Professional Documents

Culture Documents

Service Tax Notification No.11/2014 Dated 11th July, 2014

Service Tax Notification No.11/2014 Dated 11th July, 2014

Uploaded by

stephin k j0 ratings0% found this document useful (0 votes)

199 views2 pagesService Tax Notification No.11/2014 "Seeks to amend the Service Tax (Determination of Value) Rules, 2006 so as to prescribe the percentage of service portion in respect of works contracts, other than original works contract." Dated 11th July, 2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentService Tax Notification No.11/2014 "Seeks to amend the Service Tax (Determination of Value) Rules, 2006 so as to prescribe the percentage of service portion in respect of works contracts, other than original works contract." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

199 views2 pagesService Tax Notification No.11/2014 Dated 11th July, 2014

Service Tax Notification No.11/2014 Dated 11th July, 2014

Uploaded by

stephin k jService Tax Notification No.11/2014 "Seeks to amend the Service Tax (Determination of Value) Rules, 2006 so as to prescribe the percentage of service portion in respect of works contracts, other than original works contract." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

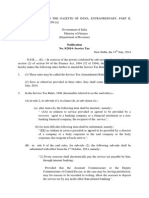

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

Government of India

Ministry of Finance

(Department of Revenue)

New Delhi, the 11

th

July, 2014

Notification

No. 11/2014 - Service Tax

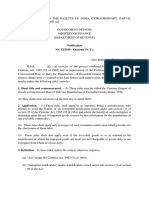

G.S.R.____ (E).- In exercise of the powers conferred by clause (aa) of sub-section (2) of

section 94 of the Finance Act,1994 (32 of 1994), the Central Government hereby makes the

following rules further to amend the Service Tax (Determination of Value) Rules, 2006,

namely:--

1. (1) These rules may be called the Service Tax (Determination of Value) Amendment

Rules, 2014.

(2) They shall come into force on the 1

st

day of October 2014.

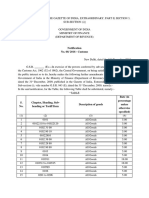

2. In the Service Tax (Determination of Value) Rules, 2006, in rule 2A, in clause (ii), for

sub-clauses (B) and (C), the following sub-clause shall be substituted, namely:--

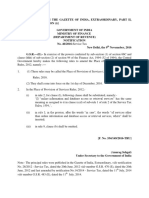

(B) in case of works contract, not covered under sub-clause (A), including works contract

entered into for,-

(i) maintenance or repair or reconditioning or restoration or servicing of any goods; or

(ii) maintenance or repair or completion and finishing services such as glazing or

plastering or floor and wall tiling or installation of electrical fittings of immovable

property,

service tax shall be payable on seventy per cent. of the total amount charged for the works

contract.

[F. No. 334 /15 /2014 -TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Note:- The principal rules were notified vide notification No.12/2006-Service Tax, dated the

19

th

April, 2006, published in the Gazette of India, Extraordinary, vide number G.S.R.228

(E), dated the 19

th

April, 2006 and last amended by notification No.24/2012-Service Tax,

dated the 6

th

June, 2012, vide number G.S.R.431(E),dated the 6

th

June, 2012.

You might also like

- RR 2-98 - AmendmentsDocument196 pagesRR 2-98 - AmendmentsArchie Guevarra100% (2)

- in The Export of Services Rules, 2005, in Rule 3, in Sub-Rule (1), in Clause (Ii)Document9 pagesin The Export of Services Rules, 2005, in Rule 3, in Sub-Rule (1), in Clause (Ii)shreyansghorawatNo ratings yet

- Service Tax Notification No.09/2014 Dated 11th July, 2014Document2 pagesService Tax Notification No.09/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Explanation 2.-New Levy or Tax Shall Be Payable On All The Cases Other Than SpecifiedDocument1 pageExplanation 2.-New Levy or Tax Shall Be Payable On All The Cases Other Than SpecifiedabracadabraNo ratings yet

- Notification No.09/2013 - Service TaxDocument2 pagesNotification No.09/2013 - Service Taxmaahi7No ratings yet

- Vide Number G.S.R. 483 (E), Dated The 11: TH THDocument1 pageVide Number G.S.R. 483 (E), Dated The 11: TH THSushant SaxenaNo ratings yet

- 02 2024 CT EngDocument1 page02 2024 CT EngSSSARMANo ratings yet

- Customs Tariff Notification No.25/2014 Dated 11th July, 2014Document1 pageCustoms Tariff Notification No.25/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Service Tax-Point of TaxationDocument1 pageService Tax-Point of TaxationNamrata Parakh MarothiNo ratings yet

- 27 Aug 2014 Circular NoDocument3 pages27 Aug 2014 Circular NockzeoNo ratings yet

- csnt71 2013Document1 pagecsnt71 2013stephin k jNo ratings yet

- st06 2012Document1 pagest06 2012Hardik PatelNo ratings yet

- 2 Notifications Cic CD - Conversion ChargesDocument9 pages2 Notifications Cic CD - Conversion ChargesSushil TyagiNo ratings yet

- Service Tax Notification No.07/2014 Dated 11th July, 2014Document3 pagesService Tax Notification No.07/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Service Tax Exemption in IndiaDocument38 pagesService Tax Exemption in IndiaAnonymous it4wrfEOdNo ratings yet

- ICT (Tax On Services) Updated Upto 15.01.2022Document15 pagesICT (Tax On Services) Updated Upto 15.01.2022Zafar IqbalNo ratings yet

- Paper 8: Indirect Tax Laws Statutory Update For May 2022 ExaminationDocument25 pagesPaper 8: Indirect Tax Laws Statutory Update For May 2022 Examinationparam.ginniNo ratings yet

- Tamil Nadu Government Gazette: Part III-Section 1 (B)Document3 pagesTamil Nadu Government Gazette: Part III-Section 1 (B)Murali VNo ratings yet

- Service Tax Rules 1994Document92 pagesService Tax Rules 1994Rishi DebNo ratings yet

- Act 20 of 2020Document8 pagesAct 20 of 2020Kriti KumarNo ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- DTT PDFDocument4 pagesDTT PDFVivek S MayinkarNo ratings yet

- SSI Exemption Under Service TaxDocument12 pagesSSI Exemption Under Service Taxdhananjay12031978No ratings yet

- CostAudit Rules 30nov2012Document3 pagesCostAudit Rules 30nov2012Saibaba YadavNo ratings yet

- 2023741475729233icto30 06 2023Document17 pages2023741475729233icto30 06 2023areebamushtaq717No ratings yet

- Amendments in Service TaxDocument15 pagesAmendments in Service TaxShankar NarayananNo ratings yet

- Hra Cca RuleDocument5 pagesHra Cca Rulebinod12340% (1)

- THE (With Holding) Rules, 2007: Sales Tax Special ProcedureDocument12 pagesTHE (With Holding) Rules, 2007: Sales Tax Special ProcedureParvez RaeesNo ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- Customs 2013Document1 pageCustoms 2013api-246792629No ratings yet

- Islamabad Capital Territory (Tax On Services) Ordinance, 2001Document12 pagesIslamabad Capital Territory (Tax On Services) Ordinance, 2001Bilal KhanNo ratings yet

- Central Excise Tariff Notification No.15/2014 Dated 11th July, 2014Document2 pagesCentral Excise Tariff Notification No.15/2014 Dated 11th July, 2014stephin k jNo ratings yet

- TH TH: Explanation.-For The Purposes of This ClauseDocument4 pagesTH TH: Explanation.-For The Purposes of This ClauseAks SomvanshiNo ratings yet

- And The of For: Irrigation LimitsDocument5 pagesAnd The of For: Irrigation LimitsPraneeth Reddy JunnuthulaNo ratings yet

- Notfctn 02 2020 CGST Rate EnglishDocument1 pageNotfctn 02 2020 CGST Rate Englishdinesh kasnNo ratings yet

- ICT Ordinance 2001 (Tax On Services) Updated Upto 30.06.2015Document12 pagesICT Ordinance 2001 (Tax On Services) Updated Upto 30.06.2015Muhammad MudasserNo ratings yet

- Changes in GST LawDocument31 pagesChanges in GST LawSUNIL PUJARINo ratings yet

- 01 2023 CT EngDocument1 page01 2023 CT Engcadeepaksingh4No ratings yet

- Notfctn 02 2021 2020 CGST RateDocument2 pagesNotfctn 02 2021 2020 CGST RateJatinMittalNo ratings yet

- Notification No. 33 of 2012 Service TaxDocument3 pagesNotification No. 33 of 2012 Service TaxAntyoday IndiaNo ratings yet

- Islamabad Capital Territory (Tax On Services) Ordinance 2001Document12 pagesIslamabad Capital Territory (Tax On Services) Ordinance 2001Aqib JavaidNo ratings yet

- NTPC Service TaxDocument4 pagesNTPC Service TaxLakshmi YechuriNo ratings yet

- ExnotestDocument4 pagesExnotestaNo ratings yet

- st17 2014Document1 pagest17 2014hqpoolkolsouthNo ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- cs09 2013Document2 pagescs09 2013stephin k jNo ratings yet

- st01 2017Document1 pagest01 2017Rajula Gurva ReddyNo ratings yet

- Notification No.23/2009 - Service Tax New Delhi, The 7 July, 2009Document1 pageNotification No.23/2009 - Service Tax New Delhi, The 7 July, 2009AMIT GUPTANo ratings yet

- 201208081223441615851MNP Regulation24nov10Document3 pages201208081223441615851MNP Regulation24nov10krishanfriendz9099No ratings yet

- Compensation Cess02 2021 Rate EngDocument1 pageCompensation Cess02 2021 Rate EngHemant SinhmarNo ratings yet

- Highlights of Key Changes in GST W.E.F January 01, 2022Document5 pagesHighlights of Key Changes in GST W.E.F January 01, 2022sumathiravirajNo ratings yet

- Building Rules 2017Document313 pagesBuilding Rules 2017Raghu Ram86% (21)

- 23 III 1a 2024Document3 pages23 III 1a 2024mesapatomia mNo ratings yet

- Taxguru - In-Companies Share Capital and Debentures Amendment Rules 2021Document2 pagesTaxguru - In-Companies Share Capital and Debentures Amendment Rules 2021Riya Shankar SharmaNo ratings yet

- Notfn 12 2019Document2 pagesNotfn 12 2019Sri CharanNo ratings yet

- Tarif PPH Final Per 21 Feb 2022Document13 pagesTarif PPH Final Per 21 Feb 2022Micco ElfandiNo ratings yet

- 73974bos59825 GSTDocument52 pages73974bos59825 GSTchashmishbabaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNo ratings yet

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jNo ratings yet

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNo ratings yet

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jNo ratings yet

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Document1 pageDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jNo ratings yet

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Document15 pagesDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jNo ratings yet

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Document3 pagesDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jNo ratings yet