Professional Documents

Culture Documents

Supreme Court Judgement On LTA

Supreme Court Judgement On LTA

Uploaded by

Arun KumarCopyright:

Available Formats

You might also like

- SC - SLP DismissedDocument2 pagesSC - SLP Dismissedmodassir husain khanNo ratings yet

- 2016 35 1501 30497 Order 01-Oct-2021Document8 pages2016 35 1501 30497 Order 01-Oct-2021HariSudhanMNo ratings yet

- 2020 31 19 25372 Order 12-Jan-2021Document11 pages2020 31 19 25372 Order 12-Jan-2021Anonymous SharklaserNo ratings yet

- Supreme CourtDocument18 pagesSupreme CourtNewsclickNo ratings yet

- Table of ContentsDocument1 pageTable of ContentsJitendra KumarNo ratings yet

- Report On Distribution of FoodgrainDocument138 pagesReport On Distribution of FoodgrainKanishk GuptaNo ratings yet

- Welder Suprem CourtDocument1 pageWelder Suprem Courtnajeebayyaril6No ratings yet

- Civil Appeal No. 473/2020: Signature Not VerifiedDocument2 pagesCivil Appeal No. 473/2020: Signature Not Verifiednalin soodNo ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not Verifiedvarun lobheNo ratings yet

- 2020 5 5 39916 Order 22-Nov-2022Document2 pages2020 5 5 39916 Order 22-Nov-2022prasanth rajuNo ratings yet

- Signature Not VerifiedDocument2 pagesSignature Not VerifiedMuthu SrinithiNo ratings yet

- Supreme Court Order Dated 12-04-2021Document3 pagesSupreme Court Order Dated 12-04-2021Sudhir ShindeNo ratings yet

- Eco Senstive Zone SupremeCourt Order - 11 Dec 2018 PDFDocument7 pagesEco Senstive Zone SupremeCourt Order - 11 Dec 2018 PDFSankanna VijaykumarNo ratings yet

- Appearance in SXDocument3 pagesAppearance in SXnitinbhaaiNo ratings yet

- Injunction Dismissed - 2019Document45 pagesInjunction Dismissed - 2019modassir husain khanNo ratings yet

- Order - 10 Mar 2022Document6 pagesOrder - 10 Mar 2022Ankit SethiNo ratings yet

- 2011 11 109 45664 Order 02-Aug-2023Document1 page2011 11 109 45664 Order 02-Aug-2023Tanmay DeshmukhNo ratings yet

- Ram Setu OrderDocument3 pagesRam Setu OrderPGurusNo ratings yet

- 2021 13 1 31973 Order 08-Dec-2021Document3 pages2021 13 1 31973 Order 08-Dec-2021Ruksar PraweenNo ratings yet

- Signature Not VerifiedDocument2 pagesSignature Not VerifiedAmySinghNo ratings yet

- 2023 4 43 50362 Order 13-Feb-2024Document2 pages2023 4 43 50362 Order 13-Feb-2024R Radha KrishnanNo ratings yet

- 2021 34 10 30631 Order 05-Oct-2021Document2 pages2021 34 10 30631 Order 05-Oct-2021Annonymous SpiderNo ratings yet

- Ayodhya Order 1Document7 pagesAyodhya Order 1Santosh BhushanNo ratings yet

- About Seniority Supreme Court JudgementDocument3 pagesAbout Seniority Supreme Court JudgementK RamakrishnanNo ratings yet

- 8181 2020 31 4 22035 Order 13-May-2020Document2 pages8181 2020 31 4 22035 Order 13-May-2020Bhumica VeeraNo ratings yet

- 36631_2016_33_3_32879_Order_25-Jan-2022Document4 pages36631_2016_33_3_32879_Order_25-Jan-2022NExus KnOxNo ratings yet

- Babri Petitions TableDocument14 pagesBabri Petitions TableAhmadShazebAzharNo ratings yet

- UOI Vs Kiran Gems - SC Latest OrderDocument1 pageUOI Vs Kiran Gems - SC Latest OrderAmitoz SinghNo ratings yet

- Ram Janm Bhumi Babri Masjid - S U P R E M E C O U R T O F I N D I ADocument3 pagesRam Janm Bhumi Babri Masjid - S U P R E M E C O U R T O F I N D I ANaresh KadyanNo ratings yet

- Supreme Court JudgementDocument2 pagesSupreme Court JudgementThe WireNo ratings yet

- Signature Not VerifiedDocument5 pagesSignature Not VerifiedShivam PatelNo ratings yet

- Signature Not Verified: Digitally Signed by Jayant Kumar Arora Date: 2018.07.21 12:52:55 IST ReasonDocument5 pagesSignature Not Verified: Digitally Signed by Jayant Kumar Arora Date: 2018.07.21 12:52:55 IST ReasonPraveena VemulapalliNo ratings yet

- FICUS PAX PRIVATE LIMITED vs. UNION OF INDIA PDFDocument10 pagesFICUS PAX PRIVATE LIMITED vs. UNION OF INDIA PDFLAW SUITSNo ratings yet

- DocumentDocument75 pagesDocumentHarshitha NMNo ratings yet

- 389 2019 4 40 40709 Order 02-Jan-2023Document1 page389 2019 4 40 40709 Order 02-Jan-2023Arihant SamdariaNo ratings yet

- Nowhera Sheik vs. UOI - HYZODocument6 pagesNowhera Sheik vs. UOI - HYZOvijaygnluNo ratings yet

- Harinath Ram Vs Union of IndiaDocument2 pagesHarinath Ram Vs Union of IndiaSaakshi Singh RawatNo ratings yet

- SC Order On Ratio ChangeDocument2 pagesSC Order On Ratio ChangeinspvizagNo ratings yet

- Signature Not VerifiedDocument6 pagesSignature Not VerifiedVikas SareenNo ratings yet

- WP (C) 267/2012 Etc.: Signature Not VerifiedDocument7 pagesWP (C) 267/2012 Etc.: Signature Not VerifiedAnamika VatsaNo ratings yet

- Signature Not VerifiedDocument5 pagesSignature Not VerifiedVaibhav SharmaNo ratings yet

- Natasha Kohli Vs Mon Mohan KohliDocument46 pagesNatasha Kohli Vs Mon Mohan KohliRicha sharmaNo ratings yet

- Signature Not VerifiedDocument5 pagesSignature Not VerifiedVenkatesh SubbaRaoNo ratings yet

- Supreme Court On Arnab Goswami's Interim BailDocument3 pagesSupreme Court On Arnab Goswami's Interim BailThe Wire100% (1)

- Maharashtra State Cooperative Bank Limited v. Asst. PF CommisionerDocument2 pagesMaharashtra State Cooperative Bank Limited v. Asst. PF Commisionerhs0036870No ratings yet

- Yogesh Narayanrao 04.05.2022Document3 pagesYogesh Narayanrao 04.05.2022Sandeep DashNo ratings yet

- In The High Court of Delhi at New DelhiDocument2 pagesIn The High Court of Delhi at New DelhiAnil KumarNo ratings yet

- State Bank of India vs. Ericsson India (P) LTD., 2018 SCC OnLine SC 497Document5 pagesState Bank of India vs. Ericsson India (P) LTD., 2018 SCC OnLine SC 497ganapathilawsassociatesNo ratings yet

- Signature Not VerifiedDocument6 pagesSignature Not VerifiedAvinashNo ratings yet

- Order - 22-Apr-2019Document1 pageOrder - 22-Apr-2019Soorya BalaNo ratings yet

- 8 Judgement Order - 08.01.2020Document2 pages8 Judgement Order - 08.01.2020mp4sabmNo ratings yet

- 1984 Order 25-Sep-2018Document6 pages1984 Order 25-Sep-2018Bhojraj Vamanrao ChavanNo ratings yet

- SC 1Document3 pagesSC 1saitejatv9No ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not VerifiedSatrajit NeogNo ratings yet

- 421342016350141549order01 Feb 2023 458004Document8 pages421342016350141549order01 Feb 2023 458004Abha KatiyarNo ratings yet

- BinaModiv - LalitModi SLP DismissedDocument3 pagesBinaModiv - LalitModi SLP DismissedSuhani ChanchlaniNo ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not Verifiedmadhav225No ratings yet

- 2024 1 30 52884 Order 06-May-2024Document7 pages2024 1 30 52884 Order 06-May-2024Deep BhattcharyyaNo ratings yet

- Contextual Foundations of International Criminal Jurisprudence: Selected Cases an Insider’S PerspectiveFrom EverandContextual Foundations of International Criminal Jurisprudence: Selected Cases an Insider’S PerspectiveNo ratings yet

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)From EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)No ratings yet

Supreme Court Judgement On LTA

Supreme Court Judgement On LTA

Uploaded by

Arun KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Supreme Court Judgement On LTA

Supreme Court Judgement On LTA

Uploaded by

Arun KumarCopyright:

Available Formats

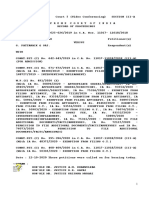

ITEM NO.

102

COURT NO.5

SECTION IIIA

SUPREME COURT OF INDIA

RECORD OF PROCEEDINGS

CIVIL APPEAL NO(s). 989 OF 2005

COMMISSIONER OF INCOME TAX,BANGALORE & ANR.

Appellant (s)

VERSUS

M/S. I.T.I. LTD.

Respondent(s)

Date: 21/01/2009 This Appeal was called on for hearing today.

CORAM :

HON'BLE MR. JUSTICE S.H. KAPADIA

HON'BLE MR. JUSTICE AFTAB ALAM

For Appellant(s) Mr. K. Rdhakrishnan, Sr.Adv.

Mr. Arijit Prasad, Adv.

Mr. Rahul Kaushik, Adv.

Mr. Tapeshwar Singh, Adv.

Mr. B.V. Balaram Das,Adv.

For Respondent(s) Mr. T.L. Vishwanatha Iyer, Sr.Adv.

Mr. Rajiv Tyagi,Adv.

Mr. Chanchal Biswal, Adv.

Mr. Vikas Mishra, Adv.

UPON hearing counsel the Court made the following

ORDER

The appeal is dismissed with no order as to costs.

(S. Thapar)

PS to Registrar

(Madhu Saxena)

Court Master

The signed order is placed on the file.

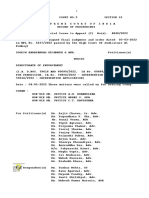

IN THE SUPREME COURT OF INDIA

CIVIL APPELLATE JURISDICTION

CIVIL APPEAL NO. 989 OF 2005

COMMISSIONER OF INCOME TAX, BANGALORE & ANR.

...APPELLANT (S)

VERSUS

M/S I.T.I. LIMITED

...RESPONDENT(S)

ORDER

A short question which arises for determination in this Civil Appeal is whether

the assessee was under statutory obligation under Income Tax Act, 1961, and/or the Rules to

collect evidence to show that its employee(s) had actually utilized the amount(s) paid towards

Leave Travel Concession(s)/Conveyance Allowance?

It may be noted that the beneficiary of exemption under Section 10(5) is an

individual employee. There is no circular of Central Board of Direct Taxes (CBDT) requiring

the employer under Section 192 to collect and examine the supporting evidence to the

Declaration to be submitted by an employee(s).

For the above reasons there is no merit in the Civil Appeal and the same is

dismissed with no order as to costs.

....................J.

[ S.H. KAPADIA ]

New Delhi,

January 21, 2009

....................J

[ AFTAB ALAM ]

You might also like

- SC - SLP DismissedDocument2 pagesSC - SLP Dismissedmodassir husain khanNo ratings yet

- 2016 35 1501 30497 Order 01-Oct-2021Document8 pages2016 35 1501 30497 Order 01-Oct-2021HariSudhanMNo ratings yet

- 2020 31 19 25372 Order 12-Jan-2021Document11 pages2020 31 19 25372 Order 12-Jan-2021Anonymous SharklaserNo ratings yet

- Supreme CourtDocument18 pagesSupreme CourtNewsclickNo ratings yet

- Table of ContentsDocument1 pageTable of ContentsJitendra KumarNo ratings yet

- Report On Distribution of FoodgrainDocument138 pagesReport On Distribution of FoodgrainKanishk GuptaNo ratings yet

- Welder Suprem CourtDocument1 pageWelder Suprem Courtnajeebayyaril6No ratings yet

- Civil Appeal No. 473/2020: Signature Not VerifiedDocument2 pagesCivil Appeal No. 473/2020: Signature Not Verifiednalin soodNo ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not Verifiedvarun lobheNo ratings yet

- 2020 5 5 39916 Order 22-Nov-2022Document2 pages2020 5 5 39916 Order 22-Nov-2022prasanth rajuNo ratings yet

- Signature Not VerifiedDocument2 pagesSignature Not VerifiedMuthu SrinithiNo ratings yet

- Supreme Court Order Dated 12-04-2021Document3 pagesSupreme Court Order Dated 12-04-2021Sudhir ShindeNo ratings yet

- Eco Senstive Zone SupremeCourt Order - 11 Dec 2018 PDFDocument7 pagesEco Senstive Zone SupremeCourt Order - 11 Dec 2018 PDFSankanna VijaykumarNo ratings yet

- Appearance in SXDocument3 pagesAppearance in SXnitinbhaaiNo ratings yet

- Injunction Dismissed - 2019Document45 pagesInjunction Dismissed - 2019modassir husain khanNo ratings yet

- Order - 10 Mar 2022Document6 pagesOrder - 10 Mar 2022Ankit SethiNo ratings yet

- 2011 11 109 45664 Order 02-Aug-2023Document1 page2011 11 109 45664 Order 02-Aug-2023Tanmay DeshmukhNo ratings yet

- Ram Setu OrderDocument3 pagesRam Setu OrderPGurusNo ratings yet

- 2021 13 1 31973 Order 08-Dec-2021Document3 pages2021 13 1 31973 Order 08-Dec-2021Ruksar PraweenNo ratings yet

- Signature Not VerifiedDocument2 pagesSignature Not VerifiedAmySinghNo ratings yet

- 2023 4 43 50362 Order 13-Feb-2024Document2 pages2023 4 43 50362 Order 13-Feb-2024R Radha KrishnanNo ratings yet

- 2021 34 10 30631 Order 05-Oct-2021Document2 pages2021 34 10 30631 Order 05-Oct-2021Annonymous SpiderNo ratings yet

- Ayodhya Order 1Document7 pagesAyodhya Order 1Santosh BhushanNo ratings yet

- About Seniority Supreme Court JudgementDocument3 pagesAbout Seniority Supreme Court JudgementK RamakrishnanNo ratings yet

- 8181 2020 31 4 22035 Order 13-May-2020Document2 pages8181 2020 31 4 22035 Order 13-May-2020Bhumica VeeraNo ratings yet

- 36631_2016_33_3_32879_Order_25-Jan-2022Document4 pages36631_2016_33_3_32879_Order_25-Jan-2022NExus KnOxNo ratings yet

- Babri Petitions TableDocument14 pagesBabri Petitions TableAhmadShazebAzharNo ratings yet

- UOI Vs Kiran Gems - SC Latest OrderDocument1 pageUOI Vs Kiran Gems - SC Latest OrderAmitoz SinghNo ratings yet

- Ram Janm Bhumi Babri Masjid - S U P R E M E C O U R T O F I N D I ADocument3 pagesRam Janm Bhumi Babri Masjid - S U P R E M E C O U R T O F I N D I ANaresh KadyanNo ratings yet

- Supreme Court JudgementDocument2 pagesSupreme Court JudgementThe WireNo ratings yet

- Signature Not VerifiedDocument5 pagesSignature Not VerifiedShivam PatelNo ratings yet

- Signature Not Verified: Digitally Signed by Jayant Kumar Arora Date: 2018.07.21 12:52:55 IST ReasonDocument5 pagesSignature Not Verified: Digitally Signed by Jayant Kumar Arora Date: 2018.07.21 12:52:55 IST ReasonPraveena VemulapalliNo ratings yet

- FICUS PAX PRIVATE LIMITED vs. UNION OF INDIA PDFDocument10 pagesFICUS PAX PRIVATE LIMITED vs. UNION OF INDIA PDFLAW SUITSNo ratings yet

- DocumentDocument75 pagesDocumentHarshitha NMNo ratings yet

- 389 2019 4 40 40709 Order 02-Jan-2023Document1 page389 2019 4 40 40709 Order 02-Jan-2023Arihant SamdariaNo ratings yet

- Nowhera Sheik vs. UOI - HYZODocument6 pagesNowhera Sheik vs. UOI - HYZOvijaygnluNo ratings yet

- Harinath Ram Vs Union of IndiaDocument2 pagesHarinath Ram Vs Union of IndiaSaakshi Singh RawatNo ratings yet

- SC Order On Ratio ChangeDocument2 pagesSC Order On Ratio ChangeinspvizagNo ratings yet

- Signature Not VerifiedDocument6 pagesSignature Not VerifiedVikas SareenNo ratings yet

- WP (C) 267/2012 Etc.: Signature Not VerifiedDocument7 pagesWP (C) 267/2012 Etc.: Signature Not VerifiedAnamika VatsaNo ratings yet

- Signature Not VerifiedDocument5 pagesSignature Not VerifiedVaibhav SharmaNo ratings yet

- Natasha Kohli Vs Mon Mohan KohliDocument46 pagesNatasha Kohli Vs Mon Mohan KohliRicha sharmaNo ratings yet

- Signature Not VerifiedDocument5 pagesSignature Not VerifiedVenkatesh SubbaRaoNo ratings yet

- Supreme Court On Arnab Goswami's Interim BailDocument3 pagesSupreme Court On Arnab Goswami's Interim BailThe Wire100% (1)

- Maharashtra State Cooperative Bank Limited v. Asst. PF CommisionerDocument2 pagesMaharashtra State Cooperative Bank Limited v. Asst. PF Commisionerhs0036870No ratings yet

- Yogesh Narayanrao 04.05.2022Document3 pagesYogesh Narayanrao 04.05.2022Sandeep DashNo ratings yet

- In The High Court of Delhi at New DelhiDocument2 pagesIn The High Court of Delhi at New DelhiAnil KumarNo ratings yet

- State Bank of India vs. Ericsson India (P) LTD., 2018 SCC OnLine SC 497Document5 pagesState Bank of India vs. Ericsson India (P) LTD., 2018 SCC OnLine SC 497ganapathilawsassociatesNo ratings yet

- Signature Not VerifiedDocument6 pagesSignature Not VerifiedAvinashNo ratings yet

- Order - 22-Apr-2019Document1 pageOrder - 22-Apr-2019Soorya BalaNo ratings yet

- 8 Judgement Order - 08.01.2020Document2 pages8 Judgement Order - 08.01.2020mp4sabmNo ratings yet

- 1984 Order 25-Sep-2018Document6 pages1984 Order 25-Sep-2018Bhojraj Vamanrao ChavanNo ratings yet

- SC 1Document3 pagesSC 1saitejatv9No ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not VerifiedSatrajit NeogNo ratings yet

- 421342016350141549order01 Feb 2023 458004Document8 pages421342016350141549order01 Feb 2023 458004Abha KatiyarNo ratings yet

- BinaModiv - LalitModi SLP DismissedDocument3 pagesBinaModiv - LalitModi SLP DismissedSuhani ChanchlaniNo ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not Verifiedmadhav225No ratings yet

- 2024 1 30 52884 Order 06-May-2024Document7 pages2024 1 30 52884 Order 06-May-2024Deep BhattcharyyaNo ratings yet

- Contextual Foundations of International Criminal Jurisprudence: Selected Cases an Insider’S PerspectiveFrom EverandContextual Foundations of International Criminal Jurisprudence: Selected Cases an Insider’S PerspectiveNo ratings yet

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)From EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)No ratings yet