Admission DigestsaldenamellNo ratings yet

- Van Dorn vs. Hon. Romillo and Richard UptonDocument1 pageVan Dorn vs. Hon. Romillo and Richard UptonInes Hamoy JunioNo ratings yet

- White vs. TennantDocument6 pagesWhite vs. TennantjohnkyleNo ratings yet

- Labor Relations 2nd S, 202021 Tuesday Class Atty. Paciano F. Fallar Jr. Sscr-Col Mid-Terms ExamsDocument2 pagesLabor Relations 2nd S, 202021 Tuesday Class Atty. Paciano F. Fallar Jr. Sscr-Col Mid-Terms ExamsOmar sarmientoNo ratings yet

- Civil Law Doctrines Recent Cases - 2014Document39 pagesCivil Law Doctrines Recent Cases - 2014Cris Margot LuyabenNo ratings yet

- Finals Rem 2 Exam (October 25, 2013)Document11 pagesFinals Rem 2 Exam (October 25, 2013)Tonton ReyesNo ratings yet

- Bernas Public International LawDocument5 pagesBernas Public International LawJorg ィ ۦۦNo ratings yet

- Insurance Course OutlineDocument55 pagesInsurance Course OutlineAdel BermejoNo ratings yet

- SSS V AguasDocument3 pagesSSS V AguasChristian UrbinaNo ratings yet

- Gnotes Skinny (Full)Document22 pagesGnotes Skinny (Full)Vada De Villa RodriguezNo ratings yet

- C3I - 1people v. DiopitaDocument2 pagesC3I - 1people v. DiopitaAaron AristonNo ratings yet

- Medel vs. Court of AppealsDocument11 pagesMedel vs. Court of AppealsMary Villanueva100% (1)

- Rcadi v. LRC (1957)Document4 pagesRcadi v. LRC (1957)Van TalawecNo ratings yet

- Wills Case Digest CompilationDocument92 pagesWills Case Digest CompilationEzi AngelesNo ratings yet

- Unson v. Abella & Austria v. ReyesDocument3 pagesUnson v. Abella & Austria v. ReyesRain HofileñaNo ratings yet

- Albano Notes SpecProDocument7 pagesAlbano Notes SpecProjilliankadNo ratings yet

- Atty. Geromo vs. La Paz HousingDocument2 pagesAtty. Geromo vs. La Paz HousingJenely Joy Areola-TelanNo ratings yet

- Martinez V Van BuskirkDocument7 pagesMartinez V Van BuskirkStefen ChingNo ratings yet

- Culled Primarily From The Lectures of Prof. Leilani GrimaresDocument13 pagesCulled Primarily From The Lectures of Prof. Leilani GrimaresGregarius CarinoNo ratings yet

- Legal Ethics DigestedDocument80 pagesLegal Ethics DigestedAlberto NicholsNo ratings yet

- Jurists Bar Review Center: 2022 Preweek LecturesDocument1 pageJurists Bar Review Center: 2022 Preweek LecturesRucheska JacintoNo ratings yet

- Succession Case DigestDocument32 pagesSuccession Case DigestJoanne Gonzales JuntillaNo ratings yet

- Tan Rem PDFDocument82 pagesTan Rem PDFfaye wongNo ratings yet

- Jmcruz Reviewer in Civ Rev 2 Atty. TLC - Midterms Case DoctrinesDocument14 pagesJmcruz Reviewer in Civ Rev 2 Atty. TLC - Midterms Case DoctrinesJm CruzNo ratings yet

- GR79758 DigestDocument2 pagesGR79758 Digestmicoleq903385No ratings yet

- Ocampo vs. Ocampo: G.R. No. 187879 July 5, 2010Document9 pagesOcampo vs. Ocampo: G.R. No. 187879 July 5, 2010demNo ratings yet

- HRL D. Feble ReviewerDocument7 pagesHRL D. Feble ReviewerKrystalynne AguilarNo ratings yet

- Political - Law - Review - Outline - Docx Filename - UTF-8''Political Law Review Outline-2Document14 pagesPolitical - Law - Review - Outline - Docx Filename - UTF-8''Political Law Review Outline-2olofuzyatotzNo ratings yet

- Succession 191716691 TranscriptDocument136 pagesSuccession 191716691 TranscriptrHea sindoLNo ratings yet

- Succession TranscriptDocument224 pagesSuccession TranscriptKrstn QbdNo ratings yet

- Wills Beda ReviewerDocument63 pagesWills Beda ReviewerVal Peralta-NavalNo ratings yet

- BPI Vs CalanzaDocument22 pagesBPI Vs CalanzavickimabelliNo ratings yet

- Capitol Hills Golf and Country Club Vs SanchezDocument25 pagesCapitol Hills Golf and Country Club Vs SanchezvickimabelliNo ratings yet

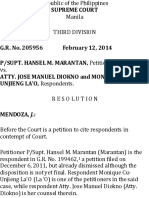

- Marantan Vs DioknoDocument13 pagesMarantan Vs DioknovickimabelliNo ratings yet

- Sison Vs CaoibesDocument18 pagesSison Vs CaoibesvickimabelliNo ratings yet

- Yasay Vs RectoDocument14 pagesYasay Vs RectovickimabelliNo ratings yet

- 2014 Bar Questions and Suggested Answers (Labor Law)Document12 pages2014 Bar Questions and Suggested Answers (Labor Law)vickimabelliNo ratings yet

- HeirsofLVvs CADocument6 pagesHeirsofLVvs CAvickimabelliNo ratings yet

- MathDocument5 pagesMathvickimabelli100% (1)

- Avadhut LGDocument2 pagesAvadhut LGvishwajeet pawarNo ratings yet

- Melendres # 1686.0 SANDS Memorandum Re Remedial PhaseDocument6 pagesMelendres # 1686.0 SANDS Memorandum Re Remedial PhaseJack RyanNo ratings yet

- Labor Law OvertimeDocument4 pagesLabor Law OvertimeMaphile Mae CanenciaNo ratings yet

- Eli Sides 3Document3 pagesEli Sides 3QuentinNo ratings yet

- (Download PDF) The Police in America An Introduction Charles Katz Full Chapter PDFDocument69 pages(Download PDF) The Police in America An Introduction Charles Katz Full Chapter PDFgurskisvei100% (9)

- Ice Candyman PresentationDocument36 pagesIce Candyman PresentationIris Delacroix0% (1)

- Bonifacio 110504233625 Phpapp02Document22 pagesBonifacio 110504233625 Phpapp02Eliza Cortez CastroNo ratings yet

- IMDA DCA Form PDFDocument1 pageIMDA DCA Form PDFDaps PounchNo ratings yet

- People v. SantosDocument2 pagesPeople v. SantosjdpajarilloNo ratings yet

- LGC Re Disciplinary ProcedureDocument9 pagesLGC Re Disciplinary ProcedureJoel A. YbañezNo ratings yet

- Criteria 1 2 3 4 5 Points Earned Portrayal of RolesDocument1 pageCriteria 1 2 3 4 5 Points Earned Portrayal of RolesChristian Dave Tad-awanNo ratings yet

- Pamela Rios - Famous Person Research ProjectDocument11 pagesPamela Rios - Famous Person Research Projectapi-460090591No ratings yet

- AP Board 8th Class Social Studies Solutions Chapter 1 Reading and Analysis of Maps - AP Board SolutionsDocument9 pagesAP Board 8th Class Social Studies Solutions Chapter 1 Reading and Analysis of Maps - AP Board SolutionsvenkataNo ratings yet

- Government CompanyDocument4 pagesGovernment CompanyCA OFFICENo ratings yet

- J. Habermas Between Facts and NormsDocument6 pagesJ. Habermas Between Facts and NormsAntonio Mosquera AguilarNo ratings yet

- Times Leader 08-27-2013Document36 pagesTimes Leader 08-27-2013The Times LeaderNo ratings yet

- Peliculas de TerrorDocument1 pagePeliculas de TerrorDanielLociaNo ratings yet

- Bullock v. Carter, 405 U.S. 134 (1972)Document13 pagesBullock v. Carter, 405 U.S. 134 (1972)Scribd Government DocsNo ratings yet

- GSIS vs. CA DigestDocument1 pageGSIS vs. CA DigestCaitlin Kintanar100% (1)

- Political TheatreDocument21 pagesPolitical TheatreRay Pinch100% (1)

- Gr5 - Helping in Haiti - PR - F - ReadworksDocument4 pagesGr5 - Helping in Haiti - PR - F - ReadworksJac Ledonio0% (1)

- NM3 Ltest5A1Document2 pagesNM3 Ltest5A1Анастасія Снєткова100% (1)

- Pak-Afghan Relations and The TalibanDocument29 pagesPak-Afghan Relations and The TalibanstabwdatdpkNo ratings yet

- 2024 02 22 - Notice of Mailing Transcript - Delphi in - Ra PDFDocument2 pages2024 02 22 - Notice of Mailing Transcript - Delphi in - Ra PDFGrizzly DocsNo ratings yet

- Jharkhand Direction and Guidelines On Postal Voting For Senior Citizens and Voters With DisabilitiesDocument9 pagesJharkhand Direction and Guidelines On Postal Voting For Senior Citizens and Voters With DisabilitiesDisability Rights AllianceNo ratings yet

- Assignment 2, Essay 4Document5 pagesAssignment 2, Essay 4Faridah HamidNo ratings yet

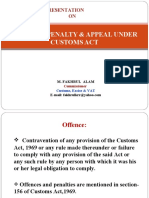

- Offence, Penalty-ICABDocument28 pagesOffence, Penalty-ICABKhadeeza ShammeeNo ratings yet

Wills - Sena Ebook

Wills - Sena Ebook

Uploaded by

Sharps VillaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wills - Sena Ebook

Wills - Sena Ebook

Uploaded by

Sharps VillaCopyright:

Available Formats

Transcribers:

Marc Roby de Chavez (MARX) Marc Roby de Chavez (MARX) Marc Roby de Chavez (MARX) Marc Roby de Chavez (MARX)

Mon Cristhoper Pasia (MON)

Ruth Anne Datay (RUTH)

Socrates Benjie Marbi (SOC)

Apri !erero (APR"#)

Professor: Atty$ Cara Santa%aria&Se'a

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

1

WILLS1

Article 774. Succession is a mode of acquisition by virtue of which the

property, rights and obligations to the extent of the value of the inheritance,

of a person are transmitted through his death to another or others either by

his will or by operation of law.

What is succession?

Succession is a mode of acquisition by virtue of

which the property, rights and obligations to the

extent of the value of the inheritance, of a person

are transmitted through his death to another or

others either by his will or by operation of law

The phrase to the extent of the value of the inheritance to

which does that apply?

Obligations

Why obligations only? The rationale of the phrase?

For protection of the heirs

What is estate?

The totality of all the properties, rights and

obligations left behind the deceased.

What is patrimony?

An inherited estate; property inherited from the

paternal side

What is liquidate?

To settle a debt or an obligation in the form of

money

The heirs continue the personality of the deceased

Must there always be someone dying before succession takes

place?

No, Succession is not confined to that which takes

place upon the death of a person.

Succession can be understood in 2 senses:

General Sense: the transmission of rights and

properties from one person to another.

Technical Sense: denotes the transfer of title to

property under the laws of descent and distribution,

taking place as it does, only on the death of a

person.

WILLS2

A person during his lifetime would acquire rights, properties

and obligations, the totality of his properties would be his

PATRIMONY

Patrimony- the totality of the property, rights and obligation

of a person who is still alive.

What happens in the patrimony if this person dies?

It may or may not be diminish.

But in all likely, it would diminish, why? What is the effect of

death upon patrimony?

Because some of the rights and obligations may be

extinguished by death. We look at death as some

kind of a filter, so when death takes place, there will

be transmission, but not all rights and obligations

will survive death, some of them will be

extinguished.

After death had intervene, how do we now refer to the

property rights and obligations which have survive death?

With respect to the heirs, it shall be known as

inheritance;

With respect to the other persons of the rest of the

world, it shall be known as estate.

How do we classify the estate? Is this a person or is this just

the totality of the properties, rights and obligations?

It is both, because essentially it is the inheritance

(the properties, rights and obligations which have

survived death) but for a limited purpose afforded

the estate some kind of a legal personality, it is

considered to be juridical person.

Why does the law afford the estate this legal personality?

It is to enable to settle the pending affairs of the

decedent, pending affairs may include the

enforcement of right belonging to the decedent or

settling obligations owed by the decedent to third

persons.

Depersonalization?

It is the patrimony which was eventually liable or

answerable for the obligations of the person who

contracted the obligation. If we invoked relativity of

contracts, we are limited to heirs and the assigns.

heirs and the assigns will only be liable to the extent

of they receive, there will be no personal liability

vesting upon them.

Depersonalization was related to Obligations and contracts.

What is depersonalization of obligation?

It means that in the end every obligations will have

to be satisfied against the property of the debtor,

every obligation. Note, if you have an obligation,

what is the remedy of the creditor against the

debtor if it does not want to perform it voluntarily?

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

2

To bring an action for specific performance. If the

debtor does not want to perform it personally and it

was performed by other persons then the liability

will be converted to reimbursing the creditor for the

expenses of letting another person to perform that

which the debtor should have done. And the debtor

should pay? Reimbursement from the debtors

property. If the obligation cannot be performed by

the debtor himself the remedy is damages, which

again will be satisfy to the debtors property. In that

preferably, but if the debtor does not have cash, the

court issues writ or levy to attach the debtors

properties, the properties will be sold and the

proceeds will be used to satisfy the obligation. All of

this showing that every obligation is satisfied against

your property. Depersonalization, patrimony to

patrimony, the debtor does not want to perform, it

cannot be perform, it can no longer be perform, the

creditor will ask for damages and such damages will

be satisfied against the debtors property. That

principle (depersonalization) support the existence

of the estate. In other words, the debtor himself

does not have to be alive to be able to satisfy an

outstanding obligation, the debtor becomes a

dispensable party. Even the debtor is dead, the

creditors has a recourse against whatever property

the debtor leave behind thru the person created by

law, the estate as a legal personality.

Why do we need that concept of patrimony to patrimony?

To protect the creditor and to create confidence in

transactions. Absence of such concept there will be

no or limited transactions. No one will have the

confidence to create transactions.

Succession vs Inheritance

Succession is the mode by which the inheritance is

transmitted while inheritance is the properties,

rights and properties which survive death.

How do we treat the corpse of the decedent would that be

property?

The corpse is not a property to be inherited

Who has a better right the spouse or the mother of the

decedent?

Spouse, because the corpse is a not a property to be

inherited

What right is afforded or acknowledge to the spouse?

The spouse has a limited right on how, where, when

the will be buried

What is the basis of saying that the spouse has the primary

right?

The law on obligation to give support

Spouses

Legitimate ascendants and descendants

Parents and their legitimate and illegitimate

children of the latter

Parents and their illegitimate and

illegitimate children of the latter

Legitimate brothers and sisters, whether

full or half-blood

How will we determine if a property, right or obligation will

survive death? When we say that rights are personal that will

not be extinguished by death, what do we mean by personal

right?

2 senses that which personal right is understood

Personal right in its general sense

inherent to the person

Personal right in its contractual sense - right

which survives death

Personal right vs real right

Personal right- enforceable against a specific of

definite person

Real right- enforceable against the whole world

A personal right may or may not be extinguished by death

because our basis that a right is so personal that it is

extinguished by death would be the nature of that right as

inhering to that person. So it is possible that we have a

personal right in its contractual sense which will survive

death.

E.g.

The right of the seller to collect from the buyer, it passes to

the estate. Such right is a personal in a contractual sense

because he can only enforce such right as against to the other

party to the contract to sell who is the buyer. He cant

enforce to any other person, in that sense it is personal. But is

it personal in its generic sense? is it something which is

inhered to the person of the decedent? NO, it is not personal

in nature in its general sense. So rights which will be

extinguished by death are that rights which are inherent to

the decedent. Personal right in its contractual sense, they are

not necessarily extinguished by death.

e.g. of personal right contractually and personal right by

nature

Right of consortium in the marriage

Are patrimonial rights be extinguished by death?

Generally transmissible

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

3

What are patrimonial rights?

Right which are related to the property

e.g. of a patrimonial right which survives death

Right of ownership which passes on from the

decedent to his heirs

Exceptions, when will patrimonial rights be extinguished by

death?

By stipulation of parties

By provision of law

e.g. of patrimonial right extinguished by death because of a

provision of law

Right of usufruct

Why is it extinguished by death?

Because the law so provides, it is extinguished upon

the death of either parties

Parties in a contract of Usufruct

Naked owner and Usufructuary

Are the rights of obligations transmissible?

Yes

What are the rights of obligation?

The rights of the creditor and the corresponding

obligation of the debtor.

Obligations of the debtor are transmissible except those

which are:

Depending on the nature of the obligation (purely

personal)

intransmissible by express provision of law

stipulation of parties.

ESTATE OF HEMADY VS LUZON SURETY

Relativity of contracts- binds only the parties, heirs and

assigns. Contracts are generally transmissible, it is binding in

the heirs. But the law provides exceptions to general

transmissibility

Express stipulation of the parties

Express provision of law

Depending on the nature of the obligation

The Supreme Court applied this conditions, is the

obligation of a guarantor one which is extinguished upon

death by express provision of law? The SC said that there is

nothing in the law which says that it will be extinguished by

death. But what about the argument that death makes a

person loose his integrity when it is a requirement for a

guarantor, how will that affect the existence of the contract

after death? The SC pointed put that this right to require the

qualification can be waived by the creditor, should the

guarantor lose all the qualification after the guaranty is

constituted the creditor is given the right to ask for a

replacement if he wants to.

It is not also express in the stipulation of parties, the

contract is silent about it

The nature of the obligation, it is not purely personal

because if we treat the contract of guaranty in its barest form

it is just an obligation to pay a sum of money, to pay when

the debtor cannot pay.

ALVAREZ VS IAC

The heirs contend that the liability arising from the

sale made by their father to Siason should be the

sole liability of deceased/of his estate, after his

death. The Supreme Court held that the heirs cant

escape the legal consequences of their fathers

transactions, which gave rise to the claim for

damages by the Yaneses. That said heirs didnt

inherit the property involved is of no moment

because, by legal fiction, the monetary equivalent

thereof devolved into the mass of their fathers

hereditary estate. And the hereditary assets are

always liable in their totality for the payment of the

debts of the estate, the heirs however, are liable

only to the extent of the value of the inheritance

WILLS3

SANTOS VS. LUMBAO

Facts:

Heir- children of Maria who are the original

owner of the land and then pending the

settlement of Marias estate. Rita, one of

the co-heirs decided to enter into an

agreement with the spouses lumbao

pertaining to the inchoate right in marias

estate. Now apparently the document

bilihan ng lupa was witness by two of

Ritas own children. However after Ritas

death they no longer wanted to honor the

document or the sale; and what were they

saying? Their saying that they were not

bound of the document or sale entered into

by Rita, they did not want to give up the

property anymore contracted by Rita.

Ruling:

The heirs are bound to the actions by their

predecessor and must honor the contract

because Property, rights and obligations are

passed on to the heirs, also because the

transaction affects the property. The

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

4

inheritance will be subject to whatever

transaction affects such property. In this

case the transaction is the deed of sale.

NHA VS ALMEIDA

Facts:

Margarita had an option to buy the

property because of the contract to sell that

she entered into with the NHA.

During her lifetime Margarita executed `a

document, which was denominated as

sinumpaang salaysay, it was witnessed by

two people in that sinumpaang salaysay. In

that sinumpaang salaysay kapag akoy

pumanaw n at naayos n ang aking mga

karapatan ay kilalanin ang kanyang anak na

si Francisca

They (heirs of Beatrice) also have a share to

the inheritance, because their mother

predeceased their grandmother so they

become also the co-heirs of margarita. It is

not therefore correct for francisca to

declare to the court that she was the only

heir left by margarita--- this is the purpose

of self adjudication.

Remember in the beginning that was the

clash. That was the theory of franciscaI

am the sole heir therefore the right goes to

me--- pero magkakaroon n sila ng

problema dahil hinahabol din ng ibang co-

heirs. So what does she do? Using the same

document she devise a new theory, she was

no longer claiming as an heir. This time

around she was claiming as an assignee.

The sinumpaang salaysay is actually an

assignment of right made by margarita in

my favor. That was now the new theory.

And it was a brilliant theory. Why? Because

it removes the sinumpaang salaysay from

the law on succession and at the same time

it renders irrelevant the actual use of self

adjudication. Now the NHA can actually

now decide without considering the

affidavit of self adjudication. Which if have

been allowed by the court and just focus on

whether or not there was a valid

assignment of right between Margarita and

Francisca--- that was their theory. And on

that premise the NHA granted the petition

of francisca.

Here again caught the heir of Beatrice to go

to court and question the grant and this

time around what did the S.C say? The S.C.

say that it did not constitute a deed of

assignment. Why not? By the very wording

of the Sinumpaang salaysay. What does it

mean? It means that the transfer be

effective, when? At the time of her death.

So, what could be a better explanation or

justification that it was a transfer mortis

causa, strictly pwedeng assignment yan coz

you can always have an assignment during,

what? During the lifetime of the transferor.

And what more when did margarita died?

She died in 1971; and when did the NHA

grant the right to Francisca? It was in 1986.

That is why the S.C said to admonish the

NHA, you should have known that at the

time you granted the right to francisca the

other heir of margarita had already a vested

right on the interest of margarita under the

contract to sell, because they gave the

grant after her death and succession to her

estate has already open, you could have not

ignore that, you should have not granted

the right to margarita.

For the purposes of discussion, with that

ruling of the S.C, that the other heir of

Margarita had a estate in the contract to

sell, does it necessarily mean all is lost for

francisca? That she could no longer claim

the right to the property as to be her own--

there is a possibility that she may acquire

the property solely and exclusively--- how?

Remember the sinumpaang salaysay? S.C

only rejected it as a deed of assignment but

it does not rule upon the validity as a last

will and testament.--- bahala n yung

probate court dian kung yan ay valid as a

last will and testament. If that sinumpaang

salaysay is obtained as a last will and

testament, then it would be possible for

francisca that she would be declare as the

sole owner or sole holder of the interest in

the contract to sell by virtue of the

sinumpaang salaysay, that is if it would be

validated as a last will and testament.

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

5

Article 777. The rights to the succession are transmitted from the moment of

the death of the decedent.

Article 777the right of succession are transmitted from the

moment of death of the testator--- what does that mean?

Illustration:

Decedent: Pedro ; died at 4pm

Heirs: Mark, Lucas and Juan

Supposing that the filiation of lucas, mark and Juan are not

that are not establish at the time that Pedro died that the

court litigation lasted for around 15yrs to establish their

filiation. So 15 years after the death of pedro a lot of things

had happened, his business has grown and his estate has

doubled in value, so how much mark, Lukas and juan are

entitled to get? So what value do we use? The value at the

time when pedro died or the value 15yrs after?

15yrs after, because they become the owners at the

time of Pedros death. Even if the filiation was

proved after 15 years, it will retroact at the time

when the decedent died. They are owners as of 4pm,

at the precise moment when the decedent died

With regard to the fruits, what will be the basis of their right?

To the fruits, to the increase of the property by the estate of

pedro--- is it also by virtue of their right to succeed which was

deemed vested at the time of pedros death?

So as of 4pm at the day of Pedros death any

acquisition that they made in the form of fruit or an

income of the property would vest in them by virtue

of Ownership no longer as the right of succession.

When we speak of decedent we refer to whom? Who is the

decedent?

The person who has died.

Is it different from the testator?

So the testator is also the decedent only he left

better prepared because he left a last will and

testament.

And what do you call the people who stands to inherit from

the decedent?

The heirs,

And the heirs, the basis of their right to inherit would be? Is it

enough the heirs have right?

Either provided by the will or provided by the

provisions of the law. And in the absence of the will

they have to rely on what is provided by the law.

Is it possible that they rely both on the provisions of the will

and the provisions of the law?

Its possible.

How is it possible?

Mixed succession.

What is mixed succession? How does the law define mixed

succession?

Mixed succession is that effected partly by will and

partly by operation of law.

article 777it implies that death is the only requisite for

succession to happen, that is not correct, death is not

sufficient, because aside from the death of the decedent it

further requires that there should be a basis for succession,

either by the compliance of the last will and testament or

provisions in the law, but remember class in our jurisdiction

testamentary succession is given preference over the

intestate succession, that is why you only refer to the

provision in the law in the absence of or in the sufficiency of

the last will and testament that left behind by the testator.

But even if you have death, if you have a last will and

testament or even in the provision of the law would be

applicable, this would not be enough for succession to take

place. What else must happen?

There should be an acceptance.

Why should there be an acceptance? What is the rationale of

the law for requiring an acceptance?

Because no one can be forced to accept the liberality

of another.. in an abstract level it would seems to be

unthinkable that anyone would not want to be left

with something gratuitously. But if you would

consider certain facts or certain circumstances there

maybe more than ankle justification for the purpose

of refuse.

Example: if the X boyfriend of your wife would leave a last

will and testament giving her momento of their relationship

before would you be happy if your wife accept the

inheritanceyour wife would be hesitant to accept the

inheritance. The law recognizes her right to refuse. If you

dont want to accept the liberality you can actually decline,

there would be no succession taking place. So tatlo yun there

should be death, basis of succession and acceptance.

When we speak of death, what kind of death that the law

contemplates?

Either actual or presumptive death.

Actual death- failure to inhale oxygen, physical death, actual

death, clinical death.

Presumptive death- when the person is missing for the

period of 7 yrs he is presumed to be death, but for the

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

6

purposes of succession 10 years from disappearance but if he

disappears in the age of 75- absence of 5yrs will be sufficient.

So what is the basis for declaration of presumptive death?

His disappearance but not just ordinary

disappearance it should be continuous

disappearance that is the basis of the law.

Disappearance must be continuous and unbroken.

10 yrs as a general rule but by way of exception if

the person disappeared after the age of 75, 5 yrs.

Why do we have that exception?

Because the law makes a presumption that the

person is weak before he disappears.

When do we consider or deemed that death has taken place

in case of presumptive death?

It is at the end of 10 yrs or five year period.

Now this period set forth, would there be any further

qualification to the rule relating to them? Do we always

observe to the 10yr or 5 yr period?

No.

Why?

There are circumstances that the 10yr and 5yr

period are not observed when the person who

disappear is in danger of death.

In that case what period do we follow?

4 yrs.

So what are these circumstances that would justify shortening

the period?

Vessel or aircraft lost during its voyage;

during war when the person missing is a member of

the armed forces and he actually participated in the

war; and

in other cases when there is a danger of death

Disappearance under the danger of deaththere is

uncertainty whether the person survive, this is the essence of

the provision, that is why you are to presume that he died.

Example:

the 9/11 incident if the person was inside the twin

tower before the incident happen and after that he

could no longer be located, then he is presumably

disappear under the circumstances grave danger to

his life, and if he could no longer be located, his body

could no longer be located then we are justified to

presume that he died in the attack.

Now suppose that we have these circumstances, there is a

disappearance for 10 or 5 yrs or a special disappearance for

4yrs, what are you suppose to do to be able to invoke

presumptive death? Are you suppose to go to court and ask it

to declare that the person disappearing, as presumptive

death?

No need to go to court, the court will not entertain

such claim, for the reason that any declaration of

presumptive death never attain finality, it can always

over turn or negated by the suddenly appearance of

the person who has been declared dead. so what do

you do? You just simply file an action for the

settlement of his estate and invoke in that

proceeding that he has been absent for this long

justifying the opening of his succession, but to bring

a separate or independent action for that purpose

alone, youll not be entertain by the court.

Can the disappearance occasioned by special circumstances

under art. 391, when is a person deemed to have died?

at the time of the disappearance.

USON VS DEL ROSARIO

Facts:

Faustino is married to maria uson but he

also have a sideline he had an affair to

maria del rosario in whom he had 4

childrenthis shows how aggressive a

mistress can bewe have the legal wife on

the other and a mistress on the other hand,

and yet after the death of the husband,

what did the mistress do? She was the one

who aggressively took over the land left by

the husband although she is a mistress,

although matalino din si Faustino kasi

pareho ng pangalan ang kinuha niang asawa

at kabit, db? Kaya siguro ngkaroon sila ng

anak ni maria del rosario dahil he took a

wife before it was discovered by maria

uson. Faustino died before the effectivity of

the civil code. Under the old civil code

illegitimate children dont have a

successional right what was the basis of

maria del rosario in claiming the land? Her

basis was the provision of the new civil code

giving right to succession to illegitimate

children , the civil code took effect 1950,

Faustino died in 1946. What was in the new

civil code for it to apply retroactively?

Vested right, this is the goal of her

contention lies, there was a provision an

ante___ provisions in the new civil code

which says that all new rights created

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

7

thereunder will be given a retro active

effect even to those situation which arose

under the old civil code, but subject to one

very important condition that no vested

right are impaired. Were there already

vested rights if the successional rights were

transferred to the illegitimate children of

Faustino. And what did the court say? The

right of the wife would be impaired to

succeed to the estate of the husband was

already vested, when? At the moment of his

death, because his death precisely open

succession. So when he died rights are

already transferred to maria uson, they

were vested in her, that is why the right

given to the legitimate children could not

be given retro active effect because to do

so would mean a reduction of the right of

maria uson which was already vested.

It is provided in Art. 2253 that the new

rights recognized by the New Civil Code in

favor of illegitimate children have

retroactive effect only when they dont

prejudice any vested right of the same

origin. From the moment of decedents

death, the rights of inheritance of his wife

over the parcels of land became vested.

Hence, the new rights recognized by NCC in

favor on the illegitimate children of

decedent cant be asserted to the

impairment of the vested right of a person.

DE BORJA VS VDA. DE BORJA

Facts:

There are two proceedings, one in rizal and

one in nueva ecija. The one in rizal was the

settlement of the estate of Francisco, the

one in nueva ecija was the probate of the

will of josefa, the relationship of the step-

son and step-mom was getting tumultuous

by the moment. so they entered into a

compromise agreement, in that agreement,

tasiana was waiving all her rights that she

has to the estate of both josefa and

Francisco for the sum of 800,000. Jose, the

step son submitted the compromise

agreement both the cfi of rizal and the cfi of

nueva ecija. The cfi of rizal approved the

compromise agreement, the cfi of nueva

ecija denied. So appeal was taken by both

tasiana and jose from the rulings of the

lower court. But tasiana technically had a

change of heart, she no longer wanted to

continue the compromise agreement

perhaps she was thinking that she was

getting the mortem of the deed. Siguro

naisip nia masmarami p xiang makukuha

kung itutuloy na lang nia yung laban instead

of compromising but there was a

compromise agreement so it was a valid

agreement. So what does she do? She

invoke the case of guevarra vs. guevarra,

she was assailing the validity of the

compromise agreement on the ground that

it was according to her invalid because it

amounted to the partition of the decedent

prior to the probate of the will. Sabi ni

taciana hindi yan pepwede

Ruling:

but the court said no the ruling in guevarra

is not even applicable because this is not a

partition of the estate, what you simply did

was to sell your inchoate right it was a

waiver of whatever inheritance you are

entitled to both estate, but was that valid?

Can she do that? Yes, because at the time of

death of the decedents both josefa and

Francisco she was already entitled to the

inheritance. But there is a difference

between being entitled and being in actual

possession of the inheritance. Actual

possession can take place after the passage

considerable time, but after the moment of

death you are already an heir you are

already entitled to the inheritance

regardless of when you will going to be in

actual possession of the inheritance. It

maybe 1yr after, it maybe 10yrs after it

doesnt matter. the law recognizes your

right at the moment of death. Now what

can you do at that time when you only have

this right in the out-clock, kasi nga wala p

sayo yung inheritance ano naman ang silbi

non, may mana nga ako wala naman sakin

ang mana ko, You can actually exercise right

of ownership to your right and one act of

ownership will be what? The right to

dispose and this is what exactly what

tasiana did, she disposes her right to the

inheritance, can she do that? Absolutely,

because she is the owner of that right and

does she do it? Yes she did through the

compromise agreement. The compromise

agreement is valid and binding upon

tasiana. What actually can comprise your

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

8

inheritance at the end? After the settlement

proceedings are completed might may not

be the same as what she thought her value

of her inheritance at the time of the

testators death. Kunyare at the time of

death the value is 500,000, pero you must

know during the settlement proceeding,

there will be inventory and satisfaction of

the obligation of the decedent. mas

madaming obligasyon mas maliit ang

matitirang net estate. mas maliit ang net

estate mas maliit ang paghahatihatian. So it

is possible that the value of the inheritance

given at the time of death, may actually be

reduce after the obligation of the estate

has been satisfied. What is the significance

of that possibility? It simply means that the

transferee, the one who creates the

transferor in this case tasiana, the money

for the waiver, the money for the right,

actually stance at risk, he may receive less

than what he paid for kasi nga pwedeng

magbago yung value after the settlement of

the estate.

To summarize Whatever transmissible

rights sold or acquired by a person will be

subject of the outcome of the settlement

proceeding. Possible b n matapus kuing

bilhin yung part ni taciana e wala pa akong

makuha sa huli? Yes, that possible, if the

obligation of the estate are far more than

the property, so ano mangyayari sa

binayaran q kay tasiana? Deemed lost, I

cannot recover

The compromise agreement is valid, since a

hereditary share in a decedent estate is

vested immediately from the moment of

the death of the decedent, although the

Compromise Agreement has been entered

into pending probate of the husbands will.

The 2

nd

wife already had an interest in the

hereditary estate, though not yet

determined. The effect of such alienation,

though, is to be deemed limited to what is

ultimately adjudicated to the vendor heir.

BONILLA VS BARCENA

Since the decedent was still alive when the case to

quiet a title was filed, the court should therefore,

had acquired jurisdiction over the person. Upon such

death, her heirs had become the absolute owners of

her property, subject to the rights and obligations of

the decedent. Hence, her heirs should be allowed to

be substituted as parties in interest for the

decedent.

WILLS4

Article 782. An heir is a person called to the succession either by the

provision of a will or by operation of law. Devisees and legatees are persons

to whom gifts of real or personal property are respectively given by virtue of

will.

Is their a distinction between an heir and legatee/devisee?

Yes

Distinguished

heir is a person called to the succession either by the

provision of a will or by operation of law

Devisees and legatees are persons to whom gifts of

real or personal property are respectively given by

virtue of will

Does the law make a distinction?

no

Why is it necessary to make a distinction, when the law itself

does not?

The distinction between an heir and devisees and

legatees would appear to be significant with regard

to one specific instance which is Preterition.

The preterition or omission of one, some, or all of the

compulsory heirs in the direct line, whether living at the time

of the execution of the will or born after the death of the

testator, shall annul the institution of an heir; but the devises

and legacies shall be valid insofar as they are not inofficious.

If the omitted compulsory heir should die before the testator,

the institution shall be effectual, without prejudice to the

right of representation (art.854)

What is effect of preterition?

annulling the institution of an heir

How is preterition be relevant?

If you are an heir and if there is Preterition your

institution as an heir will be annulled, which means

that you will not receive under the will. Example: It

was stated in the will that the sole heir will be Mr. A

but he is not related to the testator and it is proven

that there is Preterition, so instead of being the sole

heir and receiving the testators entire estate, he will

end up receiving nothing. Ganun katindi and effect

the Preterition. But if the testator instituted Mr. A

not as an heir but a devisee or legatee, even there is

Preterition and the institution of an heir is annulled,

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

9

the devise or legacy in Mr. As favor will still be

respected. Thats why it is important to determine in

what capacity the person is receiving.

The law does not help us in relation to that one because

there is an overlapping distinction between an heir and

devisees and legatees. The definition of heir is broad enough

to include the definition of devisees and legatees as defined

in Art. 782.

So the conclusion is a devisee or legatee is also an heir, so

where do you draw the line?

The authorities are one in saying that the better

definition would be an HEIR is a person given the

entire estate or a portion of estate, on the other

hand a devisees and legatees would succeed to the

testators personal or real property.

The problem is if the estate is comprised of one single

property. How would you treat the person who will receive

the entire estate and there is Preterition?

Example: I institute Ms. Cruz as my heir, then

malalaman ninyo that my only property is house and

lot. The testator omitted his children in the will. So

what happens now?

If you treat her as an heir, she will not

receive anything because her institution as

such will be completely annulled, but if you

treat as devisee she will still receive at least

of the property because, the legitime of

the children comprises half of the estate.

Because of the device and legacy, you only

have to reduce insofar as it does not impair

the legitime. Hence, even there is

Preterition and the institution of the heir is

annulled, the devise and legacy will be

respected provided that the legitimes are

not impaired.

So how will we treat her?

Go by the tenor of the institution. If her

institution is to receive the entire estate

and not to a specific property, we will treat

her as heir, dahil isa lang yung property sa

estate. It was the intention of the testator

and because of Preteretion, she will not

receive anything. But if the disposition

pertains to the testators house and lot, she

will be treated as a devisee. In this case

there will be impairment of the devise to

the extent of in order not to impair the

legitime of the children but the devise will

be respected.

Different kind of succession:

Testamentary based on last will and testament

Intestate by operation of law; in the absence of

last will and testament, and when there no valid last

will and testament as when he does not dispose of

all his properties

Mixed Art. 780. It is effected partly by will or

operation of law.

Contractual - donations propter nuptias of future

property, made by one of the future spouses to the

other to take effect after death and to be done in

the marriage settlement which is governed by

Statute of Frauds.

Compulsory

Testamentary Succession

Article 779. Testamentary succession is that which results from

the designation of an heir, made in a will executed in the form

prescribed by law.

Intestate Succession

Article 960. Legal or intestate succession takes place:

(1) If a person dies without a will, or with a void will, or

one which has subsequently lost its validity;

(2) When the will does not institute an heir to, or dispose

of all the property belonging to the testator. In such

case, legal succession shall take place only with respect

to the property of which the testator has not disposed;

(3) If the suspensive condition attached to the institution

of heir does not happen or is not fulfilled, or if the heir

dies before the testator, or repudiates the inheritance,

there being no substitution, and no right of accretion

takes place;

(4) When the heir instituted is incapable of succeeding,

except in cases provided in this Code.

Mixed Succession

Article 780. Mixed succession is that effected partly by will and

partly by operation of law.

Compulsory Succession

Compulsory - also by operation of law; succession to

the legitime, takes place DESPITE the presence of a

valid will and applies both in testate and intestate

succession; it is compulsory succession because the

compulsion lies upon the decedent who has no

choice but to leave a certain portion of his property

to certain heirs who are specified in the law. The

compulsory heirs will also make up the intestate

heirs because the compulsory heir is necessarily the

testators nearest relatives. Kaya may confusion

between intestate heirs and compulsory heirs.

NOTE: The right of intestate heir to succeed may be

defeated by simply executing the last will and

testament but the right of compulsory heir cannot

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

10

be defeated even upon the execution of a last will

and testament.

Who are to be considered as compulsory heirs under the law?

The following are compulsory heirs:

(1) Legitimate children and descendants, with

respect to their legitimate parents and

ascendants;

(2) In default of the foregoing, legitimate

parents and ascendants with respect to

their legitimate parents and descendants;

(3) The widow or widower;

(4) Acknowledged natural children, and natural

children by legal fiction;

(5) Other legitimate children referred to in

article 287.

(Art.887)

Legitime is that part of the testators property which he

cannot dispose of because the law has reserved it for certain

heirs who are, therefore, called compulsory heirs. (Art.886)

In case of illegitimate children, apply first the Iron Curtain

Rule then qualify

Compulsory Succession (illustration)

Mr. Francisco instituted Mr. X as his sole heir. When he died

he was survived by his wife, one legitimate child and four

illegitimate children. Mr. X argues that he is the sole heir.

How much will he receive?

The surviving spouse will get 1/4, the legitimate child

will get his legitime and the illegitimate children

will receive of the share of legitimate child which

is 1/4 hence Mr. X will not receive anything because

of compulsory succession.

Compulsory Succession takes precedence over testate and

intestate succession. If you have Compulsory Heir you can

only control the decedent ___ portion of the estate which is

known as the free portion it depends on the number and

type of Compulsory Heir.

Testate succession takes precedence over intestate, why?

because it is expresses the desires and wishes of the

testator while the latter contains only the presumed

will of the testator.

Contractual Succession

That which takes place when the future spouses

donate each other in their marriage settlement

future property in the event of death

Why is it contractual?

Because such disposition is made in a marriage

settlement

Why is it succession?

Effective upon death

What is the form of marriage settlement? What is it about the

marriage settlement which makes us say that the disposition

made therein which takes effect upon death would be a form

of contractual succession?

A contract

In the former Civil Code, oral marriage settlement is allowed

which is valid but unenforceable, but in the Family Code it is

required to be in writing to be valid and enforceable, hence

we have no more Contractual Succession because the Family

Code explicitly requires that donation of future spouses to

take effect upon death must now comply with the formalities

of wills and succession Article. 728. Donations which are to

take effect upon. the death of the donor partake of the

nature of testamentary provisions, and shall be governed in

the Title on Succession.

Article 783. A will is an act whereby a person is permitted with the

formalities prescribed by law, to control to a certain degree the disposition of

his estate, to take effect after his death.

In the definition provided by law, what is the indispensable

requirement to make the will a valid last will and testament?

There must be a disposition to take effect after

death. If this element is lacking we can conclude that

it is only an ordinary instrument that need not

comply with the formalities prescribed by law for the

last will and testament.

Example:

Mr. Flojo has illegitimate child but never recognized that the

child was his, but he drew an instrument where he

acknowledged the fact that he is the father of the child but

the recognition must take effect only upon his death. That

instrument was signed by Mr. flojo but does not comply with

the requirements provided by law for a valid last will and

testament. Would it still be a valid instrument? Will it be

given weight by the Court?

YES, because the instrument is NOT a last will and

testament and therefore to be valid the same need

not comply with the formalities required by law for a

last will and testament.

Why do you say that it is not a last will and testament?

Because it does not contain any disposition to take

effect upon death.

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

11

What if the only provision in the will is disinheritance and

nothing else?

It would amount to indirect disposition in favor of

intestate heirs who would receive in lieu of

disinherited heir.

VITUG VERSUS CA

Facts:

What does the husband want from the

estate?

Reimbursement for his advances

he made for the estate.

Where did the money in the bank account

come from?

From their conjugal property.

How did Rowena Corona the executrix,

attacked the Survivorship Agreement?

That it is not valid because the

contents of the same provide that

either one of the spouses will get

the fund upon the death of either

one of them, hence she contends

that it was a disposition mortis

causa, meant to take effect upon

the death and therefore the

Survivorship Agreement should

have complied with the formalities

of a valid will.

Did it complied with the formalities of a

valid will?

NO! It was just an ordinary

contract, it was hardly a will.

How did the Supreme Court resolved the

issue?

The Survivorship Agreement is

valid and need not comply with the

formalities required for a valid last

will and testament because it is not

a donation mortis causa because

the property are conjugal.

In a future marriage you have the husband,

wife and conjugal partnership of future

properties. Inside that marriage there are

three patrimonies: the husband, wife and

the conjugal partnership or community

property.

Even if you are married you can have your

separate property, now if what was

deposited is the separate property of the

wife, then the contention of Rowena the

executrix is valid. Because it will be a

donation of the wife of HER property to the

husband to take effect upon death, hence a

donation mortis casua which must be

contained in a last will and testament

complying with the formalities required by

law for a valid will. But if the fund is NOT a

separate property of the wife and NOT of

the husband, the fund is considered as

CONJUGAL PROPERTY. Under the law if they

both agree, they can actually dispose of it in

any way they want. In this case, they

invested the conjugal funds in the bank

account in a form of Survivorship

Agreement.

ALUAD VERSUS ALUAD

Discussion:

If the instrument is to be treated as a last

will and testament it would be NOT be

valid, but if the same is treated a donation

inter vivos it would be valid because there

was a conveyance of property. In this case

the same is notarized, there were 2

witnesses and there is conveyance of

property which are sufficient to make the

donation inter vivos valid.

Supreme Court held that it was a donation

mortis causa because it will take effect

upon the death of Matilde but it did not

follow the requirements provided by law for

the validity of a last will and testament.

Why was there even a conclusion as to the

true nature of the donation?

Because of the provision in the

instrument saying anytime during

the lifetime of the donor or anyone

of them should survive, they could

use, encumber or even dispose of

any or all of the parcels of land

herein donated.

Implied and even possible that Maria can

enjoy the property already even though

Matilde has not died yet and this would

support the contention that it was actually

a donation intervivos because it took effect

during the lifetime of the donor but the

Supreme Court said NO, there was only a

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

12

miswording because the donation really

would took effect upon the death of

Matilde. In the end, it held that the same

did not comply with the formalities

prescribed by law for a valid will hence it

did not convey the property to Maria or to

put it more accurately it never at all

conveyed the property to Maria during the

lifetime of Matilde thats why Matilde was

never precluded or prevented from selling

her property even after the instrument was

executed by her.

Article 784. The making of a will is a strictly personal act; it cannot be left in

whole or in part to the discretion of a third person, or accomplished through

the instrumentality of an agent or attorney.

Can the making of a will be delegated? Where do you draw

the line, of what may be delegated and not?

The mechanical act (typing) of drafting the will may

be delegated, or writing the will, unless it is

holographic will.

Potential testator hired Atty. De Chavez in relation to his will.

The testator must specify his heirs first, in what capacity they

are succeeding whether as heirs or legatees or devisees,

specify how much and what property they will receive, the

institutions or establishments and the specific amount or

property they are getting. Atty. De Chavez can fill in the

details which amount of making the will for the testator but

even the bulk of the work was done by the lawyer, the fact

remains that all of the dispositions were done by the testator.

Article 785. The duration or efficacy of the designation of heirs, devisees or

legatees, or the determination of the portions which they are to take, when

referred to by name, cannot be left to the discretion of a third person.

Article 786. The testator may entrust to a third person the distribution of

specific property or sums of money that he may leave in general to specified

classes or causes, and also the designation of the persons, institutions or

establishments to which such property or sums are to be given or applied.

Would there be an instance when a certain degree of

delegation is nonetheless allowed by law?

There can be delegation provided that the amount

and property are specified, and the class of persons

or organizations, the person who was given the

power to make the determination is limited to

naming of persons or organizations belonging to

those specified and determination of the amount to

be given to them.

WILLS5

Article 783. A will is an act whereby a person is permitted, with the

formalities prescribed by law, to control to a certain degree the disposition of

this estate, to take effect after his death

What are the characteristics of a valid will?

Individual

Unilateral

Freely and voluntary

Solemn

Dispositive of property

Mortis Causa

Purely personal

ambulatory

Article 784. The making of a will is a strictly personal act; it cannot be left in

whole or in part to the discretion of a third person, or accomplished through

the instrumentality of an agent or attorney.

Purely Personal means the disposition in the will should also

be made by the testator himself but nonetheless it does not

preclude of the delegation of the mechanical aspect of

preparing the will. For example, typing or encoding the will

maybe delegated to the lawyer or the technical or agent of

the lawyer.

Article 785. The duration or efficacy of the designation of

heirs, devisees or legatees, or the determination of the

portions which they are to take, when referred to by name,

cannot be left to the discretion of a third person.

What comprises testamentary disposition which cannot be

delegated?

Designation/appointment of heirs, legatees or

devisees

Duration and efficacy of their (heirs, legatees and

devisees) designation

Determination of the portion they are to take when

referred to by name (when referred to by name-

an important qualification because of Art. 786,

wherein the testator is allowed to make a delegation

of authority to designate not just the identity of the

recipient but also the portion to be received by the

person. And this will happen if the testator will leave

a specific amount or property to specified classes or

causes.)

Article 786. The testator may entrust to a third person the distribution of

specific property or sums of money that he may leave in general to specified

classes or causes, and also the designation of the persons, institutions or

establishments to which such property or sums are to be given or applied.

Article 787. The testator may not make a testamentary disposition in such

manner that another person has to determine whether or not it is to be

operative.

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

13

The person who was given an authority has actually have a

power not just to name the individual or entity or specified

classes or cause specified by the testator but he also have the

power to determine how much each of this people will be

getting. In reality, that pertains to a greater delegated

authority given to the third person because when the

recipient is named automatically the third person can no

longer venture into designating the portion they are to take.

(When there is a name) E.g I leave my estate to Peter, Juan

and David and I give the authority to Ms. Aguirre to

determine how much each of one will be receiving that is

not allowed (the exercise of the third persons power) why?

Because they are named individually and yet if the testator

will say Im leaving Php100,000.00 to womens causes and

the third person authorize to carry out the disposition is Ms.

Aguirre, we know what powers are given to her by virtue of

that disposition, she (the testator) actually name the causes,

the women causes, even the organization to the definite of

that disposition.

Article 788. If a testamentary disposition admits of different interpretations,

in case of doubt, that interpretation by which the disposition is to be

operative shall be preferred.

Article 790. The words of a will are to be taken in their ordinary and

grammatical sense, unless a clear intention to use them in another sense can

be gathered, and that other can be ascertained.

Technical words in a will are to be taken in their technical sense, unless the

context clearly indicates a contrary intention, or unless it satisfactorily

appears that the will was drawn solely by the testator, and that he was

unacquainted with such technical sense.

The very purpose of statutory construction is always to

determine the intention of the legislature, to determine and

to give effect the legislative intent.

In Succession, what will be determined is testamentary intent

or the intention of the testator. What is the testators intent,

thats why we have a law allowing the person to make a last

will and testament is to allow that person with unique

privilege to control the disposition of his property after his

death. So, because of that purpose we should determine

what the testamentary intent is.

First among the rules is when the testator make use of

ordinary words, what should we give in ordinary words?

Also ordinary meaning

Would there be any exceptions?

Whenever we have such fact that there is a

determination that there was an intention to use

such words in another sense

It is equally important to find out what does other sense

means, if there is no such determination of what does that

other sense means we cannot give effect to the testamentary

intent.

Example:

Mr. Mateo, a single man, not married, without

children but he is known to have a long term

relationship with Ms. Montesa, and it is publicly

known that he calls Ms. Montesa as baby. So he

made a will saying that his leaving his properties to

his only one Baby. Who is this baby in the ordinary

sense? It can only refer to a child which in fact he

does not have. Under the circumstances we would

know that he intended to use the word baby in

another sense.

What about technical words?

Technical words in a will are to be taken in their

technical sense, unless the context clearly indicates a

contrary intention, or unless it satisfactorily appears

that the will was drawn solely by the testator, and

that he was unacquainted with such technical sense.

Example:

Mr. Mateo, a fish vendor, he made a will on his own,

by simply writing it on a piece of paper, knowingly

that he has an adopted child but such child was not

judicially adopted. He made a will and gave

everything that he had to his adopted child Ms.

Aguirre. After his death somebody contested the will

saying that such deposition cannot be given an effect

because it say adopted child- someone who has

been legally adopted. Does it mean that the

disposition cannot be effected and the properties

should go to the legal heirs? In this case, we can

actually argued that notwithstanding that the

testator uses a technical term we cannot give its

interpretation as judicially adopted child because it

is established that it is an ordinary layman and he is

not familiar with legal terms and being a holographic

will so therefore we can relax the rule and make use

of an interpretation that adopted child in an

ordinary layman understanding.

Article 791. The words of a will are to receive an interpretation which will

give to every expression some effect, rather than one which will render any

of the expressions inoperative; and of two modes of interpreting a will, that

is to be preferred which will prevent intestacy.

Article 792. The invalidity of one of several dispositions contained in a will

does not result in the invalidity of the other dispositions, unless it is to be

presumed that the testator would not have made such other dispositions if

the first invalid disposition had not been made.

WILLS AND SUCCESSION REVIEWER BY

MARX, MON, SOC, APRIL and RUTH

14

Consistent with our purpose that we should always

determine the testamentary intent, the law acknowledges

that we always find a vast interpretation that will give effect

to all the provision of the will or at least every provision will

have come effect. The law also tells us that if it is impossible

to give effect to all of the provisions meaning to say that we

have to nullify some of the provision, then we preferred the

validity of other provisions unless it is shown that the testator

would not have made such other dispositions if the first

invalid disposition had not been made.

Example:

1st situation:

First Provision: Testator is giving a parcel of land to

his concubine

Second Provision: the testator made another

disposition giving 1M to the same person but he did

not make an express reference to that woman as a

Mistress.

The first provision is not valid but the second provision is

valid because there is no palpable recognition of their illicit

relationship which makes the first provision null and void.

2

nd

situation:

First Provision: Testator is giving a parcel of land to

his concubine

Second provision: the testator made another

disposition giving 1M for construct a house on the

parcel of land given to the same person in relation

to the first disposition

There is a dependency, so the first disposition being invalid

because of the illicit relationship such invalidity is carried to

the 2

nd

disposition.

As we said before, it is always possible that there is an

ambiguity or inaccuracy to appear in the disposition in a will.

But what kind of ambiguity can a will suffer?

2 kinds of ambiguity

Latent ambiguity

Patent ambiguity

There is ambiguity when there is an:

Imperfect description

When no person or property exactly answers the

description.

Example: Im giving my land to my co-employee Alcantara it

appears that there are 2 persons both of them surnamed

Alcantara working in the same company where the testator is

employed. It creates an ambiguity which of the two

Alcantaras is the one that the testator is referring. In reading

the will such ambiguity is not apparent, we will only find out

the ambiguity outside the will or circumstances outside the

will which makes the ambiguity Latent.

How should we solve such latent ambiguity?

Consult the will first, if there is no such answer,

consult extrinsic evidence

In kinds of ambiguity our first resort will always be the will

because it is the repository of testamentary intent. Always

consult the will. If we cant find the answers in the will then

we will be allowed to go outside of the will and consider

extrinsic evidence.

What kind of extrinsic evidence?

All kinds of extrinsic evidence except oral

declarations or testimonies of the testator

Why are we excluding those?

Because a dead person can no longer refute what is

being attributed to him.

Supposing that one of the Alcantaras basis was not an oral

testimony but it was an email message, would that constitute

a valid extrinsic evidence?

It can be accepted because it is not an oral

declaration.

Patent ambiguity- such ambiguity that is palpably apparent

on the face of the will, meaning by reading the will itself and

under the provision where the ambiguity lies, we can see that

there is something wrong with the disposition.

Example: I bequeath all of my houses to my friend to some of

my cousins

How do we solve patent ambiguity?

After we go by the provision of the will, then we can

consider extrinsic evidence but with certain

limitation because the law provides that we have to

consider the circumstances under which the will was

made, all other considerations will be excluded.

Example: in the preceding example, if it can be shown that at

the time of making his will 10 of his cousins attempted to kill

him, if the testator is estranged with his cousins he will not

leave them something to his cousins who made the attempt.

Article 781. The inheritance of a person includes not only the

property and the transmissible rights and obligations existing

at the time of his death, but also those which have accrued