Professional Documents

Culture Documents

Copy Ucla - Prob 10-6

Copy Ucla - Prob 10-6

Uploaded by

shaman00070 ratings0% found this document useful (0 votes)

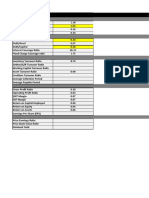

17 views1 pageThis document contains financial metrics for Wal-Mart over a 4 year period from Year 9 to Year 12. Many of the metrics for Year 0 and Year 9 are undefined or contain errors as ratios have zero denominators. The company's liquidity ratios improved from Year 10 to Year 12 with the current ratio rising from 0.94 to 1.04 and quick ratio rising from 0.12 to 0.15. Solvency ratios fluctuated over this period with total liabilities as a percentage of total assets declining from 64.8% to 60.2% and the long-term debt to equity ratio rising from 64.3% to 67%.

Original Description:

Original Title

copy_ucla_-prob_10-6

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains financial metrics for Wal-Mart over a 4 year period from Year 9 to Year 12. Many of the metrics for Year 0 and Year 9 are undefined or contain errors as ratios have zero denominators. The company's liquidity ratios improved from Year 10 to Year 12 with the current ratio rising from 0.94 to 1.04 and quick ratio rising from 0.12 to 0.15. Solvency ratios fluctuated over this period with total liabilities as a percentage of total assets declining from 64.8% to 60.2% and the long-term debt to equity ratio rising from 64.3% to 67%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views1 pageCopy Ucla - Prob 10-6

Copy Ucla - Prob 10-6

Uploaded by

shaman0007This document contains financial metrics for Wal-Mart over a 4 year period from Year 9 to Year 12. Many of the metrics for Year 0 and Year 9 are undefined or contain errors as ratios have zero denominators. The company's liquidity ratios improved from Year 10 to Year 12 with the current ratio rising from 0.94 to 1.04 and quick ratio rising from 0.12 to 0.15. Solvency ratios fluctuated over this period with total liabilities as a percentage of total assets declining from 64.8% to 60.2% and the long-term debt to equity ratio rising from 64.3% to 67%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

COMPANY NAME: Wal-Mart

YEAR 0 Year 9 Year 10 Year 11 Year 12

RISK FACTORS:

A #DIV/0! message indicates that a ratio denominator is zero.

LIQUIDITY:

Current Ratio #DIV/0! 1.26 0.94 0.92 1.04

Quick Ratio #DIV/0! 0.18 0.12 0.13 0.15

Days Receivables Held #DIV/0! #DIV/0! 3 3 3

Days Inventory Held #DIV/0! #DIV/0! 52 50 47

Days Payables Held #DIV/0! 110 32 34 32

Net Wk. Capital Days #DIV/0! #DIV/0! 22 19 18

Operating Cash Flow to Current Liabilities #DIV/0! 0.0% 38.5% 35.1% 36.5%

SOLVENCY:

Total Liabilities / Total Assets #DIV/0! 60.0% 64.8% 62.1% 60.2%

LT Debt / (LT Debt + Share Equity) #DIV/0! 37.0% 43.3% 39.1% 40.1%

LT Debt / Share Equity #DIV/0! 58.7% 76.3% 64.3% 67.0% LT Debt / Share Equity #DIV/0! 58.7% 76.3% 64.3% 67.0%

Operating Cash Flow to Total Liabilities #DIV/0! 0.0% 20.7% 19.4% 19.7%

Interest Coverage Ratio #DIV/0! #DIV/0! 9.72 8.27 8.97

Price Earnings Ratio #DIV/0! #DIV/0! 0.00 0.00 0.00

Market to Book Value Ratio #DIV/0! 0.0 0.0 0.0 0.0

You might also like

- Daktronics Analysis 1Document27 pagesDaktronics Analysis 1Shannan Richards100% (4)

- Cmalbertsen0131 Fin311 HW 1Document6 pagesCmalbertsen0131 Fin311 HW 1api-575715390No ratings yet

- ACARSWELL AC216 Final Project Ratio Analsyis 3Document9 pagesACARSWELL AC216 Final Project Ratio Analsyis 3Eliana MorganNo ratings yet

- New Ron Black The Clear MethodDocument7 pagesNew Ron Black The Clear Methodshaman0007100% (1)

- Wooden Pencil Manufacturing Business-467339 PDFDocument67 pagesWooden Pencil Manufacturing Business-467339 PDFTshenolo Nshayi100% (1)

- Vegas 4 Hour Tunnel MethodDocument13 pagesVegas 4 Hour Tunnel MethodGreg VermeychukNo ratings yet

- Financial Statement Analysis: Liquidity RatiosDocument17 pagesFinancial Statement Analysis: Liquidity RatiosPurehoney ManufacturersNo ratings yet

- Resource 20221117092754 WSC - Case - ClassDocument51 pagesResource 20221117092754 WSC - Case - ClassRajat OnzNo ratings yet

- Gokul Agro ResourcesDocument15 pagesGokul Agro Resourcesmadhu priyaNo ratings yet

- Part 4 - Group8Document9 pagesPart 4 - Group8parmeet kaurNo ratings yet

- EPL LTD Financial Statements - XDocument16 pagesEPL LTD Financial Statements - XAakashNo ratings yet

- Apex FrozenDocument18 pagesApex FrozenVishalPandeyNo ratings yet

- 16 - Manju - Infosys Technolgy Ltd.Document15 pages16 - Manju - Infosys Technolgy Ltd.rajat_singlaNo ratings yet

- Yanti Riani - 2401953410 - FML Chapter 4Document5 pagesYanti Riani - 2401953410 - FML Chapter 4Yanti RianiNo ratings yet

- DCF Financial Model Blank BDocument24 pagesDCF Financial Model Blank BBHAVVYA WADHERANo ratings yet

- Margin & ROI ComparisonsDocument6 pagesMargin & ROI ComparisonsNeeraj DaniNo ratings yet

- Anisul FDMDocument6 pagesAnisul FDManisul islamNo ratings yet

- ValorisationDocument10 pagesValorisationpgNo ratings yet

- 3) Broken Models and Circular References PDFDocument7 pages3) Broken Models and Circular References PDFAkshit SoniNo ratings yet

- Fine OrganicDocument18 pagesFine OrganicvishalNo ratings yet

- Ratio Kalbe FarmaDocument7 pagesRatio Kalbe FarmaDiva Tertia AlmiraNo ratings yet

- Financial Analysis - WalmartDocument3 pagesFinancial Analysis - WalmartLuka KhmaladzeNo ratings yet

- Niña Joy L. Arevalo BSMA II-B 3-1. Days Sales OutstandingDocument5 pagesNiña Joy L. Arevalo BSMA II-B 3-1. Days Sales OutstandingAnimeliciousNo ratings yet

- Model FormatDocument175 pagesModel Formatjain93kunalNo ratings yet

- Total Outside Liability Total Liabilities: Bal-CmaDocument4 pagesTotal Outside Liability Total Liabilities: Bal-CmabbasyNo ratings yet

- Represents The Capital Lease of Tools and Equipment (Warehouse Facilities)Document4 pagesRepresents The Capital Lease of Tools and Equipment (Warehouse Facilities)Omer KhanNo ratings yet

- ICICI SecDocument18 pagesICICI SecvishalNo ratings yet

- Company Annual Sale Turnover (' Mil MMK) 2019 2020 2021 2022Document13 pagesCompany Annual Sale Turnover (' Mil MMK) 2019 2020 2021 2022Sandar TunNo ratings yet

- Future LifestyleDocument18 pagesFuture LifestylevishalNo ratings yet

- Ford Moto Company Ratio AnalysisDocument7 pagesFord Moto Company Ratio AnalysisEmon hassanNo ratings yet

- L&T TechnologyDocument18 pagesL&T TechnologyvishalNo ratings yet

- HDFC AmcDocument18 pagesHDFC AmcVishalPandeyNo ratings yet

- 02 Laboratory Exercise 1 TemplateDocument11 pages02 Laboratory Exercise 1 TemplateMarie OsorioNo ratings yet

- Elvis Income Statement (Lecture 16 March 2024)Document9 pagesElvis Income Statement (Lecture 16 March 2024)rtsaccofficerNo ratings yet

- Accont Dalmia - For MergeDocument8 pagesAccont Dalmia - For Mergesaikatdn555No ratings yet

- P&L Publico Columbia 01.03.18 - 01.09.18Document1 pageP&L Publico Columbia 01.03.18 - 01.09.18James MarquesNo ratings yet

- Session 12.06.2024 ClassDocument9 pagesSession 12.06.2024 ClassRohan ShekarNo ratings yet

- 1) Template Detailed ModelDocument20 pages1) Template Detailed Modelabdul5721No ratings yet

- Icici Pru LifeDocument18 pagesIcici Pru LifevishalNo ratings yet

- Trading Journal BeginnersDocument48 pagesTrading Journal BeginnersadelinNo ratings yet

- Managerial Finance AssingmentDocument9 pagesManagerial Finance AssingmentEf AtNo ratings yet

- JournalDocument48 pagesJournalTaha SbaaiNo ratings yet

- AASHU Ent CMADocument10 pagesAASHU Ent CMARama KrishnaNo ratings yet

- Sample ProjectDocument20 pagesSample Projectgamopim849No ratings yet

- Nota de Intrare Receptie Nr.Document1 pageNota de Intrare Receptie Nr.Mada AndraNo ratings yet

- Walmart Financial AnalysisDocument187 pagesWalmart Financial AnalysisKareem L SayidNo ratings yet

- Ajinomoto: Gain/ (Loss) On Plant Disposal Currency Hit / (Earn)Document18 pagesAjinomoto: Gain/ (Loss) On Plant Disposal Currency Hit / (Earn)Meditation GuruNo ratings yet

- Stock Analysis Spreadsheet (5YR, 2021) (Vers 4.0) PUBLICDocument17 pagesStock Analysis Spreadsheet (5YR, 2021) (Vers 4.0) PUBLICSakib AhmedNo ratings yet

- FM11 CH 25 Tool KitDocument6 pagesFM11 CH 25 Tool KitAndhika Arya AratamaNo ratings yet

- Optimal Capital Structure Lecture NotesDocument8 pagesOptimal Capital Structure Lecture NotesMohamed HamedNo ratings yet

- CRISILDocument19 pagesCRISILBcomE ANo ratings yet

- Name: Key Indicators ParticularsDocument10 pagesName: Key Indicators Particularsinfo.aksharadesignsNo ratings yet

- Bottling of Country Liquor.Document64 pagesBottling of Country Liquor.realestatebuzz.inNo ratings yet

- Yash ChemexDocument18 pagesYash ChemexvishalNo ratings yet

- Tool Kit For Advanced Issues in Financial Forecasting: Income Statement (In Millions of Dollars)Document3 pagesTool Kit For Advanced Issues in Financial Forecasting: Income Statement (In Millions of Dollars)Thiện NhânNo ratings yet

- Valuation Model1 by Mihir KumarDocument15 pagesValuation Model1 by Mihir KumarMannaNo ratings yet

- Fsa 3Document10 pagesFsa 3adzida-1No ratings yet

- Sketchers Financial ModelDocument56 pagesSketchers Financial ModelsaonNo ratings yet

- Ratio Analysis SpreadsheetDocument3 pagesRatio Analysis Spreadsheetshikhamit20No ratings yet

- Stock Analysis Spreadsheet (10YR, 2021) (Vers 4.0) PUBLICDocument18 pagesStock Analysis Spreadsheet (10YR, 2021) (Vers 4.0) PUBLICSakib AhmedNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Ma Spotlight Increase Retail April2011Document2 pagesMa Spotlight Increase Retail April2011shaman0007No ratings yet

- Intangible AssetsDocument40 pagesIntangible Assetsshaman0007No ratings yet