Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

5 viewsMF0016

MF0016

Uploaded by

Yaseen ManiyarThis document outlines the assignment for a Treasury Management course. It includes 6 questions related to treasury functions for a hospital, analyzing interest rates on certificates of deposit and factors affecting them, implementing and maintaining effective liquidity practices, measuring and controlling interest rate risk, solving treasury problems through money market instruments and customer interactions, and explaining changes to treasury from globalization along with analyzing treasury products offered by banks. Students are expected to answer all questions, with some requiring explanations of 400 words or analyzing multiple parts. The assignment covers key treasury concepts and has students apply them to practical situations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- 12 LBO Model Seven Days Case StudyDocument6 pages12 LBO Model Seven Days Case StudyDNo ratings yet

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Solutions ManualDocument57 pagesFinancial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Solutions ManualCarrieSchmidtoryzd100% (16)

- Financial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 191001163059Document32 pagesFinancial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 191001163059josh100% (1)

- Assignment Drive FALL 2013 Program/Semester Mbads - (Sem 4/sem 6) / Mban2 / Mbaflex - (Sem 4) / PGDFMN - (Sem 2) Subject Code & Name MF0016 Treasury Management BK Id B1814 Credit 4 Marks 60Document2 pagesAssignment Drive FALL 2013 Program/Semester Mbads - (Sem 4/sem 6) / Mban2 / Mbaflex - (Sem 4) / PGDFMN - (Sem 2) Subject Code & Name MF0016 Treasury Management BK Id B1814 Credit 4 Marks 60akranjan888No ratings yet

- 7 F 93 CB 558 CDocument20 pages7 F 93 CB 558 CPabloCaicedoArellanoNo ratings yet

- AGSO J07 Question Paper Final DraftDocument4 pagesAGSO J07 Question Paper Final Draftatish7No ratings yet

- MMPC 014Document6 pagesMMPC 014Pawan ShokeenNo ratings yet

- Final Paper 1Document12 pagesFinal Paper 1ishujain007No ratings yet

- Assignment - DCM2102 - Financial Management - Bcom 3 - Set-1 and 2 - Sep 2023Document14 pagesAssignment - DCM2102 - Financial Management - Bcom 3 - Set-1 and 2 - Sep 2023arinkalsotra19042003No ratings yet

- BF405 Nov 2018 PDFDocument4 pagesBF405 Nov 2018 PDFhuku memeNo ratings yet

- Assignment Drive WINTER 2017 Program MBA Semester IV Subject Code & Name MA0046 Merchant Bankers BK Id B1812 Credit 4 Marks 60Document2 pagesAssignment Drive WINTER 2017 Program MBA Semester IV Subject Code & Name MA0046 Merchant Bankers BK Id B1812 Credit 4 Marks 60Sujal SNo ratings yet

- MMPMC 014Document3 pagesMMPMC 014Ashvanee Kr. PathakNo ratings yet

- Critical Thinking: Difficulty: Objective: Terms To Learn: Capital BudgetingDocument5 pagesCritical Thinking: Difficulty: Objective: Terms To Learn: Capital BudgetingMaha HamdyNo ratings yet

- 597183Document2 pages597183yesy123456No ratings yet

- LRM QDocument2 pagesLRM QJibon JainNo ratings yet

- Fm202 Exam Questions 2013Document12 pagesFm202 Exam Questions 2013Grace VersoniNo ratings yet

- DAIBB Lending - 1Document40 pagesDAIBB Lending - 1Md Alim100% (1)

- Tutorial 6 SolutionsDocument4 pagesTutorial 6 Solutionsmerita homasiNo ratings yet

- Exam Banking Financial Services Draft Jan 2020 With SolutionsDocument10 pagesExam Banking Financial Services Draft Jan 2020 With SolutionsBD04No ratings yet

- Important Questions of FMDocument2 pagesImportant Questions of FMCharchit RawalNo ratings yet

- MMPC 14Document2 pagesMMPC 14twinklekumari76263No ratings yet

- 2100 Solutions - CH8Document58 pages2100 Solutions - CH8ds hhNo ratings yet

- Sem 5 QuesDocument5 pagesSem 5 QuesHumayra RahmanNo ratings yet

- Credit Risk Assessment 1 May 2011Document5 pagesCredit Risk Assessment 1 May 2011Basilio MaliwangaNo ratings yet

- FM5.2 Receivable ManagementDocument15 pagesFM5.2 Receivable ManagementAbdulraqeeb AlareqiNo ratings yet

- Que Bank PFMDocument5 pagesQue Bank PFMAmit KesharwaniNo ratings yet

- B1 Free Solving (May 2019) - Set 1Document5 pagesB1 Free Solving (May 2019) - Set 1paul sagudaNo ratings yet

- MA0043Document2 pagesMA0043Tenzin KunchokNo ratings yet

- MN2134 Online Exam Questions - 2020-2021Document3 pagesMN2134 Online Exam Questions - 2020-2021Shoaib AhmedNo ratings yet

- NMIMS Sept Latest AssignmentsDocument42 pagesNMIMS Sept Latest AssignmentsAmanDeep Singh0% (1)

- Solution Manual To Lectures On Corporate Finance Second EditionDocument80 pagesSolution Manual To Lectures On Corporate Finance Second Editionwaleedtanvir100% (2)

- Final-Term Exam (Take-Home) Fall - 2020 Department of Business AdministrationDocument4 pagesFinal-Term Exam (Take-Home) Fall - 2020 Department of Business Administrationsyed aliNo ratings yet

- 1FT & 1JF ACC9011M TCA RESIT 2022 v1Document5 pages1FT & 1JF ACC9011M TCA RESIT 2022 v1waqas aliNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- Financial ManagementDocument8 pagesFinancial Managementoptimistic070% (1)

- Banking AssignmentDocument21 pagesBanking AssignmentBhanumati BhunjunNo ratings yet

- MF Global's "Break The Glass" DocumentDocument23 pagesMF Global's "Break The Glass" DocumentDealBookNo ratings yet

- Business Analysis: (B) What Is An Operating Turnaround Strategy ? 4Document4 pagesBusiness Analysis: (B) What Is An Operating Turnaround Strategy ? 4Davies MumbaNo ratings yet

- CH01 Current Asset MGTDocument29 pagesCH01 Current Asset MGTMona A HassanNo ratings yet

- Solved SMU Assignment / ProjectDocument3 pagesSolved SMU Assignment / ProjectArvind KNo ratings yet

- Naqdown Clincher QuestionDocument13 pagesNaqdown Clincher QuestionsarahbeeNo ratings yet

- Financial Accounting: Recording, Analysis and Decision MakingDocument56 pagesFinancial Accounting: Recording, Analysis and Decision MakingKyleNo ratings yet

- Mba Part 1 Mbad Financial Management 13415 2020Document3 pagesMba Part 1 Mbad Financial Management 13415 2020Panchu HiremathNo ratings yet

- Business Strategy: Page 1 of 8Document8 pagesBusiness Strategy: Page 1 of 8vikkyNo ratings yet

- ACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgDocument2 pagesACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgGauri SinghNo ratings yet

- Outline 5 PDFDocument6 pagesOutline 5 PDFfajarNo ratings yet

- Sub Rma 503Document10 pagesSub Rma 503Areeb BaqaiNo ratings yet

- School of Business and Law: AssignmentDocument8 pagesSchool of Business and Law: AssignmentMHANo ratings yet

- Working Capital Management: Learning OutcomesDocument5 pagesWorking Capital Management: Learning Outcomesmanique_abeyratneNo ratings yet

- The Lee Kong Chian School of Business: Academic Year 2013 /14 Term 1Document6 pagesThe Lee Kong Chian School of Business: Academic Year 2013 /14 Term 1Ian Eldrick Dela CruzNo ratings yet

- Theoretical Notes AS AccountingDocument33 pagesTheoretical Notes AS Accountingeaglerealestate31No ratings yet

- Account Receivables OverviewDocument54 pagesAccount Receivables OverviewAnthony MontéiroNo ratings yet

- SMM148 Theory of Finance QuestionsDocument5 pagesSMM148 Theory of Finance Questionsminh daoNo ratings yet

- Financial Management - Sem Ii - Question BankDocument11 pagesFinancial Management - Sem Ii - Question BankHIDDEN Life OF 【शैलेष】No ratings yet

- Cash Conversion Cycle ThesisDocument5 pagesCash Conversion Cycle ThesisMartha Brown100% (2)

- Question BankDocument8 pagesQuestion BankEvangelineNo ratings yet

- Mastering Trade Lines "A Guide to Building Credit and Financial Success"From EverandMastering Trade Lines "A Guide to Building Credit and Financial Success"No ratings yet

MF0016

MF0016

Uploaded by

Yaseen Maniyar0 ratings0% found this document useful (0 votes)

5 views2 pagesThis document outlines the assignment for a Treasury Management course. It includes 6 questions related to treasury functions for a hospital, analyzing interest rates on certificates of deposit and factors affecting them, implementing and maintaining effective liquidity practices, measuring and controlling interest rate risk, solving treasury problems through money market instruments and customer interactions, and explaining changes to treasury from globalization along with analyzing treasury products offered by banks. Students are expected to answer all questions, with some requiring explanations of 400 words or analyzing multiple parts. The assignment covers key treasury concepts and has students apply them to practical situations.

Original Description:

MBA

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the assignment for a Treasury Management course. It includes 6 questions related to treasury functions for a hospital, analyzing interest rates on certificates of deposit and factors affecting them, implementing and maintaining effective liquidity practices, measuring and controlling interest rate risk, solving treasury problems through money market instruments and customer interactions, and explaining changes to treasury from globalization along with analyzing treasury products offered by banks. Students are expected to answer all questions, with some requiring explanations of 400 words or analyzing multiple parts. The assignment covers key treasury concepts and has students apply them to practical situations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views2 pagesMF0016

MF0016

Uploaded by

Yaseen ManiyarThis document outlines the assignment for a Treasury Management course. It includes 6 questions related to treasury functions for a hospital, analyzing interest rates on certificates of deposit and factors affecting them, implementing and maintaining effective liquidity practices, measuring and controlling interest rate risk, solving treasury problems through money market instruments and customer interactions, and explaining changes to treasury from globalization along with analyzing treasury products offered by banks. Students are expected to answer all questions, with some requiring explanations of 400 words or analyzing multiple parts. The assignment covers key treasury concepts and has students apply them to practical situations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

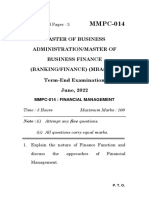

ASSIGNMENT

DRIVE SPRING 2014

PROGRAM MBADS (SEM 4/SEM 6)

MBAFLEX/ MBAN2 (SEM 4)

PGDFMN (SEM 2)

SUBJECT CODE &

NAME

MF0016

TREASURY MANAGEMENT

BK ID B1814

CREDIT 4

MARKS 60

Note: Answer all questions. Kindly note that answers for 10 marks questions should be

approximately of 400 words. Each question is followed by evaluation scheme.

Q.No Question Marks Total Marks

1 Consider you are the chief financial officer of a hospital. How would you oversee the

companys Treasury function?

Functions

10 10

2 The interest rate offered on Certificate of Deposits varies from bank to bank. Refer some of

the public sector and private sector banks and analyse the factors affecting the interest rates.

Certificate of Deposits

Factors (3 banks)

4

3*2= 6

10

3 Assume you are the Treasurer of a Company. How would you implement and maintain

effective liquidity practices in your company?

Explain effective liquidity practices in your

company

10

10

4 Analyse the techniques for measuring Interest Rate Risk. Explain the concept of asset-liability

rate sensitivity and strategies for controlling Interest Rate Risk

Analyse the techniques for measuring Interest Rate

Risk

5

10

Explain the concept of asset-liability rate sensitivity

and strategies

5

5 Assume you are a treasurer of a company and you are faced with two situations.

Explain how would you solve these problems.

The cases could be a) large loan repayment coinciding with delay in receipt of a large trade

receivable; b) and locking up customer advances in payment towards fixed assets.

Use of money market instruments

Interactions with the customers

5*2=10

10

6

Briefly explain at least three actions relating to treasury that have changed substantially with

globalization. Visit a bank and analyse the various treasury products offered by the bank to

its customers. Identify which of these are suitable for a large company with cash to invest, and

why.

Latest developments in Treasury

Treasury products of two banks

4

2*3=6

10

You might also like

- 12 LBO Model Seven Days Case StudyDocument6 pages12 LBO Model Seven Days Case StudyDNo ratings yet

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Solutions ManualDocument57 pagesFinancial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Solutions ManualCarrieSchmidtoryzd100% (16)

- Financial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 191001163059Document32 pagesFinancial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 191001163059josh100% (1)

- Assignment Drive FALL 2013 Program/Semester Mbads - (Sem 4/sem 6) / Mban2 / Mbaflex - (Sem 4) / PGDFMN - (Sem 2) Subject Code & Name MF0016 Treasury Management BK Id B1814 Credit 4 Marks 60Document2 pagesAssignment Drive FALL 2013 Program/Semester Mbads - (Sem 4/sem 6) / Mban2 / Mbaflex - (Sem 4) / PGDFMN - (Sem 2) Subject Code & Name MF0016 Treasury Management BK Id B1814 Credit 4 Marks 60akranjan888No ratings yet

- 7 F 93 CB 558 CDocument20 pages7 F 93 CB 558 CPabloCaicedoArellanoNo ratings yet

- AGSO J07 Question Paper Final DraftDocument4 pagesAGSO J07 Question Paper Final Draftatish7No ratings yet

- MMPC 014Document6 pagesMMPC 014Pawan ShokeenNo ratings yet

- Final Paper 1Document12 pagesFinal Paper 1ishujain007No ratings yet

- Assignment - DCM2102 - Financial Management - Bcom 3 - Set-1 and 2 - Sep 2023Document14 pagesAssignment - DCM2102 - Financial Management - Bcom 3 - Set-1 and 2 - Sep 2023arinkalsotra19042003No ratings yet

- BF405 Nov 2018 PDFDocument4 pagesBF405 Nov 2018 PDFhuku memeNo ratings yet

- Assignment Drive WINTER 2017 Program MBA Semester IV Subject Code & Name MA0046 Merchant Bankers BK Id B1812 Credit 4 Marks 60Document2 pagesAssignment Drive WINTER 2017 Program MBA Semester IV Subject Code & Name MA0046 Merchant Bankers BK Id B1812 Credit 4 Marks 60Sujal SNo ratings yet

- MMPMC 014Document3 pagesMMPMC 014Ashvanee Kr. PathakNo ratings yet

- Critical Thinking: Difficulty: Objective: Terms To Learn: Capital BudgetingDocument5 pagesCritical Thinking: Difficulty: Objective: Terms To Learn: Capital BudgetingMaha HamdyNo ratings yet

- 597183Document2 pages597183yesy123456No ratings yet

- LRM QDocument2 pagesLRM QJibon JainNo ratings yet

- Fm202 Exam Questions 2013Document12 pagesFm202 Exam Questions 2013Grace VersoniNo ratings yet

- DAIBB Lending - 1Document40 pagesDAIBB Lending - 1Md Alim100% (1)

- Tutorial 6 SolutionsDocument4 pagesTutorial 6 Solutionsmerita homasiNo ratings yet

- Exam Banking Financial Services Draft Jan 2020 With SolutionsDocument10 pagesExam Banking Financial Services Draft Jan 2020 With SolutionsBD04No ratings yet

- Important Questions of FMDocument2 pagesImportant Questions of FMCharchit RawalNo ratings yet

- MMPC 14Document2 pagesMMPC 14twinklekumari76263No ratings yet

- 2100 Solutions - CH8Document58 pages2100 Solutions - CH8ds hhNo ratings yet

- Sem 5 QuesDocument5 pagesSem 5 QuesHumayra RahmanNo ratings yet

- Credit Risk Assessment 1 May 2011Document5 pagesCredit Risk Assessment 1 May 2011Basilio MaliwangaNo ratings yet

- FM5.2 Receivable ManagementDocument15 pagesFM5.2 Receivable ManagementAbdulraqeeb AlareqiNo ratings yet

- Que Bank PFMDocument5 pagesQue Bank PFMAmit KesharwaniNo ratings yet

- B1 Free Solving (May 2019) - Set 1Document5 pagesB1 Free Solving (May 2019) - Set 1paul sagudaNo ratings yet

- MA0043Document2 pagesMA0043Tenzin KunchokNo ratings yet

- MN2134 Online Exam Questions - 2020-2021Document3 pagesMN2134 Online Exam Questions - 2020-2021Shoaib AhmedNo ratings yet

- NMIMS Sept Latest AssignmentsDocument42 pagesNMIMS Sept Latest AssignmentsAmanDeep Singh0% (1)

- Solution Manual To Lectures On Corporate Finance Second EditionDocument80 pagesSolution Manual To Lectures On Corporate Finance Second Editionwaleedtanvir100% (2)

- Final-Term Exam (Take-Home) Fall - 2020 Department of Business AdministrationDocument4 pagesFinal-Term Exam (Take-Home) Fall - 2020 Department of Business Administrationsyed aliNo ratings yet

- 1FT & 1JF ACC9011M TCA RESIT 2022 v1Document5 pages1FT & 1JF ACC9011M TCA RESIT 2022 v1waqas aliNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- Financial ManagementDocument8 pagesFinancial Managementoptimistic070% (1)

- Banking AssignmentDocument21 pagesBanking AssignmentBhanumati BhunjunNo ratings yet

- MF Global's "Break The Glass" DocumentDocument23 pagesMF Global's "Break The Glass" DocumentDealBookNo ratings yet

- Business Analysis: (B) What Is An Operating Turnaround Strategy ? 4Document4 pagesBusiness Analysis: (B) What Is An Operating Turnaround Strategy ? 4Davies MumbaNo ratings yet

- CH01 Current Asset MGTDocument29 pagesCH01 Current Asset MGTMona A HassanNo ratings yet

- Solved SMU Assignment / ProjectDocument3 pagesSolved SMU Assignment / ProjectArvind KNo ratings yet

- Naqdown Clincher QuestionDocument13 pagesNaqdown Clincher QuestionsarahbeeNo ratings yet

- Financial Accounting: Recording, Analysis and Decision MakingDocument56 pagesFinancial Accounting: Recording, Analysis and Decision MakingKyleNo ratings yet

- Mba Part 1 Mbad Financial Management 13415 2020Document3 pagesMba Part 1 Mbad Financial Management 13415 2020Panchu HiremathNo ratings yet

- Business Strategy: Page 1 of 8Document8 pagesBusiness Strategy: Page 1 of 8vikkyNo ratings yet

- ACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgDocument2 pagesACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgGauri SinghNo ratings yet

- Outline 5 PDFDocument6 pagesOutline 5 PDFfajarNo ratings yet

- Sub Rma 503Document10 pagesSub Rma 503Areeb BaqaiNo ratings yet

- School of Business and Law: AssignmentDocument8 pagesSchool of Business and Law: AssignmentMHANo ratings yet

- Working Capital Management: Learning OutcomesDocument5 pagesWorking Capital Management: Learning Outcomesmanique_abeyratneNo ratings yet

- The Lee Kong Chian School of Business: Academic Year 2013 /14 Term 1Document6 pagesThe Lee Kong Chian School of Business: Academic Year 2013 /14 Term 1Ian Eldrick Dela CruzNo ratings yet

- Theoretical Notes AS AccountingDocument33 pagesTheoretical Notes AS Accountingeaglerealestate31No ratings yet

- Account Receivables OverviewDocument54 pagesAccount Receivables OverviewAnthony MontéiroNo ratings yet

- SMM148 Theory of Finance QuestionsDocument5 pagesSMM148 Theory of Finance Questionsminh daoNo ratings yet

- Financial Management - Sem Ii - Question BankDocument11 pagesFinancial Management - Sem Ii - Question BankHIDDEN Life OF 【शैलेष】No ratings yet

- Cash Conversion Cycle ThesisDocument5 pagesCash Conversion Cycle ThesisMartha Brown100% (2)

- Question BankDocument8 pagesQuestion BankEvangelineNo ratings yet

- Mastering Trade Lines "A Guide to Building Credit and Financial Success"From EverandMastering Trade Lines "A Guide to Building Credit and Financial Success"No ratings yet