Professional Documents

Culture Documents

Pita 2011

Pita 2011

Uploaded by

Zilmer1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pita 2011

Pita 2011

Uploaded by

Zilmer1Copyright:

Available Formats

(a) Non-Taxable Deductions

i NHF Contributions

ii NHIS Contributions

iii Life Assurance Premium

iv Pension Contribution

v Gratuities

vi Consolidated Relief of: 20%

the higher of 200,000 or 1% of Gross Earnings

b) Tax Table

First 300,000 @ 7%

Next 300,000 @ 11%

Next 500,000 @ 15%

Next 500,000 @ 19%

Next 1,600,000 @ 21%

Above 3,200,000 @ 24%

of Gross Earnings; plus

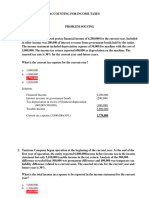

Name: Olaide Ibidunni

Grade Level:

Step

Item Annual Monthly

Basic Salary 3,000,000.00 250,000.00

Housing 1,200,000.00 100,000.00

Transport 600,000.00 50,000.00

other Allowances 250,000.00 20,833.33

-

-

-

Gross Earnings 5,050,000.00 420,833.33

Less: Deductions:

NHF Contributions 50,000.00 4,166.67

NHIS Contributions 25,000.00 2,083.33

Life Assurance Premium - -

Pension Contribution 360,000.00 30,000.00

Gratuities 150,000.00 12,500.00

Consolidated Relief 1,210,000.00 100,833.33

Total Tax Exempt 1,795,000.00 149,583.33

Taxable Income 3,255,000.00 271,250.00

Less: Taxes Payable 573,200.00 47,766.67

Net Pay 2,681,800.00 223,483.33

Schedule of Annual Earnings

You might also like

- TAX SolutionsDocument24 pagesTAX SolutionsJerome MadrigalNo ratings yet

- Partnership - OperationDocument11 pagesPartnership - OperationAiziel OrenseNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- A.2. Liabilities and Equity EssayDocument5 pagesA.2. Liabilities and Equity EssayKondreddi SakuNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- FS Group 2Document5 pagesFS Group 2Ge-Ann BonuanNo ratings yet

- Kertas Kerja (Yesaya Ab 92 Ol RS 2) - Susper A - PPH BadanDocument7 pagesKertas Kerja (Yesaya Ab 92 Ol RS 2) - Susper A - PPH BadanRayentNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Note On Tax Rebate On Takaful Contribution 2019 20 Other Than SalariedDocument1 pageNote On Tax Rebate On Takaful Contribution 2019 20 Other Than Salariedsyed aamir shahNo ratings yet

- Estimated Revenues, Profits and Expenditure For Next Three YearsDocument6 pagesEstimated Revenues, Profits and Expenditure For Next Three YearsRajeev Kumar GottumukkalaNo ratings yet

- Module 6 Business Income Exercise SolutionsDocument13 pagesModule 6 Business Income Exercise SolutionshodaNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- Chapter 2 SolutionsDocument5 pagesChapter 2 SolutionskendozxNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- AfstDocument15 pagesAfstAEDRIAN LEE DERECHONo ratings yet

- Taxable Income and Income Tax - Foreign Tax Credit - AdministrDocument52 pagesTaxable Income and Income Tax - Foreign Tax Credit - AdministrCharlotte MalgapoNo ratings yet

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- Deductible Non-Deductible: PenaltiesDocument6 pagesDeductible Non-Deductible: PenaltiesFerl ElardoNo ratings yet

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- Payroll Template Single Employee - Segun Akiode - 2022Document1 pagePayroll Template Single Employee - Segun Akiode - 2022Eben-Haezer100% (1)

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- Session 2 Income Statement FC Exercise - QuestionDocument2 pagesSession 2 Income Statement FC Exercise - Questionnhutminh2706No ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- 18515pcc Sugg Paper Nov09 5 PDFDocument16 pages18515pcc Sugg Paper Nov09 5 PDFGaurang AgarwalNo ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Tax Calculation FY 2024 25 OldRegimeDocument2 pagesTax Calculation FY 2024 25 OldRegimemohangboxNo ratings yet

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- FNCE371 Assignment 1: Case 3: Credit Policy ManagementDocument18 pagesFNCE371 Assignment 1: Case 3: Credit Policy ManagementsmaNo ratings yet

- Dardarat Dilg Budget ReportsDocument4 pagesDardarat Dilg Budget ReportsApril Joy Sumagit HidalgoNo ratings yet

- Week 8 ExampleDocument3 pagesWeek 8 Examplejemybanez81No ratings yet

- E-Filling of Returns (Shivdas 10 Years)Document122 pagesE-Filling of Returns (Shivdas 10 Years)Unicorn SpiderNo ratings yet

- 02 FAR02-answersDocument18 pages02 FAR02-answersBea GarciaNo ratings yet

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- 2015 Annual Accomplishment ReportDocument8 pages2015 Annual Accomplishment ReportAngelica Aquino GasmenNo ratings yet

- Fiscal ImpactDocument2 pagesFiscal ImpactJeremy TurleyNo ratings yet

- Appendix D Accounting For Deferred Income TaxesDocument2 pagesAppendix D Accounting For Deferred Income TaxesLan Hương Trần ThịNo ratings yet

- Computation of Toatal IncomeDocument4 pagesComputation of Toatal IncomePRITAM PATRANo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Paye Template Updated Jan 2017Document7 pagesPaye Template Updated Jan 2017Oluwatosin IsholaNo ratings yet

- TRAIN Part 1 - Income TaxDocument53 pagesTRAIN Part 1 - Income TaxGianna CantoriaNo ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Tax SimulatorDocument10 pagesTax SimulatorAnil KesarkarNo ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- I. Assets: 2018 2019Document7 pagesI. Assets: 2018 2019Kean DeeNo ratings yet

- Liabilites 2000 2001 Assets 2000 2001: Balance SheetDocument9 pagesLiabilites 2000 2001 Assets 2000 2001: Balance SheetGiri SukumarNo ratings yet

- 11 Profitability ParametersDocument23 pages11 Profitability ParametersDaris Putra Hadiman100% (2)

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Financial Plan Income StatementDocument1 pageFinancial Plan Income Statementbien groyonNo ratings yet

- 2023 BudgetDocument1 page2023 Budgetmisyel deveraNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet