Professional Documents

Culture Documents

SL - No 1: A Nnex Ure

SL - No 1: A Nnex Ure

Uploaded by

KristamRajuCopyright:

Available Formats

You might also like

- A Project Report On Survey On Customer Satisfaction of Philips LightingsDocument47 pagesA Project Report On Survey On Customer Satisfaction of Philips LightingsBabasab Patil (Karrisatte)50% (6)

- A Project Report On Business Intelligence and It's Use in Decision Making" at TARANG SOFTWARE TECHNOLOGY LTD, BangaloreDocument65 pagesA Project Report On Business Intelligence and It's Use in Decision Making" at TARANG SOFTWARE TECHNOLOGY LTD, BangaloreBabasab Patil (Karrisatte)100% (1)

- CREDIT Risk Management Zuaricement 2013Document87 pagesCREDIT Risk Management Zuaricement 2013Dinesh Kumar Gattu50% (2)

- A Project Report On Identifying Car Preference and Buying Behaviour of The Car OwnersDocument86 pagesA Project Report On Identifying Car Preference and Buying Behaviour of The Car OwnersBabasab Patil (Karrisatte)60% (5)

- Veeresh - DCCBank - FinalDocument80 pagesVeeresh - DCCBank - FinalSangamesh BagaliNo ratings yet

- Main ProjectDocument85 pagesMain ProjectMani Prasanth0% (1)

- Equitas Holding FinalDocument9 pagesEquitas Holding FinalRajat NidoniNo ratings yet

- Nusrat, E-Banking Practices in COVID-19, Report 2021Document71 pagesNusrat, E-Banking Practices in COVID-19, Report 2021Tasmia KawsarNo ratings yet

- A Study On Risk and Return Analysis of Pharma Companies in IndiaDocument47 pagesA Study On Risk and Return Analysis of Pharma Companies in Indiakarthikkarthi6301No ratings yet

- Project SubDocument90 pagesProject Subroja sujatha s bNo ratings yet

- Working Capital Management OF Oil and Natural Gas Corporation (Ongc)Document32 pagesWorking Capital Management OF Oil and Natural Gas Corporation (Ongc)sujeetsalianNo ratings yet

- Performance ProjectDocument108 pagesPerformance ProjectjayanthiNo ratings yet

- Funds Flow Statement LancoDocument86 pagesFunds Flow Statement Lancothella deva prasadNo ratings yet

- HR TopicDocument59 pagesHR Topicyadavpintu007No ratings yet

- Gold-As Investment Perspective: Dissertation Project Report On " "Document4 pagesGold-As Investment Perspective: Dissertation Project Report On " "Berkshire Hathway coldNo ratings yet

- Working Capital Management of Reliance Infra LTDDocument76 pagesWorking Capital Management of Reliance Infra LTDniceprachiNo ratings yet

- Perception 2Document59 pagesPerception 2harshNo ratings yet

- Complete Topic Funds Flow Analysis at ZAURI CementDocument92 pagesComplete Topic Funds Flow Analysis at ZAURI CementSyed MurthzaNo ratings yet

- Fsa - IciciDocument85 pagesFsa - IciciMOHAMMED KHAYYUMNo ratings yet

- Budget &budgetary ControlDocument94 pagesBudget &budgetary ControlP.lakshmanareddyNo ratings yet

- Chandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedDocument89 pagesChandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedVenky PoosarlaNo ratings yet

- A Study On Migration of Existing HDFC Customers To Digital PlatformDocument36 pagesA Study On Migration of Existing HDFC Customers To Digital PlatformMoreshwarNo ratings yet

- Chapter - 1Document32 pagesChapter - 1raj tripathiNo ratings yet

- Design of Sidewalk Using Pervious Concrete: A Project Report Submitted byDocument37 pagesDesign of Sidewalk Using Pervious Concrete: A Project Report Submitted byvismaya sunilNo ratings yet

- Project Report Submitted in Partial Fulfillment For The Award of The Degree ofDocument80 pagesProject Report Submitted in Partial Fulfillment For The Award of The Degree ofMubeenNo ratings yet

- Uday Project ReportDocument53 pagesUday Project ReportudayNo ratings yet

- E00b1-Financial Statement Analysis-IciciDocument64 pagesE00b1-Financial Statement Analysis-IciciwebstdsnrNo ratings yet

- Thesis On Mutual FundDocument185 pagesThesis On Mutual Fundsidhantha83% (6)

- Capital Structure Analysis at Bharathi CementDocument21 pagesCapital Structure Analysis at Bharathi Cementferoz khan100% (1)

- A Project Report: "Equity Analysis"Document103 pagesA Project Report: "Equity Analysis"Sampath SanguNo ratings yet

- Submitted in Partial Fulfilment of The Requirement For The Degree ofDocument58 pagesSubmitted in Partial Fulfilment of The Requirement For The Degree ofPragya ChakshooNo ratings yet

- A Study On Capital Budgeting in Heritage Foods Inida LTD., KasipentlaDocument8 pagesA Study On Capital Budgeting in Heritage Foods Inida LTD., Kasipentlasree anugraphics100% (1)

- A Study On Budget N Budgetary Control in VPT-CHDDocument117 pagesA Study On Budget N Budgetary Control in VPT-CHDBabikiran Appasani100% (1)

- Home Loan About Samarth FinanceDocument72 pagesHome Loan About Samarth FinanceshaileshNo ratings yet

- A STUDY OF SERVICE PROVIDER BY PRIVATE SECTOR BANK AND PUBLIC SECTOR BANK A BankDocument86 pagesA STUDY OF SERVICE PROVIDER BY PRIVATE SECTOR BANK AND PUBLIC SECTOR BANK A BankShahzad SaifNo ratings yet

- Comparative Study Into Sales & Distribution of AMUL DAIRY & PARAG DAIRYDocument124 pagesComparative Study Into Sales & Distribution of AMUL DAIRY & PARAG DAIRYViraj WadkarNo ratings yet

- SachinDocument89 pagesSachinDeep LathNo ratings yet

- A Project On Working Capital ManagementDocument77 pagesA Project On Working Capital ManagementGurucharan SorenNo ratings yet

- Impact of Dividend Policy On Shareholders Value A Study of Indian FirmsDocument39 pagesImpact of Dividend Policy On Shareholders Value A Study of Indian FirmsMilica Igic0% (1)

- Ravi ProjectDocument92 pagesRavi ProjectAvinash Avii100% (1)

- Fazil Project..Document53 pagesFazil Project..Shahdab Sagari100% (1)

- A Study of Various Insurance Scheme On Cancer Disease at Wenzins Technologies IndiaDocument73 pagesA Study of Various Insurance Scheme On Cancer Disease at Wenzins Technologies IndiaRitesh KumarNo ratings yet

- UjjijuDocument80 pagesUjjijuMannu BhardwajNo ratings yet

- Financial Statement Analysis in BhelDocument4 pagesFinancial Statement Analysis in BhelRohit Vishwakarma100% (1)

- A Study On Credit Appraisal Procedures Followed at Zest MoneyDocument70 pagesA Study On Credit Appraisal Procedures Followed at Zest Moneyneekuj malikNo ratings yet

- Pradeep ProjectDocument66 pagesPradeep Project9908107924No ratings yet

- 20bsp1623 Project ReportDocument36 pages20bsp1623 Project ReportPRACHI DAS100% (1)

- A Project Report On Consumer Buying BehaviourDocument94 pagesA Project Report On Consumer Buying BehaviourNithin RajuNo ratings yet

- A Study On Organization CultureDocument94 pagesA Study On Organization CultureNaina SoniNo ratings yet

- Muthoot Finance PDFDocument16 pagesMuthoot Finance PDFKishore KumarNo ratings yet

- A Study On Comparative Analysis of Mutual Funds and Equity Shares at SBI Mutual Funds, Bangalore PDFDocument79 pagesA Study On Comparative Analysis of Mutual Funds and Equity Shares at SBI Mutual Funds, Bangalore PDFsubratNo ratings yet

- A9f89 - CASH FLOW STATEMENTDocument75 pagesA9f89 - CASH FLOW STATEMENTOmpriya AcharyaNo ratings yet

- Reliance Mutual Funds ProjectDocument58 pagesReliance Mutual Funds ProjectShivangi SinghNo ratings yet

- Project Report On Personal Loan CompressDocument62 pagesProject Report On Personal Loan CompressSudhakar GuntukaNo ratings yet

- A Study On Effectiveness of Cost Benefit Analysis in Dharani Sugars and Chemicals LTD., VasudevanallurDocument85 pagesA Study On Effectiveness of Cost Benefit Analysis in Dharani Sugars and Chemicals LTD., VasudevanallurJanagar Raja SNo ratings yet

- Ratio AnalysisDocument80 pagesRatio AnalysisAbhijeet Patil0% (1)

- A Project Report On Financial Ratio Analysis of Sri Halsidhnath S.S.K LTD NipaniDocument76 pagesA Project Report On Financial Ratio Analysis of Sri Halsidhnath S.S.K LTD NipaniArun Sankar P100% (1)

- A Project Report On Financial Ratio Analysis of Sri Halsidhnath S.S.K LTD Nipani PDFDocument76 pagesA Project Report On Financial Ratio Analysis of Sri Halsidhnath S.S.K LTD Nipani PDFhaz008No ratings yet

- A Project Report On Financial Ratio Analysis of Sri Halsidhnath S.S.K LTD Nipani PDFDocument76 pagesA Project Report On Financial Ratio Analysis of Sri Halsidhnath S.S.K LTD Nipani PDFhaz008No ratings yet

- Ratio Analysis at Nirani Sugar Limited Project Report Mba FinanceDocument74 pagesRatio Analysis at Nirani Sugar Limited Project Report Mba FinanceBabasab Patil (Karrisatte)100% (1)

- A PROJECT REPORT ON Ratio Analysis at NIRANI SUGAR LIMITED PROJECT REPORT MBA FINANCEDocument76 pagesA PROJECT REPORT ON Ratio Analysis at NIRANI SUGAR LIMITED PROJECT REPORT MBA FINANCEmoula nawazNo ratings yet

- A Project Report On Estimation of Working Capital Reqiurements Krishna Sugar Factory AthaniDocument72 pagesA Project Report On Estimation of Working Capital Reqiurements Krishna Sugar Factory Athanigshetty08_966675801No ratings yet

- A Project Report On Working Capital Management Nirani Sugars LTDDocument95 pagesA Project Report On Working Capital Management Nirani Sugars LTDBabasab Patil (Karrisatte)100% (4)

- A Project Report On Customer Awareness Level in Market For HDFC Standard Life Insurance Corporation in Dharwad CityDocument98 pagesA Project Report On Customer Awareness Level in Market For HDFC Standard Life Insurance Corporation in Dharwad CityBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Comparative Analysis of The New Indian Express Times of India and The Hindu in Hubli CityDocument74 pagesA Project Report On Comparative Analysis of The New Indian Express Times of India and The Hindu in Hubli CityBabasab Patil (Karrisatte)0% (1)

- A Project Report On Evaluation of Distribution Channels in The Riddhi Siddhi Gluco Boils LTDDocument82 pagesA Project Report On Evaluation of Distribution Channels in The Riddhi Siddhi Gluco Boils LTDBabasab Patil (Karrisatte)No ratings yet

- Executive SummeryDocument67 pagesExecutive SummeryBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Customer Satisfaction Level at Kirloskar LTDDocument85 pagesA Project Report On Customer Satisfaction Level at Kirloskar LTDBabasab Patil (Karrisatte)100% (1)

- A Project Report On A Study On Impact of Iso Procedures On Quality Control at SisDocument77 pagesA Project Report On A Study On Impact of Iso Procedures On Quality Control at SisBabasab Patil (Karrisatte)100% (1)

- A Project Report On Comparative Study of Salary Accounts of Various Banks at Icici BankDocument62 pagesA Project Report On Comparative Study of Salary Accounts of Various Banks at Icici BankBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Analysis On Market Potential of Special Savings Account at Icici BankDocument73 pagesA Project Report On Analysis On Market Potential of Special Savings Account at Icici BankBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Comparative Analysis of The New Indian Express, Times of IndiaDocument79 pagesA Project Report On Comparative Analysis of The New Indian Express, Times of IndiaBabasab Patil (Karrisatte)75% (8)

- A Project Report On Production Expansion of Vitrified Tiles of MCLDocument94 pagesA Project Report On Production Expansion of Vitrified Tiles of MCLBabasab Patil (Karrisatte)100% (1)

- A Project Report On Causes For Absenteeism in B.D.K. Engineering Industry Ltd. HubliDocument80 pagesA Project Report On Causes For Absenteeism in B.D.K. Engineering Industry Ltd. HubliBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Capital Budgeting at Godavari Sugar Mills LTDDocument66 pagesA Project Report On Capital Budgeting at Godavari Sugar Mills LTDBabasab Patil (Karrisatte)100% (2)

- A Project Report On A STUDY of EQUITY On CAPITAL MARKETS at Indian Infoline BengloreDocument101 pagesA Project Report On A STUDY of EQUITY On CAPITAL MARKETS at Indian Infoline BengloreBabasab Patil (Karrisatte)100% (1)

- A Project Report On Brand Positioning of Big BazaarDocument86 pagesA Project Report On Brand Positioning of Big BazaarBabasab Patil (Karrisatte)50% (2)

- A Project Report On Pre and Post Acquisition Activities Related To Various Avenues of Marketing Aspects at VodafoneDocument97 pagesA Project Report On Pre and Post Acquisition Activities Related To Various Avenues of Marketing Aspects at VodafoneBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Organizational Study of Dharwad Milk Union Limited DharwadDocument46 pagesA Project Report On Organizational Study of Dharwad Milk Union Limited DharwadBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Brand Preferences of Mango Soft Drinks Among The Consumers of Hubli & DharwadDocument60 pagesA Project Report On Brand Preferences of Mango Soft Drinks Among The Consumers of Hubli & DharwadBabasab Patil (Karrisatte)100% (1)

- A Project Report On Brand Awareness Level of Keshawa Cement BagalkotDocument83 pagesA Project Report On Brand Awareness Level of Keshawa Cement BagalkotBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Organizational Study of Dharwad Milk Union LimitedDocument51 pagesA Project Report On Organizational Study of Dharwad Milk Union LimitedBabasab Patil (Karrisatte)100% (2)

- A Project Report On Organization Study of Dharwad Milk UnionDocument45 pagesA Project Report On Organization Study of Dharwad Milk UnionBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Organization Study and Awareness of ICICI Prudential Life Insurance Co. LTDDocument78 pagesA Project Report On Organization Study and Awareness of ICICI Prudential Life Insurance Co. LTDBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Non-Performing Assets of Bank of MaharashtraDocument80 pagesA Project Report On Non-Performing Assets of Bank of MaharashtraBabasab Patil (Karrisatte)No ratings yet

- A Project Report On B2B Communication For The Promotion of Blister Packaging Machines and Understading International Business ProcessDocument69 pagesA Project Report On B2B Communication For The Promotion of Blister Packaging Machines and Understading International Business ProcessBabasab Patil (Karrisatte)100% (1)

- A Project Report On On Indian Oil Out Lets and Bazzar Traders On Servo Lubricants at IOCLDocument58 pagesA Project Report On On Indian Oil Out Lets and Bazzar Traders On Servo Lubricants at IOCLBabasab Patil (Karrisatte)No ratings yet

- A Project Report On Organization Culture at Jinabakul Forge PVT LimitedDocument76 pagesA Project Report On Organization Culture at Jinabakul Forge PVT LimitedBabasab Patil (Karrisatte)100% (1)

- A Project Report On Non Performing Assets & Banking StudiesDocument76 pagesA Project Report On Non Performing Assets & Banking StudiesBabasab Patil (Karrisatte)100% (7)

- A Project Report On Non Performing Asset of Commercial Bank in India at IdbiDocument75 pagesA Project Report On Non Performing Asset of Commercial Bank in India at IdbiBabasab Patil (Karrisatte)100% (1)

SL - No 1: A Nnex Ure

SL - No 1: A Nnex Ure

Uploaded by

KristamRajuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SL - No 1: A Nnex Ure

SL - No 1: A Nnex Ure

Uploaded by

KristamRajuCopyright:

Available Formats

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.

K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 1

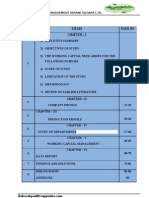

TABLE INDEX

SL.NO

CONTENTS

PAGE

NO.

1

PART I

EXECUTIVE SUMMARY

2

PART I I

INDUSTRY PROFILE

3

PART I I I

INTRODUCTION OF COMPANY

4

PART I V

RESEARCH METHDOLOGY

OBJECTIVES OF THE STUDY

6

PART V

WORKING CAPITAL MANAGEMENT

7

PART VI

DATA ANALYSIS AND INTERPRETATION

8

PART VI I

FINDINGS

SUGGESTIONS &

CONCLUSIONS.

9

ANNEXURE

FINANCIAL STATEMENT.

BIBILOGROPHY.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 2

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 3

INDUSTRIAL PROFILE

ABOUT THE SUGAR INDUSTRY IN INDIA:-

India has been known as the original home of sugar &

sugar cane. Indian Mythology supports the above facts ass it

contains legends showing the origin of sugarcane India is the

second largest producer of sugarcane next to BRAZIL. Presently

above 4 million Hectors land is under the sugarcane with an

average yield of 70 tons per hectors. India is the largest single

producer of the sugar including traditional trade Sugar sweeteners,

Khandsari & gur equivalent to 26 million tonnes row value followed

by Brazil in second place at 18.5 million tonnes. Even in respect of

white crystal sugar. India has ranked No.1 position in 7 out of last

10 years

HISTORY OF SUGAR INDUSTRY IN INDIA:-

Traditional sweeteners gur &

khandsary are consumed mostly by the rural population in India. In

the early 1930s nearly 2/3rd of sugarcanes production of

alternates sweeteners gur & khandsari. With better standard of

living & higher incomes, the sweetener demand has shifted to white

sugar. Currently about 1/3rd sugarcane production is utilized by

the Gur & Khandsari sectors. Being in the small scale sector, these

two sectors are completely free form controls & taxes which are

applicable to sugar sector.

The advent of the modern sugar processing

industry in India began 1930 with grant of tariff to the Indian

sugar industry, The number of sugar mills increased from 30 in

the year 1930-31 to 135 in the year 1935-36 &the production

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 4

during the same period in created form 1.20 lakh tonnes to 9.34

lakh tonnes under the dynamic leadership of private sector.

The area of planning for industrial

development began in 1950-51 & Government laid down targets of

sugar production & consumption, licensed & installed capacity,

Sugarcane production during each of Five year plan periods.

NEED FOR THE STUDY

The study has been conducted for gaining practical knowledge

about Ratio analysis of Shri Halasidhnath Sahakari Sakhar

Karkhana. Ltd.

The study is undertaken as a part of the MBA curriculum from

1st July 2010 to 20th August 2010 in the form of summer in

plant training for the fulfillment of the requirement of MBA

degree.

TITLE OF THE PROJECT

This project A Study on ANALYSIS OF FINANCIAL PERFORMANCE

ON The BASIS OF FINANCIAL RATIOS of Halsidhanath Sahakari

Sakhar Karkhana Ltd

OBJECTIVES:-

To study the profitability of

Halsidhanath Sahakari Sakhar Karkhana Ltd. Nipani.

To study the liquidity position.

To find activity turnover

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 5

To study operating efficiency of

Halsidhanath Sahakari Sakhar Karkhana Ltd Nipani.

SCOPE OF THE STUDY

The scope of the study is identified after and during the study

is conducted. The main scope of the study was to put into

practical the theoretical aspect of the study into real life work

experience. The study of Ratio analysis further the study is

based on last 5 years Annual Reports Shri Halasidhnath

Sahakari Sakhar Karkhana. Ltd.

LIMITATIONS OF THE STUDY

The analysis is limited to just five years of data study (from year

2005 to year 2009) for financial analysis.

Limited interaction with the concerned heads due to their busy

schedule.

METHDOLOGY

In preparing of this project the information collected from the

following sources.

Primary data:

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 6

The Primary data has been collected from Personal Interaction with

Finance manager Mrs.S.M.Siragave and other staff members.

Secondary data:

The major source of data for this project was collected through

Balance sheet of SSHSKL

Profit and loss account of 5 year period from 2005-2009

SAMPLING DESIGN

Sampling unit : Financial Statements.

Sampling Size : Last five years financial statements.

Tools Used: MS-Excel has been used to create a Charts and

calculation.

Findings

Gross profit and net profits are decreased during the period

of study, which indicates that firms inefficient management

in manufacturing and trading operations.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 7

Gross profit and net profits are increased during the period

of 2004-05 which indicates that firms efficient management

in manufacturing and trading operations.

Liquidity ratio of the firm is not better liquidity position in

over the five years. It shows that the firm had not sufficient

liquid assets.

The inventory of the firm in the first year has been sold very

slow. And there is an increase in the movement of the

inventories but it slightly decreased in the last year. This may

be a sign not good to the firm.

The fixed assets turnover ratio

of the firm has in 2004-05 the ratio is 0.85 and it increase in

the next 3years continuously and it again decrease in

2008-09.

The current assets turnover

ratio is increasing during the period of 2004-06 and again it

decrease in the period of 2006-07. And again increase in

next two year slithightlliy.

Direct Material cost ratio of the

firm is has less material cost during the period of 2004-05 &

2007-08 and it raised in the year of 2005-06 and 2008-09.

The cost of direct labour of the

firm in the year of 2004-05 is 4.94%and it increasing

slithightlliy up to 2007-08 and it decrease in the next year.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 8

The cost of manufacturing

overhead of the firm in the year of 2004-05 is 5.22% where it

compare to the next 3year it increase rapidly.

SUGGESTIONS

The profit Of the Company Is not in a good Position For That

company has to Take Alternative Actions such As

Increasing in Procurement in sugarcane ,

Production, and Control in Expenses Like,

Administrative, selling Etc.

The firms have low current ratio so it should increase its

current ratio where it can meet its short term obligation

smoothly.

Liquidity ratio of the firm is not better liquidity position in

over the five years. So I suggested that the firm maintain

proper liquid funds like cash and bank balance.

CONCLUSION

This project of Ratio analysis in the production concern is not

merely a work of the project. But a brief knowledge and experience

of that how to analyze the financial performance of the firm. The

study undertaken has brought in to the light of the following

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 9

conclusions. According to this project I came to know that from the

analysis of financial statements it is clear that SHSSK Ltd. Have

been incurring loss during the period of study. So the firm should

focus on getting of profits in the coming years by taking care

internal as well as external factors. And with regard to resources,

the firm is take utilization of the assets properly. And also the firm

has a maintained low inventory.

INTRODUCTION OF CONCEPTS

India is developing country in which more than 70%

population is dependent upon agriculture. In India Wheat, Cotton,

Rice, Tobacco & Sugarcane are the some main crops. But the sugar

cane is one of the important agricultural productions. And or by

using the sugar We produce sugar. Which is very important item of

daily meals? Sugar is mainly used for tea, Coffee and so many food

products. It is also important raw material for bakery industry. The

Sugar is produced by so many co-operative and also private

factories. The first scheme of sugar factory in co-operative society

has been introduced byMr.G.N. Sahastrabudhe & R.N. Hiremath in

1912. But first Co-operative sugar factory started in 1918, by the

Lallubhai Samaldas & G. N. Sahastrabudhe in baramati. But due to

Lake Of sugar Cane the factory stopped its working in 1924.

After that, in co-operative field, under the guidance of

Vilnalirao patil, Dr Dhanjay Gudgil Tried to start second

co-operative sugar factory. He was started pravar -co-operative

Sugar factory in 1950 at loni this factory got success in market

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 10

therefore some other sugar Factories were going to start in Pune,

after, the late 1970 there was a rapid increase in trend of

co-operative sugar factory.

INDUSTRIAL PROFILE

ABOUT THE SUGAR INDUSTRY IN INDIA:-

India has been known as the original home of sugar &

sugar cane.indian Mythology supports the above facts as it

contains legends showing the origin of sugarcane India is the

second largest producer of sugarcane next to BRAZIL. Presently

above 4 million Hectors land is under the sugarcane with an

average yield of 70 tonnes per hectors. India is the largest single

producer of the sugar including traditional trade Sugar sweeteners,

Khandsari & gur equivalent to 26 million tonnes row value followed

by Brazil in second place at 18.5 million tonnes. Even in respect of

white crystal sugar. India has ranked No.1 position in 7 out of last

10 years

HISTORY OF SUGAR INDUSTRY IN INDIA:-

Traditional sweeteners gur &

khandsary are consumed mostly by the rural population in India. In

the early 1930s nearly 2/3rd of sugarcanes production of

alternates sweeteners gur & khandsari. With better standard of

living & higher incomes, the sweetener demand has shifted to white

sugar. Currently about 1/3rd sugarcane production is utilized by

the Gur & Khandsari sectors. Being in the small scale sector, these

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 11

two sectors are completely free form controls & taxes which are

applicable to sugar sector.

The advent of the modern sugar processing

industry in India began 1930 with grant of tariff to the Indian

sugar industry, The number of sugar mills increased from 30 in

the year 1930-31 to 135 in the year 1935-36 &the production

during the same period in created form 1.20 lakh tonnes to 9.34

lakh tonnes under the dynamic leadership of private sector.

The area of planning for industrial

development began in 1950-51 & Government laid down targets of

sugar production & consumption, licensed & installed capacity,

Sugarcane production during each of Five year plan periods.

MANUFACTURING PROCESS & TECHNOLOGY:-

Sugar (sucrose) is a carbohydrate that

occurs naturally in every fruit & vegetable is a major product of

pirotosynthesis, the process by which plants transforms the suns

energy into food. Sugar occurs in greatest quantities in sugarcane

& sugar beets form which it is separated for commercial use. The

natural sugar stored in the cal stalk or beet root is separated from

rest of the plant material through a process known as refining

For sugarcane the process of retaining is carried out in following

steps.

Pressing of sugarcane to extract the juice.

Boiling the juice unit it begins to thicken & sugar begin to

crystallize.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 12

Spinning the crystal in a centrifuge to remote the syrup,

producing raw sugar.

Shipping the raw sugar to a refinery where it is wasted &

filtered to remove Remaining non sugar ingredient & colour.

Crystallizing, drying & packing the refined sugar.

Beet sugar processing is the similar but it is alone in one

continuous process without the raw sugar stage. The sugar beets are

washed sliced & soaked in hot water to separate the sugar containing

juice from the beet fiber. The sugar laden juice is the purified, filtered,

For the sugar industry, capacity utilization is conceptually different

from the applicable to industries in general. In depends on three

crucial factors the actual numbers of ton sugarcane crushed in a

day, the recovery rate which generally depends on the quality of

the cane & actual length of the crushing season.

Since cane is not transported to any great extent, the

quality of the cane that a factory receiver on its location & it

outside its control. The length of the crushing season also depends

upon location with the maximum being in south Indian. sugarcane

in India is used to make either sugar, Khandsari or gur . However

sugar products produced are divided into four basic categories;

Granulated, brown, liquid, sugar, and invert sugar.

PFROFILE OF THE COMPANY

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 13

Name of the factory Shree Halasidnath Sahakari

Sakhar Karkhana LTD.

Address Shree Halasidnath Sahakari

Sakhar Karkhana LTD.

Shankaranand nagar,

Nipani.

TAL:-Chikodi.

DIST:-Belgaum

PIN:-591237.

Year of Establishment APRIL-1981.

1

st

Crushing Season JANUARY-1983.

Register Number DSK/REG-2/80-81.

Register Date 22-04-1981.

Phone Number STD CODE (08338)

Chairman-220355

Office-222090

FAX Number (08338)221315

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 14

BACKGROUND & INCEPTION COMPANY.

Halsidhanath sahakari sakhar karkhana is placed 3 km

away from Nipani in north side at Shankaranandnagar , Tal:chikodi

Dist: belgaum. Halsidhanath sahakari sakhar karkhana is the

support pillar to the sugar cane producer farmes in the Nipani area.

The karkhana wa started by the some social workers in nipani

area with a view to provide an good option to the former in this

area like sugarcane.

Mr. Baburao Budihalkar was the chief promoter in this

project But, some other The foundation of karkhana building was

held on 9-11-1982. The chief guest for this function was

Shri.Rajiv Gandhi who was the prime minister of India in that time.

The Karkha started its regular working on 30-9-1989. The delay

was due to the changing political conditions in Karnataka state.

The Karkhana developed a very good rapport with the farmers in

this area and worked for their progress . So, the karkhana is

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 15

operating in entire Chikkodi taluka

andAlur,Bhairapur,Kanagala,Shippur,Karajaga,Rashing,Bad,Nangnur,

Mattiwade,Hitani,Shekinhasur,Konankeri, sadlaga thirteen(13) vill

ges in Hukkeri taluka. Only Belgum in Belgum laluka and Soudatti

in Raibag Taluka all these part of Belgaum district in the Karnataka

state. And Arjuni, Chikhali, Gorambe, Shendur, Shankarwadi,

Vandur all these eight (8) villages in Kagal taluka is a part of

Kholapur district in the Maharashtra state Thus, it will comprise of

part of Belgaum district and part of Kolhapur district, from two

adjoining states.

OBJECTIVES AND FUNCTIONS:-

The principle object of the karkhana will be to promote the

interests of all its members to attain their social and

economic betterment through self help and mutual aid in

accordance with the co-operative principles.

To prepare and implement the programme for harvesting and

transportation of sugarcane on behalf of the members from

their field to factory in supply of sugarcane to factory for

crushing and to avoid probable losses of sugar in cane.

To manufacture sugar, Jaggery and its allied by products

from the sugarcane supplied by the members and other and

to sale these products at good price.

To install the factory for manufacture sugar on large scale

basis and to take all necessary steps to run it efficiently

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 16

To install the necessary machinery required for producing of

bagasse, molasses, Press-mud etc.

To ruchase the means of transportation and to run, to give

and to take on hire basis.

To install research centers and to assist the existing research

institutions and to undertake research work helpful to

sugarcane, sugar and allied industry.

NATURE OF THE BUSINESS CARRIED:-

S.H.S.S.K.LTD. is co-operative sector firm.

It is a manufacturing company It produces sugar, molasses And

supplies sugar tp Nipani, Chikodi Taluka, Raibag Taluka, saudatti,

and Hukkeri Taluka. It operates within Karnataka as well as outside

Karnataka.

Nature of business carried Shri Halasidhanath sahakari Sakhar

Karakhana Ltd is involved in the activity of manufacturing white

crystal sugar products which is the main product. The process of

production involves conversion of.

Raw sugar cane to sugar,

Raw sugar to refined sugar, Molasses, Bagasses are its by

products.

MOLASSES: Molasses is mainly used for the manufacture of

ethyl alcohol(ethanol)yeast and cattle feed.

BAGASSES: Bagasses is usually as a combustible in the

furnaces to produce steam which in turned is used to

generate the power, it is also used as raw materials for the

production of paper and as feedstock for the cattle.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 17

PRODUCT PROFILE

Shri Halasidhanath Sahakar Sakhari Karakhana Ltd established for

the purpose of sugar while producing the sugar some raw juice

and raw bagasses become molasses and some other by-product.

The Shri Halasidhanath Sahakar Sakhari

Karakhana Ltd is producing following product

1) Sugar

A) Medium-30

B) Small-30

C) Levy

2) Molasses

3) Compost

4) Bagasses

AREA OF OPREATION

The Shri Halasidhanath Sahakar Sakhari Karakhana Ltd has wide

range of area of operation for continuous and regular flow of sugar

cane from different authorized area within the 80 kms. Around the

spot of plant includes some region of two states from Maharashtra

and Karanataka under.

SR.NO NAME OF

TALUKA

DISTRICT NUMBER

1 Chikodi Belgaum 43

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 18

2 Hukkeri Belgaum 05

3 Raibag Belgaum 04

4 Belgaum Belgaum 01

5 Jamkhandi Baglkot 01

6 Athani Belgaum 05

7 Kagal Kholapur 09

TOTAL 68

OWNERSHIP PATTERN

Shri Halasidhanath Sahakar Sakhari Karakhana Ltd established in

the year 1981 at Hala sugar gram of chikodi Taluka. It was resolved

to collect the share of established this sugar factory in co-operative

basis. Let the late Baburao B patil Budhialkar and other social

workers and leader working in co-operative sector also come

forward to assist team in the starting this factory. It is joint

venture with share capital of Rs. 104940000 contributed by

18990 share holders. The company was established in the year

April 1981 & started the crushing in January 1983. The company is

registered under the provision of companies Act-1956.

THERE IS TOTALLY 15 BODS.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 19

Grower member will elect 12 BODS

1 Director will be elected by the co-operative.

1 Director nominated by the principal of financial agency.

Apart from this 14 director, managing director will be

deputed by the government

PRESENT BOARD OF DIRECTORS ELECTED DIRECTOR

Shri. D.A.Chougale Managing

Director

Shri. Babasaheb .S. Saasne Chairman

Shri .Ramagounda .R. Patil Vice- Chairman

Shri .Ganesh .P. Hukkeri Director

Shri .Appasaheb .S. Jolle Director

Shri. Annasaheb .A. Patil Director

Shri. Vishawanath .S. Kamate Director

Shri. Malagounda .P. Patil Director

Shri. Anand .D. Ginde Director

Shri. Chandrakant .S. Kotiwale Director

Shri. Ramagounda .B. Patil Director

Shri. Ramagounda .Y. Patil Director

Shri. Kanthinath .G. Chougale Director

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 20

MEMBERSHIP OF SHARE CAPITAL:-

The membership of Shri Halsidhanath Sahakari

Karakana Ltd has been accepted by different individuals and firms

categorized into three classes as under

A Class involves the grower (farmers of agricukturist)

B Class involves the institute and non-grower

These are:-

1. Co-operative Societies

2. The belgaum District Central Co-operative Bank Ltd.

3. Karnataka State Agro Industrias Co-operation,

Bangalor.

C Class involves the state government of karnakata.

The above said members born their share as share capital

as

Sr

No

Member class No of Shares Share

capital

1 A Grower

B co-operative society

15,924 613.52

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 21

COMPETITORS INFORMATION

The main competitors are as follows

Doodh Ganga Shakari Sakhare Karkhane, Ltd

Crashing capacity-5500 TCD

Recovery -11.5%

Sugar production -10000 Qtls (per day).

Venkateshwer Sugar Ltd

Cashing capacity -2500 TCD

Recovery -10.5%

Sugar production -3000 qtls (par day).

Renuka Sugar Ltd

Crashing capacity -10000 TCD

Recovery -11.2%

2 Non-Grower 3065 60.06

3 C Government of

Karanataka

1

375.82

Total 18990

1049.40

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 22

Sugar production -14000 Qtls (par day).

INFRASTRUCTURAL FACILITY

CATEEN

The management provides multi-purpose cooking range,

utensils, working capital, and installation of gas equipment free

building expenditure towards purchase of furniture. Actual

expenditure towards consumption of water, electricity and gas,

annual subsidy. the rates of foodstuffs in the canteen are fixed on

no no profit basis. The workers who are working in the

production department are entitled for Tea free at cost while they

are on duty.

TRNSPORTATION

Up to 40 km. three transportation facilities is provided

to farmers rate structure of vehicles as per kilometres

Sr.

No

KM Rate per

km

Sr No KM Rate

per km

1 5 45.56 11 55 156.77

2 10 57.76 12 60 166.83

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 23

3 15 73.12 13 65 174.02

4 20 86.34 14 70 183.80

5 25 98.16 15 75 192.75

6 30 106.30 16 80 199.12

7 35 117.45 17 85 209.24

WATER

It is established the river Vedganga. there is

sufficient supply of water required for production process.

POWER

There is provision electricity from KPTCL. & company

generates its own power through boilers during crushing of

sugarcane.

ACHIEVEMENTS

In 1996-97 from South Indian Sugar Technologists

Association (SISTA) for best achievement award in cane

development.

FATURE GROWTH AND PROSPECTUS

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 24

To undertake such activities as are identical and conductive

to the development the society.

To inn coverage for other crops where sugarcane not grown.

To expand crushing capacity.

WORKFLOW MODEL (END TO END MODEL )

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 25

Heating 65 C->Lime +SO2

application

APPLICATION OF 7S MODEL

OF MC, KENSEYS

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 26

Strategic planning refer to the management processes in

organization which helps in management to determine the future

impact of change and take the currentdecisions to reach designed

future. The management literature is replace which instance of

organization which have fade stress in strategic planning but not

have been phenomenally successfully.

Consultants at the Mc.Kensys company very well

known management consultancy firm the created states develop

the 7 s frame work towards the end of 7 s diagnose the causes of

organizational problems and to formulate problems for important.

The following is the 7s frame related to the Mc. Kennys 7s frame

work

According to waterman organizational change is

not simply matter of structure although structure is a significant

variable in the management of change. Again it is not a simple

relationship between strategy and structure although strategy is

also critical as put.

In their view effective organizational change may be

understood to be a complex relationship between strategy,

structure, system and style, skill, staff, and super ordinate goals.

The framework suggests that there is a multiplicity of factors that

influence an organization and ability to change and its proper

mode of change.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 27

STRUCTURE OF ORGNIGIATION

SHARE HOLDER

CHAIRMAN

MANAGING DIRECTOR

BOARD OF DIRECTOR

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 28

SHARE SECTION

Head: - M.T. PATIL

According to by-law, the factories authorized share

capital is Rs 20 crores. Atresent the number of shareholders is

18990 and capital collected from all the shareholders. i.e. Rs

10,49,40,000/-

The membership of Shri Halsidhanath Sahakari

Karakana Ltd has been accepted by different individuals and firms

categorized into three classes as under

A Class involves the grower (farmers of agricukturist)

B Class involves the institute and non-grower

These are:-

4. Co-operative Societies

5. The belgaum District Central Co-operative Bank Ltd.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 29

6. Karnataka State Agro Industrias Co-operation,

Bangalor.

C Class involves the state government of karnakata.

The above said members born their share as share capital

as

TIME OFFICE LABOUR WELFARE DEPARTMENT

Sr

No

Member class No of Shares Share

capital

1 A Grower

B co-operative society

15,924 613.52

2 Non-Grower 3065 60.06

3 C Government of Karanataka 1 375.82

Total 18990

1049.40

NAME OF

THE

DEPT

PERMA

NENT

SEATION

AL

GOV

T

CONSTR

U

CTUAL

DAILY

WAGE

S

CONTR

ACT

TOTA

L

Time

Office

6 4 - - - 3 13

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 30

HEAD: - S.G. MORE.

Time office is one of the main part of the factory

because in time office all records regarding many types of

Security 13 - - 6 - 3 22

Store 6 5 - 1 - 9 21

Civil 4 - - - - - 4

Environm

ent

3 3 - 1 - 9 16

Administ

rative

15 3 1 5 - 6 30

General

A/C

10 - - - - 3 13

Cane A/C 7 2 - 1 - 6 16

Vehicle 7 4 - - - - 11

Medical 1 - - 1 - - 2

Agricultu

re

28 62 - 5 2 39 136

Engineer 90 70 - 3 3 41 207

Manufact

urer

8 99 - - 2 38 147

TOTAL 198 252 1 23 7 157 638

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 31

departments and about the details of their employees are recorded

so it must require in each and every organization.

There is no special department like HRD or Personal

management in the factory time and labour welfare office is there,

in this office there is labour welfare officer & head time keeper,

shift time keeper and wage clerk is there.

WELFARE FACILITY

To take care of all the workers, the organization will

provide the some following facility those are:-

A. Bonus is 08.33%based on the

worker salary.

B. Quarter, hospital etc. facility

and allowances

C. Canteen facility

D. Promotion facility

E. Permanent employees get one

increment every year.

F. School facility to the worker

children.

G. And medical facility are available

if any accident occurs.

PURCHASE SECTION

Purchasing plays an important and significant

role in processing industry. Purchasing is tough task, which is to be

performed very carefully. It functions on the principal of Money

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 32

saved in purchased is money gained in sales. Profit can also be

earned in purchasing process by the purchase manager by his

knowledge about the entire market.

STORE DEPARMENT:-

THE WORKING FLOW CHART SHOWN BELOW

In this factory the store department in

charge will be Shri Kadam sir under their the information will be

here.

Main Points:-

The store keeper will check the

supplier quantity and afterwards send to the respective

section wise. For ex.:- Cement, Belt etc After this the

material verification will be taken by under chief enginee

The store keeper will entry the

purchased material in a book in systematic manner.

The daily transactions will be

held in the books of power house main panel board.

Store department is just like a

godown because in department all materials which are

needed to the factory are stored.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 33

The store house which contains

the 21 heads. They are follows:-

Heads :-

1. Oil and lubricants Ex :- Bearing

oil, Greece, etc being purpose machinery.

2. Manufacturing goods Ex:-

Chemical, sulphur etc uses of sugar processing.

3. Hardware Ex:- Nutbolt, chain,

MS bar etc uses of machinery maintenance.

4. Welding materials Ex:-

Welding rod, screen, black glass uses of welding purpose.

5. Drawing materials Ex:-

Ammonia paper, Dressing paper, etc machinery

maintenance of engineering department.

6. Electrical goods Ex:- Pressure

gauge, vacuum gauge, temperature gauge etc for

machinery maintenance.

7. Tools and tackles Ex:- Spaner,

screw driver etc.

8. Transmission of goods Ex:-

Bearing oil, oil seal, bearing glue

9. Iron and steel These are used

for machinery maintenance of engineering department.

10. Building materials Ex:-

Cement, steel, stone crystal, sand etc uses of concrete

foundation for machinery.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 34

11. Machinery and machine spare

Ex:- Bearing, coupling, nutbolt etc.

12. Pipe and pipe fitting Ex:-

pipe, bend, flang etc

13. Furniture and fixtures Ex:-

Chairs, tables etc

14. Stationary Ex:- Log book ,

indent book, bucket etc.

15. Rubber goods Ex:- Bush,

rubber belt, wheel, ordinary material.

16. Library Ex:- Books.

17. Vehcle spare

18. Medical Ex:- Druds, tablets,

syringe, salines etc.

19. Printing Ex:- Log, book,

store recipt book etc..

20. Computer spare Ex:-

Ribbon, cartridge, pen drive etc.

SALES SECTION

The main product of H.S.S.K.Ltd is sugar and

by-Bagasses, Molasses, and press mud. These all are sold by

calling tenders. Because the factory has no right to sale these

products directly in the open market. The Office Superintendent

does this work and sales officer with the help of sugar directors

Bangalore Central Govt. fixes the selling quantity.

There are two types of sales:-

A. Free sale--------- 90% of the

produced sugar.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 35

B. Levy sale--------10% of the

produced sugar.

The factories by-products like,

A. Bagasses-------used in paper

industry.

B. Molasses-------used in

distilleries.

C. Press-Mud-----used in

fertilizer.

SECURITY SECTION

There are 22 security guards and their function are,

1) Checking in-out persons and

vehicles.

2) Protecting and securing proper

and best use of assets of the factory.

3) Maintaining the below

mentioned registers,

A. Attendance registers.

B. Visitors register.

C. Vehicle register.

D. Workers get pass

E. Bagasse, Molasses, Press-Mud

get pass.

Cane Development Section

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 36

Department-Structure

Chief of C.D.O

For Manager

C.D.O

Assistants

AssistantC.D.O

Workers

Cane-Inspector

Field-Offices

The duty of C.D.O (Cane Development Officer) is

to develop the growth of sugarcane by providing training and

seeds to the farmers.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 37

Cane development process:-

Providing training to the

farmers.

Providing seeds on loan basis.

Seeds are developed in the firm

and distributed to farmers.

Early detection and pests and

crop decreases and providing solution

Cane-Verities:-

Karnataka Hybrid Seeds.

Coimbatore

Coimbatore Cadlar

Coimbatore Melattur.

ENGINEERING-DEPARTMENT

HEAD:-M Umapati

It is very important department to any factory,

because engineer only have capacity to run the production

smoothly. In this factory this section has217 employee The main

functions of this section as follows,

1. To take of all the divisions like

boiler, mill, electricity etc.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 38

2. To ensure that all machineries

are in good condition.

3. They inform board of

management about scares materials and make them to

purchase that material.

4. The repair the broken down

machines and make them to work properly.

Department-Structure

Assistant Electrical Environmental Work-Shop

Civil

Engineer Engineer Engineer Engineer

Engineer

Supervisor Supervisor Supervisor Supervisor

Supervisor

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 39

Worker Worker Worker Worker

worker

During off season their functions are,

1. Maintenance of all the

machineries currently.

2. Overhauling of the machineries.

3. Machinery erection.

PRODUCTION DEPARTMENT

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 40

The Chief Engineer, chief

chemist and Civil engineer from the structure of the

production

The chief engineers work is to

technical and mechanical works and improve them to

increase the production capacity.

The chief chemist work is to

instruct how where & when to use chemical in the production

process.

The civil engineers work is to

plan where to situate the machineries and also they advise

useful suggestions to make the production very easy and

smooth.

COMPARATIVE STUDY OF PRODUCTION OF SUGAR

Sr.

No

YEAR SHARE

CAPITAL

SUGARCANE

CRUSHING

SUGAR

PRODUCTION

RECOVERY

RATE

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 41

Cane Yard:- In this collect

sugarcane from the farmers.

Cane weight:- In this they

measure sugarcane including vehicle after unloading the

cane. they measure vehicle weight and they deduct that

weight in the total weight. Thus they get the actual weight of

the cane. They prepare 3 weight receipts with the help of

computers, one goes to cane a/c, another goes to farmers

and third one goes to transfot office.

A/C (In MT) (In qtl)

1

2004-05 837.13 141430.852

151480 10.71

2

2005-06 972.40 210556.428

239950 11.40

3

2006-07 1049.40 241130.000

275240 11.41

4

2007-08 1125.40 113345.000

132920 11.82

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 42

Cane Carrier:- The unloaded

cane is put down in carrier and carrier is driven by the motor

It is concerned to cane cutter.

Cane cutter:- there are two

types cane cutter,

1) 1

st

cutter---In this cane cuts

into 12 to 20 inches.

2) 2

nd

cutter---In this cane cuts

into 12 to 20 inches.

After cutting cane is forwarded in fibriser. The fidrised cane

is taken into mill section.

Mill Section: - In this section,

the cane is squeezed. Whatever the quantity of juice quizzed

in the mill is pumped into clarification house. At this time

they get the by- product called bagasse.

Dorr:- The juice has come by-

product like press mud and bagasse before it is taken stored

in the Dorr. After storing in the Dorr these are separated and

move down ward.

Evaporators:- After

classification of the juice stored in Dorr. Then it is taken in

to Evaporators to evaporate that the water evaporation juice

is taken into pan section.

Pan Section:- In this section

again syrup (juice) is boiled or heated by the steam. In this

section they remove water, which is mixed in the syrup.

After that make crystals.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 43

Centrifugals:- This is last

process in producing sugar in this section factory gets a

main by-product molasses and stores it in storage tank.

They produce mainly 3 types of

sugar,

1) L30: This is big crystal.

2) L30: This is medium crystal.

3) L20: This is small crystal.

GODOWN

After packing the sugar in the gunny, they are stored in the

godown. In the godown they maintain register consisting the

records of stock, dispatch and closing balance.Factory has 4 large

God owns and their capacity is given below,

STORE

HOUSE

CSPSCITY (In qtl bags)

2 1lakhs

2 70000

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 44

SKILL

Skill is the distinctive capabilities or competence of the

organization as a whole, Skills developed are,

Product quality awareness.

Time management.

Result orientation.

Dedication.

This type of training also known as job instruction training is

the most commonly used method. Under this method, the

individual is placed on a regular job though the skill necessary to

perform that job. The trainee learns under the supervision of a

qualified worker of instructor. On-the-job training has the

advantage of giving firsthand knowledge and experience under the

actual working condition. While the trainee learns how to perform

job, he is also a regular worker rendering the services for which he

paid. The problem of transfer of trainee is also minimized as the

person learns on-the job training methods includes job rotations,

coaching job instruction or training through step-by-step and

committee assignment.

STYLE

Style includes two things, one management style and

organizational culture. Management style the way in which the

managerial personnel behave and collectively spend their time to

achieve organizational goals, it consists the way of lending.

motivating and the style of leadership in the management. Here

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 45

they usually use authoritative style means top to down decision

making parameter pertaining to day-to-day operation but they

allow subordinates to participate in the decisions affecting their

interest and ask their suggestions for their decisions. This makes

organization more effective.

SRTATEGY

Strategy means the actions which a company plans in to or

anticipates of changes in its external environment. In other words it

is the determination of basis long term objectives or courses of

action and allocation of resources to achieve the organizational

goals. They are as follows,

Waste Elimination S.H.S.S.K. Ltd.

Produces molasses and sell it to liquor industries. And it uses

biogases boilers in order to generate energy for factory during

crushing process.

Cost Reduction: They are

reducing the intake of employees and reducing the number of

employees in order to reduce cost. They are not depending on

K.P.T.C.L. for power while crushing process is carrying on. They

produce energy by boilers.

SYSTEM

A system includes formal and informal

procedures that support the strategy and structure. In other words,

it is the processes and flows that shown how an company gets its

day-to-day things done. This includes the procedures and the

routines that will characterized how important work to be done. i.e.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 46

financial system, hiring, promotion and performance appraisal

system and information system etc.

PRODUCTION PROCESS:-

Pressing of sugarcane to extract

the juice.

Boiling the juice until it begins

to thicken and sugar begins to crystallizes.

Spinning the crystals in a

centrifuge to remove the syrup, producing raw

sugar.

Shipping the raw sugar to a

refinery where it is washed and filtered to remove

remaining non-sugar ingredients and color crystallizing,

and drying packing the refined sugar.

INVENTORY CONTROL SYSTEM

Here in stored department the inventory control used FIFO.

Here the method FIFO is appropriate because the sugarcane is not

a durable commodity it is better to crush the sugarcane freshly. It

is not stored for a long time because it turned in too dry sooner.

STAFF

Staffs refer to the people in the enterprise and their

socialization into the socialiseational culture. Productive high

performing employees are the companies

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 47

most valuable assets. The company follows a progressive policy

taking keen interest in its personnel and well beings and progress,

which builds a strong sense of belongingness.

Technical Department:-

A. Machine shop and maintenance

quality assurance.

B. Laboratory

C. Tool room

D. Manufacturing engineering

departments

E. Production planning and control

F. Research and development

Non-Technical

Department:-

A. Administration

B. Clerical

DUTIES AND RESPONSIBILITIES:-

Technical Staff:-

Operators/Technicians:-

Carry out the work as per the

instruction and job allocation.

In process inspection wherever

applicable.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 48

Maintenance in charge:-

1. Planning of preventing

maintenance.

2. Attending breaks down

maintenance.

3. Taking corrective action for

reduce break down.

4. Planning spares and raising

purchase intend.

5. Maintaining the quality record.

SHARED VALUE

There are values shares by the members of the organization.

It is the super ordinate goal that is centrally responsible for

providing a core mission to the organization Used as an umbrella,

which embraces all the other managerial activities. In short it says

what does the organization stands for and what is believes in. A

devoted and sincere contribution to the mankind through the

various business activities of the company and compromise to the

quality.

1. Continues growth is the main

force behind the achievement of S.H.S.S.K ltd.

2. Customer satisfaction through

quality services.

3. Quick decision and execution

with speed.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 49

SWOT ANNALYSIS OF THE COMPANY

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 50

STRENGHTS

Produces good quality of sugar.

Its near the river of the

Vedganga so there is availability of the sufficient water.

SHSSK is not dependent of

KPTCL for supply of power while production is carrying on the

generator through rower.

WEAKNESS:-

Since it is agro based industry

monsoon effects its production.

Lack of good administration.

Lack of infrastructure.

Backward technology and

complexity

OPPORTUNITIES:-

Possibility of willing

co-operation by bank.

Arrangement for KPTCL grid.

THREATS:-

Competition from the domestic

player.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 51

Due to unfavorable Govt. Polices,

factory has to sell sugar below its production cost.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 52

.

NEED FOR THE STUDY

The study has been conducted for gaining practical knowledge

about Ratio analysis of Shri Halasidhnath Sahakari Sakhar

Karkhana. Ltd.

The study is undertaken as a part of the MBA curriculum from

1st July 2010 to 20th August 2010 in the form of summer in

plant training for the fulfillment of the requirement of MBA

degree.

TITLE OF THE PROJECT

This project A Study on RATIO ANALYSIS of Halsidhanath

Sahakari Sakhar Karkhana Ltd is considered as an analytical

research

OBJECTIVES

To study the profitability of

Halsidhanath Sahakari Sakhar Karkhana Ltd. Nipani.

To study the liquidity position.

To find activity turnover

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 53

To study operating efficiency of

Halsidhanath Sahakari Sakhar Karkhana Ltd Nipani.

SCOPE OF THE STUDY

The scope of the study is identified after and during the study

is conducted. The main scope of the study was to put into

practical the theoretical aspect of the study into real life work

experience. The study of Ratio analysis further the study is

based on last 5 years Annual Reports Shri Halasidhnath

Sahakari Sakhar Karkhana. Ltd.

LIMITATIONS OF THE STUDY

The study duration (summer in plant) is short.

The analysis is limited to just five years of data study (from year

2005 to year 2009) for financial analysis.

Limited interaction with the concerned heads due to their busy

schedule.

METHDOLOGY

In preparing of this project the information collected from the

following sources.

Primary data:

The Primary data has been collected from Personal Interaction with

Finance manager Mrs.S.M.Siragave and other staff members.

Secondary data:

The major source of data for this project was collected through

Balance sheet of SSHSKL

Profit and loss account of 5 year period from 2005-2009

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 54

SAMPLING DESIGN

Sampling unit : Financial Statements.

Sampling Size : Last five years financial statements.

Tools Used: MS-Excel has been used for calculations.

THEORETICAL FRAME WORK

INTRODCTION:- Finance is life blood of the business. The

financial management is the study about the process of procuring

and judicious use of financial resources is a view to maximize the

value of the firm. There by the value of the owners i.e. the

example of equity share holders in a company is maximized. The

traditional view of financial management looks into the following

function that a finance manager of a business firm will perform.

1. Arrangement of short-term and

long-term funds from the financial institutions.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 55

2. Mobilization of funds through

financial instruments like equity shares, bond Preference shares,

debentures etc.

3. Orientation of finance with the

accounting function and compliance of legal provisions relating

to funds procurement, use and distribution. With increase in

complexity of modern business situation, the role of the

financial manager is not just confirmed to procurement of

funds, but his area of functioning is extended to judicious and

efficient use of funds available to the firm, keeping in view the

objectives of the firm and expectations of providers of funds.

DIFINATION:-

Financial Management has been defined differently by different

scholars.

1) Howard and Upton:-

Financial Management is the application of the planning

and control function to the finance functions

2) Bringham:- Financial

Management is an area of financial decision making

harmonizing, individual motives and enterprise goals

MEANING OF RATIOS

Financial Statement contains a wealth of information which, if

properly analyzed and interpreted, can provide valuable insights

into a firms performance and position. Analysis Soft financial

statements is of interest to (short terms well as long term)

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 56

investors, security analysts, managers, and others financial

statement analysis may be done for a variety of purpose, which

may range from a simple analysis of the short -term liquidity

position of the firm to a comprehensive assessment of the

strengths and weaknesses of the firm in various areas.

The principal tool of financial statement

analysis is financial ratio analysis. An absolute figure does not

convey much meaning. Ti, there for, become necessary to study a

certain figure in relation to some other relevant figure to arrive at

certain conclusion e.g. If we give the figure of only gross profit

earned by certain firm, we cannot say

whether the gross profit is heavy, reasonable or sufficient

for this purpose we must take into consideration the figure of sales.

Thus, the gross profit to is required to be studied in relation to

the sales to decide the percentage of gross profit to sale on the

basis of percentage we can conclude whether the gross profit

earned is reasonable or otherwise. Thus the relationship between

the two figures expressed mathematically is called a ratio.

OBJECTIVES OF RATIO ANALYSIS:-

The study of financial statement

of any corporate will help in knowing its present and future

earning capacity.

The study of financial resources

can help in knowing whether a company can pay its long-term

or short-term liabilities.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 57

Its very use full to know how

much working capital is employed in business and same

effectively used.

Its use full to measure earning

capacity and its comparison to other competitive units.

Help full to known marginal

efficiency.

Use full to future planning.

INTERPRETATION OF RATIOS

The benefit of the ratio analysis depends to great extent

upon their correct interpretation. Interpretation requires

considerable ability on the part of the analyst. He has to decide

whether the relationship disclosed by the ratio is satisfactory or not.

He has to base his decision on experience, or on comparison may

be interpreted in any one of the following ways.

1) BASED ON SINGLE RATIO

AND GROUP RATIOS:-

The interpretation may be based on individual ratio e.g. If current

ratio persistently falls and goes below one, it can be interpreted as

an indication of short-term insolvency. However, one cannot get

the position corrected by

studying individual ratio in isolation. It is therefore a common

practice to study

and interpret a set of several related ratios e.g. for short-term

solvency both the

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 58

ratios, whose significance is not fully understood , are made more

meaningful

by the computing and study of additional relevant ratios.

2) COMPARISON OVERTIME:-

Ratio analysis is primarily useful for studying trends,

indicating rise, decline or stability over a period of time. For this

purpose, ratios by themselves are of no particular significance. For

reveling such trends, the same ratio or a group of ratios is studied

over period of years. Thus the movements in the ratios, rather than

the ratios themselves, are important.

3) INTER-FIRM

COMPARISON:-

Ratios of undertakings are compared with the respective

ratios of other firm in the same industry and with the industry on

average An immense benefit is likely to from such comparison as

the concerns similarly situated are as a matter of fact , to sail in

the same boat.

PROCEDURE OF

ANALYSIS:-

First or all the depth, object and extent of analysis must be

determined, so that necessary information can collect. The analysis

is required to go through various financial statements of the

business and collect other required information from the

management. The analysis is required to rearrange the data given

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 59

in the financial statements in a manner, which will help the to

analysis the statements easily and conveniently. After analyzing the

statement the interpretation is made and the conclusions are drawn.

TYPES OF RATIOS:-

Classification of ratios is done in two ways.

A. According to nature of items.

B. According to purpose of the

function.

A) According to nature of items:-

1) Balance Sheet Ratios:- The

ratios exhibiting the relationship between two item or

group of items in the balance sheet e.r. Relation between

current Assets and Current Liabilities.

2) Revenue Statement or Profit and

loss account ratios:- The ratios disclosing the relationship

between two items or group of items in the profit and loss

account it. Relationship between Sales and Gross profit.

3) Inter Statement or Composite

Ratio:- The ratios indicating the relationship of certain

items in the balance sheet with some figures in the

revenue statements i.e. Net Profit and Capital or Sales

and Fixed Assets.

B) Functional Classification:-

Liquidity Ratios; - These ratios

measure the liquid position of the enterprise i.e. whether

the current assets to pay current liabilities as and when

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 60

they mature. Thus, these ratios indicates short-term

solvency of the business

Leverage Ratios; - They

indicate the relative use of debt and equity in financing

assets of the firm. The extent, to which the practice of

trading on equity can be carried on safety, can be known

through these ratios.

Activity Ratios:- These ratios

measure the efficiency in the employment of funds in the

business operations. They respect the companys level of

activities in relation to its turnover.

Profitability Ratios:- There

ratios measure overall performance. And profits earning

Capacity of the business. They reveal the effect of the

business transaction on the profit position of the

enterprise.

PROFITABILITY RATIO:-

1) Gross Profit Ratio:- This ratio

reflects the efficiency with which the management produces

each unit product. The ratio is calculated as under:

Gross Profit Ratio= Profit

Sales

It is the ratio which is most commonly employed by accountants

for comparing the earnings of business for one period with those

of other or earnings of one concern with of another in the same

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 61

industry. It indicates the degree to which selling prices goods per

unit may decline without in losses on operations for the firm.

2) Net Profit Ratio:-Net Profit is that proportion of net sales

which remains to the owners or the shareholders after all costs.

Charges and expenses including income-tax have been deducted.

It is calculated as under.

Net profit (after tax)

Sales

It differs from the ratio of operating profit is to net sales in as

much as it is calculated after adding non-operating incomes, like

interest, dividends on investment etc. To operating profit and

deducting non-operating expenses such as loss on sale of old

assets, provisions for legal damages etc. from such profits.

LIQUIDITY/SOLVENCY RATIO:-

1) Current Ratio or working

capital Ratio or 2:1 Ratio:- It is a ratio of current assets to

current liabilities. The ratio is calculated by dividing the current

assets by the current liabilities.

Current Assets

Current liabilities

Certain authorities have suggested that in order to ensure solvency

of a concern. Current assets should be at least twice the liabilities

and therefore. his ration is known as 2:1 ratio.

FINANCIAL RATIO ANALYSIS OF SRI HALSIDHNATH S.S.K LTD

BASAVESWAR ENGNEERING COLLEGE BAGALKOTPage 62

2) Liquid Ratio or Acid Test Ratio

or Quick Ratio:- The current Ratio fails to serve as a realistic

guide to the solvency of the concern, as the major portion on

the current assets may comprise of such assets which cannot

be converted immediately cash (e.g. stock) to meet the

immediate liabilities. It this ratio is 1:1, it is considered that all

claims will be met when they arise.

Quick / Liquid Assets

Current liabilities

ACTIVITY RATIO

1) Inventory Turnover Ratio:- The

term Inventory Turnover refers to the number of times in a

year inventories are sold and replaced.

Inventory Turnover Ratio:- Cost of Goods Sold or sales

Average Inventory at cost

It is Indication of the velocity with which merchandize moves

through the business. This is a test of inventory to discover

possible trouble in the form of over stocking or over valuation. It