Professional Documents

Culture Documents

IFRS 13 Valuation Tecniques and The Fair Value Hierarchy: Quick Reference Guide 6.1

IFRS 13 Valuation Tecniques and The Fair Value Hierarchy: Quick Reference Guide 6.1

Uploaded by

kengsheongteh0 ratings0% found this document useful (0 votes)

14 views1 pageThis document provides a quick reference guide on IFRS 13 valuation techniques and the fair value hierarchy. It defines and provides examples of the market, cost, and income approaches to valuation. It also outlines the three-level fair value hierarchy as defined in IFRS 13, categorizing inputs to valuation as level 1 (quoted prices in active markets), level 2 (observable inputs other than quoted prices), or level 3 (unobservable inputs). The purpose is to maximize the use of observable inputs and minimize the use of unobservable inputs in fair value measurement.

Original Description:

IFRS13

Original Title

Ifrs13 Quick 1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a quick reference guide on IFRS 13 valuation techniques and the fair value hierarchy. It defines and provides examples of the market, cost, and income approaches to valuation. It also outlines the three-level fair value hierarchy as defined in IFRS 13, categorizing inputs to valuation as level 1 (quoted prices in active markets), level 2 (observable inputs other than quoted prices), or level 3 (unobservable inputs). The purpose is to maximize the use of observable inputs and minimize the use of unobservable inputs in fair value measurement.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views1 pageIFRS 13 Valuation Tecniques and The Fair Value Hierarchy: Quick Reference Guide 6.1

IFRS 13 Valuation Tecniques and The Fair Value Hierarchy: Quick Reference Guide 6.1

Uploaded by

kengsheongtehThis document provides a quick reference guide on IFRS 13 valuation techniques and the fair value hierarchy. It defines and provides examples of the market, cost, and income approaches to valuation. It also outlines the three-level fair value hierarchy as defined in IFRS 13, categorizing inputs to valuation as level 1 (quoted prices in active markets), level 2 (observable inputs other than quoted prices), or level 3 (unobservable inputs). The purpose is to maximize the use of observable inputs and minimize the use of unobservable inputs in fair value measurement.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Chartered Accountants Program Financial Accounting & Reporting

Unit 6 Quick reference guide 6.1 Page 6-1

QRG

Quick reference guide 6.1

IFRS 13 valuation tecniques and the fair

value hierarchy

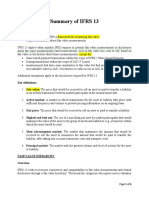

Valuation techniques (IFRS 13 Appendix A and para. 62)

Valuation techniques Definition Examples

Market approach A valuation technique that uses prices and

other relevant information generated by market

transactions involving identical or comparable (i.e.

similar) assets, liabilities or a group of assets and

liabilities, such as a business

Prices/ratios

Market transactions

Identical or similar assets/liabilities

Cost approach A valuation technique that reflects the amount that

would be required currently to replace the service

capacity of an asset

Cost to replace the function of the

asset

Income approach A valuation technique that converts future amounts

(e.g. cash flows or income and expenses) to a single

current (i.e. discounted) amount. The fair value

measurement is determined on the basis of the value

indicated by current market expectations about those

future amounts

Discounted cash flow

Option pricing models

IFRS 13 Fair Value Measurement specifies a three-level hierarchy that categorises the inputs to the

valuation technique/s used to measure fair value.

The Standard requires the use of relevant observable inputs (Levels 1 and 2) to be maximised

and the use of unobservable inputs (Level 3) to be minimised.

Fair value hierarchy (IFRS 13 Appendix A and para. 72)

Level Definition Examples

1 Quoted prices (unadjusted) in active markets for

identical assets or liabilities that the entity can access

at the measurement date

Quoted prices for shares listed on a

stock exchange

A companys market capitalisation

2 Inputs other than quoted prices included within Level

1 that are observable for the asset or liability, either

directly or indirectly

Interest rates

Valuation multiples

Price per square metre

3 Unobservable inputs for the asset or liability Forecast cash flows

Estimated replacement cost

You might also like

- Fair Value Measurement Inventory and Biological Asset Key PDFDocument38 pagesFair Value Measurement Inventory and Biological Asset Key PDFRNo ratings yet

- Ifrs 13Document3 pagesIfrs 13syedtahaaliNo ratings yet

- Price AnalysisDocument13 pagesPrice Analysisyam0078No ratings yet

- Embezzlement at Koss Over 12 Years!Document8 pagesEmbezzlement at Koss Over 12 Years!kengsheongtehNo ratings yet

- Embezzlement at Koss Over 12 Years!Document8 pagesEmbezzlement at Koss Over 12 Years!kengsheongtehNo ratings yet

- Ifrs 13Document7 pagesIfrs 13kadermaho456No ratings yet

- Ifrs 13: Fair Value MeasurementDocument7 pagesIfrs 13: Fair Value MeasurementAira Nhaira MecateNo ratings yet

- IFRS 13 GÇö Fair Value MeasurementDocument8 pagesIFRS 13 GÇö Fair Value Measurementdavidwijaya1986No ratings yet

- MA 3103 4. IFRS 13 Fair Value MeasurementDocument6 pagesMA 3103 4. IFRS 13 Fair Value MeasurementAnna Paula GallemitNo ratings yet

- Summary of IFRS 13Document8 pagesSummary of IFRS 13Jude Okoli0% (1)

- Fair ValueDocument24 pagesFair Valuen39e134No ratings yet

- Ifrs 13 Fair Value MeasurementDocument13 pagesIfrs 13 Fair Value MeasurementCazol MdzalimboNo ratings yet

- Pfrs 13 Fair Value MeasurementDocument6 pagesPfrs 13 Fair Value MeasurementEunel AciertoNo ratings yet

- Lecture 2Document30 pagesLecture 2Brenden Kapo100% (1)

- Module 2 - IFRS13Document7 pagesModule 2 - IFRS13mojama7866No ratings yet

- L9. IFRS 13 - Fair Value MeasurementDocument7 pagesL9. IFRS 13 - Fair Value MeasurementAhmed HussainNo ratings yet

- 1 Discuss Briefly About Fair Value Measurement and ImpairmentDocument13 pages1 Discuss Briefly About Fair Value Measurement and ImpairmentBosena TadegeNo ratings yet

- Pfrs-13 PptxfimalDocument34 pagesPfrs-13 PptxfimalNicah Shayne B. MadayagNo ratings yet

- FV Measurements IFRS 13 For Real Estate Industry (PWC 2011)Document11 pagesFV Measurements IFRS 13 For Real Estate Industry (PWC 2011)So LokNo ratings yet

- IFRSDocument18 pagesIFRSYakini entertainmentNo ratings yet

- Ifrs 13Document3 pagesIfrs 13Bheki TshimedziNo ratings yet

- Fair Value Measurement IFRS 13 (Effective From 1.1.2013)Document4 pagesFair Value Measurement IFRS 13 (Effective From 1.1.2013)Duyen HuynhNo ratings yet

- Ifrs 13 Fair Value Measurement: Guidance OnDocument4 pagesIfrs 13 Fair Value Measurement: Guidance Onmusic niNo ratings yet

- Valuation Approaches and MethodsDocument11 pagesValuation Approaches and MethodsChulbul PandeyNo ratings yet

- In The Headlines Issue 2011 17Document6 pagesIn The Headlines Issue 2011 17Amit SitalNo ratings yet

- UntitledDocument8 pagesUntitledK SANMUKHA PATRANo ratings yet

- Appendix I: Fair Value Measurement: 1. HistoryDocument9 pagesAppendix I: Fair Value Measurement: 1. HistoryLBNo ratings yet

- Fair ValueDocument44 pagesFair Valuenati100% (1)

- CH 2Document13 pagesCH 2Robbob JahloveNo ratings yet

- Biological Assets PDFDocument34 pagesBiological Assets PDFUnknown WandererNo ratings yet

- Indas 113 PDFDocument8 pagesIndas 113 PDFBhupen SharmaNo ratings yet

- Lidiys Handout Ch2Document10 pagesLidiys Handout Ch2Dùķe HPNo ratings yet

- IFRS 13 NewDocument16 pagesIFRS 13 NewAS GamingNo ratings yet

- MFRS 13 FVDocument14 pagesMFRS 13 FVNur 'Atiqah0% (1)

- Topic 1 Mfrs13 Fair Value MeasurementDocument29 pagesTopic 1 Mfrs13 Fair Value MeasurementNur Syareena AdnanNo ratings yet

- MFRS 13 FValueDocument14 pagesMFRS 13 FValuefaiez jamilNo ratings yet

- Analysis of SFAS 157, Fair Value Measurements: Starting Point For Making Dijficult ValuationsDocument5 pagesAnalysis of SFAS 157, Fair Value Measurements: Starting Point For Making Dijficult ValuationsShree Punetha PeremaloNo ratings yet

- Fair Value Measurement and ImpairmentDocument2 pagesFair Value Measurement and Impairmentyonatan tesemaNo ratings yet

- (C) Fair ValueDocument2 pages(C) Fair Valuekeshvika singlaNo ratings yet

- IFRS 13 FAIR VALUE MEASUREMENT FinalDocument12 pagesIFRS 13 FAIR VALUE MEASUREMENT FinalAppu KhoteNo ratings yet

- Chapter 5 - Fair Value Measurement: Review QuestionsDocument5 pagesChapter 5 - Fair Value Measurement: Review QuestionsShek Kwun HeiNo ratings yet

- University of Cebu Main-Campus College of Engineering Mechanical EngineeringDocument6 pagesUniversity of Cebu Main-Campus College of Engineering Mechanical EngineeringRhadel GantuangcoNo ratings yet

- RMK 7Document3 pagesRMK 7Nimas Ayang AgastaNo ratings yet

- IFRS 13 Fair ValueDocument2 pagesIFRS 13 Fair ValueCatalin BlesnocNo ratings yet

- Accountancy & Financial Management Iii Accountancy & Financial Management IiiDocument9 pagesAccountancy & Financial Management Iii Accountancy & Financial Management IiiyashviNo ratings yet

- Intermediate CH 2Document17 pagesIntermediate CH 2Yilkal AbereNo ratings yet

- Chapter 1 - Fair Value MeasurementDocument66 pagesChapter 1 - Fair Value Measurementansath193No ratings yet

- Ifrs 13Document23 pagesIfrs 13Reever RiverNo ratings yet

- Indian Accounting Standard 113Document2 pagesIndian Accounting Standard 113ca.sanket1No ratings yet

- Ind AS 113Document11 pagesInd AS 113Crystal CrystalNo ratings yet

- Chapter 7 Primer On Relative Valuation MethodsDocument16 pagesChapter 7 Primer On Relative Valuation MethodsPankaj AgrawalNo ratings yet

- MVS 11 Methods (Exp Draft)Document6 pagesMVS 11 Methods (Exp Draft)shahrilcangNo ratings yet

- Fair Value of The Equity InstrumentDocument1 pageFair Value of The Equity InstrumentTremolo backNo ratings yet

- Fair Value HierarchyDocument3 pagesFair Value HierarchyFantayNo ratings yet

- IFA I - CH Two - NoteDocument12 pagesIFA I - CH Two - Notehilina bertaNo ratings yet

- PFRS 13 - Fair Value MeasurementDocument7 pagesPFRS 13 - Fair Value MeasurementMary Yvonne AresNo ratings yet

- Ifrs ImparimentDocument14 pagesIfrs ImparimentNigussie BerhanuNo ratings yet

- IFRS 13 - Fair Value MeasurementDocument13 pagesIFRS 13 - Fair Value MeasurementPrincess EngresoNo ratings yet

- Intermidiate FA I ChapterDocument11 pagesIntermidiate FA I Chapteryiberta69No ratings yet

- IFRS 13, Fair Value Measurement - ACCA GlobalDocument7 pagesIFRS 13, Fair Value Measurement - ACCA Globalvivsubs18No ratings yet

- Course Schedulefasjfafjalf Fafaf FafafDocument3 pagesCourse Schedulefasjfafjalf Fafaf FafafkengsheongtehNo ratings yet

- Fair Value Measurement of A Liability or An Entity's Own Equity InstrumentsDocument1 pageFair Value Measurement of A Liability or An Entity's Own Equity InstrumentskengsheongtehNo ratings yet