Professional Documents

Culture Documents

Members:: - Alfaro Anaya Paola - Ávalos Murillo Alejandra - Barrera Hernández Leticia - Sánchez Ríos Cinthya Zuleyma

Members:: - Alfaro Anaya Paola - Ávalos Murillo Alejandra - Barrera Hernández Leticia - Sánchez Ríos Cinthya Zuleyma

Uploaded by

letiluck30 ratings0% found this document useful (0 votes)

6 views5 pagesThis document summarizes Pepsico Inc.'s statement of earnings for 2011 and 2012. It notes that net revenues increased during this period as the company expanded its market, sold new products with increased advertising, and launched new sales promotions that attracted consumers. Operating expenses also increased in 2012 compared to 2011 due to higher selling and administrative expenses to support increased production and sales. The integral result of financing showed that financial costs exceeded financial products since the company was paying significant interest after taking on bank funding. Taxes paid, including income tax and employee profit sharing, reduced the overall taxable profit for each year.

Original Description:

Original Title

Pepsi

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes Pepsico Inc.'s statement of earnings for 2011 and 2012. It notes that net revenues increased during this period as the company expanded its market, sold new products with increased advertising, and launched new sales promotions that attracted consumers. Operating expenses also increased in 2012 compared to 2011 due to higher selling and administrative expenses to support increased production and sales. The integral result of financing showed that financial costs exceeded financial products since the company was paying significant interest after taking on bank funding. Taxes paid, including income tax and employee profit sharing, reduced the overall taxable profit for each year.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views5 pagesMembers:: - Alfaro Anaya Paola - Ávalos Murillo Alejandra - Barrera Hernández Leticia - Sánchez Ríos Cinthya Zuleyma

Members:: - Alfaro Anaya Paola - Ávalos Murillo Alejandra - Barrera Hernández Leticia - Sánchez Ríos Cinthya Zuleyma

Uploaded by

letiluck3This document summarizes Pepsico Inc.'s statement of earnings for 2011 and 2012. It notes that net revenues increased during this period as the company expanded its market, sold new products with increased advertising, and launched new sales promotions that attracted consumers. Operating expenses also increased in 2012 compared to 2011 due to higher selling and administrative expenses to support increased production and sales. The integral result of financing showed that financial costs exceeded financial products since the company was paying significant interest after taking on bank funding. Taxes paid, including income tax and employee profit sharing, reduced the overall taxable profit for each year.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 5

Members:

Alfaro Anaya Paola

valos Murillo Alejandra

Barrera Hernndez Leticia

Snchez Ros Cinthya Zuleyma

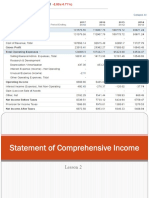

Statement of Earnings

Pepsico Inc.

Statement of Earnings at December 31, 2011 and 2012.

Analysis to the Income Statement

Net Revenues

During the period covering the years 2011 and 2012 a significant increase in

company sales increase was observed, because it expanded their market began to

sell new products, increased advertising due to new products, besides that sales

promotions that caught the attention of consumers were launched, and it was

through this that sales increased.

Operating Expenses

In 2012 increased compared to 2011 this is because the company had more selling

expenses and administrative expenses and increased sales because there was no

retrenchment unlike more money is invested to produce products so that total

operating expenses are high but in this case the selling outweigh the

administrative, as they target more money to manufacture the product.

Analysis to the Income Statement

Integral Result of Financing

The integral result of financing is comprised of financial products and financial

expenses, where those products are all sums earned by banking and expenses are

those expenses derived financed with borrowed funds. This state tell us that the

costs outweigh the products and therefore are paying much interest to glad we

funded with a bank.

Taxes ISR and PTU

When calculating income tax for the year is integrated income minus deductions

and employee profit sharing paid for the year. Likewise controlled to mantain

profits as income tax has been paid, hence the tax profit for the year would

decrease the income tax paid in the end to have free net profit or net income after

taxes paid.

You might also like

- FIN621 Solved MCQs Finalterm Mega FileDocument23 pagesFIN621 Solved MCQs Finalterm Mega FileKashif Rana50% (4)

- EF Chapter 2 - The Income StatementDocument19 pagesEF Chapter 2 - The Income StatementPandi IndraNo ratings yet

- Inc StatDocument9 pagesInc StatAleem JafferyNo ratings yet

- Name: Matriculation No: Identity Card No.: Telephone No.: E Mail: Learning CentreDocument10 pagesName: Matriculation No: Identity Card No.: Telephone No.: E Mail: Learning CentreEfan VeslerNo ratings yet

- Analysis of Food Sector in Pakistan: Mam Humaira ShahidDocument59 pagesAnalysis of Food Sector in Pakistan: Mam Humaira ShahidSameen HussainNo ratings yet

- Analysis of Food Sector in Pakistan: Mam Humaira ShahidDocument58 pagesAnalysis of Food Sector in Pakistan: Mam Humaira ShahidSameen HussainNo ratings yet

- Finman ScriptDocument3 pagesFinman ScriptREA ANGELINE BARDOSNo ratings yet

- Difference Between Financial & Managerial AccountingDocument3 pagesDifference Between Financial & Managerial AccountingAnisa LabibaNo ratings yet

- Statement of Comprehensive Income (SCI)Document35 pagesStatement of Comprehensive Income (SCI)Jung WonnieNo ratings yet

- Income StatementsDocument5 pagesIncome StatementsAdetunbi TolulopeNo ratings yet

- 5.01 Budget Planning ControlDocument28 pages5.01 Budget Planning ControlSoeripto TanjodjoNo ratings yet

- Finance Competition-2Document6 pagesFinance Competition-2api-535920590No ratings yet

- FinalAnnualReport O.brookerDocument29 pagesFinalAnnualReport O.brookerleenaa01No ratings yet

- Statement of Comprehensive IncomeDocument38 pagesStatement of Comprehensive IncomeDaphne Gesto SiaresNo ratings yet

- Income Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Document47 pagesIncome Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Jenkins Jose Shirley100% (1)

- Budget Planning & Control: Tirsolito C. SalvadorDocument28 pagesBudget Planning & Control: Tirsolito C. SalvadorTams AngelNo ratings yet

- Income StatementsDocument5 pagesIncome StatementsraelylachotaNo ratings yet

- The Impact of Finance On Financial StatementsDocument2 pagesThe Impact of Finance On Financial StatementsLiti Luke100% (4)

- FA Assign-2 Group-6 PDFDocument15 pagesFA Assign-2 Group-6 PDFSyed Ali Messam ShamsiNo ratings yet

- Lecture 3-Administering The BudgetDocument27 pagesLecture 3-Administering The BudgetFathurrahman AnwarNo ratings yet

- Revenue and Expense Recognition, Income Statement Preparation, Procedure and Presentation of Income StatementDocument11 pagesRevenue and Expense Recognition, Income Statement Preparation, Procedure and Presentation of Income StatementAbigail Elsa Samita Sitakar 1902113687No ratings yet

- Cat 1 Advanced Accounting 1 October 2021Document5 pagesCat 1 Advanced Accounting 1 October 2021ditai julius kayeregeNo ratings yet

- Explain The Difference Between Sales Revenue and Net Sales. Sales RevenueDocument3 pagesExplain The Difference Between Sales Revenue and Net Sales. Sales RevenueHuda waseemNo ratings yet

- Business Studies: 5.3 - Income StatementsDocument9 pagesBusiness Studies: 5.3 - Income StatementsUpasana ChaubeNo ratings yet

- Report - Basic Financial Statements-EriveDocument18 pagesReport - Basic Financial Statements-Eriveevita eriveNo ratings yet

- Income StatementDocument3 pagesIncome StatementMamta LallNo ratings yet

- Rohit Corporate AccountingDocument11 pagesRohit Corporate AccountingMah Noor FastNUNo ratings yet

- MBALN612 Assignment 1 Ahmed Omer Redha: Part - 1Document14 pagesMBALN612 Assignment 1 Ahmed Omer Redha: Part - 1ahmedomerredhaNo ratings yet

- Lecture 1 CHP 1 No SolutionsDocument20 pagesLecture 1 CHP 1 No SolutionsHarry2140No ratings yet

- Lesson 2 Statement of Comprehensive IncomeDocument23 pagesLesson 2 Statement of Comprehensive IncomePaulette Sarno80% (5)

- UEU Journal - Income Smoothing Anaysis in Snacks IndustryDocument14 pagesUEU Journal - Income Smoothing Anaysis in Snacks Industrykanina.putri4No ratings yet

- APLK - Earnings Quality - Arsyan AdimasDocument6 pagesAPLK - Earnings Quality - Arsyan AdimasAdimas Hanindika100% (1)

- Financial Statements of Sole ProprietorshipDocument39 pagesFinancial Statements of Sole ProprietorshipVishal Tanwar100% (1)

- Accounting! What's It All About?: THE Business CycleDocument10 pagesAccounting! What's It All About?: THE Business CycleMarcinNo ratings yet

- CH 4 - Financial AnalysisDocument13 pagesCH 4 - Financial AnalysisbavanthinilNo ratings yet

- Financial Statement PresentationDocument33 pagesFinancial Statement Presentationcyrene jamnagueNo ratings yet

- Terminalogies Used in Financial Statements and Insights From Annual ReportsDocument24 pagesTerminalogies Used in Financial Statements and Insights From Annual ReportsKaydawala Saifuddin 20100% (1)

- Lifestyle International (India) Financials 2011Document44 pagesLifestyle International (India) Financials 2011rohitram43No ratings yet

- BSBFIA402 Assessment 1 VF FinanzasDocument10 pagesBSBFIA402 Assessment 1 VF FinanzasLiliana Cañon GomezNo ratings yet

- 5.3 Income StatementDocument4 pages5.3 Income StatementHiNo ratings yet

- What Is The Statement of Comprehensive Income?: EquityDocument4 pagesWhat Is The Statement of Comprehensive Income?: EquityKatherine Canisguin AlvarecoNo ratings yet

- Income StatementDocument21 pagesIncome StatementKoo TaehyungNo ratings yet

- Lecture Three Chapter FiveDocument4 pagesLecture Three Chapter Fivebouchra bouchraNo ratings yet

- APPLEDocument12 pagesAPPLEenockNo ratings yet

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoDocument6 pagesLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithNo ratings yet

- FBMINT T1 EBITDA - EBIT - EBT - EAT EngDocument11 pagesFBMINT T1 EBITDA - EBIT - EBT - EAT EngTamer BAKICIOLNo ratings yet

- Fin621 Final Term Solved MCQS: JournalizingDocument23 pagesFin621 Final Term Solved MCQS: JournalizingIshtiaq JatoiNo ratings yet

- Fabm1 10Document14 pagesFabm1 10Francis Esperanza0% (1)

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryNo ratings yet

- Financial Analysis Ratio Analysis of The Shifa International HospitalDocument4 pagesFinancial Analysis Ratio Analysis of The Shifa International HospitalNaheed AdeelNo ratings yet

- Topic II - Statement of Comprehensive IncomeDocument8 pagesTopic II - Statement of Comprehensive IncomeJianne Ricci GalitNo ratings yet

- Analysis of Asian PaintsDocument3 pagesAnalysis of Asian PaintsCreativity life with SmritiNo ratings yet

- Fundamentals of PTNGN PDFDocument27 pagesFundamentals of PTNGN PDFEdfrance Delos Reyes0% (1)

- JFC ACCTG102-FSOverviewSW1Document6 pagesJFC ACCTG102-FSOverviewSW1JaneNo ratings yet

- Importance and Preparation of Income StatementDocument35 pagesImportance and Preparation of Income StatementChristina BinoboNo ratings yet

- ReclassificationDocument5 pagesReclassificationgiorgiandrettaNo ratings yet

- Home Depot Financial QuestionDocument3 pagesHome Depot Financial Questionmktg1990No ratings yet

- The Simple Side Of Financial Management: Simple Side Of Business Management, #2From EverandThe Simple Side Of Financial Management: Simple Side Of Business Management, #2Rating: 1 out of 5 stars1/5 (1)