Professional Documents

Culture Documents

The Great Indian Market - NCAER

The Great Indian Market - NCAER

Uploaded by

Rupesh SharmaCopyright:

Available Formats

You might also like

- Bill Evans Voicings Rootless ChordsDocument1 pageBill Evans Voicings Rootless ChordsYami Yugi100% (1)

- 2 As - Le Discours Théatral842240609Document43 pages2 As - Le Discours Théatral842240609Mehdi Alpes100% (12)

- Group 13 - ME Group Assignment 2Document8 pagesGroup 13 - ME Group Assignment 2deepak krishnanNo ratings yet

- India Petroleum StatisticsDocument10 pagesIndia Petroleum StatisticsAjay GuptaNo ratings yet

- Equity Research Report On Tata MotorsDocument26 pagesEquity Research Report On Tata MotorsRijul SaxenaNo ratings yet

- Effects of Global Meltdown On Indian Auto IndustryDocument48 pagesEffects of Global Meltdown On Indian Auto Industrychinthunair1423No ratings yet

- Economic Survey Tables 2009-2010Document132 pagesEconomic Survey Tables 2009-2010nikhilam.comNo ratings yet

- Emerging Indian Scenario: Trends in The Indian Economy Indian GDP - Trend of Growth RateDocument5 pagesEmerging Indian Scenario: Trends in The Indian Economy Indian GDP - Trend of Growth Raterenjith1971No ratings yet

- Data of EconomatricsDocument2 pagesData of EconomatricsArmaan JunaidNo ratings yet

- Asm Chap 4 Bus 3382Document9 pagesAsm Chap 4 Bus 3382Đào ĐăngNo ratings yet

- TvsDocument10 pagesTvsAnupam Chaplot100% (1)

- Automobile GasketsDocument17 pagesAutomobile GasketsGAMING WITH RVKNo ratings yet

- Automobile Industry: Presented by Josh Jit Singh BaliDocument15 pagesAutomobile Industry: Presented by Josh Jit Singh BalivjsbaliNo ratings yet

- ConsoDocument11 pagesConsoRJNo ratings yet

- Tables Bond MarketDocument4 pagesTables Bond MarketIshwar ChhedaNo ratings yet

- Select Economic IndicatorsDocument2 pagesSelect Economic IndicatorsArun ChandraNo ratings yet

- BestDocument21 pagesBestPragg AggarwalNo ratings yet

- Fuel Pump Servicing PDFDocument8 pagesFuel Pump Servicing PDFYv VardarNo ratings yet

- Ekonomi Teknik: Prarancangan Pabrik Sirop Glukosa Dari Pati Jagung Secara Enzimatis Dengan Kapasitas 96.000 Ton/TahunDocument6 pagesEkonomi Teknik: Prarancangan Pabrik Sirop Glukosa Dari Pati Jagung Secara Enzimatis Dengan Kapasitas 96.000 Ton/TahunamaliaNo ratings yet

- TelecomDocument8 pagesTelecomVaibhav JainNo ratings yet

- Fundamental Analysis of Bajaj Auto LTDDocument20 pagesFundamental Analysis of Bajaj Auto LTDnitumfc100% (1)

- MECWIN Investment ProposalDocument4 pagesMECWIN Investment ProposalVamsi PavuluriNo ratings yet

- Handbook of Energy & Economic Statistics of Indonesia 2009Document66 pagesHandbook of Energy & Economic Statistics of Indonesia 2009isan najmiNo ratings yet

- Atbsp Map-Abcd 070218 PDFDocument113 pagesAtbsp Map-Abcd 070218 PDFGsp ChrismonNo ratings yet

- Auto Industry Analysis: By-Arabinda Kar PGDM Ii YearDocument15 pagesAuto Industry Analysis: By-Arabinda Kar PGDM Ii Yearyush_313No ratings yet

- Auto Industry Analysis: By-Arabinda Kar PGDM Ii YearDocument15 pagesAuto Industry Analysis: By-Arabinda Kar PGDM Ii YearSitesh PratapNo ratings yet

- FIB Research - NSE Financial StatsDocument16 pagesFIB Research - NSE Financial StatslexmuiruriNo ratings yet

- Auto Industry at A GlanceDocument9 pagesAuto Industry at A GlanceAkshay KaushalNo ratings yet

- 10 Chapter 3Document75 pages10 Chapter 3Muzeeb SaifiNo ratings yet

- World Bank Road Use Costs Study Results: June 9, 2006Document12 pagesWorld Bank Road Use Costs Study Results: June 9, 2006Yanto BasriNo ratings yet

- Financial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Document25 pagesFinancial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Ali RazaNo ratings yet

- Various Categories: Year Area in Lakh Hectares Production in Lakh Bales of 170 Kgs Yield Kgs Per HectareDocument5 pagesVarious Categories: Year Area in Lakh Hectares Production in Lakh Bales of 170 Kgs Yield Kgs Per Hectareamninder69No ratings yet

- Assignment I - PGDM-IE T-1 (2022-24) - QTDocument4 pagesAssignment I - PGDM-IE T-1 (2022-24) - QTAtharv DaphaleNo ratings yet

- MGT782 Individual Assignment 1Document10 pagesMGT782 Individual Assignment 1arzieismailNo ratings yet

- Marketing MixDocument113 pagesMarketing MixrgibmNo ratings yet

- Real Estate PPT (Final)Document63 pagesReal Estate PPT (Final)9920163728100% (1)

- Panning For Mass Transit Systems A Few Points To PonderDocument32 pagesPanning For Mass Transit Systems A Few Points To PonderSreenivas SungadiNo ratings yet

- Camarines Norte - AlbayaldeDocument56 pagesCamarines Norte - AlbayaldeJChris EsguerraNo ratings yet

- Economic Survey 2007Document74 pagesEconomic Survey 2007AbhishekNo ratings yet

- Balance-Sheet 015138Document6 pagesBalance-Sheet 015138mesadaeterjohn.studentNo ratings yet

- Research Insight On Automotive Industry: 165 Million Tyres / Year ProductionDocument8 pagesResearch Insight On Automotive Industry: 165 Million Tyres / Year ProductionShilpi KumariNo ratings yet

- NWKRTCDocument97 pagesNWKRTCAkash UppinNo ratings yet

- Mens Wear EnviornmentDocument3 pagesMens Wear EnviornmentNiladri SahaNo ratings yet

- Small Scale Industries by Anas AhamadDocument17 pagesSmall Scale Industries by Anas AhamadMd Anas Ahmed AnasNo ratings yet

- Demand Forecasting of Bajaj MotorcyclesDocument20 pagesDemand Forecasting of Bajaj MotorcyclesVipul ManglikNo ratings yet

- "Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiDocument17 pages"Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiPrakash SharmaNo ratings yet

- Diesel Demand Million Ton Bio-Diesel Requirement For Blending Million Ton at 5% at 10% at 20%Document24 pagesDiesel Demand Million Ton Bio-Diesel Requirement For Blending Million Ton at 5% at 10% at 20%prasanna020391No ratings yet

- MOSPI SPB Pg148 Rail Gen StatDocument1 pageMOSPI SPB Pg148 Rail Gen StatishitashuklaNo ratings yet

- Hero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersDocument35 pagesHero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersCharan KowtikwarNo ratings yet

- Urban Transport and Automobile Air Pollution in Mysuru, IndiaDocument20 pagesUrban Transport and Automobile Air Pollution in Mysuru, IndiaAzis Kemal FauzieNo ratings yet

- Table March 2018Document37 pagesTable March 2018Venkatesh VNo ratings yet

- Vehicle Sales FiguresDocument9 pagesVehicle Sales FiguresneosamandersonNo ratings yet

- Retail Lab FinancialsDocument6 pagesRetail Lab Financialspratyay gangulyNo ratings yet

- Rakesh Sonar Vikas Sharma Lokesh Gupta Manish PandeyDocument58 pagesRakesh Sonar Vikas Sharma Lokesh Gupta Manish PandeycharukatNo ratings yet

- Rakesh Sonar Vikas Sharma Lokesh Gupta Manish PandeyDocument58 pagesRakesh Sonar Vikas Sharma Lokesh Gupta Manish PandeyPriyanka DhingraNo ratings yet

- AdrasanaDocument12 pagesAdrasanaGAMING WITH RVKNo ratings yet

- NDDB AR 2016-17 Eng 0 Part44Document2 pagesNDDB AR 2016-17 Eng 0 Part44siva kumarNo ratings yet

- Bajaj Electricals Ltd.Document30 pagesBajaj Electricals Ltd.modaksaikat100% (2)

- An Introduction To Pakistan's Sugar Industry: TH TH THDocument12 pagesAn Introduction To Pakistan's Sugar Industry: TH TH THSennen DesouzaNo ratings yet

- Fluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceFrom EverandFluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Exporting Services: A Developing Country PerspectiveFrom EverandExporting Services: A Developing Country PerspectiveRating: 5 out of 5 stars5/5 (2)

- MWKS PresentationDocument11 pagesMWKS PresentationDragos Dănuț RobuNo ratings yet

- Director or Leader? How To Gain Control of The Choir (And How To Give It Away)Document6 pagesDirector or Leader? How To Gain Control of The Choir (And How To Give It Away)Jason ChingNo ratings yet

- Mapeh 2Document11 pagesMapeh 2Patrick Benedict RobieneNo ratings yet

- Introduction To TheatreDocument30 pagesIntroduction To TheatreGerald GetaladoNo ratings yet

- P1 PoemsDocument16 pagesP1 Poemswoo woo wongNo ratings yet

- Restore Electric PartsDocument2 pagesRestore Electric PartsGeorge MogaNo ratings yet

- Batch-01 September (2018)Document29 pagesBatch-01 September (2018)Namit NayanNo ratings yet

- JMD 1Document10 pagesJMD 1bobpick68No ratings yet

- Toshiba 32WL65RSDocument60 pagesToshiba 32WL65RSHalfaByteNo ratings yet

- bm946 Miniscore Fuga Y-Misterio PiazzollaDocument9 pagesbm946 Miniscore Fuga Y-Misterio PiazzollaAnonymous PersonNo ratings yet

- Blues in C: Fraseggi RosDocument2 pagesBlues in C: Fraseggi RosNicola AvonNo ratings yet

- Lesson 1Document4 pagesLesson 1Mark Russell MangubatNo ratings yet

- Close To You: The Carpenters C % % % C B B B E E C CDocument1 pageClose To You: The Carpenters C % % % C B B B E E C CDavid Ripoll LopezNo ratings yet

- Television Advertising Campaign - ToothpasteDocument10 pagesTelevision Advertising Campaign - ToothpastearcherselevatorsNo ratings yet

- Jazz Improvisation For TeachersDocument12 pagesJazz Improvisation For Teachersybird1No ratings yet

- Natya ShastraDocument4 pagesNatya ShastraRatnakar KoliNo ratings yet

- Morse Code: TelegraphDocument3 pagesMorse Code: TelegraphEkin ShekinNo ratings yet

- Programming Analogue SynthsDocument132 pagesProgramming Analogue SynthsGui Felipe100% (1)

- Updated ResumeDocument2 pagesUpdated Resumeapi-453096657No ratings yet

- Col Madden Arrives Oct 1981Document1 pageCol Madden Arrives Oct 1981John SporrerNo ratings yet

- Episode 2 - "Deep Water"Document22 pagesEpisode 2 - "Deep Water"Vishnu SinhaNo ratings yet

- Strategies For Facilitating Learning inDocument46 pagesStrategies For Facilitating Learning inDaniel Angelo IslaNo ratings yet

- Already GoneDocument3 pagesAlready GoneladymyaNo ratings yet

- NovoQuad Brochure - ND-BU001Document7 pagesNovoQuad Brochure - ND-BU001Nguyen Phuc NguyenNo ratings yet

- ACE Instrumentation - Ace - Eng - 2010Document28 pagesACE Instrumentation - Ace - Eng - 2010kanovacax100% (1)

- ALL THAT JAZZ PianoDocument9 pagesALL THAT JAZZ Pianor.v.straatenNo ratings yet

- Water Technology 25th Anniversary IssueDocument84 pagesWater Technology 25th Anniversary Issuemelinda_kempfer5554No ratings yet

- Medpgeed201901 Mclass3Document2 pagesMedpgeed201901 Mclass3Lupe Arias TorresNo ratings yet

The Great Indian Market - NCAER

The Great Indian Market - NCAER

Uploaded by

Rupesh SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Great Indian Market - NCAER

The Great Indian Market - NCAER

Uploaded by

Rupesh SharmaCopyright:

Available Formats

The Great Indian Market

August 9, 2005

Results from the NCAERs

Market Information Survey of Households

In association with

Business Standard

The rapid rise in incomes will lead to an even faster increase in

demand for consumer durables and expendables

As a result, the ownership of goods will also go up significantly

What will power this is the increased usage in different income

classes

coupled with the rise in the size of the Great Indian Middle Class

Key Findings

13,149 8,727 6,024 3,437 White Goods

6,774 4,335 3,006 1,850 Refrigerators

9,957 6,295 4,580 1,785 CTV Regular

8,369 4,663 2,599 760 Motorcycles

3,466 1,560 788 276 Cars

2009-10 2005-06 2001-02 1995-96

Demand of Consumer Durables

(Figures in '000)

3,364 2,596 1,977 1,190

Washing

Powder

50 33 21 7 Shampoos

10,586 8,514 6,977 4,582 Edible Oil

2009-10 2005-06 2001-02 1995-96

Demand of Consumer Expendables

(Figures in 000 tonnes)

Penetration of Consumer Durables

(Number of households owning goods per '000 households)

451.7 319.1 247.1 149.4 White Goods

224.9 160.7 134.0 86.1 Refrigerators

314.0 213.0 145.6 72.0 CTV Regular

282.6 147.6 70.8 29.3 Motorcycles

91.4 50.2 30.0 16.1 Cars

2009-10 2005-06 2001-02 1995-96

809.6 745.6 693.0 607.4

Washing

Powder

583.2 480.7 391.7 182.1 Shampoos

999.6 999.0 998.3 912.7 Edible Oil

2009-10 2005-06 2001-02 1995-96

Penetration of Expendables

(Number of households using consumables per '000 households)

Income Groupings and Ownership

(Ownership per household, 2001-02)

Annual

household

Income

('000)

Households

(Million)

Two

Wheeler

CTV Ref AC Car

D eprived < 9 0 1 3 5 . 4 0 . 0 7 0 . 0 5 0 . 0 4 0 . 0 0 0 . 0 0

Aspirers 9 0 - 2 0 0 4 1 . 3 0 . 4 7 0 . 4 0 0 . 3 4 0 . 0 2 0 . 0 4

Middle Class 2 0 0 - 1 ,0 0 0 1 0 . 7 0 . 7 0 0 . 7 3 0 . 6 2 0 . 1 5 0 . 3 2

R ich > 1 ,0 0 0 0 . 8 0 . 7 1 0 . 9 9 0 . 7 4 0 . 4 3 0 . 8 3

Total 1 8 8 . 2 0 . 2 0 0 . 1 7 0 . 1 4 0 . 0 1 0 . 0 3

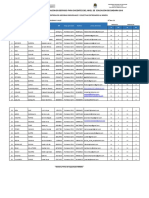

Growing Prosperity - All India

1,31,176 1,35,378

28,901

3,881

651

189

63

11

5

41,262

9034

1712

546

201

40

20

1995-96 2001-02

<90

91-200

201-500

501-1,000

1,001-2,000

2,001-5,000

5,001-10,000

10,001+

1,32,249

53,276

13,183

3,212

1,122

454

103

52

75,304

22,268

6,173

2,373

1037

255

141

2005-06 2009-10

<90

91-200

201-500

501-1,000

1,001-2,000

2,001-5,000

5,001-10,000

10,001+

1,14,394

Income figures in 000 per annum at 2001-02 prices, households in 000 numbers

R ural markets will increase in importance

How do middle class consumers in the rural India

differ from their urban counterparts, and how will

this change in the years to come?

D o consumption patterns differ across occupation

groups in urban and rural areas as well?

Key Findings

61.3 60.1 58.1 Low cost items

56.7 56.9 50.0 Fans

23.7 23.9 23.8 White goods

44.2 54.5 54.0 Television

37.9 36.0 37.9 Automotives

10.9 8.0 2.1 Cars/Jeeps

57.7 58.2 52.7 Mopeds

48.3 39.8 47.3 Motorcycles

39.9 39.4 33.1 Scooters

Consumer Durables

2009-10 2001-02 1995-96

Rural Demand- Consumer Durables

(% of All India)

54.9 50.8 50.4

Washing

powder

75.6 71.4 68.7 Washing cakes

54.7 52.5 49.8 Toilet soaps

33.0 31.9 27.2 Shampoos

30.3 42.8 36.0

Packaged

biscuits

28.1 27.3 28.6

Health

beverages

62.9 67.1 64.3 Edible oil

Consumer Expendables

2009-10 2001-02 1995-96

Rural Demand- Expendables

(% of All India)

Consumer Durables

2001-02 2009-10 2001-02 2009-10

Motorcycle 1 3 4 . 3 3 2 0 . 7 1 0 9 . 0 2 5 0 . 9

Television 9 4 2 . 8 1 2 5 8 . 9 6 1 6 . 3 5 6 1 . 3

Car 3 1 . 4 5 2 . 2 1 . 6 3 . 5

Consumer Expendables

2001-02 2009-10 2001-02 2009-10

Edible Oil 1 0 0 0 . 0 1 0 0 0 . 0 1 0 0 0 . 0 1 0 0 0 . 0

Shampoos 8 2 7 . 8 1 0 0 0 . 0 3 5 4 . 5 4 5 8 . 4

Washing Powder 9 0 4 . 7 1 0 0 0 . 0 7 7 5 . 4 9 4 6 . 9

Urban Rural

Urban Rural

Urban-Rural Usage Pattern in Middle Income Group

(Per 000 Households)

Two Wheelers

2001-02 2009-10 2001-02 2009-10

Salary Earner 4 9 5 . 0 8 3 4 . 0 2 8 6 . 0 7 5 5 . 0

Professionals 8 5 9 . 0 1 5 3 9 . 0 5 2 1 . 0 1 3 5 4 . 0

Televisions

2001-02 2009-10 2001-02 2009-10

Salary Earner 1 0 8 0 . 0 1 4 5 2 . 0 7 4 4 . 0 1 0 5 6 . 0

Professionals 1 1 2 8 . 0 1 7 5 9 . 0 9 2 9 . 0 1 2 0 1 . 0

Urban Rural

Urban Rural

Ownership Pattern across Occupational Groups

(Per 000 Households)

D o consumption patterns differ across towns of different sizes as well

and how is this likely to change over the next few years?

How do consumption patterns vary across the top cities?

How important are the top cities in the demand for major durables

today?

D o more Mumbaikars own cars than D elhi- ites? How does the usage

of durables differ across cities?

Key Findings

Town Siz e Two wheeler White goods Television Low cost goods

> 5 0 lakh 3 8 2 . 0 2 1 1 4 9 . 9 5 1 1 8 5 . 4 9 4 1 5 0 . 1 9

1 0 - 5 0 lakh 6 2 7 . 0 2 9 7 0 . 9 1 7 9 2 . 0 1 4 8 2 5 . 1 3

5 - 1 0 lakh 5 0 4 . 1 9 7 5 6 . 5 4 8 4 5 . 5 4 4 1 9 . 3 5

< 5 lakh 3 4 6 . 0 7 4 2 7 . 6 8 6 8 2 . 5 3 3 8 3 7 . 4 6

Ownership Pattern by Siz e of Town

(Per 000 Households)

Household Expenditures Across Top Cities

(Proportion of total expenditure in households earning

over Rs 3 lakhs per annum)

Cities Health Outdoor eating

Vijayawada 4 . 6 3 . 3

Indore 7 . 7 4 . 4

Bangalore 8 . 2 3 . 3

Chennai 5 . 2 4 . 9

D elhi 6 . 3 4 . 8

Mumbai 3 . 3 3 . 8

Ahmedabad 6 . 9 5 . 1

Kolkatta 4 . 1 5 . 1

Durables Stock

Top 67 Cities All India (% Share)

Scooter 2 4 3 . 2 7 8 . 6 4 4

Motorcycle 1 3 8 7 0 . 8 2 7

CTV R egular 4 8 6 . 7 1 4 5 . 6 4 7

Cars/Jeeps 1 4 5 . 8 3 0 6 8

R efrigerators 4 9 2 . 5 1 3 4 5 2

Washing Machines 3 1 6 . 4 7 2 . 4 6 1

Usage Pattern

Share and Usage Pattern of Top 67 Cities in 2001-02

(Ownership in per 000 households; share of stock in percent)

422.3 574.9 212.1 301.0 Total

857.6 822 597.1 526.8 >300

703.8 616.1 391.6 272.7 180-300

647.9 503.2 226.3 163.2 135-180

221.5 224.8 67.8 80.3 90-135

29.4 29.2 0 0 <90

Mumbai Delhi Mumbai Delhi

Washing Machines Cars

Income Class

(Rs. 000)

Usage of Durables in Delhi and Mumbai

(Ownership per '000 household)

D oes it make more sense to target a marketing

plan for refrigerators at two wheeler owners as

compared to those owning TVs or even ACs?

Who buy second hand goods in India and in which

products are they more widely preferred?

Key Findings

Durables All India Urban Rural

Two wheelers 2 1 . 8 3 1 . 3 9 . 2

Cars/Jeeps 8 3 . 8 8 9 . 0 1 7 . 1

Televisions 2 6 . 3 3 6 . 7 8 . 7

AC 8 5 . 9 8 8 . 2 3 1 . 7

Cellphones 6 4 . 5 8 0 . 4 3 5 . 8

Credit cards 1 2 . 9 3 6 . 1 4 . 0

Ownership of Refrigerators by those owing other Durable

(Percent of households owing various durable)

5.6 1.4 Washing Machines

2.3 4.0 Refrigerators

3.0 1.8 Color TV

12.5 4.5 Motorcycles

16.3 11.2 Scooters

Rural Urban

Share of Second Hand Goods in 2001-02

(% of total purchase)

Thank You

You might also like

- Bill Evans Voicings Rootless ChordsDocument1 pageBill Evans Voicings Rootless ChordsYami Yugi100% (1)

- 2 As - Le Discours Théatral842240609Document43 pages2 As - Le Discours Théatral842240609Mehdi Alpes100% (12)

- Group 13 - ME Group Assignment 2Document8 pagesGroup 13 - ME Group Assignment 2deepak krishnanNo ratings yet

- India Petroleum StatisticsDocument10 pagesIndia Petroleum StatisticsAjay GuptaNo ratings yet

- Equity Research Report On Tata MotorsDocument26 pagesEquity Research Report On Tata MotorsRijul SaxenaNo ratings yet

- Effects of Global Meltdown On Indian Auto IndustryDocument48 pagesEffects of Global Meltdown On Indian Auto Industrychinthunair1423No ratings yet

- Economic Survey Tables 2009-2010Document132 pagesEconomic Survey Tables 2009-2010nikhilam.comNo ratings yet

- Emerging Indian Scenario: Trends in The Indian Economy Indian GDP - Trend of Growth RateDocument5 pagesEmerging Indian Scenario: Trends in The Indian Economy Indian GDP - Trend of Growth Raterenjith1971No ratings yet

- Data of EconomatricsDocument2 pagesData of EconomatricsArmaan JunaidNo ratings yet

- Asm Chap 4 Bus 3382Document9 pagesAsm Chap 4 Bus 3382Đào ĐăngNo ratings yet

- TvsDocument10 pagesTvsAnupam Chaplot100% (1)

- Automobile GasketsDocument17 pagesAutomobile GasketsGAMING WITH RVKNo ratings yet

- Automobile Industry: Presented by Josh Jit Singh BaliDocument15 pagesAutomobile Industry: Presented by Josh Jit Singh BalivjsbaliNo ratings yet

- ConsoDocument11 pagesConsoRJNo ratings yet

- Tables Bond MarketDocument4 pagesTables Bond MarketIshwar ChhedaNo ratings yet

- Select Economic IndicatorsDocument2 pagesSelect Economic IndicatorsArun ChandraNo ratings yet

- BestDocument21 pagesBestPragg AggarwalNo ratings yet

- Fuel Pump Servicing PDFDocument8 pagesFuel Pump Servicing PDFYv VardarNo ratings yet

- Ekonomi Teknik: Prarancangan Pabrik Sirop Glukosa Dari Pati Jagung Secara Enzimatis Dengan Kapasitas 96.000 Ton/TahunDocument6 pagesEkonomi Teknik: Prarancangan Pabrik Sirop Glukosa Dari Pati Jagung Secara Enzimatis Dengan Kapasitas 96.000 Ton/TahunamaliaNo ratings yet

- TelecomDocument8 pagesTelecomVaibhav JainNo ratings yet

- Fundamental Analysis of Bajaj Auto LTDDocument20 pagesFundamental Analysis of Bajaj Auto LTDnitumfc100% (1)

- MECWIN Investment ProposalDocument4 pagesMECWIN Investment ProposalVamsi PavuluriNo ratings yet

- Handbook of Energy & Economic Statistics of Indonesia 2009Document66 pagesHandbook of Energy & Economic Statistics of Indonesia 2009isan najmiNo ratings yet

- Atbsp Map-Abcd 070218 PDFDocument113 pagesAtbsp Map-Abcd 070218 PDFGsp ChrismonNo ratings yet

- Auto Industry Analysis: By-Arabinda Kar PGDM Ii YearDocument15 pagesAuto Industry Analysis: By-Arabinda Kar PGDM Ii Yearyush_313No ratings yet

- Auto Industry Analysis: By-Arabinda Kar PGDM Ii YearDocument15 pagesAuto Industry Analysis: By-Arabinda Kar PGDM Ii YearSitesh PratapNo ratings yet

- FIB Research - NSE Financial StatsDocument16 pagesFIB Research - NSE Financial StatslexmuiruriNo ratings yet

- Auto Industry at A GlanceDocument9 pagesAuto Industry at A GlanceAkshay KaushalNo ratings yet

- 10 Chapter 3Document75 pages10 Chapter 3Muzeeb SaifiNo ratings yet

- World Bank Road Use Costs Study Results: June 9, 2006Document12 pagesWorld Bank Road Use Costs Study Results: June 9, 2006Yanto BasriNo ratings yet

- Financial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Document25 pagesFinancial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Ali RazaNo ratings yet

- Various Categories: Year Area in Lakh Hectares Production in Lakh Bales of 170 Kgs Yield Kgs Per HectareDocument5 pagesVarious Categories: Year Area in Lakh Hectares Production in Lakh Bales of 170 Kgs Yield Kgs Per Hectareamninder69No ratings yet

- Assignment I - PGDM-IE T-1 (2022-24) - QTDocument4 pagesAssignment I - PGDM-IE T-1 (2022-24) - QTAtharv DaphaleNo ratings yet

- MGT782 Individual Assignment 1Document10 pagesMGT782 Individual Assignment 1arzieismailNo ratings yet

- Marketing MixDocument113 pagesMarketing MixrgibmNo ratings yet

- Real Estate PPT (Final)Document63 pagesReal Estate PPT (Final)9920163728100% (1)

- Panning For Mass Transit Systems A Few Points To PonderDocument32 pagesPanning For Mass Transit Systems A Few Points To PonderSreenivas SungadiNo ratings yet

- Camarines Norte - AlbayaldeDocument56 pagesCamarines Norte - AlbayaldeJChris EsguerraNo ratings yet

- Economic Survey 2007Document74 pagesEconomic Survey 2007AbhishekNo ratings yet

- Balance-Sheet 015138Document6 pagesBalance-Sheet 015138mesadaeterjohn.studentNo ratings yet

- Research Insight On Automotive Industry: 165 Million Tyres / Year ProductionDocument8 pagesResearch Insight On Automotive Industry: 165 Million Tyres / Year ProductionShilpi KumariNo ratings yet

- NWKRTCDocument97 pagesNWKRTCAkash UppinNo ratings yet

- Mens Wear EnviornmentDocument3 pagesMens Wear EnviornmentNiladri SahaNo ratings yet

- Small Scale Industries by Anas AhamadDocument17 pagesSmall Scale Industries by Anas AhamadMd Anas Ahmed AnasNo ratings yet

- Demand Forecasting of Bajaj MotorcyclesDocument20 pagesDemand Forecasting of Bajaj MotorcyclesVipul ManglikNo ratings yet

- "Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiDocument17 pages"Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiPrakash SharmaNo ratings yet

- Diesel Demand Million Ton Bio-Diesel Requirement For Blending Million Ton at 5% at 10% at 20%Document24 pagesDiesel Demand Million Ton Bio-Diesel Requirement For Blending Million Ton at 5% at 10% at 20%prasanna020391No ratings yet

- MOSPI SPB Pg148 Rail Gen StatDocument1 pageMOSPI SPB Pg148 Rail Gen StatishitashuklaNo ratings yet

- Hero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersDocument35 pagesHero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersCharan KowtikwarNo ratings yet

- Urban Transport and Automobile Air Pollution in Mysuru, IndiaDocument20 pagesUrban Transport and Automobile Air Pollution in Mysuru, IndiaAzis Kemal FauzieNo ratings yet

- Table March 2018Document37 pagesTable March 2018Venkatesh VNo ratings yet

- Vehicle Sales FiguresDocument9 pagesVehicle Sales FiguresneosamandersonNo ratings yet

- Retail Lab FinancialsDocument6 pagesRetail Lab Financialspratyay gangulyNo ratings yet

- Rakesh Sonar Vikas Sharma Lokesh Gupta Manish PandeyDocument58 pagesRakesh Sonar Vikas Sharma Lokesh Gupta Manish PandeycharukatNo ratings yet

- Rakesh Sonar Vikas Sharma Lokesh Gupta Manish PandeyDocument58 pagesRakesh Sonar Vikas Sharma Lokesh Gupta Manish PandeyPriyanka DhingraNo ratings yet

- AdrasanaDocument12 pagesAdrasanaGAMING WITH RVKNo ratings yet

- NDDB AR 2016-17 Eng 0 Part44Document2 pagesNDDB AR 2016-17 Eng 0 Part44siva kumarNo ratings yet

- Bajaj Electricals Ltd.Document30 pagesBajaj Electricals Ltd.modaksaikat100% (2)

- An Introduction To Pakistan's Sugar Industry: TH TH THDocument12 pagesAn Introduction To Pakistan's Sugar Industry: TH TH THSennen DesouzaNo ratings yet

- Fluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceFrom EverandFluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Exporting Services: A Developing Country PerspectiveFrom EverandExporting Services: A Developing Country PerspectiveRating: 5 out of 5 stars5/5 (2)

- MWKS PresentationDocument11 pagesMWKS PresentationDragos Dănuț RobuNo ratings yet

- Director or Leader? How To Gain Control of The Choir (And How To Give It Away)Document6 pagesDirector or Leader? How To Gain Control of The Choir (And How To Give It Away)Jason ChingNo ratings yet

- Mapeh 2Document11 pagesMapeh 2Patrick Benedict RobieneNo ratings yet

- Introduction To TheatreDocument30 pagesIntroduction To TheatreGerald GetaladoNo ratings yet

- P1 PoemsDocument16 pagesP1 Poemswoo woo wongNo ratings yet

- Restore Electric PartsDocument2 pagesRestore Electric PartsGeorge MogaNo ratings yet

- Batch-01 September (2018)Document29 pagesBatch-01 September (2018)Namit NayanNo ratings yet

- JMD 1Document10 pagesJMD 1bobpick68No ratings yet

- Toshiba 32WL65RSDocument60 pagesToshiba 32WL65RSHalfaByteNo ratings yet

- bm946 Miniscore Fuga Y-Misterio PiazzollaDocument9 pagesbm946 Miniscore Fuga Y-Misterio PiazzollaAnonymous PersonNo ratings yet

- Blues in C: Fraseggi RosDocument2 pagesBlues in C: Fraseggi RosNicola AvonNo ratings yet

- Lesson 1Document4 pagesLesson 1Mark Russell MangubatNo ratings yet

- Close To You: The Carpenters C % % % C B B B E E C CDocument1 pageClose To You: The Carpenters C % % % C B B B E E C CDavid Ripoll LopezNo ratings yet

- Television Advertising Campaign - ToothpasteDocument10 pagesTelevision Advertising Campaign - ToothpastearcherselevatorsNo ratings yet

- Jazz Improvisation For TeachersDocument12 pagesJazz Improvisation For Teachersybird1No ratings yet

- Natya ShastraDocument4 pagesNatya ShastraRatnakar KoliNo ratings yet

- Morse Code: TelegraphDocument3 pagesMorse Code: TelegraphEkin ShekinNo ratings yet

- Programming Analogue SynthsDocument132 pagesProgramming Analogue SynthsGui Felipe100% (1)

- Updated ResumeDocument2 pagesUpdated Resumeapi-453096657No ratings yet

- Col Madden Arrives Oct 1981Document1 pageCol Madden Arrives Oct 1981John SporrerNo ratings yet

- Episode 2 - "Deep Water"Document22 pagesEpisode 2 - "Deep Water"Vishnu SinhaNo ratings yet

- Strategies For Facilitating Learning inDocument46 pagesStrategies For Facilitating Learning inDaniel Angelo IslaNo ratings yet

- Already GoneDocument3 pagesAlready GoneladymyaNo ratings yet

- NovoQuad Brochure - ND-BU001Document7 pagesNovoQuad Brochure - ND-BU001Nguyen Phuc NguyenNo ratings yet

- ACE Instrumentation - Ace - Eng - 2010Document28 pagesACE Instrumentation - Ace - Eng - 2010kanovacax100% (1)

- ALL THAT JAZZ PianoDocument9 pagesALL THAT JAZZ Pianor.v.straatenNo ratings yet

- Water Technology 25th Anniversary IssueDocument84 pagesWater Technology 25th Anniversary Issuemelinda_kempfer5554No ratings yet

- Medpgeed201901 Mclass3Document2 pagesMedpgeed201901 Mclass3Lupe Arias TorresNo ratings yet