Professional Documents

Culture Documents

Indian Stock Market An Overview

Indian Stock Market An Overview

Uploaded by

carthik19Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Stock Market An Overview

Indian Stock Market An Overview

Uploaded by

carthik19Copyright:

Available Formats

INDIAN STOCK MARKET:

AN OVERVIEW

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

Stock Market

Primary Market Secondary Market

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

PRIMARY MARKET

IPO vs Seasoned Issues

Pricing of issues

Fixed pricing

Book building

Public offer vs Private placement

Demat issues

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

PRICING OF ISSUES

Companies eligible to make public issue can freely

price their equity shares or any security.

Fixed Price

Book Building

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

FIXED PRICE

In the fixed-price issue method, the issuer

fixes the issue price well before the actual

issue. For this very reason, it is cautious

and conservative in pricing the issue so that

the issue is fully subscribed. Underwriters

also do not like the issue to devolve on them

and hence favour conservative pricing of the

issue. For these practical reasons, the issue

price in the case of traditional fixed price

method generally errs on the lower side

and, therefore, in the investors favour.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

BOOK BUILDING

Book-building is a process of price discovery used

in public offers. The issuer sets a floor price and a

band within which the investor is allowed to bid for

shares.

The upper price of the band can be a maximum of

1.2 times the floor price.

The investor had to bid for a quantity of shares he

wished to subscribe to within this band.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

BOOK BUILDING

Bids to remain open for at least 5 days

Only electronic bidding is permitted

Bidding demand is displayed at the end of every

day.

The lead manager analyses the demand generated

and determines the issue price or cut-off price in

consultation with the issuer.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

CUT-OFF PRICE

The cut-off price is the price discovered by

the market. It is the price at which the

shares are issued to the investors.

Investors bidding at a price below the cut-off

price are ignored.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

Lets say a company wants to issue

10,00,000 shares. The floor price for one

share of face value, Rs10, is Rs48 and the

band is between Rs48 and Rs55.

At Rs55, on the basis of bids received, the

investors are ready to buy 2,00,000 shares.

So the cut-off price can not be set at Rs55

as only 2 lacs shares will be sold.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

So as a next step, the price is lowered to

Rs54. At Rs54, investors are ready to buy 4

lacs shares. So if the cut-off price is set at

Rs54, 6 lacs shares will be sold. This still

leaves 4 lacs shares to be sold.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

The price is now lowered to Rs53. At Rs53,

investors are ready to buy 4 lacs shares.

Now if the cut-off price is set at Rs53, all ten

lacs shares will be sold.

Investors who had applied for shares at

Rs55 and Rs54 will also be issued shares at

Rs53.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

FIXED PRICE VS. BOOK BUILDING

Fixed Price Book Building

1. The price is known in advance

to investor and the demand is

known at close of the issue.

2. Conservative pricing (Low

price)

3. Generally oversubscribed

4. It favours the investors

1. Demand can be known at the

end of every day but price is

known at the close of issue.

2. Aggressive pricing (High

Price)

3. No pressure of unsatisfied

demand in the market.

4. It favours the issuers.

www.pptmart.com

BOOK BUILDING

Objective is efficient price discovery.

Asymmetric information between promoter and

investors.

Investors always remain in dark.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

PRIVATE PLACEMENT

It involves issues of securities to a limited number of

subscribers, such as banks, FIs, MFs and high net worth

individual.

It is arranged through a merchant banker, an agent of issuers,

who brings together the issuers and investor(s).

Securities offered are exempt from public disclosers

regulations and registration requirements of the regulatory

body.

This market is preferred by small and medium size firms,

particularly new entrants who do not have track record of

performance.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

PRIVATE PLACEMENT VS PUBLIC ISSUES

Private Placement Public Issues

1. Issues are offered to mature

and sophisticated institutional

investors.

2. No discloser requirements.

3. Issues are not screened and

this increases the risk.

1. Issues are primarily offered to

retail investors.

2. Discloser requirement is

there.

3. All issues are screened.

www.pptmart.com

DEMATERIALISATION OF SHARES:

Trading in the shares of the Company is

compulsory in dematerialized form for all investors.

The Company has, therefore, enlisted its shares

with both the depositories, viz, National Securities

Depository Limited (NSDL) and Central Depository

Services India Limited (CDSL).

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

WHAT IS DEMATERIALISATION?

Dematerialisation is a process by which the

physical share certificates of an investor are

taken back by the Company and an

equivalent number of securities are credited

in electronic form at the request of the

investor.

An investor will have to first open an

account with a Depository Participant so

that the dematerialised holdings can be

credited into that account.

This is very similar to opening a Bank

Account.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

WHAT IS A DEPOSITORY?

A Depository (NSDL & CDSL) is an organisation

like a Central Bank where the securities of a

shareholder are held in the electronic form at the

request of the shareholder through the medium of a

Depository Participant.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

WHO IS A DEPOSITORY PARTICIPANT?

A Depository Participant (DP) is your

representative (agent) in the depository

system providing the link between the

Company and you through the Depository.

While the Depository can be compared to a

Bank, DP is like a branch of your bank with

whom you can have an account.

According to SEBI guidelines, Financial

Institutions like banks, stockbrokers etc. can

become participants in the depository.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

HOW DOES THE DEPOSITORY SYSTEM

OPERATE?

The Depository System functions very much

like the banking system.

A bank holds funds in accounts whereas a

Depository holds securities in accounts for

its clients.

A Bank transfers funds between accounts

whereas a Depository transfers securities

between accounts.

In both systems, the transfer of funds or

securities happens without the actual

handling of funds or securities.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

SECONDARY MARKET

Trading

Clearing &Settlement

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

TRADING

Cash Trading

Spot Trading

Forward, future (derivative trading)

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

TRADING

The NSE trading system called 'National Exchange

for Automated Trading' (NEAT) is a fully automated

screen based trading system.

It is on line and nationwide trading system.

It adopts the principle of an order driven market.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

TRADING MECHANISM

In this system a member can punch into the

computer quantities of securities and prices at

which he likes to transact.

The transaction is executed as soon as it finds a

matching sale or buy order from a counter party.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

TRADING MECHANISM

A single consolidated order book for each

stock displays, on a real time basis, buy and

sell orders originating from all over the

country.

The book stores only limit orders, which are

orders to buy or sell shares at a stated

quantity and stated price.

The limit orders are executed only if the

price quantity conditions match.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

THE LIMIT ORDER BOOK FOR TITAN ON THE

NSE (ON 12 APRIL, 2005, AT 11.00 A.M.)

Buy Qty Buy Price Sell Price Sell Qty

95

25

100

10

150

237.25

237.20

237.15

237.10

237.00

237.70

237.90

238.00

238.20

238.25

129

72

827

50

10

www.pptmart.com

One can buy a share by paying Rs237.7 and sell a

share at Rs 237.25.

The difference is the bid-ask spread.

There is one potential complication to this simple

scenario.

The prices of Rs237.25 and Rs237.7 actually

represent commitments to trade up to a specified

number of shares.

If somebody wants to buy 150 shares, what will

happen?

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

LIMIT ORDERS

Investors may also place limit orders, whereby they

specify prices at which they are willing to buy or sell

a security.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

LIMIT ORDERS

Condition

Action

Price below

the limit

Price above

the limit

Buy Limit-buy

Order

Stop-Buy

Order

Sell Stop-Loss

Order

Limit-Sell

Order

www.pptmart.com

Limit-buy Order and Limit-Sale order

Limit-buy Order

If the stock falls below the limit on a limit-buy order then

the trade is to be executed.

See the price list of Titan: Somebody has placed a buy

order for 25 shares of Titan at Rs237.2 per share.

If price falls to Rs237.2 (from its current level of

Rs237.25), then this buy order will be executed.

Limit-Sale order?

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

What happens if a limit order is placed between the

quoted bid and ask prices?

Suppose you have instructed your broker to buy

Titan at a price of Rs237.4 or better.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

TRADING MECHANISM

The trading system provides tremendous flexibility

to the issuers in terms of kinds of orders that can be

placed on the system.

Several time related (Good-till-Cancelled, Good-till-

Day, Immediate-or-Cancel), and

Price-related (buy/sell limit and stop-loss orders)

conditions can be easily built into an order.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

STOP-LOSS ORDERS

It is an order placed with a broker to sell once the

stock reaches a certain price.

A stop-loss is designed to limit an investor's loss on

a security position.

Setting a stop-loss order for 10% below the price at

which you bought the stock will limit your loss to

10%.

For example, let's say you just purchased ACC at

Rs50 per share. Right after buying the stock you

enter a stop-loss order for Rs45. This means that if

the stock falls below Rs45, your shares will then be

sold at the prevailing market price.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

MARKET TIMINGS

Trading on the equities segment takes place

on all days of the week (except Saturdays

and Sundays and holidays declared by the

Exchange in advance). The market timings

of the equities segment are:

Normal Market Open : 09:55 hours

Normal Market Close : 15:30 hours

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

CLEARING AND SETTLEMENT PROCESS AT NSE

NSE

1

DEPOSITORIES 8 NSCCL 9 CLEARING

BANK

6 7

10 5 2 3 4 11

CUSTODIAN / DP

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

CLEARING AND SETTLEMENT PROCESS

1. Trade details from Exchange to NSCCL

2. NSCCL notifies the consummated trade details to

custodians who

affirm back. Based on the affirmation, NSCCL determines

obligations.

3. Download of obligation and pay-in advice of funds/

securities.

4. Instructions to clearing banks to make funds available by

pay-in-

time.

5. Instructions to depositories to make securities available by

pay-in-

time.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

CLEARING AND SETTLEMENT PROCESS

6. pay-in of securities (NSCCL advises depository to debit

pool

account of custodians and credit its account and depository

does

it).

7. pay-in of funds (NSCCL advises Clearing Banks to debit

account

of custodians and credit its account and clearing bank does

it).

8. Pay-out of securities (NSCCL advises depository to credit

pool

account of custodians and debit its account and depository

does

it).

9. Pay-out of funds (NSCCL advises Clearing Banks to credit

account of custodians and debit its account and Clearing

Banks

does it).

10. Depository informs custodians

11. Clearing Banks inform custodians

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

CLEARING AND SETTLEMENT PROCESS

Custodians ( for A who is buyer and for B who is seller)

Clearing bank records the following entries:

(for 7) Custodian ( for A) A/C Dr

To NSCCL A/C

(for 9) NSCCL A/C ..Dr

To Custodian (for B) A/C

Depositories record the following entries (shares):

(for 6) Custodian ( for B) A/C Dr

To NSCCL A/C

(for 8) NSCCL A/C ..Dr

To Custodian (for A) A/C

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

SETTLEMENT CYCLE

ROLLING SETTLEMENT

At NSE and BSE, trades in rolling

settlement are settled on a T+2 basis i.e. on

the 2nd working day.

For arriving at the settlement day all

intervening holidays, which include bank

holidays, NSE holidays, Saturdays and

Sundays are excluded.

Typically trades taking place on Monday are

settled on Wednesday, Tuesday's trades

settled on Thursday and so on.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

A TABULAR REPRESENTATION OF THE SETTLEMENT CYCLE FOR ROLLING

SETTLEMENT

Activity Day

Trading Rolling Settlement

Trading

T

Clearing Custodial

Confirmation

T+1 working days

Settlement Securities and Funds

pay in

Securities and Funds

pay out

T+2 working days

T+2 working days

www.pptmart.com

INDEX-BASED MARKET-WIDE CIRCUIT BREAKERS

(W.E. FROM JULY 2001)

The index-based market-wide circuit

breaker system applies at 3 stages of the

index movement, either way viz. at 10%,

15% and 20%.

These circuit breakers when triggered, bring

about a coordinated trading halt in all equity

and equity derivative markets nationwide.

The market-wide circuit breakers are

triggered by movement of either the BSE

Sensex or the NSE S&P CNX Nifty,

whichever is breached earlier.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

DURATION OF TRADING HALT (IN MINUTES)

% movement

in either

indices in

either

direction

Before 1 p.m. 1 p.m. to 2

p.m.

2 p.m. to 2.30

p.m.

After 2.30

p.m.

10 60 30 30 No halt

15 120 60 Trading halt

for the

remainder of

the day

Trading halt

for the

remainder of

the day

20 Trading halt

for the

remainder of

the day

Trading halt

for the

remainder of

the day

Trading halt

for the

remainder of

the day

Trading halt

for the

remainder of

the day

www.pptmart.com

RISK MANAGEMENT

MARGIN MONEY

Categorisation of stocks for imposition of margins

The Stocks which have traded atleast 80% of the

days for the previous six months shall constitute the

Group I and Group II.

Out of the scrips identified above, the scrips having

mean impact cost of less than or equal to 1% shall

be categorized under Group I and the scrips where

the impact cost is more than 1, shall be categorized

under Group II.

The remaining stocks shall be classified into Group

III.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

The impact cost shall be calculated on the

15th of each month on a rolling basis

considering the order book snapshots of the

previous six months. On the basis of the

impact cost so calculated, the scrips shall

move from one group to another group from

the 1st of the next month.

For securities listed for < 6 months, the

trading frequency and the impact cost shall

be computed using the entire trading history

of the security.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

WHAT IS IMPACT COST?

What is impact cost? It is the cost of executing a

transaction on the stock exchanges.

Suppose you want to buy 150 shares of Titan.

You would be able to buy the first 129 shares at a price of

Rs237.7 per share. However, to buy the remaining 21

shares, you have to pay Rs237.9 per share. The higher

the number of shares that you want to buy will have an

impact on the price of the stock.

This is measured by what is known as the impact cost of

the trade.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

The average buy price for 150 shares=

(Rs237.7x129 + Rs237.9x21)/150 = Rs237.728

The average of the best bid and ask price is given

by Rs 237.475.

You should ideally expect to buy or sell shares of

Titan at this price.

The impact cost of the order is therefore given by:

Impact cost = (237.728 237.475)/237.475

= 0.106%

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

What does impact cost signify?

It means you incurred a cost of 0.106% to buy 150

shares because of the liquidity conditions in that

stock. The more liquid a stock is the lower its

impact cost.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

VALUE AT RISK MARGIN

Security VaR Margin

Group I The scrip wise daily volatility calculated using the

exponentially weighted moving average (EWMA)

method on daily return.

The scrip wise daily VaR margin would be 3.5

times the volatility so calculated subject to a

minimum of 7.5%.

Group II The VaR margin shall be higher of scrip VaR (3.5

sigma) or the index VaR (3 sigma), and it shall

be scaled up by square root of 3.

Group III

The VaR margin = 5 x the index VaR x 3.

www.pptmart.com

INDEX VAR

The index VaR would be the higher of the

daily Index VaR based on S&P CNX NIFTY or

BSE SENSEX. The index VaR would be

subject to a minimum of 5%.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

COMPUTATION VAR

Calculate the daily logarithmic return of share

R

i

= In (P

i

/ P

i-1

)

Compute the initial volatility by calculating the

standard deviation of returns for the one year

period using the formula

SD =

0

= [ 1/n {R

i

E(R

i

)}

2

]

n

i 1

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

Calculate the daily volatility for he subsequent days

using EWMA mothod.

For day 1, the volatility will be

1

= [ (

0

)

2

+ (1 ) R

1

2

]

For day 2, the volatility will be

2

= [ (

1

)

2

+ (1 ) R

2

2

]

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

Daily VaR for individual scrip = 3.5 sigma

Daily Var for index = 3 sigma

A higher SD level is used for the script because the

script is expected to have higher volatility as

compared to the index, which is a portfolio. The

volaility estimate at 3 sigma level represents 99%

VaR.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

BUYING ON MARGIN

SEBI approved margin trading in January 2004 and

it was introduced in February 2004 in India.

If you have a margin account with kotakstreet.com

and your margin account balance is Rs10,000, then

you can buy shares up to Rs40,000.

Effectively kotakstreet.com provides you with a loan

of Rs30,000 to complete your transaction.

The margin in the account is the portion of the

purchase price contributed by the investor; the

reminder is borrowed from the broker.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

PERCENTAGE MARGIN

Suppose that the investor initially pays Rs6,000 toward the

purchase of Rs10,000 worth of stock (100 shares of Rs100

each), borrowing the remaining Rs4,000 from the broker.

The initial balance sheet looks like this:

Assets Liabilities and Owners

Equity

Value of stock Rs10,000 Loan from broker Rs4,000

Equity 6,000

The initial percentage of margin is

Margin = Equity/value of stock = 6000/10,000 = 0.60

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

If the stocks price declines to Rs70 per share, the account

balance becomes:

Assets Liabilities and Owners

Equity

Value of stock Rs7,000 Loan from broker Rs4,000

Equity 3,000

The percentage of margin is now

Margin = Equity/value of stock = 3000/7,000 = 0.43 or 43%

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

MAINTENANCE MARGIN

Suppose the maintenance margin is 30%. How far could the

stock price fall before the investor would get a margin call?

Let P be the price of the stock. The value of the investors 100

shares is then 100P, and the equity in his or her account is

100P-Rs4,000.

Thus we can say

(100P-4000) / 100P = 0.3

Or P = Rs57.14

If the price of the stock were to fall below Rs57.14 per share,

the investor would get a margin call.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

SHORT SELLING

Short selling is generally defined as the practice of

selling borrowed securities.

Suppose, A feels current market price of a share is

Rs.50 and it will reduce Rs.25. He takes loan of a

share.

Sell Rs.50

Buy Rs.25 and return the share

Profit Rs.25

Maximum profit is 50 if price is zero, but, maximum

loss is unlimited.

Dividend: If dividend is Rs.5, profit Rs.25 5 = 20.

Then dividend is to be paid by the short seller to the

lender of the share.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

USES OF SHORT SELLING:

Investors short sell for one of two reasons:

1. To seek speculative profit when the price of a

security is expected to drop.

2. To protect a profit and defer taxes by Hedging

their position.

All shorts are executed on

margin.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

SHORTING OR MARGIN:

The investor has to deposit only margin

money.

Return on Invested Capital from Short Sale

= (Proceeds from Sales Purchase Cost of Share Dividend)/Equity

Deposit

Suppose margin is 60% ( initial margin),

Current market price of a share is Rs.100,

and it is expected to reduce to Rs80.

Dividend is Rs.5

Return = (100 80 5)/60 = 15/60 = 25%

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

SPECULATING WITH SHORT

SALE:

Short Sale Initiated: 300 Equity Share @ Rs50 =

Rs15000

Short Sale Covered: 300 x Rs30 =

9000

Profit = 6000

Dividend @ Rs.5 =

1500

N/Profit =

4500

Equity Deposit @ 50% =

7500

Return

= (4500/7500) x 100 = 60%

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

MARGIN CALLS ON SHORT POSITIONS

Suppose that you are bearish on ACC stock

and that its current market price is Rs100

per share. You tell your broker to sell short 1

share. The broker borrows 1 share either

from another customers account or from

another broker.

Suppose the broker has a 50% margin

requirement on short sales. This means that

you must have either cash or security in

your account worth Rs50 that can serve as

margin on the short sale.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

Like investors who purchase stock on margin, a

short-seller must be concerned about margin call. If

the stock price rises, the margin in the account will

fall; if margin falls to the maintenance level, the

short-seller will receive a margin call.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

Suppose that the broker has a maintenance margin

of 30% on short sales. This means that the equity in

your account must be at least 30% of the value of

your short position at all times. How far can the

price of ACC go up before you get a margin call?

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

Suppose price has increased to P (where P>100).

The loss on short sales is P 100.

Then the margin money has reduced to 50 (P -

100).

This reduced margin money is 30% of P.

Thus, 50 (P -100) = .3 P

Or 150 P = .3P

Or 1.3 P = 150

Or P 115.38.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

If ACC stock should rise above Rs115.38,

you would get a margin call, and you will

either have to put up additional cash or

cover your short position.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

STOP-BUY ORDER

You have sold ACC on short for Rs100.

If the share price falls, you will profit from short

sale.

On the other hand, if the share price rises, lets say

Rs130, you will lose Rs30 per share.

But suppose that when you initiate the short sale,

you also enter a stop-buy order at Rs120.

The stop-buy order will be executed if the share

price surpasses Rs120, thereby limiting your losses

to Rs20 per share.

The stop-buy order thus provides protection to the

short-seller if the share price moves up.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

SHORT SALES TO PROTECT A PROFIT AND

DEFER TAXES BY HEDGING THEIR POSITION:

01.01.2005

Bought 100 Shares of X Company @ Rs.20 Cost

Rs.2000

Now Price Rs.50 Value

Rs.5000

Net Profit

Rs.3000

To protect Net Profit, he will now short sales of 100 shares @

Rs.50.

He has two positions one short and one long of equity shares.

Note that although this short sales is executed with borrowed

securities, it is not necessary to deposit margin money,

because his current holding of the stock serves this purpose.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

SHORT SALES TO PROTECT A PROFIT AND

DEFER TAXES BY HEDGING THEIR POSITION:

Price Rs.80 Price

Rs.30

Value of the Stock 8000

3000

Original Cost 2000

2000

___________

____________

Profit 6000

1000

Less Loss on short sales

(Add profit on Short Sales)

Short Sales Initiated 5000 5000

Short Sales Covered 8000 3000

________ ________

(-)3000

+2000

________

_______

NET PROFIT 3,000

3,000

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

SHORT-SALES MAY BE

REINTRODUCED

Why SEBI is planning to reintroduce Short-sales?

When it was banned?

How does short- sale help the market?

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

Indian Security Market

A profile

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

GROWTH AND DEVELOPMENT OF INDIAN

STOCK MARKET (BSE)

AVERAGE DAILY TURNOVER

0

500

1000

1500

2000

2500

3000

3500

4000

4500

95 96 97 98 99 00 01 02 03 04

Year

A

v

e

r

a

g

e

D

a

i

l

y

V

o

l

.

o

f

T

u

r

n

o

v

e

r

(

R

s

.

c

r

)

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

NO. OF COS LISTED

5300

5400

5500

5600

5700

5800

5900

6000

98 99 00 01 02 03 04

Year

N

o

.

o

f

L

i

s

t

e

d

C

o

m

p

a

n

i

e

s

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

MARKET CAPITALIZATION

0

200000

400000

600000

800000

1000000

1200000

1400000

95 96 97 98 99 00 01 02 03 04

Year

M

a

r

k

e

t

C

a

p

i

t

a

l

i

z

a

t

i

o

n

(

R

s

c

r

)

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

INTERNATIONAL SCENARIO AT END DECEMBER 2001

(SOURCE: S&P EMERGING STOCK MARKET FACT BOOK, 2002)

Particulars USA UK Japan Germany Singapor

e

Hong

kong

China India

No. of listed Cos. 6,355 1,923 2,471 988 386 857 1,160 5,795

Market capitalisation

($ Bn.)

13,810 2,217 2,252 1,072 117 506 524 110

Turnover ($ Mn.)

29,041

1,872

1,826

1,420

63

196

449

249

Turnover ratio (%)

201.3

78.4

67.9

124.7 46.9

34.8 81.3 191.4

www.pptmart.com

MARKET CAPITALIZATION AND TURNOVER OF MAJOR MARKETS (US $

MILLION)

(SOURCE: S&P EMERGING STOCK MARKET FACT BOOK, 2002)

Country/Region MC

1990

MC

2000

MC

2001

TO

1990

TO

2000

TO

2001

Developed

Markets

Australia

Japan

UK

USA

8,795,239

108,879

2,917,679

848,866

3,059,434

29,614,264

372,794

3,157,222

2,576,992

15,104,037

25,246,554

374,269

2,251,814

2,217,324

13,810,429

4,616,473

40,113

1,602,388

278,740

1,751,252

43,912,999

226,325

2,693,856

1,835,278

31,862,485

39,676,018

240,667

1,826,230

1,871,894

29,040739

All Emerging

Markets

China

India

Indonesia

Korea

Malaysia

Philippines

Taiwan

604,420

-

38,567

8,081

110,594

48,611

5,927

1,00,710

2,608,486

580,991

148,064

26,834

148,649

116,935

51,554

247,602

2,572,064

523,952

110,396

23,006

220,046

120,007

41,523

292,621

898,233

-

21,918

3,992

75,949

10,871

1,216

715,005

3,956,869

721,538

509,812

14,311

1,067,669

58,500

8,196

983,491

2,400,844

448,928

249,298

9,667

703,960

20,772

3,148

544,808

World Total

US as % of

World

India as % of

World

9,399,659

32.55

0.41

32,222,750

46.87

0.46

27,818,618

49.64

0.40

5,514,706

31.76

0.40

47,869,867

66.56

1.06

42,076,862

69.02

0.59

www.pptmart.com

SAVINGS OF HOUSEHOLD SECTOR IN FINANCIAL

ASSETS

According to RBI data, household sector accounted

for 89% of gross domestic savings during 2000-01,

53% of their savings were in financial assets.

They invested

44% of financial savings in deposits

34% in insurance/PFs

12 % on small savings

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

SAVINGS OF HOUSEHOLD SECTOR IN FINANCIAL ASSETS

(SOURCE:RBI)

Financial Assets 1990-91 1992-93 1994-95 1996-97 1998-99 2000-01

Currency

Fixed income securities

Deposits

Insurance/PF

Small savings

Securities Market

MFs

Govt. Securities

Other Securities

10.6

74.9

33.3

28.4

13.2

14.4

9.1

0.2

5.1

8.2

74.6

42.5

27.2

4.9

17.2

8.6

0

8.6

10.9

77.0

45.5

22.5

9.0

12.1

3.8

0.1

8.2

8.6

84.5

48.1

29.4

7.0

6.9

2.7

0.4

3.8

10.4

85.3

39.2

33.3

12.8

4.2

1.9

0.6

1.7

6.4

89.4

44.3

33.5

11.6

4.3

1.3

1.6

1.4

Total 100 100 100 100 100 100

www.pptmart.com

STOCK MARKET INDEX

All India All Industries Share Price Index combined

and published by the Economic Times on daily

basis.

S&P CNX Nifty combined and published by NSE

India on daily basis.

BSE Sensex combined and published by BSE on

daily basis.

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

COMBINED MARKET INDEX AND RETURN OF ECONOMIC TIMES

AND NIFTY FROM MAY 1961 TO JUNE 2005

0

500

1000

1500

2000

2500

Market Index

-.2

-.1

.0

.1

.2

Market Return

65 02

68 72

76 80 84 89 94 98 92

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

ECONOMIC TIMES DAILY PRICES AND RETURNS FROM MAY 1961 TO JUNE

1990

0

100

200

300

400

500

600

Economic Times Price

-.08

-.04

.00

.04

.08

Economic Times Return

61 65 68 72

76 80

84 89

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

NIFTY PRICES AND RETURNS FROM JULY 1990 TO JUNE 2005

0

500

1000

1500

2000

2500

1992 1994 1996 1998 2000 2002 2004

Nifty Price

-.2

-.1

.0

.1

.2

Nifty Return

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

CONDITIONAL STANDARD DEVIATION OF THE COMBINED INDICES OF THE

ECONOMIC TIMES AND S&P CNX NIFTY (MAY 1961 TO JUNE 2005)

ESTIMATED ON THE CONDITIONAL VARIANCE EQUATION OF TGARCH (1,1)

.00

.01

.02

.03

.04

.05

.06

.07

.08

Conditional standard deviation

65 70 75 80 90 92 02 85 97

w

w

w

.

p

p

t

m

a

r

t

.

c

o

m

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Tuscan Lifestyles CalculationsDocument2 pagesTuscan Lifestyles Calculationsngeevarg0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- QC KraDocument46 pagesQC KraPalla Bhaskara Rao83% (6)

- Sub: SH Jagdish Kumar DO (Expired) - Detail of Terminal Dues and Dues/loans OutstandingDocument1 pageSub: SH Jagdish Kumar DO (Expired) - Detail of Terminal Dues and Dues/loans OutstandingSpUnky RohitNo ratings yet

- (WWW - Entrance-Exam - Net) - SBI BANK Clerk Solved Exam PaperDocument7 pages(WWW - Entrance-Exam - Net) - SBI BANK Clerk Solved Exam PaperSpUnky Rohit0% (1)

- TDS On SalariesDocument3 pagesTDS On SalariesSpUnky RohitNo ratings yet

- Punjab Technical University, JalandharDocument1 pagePunjab Technical University, JalandharSpUnky RohitNo ratings yet

- Corporate Debt Market: Developments, Issues & Challenges: Efficient Allocation of ResourcesDocument11 pagesCorporate Debt Market: Developments, Issues & Challenges: Efficient Allocation of ResourcesManmeetSinghNo ratings yet

- Strategic Management - An IntroductionDocument26 pagesStrategic Management - An IntroductionSpUnky RohitNo ratings yet

- Organisational ChangeDocument209 pagesOrganisational ChangeSasirekha89% (27)

- Punjab Technical University, JalandharDocument1 pagePunjab Technical University, JalandharSpUnky RohitNo ratings yet

- A Presentation On Infosys BYDocument40 pagesA Presentation On Infosys BYSpUnky RohitNo ratings yet

- Presentation: Role of State in Developing Debt MarketsDocument21 pagesPresentation: Role of State in Developing Debt MarketsSpUnky RohitNo ratings yet

- Corporat Bond Market RK v11Document11 pagesCorporat Bond Market RK v11SpUnky RohitNo ratings yet

- ImfundDocument21 pagesImfundSpUnky RohitNo ratings yet

- Marketing Aptitude For SBI AssociatesDocument48 pagesMarketing Aptitude For SBI AssociatesShiv Ram Krishna100% (1)

- Stages of SMDocument3 pagesStages of SMSpUnky RohitNo ratings yet

- Natural Resource EnvironmentDocument5 pagesNatural Resource EnvironmentSpUnky RohitNo ratings yet

- rc4110 18e PDFDocument12 pagesrc4110 18e PDFandroidc660No ratings yet

- Jason Fanjaya Jana MKT ResearchDocument7 pagesJason Fanjaya Jana MKT Researchaudityaeros666No ratings yet

- Consumer ArithmeticDocument40 pagesConsumer ArithmeticShannon SmithNo ratings yet

- Practical Applications of Operations ResearchDocument26 pagesPractical Applications of Operations ResearchPranav Marathe89% (9)

- 2023 Mock Paper 1 BRD HL IB Business Management Copy 2Document4 pages2023 Mock Paper 1 BRD HL IB Business Management Copy 2pandasniper567No ratings yet

- Business Review (Ms. Jennifer)Document2 pagesBusiness Review (Ms. Jennifer)Abiang, Jennifer BañagaNo ratings yet

- Procure 2 MaintainDocument7 pagesProcure 2 MaintainfanoustNo ratings yet

- Job SatisfactionDocument19 pagesJob SatisfactionSafi SheikhNo ratings yet

- Major Project BBA 6th SemesterDocument51 pagesMajor Project BBA 6th SemesterGungun KumariNo ratings yet

- US Internal Revenue Service: Per Diem Rates Rev Rulings and ProcDocument2 pagesUS Internal Revenue Service: Per Diem Rates Rev Rulings and ProcIRSNo ratings yet

- Definition of Credit RatingDocument6 pagesDefinition of Credit RatingJethro Timothy CornejoNo ratings yet

- Sap SD 101Document2 pagesSap SD 101Karnataka567No ratings yet

- P3 Revision NotesDocument28 pagesP3 Revision NotesTripleFireWingsNo ratings yet

- Procedure in The Implementation of The Ati Supplemental Contract For Infrastructure Projects ($300 Million ATI Commitment)Document4 pagesProcedure in The Implementation of The Ati Supplemental Contract For Infrastructure Projects ($300 Million ATI Commitment)Suzette AbejuelaNo ratings yet

- Responsible Investment Guidelines GENERALIDocument15 pagesResponsible Investment Guidelines GENERALIglezperaltaNo ratings yet

- Take Action #1 Now.: Enroll in The PrapDocument20 pagesTake Action #1 Now.: Enroll in The PrapSalman AhmadNo ratings yet

- All Document Reader 1712239380407Document11 pagesAll Document Reader 1712239380407selomNo ratings yet

- Intellectual Property Rights in India With Special Reference To Trademarks:A Critical StudyDocument6 pagesIntellectual Property Rights in India With Special Reference To Trademarks:A Critical StudyshikhaNo ratings yet

- Fatima - Siddiqui - A Study On Factors Influencing Investors To Invest inDocument63 pagesFatima - Siddiqui - A Study On Factors Influencing Investors To Invest infatima siddiquiNo ratings yet

- ConsignmentDocument21 pagesConsignmentsantbaksmishra6145No ratings yet

- Week 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGDocument23 pagesWeek 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGfernan opeliñaNo ratings yet

- Management ProjectDocument20 pagesManagement ProjectPrasad BhumkarNo ratings yet

- Sep 2020 Solved NMIMS 1st and 2nd Year Assignment Call 9025810064Document59 pagesSep 2020 Solved NMIMS 1st and 2nd Year Assignment Call 9025810064Palaniappan NNo ratings yet

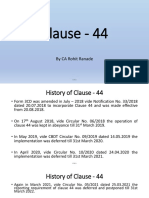

- Important Amendments Relating To Form No 3CD - Clause No 44 by CA. Rohit RanadeDocument22 pagesImportant Amendments Relating To Form No 3CD - Clause No 44 by CA. Rohit RanadeKanhaiya AgrawalNo ratings yet

- FM II 2022 Assignment IDocument7 pagesFM II 2022 Assignment IAmanuel AbebawNo ratings yet

- DMAIC Approach To Improving PRDocument69 pagesDMAIC Approach To Improving PRVen LagunayNo ratings yet

- Application For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFDocument6 pagesApplication For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFdasuyaNo ratings yet

- Plantilla de Estructuras Organizacionales - HubSpotDocument8 pagesPlantilla de Estructuras Organizacionales - HubSpotAsesor 3GNo ratings yet