Professional Documents

Culture Documents

Garman Kohlhagen Model

Garman Kohlhagen Model

Uploaded by

Hanna Christelle Ho0 ratings0% found this document useful (0 votes)

350 views3 pagesThe Garman Kohlhagen Model is used to price European options on foreign exchange rates. It takes into account both the domestic and foreign interest rates, unlike the Black-Scholes model. Variables used in the Garman Kohlhagen Model to calculate option prices include the spot price, maturity date, forward points, domestic interest rate, foreign interest rate, and implied volatility. The model makes fewer assumptions than Black-Scholes, handling two different interest rates for the currencies involved. It provides formulas to calculate prices of calls and puts on foreign exchange.

Original Description:

Garman

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Garman Kohlhagen Model is used to price European options on foreign exchange rates. It takes into account both the domestic and foreign interest rates, unlike the Black-Scholes model. Variables used in the Garman Kohlhagen Model to calculate option prices include the spot price, maturity date, forward points, domestic interest rate, foreign interest rate, and implied volatility. The model makes fewer assumptions than Black-Scholes, handling two different interest rates for the currencies involved. It provides formulas to calculate prices of calls and puts on foreign exchange.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

350 views3 pagesGarman Kohlhagen Model

Garman Kohlhagen Model

Uploaded by

Hanna Christelle HoThe Garman Kohlhagen Model is used to price European options on foreign exchange rates. It takes into account both the domestic and foreign interest rates, unlike the Black-Scholes model. Variables used in the Garman Kohlhagen Model to calculate option prices include the spot price, maturity date, forward points, domestic interest rate, foreign interest rate, and implied volatility. The model makes fewer assumptions than Black-Scholes, handling two different interest rates for the currencies involved. It provides formulas to calculate prices of calls and puts on foreign exchange.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Hanna Christelle Ho

Garman Kohlhagen Model

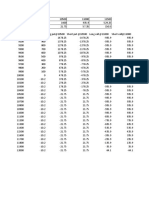

The Garman Kohlhagen Model is a pricing calculation that is used for European

options, those that can be exercised only on maturity date. It assesses European

options on spot foreign exchange. Variables that help find the price of an option on an

exchange rate include the spot price, the maturity date or the time it has before it

expires, the forward points, the domestic currency interest rate, and the implied

volatility. The assumptions made on the Black Scholes model are reduced in the

Garman Kohlhagen Model. The Garman Kohlhagen Model is different from the Black

Scholes Model. The German Kohlhagen Model is an extension of the Black Scholes

Model to handle one interest rate for each of the currency.

The assumptions include:

Options being exercised only on maturity date

Taxes, margins, or transaction costs are excluded

Domestic and foreign risk free interest rates are held constant

Underlying instrument has a price volatility also held constant

Lognormal distribution is observed in the price movements of the underlying

instrument.

C(S

0

, T, X) is the price of a call option where X is the strike price or exercise price that

expires in T years where S

0

serves as the actual spot exchange rate.

Where in

where

is the domestic currency value of a call option into the foreign currency.

P(S

0

, T, X) is the price of a put option where X is the strike price or exercise price that

expires in T years where S

0

serves as the actual spot exchange rate.

is the value of a put option.

Call Option Delta

Put Option Delta

Sources:

http://www.fincad.com/derivatives-resources/wiki/garman-kohlhagen-model.aspx

http://www.stat.unc.edu/faculty/cji/fys/2010/FX-options.pdf

http://flash.lakeheadu.ca/~pgreg/assignments/optionsn.pdf

You might also like

- Solutions To Derivative Markets 3ed by McDonaldDocument28 pagesSolutions To Derivative Markets 3ed by McDonaldRiskiBiz13% (8)

- ANDIMA'S Brazilian Government Bonds Guide - Characteristics, Pricing and Calculating MethodologyDocument34 pagesANDIMA'S Brazilian Government Bonds Guide - Characteristics, Pricing and Calculating MethodologydzbankNo ratings yet

- Sample 2Document2 pagesSample 2vijay kumarmodi100% (1)

- Blueprint For Options Success - Strategic TraderDocument17 pagesBlueprint For Options Success - Strategic TraderRosNo ratings yet

- Garman Kohlhagen ModelDocument3 pagesGarman Kohlhagen ModelJosh RamosNo ratings yet

- Schumpeter Theory of Business CycleDocument10 pagesSchumpeter Theory of Business CycleNichherla JyotiNo ratings yet

- Chapter 24. Epilogue: The Story of Macroeconomics: I. Motivating QuestionDocument4 pagesChapter 24. Epilogue: The Story of Macroeconomics: I. Motivating QuestionAhmad Alatas100% (1)

- Ralph M. Wrobel - Social Market Economy (... ) (2008, Paper)Document20 pagesRalph M. Wrobel - Social Market Economy (... ) (2008, Paper)Roger KriegerNo ratings yet

- Theoretical and Conceptual Differences Between The Conventional EconomicsDocument7 pagesTheoretical and Conceptual Differences Between The Conventional EconomicsMoises Rincon0% (1)

- Harvard BlackscholesDocument8 pagesHarvard BlackscholesGuilherme Ozores PiresNo ratings yet

- Barro, Sala I Martin - 1992Document47 pagesBarro, Sala I Martin - 1992L Laura Bernal HernándezNo ratings yet

- Exchange Rate Theory - A ReviewDocument43 pagesExchange Rate Theory - A Revieweric3215No ratings yet

- Externalities Hindriks Myles Ch7 SlidesDocument34 pagesExternalities Hindriks Myles Ch7 Slidessylstorm100% (2)

- Kalecki - 1962 - Observations On The Theory of GrowthDocument21 pagesKalecki - 1962 - Observations On The Theory of GrowthDanyel PalaciosNo ratings yet

- Appleyard ResúmenDocument3 pagesAppleyard ResúmenTomás J DCNo ratings yet

- Fin MKTDocument38 pagesFin MKTRaimond DuflotNo ratings yet

- Tax EvasionDocument42 pagesTax EvasionSezgin TokalaçNo ratings yet

- Does Trade Cause Growth?: A. F D RDocument21 pagesDoes Trade Cause Growth?: A. F D Rjana_duhaNo ratings yet

- The Quantity Theory of MoneyDocument37 pagesThe Quantity Theory of MoneyLuciano PatruccoNo ratings yet

- Solutions Williamson 3e IM 05Document10 pagesSolutions Williamson 3e IM 05Diaconu MariannaNo ratings yet

- Rodrickbthe Real Exchange Rate and Economic Growth PDFDocument46 pagesRodrickbthe Real Exchange Rate and Economic Growth PDFPatricia GarciaNo ratings yet

- FuturesDocument102 pagesFuturesSon LamNo ratings yet

- Solucionario Ejercicios Capitulo 7 Hindriks ExternalidadesDocument19 pagesSolucionario Ejercicios Capitulo 7 Hindriks ExternalidadesDemetrio Pardo HerreraNo ratings yet

- Interview With Gary GortonDocument16 pagesInterview With Gary GortonHossein KazemiNo ratings yet

- Physiocracy & MercantilismDocument8 pagesPhysiocracy & MercantilismNobin ChowdhuryNo ratings yet

- Ch01HullOFOD9thEdition - EditedDocument36 pagesCh01HullOFOD9thEdition - EditedHarshvardhan MohataNo ratings yet

- Modren Quantity Theory of Money Ugc Net Economics IAS Economics Mains Ma Entrance Econ9micsDocument7 pagesModren Quantity Theory of Money Ugc Net Economics IAS Economics Mains Ma Entrance Econ9micsNaresh SehdevNo ratings yet

- Handout 15 DSGE IrisDocument61 pagesHandout 15 DSGE IrisJose LeivaNo ratings yet

- Benin Code 2017 Marches PublicsDocument54 pagesBenin Code 2017 Marches PublicsAbraham AvakoudjoNo ratings yet

- Economics Is HardDocument4 pagesEconomics Is HardZerohedge63% (8)

- International Accounting Chap 006Document39 pagesInternational Accounting Chap 006ChuckNo ratings yet

- Derivatives Market 1 PDFDocument87 pagesDerivatives Market 1 PDFRaksha ThakurNo ratings yet

- DerivativesDocument21 pagesDerivativesMandar Priya PhatakNo ratings yet

- 7 - 8. Intern M - ADocument21 pages7 - 8. Intern M - ARaimond DuflotNo ratings yet

- Life Insurance Mathematics Ragnar Norberg 2002Document49 pagesLife Insurance Mathematics Ragnar Norberg 2002Clerry SamuelNo ratings yet

- Terms of TradeDocument25 pagesTerms of Tradetaufeeki1002No ratings yet

- A Linear Model of Cyclical GrowthDocument14 pagesA Linear Model of Cyclical GrowthErick ManchaNo ratings yet

- Intertemporal Choice, Time AllocationDocument9 pagesIntertemporal Choice, Time AllocationhishamsaukNo ratings yet

- Chap 8 AnswersDocument7 pagesChap 8 Answerssharoz0saleemNo ratings yet

- Target Accrual Redemption Notes (Tarns)Document4 pagesTarget Accrual Redemption Notes (Tarns)Quentin Van Der BoucheNo ratings yet

- A New Age of Protectionism? The Economic Crisis and Transatlantic Trade PolicyDocument37 pagesA New Age of Protectionism? The Economic Crisis and Transatlantic Trade PolicyGerman Marshall Fund of the United StatesNo ratings yet

- Small Country and Large CountryDocument3 pagesSmall Country and Large Countryhims08No ratings yet

- An Introduction Game TheoryDocument8 pagesAn Introduction Game TheoryhenfaNo ratings yet

- DV3165 Development Management Chapter 2.2Document5 pagesDV3165 Development Management Chapter 2.2Aminah AliNo ratings yet

- Chapter 1 PDFDocument15 pagesChapter 1 PDFRodina MuhammedNo ratings yet

- Portfolio ConstructionDocument21 pagesPortfolio ConstructionRobin SahaNo ratings yet

- Efficient Markets: A Testable Hypothesis To Answer The Question: How Are Securities Market Prices Determined?Document26 pagesEfficient Markets: A Testable Hypothesis To Answer The Question: How Are Securities Market Prices Determined?james4819No ratings yet

- Speculative Currency AttacksDocument4 pagesSpeculative Currency AttacksSuhas KandeNo ratings yet

- Hedging Currency Risks (Dynamic Hedging Strategies Based On O&A Trading ModelsDocument12 pagesHedging Currency Risks (Dynamic Hedging Strategies Based On O&A Trading ModelsevergreennarenNo ratings yet

- Hedging With Foreign Currency Options: by Soeren HansenDocument16 pagesHedging With Foreign Currency Options: by Soeren HansenPrabhat Kumar TiwariNo ratings yet

- Binomial Option Pricing Model: Done By: Dheepa Ravi Mohana Priya. VDocument13 pagesBinomial Option Pricing Model: Done By: Dheepa Ravi Mohana Priya. Vmohana2589No ratings yet

- FRM Ch6 OptionsDocument12 pagesFRM Ch6 OptionsDario GirardiNo ratings yet

- Plugin Risk Non Continuous HedgeDocument6 pagesPlugin Risk Non Continuous HedgeMoss MbuguaNo ratings yet

- Chen Paper2 PDFDocument10 pagesChen Paper2 PDFAyush punjNo ratings yet

- Chapter 11Document16 pagesChapter 11jtom1988No ratings yet

- FX Options ReadingDocument16 pagesFX Options ReadingdayyanbajwaNo ratings yet

- Development of Algorithmic Volatility Trading Strategies For Equity OptionsDocument18 pagesDevelopment of Algorithmic Volatility Trading Strategies For Equity Optionsc0ldlimit8345No ratings yet

- Shaleen Assignment 1Document9 pagesShaleen Assignment 1shaleen bansalNo ratings yet

- Graham3e ppt08Document38 pagesGraham3e ppt08Lim Yu ChengNo ratings yet

- Black ScholesDocument3 pagesBlack ScholesAditiNo ratings yet

- Currency OptionsDocument14 pagesCurrency Optionsvicky19No ratings yet

- FMPMC 411: Course Learning OutcomesDocument8 pagesFMPMC 411: Course Learning OutcomesAliah de GuzmanNo ratings yet

- Options Straddles Using 0xremington Indicators - NadoDocument13 pagesOptions Straddles Using 0xremington Indicators - Nadopuchio senpaiNo ratings yet

- Class 1 SolutionsDocument3 pagesClass 1 Solutionsyenz88No ratings yet

- Black ScholesDocument6 pagesBlack Scholesvarshachotalia1305No ratings yet

- Financial Options in DepthDocument41 pagesFinancial Options in Depthlets_do_this_dogNo ratings yet

- Banknifty DoctorDocument9 pagesBanknifty DoctorMeghali BorleNo ratings yet

- Short Iron CondorDocument3 pagesShort Iron Condorvirat kohliNo ratings yet

- Strategy Name Number of Option Legs Direction: Strangle 2 Market NeutralDocument8 pagesStrategy Name Number of Option Legs Direction: Strangle 2 Market Neutralg_ayyanarNo ratings yet

- Assignment 3. WordDocument14 pagesAssignment 3. WordValeria MollinedoNo ratings yet

- Trade Times TanishCapital DamuDocument20 pagesTrade Times TanishCapital DamuSrini VasanNo ratings yet

- Options Trading (Advanced) ModuleDocument11 pagesOptions Trading (Advanced) ModuleavinashkakarlaNo ratings yet

- Currency OptionsDocument6 pagesCurrency OptionsDealCurry100% (1)

- Options Basics - SummaryDocument37 pagesOptions Basics - SummaryArham Kumar JainBD21064No ratings yet

- Flowsniper Daily ReportDocument1 pageFlowsniper Daily ReportMatt EbrahimiNo ratings yet

- Properties of Stock OptionsDocument20 pagesProperties of Stock OptionsShashank TyagiNo ratings yet

- 0dte OptionsDocument13 pages0dte OptionsnatimeakekazeNo ratings yet

- Greeks PutDocument27 pagesGreeks PutMuneeb AmanNo ratings yet

- Options Trading SimplifiedDocument12 pagesOptions Trading Simplifiedpudiwala0% (1)

- Chap021 Text Bank (1) SolutionDocument50 pagesChap021 Text Bank (1) Solutionandlesmason50% (2)

- Option Trading WorkbookDocument28 pagesOption Trading WorkbookcorreiojmNo ratings yet

- Option Profit - Loss Graph Maker - Free From Corporate Finance InstituteDocument5 pagesOption Profit - Loss Graph Maker - Free From Corporate Finance InstituteDestin WillowNo ratings yet

- Course Otam32Document4 pagesCourse Otam32Sushil MundelNo ratings yet

- Option Pricing Model: © Kaji DahalDocument75 pagesOption Pricing Model: © Kaji DahalAnkit AgarwalNo ratings yet

- MGMT 41150 - Chapter 13 - Binomial TreesDocument41 pagesMGMT 41150 - Chapter 13 - Binomial TreesLaxus DreyerNo ratings yet

- Investopedia. Using - The Greeks - To Undersand OptionsDocument5 pagesInvestopedia. Using - The Greeks - To Undersand OptionsEnrique BustillosNo ratings yet

- OWOTT3Document236 pagesOWOTT3Akash MukherjeeNo ratings yet

- What Is An Options Contract?Document2 pagesWhat Is An Options Contract?Niño Rey LopezNo ratings yet

- Spread Worksheet LockedDocument8 pagesSpread Worksheet LockedJack ToutNo ratings yet

- High Probability Option Trading Covered Calls and Credit SpreadDocument69 pagesHigh Probability Option Trading Covered Calls and Credit Spreadjeorba56100% (3)