Professional Documents

Culture Documents

Glossary - Transfer Taxes

Glossary - Transfer Taxes

Uploaded by

rubbtuna0 ratings0% found this document useful (0 votes)

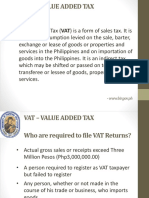

13 views1 pageThe document discusses key concepts related to value-added tax (VAT) in the Philippines. It states that VAT should not be imposed on goods destined for consumption outside the taxing authority's territorial borders (Cross Border Doctrine). It defines VAT as a tax on consumption levied on the sale or import of goods, properties, or services in the Philippines. It also defines VAT-Registered Person as someone registered according to the law and VAT-Registrable Person as someone required to register but failed to do so.

Original Description:

Glossary on Tax Terms (Transfer Taxes)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses key concepts related to value-added tax (VAT) in the Philippines. It states that VAT should not be imposed on goods destined for consumption outside the taxing authority's territorial borders (Cross Border Doctrine). It defines VAT as a tax on consumption levied on the sale or import of goods, properties, or services in the Philippines. It also defines VAT-Registered Person as someone registered according to the law and VAT-Registrable Person as someone required to register but failed to do so.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views1 pageGlossary - Transfer Taxes

Glossary - Transfer Taxes

Uploaded by

rubbtunaThe document discusses key concepts related to value-added tax (VAT) in the Philippines. It states that VAT should not be imposed on goods destined for consumption outside the taxing authority's territorial borders (Cross Border Doctrine). It defines VAT as a tax on consumption levied on the sale or import of goods, properties, or services in the Philippines. It also defines VAT-Registered Person as someone registered according to the law and VAT-Registrable Person as someone required to register but failed to do so.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

-V-

Cross Border Doctrine. No VAT shall be

imposed to form part of the cost of the

goods destined for consumption outside the

territorial border of the taxing authority.

Value Added Tax. It is a tax on

consumption levied on the sale, barter,

exchange or lease of goods or properties or

services in the Philippines and on

importation of goods into the Philippines.

VAT-Registered Person. Refers to a VAT

person who is registered in accordance with

the law or who opted to be registered as a

VAT person.

VAT-Registrable Person. Refers to any

person who is required to register but failed

to do so.

You might also like

- Tax 56 Activity 2Document2 pagesTax 56 Activity 2Hannah Alvarado BandolaNo ratings yet

- PM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)Document22 pagesPM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)dodong123100% (1)

- VAT ReportDocument32 pagesVAT ReportNoel Christopher G. BellezaNo ratings yet

- Tax 2 ReviewerDocument21 pagesTax 2 ReviewerLouis MalaybalayNo ratings yet

- Value-Added Tax PDFDocument118 pagesValue-Added Tax PDFRazel MhinNo ratings yet

- Lecture On VAT Output Vat PDFDocument7 pagesLecture On VAT Output Vat PDFCarl's Aeto DomingoNo ratings yet

- TAX ReviewerDocument3 pagesTAX ReviewerCely jisonNo ratings yet

- Percentage Taxes: Transfer of Goods or ServicesDocument10 pagesPercentage Taxes: Transfer of Goods or ServicesCPAREVIEWNo ratings yet

- A. VatDocument5 pagesA. VatKaye L. Dela CruzNo ratings yet

- Capital Gains TaxDocument2 pagesCapital Gains TaxShiena Lou B. Amodia-RabacalNo ratings yet

- Business TaxesDocument51 pagesBusiness TaxesLuna CakesNo ratings yet

- Percentage Tax in The PhilippinesDocument3 pagesPercentage Tax in The PhilippinesfrazieNo ratings yet

- Value Added TaxDocument15 pagesValue Added TaxJoshua PeraltaNo ratings yet

- Tax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsDocument12 pagesTax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsChaNo ratings yet

- Bustax ReviewerDocument7 pagesBustax ReviewerJeremy JimenezNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- WWW - Bir.gov - PHDocument4 pagesWWW - Bir.gov - PHRoy Amigo Jr.No ratings yet

- (G5 P1) VatDocument41 pages(G5 P1) VatFiliusdeiNo ratings yet

- Value Added Tax: 1. DefinitionDocument2 pagesValue Added Tax: 1. DefinitionElla Mae Lopez YusonNo ratings yet

- Module 3 - Value Added TaxDocument113 pagesModule 3 - Value Added TaxAllan C. MarquezNo ratings yet

- VAT Casasola NotesDocument7 pagesVAT Casasola NotesCharm AgripaNo ratings yet

- Business: Chapter 16: Nature and Concept of Buness TaxesDocument4 pagesBusiness: Chapter 16: Nature and Concept of Buness TaxesAnamir Bello CarilloNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- Vat With TrainDocument16 pagesVat With TrainElla QuiNo ratings yet

- Finals in Taxation Law ReviewDocument15 pagesFinals in Taxation Law ReviewSij Da realNo ratings yet

- Tax 2 AssignmentDocument6 pagesTax 2 AssignmentKim EcarmaNo ratings yet

- Case: Cir V PLDTDocument29 pagesCase: Cir V PLDTJaymee Andomang Os-agNo ratings yet

- Value Added TaxesDocument33 pagesValue Added TaxesCathleen TenaNo ratings yet

- Bureau of Internal RevenueDocument3 pagesBureau of Internal RevenueAngeline LlamasNo ratings yet

- Comprehensive VAT TAXATION (3!31!14)Document166 pagesComprehensive VAT TAXATION (3!31!14)dereckriveraNo ratings yet

- TAX Midterm ReviewerDocument10 pagesTAX Midterm ReviewerCookie MasterNo ratings yet

- Business TaxationDocument6 pagesBusiness TaxationPATRICK JAMES BALOGBOG ROSARIONo ratings yet

- Comparison VAT.Document11 pagesComparison VAT.Francis Ian BirondoNo ratings yet

- VAT ReportDocument21 pagesVAT ReportNoel Christopher G. BellezaNo ratings yet

- Gimenez Jose Mari CDocument14 pagesGimenez Jose Mari CMari Calica GimenezNo ratings yet

- VALUE ADDED TAX and EXCISE TAXDocument18 pagesVALUE ADDED TAX and EXCISE TAXTrisha Nicole Flores0% (1)

- Taxation IIDocument3 pagesTaxation IIAnonymous BNrz1arNo ratings yet

- Answer Tax Concepts RehashDocument2 pagesAnswer Tax Concepts RehashAnice YumulNo ratings yet

- A NonDocument2 pagesA NonAlthea PalmaNo ratings yet

- Value Added TaxDocument29 pagesValue Added TaxSNLTNo ratings yet

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justineNo ratings yet

- Taxation Value-Added Tax: Lecture NotesDocument23 pagesTaxation Value-Added Tax: Lecture Notestherezzzz0% (1)

- B. Introduction To VAT FinalDocument102 pagesB. Introduction To VAT FinalNatalie SerranoNo ratings yet

- Importance of TaxationDocument2 pagesImportance of TaxationIvan Delos ReyesNo ratings yet

- Melanie S. Samsona Business Tax Chapter 7 ExercisesDocument3 pagesMelanie S. Samsona Business Tax Chapter 7 ExercisesMelanie SamsonaNo ratings yet

- Lesson 15: TaxationDocument15 pagesLesson 15: TaxationRheanne OseaNo ratings yet

- Introduction To Business TaxesDocument3 pagesIntroduction To Business Taxesyatot carbonelNo ratings yet

- Antonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenDocument22 pagesAntonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenJayvee FelipeNo ratings yet

- Law On Taxation: ConceptDocument78 pagesLaw On Taxation: ConceptgoerginamarquezNo ratings yet

- Types of TaxesDocument27 pagesTypes of TaxesJosh DumalagNo ratings yet

- Business TaxesDocument100 pagesBusiness Taxeslynne tahilNo ratings yet

- LESSON Week 9 Introduction To Real Estate TaxationDocument5 pagesLESSON Week 9 Introduction To Real Estate TaxationJheovane Sevillejo LapureNo ratings yet

- Tax 2 Notes Finals 4Document36 pagesTax 2 Notes Finals 4Boom ManuelNo ratings yet

- VatDocument50 pagesVatnikolaevnavalentinaNo ratings yet

- TaxationDocument9 pagesTaxationTeodulo VillasenorNo ratings yet

- Zero - Rated / Effectively Zero-Rated Transactions ExplanationDocument2 pagesZero - Rated / Effectively Zero-Rated Transactions ExplanationValerie Kaye BinayasNo ratings yet

- BirDocument1 pageBirPrncssbblgmNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Kiok Loy Vs NLRCDocument2 pagesKiok Loy Vs NLRCrubbtunaNo ratings yet

- Liberty Union Vs Liberty CottonDocument2 pagesLiberty Union Vs Liberty Cottonrubbtuna100% (1)

- Cta 1D Ac 00017 D 2006sep11 RefDocument16 pagesCta 1D Ac 00017 D 2006sep11 RefrubbtunaNo ratings yet

- Atlanta Industries Vs SebolinoDocument2 pagesAtlanta Industries Vs Sebolinorubbtuna33% (3)

- Songco Vs NLRCDocument2 pagesSongco Vs NLRCrubbtuna100% (1)

- Legal Memo - in Pari DelictoDocument4 pagesLegal Memo - in Pari DelictorubbtunaNo ratings yet

- Go-Tan vs. Sps. TanDocument3 pagesGo-Tan vs. Sps. Tanrubbtuna80% (5)

- Ocampo Vs Potenciano DigestDocument2 pagesOcampo Vs Potenciano Digestrubbtuna100% (1)

- Civil Code of The PhilippinesDocument328 pagesCivil Code of The PhilippinesrubbtunaNo ratings yet