Professional Documents

Culture Documents

Tax Computation - TechM

Tax Computation - TechM

Uploaded by

Rohit NimeshOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Computation - TechM

Tax Computation - TechM

Uploaded by

Rohit NimeshCopyright:

Available Formats

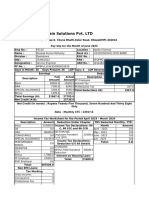

Fixed Component Per Annum Per Month

Basic 0

HRA 0

Conveyance 0

Personal pay 0

Lunch Reimbursement 0

LTA 0

Medical 0

PF 0

Total Fixed 0 0

Variable Component 0

Total 0 0

Amount Credited to bank account per month

Basic 0

HRA 0

Conveyance 0

Personal pay 0

LTA

Total 0

Less: Deductions in pay slip

Employee's PF Contribution 0

Income Tax -4167

Professional Tax 200

Total -3967

Net amount Credited to Bank Account 3967

Amount received as reimbursement/suddexo's 0

Monthly Cash Inflow 3967

Tax Computation

Investment for 80C 100000 90000 80000 70000 60000

Taxable Portion of the salary

Basic 0

HRA 0

Personal pay 0

LTA 0

Variable Component 0

Taxable Portion of the salary 0

HRA computaion

Excess of rent over 10% of Basic 0

40% of Basic 0

Actual HRA 0

Least of the above 0

Taxable (Actual -least) 0

Deduction under 80C

Employee's PF Contribution 0

LIC 0

Others 0

Total 0

Exc.Variable

Taxable Income 0 -90000 -80000 -70000 -60000

Tax Payable -50000 -77000 -74000 -71000 -68000

Tax Payable per month -4167 -6417 -6167 -5917 -5667

Amount received on year end

100% 80% 60% 40%

Variable Component 0 0 0 0

LTA

Net of Tax 0 0 0 0

Tax on variable per month 0 0 0 0

Performance Criteria

55000

-55000

-66500

-5542

You might also like

- T&M Services Consulting Pvt. Ltd. Payslip For The Month Of: June-2017Document1 pageT&M Services Consulting Pvt. Ltd. Payslip For The Month Of: June-2017Bridge67% (3)

- PayslipDocument1 pagePayslipHimanshu_Sharm_749150% (4)

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- RR 10-08Document30 pagesRR 10-08matinikki100% (1)

- Letters p1 Individual and Company Nil Estimate 3Document3 pagesLetters p1 Individual and Company Nil Estimate 3Mark SilbermanNo ratings yet

- Null 3Document2 pagesNull 3bibhuti bhusan routNo ratings yet

- Primer On TRAIN LAW 2018 As of March 13Document16 pagesPrimer On TRAIN LAW 2018 As of March 13Niel Edar BallezaNo ratings yet

- QUA05891 SepSalarySlipwithTaxDetailsDocument1 pageQUA05891 SepSalarySlipwithTaxDetailssrajput66No ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Legal Update 13-2016 Additional Retirement Fund Contributions Sept2016Document5 pagesLegal Update 13-2016 Additional Retirement Fund Contributions Sept2016Madzhiya HulisaniNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Income Tax CalculationDocument1 pageIncome Tax Calculationsoumyadeep1947No ratings yet

- Provident Fund ProvisionDocument6 pagesProvident Fund ProvisionLOKESH KUMAR SINHANo ratings yet

- Rwanda - Individual SummaryDocument6 pagesRwanda - Individual SummaryKasendereNo ratings yet

- Component Monthly Annual TaxableDocument3 pagesComponent Monthly Annual TaxableSachi SurbhiNo ratings yet

- Front - Maintain Training FacilitiesDocument5 pagesFront - Maintain Training FacilitiesRechie Gimang AlferezNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- Jan 2017Document31 pagesJan 2017Sushobhan DasNo ratings yet

- Incometax CalcualtorDocument4 pagesIncometax Calcualtorprakash_pkNo ratings yet

- Xxbkash Final Salinctx CertDocument1 pageXxbkash Final Salinctx Certsatish1981No ratings yet

- Taxable and NontaxableDocument11 pagesTaxable and NontaxableKhym Jie Purisima100% (1)

- Abm Income TaxationDocument8 pagesAbm Income TaxationNardsdel RiveraNo ratings yet

- Primer On Republic Act No. 10963Document12 pagesPrimer On Republic Act No. 10963tinctNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- NOLCODocument8 pagesNOLCOChristopher SantosNo ratings yet

- Tax Treatment of Retirement Fund BenefitsDocument29 pagesTax Treatment of Retirement Fund BenefitsMadzhiya HulisaniNo ratings yet

- Articulo Ingles Trabajo ProcedimientoDocument3 pagesArticulo Ingles Trabajo ProcedimientoCamilo RuizDjNo ratings yet

- PDF 1689599710Document2 pagesPDF 1689599710bibhuti bhusan routNo ratings yet

- Payslip 59904 202401Document1 pagePayslip 59904 202401Sk Imran IslamNo ratings yet

- Sala Rios GuiaDocument9 pagesSala Rios GuiaNiNaNo ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- Taxation of Employment IncomeDocument7 pagesTaxation of Employment IncomeJamvy Jose FernandezNo ratings yet

- Earnings Entitled Amt. Earned Amt. Arrears Deductions AmountDocument5 pagesEarnings Entitled Amt. Earned Amt. Arrears Deductions AmountAditya PLNo ratings yet

- Direct Tax Code and Its Impact On Individuals: Submitted By: Hemant Baranda (Student of Foresight School)Document22 pagesDirect Tax Code and Its Impact On Individuals: Submitted By: Hemant Baranda (Student of Foresight School)Dhru Nayan BhattNo ratings yet

- Tax UpdateDocument149 pagesTax UpdateJamz LopezNo ratings yet

- Intro To General Principles in TaxationDocument18 pagesIntro To General Principles in TaxationbeverlyrtanNo ratings yet

- Salary Slip (31221188 June, 2019)Document1 pageSalary Slip (31221188 June, 2019)ahmed aliNo ratings yet

- 2018-Tax Reform For Acceleration and Inclusion2Document14 pages2018-Tax Reform For Acceleration and Inclusion2Sinetch EteyNo ratings yet

- Income TaxDocument60 pagesIncome TaxashishNo ratings yet

- Salary Slip (31642060 January, 2019) PDFDocument1 pageSalary Slip (31642060 January, 2019) PDFAbdullah AnjumNo ratings yet

- 2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)Document11 pages2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)MGVMonNo ratings yet

- Salary Slip (00890429 February, 2019)Document1 pageSalary Slip (00890429 February, 2019)shah fahadNo ratings yet

- Input To Be Provided in The Cells in YellowDocument2 pagesInput To Be Provided in The Cells in YellowNikhil KautilyaNo ratings yet

- Lesson 5 Part 2 TranscriptionDocument10 pagesLesson 5 Part 2 TranscriptionErica Joy M. SalvaneraNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- Tutorial TaxDocument7 pagesTutorial TaxSumaiyyahRoshidiNo ratings yet

- Pay SlipDocument1 pagePay Slipdanish_83No ratings yet

- Form 16 For AY 2015-16 CAknowledge - inDocument16 pagesForm 16 For AY 2015-16 CAknowledge - inKiranNo ratings yet

- Sudha 2022 PDFDocument1 pageSudha 2022 PDFBikash KumarNo ratings yet

- Income From Other SourcesDocument6 pagesIncome From Other Sourcesanusaya1988No ratings yet

- Salary Structure For 2008-2009Document28 pagesSalary Structure For 2008-2009anon-289280No ratings yet

- NJ Employer WHDocument24 pagesNJ Employer WHaakritichNo ratings yet

- CTC ComputationDocument2 pagesCTC ComputationKNRavi KiranNo ratings yet

- BIR (Philippines) FBT Guidelines: Revenue Regulation 50-18Document16 pagesBIR (Philippines) FBT Guidelines: Revenue Regulation 50-18Cuayo JuicoNo ratings yet

- Anuyash Camicals India PVT LTD Payslip For The Month Of: Apr - 2023Document1 pageAnuyash Camicals India PVT LTD Payslip For The Month Of: Apr - 2023Asmin Sultana AhmedNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- RahulDocument1 pageRahulamancommercialNo ratings yet

- 7934 PrinciplesofpartnershipDocument1 page7934 PrinciplesofpartnershipRohit NimeshNo ratings yet

- 152 mentalhealthinemerWHODocument8 pages152 mentalhealthinemerWHORohit NimeshNo ratings yet

- MedakDocument17 pagesMedakRohit NimeshNo ratings yet

- Raamakrishna Paramahamsa UpanishadDocument2 pagesRaamakrishna Paramahamsa UpanishadRohit NimeshNo ratings yet

- ChittoorDocument17 pagesChittoorRohit NimeshNo ratings yet

- NabookDocument211 pagesNabookRohit NimeshNo ratings yet